Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>1998</strong><br />

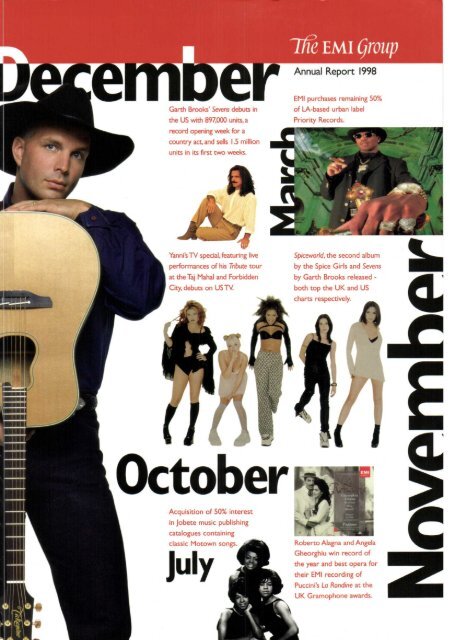

EMI purchases remaining 50%<br />

Gar$ Brooks' Ser.ens debus in<br />

fie US widr 897,000 units, a<br />

of LA-based urban label<br />

Priority Records.<br />

record opening Y\€ek for a<br />

country a6 and sells 1.5 million<br />

uniB in its first two u/eeks.<br />

YannilTV special, featuring live<br />

performances of his Tribute tcur<br />

at the Taj Mahal and Forbidden<br />

Cny, debuts on USTV<br />

Spiceworld, the second album<br />

by the Spice Girls and Seyens<br />

by Ganh Brook released -<br />

both top the UK and US<br />

charu respectively.<br />

Acquisition of 50% interest<br />

in Jobete music publishing<br />

catalogues containint<br />

classic Motown son8s.<br />

<br />

Roberto Alagna and Angela<br />

Gheorghiu win record of<br />

the year and best opera for<br />

their EMI recording of<br />

Puccini's Lo Rondine at the<br />

UK Gramophone awards.

Highlights of theyear<br />

I ChairTruni slalenenl<br />

6 OperaiinE md fimcial review<br />

21 Corponre Sovemanc€<br />

2t Renunenrion Commitee r€port<br />

32 Staremenl oi Direcrors responsililiries<br />

Finan

Chairman's statement<br />

Dear Shareholder,<br />

I hi\ has been anorher er en tlul lear lor the L\ll (;l()up. lt r!a: ottc o1 gre.tt c hange and<br />

exc(,ll('nr prosress. \\i'dclivtrcd a good pcrloruance achier ed narkcl sliare .qrorvth<br />

in dillicult markcl .on(lirions,'lnd Iook nan)'posilive steps lo strcngthen the long ternl<br />

posirion of the Compan,v Setttrg aside the in.rP,tcl ol curlenc)'. both (lrouP lurno!cr<br />

ol L l.5 86. I million ,r nd opcrating profi t ol f.408.5 milljon increast'd bv 5 .8"1' ar\d 2.3"/,<br />

respccrir,ell',inaglobal music narket lhnl Sft'\\'oth 3.2%.OLlr(onlinLlinEcorfidence<br />

in lhe luture prospr( ls o' our business is tellcr rtd in the 6.1% int lease in the firll rr'.rr<br />

diviclend to 16.0p.<br />

Evcr),one in thc rrusi[ industry \r.]\ nllected b1'thc rre.tkncss in laPan and<br />

Sourh [asr AsL]. and L Nl l $'as no exception. I lowcver. tol the Inost part, rve had a r"er1'<br />

.qood ) car in rhe rest ol the rr orld. perhaps better than mosL O\1'rall. \1'e increased olrr<br />

$ orld marker sh,irc lrorn 1.1.3% Io I 4.8% Icinforcins our po:itton as the ir orld s lhid<br />

largest music cotnl),rt)t<br />

I am panicularli, pleascd u'iLh our pct lormance in Notth ,\merica n'here n t' gained<br />

marker sharc ancl rl^'ed irom being nLlnber six jn the marl(el lo lumbel [our. \{ilh Ihe<br />

exception ol Gerorar)\: our European bLisinesses deliverecl grxrd results, maitlta tn illl , ,r t<br />

overallposirlonasrhenumberlttonrLtsiccomPan) inFuroPe \\ I gaincd sh.lrt'. ,t nd lilther<br />

srrengrhcncd our nunber ore position in Ihe UK. desPjlc it small deciine in thc n,lrkt't<br />

In Francc. \\,c increased markel sharc clue ro lhe strensth ol our local rePertoirc. our snall<br />

bul .erorving businesses in [,rslern Ittrope also tutned itt cxccllent resu]ts. In L,llir America,

Chainnan's statement continued<br />

From left to righc Now JB<br />

compiladon, Pa!l Mccaftney,<br />

'Brir' award. Maria Callas,<br />

Joe Cockei Vanessa l"1ae,<br />

Blur, Thalia, Marcy PlaySround.<br />

Jetr Chang (top) and E la Saila<br />

Sola (below), show the rich<br />

d versity ol interna! onal talent<br />

across al musical Senres n<br />

ElYl Recorded Music.<br />

EMI started to see srrong Sains in sales and profits, particularly in Mexico. ArSentina and<br />

Chile. We also continued ro build our local roster and expand into new markets such as<br />

Bolivia. Ecuador, Paraguay. Peru and UruSuay.<br />

On the creative side, r.l'e have had one of our most successful years ever 32 releases<br />

sold in excess of one million units: seven of rhose albums sold over Ihree milliot units.<br />

Most encouratinS is the number of million-sellint arrisrs \\,ho are eirher new developing<br />

or newly signed to EMI rhis year; arrisrs such as Meredith Brooks. Robbie U/illiams, Foo<br />

Fighters and Dreams Come lrue, to name onl)/ a few The Verue. for example. have risen to<br />

being superstars in ayearwith the release o'i Urban Hymns a res(imony ro their ralenr and<br />

the abiliries of our A&R and inlernational marketing reams.<br />

Our aim is ro become the world's leadint music compaly and our busine\s srraregjes<br />

<br />

<br />

<br />

<br />

t<br />

support rhis objective. Ir is the inrenrion oI rhe Board and the nanagemeot team<br />

conlinually to improve our global business operarjons and to seek efficiencies to drive<br />

down our cost base.<br />

In May 1997, we announced a resrructuring ofour North American business, led by<br />

Ken Berry Chief Execurive Officer of EMI Recorded Music. Nor only have we made grear<br />

slrides in market share, but we have done so al rhe same rime as significanrly reducing our

cost basc. Throush out resuuclLrrins, \\'e ha\ie reached our tar.qeted cosl 5n! itl8s ,lncl cleated<br />

a srroil3cr. nore llexible orE,rrisatior in lhe process.<br />

1he reorganisarion ol oLr Japanese business is proceeclil.< n cll n ith a ncrt<br />

teneratjon ol leadership nor'v in platr. A nunbcr of important 5teps \\'ere takt'n in the<br />

)'ear. Thc new managemenl l0(lm h.rs st.rrted to restruclutc thc companv lo it1( r( .1\(<br />

its market orlentation, palliculnrh in Inusic selection and ma rketins. A& R tea rn5 h,l! ('<br />

been rer.iralised. lhe rosler h.rs bcen reduced and energv i5 bcjnS Iocused on tho;i' artists<br />

rr rrl^ rneFrearcrl polenr.dllur '..,, ' \.<br />

In Europe, \\'e completecl reorganisations in E-\11 Electrola in German) and<br />

1n E\11 Classics in the L K and r\ e conr inued to bulld upon our sllon.q prcscncc<br />

throushour rhe major markcls. Onr ol lhc mosr inlportant issues lacing Etr/il in Iurop('.<br />

1r<br />

-<br />

ho!\,evcr. is lhe impacr ol corvertitg markets as a result ol the intlodu( lion ol lhc Euro.<br />

Our response is to build ,ln inlr.islruature which will realise the econonics ol s(.tl('<br />

allorded by a single. iltegrated m.rtketpLace \,vhile ensurin.-c that \,\'e conlinut ('llc( liVel\ lo<br />

serve local music needs.<br />

Our manulacrurinS is :lalc ol lhc-arl in all mark..ts. but r'r-c continued lo push ottr<br />

planrs ro lou'er their costs cr,cn ltrrthcr Continuous improvemcnt in our dislribulion

capabiliries and further procurement savings also remained an area of focus during the year.<br />

suGcesses<br />

1997 Billboard Music Awards:<br />

EMI Music Publishing<br />

Pop Publisher of the year.<br />

R&B Publisher of the yean<br />

Country Publisher of the year.<br />

Rap single of the year - Ill be<br />

missing you Puff Doddy.<br />

Rap artist of the y€ar-<br />

Puff Daddy.<br />

<strong>1998</strong> Brit Awards:<br />

EMI Recorded Music<br />

gest British Group - fhe Yerve.<br />

Eest British Album by a British<br />

High€st-sellinS British album<br />

acr worldwide SPrce 6irls.<br />

EMI Music PublishinS<br />

Best British Male Solo Artist<br />

Finley Quoye.<br />

Best Brhish Dance Act -<br />

The ProdiEt.<br />

4oth <strong>Annual</strong> Grammy Awards:<br />

EMI Music Publishint received over<br />

100 nominations coverinS every<br />

musical genre. EMI l'1usic<br />

Publishint won 20 Grammys<br />

and ElYl Recorded Music v/on L<br />

ASCAP Awards:<br />

EMI Music Publishing<br />

1997 Pop Publisher of the year,<br />

Rhythm and Soul Publisher of<br />

the year plus tour individual<br />

awards for EMI songwriters.<br />

1997 Gramophone Awards:<br />

EMI R€corded Music<br />

Best opera - Rob€rto AlaSna and<br />

AnSela GheorShiu! Lo Rondine.<br />

Record of the year Roberto<br />

Alagna and Angela Gheorghius<br />

Best Concerto Recording -<br />

Sir Simon Rattl€ with fhomos<br />

Zehetnair.<br />

Several key acquisitions were complered in 199798. In luly, we announced the<br />

purchase of a 50% interest in the highly prized lobete music publishinS cataloSues.<br />

