Annual Report – 2006-07 (full download) - Dish TV

Annual Report – 2006-07 (full download) - Dish TV

Annual Report – 2006-07 (full download) - Dish TV

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INDEX<br />

DIRECTORS’ REPORT............................................................................................... 18<br />

STATEMENT PURSUANT TO SECTION 212 .............................................................. 21<br />

CORPORATE GOVERNANCE REPORT ........................................................................ 22<br />

SHAREHOLDERS’ INFORMATION ............................................................................. 27<br />

MANAGEMENT DISCUSSION AND ANALYSIS .......................................................... 30<br />

FINANCIALS............................................................................................................. 33<br />

CASH FLOW STATEMENT ........................................................................................ 59<br />

CONSOLIDATED FINANCIAL STATEMENTS .............................................................. 61

GROUP<br />

DIRECTORS' REPORT<br />

To the Members,<br />

Your Directors take pleasure in presenting the 19 th <strong>Annual</strong> <strong>Report</strong><br />

together with the Audited Statement of Accounts of the Company for<br />

the year ended March 31, 20<strong>07</strong>.<br />

RESPONSIBILITY STATEMENT:<br />

In terms of and pursuant to Section 217(2AA) of the Companies Act,<br />

1956, your Directors, in relation to the <strong>Annual</strong> Statement of Accounts<br />

for financial year <strong>2006</strong>-20<strong>07</strong>, state and confirm that:<br />

a) the Accounts had been prepared on a 'going concern' basis and<br />

in such preparation the applicable accounting standards had<br />

been followed with proper explanation relating to material<br />

departures;<br />

b) your Directors had selected such accounting policies and applied<br />

them consistently and made judgements and estimates that are<br />

reasonable and prudent so as to give a true and fair view of the<br />

state of affairs of the Company at the end of the financial year,<br />

and of the loss of the Company for that year; and<br />

c) your Directors had taken proper and sufficient care for<br />

maintenance of adequate accounting records in accordance with<br />

the provisions of the Companies Act, 1956 as amended, for<br />

safeguarding the assets of the Company and for preventing and<br />

detecting fraud and other irregularities.<br />

FINANCIAL HIGHLIGHTS:<br />

During the year <strong>2006</strong>-20<strong>07</strong> total revenue of your Company has<br />

increased from Rs. 314.62 Million to Rs. 1,943.34 Million as compared<br />

to last year 2005-<strong>2006</strong> which is an increase around 517.66%.<br />

The financial highlights of your Company for the year ended March<br />

31, 20<strong>07</strong> are summarised below:<br />

(Rs. in Million)<br />

Particulars Year ended Year ended<br />

31.03.20<strong>07</strong> 31.03.<strong>2006</strong><br />

Sales & Services 1,909.37 314.62<br />

Other Income 33.97 Nil<br />

Total Income 1,943.34 314.62<br />

Total Expenses 4,454.16 1,189.48<br />

Profit/(Loss) before<br />

Tax and Exceptional Item (2,510.82) (874.86)<br />

Provision for Taxation (net) 2.50 0.32<br />

Profit/(Loss) after Tax<br />

before Exceptional item (2,513.33) (875.18)<br />

Add: Exceptional Item Nil 1,203.43<br />

Profit/(Loss) after Tax (2,513.33) (2,<strong>07</strong>8.61)<br />

Prior Period Adjustments (5.48) (0.29)<br />

Net - Income/(Loss)<br />

Profit/(Loss) for the Year (2,518.81) (2,<strong>07</strong>8.32)<br />

Add: Balance brought (3,268.59) (1,190.26)<br />

forward<br />

Less: Transfer to (3,268.59) Nil<br />

Restructuring Account<br />

Amount available for (2,518.81) (3,268.59)<br />

appropriations<br />

Appropriations:<br />

Dividend Nil Nil<br />

Tax on Dividend Nil Nil<br />

General Reserve Nil Nil<br />

Balance carried forward (2,518.81) (3,268.59)<br />

BUSINESS OVERVIEW:<br />

Over the last one year, a lot of effort has gone into putting the<br />

fundamentals in place in the areas of organisation development, hiring<br />

of high quality talent and further strengthening of the Sales, Distribution<br />

and Service functions. We have created an infrastructure which is<br />

equipped to handle the pressures of operating in a high growth and<br />

highly competitive service environment. In order to create a stronger<br />

customer facing organisation and improve speed to market, 7<br />

geographic zones have been carved out, each headed by an<br />

empowered senior professional. Service reach has been expanded<br />

considerably and our distribution now extends to almost 4,000 towns.<br />

A host of new features like Near Video on Demand and several new<br />

Games have strengthened our portfolio of offerings. We have also<br />

made rapid strides in urban markets, which are now increasing their<br />

contribution to the overall subscriber base. Implementation of CAS in<br />

parts of Delhi, Mumbai and Kolkata also created an opportunity that<br />

gave a fillip to the DTH Industry with a 20% switchover happening<br />

from cable to DTH. <strong>Dish</strong> <strong>TV</strong> <strong>full</strong>y leveraged this opportunity through<br />

