Understanding CDM Methodologies - SuSanA

Understanding CDM Methodologies - SuSanA

Understanding CDM Methodologies - SuSanA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

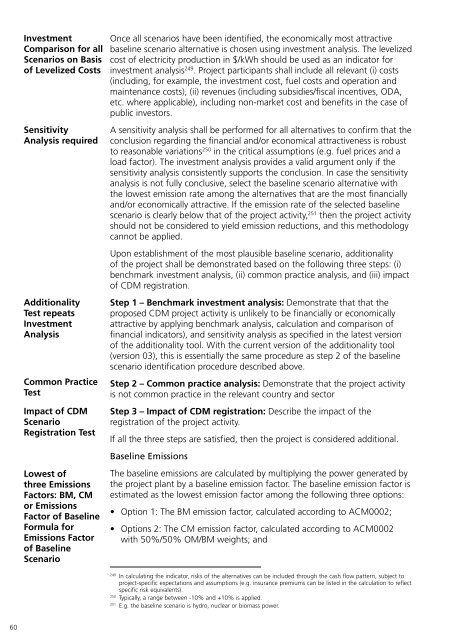

Investment<br />

Comparison for all<br />

Scenarios on Basis<br />

of Levelized Costs<br />

Sensitivity<br />

Analysis required<br />

Additionality<br />

Test repeats<br />

Investment<br />

Analysis<br />

Common Practice<br />

Test<br />

Impact of <strong>CDM</strong><br />

Scenario<br />

Registration Test<br />

Lowest of<br />

three Emissions<br />

Factors: BM, CM<br />

or Emissions<br />

Factor of Baseline<br />

Formula for<br />

Emissions Factor<br />

of Baseline<br />

Scenario<br />

Once all scenarios have been identified, the economically most attractive<br />

baseline scenario alternative is chosen using investment analysis. The levelized<br />

cost of electricity production in $/kWh should be used as an indicator for<br />

investment analysis 249 . Project participants shall include all relevant (i) costs<br />

(including, for example, the investment cost, fuel costs and operation and<br />

maintenance costs), (ii) revenues (including subsidies/fiscal incentives, ODA,<br />

etc. where applicable), including non-market cost and benefits in the case of<br />

public investors.<br />

A sensitivity analysis shall be performed for all alternatives to confirm that the<br />

conclusion regarding the financial and/or economical attractiveness is robust<br />

to reasonable variations 250 in the critical assumptions (e.g. fuel prices and a<br />

load factor). The investment analysis provides a valid argument only if the<br />

sensitivity analysis consistently supports the conclusion. In case the sensitivity<br />

analysis is not fully conclusive, select the baseline scenario alternative with<br />

the lowest emission rate among the alternatives that are the most financially<br />

and/or economically attractive. If the emission rate of the selected baseline<br />

scenario is clearly below that of the project activity, 251 then the project activity<br />

should not be considered to yield emission reductions, and this methodology<br />

cannot be applied.<br />

Upon establishment of the most plausible baseline scenario, additionality<br />

of the project shall be demonstrated based on the following three steps: (i)<br />

benchmark investment analysis, (ii) common practice analysis, and (iii) impact<br />

of <strong>CDM</strong> registration.<br />

Step 1 – Benchmark investment analysis: Demonstrate that that the<br />

proposed <strong>CDM</strong> project activity is unlikely to be financially or economically<br />

attractive by applying benchmark analysis, calculation and comparison of<br />

financial indicators), and sensitivity analysis as specified in the latest version<br />

of the additionality tool. With the current version of the additionality tool<br />

(version 03), this is essentially the same procedure as step 2 of the baseline<br />

scenario identification procedure described above.<br />

Step 2 – Common practice analysis: Demonstrate that the project activity<br />

is not common practice in the relevant country and sector<br />

Step 3 – Impact of <strong>CDM</strong> registration: Describe the impact of the<br />

registration of the project activity.<br />

If all the three steps are satisfied, then the project is considered additional.<br />

Baseline Emissions<br />

The baseline emissions are calculated by multiplying the power generated by<br />

the project plant by a baseline emission factor. The baseline emission factor is<br />

estimated as the lowest emission factor among the following three options:<br />

• Option 1: The BM emission factor, calculated according to ACM0002;<br />

• Options 2: The CM emission factor, calculated according to ACM0002<br />

with 50%/50% OM/BM weights; and<br />

249<br />

In calculating the indicator, risks of the alternatives can be included through the cash flow pattern, subject to<br />

project-specific expectations and assumptions (e.g. insurance premiums can be listed in the calculation to reflect<br />

specific risk equivalents).<br />

250<br />

Typically, a range between -10% and +10% is applied.<br />

251<br />

E.g. the baseline scenario is hydro, nuclear or biomass power.<br />

60