Containint all the classic sonts from the Motolr.r era, the acquisition fufiher reinforces EMI<br />

Music PublishinSs position as the world's number one music publisher In March <strong>1998</strong>, EMI<br />

Recorded Music announced the completion of the acquisition of Priority Records, one of the<br />

largest remaininS independent US record labels in the growing urban/rap 6enre.<br />

Also in March, we announced the substantial completion of the sale of the HMV<br />

Croup to a new retailinS venrure, combining HMV, Dillons and waterstones in a single<br />

enterpdse called HMV Media Croup, for up ro €50O million. The Croup retained an initial<br />

investment of €87.5 million, which tave us a 45.2% interest in the new compaly at<br />

31 March <strong>1998</strong>. The transacrion broughl together rllree leading specialist retailers with<br />

cornmon operating characteristics and strengths. h enabled EMI to realise a cash value<br />

for rhe HMV Group as well as providin8 it with the opportuniry to participate in the<br />

future performance of rhe HMV Media Croup. The divestment of HMV Group also enabled<br />

us ro reduce indebtedness and released capital for continued investment in our global<br />

music business-<br />

The sale of the HMV Croup is the culmination of a se es of steps begun in the<br />

mid'1980s ro enalle us to concentate on businesses which own and exploit the rights to<br />

world-class intellectual properry and creative assets. We are now focused purely on music<br />

recordlng and music publishing, We have a simpler, more music focused manaSement<br />

structure and a mole efficient orSanisation upon which to pursue our aim of becomilg the<br />

world's leading music company.<br />

Upon the sale of the HMV Croup, Stuart McAllister, Chief Executive, resi8ned from<br />

the EMI Croup Board to join rhe Board of HMV Media croup. Stuafl had been Chief<br />

Executive of HMV Group for over ten years and oversaw its transition from a UK based<br />

music retailer to the largest inlenational specialist retailer in the world.<br />

Accordingly, I would like to thank Stuart for his guiding role and to wish him ard<br />

HMV Media Croup (onrinued success.<br />

Shordy after year end, in April <strong>1998</strong>, Iim Fifield resigned as President and CEo of<br />

EMI Music ard as a Direcror of EMI Group plc, after ten years with the Group during<br />

which time EMI grew hom being lhe world's fifth largest music company to number three.<br />

I would like ro thank Jim for the pivotal role he has played in positioninS EMI as one<br />

of the leading and mosr respected rnusic companies in the world and to wish him every<br />

success in the furure.<br />

Also in April, Ken Berry chief Executive officer of EMI Recorded Music, and Marrin<br />

Bandier, Chief Executive officer of IMI Music Publishing, were appointed to the EMI Group<br />

Board as Executive Directors. Ken and Marry have over fifty years' experience in the music<br />

indusrry berween them and rheir operational experience will be invaluable to the Board s<br />

deliberations and the continued stewardship of the IMI Group.<br />

At the same rime, Simon Duffy was appointed Joint Deputy Chairman. Simon has been<br />

Croup Finance Director since 1992 andwill continue in that role in addition to his new<br />

duties as loint Depury Chairman. I am delighted the Board has acknowledged his imponanr<br />

contribution to the company in this way.

I would also like to welcome Kathleen o'Donovan and Sir Dominic Cadbury to the<br />

Board as Non-executive Directors. Both have a wealth of business experience and their<br />

skills will complement those of our existing Non-executive Directors.<br />

Sir Graham Day has indicated his wish to retire from the Board following the AGM<br />

this year Graham has been a Non-executive Director with THORN EMI and EMI since 1990<br />

and we will rniss his wise counsel and tremendous business experience.<br />

Nothing we have achieved throughout the year would have been possible without the<br />

comrnitmenr of oul employees. In addition to the ortanisadonal changes to which they have<br />

had ro adjusr, EMI has also been the subject of often very speculative and misleading<br />

comment and media coverage. Throughout this potentially destabilising time, our<br />

employees uound the world continued ro focus on building the business. on your behalf<br />

I would like to thank them for their undeterred enthusiasm and loyalry to EMI.<br />

EMI remains confident about the prospects for the music industry. we continue lo<br />

invest in those businesses and genres which offer the greatesr growth potential. The quality<br />

of our manatemen! teart the inftinsic value of our recorded music and music PublishinS<br />

copyrights and our powerful posilion in both emer8ing ard developed markets will enable<br />

us to exploit opportunities successfully for developing shareholder value against a<br />

background of industry change.<br />

EMI has the riSht manaSement tearn, the right stntegy and the financial strength to be<br />

a vigorous and successful compedtor in the music industry. we look forward to a great<br />

future as an independent force in music.<br />

SirColin Southgate<br />

Chairman

Operating and financial review<br />

REVIEW OF COMMERCIAL PERFORMANCE<br />

EMI R€corded Music<br />

In unit terms. album sales were up nearly 3%. wirh growth in CD sales offsettint a decline<br />

as ever<br />

5pjce<br />

.Best sellinS US album last<br />

year,5.lm units sold.<br />

. Second biSSest-selling debut<br />

album in US by a UK acr.<br />

.The groupl frrst six sinSles<br />

went to No.l in UK charts.<br />

.tirst act since 1989 to have<br />

two of UKI top frve selling<br />

albums in any one y€ar (1997).<br />

.Album sales to date. 3lm<br />

and rising.<br />

in music casselle sales. In total, CDs now represenr nearly 82% of total a]bum sales.<br />

199798 was a goodyear for EMI Recorded Music, continuing our track record of<br />

arlislic success and skill in the marketing of new ralent. 'Superstar' releases, including those<br />

from Ihe Spice Cirls, Carth Brooks. Janet Jackson and The Rolling Stones. achieved Srear<br />

commercial success. Additionally, Recorded Music beneflted from important breakthrough<br />

albums by The Verve, Meredith Brooks. Radiohead and Marcy Playground. Albums from<br />

successful recent sitnings included those from Yanni. Dreams Come True and Robbie<br />

Williams. In addilion, EMIs compilation series Nou and Brauo continued ro sell well wirh<br />

lhe Nor, series on its 38th volume ard Brduo on irs l9rh. In rotal. 32 releases sold more rhan<br />

one million units, compared to 25 last year.<br />

Despite the small decline in the UK wholesale market, EMI retained its number one<br />

position with a strong increase in market share. The Verve. the Spice cirls, Radiohead.<br />

Eternal, Robbie Williams and continued stront sales ftom EMI and Virgins NoD and Besr<br />

Eurr.... compilation series were norable contribulors to this success.<br />

The music markets ofContinental Europe generally showed improvement over last year<br />

One of the stronsest markers was France, which recovered from a p or year deficit<br />

lo grow in excess of 8%. EMI tained market share in France, largely on the strength of its<br />

local repertoire. including Daf[ Punk, 2 Be 3, Julian Clerc and I AM.<br />

EMI's pedormance in Germany was disappointing. Allhough EMI and VirSin had<br />

Sreat success with inrernational acts such as Chumbawamba, a relatively weak local release<br />

schedule resulted in a loss of marker share.<br />

The emerging markets of Eastern Europe conrinued thet strong growth, helpinS<br />

Europe overall achieve an increase of over 4%. IMI maintained irs marker leading posirion<br />

in Eastem Europe and number two position in Europe overall.<br />

Garth Brooks 67m units<br />

fastest-selling album artist in tlS historygilyJoel<br />

59m unirs<br />

EaSles 6lm units

Operating and financial review<br />

REVIEW OF COMMERCIAL PERFORMANCE<br />

EMI R€corded Music<br />

In unit terms. album sales were up nearly 3%. wirh growth in CD sales offsettint a decline<br />

as ever<br />

5pjce<br />

.Best sellinS US album last<br />

year,5.lm units sold.<br />

. Second biSSest-selling debut<br />

album in US by a UK acr.<br />

.The groupl frrst six sinSles<br />

went to No.l in UK charts.<br />

.tirst act since 1989 to have<br />

two of UKI top frve selling<br />

albums in any one y€ar (1997).<br />

.Album sales to date. 3lm<br />

and rising.<br />

in music casselle sales. In total, CDs now represenr nearly 82% of total a]bum sales.<br />