increased marketing spends on a series of brand building and<br />

promotional initiatives in both Urban and Rural markets, thereby giving<br />

our brand a strong national footprint.<br />

All the above initiatives resulted in strong subscriber growth. We<br />

added 1.1 million subscribers, resulting in a year end subscriber<br />

base of 2.0 million, representing a dominant market share of 75%.<br />

Throughout the year, <strong>Dish</strong> <strong>TV</strong> has maintained its leadership position<br />

despite the advent of competition.<br />

DTH is a very well entrenched technology in the broadcasting industry<br />

and is one of the most prevalent modes of distribution of television<br />

channels internationally, though it is still in its infancy in India. It has<br />

various advantages over traditional cable systems. With the increase<br />

in scope of CAS in India and with rapid television penetration expansion,<br />

18

the DTH industry will continue to increase its market share in the<br />

distribution space. Your Directors are confident of this Company riding<br />

on this growth and maintaining its leadership position in the years to<br />

come.<br />

Going forward, the competition will be more intense for which<br />

strategies are in place to maintain our lead and sustain the growth on<br />

a continuous basis.<br />

DEMERGER OF BUSINESS UNDERTAKINGS:<br />

Upon receipt of approvals from the Hon'ble High Courts of Bombay<br />

and Delhi, and other Regulatory Authorities, the process of (a) demerger<br />

of the Direct Consumer Services business undertaking of Zee<br />

Entertainment Enterprises Limited (formerly known as Zee Telefilms<br />

Limited - 'ZEEL'), and (b) merger of Siti Cable Network Limited and<br />

New Era Entertainment Network Limited were success<strong>full</strong>y concluded<br />

during the year. The Scheme was approved by the Hon'ble High Court<br />

of judicature at Delhi on December 18, <strong>2006</strong> and Hon'ble High Court of<br />

judicature at Bombay on January 12, 20<strong>07</strong> and became effective from<br />

January 19, 20<strong>07</strong> on filing certified copies of High Court Orders with<br />

Registrar of Companies at Mumbai and NCT of Delhi and Haryana.<br />

Subsequently the equity shares of your Company, both those issued<br />

to the shareholders of ZEEL and the existing reorganised shares, were<br />

listed at the Stock Exchanges effective April 18, 20<strong>07</strong>.<br />

SUBSIDIARY OPERATIONS:<br />

Pursuant to the scheme of arrangement M/s. Integrated Subscriber<br />

Management Services Limited (ISML), a wholly owned subsidiary of<br />

Siti Cable Network Limited became wholly owned subsidiary of the<br />

Company with effect from April 1, <strong>2006</strong>. Pursuant to Section 212(1) of<br />

the Companies Act,1956, the Audited Accounts alongwith the Auditors'<br />

<strong>Report</strong>, Directors' <strong>Report</strong> and Cash Flow Statement of all the<br />

Subsidiary Companies are separately attached.<br />

As required by Accounting Standard-21 issued by the Institute of<br />

Chartered Accountants of India, the financial statements of the<br />

Company reflecting the Consolidation of the Accounts of its<br />

subsidiaries to the extent of equity holding of the Company in this<br />

company are included in this <strong>Annual</strong> <strong>Report</strong>.<br />

SHARE CAPITAL:<br />

During the year, as approved by the Members at the Extra Ordinary<br />

General Meeting held on September 16, <strong>2006</strong>, the share capital of the<br />

Company was sub-divided from 73,000,000 equity shares comprising<br />

of Rs.10/- each to 730,000,000 equity shares of Re.1/- each. Pursuant<br />

to the Scheme of Arrangement, besides reorganisation of the share<br />

capital, your Company had issued and allotted 249,300,890 equity shares<br />

of Re. 1/- each to shareholders of Zee Entertainment Enterprises Limited.<br />

CHANGE OF NAME:<br />

To reflect the major business segment of your Company, the Members<br />

had approved, at their meeting held on December 18, <strong>2006</strong>, change of<br />

name of the Company. Consequent to receipt of all relevant approvals,<br />

change in the name of the Company from ASC Enterprises<br />

Limited to <strong>Dish</strong> <strong>TV</strong> India Limited had become effective from<br />

March 7, 20<strong>07</strong>.<br />

PUBLIC DEPOSITS:<br />

During the year, your Company has not accepted any Deposits under<br />

Section 58A and Section 58AA of the Act, read with Companies<br />

(Acceptance of Deposits) Rules, 1975.<br />

CORPORATE GOVERNANCE:<br />

A separate report on Corporate Governance together with Auditors'<br />

Certificate on compliance is attached to this <strong>Annual</strong> <strong>Report</strong> as also a<br />

Management Discussion and Analysis statement.<br />

DIRECTORS:<br />

During the year Messrs. Punit Goenka, Rajagopalan Chandrasekhar,<br />

Laxmi Narain Goel and Ashok Kumar Goel resigned as Directors.<br />

Your Directors wish to place on record their appreciation of the<br />

contribution of these Directors.<br />

Your Board had appointed Mr. Jawahar Lal Goel, Mr. B. D. Narang,<br />

Mr. Arun Duggal and Mr. Ashok Kurien with effect from January 6,<br />

20<strong>07</strong> as Additional Directors of the Company. Mr. Jawahar Lal Goel<br />

was also appointed as the Managing Director of the Company with<br />

effect from January 6, 20<strong>07</strong>. The Shareholders of the Company had<br />

approved the appointment of all the Directors including the appointment<br />

of Mr. Jawahar Lal Goel as the Managing Director of the Company in<br />

the meeting held on February 2, 20<strong>07</strong>.<br />

Your Board had also appointed Dr. Pritam Singh with effect from April<br />

27, 20<strong>07</strong> as an Additional Director of your Company. Dr. Pritam Singh<br />

will vacate his office at the ensuing <strong>Annual</strong> General Meeting and has<br />

filed his consent to act as Director of the Company. Notice has been<br />

received from a Member of the Company under Section 257 of the<br />

Companies Act, 1956 for the appointment of Dr. Singh as Director.<br />

Appropriate resolution seeking your approval to his appointment is<br />

appearing in the Notice convening the 19 th <strong>Annual</strong> General Meeting of<br />

the Company.<br />

AUDITORS:<br />

Statutory Auditors M/s. MGB & Co., Chartered Accountants, Delhi,<br />

retire at the ensuing <strong>Annual</strong> General Meeting and, being eligible, offer<br />

themselves for re-appointment.<br />

19

GROUP<br />

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN<br />

EXCHANGE EARNINGS AND OUTGO:<br />

Information required to be provided under Section 217(1)(e) of the<br />

Companies Act, 1956 read with the Companies (Disclosure of<br />

Particulars in the <strong>Report</strong> of the Board of Directors) Rules, 1988 in<br />

relation to Conservation of Energy and Technology Absorption are<br />

currently not applicable to the Company.<br />

Particulars of foreign currency earnings and outgo during the year are<br />

given in Schedule 35.3 to the Notes to the Accounts forming part of<br />

the <strong>Annual</strong> Accounts.<br />

PARTICULARS OF EMPLOYEES:<br />

Information required to be furnished in terms of Section 217(2A) of the<br />

Companies Act, 1956 ('Act') read with the Companies (Particulars of<br />

Employees) Rules, 1975 is required to be set out in an annexure to<br />

this report. However, in terms of Section 219(1)(b) of the Act, the<br />

<strong>Report</strong> and Accounts are being sent to the shareholders excluding the<br />

aforesaid annexure. Any shareholder interested in obtaining copy of<br />

the same may write to the Company Secretary at the Corporate Office.<br />

None of the employees listed in the said annexure are related to any<br />

Director of the Company.<br />

ACKNOWLEDGEMENTS:<br />

Your Directors take this opportunity to place on record their<br />

appreciation of the dedication and commitment of employees at all<br />

levels that has contributed to the success of your Company. Your<br />

Directors thank and express their gratitude for the support and cooperation<br />

received from the Central and State Governments - mainly<br />

the Ministry of Information and Broadcasting and the Department of<br />

Telecommunications - and other stakeholders including viewers,<br />

vendors, bankers, investors, service providers as well as regulatory<br />

and Governmental authorities.<br />

For and on behalf of the Board of Directors<br />

Place : Noida Jawahar Lal Goel B. D. Narang<br />

Date : June 28, 20<strong>07</strong> Managing Director Director<br />

20

STATEMENT PURSUANT TO SECTION 212 OF THE COMPANIES<br />

ACT, 1956 RELATING TO SUBSIDIARY COMPANIES<br />

1. Name of the subsidiary Integrated Subscriber Agrani Satellite Agrani Convergence<br />

Management Services Limited Limited<br />

Services Limited<br />

2. Financial year ended March 31, 20<strong>07</strong> March 31, 20<strong>07</strong> March 31, 20<strong>07</strong><br />