199798 was a goodyear for EMI Recorded Music, continuing our track record of<br />

arlislic success and skill in the marketing of new ralent. 'Superstar' releases, including those<br />

from Ihe Spice Cirls, Carth Brooks. Janet Jackson and The Rolling Stones. achieved Srear<br />

commercial success. Additionally, Recorded Music beneflted from important breakthrough<br />

albums by The Verve, Meredith Brooks. Radiohead and Marcy Playground. Albums from<br />

successful recent sitnings included those from Yanni. Dreams Come True and Robbie<br />

Williams. In addilion, EMIs compilation series Nou and Brauo continued ro sell well wirh<br />

lhe Nor, series on its 38th volume ard Brduo on irs l9rh. In rotal. 32 releases sold more rhan<br />

one million units, compared to 25 last year.<br />

Despite the small decline in the UK wholesale market, EMI retained its number one<br />

position with a strong increase in market share. The Verve. the Spice cirls, Radiohead.<br />

Eternal, Robbie Williams and continued stront sales ftom EMI and Virgins NoD and Besr<br />

Eurr.... compilation series were norable contribulors to this success.<br />

The music markets ofContinental Europe generally showed improvement over last year<br />

One of the stronsest markers was France, which recovered from a p or year deficit<br />

lo grow in excess of 8%. EMI tained market share in France, largely on the strength of its<br />

local repertoire. including Daf[ Punk, 2 Be 3, Julian Clerc and I AM.<br />

EMI's pedormance in Germany was disappointing. Allhough EMI and VirSin had<br />

Sreat success with inrernational acts such as Chumbawamba, a relatively weak local release<br />

schedule resulted in a loss of marker share.<br />

The emerging markets of Eastern Europe conrinued thet strong growth, helpinS<br />

Europe overall achieve an increase of over 4%. IMI maintained irs marker leading posirion<br />

in Eastem Europe and number two position in Europe overall.<br />

Garth Brooks 67m units<br />

fastest-selling album artist in tlS historygilyJoel<br />

59m unirs<br />

EaSles 6lm units

IMI made several keyacquisirions of local reperroire. In Brazil, the successlul<br />

Op€rating and finaDcial Eview continued<br />

The US lvholesale marke<br />

as measured by rerai, ,r,"r, ,"nt<br />

t'"* uoour 1% durinS the year aithough consumer demand,<br />

During lhe /ear Racorded<br />

Music completed rhe<br />

acquisjrion of priorit/<br />

Records ro gjve Efll a leadrng<br />

posjrion in rhe growing<br />

urban/rip 8enre. Below,<br />

Wesrstde Co/rnecriof, one of<br />

Prioriry s platinum.selling acrs.<br />

overall, the marker con,rnu"O ,rarn.O<br />

r,.ong. growing at 5.5% according ro sotndsrdn.<br />

rarionalisarion occurred. :o show signs of slabilisa rion as retail reorganisa rion and<br />

Through a srrong release s<br />

Spiccwasrhebiggesr,urtn,u,o,tn"o''"'MIaSSressiveiySrewmarketshareintheUS.<br />

5 million unirs sold. wh,," our,,]l<br />

tn.tu'"noar 1997 accordint to s'rndsrcn, wilh over<br />

utoout s/u?ns came in<br />

successfur at number releases<br />

four orher cun-," highly<br />

,ao,n ,u' Yanni' The<br />

compilation<br />

RollinB stones album.<br />

and the<br />

Et,<br />

I'ure Mods<br />

o",n"t'utoton<br />

",ro<br />

incrudins Masrer r M,"" r;-,;i,ff:Havrcry successrul vear with prioriry arrisrs<br />

The economic weakness ar<br />

music marker. Airhough rMr harl<br />

rtainty in IaPan conlinued to depress rhe local<br />

Dreams come rrue BJ;;;;l; ;:i::]: ;:TillJ::J":::l:T::::Tl<br />

maintained our numier three position in the market.<br />

Music malkers in Sourh Easl<br />

region, rhe hardesr hir being rhe m<br />

uffered in line with the economic woes in rhe<br />

condirions EMI main,",n"O n]urk.arO.,,<br />

of Sourh Korea and Thailand. Despile rhe difncuh<br />

lhe spice Girls, Michu"t ,".rn, ,o ot<br />

tnjtt in the retion lnlemalional successes came from<br />

trom Faye wong and an"", an," ,Jil<br />

d vanessa Mae' while local successes came<br />

In conrast, rhe Latin Ame c;<br />

to experience hith growrh. rut cort sic market' led by Brazil and Mexico, continued<br />

Panicdariy stront gu,n, ,n ,",", .n,tounies<br />

jn Mexico' Argentina and chiie made<br />

included rhe spice Girls, Backsrreer<br />

rs The reSion's maior international seilers<br />

the Rolling<br />

to.ut ,u.."rr., srones and Yanni.<br />

.orin6;;, ar,.r,,i"tt<br />

wirh srrong<br />

as. legiao<br />

and Exajrasamba<br />

Urbana. tos fu(anes de Tjiudna<br />

IMI gained market share in N€<br />

where major inrernar';;;;;;,;::,tealand and south Arrica durins the<br />

.,rded vear<br />

rhe Sprce Cirls,<br />

and Meredirh Brookr.<br />

laner lackson. Radiohead<br />

Overall, EMI Recorded Music ir<br />

reinlorcing irs posiri"".;,;";;;;ttttased its market share ftom143%tot4.8%,<br />

third largesl music companla<br />

Strategic acquisitions _ Recorded Musir<br />

During rhe year, EMI Recorded Mult't tade several srrategic<br />

its iont investments rerm position.<br />

to srrengthen<br />

In rhe US. ir ar quired rhe rem.<br />

in rhe growing urbaa'7ra;;.;,;1'"'* 50% orPrioriry Records, a leading iaber<br />

Virsin Record: Amer;"r.;;;;;<br />

^:1T-t.acqurred<br />

rhe jniridl 50% in rhe prjor vear<br />

and disrribution comp.ni-'-"'" "otuou Media a leadint rndependent New Age" laber<br />

The combinarioa of Naracla.s ar<br />

::i:lsrincrudinsyan",;".*;;;;;*;T"'ffiT:::;::::*:.i::il,,Xl*"<br />

pre5ence and new djsrrjburion oppor<br />

also acquired wesrwo"na.,n""riJ*lll'ies in rhis trowirt tenre virEirr Records Anerica<br />

one of the iargesr<br />

companies direct response<br />

in the world.<br />

music marketinE

Bravo l9 comp lar on<br />

Million sellerc (tucalyear 97198)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Spice Girls<br />

levens<br />

Urban Hymns<br />

Janet lackson Ihe Velvet Rope <br />

The Rolling Stones Bridges to Babylon 3.5+ million<br />

0l{ Computer<br />

Yanni<br />

<br />

Spice Girls Spiceworld ll million<br />

Garth Brooks<br />

The Verve<br />

Meredith aro9tl l]uryq tle tjggs<br />

Backstreet Boys Backstreet! Back<br />

Foo Fighters<br />

Eternal<br />

Compilation<br />

John Lennon<br />

Boowy<br />

<br />

Greatest Hits<br />

Bravo l9<br />

<br />

<br />

Various Artists Pure lloods<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Spice Girls 5pice Girls Video <br />

| 3 Paul McCartney tlaming Pie<br />

l4 Compilation<br />

Ihe Colour & the Shape 1.5+ million<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

€ompilation <br />

€hemical Brothers Dig your own hole<br />

<br />

<br />

22 Soundtrack Romeo and Juliet vol I l+ million<br />

23 Joe Cocker Across from I'lidnight l+ mrllion<br />

<br />

<br />

<br />

<br />

<br />

€ompilation <br />

Dreams Come True Sing or Die<br />

26 Marcy Playground llarcy Playground<br />

27 Megadeth Cryptir Writings<br />

<br />

<br />

Compilation<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

3l Queen<br />

Rock Compilation <br />

32 Compilation

Bravo l9 comp lar on<br />

Million sellerc (tucalyear 97198)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Spice Girls<br />

levens<br />

Urban Hymns<br />

Janet lackson Ihe Velvet Rope <br />

The Rolling Stones Bridges to Babylon 3.5+ million<br />

0l{ Computer<br />

Yanni<br />

<br />

Spice Girls Spiceworld ll million<br />

Garth Brooks<br />

The Verve<br />

Meredith aro9tl l]uryq tle tjggs<br />

Backstreet Boys Backstreet! Back<br />

Foo Fighters<br />

Eternal<br />

Compilation<br />

John Lennon<br />

Boowy<br />

<br />

Greatest Hits<br />

Bravo l9<br />

<br />

<br />

Various Artists Pure lloods<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Spice Girls 5pice Girls Video <br />

| 3 Paul McCartney tlaming Pie<br />

l4 Compilation<br />

Ihe Colour & the Shape 1.5+ million<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

€ompilation <br />

€hemical Brothers Dig your own hole<br />

<br />

<br />

22 Soundtrack Romeo and Juliet vol I l+ million<br />

23 Joe Cocker Across from I'lidnight l+ mrllion<br />

<br />

<br />

<br />

<br />

<br />

€ompilation <br />

Dreams Come True Sing or Die<br />

26 Marcy Playground llarcy Playground<br />

27 Megadeth Cryptir Writings<br />

<br />

<br />

Compilation<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

3l Queen<br />

Rock Compilation <br />

32 Compilation

operating and fnancial review aontinued<br />

Copacabana catalogue was acquired Siving EMI the worldwide riShts to 4.300 master<br />

recordings encompassing a rante of geffes, including 5amba, Sertaneja and retional music.<br />

ln Europe. IMI acquired l0O% of CMC Records. a Danish record company specialising<br />

in local pop/dance repertoire. EMI also acquired an addirional 30% of Minos'EMl S.A.,<br />

specialising in Greek local repenoire, increasins its interesl in the company to 90%.<br />

In addirion. EMI Recorded Music established new companies in the emersinB music<br />

markels of Bolivia, Ecuador, Paraguay, Peru, and Uruguay.<br />

<strong>1998</strong>/99 R€corded Music release schedule<br />

Major arrist leleases scheduled for <strong>1998</strong>/99 include: new studio albums from Smashing<br />

Pumpkins, Beasrie Boys, Blur, Backsneet Boys,lenny Kravitz, !ni8ma, Roxette, Deana<br />

Carrer Lurher Vandross. Fun Lovin Criminals, Ice Cube and Massive Attack; "Live" albums<br />

from Garth Brooks. Bob Seger and The Rolling Stones; a createst Hits album from Meat<br />

Loaf and major tapanese releases by Dreams Come True, Yumi Matsutoya, Kuroyume, Hotei<br />

and Aska.<br />

lYusic Pob ishinS generates<br />

income from copyright<br />

royalc esr mechanical,<br />

synchronisat on. l'1ajor<br />

successes in mechanical and<br />

performance roya ties ast year<br />

included The Prod sy (oP),<br />

Sting (/€ft), Ihe Fuli/vlonty<br />

soundrrack a bum and Texas.<br />

Synchronisation royakies are<br />

due when a song is us€d in an<br />

advert or f m. For example,<br />

CraiSArmstrongs Rise' was<br />

us€d on the Citroen X$ra<br />

advert in the lJK.<br />

EMI Music Publishing<br />

Music PublishinE, the world's leader with over one million copyriShts, mairtained its<br />

uack record of continued sales and profit growth despite the lower growth m major<br />

developed markets.<br />

Major successes this year included The ProdiSy, The VeNe, Iamiroquai, Matchbox 20,<br />

Savage carden, Puff Daddy & the Family. Iros Ramazzotli. The Nororious B.l.G.. Third Eye<br />

Blind, Deana Carter, CountinS Crows and Texas.<br />

once again this year, EMI Music PublishinB received numerous indusrry awards.<br />

including Billboard's Pop, R&B and Country Publisher of Ihe Year in the US. and top music<br />

publisher in the US, UK, Germany and Canada.<br />

In one of the most significant music publishing arrangements, EMI Music Publishing<br />

acquired a 5O% interest in the lobete Music publishing companies. tobetei calaloSues<br />

contain the great hit songs of the Motown era, including My Girl'. 'l ll Be There". "l Heard<br />

it Through the Grapevine". You Are the Sunshine of My Life and l IusI Called lo Say I Love<br />

You'. Iobere's 15,000 copyriShts include rnore than lo0 number one songs, recorded by such<br />

letendary artists as Stevie wonder. Maruin Gaye, The Temptations, Diana Ross and the<br />

Supremes and Smokey Robinson.<br />

In arother major deal, IMI Music Publishing secured a long term publishing<br />

arangemenr with Sthg, and will represent his entire back'catalogue (both solo works<br />

and as a mem-ber ofThe Police) and cunent and future material throughout the world on a<br />

long term basis. orher significant deals included Keith Sweat. Cleopalra. Usher, Matchbox<br />

20, Meredirh Brook and Chumbawamba, and the renewal of publishint arrantements with<br />

Aerosmith, Ianet lackson and Carlton TV<br />

Throuthout rhe year. EMI Music Publishing entered new markets, operinS offices in<br />

Taiwan and South Korea - firsts for an iltemadona] publisher ald entered into an<br />

agreement with the Music Copyright Sociery of China to represerl our music in<br />

mainlard China.<br />

Expansion also continued into Easrern Europe with direct opera ons being<br />

<br />

The acqulsirion of a 50% inlerest<br />

in rhe Jobete rnuslc publish ng<br />

catalogues further reinforces<br />

El'4li position as the world\<br />

leading pub isher.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

ln the year El4l Music Publishing<br />

introduced its on-lne lyric<br />

cataloSue for profession:l music<br />

research€rs. (enrimus cpub.com)

op.fathg 6nd finarkid lwlcvr .ondrucd<br />

Globrl waming pot€ntial<br />

CO, emiRed du€ to eners<br />

!se in b!ildingsfactories<br />

established in the Czech and Slovak Republics, Poland and Hun8ary and licensint<br />

anansemenls in Russia, Slovenia, Croatia, Turkey and the Baltic Srates.<br />

oTHER TSSUES - 8US|I{ESS<br />

Piracy and technology<br />

For many years now our intellectual properry rights have been subject to pincy. In<br />

September 1997, the International Federation of Phonographic Industries undertook<br />

a furdamental reassessment ol Slobal pincy, the results of which were disconcertinS.<br />

It is now believed the pirare marker is wonh in excess of US$5 billion and rhat, globally,<br />

<br />

<br />

Global waming pot.nti.l<br />

COr emifted doe to en€rty<br />

use in buildings/hctorie!<br />

(Ionne'/fl million)<br />

one in every three music carde$ is a pirate copy.<br />

Such evidence reinforces the need for a tough and orchesnated approach to pirary-<br />

Illustmdve of this was the recent adoption of rwo treades under the auspices of the World<br />

Imellectual Properry Ortanisation.<br />

Pressure from industry and Sovernments will continue on those failing to enforce<br />

or protect intellectual properry rights around the world and we continue to support,<br />

throuSh industry and govemment initiatives, any measures which help protect our valuable<br />

recording and publishing copyrights.<br />

Providint proSress continues to be made towards both establishing and enforcing<br />

copyright legislation, the long tem growth opportunities afforded by technology and diSiral<br />

distribution will far oufweith any threats in the short lerm.<br />

(1997 and <strong>1998</strong> turnove. ar<br />

srandard for environmental management. This means that over 60% of EMI'S CD outPut now<br />

comes from ISO ceflified facto es.<br />

Charitable donations<br />

Charitable donations for the croup totalled f3 6 milllon this year, includinB f2.lmillion<br />

in rhe UK. The Music sound Foundation, established in our centenary year last year,<br />

has made a commendable start and next year will publish its fust annual report for lhe<br />

pedod ended 3l March 1999. This will include details of its activities and allocation<br />

of its funds.<br />

FII{ANCIAL REYIEW<br />

Basis of presentation<br />

The results presented in the <strong>Annual</strong> RePon focus on EMI & HMV excluding Thom, which<br />

is included under'demerged business in the financial statements section.<br />

For the second consecutive year the results have been srgnificandy alfected by the<br />

movemenr in exchange rates and, therefore, in order to show the underlying performance<br />

of the Croup in its operatinS cunencies, we have reported some of our key financial<br />

paramerers ar bolh constanl (1997 reported) and actual (<strong>1998</strong> reported) exchange rates<br />

Turnover<br />

EMI & HMV turnover rose 5.8% to €3,586 1 million at constanl exchanEe rates However'<br />

rhe continued strentth of sterling, mainly aSainst the Deutschmark, US dollar, laPanese yen<br />

and the French franc, reduced reporred revenues to f3,309.4 million.<br />

EMI Music's turnover at conslant exchanSe rates increased 4.1%to 82,592.5 million,<br />

ahhough at acrual rates it fell 5.6% to €2,352-7 million. HMV crouPs turnover Srew 13 1%<br />

at constanl rates to €993.6 million and by 8 9% at actual rates to €956 7 million'<br />

<br />

<br />

<br />

<br />

Costs<br />

Cost of sales as a percentage of turnover and total costs is consistent year'on'year Music<br />

publishing royalry cosrs have fallen slightly as a percentage of rurnover, but this has been<br />

offset mainly by increased marketinS and promotion spend in Recorded Music. Dist bution<br />

costs remained broadly unchanged as a percentate of turnover whilst administration costs<br />

have fallen year on-year.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

other operating income<br />

orher operating lncome fell from €71.7 million to f45.6 million. This was mainly due to<br />

lower joint venture income as a result of fewer N0 , compilation albums being released and<br />

lower total income fiom the Brduo series during the year'<br />

Associated undertakings<br />

our share of profits less losses of associated undertakinSs increased by el 3millionto<br />

fO.9 million mainly due ro the imPact of Priority Records, held as an associate for rhe full<br />

year. The remaininS 50% of Prioriry Records was acquir€d on 27 March <strong>1998</strong>.

operating and inamlal rwiew conti r€d<br />

<br />

<br />

operating profit by<br />

origin- <strong>1998</strong> El'll & Hi.lV<br />

<br />

operating prolit<br />

EMI & HMV reported an increase in operating profir before exceptional items of 2.3% ro<br />

f4O8.5 million at constalt exchange rates. However, rhe srrengrh of srerling resuhed in a<br />

decline to f 371.4 million at acrual exchange rares.<br />

EMI Musics operaring profir before exceptional items rose l 0% ar consram exchange<br />

rates to €378.7 million, while ar actual exchante rates ir fell 8.8% to f341.8 million.<br />

HMV 6loup's operating profit before exceptional irems rose 17.9% to €29.6 million or<br />

18.7% at consranr exchange rares to €29.8 million.<br />

Us doL /l<br />

<br />

Analysi3 of impad of<br />

et(hange on operating profit<br />

in <strong>1998</strong> EHI & Hl'lY<br />

<br />

<br />

<br />

The further appreciarion of srerling, mainly against rhe US dollar, rhe Deurschmark,<br />

French franc, Netherlands guilder, and other European currencies. resulred in ar adverse<br />

exchanSe translation impacr of f37.1 million on operating profit at actual exchante rates.<br />

Return on sales<br />

Retum on sales for the conrinuing operarions declined slightly ro 14.6% ar consiant<br />

exchanSe rates, l4.5Zo ar acrual rares, mainly reflecting rhe disappoindng performance in<br />

Japan, Sourh Easr Asia and Germany.<br />

Finance charges<br />

CharSes were f45.3 million higher than in rhe prior year. lnteresr rates rose in borh rhe<br />

UK and US malkets. However, the increase of bonowings in the bonowings,ro,cash mix<br />

in the year. plus fee and inreresr earnings generated from the bridging loan provided ro<br />

HMV Media Group, have resulted in a slighr reducrion in rhe overall average interest rate<br />

on net bo[owin8s. The favourable impacl of the reduced average interest rate was<br />

outweithed by the increased borrowing levels from the rerurn of capiral ro shareholders<br />

and acquisitions (mainly Iobete) made in the year, as well as the high level of borrowings<br />

at 3l March 1997.<br />

Profit before taxation<br />

EMI & HMV profir before aax (PBT) and exceprional items ar consranr exchange rares fell<br />

lO.O% to f342.4 million, while at acrual rares ir fell €73.4 millior (19.3%) ro €307.1 million.<br />

The fall in PBT largely reflects rhe increase in finance charges followint acquisitions atd the<br />

return of capital ro shareholders.<br />

Taxation<br />

EMI & HMV s tax rare was reduced to 31.7% compared ro a rax rare of 36.5% in the prior<br />

year. fhis reflects rhe conrinued change in rhe geographic mix of earnings, funher tax<br />

planning and the favourable impacr of Foreign lncome Dividends.<br />

Minority intcrests<br />

The minoriry interests' charge has fallen from fl 1.2 million in rhe pdor year ro f9.9 million.<br />

The main change was the reducrion in rhe Toshiba-EMt (TOEMI) minoriry lnteresr charge,<br />

pardy offset by the inclusion of 5O% of Jobetes profit afrer tax since July 1997. Ar constanr<br />

exchalge rates, rhe rninoriry interests' charge is flat.

Earnings per share<br />

The adjusred fully diluted EPS was 24.6p for the year, compared to 26.5p (restated) in the<br />

prior year At consrant exchange rates, the adjusred fully diluted EPS is 27.4p, an increase of<br />

3.4% against the prior year This was aided by a reduction in the weighted average number<br />

of shares over the year, followinS the retum of f48o million in capital io shareholders in<br />

l\ly 1997 .<br />

Dividend<br />

The Board is recommendinS a 6.7% increase in the full year dividend to 16.0p, resulting in<br />

dividend cover of 1.5 times.<br />

l{et borrowings<br />

Net bonowings increased by f646.3 million to f95 3.5 million. This was principally due to<br />

rhe return ofcapiral to shareholden of €480 million and total interest, tax and dividend<br />

payments of €26 5.8 million, partially offset by a net benefrt of €93.2 million from the sale of<br />

HMV and lower capital expenditure.<br />

[et borrcwinsr novement (m<br />

I t997 r <strong>1998</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

operating exceptional item<br />

The €43.3 million charSe for operatinS exceptional items consisted principally of the<br />

costs ofmanagement and property rationalisation consequent upon closing EMI'S head<br />

office in New York, including the termination payment to Jim Fifield, and the disposal<br />

of HMV. I[ a]so included a number of integntion costs following the acquisidon of<br />

businesses during the year<br />

on-operating exceptional item<br />

The profit of f 101.3 million on businesses disposed of or teminated, shown as a<br />

non-operatinS excepdonal item, relates substandally to the disposal of HMV<br />

Disposal of Hl'lV Group<br />

The disposal of HMV for up to f500 million (subject to funher adjustments) was amounced<br />

on 25 February <strong>1998</strong> and substantially completed on 28 March <strong>1998</strong>. The Group received<br />

f4l3.l million cash as proceeds before 3l March <strong>1998</strong>, but then provided a €20o.o million<br />

bridging loan, which has since been refinanced from the proceeds of a hi6h yield debt issue<br />

made by HMV Media Group plc. Further consideration of €50.0 million is subjecr to certain

oP.rad.B.rd fr|.nd.l nrlcw cotrtirrtd<br />

conditions beinS mer by HMV Media 6roup.<br />

The Group retained an initial investmenr of €87.5 million, which gave us a 45.2%<br />

inreresr in HMV Media Group (which comprises HMV Group and Waterstone's booksellers<br />

which HMV Media Group acquired from 1VH Smirh croup plc on 23 March <strong>1998</strong>).<br />

We have accounred for rhis interest as an associate at 3l March <strong>1998</strong>, and funher<br />

information is shown on pates 47, 49, 63 and 65 in the financial statements.<br />

Turnover- Op.rating prolit<br />

Con.tant rates b.fore oper-<br />

({.) Constant rate3<br />

(.m)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Second-half performancc<br />

Our srong second.half release schedule lrom Ocrober ro March, which included multi<br />

million selling albums from rhe Spice Cirls, Carrh Brooks, Janet Jackson and The Verve,<br />

produced a 5.1% increase in opemrint proflr on sales up 6.5% ar constant exchange rares,<br />

with sales up by 4.9% in IMI Music and by 12.4% inHMY. Operatint pronr increased<br />

by 3.5% in EMI Music and 17.7% in HMVon rhe same basis.<br />

This reflects at improved performance across the world, including Japan, which<br />

benefited ftom a release schedule and sales better than expected at the dme of the<br />

Christmas rading updare. Performance in other Asian mukers has been affecred<br />

<br />

by softer market<br />

conditions, provisions against anist advances<br />

<br />

and rarionalisation.<br />

<br />

<br />

<br />

A further adverse exchange impact of €2 3- l million on operatin6 profit and<br />

€ 133.6 million on sales in the second half reduced this improvemenr ro a reported<br />

3.1% and 0.5% decline r€spectively at actual exchange rates. profit before taxation and<br />

exceptional items fell by 5.4% at constant exchange rates due ro increased finance char6es.<br />

Net cash inJlow from operaring acrivities ar f 32 5.2 million was l9.l % higher rhan<br />

the pdor year This was mainly due to lower working capital requiremenB of €67.3 million<br />

partially offset by an increased spend againsr provisions of f41.5 million-<br />

Financial needs and resolrces<br />

Additional working capital requirements decreased from fl34-5 million in rhe year ended<br />

3l March 1997 to €67.1 million in the cuffenr year. This improvement is Iargely rhe resulr<br />

of a smaller outflow on advalces, lower founh qua er shipments and faster pal,rnents by<br />

some US retailers than in the prior year.<br />

The net cash inJlow from operadng acdvities of f298.9 million reflects reduced<br />

working capital requiremenrs offset partially by the increased spend against provisions.<br />

Reconciliation of movemenas<br />

i. 3h.rcholderc' funds am<br />

Shareholders' funds<br />

Shueholders' funds have fallen by €656.1 million rhis year ro a deflcit of f652.6 million<br />

at 3l March 199E, from a posirive f3.5 million ar 3l March 1997. profit for rhe year of<br />

f228.7 million has been offser by dividends of €126.0 rnillion, the return of capital, together<br />

with associated cosrs, of f484.0 million, together wirh ner goodwill charged in rhe year<br />

off276.l million,largely rcladng to the acquisitions of prioriry Records and of an interesr in<br />

HMV Media GrouP.<br />

oTHER TSSUES - FD|AI|CE<br />

Y€ar 2000 cost<br />

We commenled in lasr year s <strong>Annual</strong> Repofi thar special sreering commirlees had been

set up throughout the Group to correct the systems applications that will be alTected as<br />

the year changes from I 999 to 2000.<br />

Acrion plans have been put in place and EMI'S internal audit unit has been reviewing<br />

their prosress. The Group believes that all vulnerable systems have been identified and will<br />

be rectified ahead of time.<br />

we estimate that the total costs to fhe Group will be €25.0 million which, in<br />

accordance with UITF 20, are being written offas incurred or capitalised where the costs<br />

are value enhalcing to the systerns concemed The costs charyed to the profit and loss<br />

account in the cunent year were €5.2 million whilst f3.9 million has been capitalised<br />

within fixed assets.<br />

EltlU prognmme<br />

The gradual implementation of the sinSle cunency unit (Euro) is likely to incur considerable<br />

costs both in training and in systems application.<br />

We curendy intend to charge these costs to the profit and loss account as incurred.<br />

Costs ro date have not been siSnificafi.<br />

There still remain a number of issues to be resolved with European Monetary Union<br />

and, for this reason, EMI has decided to become a late adopter The issue and process of<br />

possible implementation will be monitored through steering committees and progress will<br />

be included in subsequent <strong>Annual</strong> or Interim <strong>Report</strong>s.<br />

Changes in accounting pollcles<br />

FRSg "Associates and Joint Ventures" and FRS l0 "Goodwill and Intangible Assets" were<br />

issued in November and December 1997. Neither were rnandatory for the year ended<br />

3 I March I 998. Both standards were adopted with effect from I April I 998. The main<br />

impact of FRsg will be on the accounting and disclosue of oul new associate, HMV Media<br />

Group. Following the introduction of FRslo, we will have amonisation charges to be bome<br />

in the profit and loss account for goodwill on future acquisitions ald cunent and future<br />

music publishing copyrights held on the balance sheet. The life over which the assets will<br />

During the year EMI continu€d<br />

its international expansion and<br />

now has a presence in over<br />

70 countries.

Trc rlvr rad grea: rL,rtss:r<br />

rl.c 998 Br r awr,:s w rr r ;<br />

both Besr Brrsf Gro!r rr.8€5!<br />

8r rilh Albunr by a Erir r r A rsr<br />

.+-

opereting and fimn.ial nyiw Goitinued<br />

be amorrised is llmiled by FRS 10 ard since we do not feel rhat the amortisation charge<br />

necessarily reflects the diminution in the value for all assers over rime, these charSes will<br />

be removed in the calculation of the adjusted earnings per share.<br />

TREASURY MAI{AGEMENT<br />

Treasurt policies<br />

The treasury activities of the Group are carried out in accordance with policies approved<br />

by the Board. these policies cover lhe managernent of funding, inreresr rare and foreign<br />

exchange rate exposure, and counter.party risk. The policies also cover the use oI financial<br />

inslruments, hcluding derivatives.<br />

The purpose of these policies is to ensure that adequate. cost-effective fundins<br />

is available to the Croup at all times and that exposure to financial risk is minimised.<br />

Group Treasury does not operate as a profit cenfie and the Croup's policies prohibir the<br />

use of financial instruments for speculative purposes.<br />

Appropdare controls and monitoring systems are in place ro ensure all Treasury<br />

aclivities are undertaken within the policy parameters. The Treasury Management<br />

Committee, chaired by the Croup Finance Director, meers tegularly to monitor ald<br />

control Treasurys activities. The department is subject to regular audir by an independent<br />

extemal auditor<br />

Funding and interest rate exposure<br />

The Group is currently funded throu6h the use of short and medium term commirred<br />

and uncommined bank faciliries. Additional bank facilities were a anged in June 1997<br />

to fund the return of capital to shareholders. Overall, the facilities urilised have a broad<br />

range of marurities which are re-negotiated as they fall due in compliance wirh the<br />

Treasury policy of havins facilities available to cover I I 5 % of anticipated peak net<br />

bonowinSs, taking into accounl any set oIT arrangements with rhe Croups bankers,<br />

The croup works with a select group of inrernational banks which service the<br />

Croups requirements.<br />

Following rhe retum of capinl and pursuanr ro the Treasury policy of fixing interest<br />

rates on between 2 5% and 7 5% of ner bonowings, the Group enlered into a series of lhree<br />

year interest rate caps ro hedge against future increases in UK and US irreresr rales. Deails<br />

of rhese are set our on paSe 53, note 17.<br />

The Group also uses interest rate swaps to manage its fixed/floatint Iate mix. Swaps<br />

held at 3l March <strong>1998</strong> are detailed on paEe 53. note l7(iv)a).<br />

Foreign currency exposure<br />

The croup. due to the international nature of irs opemtions, has faced particular currency<br />

exposure in view of sterling s srengrh. The croup has conrinued irs policy, revised in 1997<br />

followinS demerger, of not hed$Dt translation exposures, except to the extent thar overseas<br />

liabilities, including borrowings, provide a narural hedge.<br />

It is also the Group's poliry not ro hedge profir ard loss account translation exposure.<br />

Transaction exposure is hedged where deemed appropriare.<br />

Forward rate contracts held ar 3l March <strong>1998</strong> are derailed on page 53. nore l7(iv)b).

Board of Dircctors<br />

ErecutiYe Directors<br />

Sir Colin Southgate<br />

Lnqtrrnan<br />

Sir Cohn (59) joined thecompnny<br />

in 1983 afrer23yearsln the<br />

inlormal jon rechnology jndustry<br />

llejoined tbe Board rn 1984.<br />

bccam€ \lanaeinS Direclor in<br />

l985 Chief lxecurive in 1987<br />

and was elected Chairman in 1989.<br />

Sircolin is Chairlllan of rhe<br />

noyalopera House andfte Music<br />

Sound Foundarion as w€ll as r<br />

Trusree oI fie NalionalCallery<br />

He is a member of rhe coun of<br />

tbe Bank ot [nSland md is a<br />

Non execurive Director of<br />

The Terence chapmrn Cloup plc<br />

and whirehend Mann Group plc.<br />

Simon Duffy A r'ro^<br />

Ioint Deput\ chairman and<br />

Group Finance Director<br />

Simon Dufiy (48) {'as appoinred<br />

Group Finance Dlecror in 1992<br />

and. in April I998. i r'as.ppoinred<br />

Ioinr Depury Chairman. I Ie joined<br />

from Unired Dilrillen !t here he had<br />

been Operations Direcror since<br />

1989. havinS previously been<br />

Direcror of Corporare tinancc<br />

atGninness.<br />

Prior .o loining Cuinness.<br />

Simon worked in rhe merchanr<br />

banking. m. natement (onsulring<br />

and rhe oll and mining indusrrles.<br />

Simon ha Non execurive<br />

Direcror ot Bcrislord plc. hperial<br />

Iobacocroup plc. HMV Media<br />

Croup pl( and Gl\T. Group plc.<br />

He ii iko r Cove.nor ofThe<br />

lnreilecrual frop€n_! lnstilur€.<br />

Martin Bandi€r<br />

Chi?f Ex?(utive offrcer.<br />

rMI Mustc Publishnq<br />

I'lartin Bandicr(56) ioined the<br />

EN,tl Boird in April 19S8.Iiejoined<br />

EMI M!sic I'ublishing di itsVice<br />

chnirman in 1989. upon lhe<br />

acqulsirion ot sBK Interrai n€nr<br />

$orld.lnc.. in i(hich hc ifas a<br />

loundioSpaftn€r. He is<br />

appoirred C[o of IM I Music<br />

l'ublishinE in 1991.<br />

Maflin beganhis carccr in<br />

music p! bLishing in 197 5.<br />

He is d direcor oi,^SCAI<br />

(Anerican So(<br />

jeq ol Comp()sers.<br />

Aulhols and Publirhers). Ihe<br />

Narional \lusic Publisheri<br />

r\soci:rion (NiltPA), the BMI<br />

Foundarion. Lhe Songwrircrs Hall<br />

ofFime rhe Rock and RoI llall of<br />

l'am€ rnd rhe Syn.use UniveEiry<br />

New York Cily Advisory Boad.<br />

\atere he is ilsoamemberolthe<br />

Board oflrusrees. He is also a<br />

mehber ol NARA5 (NarionJ<br />

Academy of RecordnrS Anr and<br />

S.iences)and rhc Friars<br />

Ken Berry<br />

Chiel Executve 1Jfrct,<br />

FMI Reorded Musi(<br />

K€n Berry (46) joined rhe Board<br />

in April <strong>1998</strong>.IIe is Chietlxccurive<br />

ollicerot IMI Recorded Music.<br />

responsible tor rhe Companyi<br />

recordedmusi( business op€rarions<br />

(cn ioined IMI in 1992 is<br />

Chairm,rn and CIO oI ViISin ]\'lusic<br />

on its acquisidon lromrheVirgjn<br />

Grorp.In 1994 he was promored<br />

ro lhe new pon o'Presidenrand<br />

CBO of [M] Recolded Musi..<br />

respontible tor EM I s recorded<br />

mosi. operalionl' ourside ot Nonh<br />

,{meric,r. IIe {'rs appoinled Io his<br />

cunent posilion in June 1997.<br />

Ken began his careel in the<br />

music indusrry in l9?3 with Vir8in<br />

Group whcrc hc eventually beca mc<br />

m.ron8irrg directur 01 Virgin Music.<br />

l{on-executiY€ Directors<br />

Summary of Board<br />

commlttees<br />

Sir Peter Walte6<br />

Joint Depury Chairmon<br />

Sir Perer(67) $'as appoinred lo rhe<br />

Board in 1989 and became DePutY<br />

Chairman in 1990.<br />

sir lerer is chairman of<br />

smirhKline Beecham plc. D€puty<br />

chairnan ol HSBC Holdings pLc and<br />

a Directorol saarchi & Saar.hiplc.<br />

He is Chairnan of $e Truslees oI<br />

rhe Police toundadoD and: Trustee<br />

ol $e lnsrilure oilconomic Alfaits.<br />

He spenr rhe maiority ofhis<br />

ca-r€er s ifi Brilish Pel roletrm<br />

where he !!'as a ManaSing Direcror<br />

for sevenleen y€ars and Chairnan<br />

loreishLyears.<br />

Eric Nicoli<br />

Eric Nicoli (47) was appoinled<br />

torhe Boad in 1993. He isGroup<br />

Chief Fxe.urive olUnired Biscui$<br />

(Holdings) plc which he joined<br />

irom Rown rree Mackinlosh in<br />

1980. Hewasappoinred ro lhe<br />

IIB BGrd 1989 as Chiel<br />

Execudve 'n ot lhe Croup's Iulopean<br />

Opelauons, asquminS his currenr<br />

role in 1991.<br />

tr'c's Chairnan ol rhe Percenr<br />

Club, Deputy Chaiman of Bulinets<br />

in rhe Communirya member of rhe<br />

Execudve Commillee of I he Food<br />

rnd Dfnk Federadon and of lhe<br />

Policy hsues Council oI I hc<br />

lnsrirure of Clocery DislIibution.<br />

Sir Graham Day<br />

Sir Cralam (65) $,a! appoinred lo rhe<br />

Board in 1990 lle iscouns.lto rhe<br />

Adan r ic Canada law finn. Stewarr<br />

McKe[y Yirlinf Scales and is<br />

chanc€llor of Dalhousie Unive15iry<br />

Hc was formerly ChairnDn ol<br />

Cadbury Schw€ppes, Powercen, The<br />

Rover crcup and Brirish shipbuilders.<br />

Sir Griham is Depur! chaiman<br />

of Ugland lnrernar ional HoldinSs plc.<br />

He is also a Drrecrol ola numbel oI<br />

companie! in rhe UK and canada.<br />

includin8 tzird Group plc. The Bank<br />

ot Nova Scoria and EmPireCompany<br />

Limired, He ira consulnol lo the law<br />

tirm Ashulsr \'lonis Crisp in rhe UK<br />

and an Adlisor Io rhe Bosron<br />

consulting Group.<br />

Sir Dominic Cadbury<br />

I'ta I'tBl<br />

SirDominic(58) io'ned lhe Soard<br />

in <strong>1998</strong>. He n Chairman ofcadbury<br />

Schwepper plc. Sir Dominic ioined<br />

cadbury khw'eppes in t964 afier<br />

gl]dlrarion from Sranford universiry.<br />

lle joined rhe Board of Cadbury<br />

Schweppes in 197t as lilanaging<br />

Direcrorol rheir loods Dlvision and<br />

subsequently held a number of Board<br />

posirions. b€coning Chairman in<br />

t993<br />

Sir Dominic ir Chairnan of The<br />

E(onornjsr Croup and Dcpury<br />

chrirman ofrhe Qualifrcarions &<br />

Curiculu m Aulhorily ln lanuary<br />

<strong>1998</strong>, he was appoinr€d h€sidenl of<br />

rhe Food and ftink Federarion.<br />

Dr Harald Einsmann<br />

Harald Einsmann(64)was<br />

appoinredro the Boald in 1992.<br />

He is lx€cutlve vice fresidenr ;nd<br />

a menbcr oI ltoder & Camble!<br />

Main Borrd and Executlve<br />

Commi.tee.ltc began his (areer<br />

r'r'irh Procrer& Gamble in 196l d<br />

was nppoint€d lresidenr of ils<br />

Europ€. Middlc Inst and ftica<br />

ReSion in 1990.<br />

Harald is a Direcror ol lhe<br />

American Chamber ot comm€rce<br />

in BelSiumand a member ol lhe<br />

Advisory Board olrhe lniversiry oI<br />

Bosron inBrusselt. He isa member<br />

ol th€ Board ofSrola. a member<br />

(ompany ot rhe Srvedish<br />

uallenberg Croup.<br />

Hugh lenkins c[E<br />

IIoEh lenkins (64) joined rhe<br />

Boad in 1995. HuEh is Chairman<br />

olThom plc.<br />

IIe is nNon-cxe.rdv€ Diteclor<br />

of rhe R.ank croup plc. ,ohn:on<br />

Ma hey plc and cdrtmore<br />

European Trusr and wa' unlil 1995,<br />

chairman and cbiel E-.(ecudve of<br />

Prudenrial lonfolio vanaSels and a<br />

Direcror ot ft'udenrial Corporalion.<br />

Kathleen 0'Donovan<br />

8SC ACA<br />

KalNeeno Donovan (41) joined<br />

lhe Bonrd in 1997<br />

Karhleen joined BTR as Finance<br />

Dirccror in l99l . She u?s formelly<br />

a praner with lmsl & Youns.<br />

Audit committec<br />

Chatred btt tfu Non.exetutue<br />

Ioint Deputll Chairmon<br />

It'lembership: All Non-execulive<br />

Direcrols. The Group Finance<br />

Direrror and arepresenldrive oI<br />

th€ compdny s exrernal auditors<br />

nomDlly ar rend Jl meel ings.<br />

Remuneration<br />

committe€<br />

choiredbu the N on executive<br />

loint Depiury Chairman<br />

Memberhip: All Non execurlve<br />

Dirccrors. The Chiilmnn normally<br />

,I rend5 meer ings by invilarion.<br />

llomination committee<br />

Choired bu the N on executive<br />

loint Deputy Chairman<br />

l\'lembeIshjpr All Non execulive<br />

Direclors and lhe chailman.<br />

Er€cutive committee<br />

Chaired by the Chairman<br />

Mem bershipr All Execolive<br />

Direcrors. Seniol Compnny<br />

€xecudves may be invird<br />

Finance committee<br />

Chairedby the senior Director<br />

present<br />

Membership: The ChaimDn and<br />

rhe Croop linance Diledor 'Ihe<br />

Croup Trensurel a(endr meetin8s,<br />

as reqdred.<br />

Cap€x committee<br />

(haired bq the Charman<br />

Membership: l hc Chairman<br />

and rhe croup Finance Dileclor<br />

Olher Directon. senior CornPany<br />

exe(uriv6 and exlemal advisers<br />

may be invjred ro anend mee(ings.

Corporate governance<br />

Cadbury Committee<br />

The Directors' report includes on pages 23 and 24 the annual statemenr of compliance wirh rhe Code of Besr practice.<br />

As recommended by the Cadbury Committee, the Board contains a balance of borh Execurive and independenl<br />

Non execurive Direcrors. The Execurive Direcrors comprise the Chairman, rhe Ioinr Depury Chairman & Group<br />

Finance Direclor, and lhe Chief Executive Officers of EMI Recorded Music and EMI Music publishing, the operaring<br />

heads of our two business divisions. The biographies of the EMI Board members appear opposire.<br />

All Directors are required to be re'elecred by shareholders at regular intervals. The appoinrmenr of<br />

each Non-executive Director is for a fixed term of not rnore lhan three years with re-appointment subject to review<br />

by the Nomination Commirree.<br />

Board committees<br />

The principal commitees dre listed opposire.<br />

Greenbury Committee<br />

The EMI Croup has complied with the disclosure requirements in respect of Directors remuneration arising from<br />

the Greenbury Committee recommendadons. These are contained within the Remuneration Committee report<br />

or paEes 25 to 3 l.<br />

Y€ar 2000<br />

As I stated last year, a steering committee has been monitoring any porenrially vulnerable systems across the croup,<br />

andwe are conJident that our operatinS systems will be fully functional when we cross the millennium threshold.<br />

As recommended by the Urgent lssues Task Force of the Accounting Standards Board, a statement on our year 2000<br />

policy and cosrs is included in rhe Operating and financial reviewon pages t6 and 17.<br />

Hampel Committee<br />

Since the publicarion ofthe HamPel <strong>Report</strong> on corporare Soverlance, the London Srock Exchange has published a<br />

consultative documenr serrinE out proposed principles of good governance and a code ofbest practice on corporate<br />

governance - the 'Combined Code, which consolidates the recomme.ndarions of rhe Greenbury and Cadbury codes<br />

with those of Hampel.<br />

I[ is the intention thar rhe combined Code will be appended ro the Lisring Rules of the London Stock Exchange.<br />

Companies will be required to disclose in lheir <strong>Annual</strong> <strong>Report</strong>s how rhey have applied principles ofgood governatce,<br />

whether they have complied with the provisions oI rhe code of best pracrice and explain any areas where rhey have<br />

not.<br />

For the EMI crouP. it is likely rhat our first compliance srarement will appear in our nexr <strong>Annual</strong> <strong>Report</strong>, for the<br />

year ended 3l March 1999. I am coffidenl that the Board will conrinue ro guide rhe Company in rhe best inreresrs of<br />

its shareholders and to meer wirh rhe principles and spirit ofgovernance of rhe new cornbined code.<br />

<br />

<br />

,--<br />

Sir Perer Wahers<br />

Joint Depury Choirnqn

Directors' report<br />

for rheyear ended 3l Mrich <strong>1998</strong><br />

The Chairman's sratement together with the operating and finalcial review il this <strong>Annual</strong> <strong>Report</strong> contain details of<br />

the principal operations of the Group during the year and likely future developments.<br />

The sale of HMV Croup (comprising HMV atd Dillons) lo HMV Media Group plc, in which the Company<br />

retains a 43.2% interest (4O.8% on a fully diluted basis) was substantially completed on 28 March <strong>1998</strong>.<br />

Dividends<br />

An inrerim dividend of 4.2 5p per Ordinary Share was paid as a Foreign Income Dividend (FID) on 6 March <strong>1998</strong>. The<br />

Board is recommending a final dividend of I 1.7 5p per Ordinary Share, making a total of 16.0p (1997: I 5.0p restated).<br />

The final dividend will be payable as a FID on Friday, 2 October <strong>1998</strong> to Ordimry shareholders on the register as at<br />

close ofbusiness on Friday, 28 AuSust <strong>1998</strong>, wirh the shales going ex-dividend on Monday 24 August <strong>1998</strong>.<br />

Share capital<br />

On 2l Iuly I 997, rhe Company effecred a share capital reorSanisation with the aim of relurninS approximately one<br />

renth of the Croup's rnarket capitalisation to shareholders on the register as at the close of business on l8 luly 1997<br />

and enhancing the Croup's financial structure.<br />

Details of the share capiral reorganisarion and shares issued during lhe year are set out in Note 23 on paSe 57.<br />

In connecrion wirh rhe share capital reorganisation, the Company purchased and cancelled its own shares, as follows:<br />

a) on I 7 June 1997. pursuanr ro the Companys rhen existin8 8eneral market purchase authority granted at the<br />

1996 Atnual Ceneral Meering, the Company made an on'market purchase of 120.000 of its own Ordinary<br />

Shares of 2 5p each for an aggregare amounr paid of f l.404.00O. This purchase was made ro simplify the ta-x<br />

consequences for the share capital reorganisariol of certain share issues rhat mitht not otherwise have been<br />

regarded as paid up by the receipt of new consideration for tax purposes; and.<br />

b) on 22 July 1997, pursuant to rhe specific authoriry tranted at the Extraordinary Ceneral Meeting of the<br />

Company held on l8 July 1997, rhe Company made an off-market purchase from Swiss Bank CorPoration of rwo<br />

ol irs own 123/tp Undesignared Shares and 13.192 of irs own l4p Ordinary Shares for an atgregate amourt paid<br />

of €7 1,642. The shares purchased represenred rhe fractional entitlements that arose lbllowing the share capital<br />

consolidation that formed part of the share caPital reorganisarion.<br />

Substantial shareholder<br />

As ar 20 May <strong>1998</strong>, lhe Company had been notified by the Prudenrial Corporation Sroup of companies that it had<br />

a material inrerest of 34.963,05 7 Ordinary Shares (4.44%) ln rhe Company s ordinary shale caPital<br />

Emplolment policies<br />

The EMI Group is a decenrralised organisarion wirh rhe aim ofemploying and developing the best people, puning<br />

them in rhe right posirions wirh a significant level of deleSaled authoriry and responsibiliry and suPPorlirg them with<br />

rhe infrastrucrure and technology required to perform ar the hi8hest levels and at the lowest costs with the quickest<br />

response time.<br />

Responsibility for employment maners therefore rests primarily wirh each business operation under the teneral<br />

urnbrella of EMI Groups policy and procedure guidelines.<br />

EMt Group companies are commifted to the maintenance of a work environment free of discdmination on the<br />

grounds of gender, nationality, ethnic or racial origin, non-job related disabiliry or marital status<br />

The inaugural meeting of the Croupb European Round Table was held in September 1997, in keePing wilh<br />

another of rhe Croups key employmenr goals of encouraSing employee involvement and communication across<br />

as wide a range of business issues as Possible.<br />

Informadon on share options Sranted to employees ls Siven in Note 23(iv) on Page 58.<br />

Supplier payment policy<br />

The Company negotiares paymenr lerms wirh its suppliers on an individual basis, with the normal spread being<br />

payment ar rhe end of rhe monfi following delivery plus 30 or 60 days. It is the Companys policy to senle the terms<br />

of payment when agreeing the terms of each transaction, to ensure that the suppliers are made aware of the rerms. and<br />

to abide by them. The number of days purchases outstanding ar 3l March <strong>1998</strong> is calculated at 22 days.<br />

Charitable and political contributions<br />

Charitable, sponsorship and fund raising activities carried out durint the year within the Group contributed some<br />

€3.6m ro charitable organisations and communities around the world. These included UK charirable donations<br />

amounrinS ao f2.lm. No UK political conlributions wete made

Research and deYelopment<br />

Research and developmenl is the responsibility of the croups businesses. During rhe year, Group expendirure on<br />

research and development rotalled €0.1m.<br />

Directors<br />

The present Directors of the Company are named on page 2O. All served as Directors rluoughout rhe year, other rhan<br />

IGdleen O Dorovan, who was appoinred a Director on 2l November 1997, Sir Dominic Cadbury who was appointed<br />

on 2O February <strong>1998</strong>, and Mr M N Bandier and Mr K M Berry who were both appointed after the year end on<br />

l7Ap l<strong>1998</strong>.<br />

Mr S McAllisrer and Mr J G Fifield also serued as Directors during the year Mr McAllisrer resitned as a Directol<br />

on 28 March <strong>1998</strong>, followin8 rhe subsranrial completion of rhe sale of HMV Croup to HMV Media Croup plc.<br />

Mr Fifield resigned as a Director on l7 April <strong>1998</strong>.<br />

As advised in the Chairman's stalement on page 5, 5t craham Day has indicared his wish lo relire as a Direcror<br />

with effect from rhe conclusion of the <strong>Annual</strong> General Meering.<br />

Sir Peter Walters retires by rctadon pursuant to Arricle 1 l2 at the <strong>Annual</strong> Ceneral Meetint and, being eligible,<br />

offers himself for re-elecrion.<br />

MI Bandier, Mr Berry Sir Dominic Cadbury and Katl e€n O'Donovan all retire ar the <strong>Annual</strong> General Meeting<br />

pursuant to Arricle I l9 and, being eligible, offer themselves for re election.<br />

No Director had a marerial interest in any contract of significance subsisting at the end of or during the year<br />

involvinS any Croup compaly, other than those who have a service conrract. Details of Direcrors' inreresrs in the<br />

shares of the Company at the year end and entidement to notice are set oul in the Remuneration Cornmittee report<br />

on pages 25 to 31.<br />

Auditors<br />

Emst & Young have expressed their willingness to continue in office as auditors and a resolurion proposing rheir<br />

reappoiffment and authorising the Directors to determine their remuneration will be put ro the <strong>Annual</strong> ceneral Meeting.<br />

Corporate governance, going conceln and internal financial control<br />

The ComPany has complied throuShout the year with the provisions of the Code of Besr Pracrice issued by the<br />

Commi[ee on the Financial Aspects of Corporare Covernance (rhe 'Cadbury Committee").<br />

The Directors, having made appropriate inquiries, believe that the Group has adequare resources ro conrinue in<br />

oPerational existence for rhe foreseeable future. For rhis reason, they continue to adopt the going concem basis in<br />

preparin6 the accounts.<br />

The Board of Directors has overall responsibiliry for the croups syslem of inremal financial confiol. The full<br />

Board meers regularly throughoul the year and a number of matters are specifically reserved for irs approval. This<br />

ensures that the Directors maintain control over siSnificant strateSic, financial and compliance ma[ers. The system<br />

of controls can provide only reasonable and not absolute assurance against material misslatement or loss.<br />

The Group has an esrablished oryanisarional structure with clearly defined lines of responsibiliry and reporting.<br />

The Board has devolved to executive manatement the responsibiliry for rhe implementation and mainrenance of the<br />

crouP's system of internal financial control. Each business unir operates in accordance with procedures and policies<br />

ser our in Croup manuals which dicrate policies applicable, in common, to all unirs.<br />

The Croup operates a comprehensive annual planning and linancial reporting process and prepares borh<br />

medium-lerm statetic Plans, which focus on key business risks, and annual budgers, both of which are formally<br />

approved by the Board. The Croup's performance is monirored a8ainst budger on a monlhly basis and all significant<br />

vadances are invesligared. The Group also has defined aurhorisalion procedures in respect oI cerrain mallers,<br />

including caPital exPenditure, investrnenrs, the Srantins of Buarantees and rhe use of financial instruments.<br />

The srrength of an internal financial control system is dependent on rhe quality and inregriry of manatemenr<br />

and staff. Intetriry is reinforced by an annual compliance cerrificarion process throughout rhe croup, under which key<br />

executives and managers siSn a cenificate confirmint their compliance with rhe Croups rnanuals.<br />

The internal financial control syslem is monitored and supporred by an inrernal audir funclion in each of rhe<br />

major business units which reports both to the Audit Comminee and management. The responsibilities of the internal<br />

audit function include assessint risks, recommendint improvements in the conrrol environmetr and ensuring<br />

comPliance wilh the Groups procedures and policies. The work of the internal audit departmenrs is focused on rhose<br />

areas lhat are considered to have the highest risk. The Audit Commlttee reviews the risk assessment and audit plan<br />

prepared by each of rhe internal audil deparrmenrs.

DliEtorC itPat cor hu.d<br />

The Board has reviewed the effectiveness of the Groups system of internal financial control as it oPerated during<br />

the year.<br />

Emst & Young have reviewed the above statements in so far as they relate to the paragraphs in the Code of Best<br />

Practice that the Iondon Stock Exchange has specified ior their review and their report is set out on page 33.<br />

lssues of share capital<br />