3. Holding Company’s interest 100% 100% 51%<br />

4. Share held by the Holding Company in the subsidiary 50,000 Equity 94,401,004 Equity 12,470,544 Equity<br />

Shares of Rs. 10/- each Shares of Rs. 10/- each Shares of Rs. 10/- each<br />

5. The net aggregate of profits or (losses) for the current<br />

financial year of the subsidiary so far as it concerns<br />

the members of the Holding Company<br />

a) dealt with or provided for in the accounts of the Holding Company Nil Nil Nil<br />

b) not dealt with or provided for in the accounts of the Holding Company Rs. (2,270,636) Nil Rs. (4,288,463)<br />

6. The net aggregate of profits or losses for the current<br />

financial year of the subsidiary so far as it concerns<br />

the members of the Holding Company<br />

a) dealt with or provided for in the accounts of the Holding Company Nil Nil Nil<br />

b) not dealt with or provided for in the accounts of the Holding Company Rs. 9,655,527 Nil Rs. (401,564,324)<br />

Note : As the financial year of the subsidiary companies coincides with the financial year of the Holding Company, Section 212(5) of the Companies Act, 1956 is not<br />

applicable.<br />

For and on behalf of the Board<br />

Jawahar Lal Goel<br />

Managing Director<br />

Rajeev K. Dalmia<br />

Chief Financial Officer<br />

B. D. Narang<br />

Director<br />

Jagdish Patra<br />

Company Secretary<br />

Place : Noida<br />

Date : June 28, 20<strong>07</strong><br />

21

GROUP<br />

REPORT ON CORPORATE GOVERNANCE<br />

The Company confirms that it has complied with all mandatory<br />

requirements to Clause 49 of the Listing Agreement. The Equity Shares<br />

of the Company got listed on the National Stock Exchange (NSE) and the<br />

Bombay Stock Exchange (BSE) on April 18, 20<strong>07</strong> and on the Calcutta<br />

Stock Exchange (CSE) on June 6, 20<strong>07</strong>. Although the provisions pertaining<br />

to the Listing Agreement is not strictly applicable as on March 31, 20<strong>07</strong>,<br />

however as a good management practice, we have provided information<br />

upto the date of approval of the <strong>Annual</strong> Accounts i.e. June 28, 20<strong>07</strong>.<br />

BOARD'S PHILOSOPHY ON CORPORATE GOVERNANCE<br />

At <strong>Dish</strong> <strong>TV</strong> we firmly believe that good corporate governance is critical<br />

to sustaining corporate development, increasing productivity and<br />

competitiveness. The governance process should ensure that the<br />

available resources are utilised in a manner that meets the aspirations<br />

of all its stakeholders. Your Company's essential charter is shaped<br />

by the objectives of transparency, professionalism and<br />

accountability. The Company continuously endeavour to improve on<br />

these aspects on an ongoing basis.<br />

Company believes that Corporate Governance is the commitment to<br />

compliance with all Laws, Rules and Regulations that apply to it with<br />

the spirit and intent of high business ethics, honesty and integrity<br />

resulting in the effective control and management system in the<br />

organisation leading towards the enhancement of medium and long<br />

term shareholders’ value and interest of other stakeholders. It brings<br />

into focus the fiduciary and the trusteeship role of the Board to<br />

align and direct the actions of the organisation towards creating wealth<br />

and shareholders’ value.<br />

BOARD OF DIRECTORS<br />

a) Composition and Category of Directors<br />

<strong>Dish</strong> <strong>TV</strong> Board has an optimum combination of Executive and<br />

Non-Executive Directors, to ensure independent functioning. Non-<br />

Executive Directors include persons drawn from amongst<br />

eminent professionals with experience in business/finance/<br />

taxation/technology.<br />

Composition of the Board as on June 28, 20<strong>07</strong><br />

22<br />

Category of Directors No. of % to total<br />

Directors No. of<br />

Directors<br />

Executive Director 1 17<br />

Independent Directors 3 50<br />

Other Non-Executive Directors 2 33<br />

Total 6 100<br />

The particulars of Directors, their attendance at the <strong>Annual</strong> General<br />

Meeting and Board Meetings held from April 1, <strong>2006</strong> up till June<br />

28, 20<strong>07</strong> and also their other directorships in Public Companies<br />

and membership of Audit Committee and Shareholders' Grievance<br />

Committee as on June 28, 20<strong>07</strong> are as under:<br />

Name of Category Attendance at No. of No. of<br />

Director Board 18th Directorship Member-<br />

Meetings AGM held of other ships of<br />

(Total 26 on Sept. 29, Companies Board Sub-<br />

Meetings) <strong>2006</strong> Committees<br />

Mr. Subhash PD,NED 1 No 7 1<br />

Chandra<br />

(Chairman)<br />

Mr. Jawahar ED 9 N.A 8 1<br />

Lal Goel*<br />

(Managing<br />

Director)<br />

Mr. Ashok PD,NED 5 N.A 2 3<br />

Kurien**<br />

Mr. B. D. NED,ID 6 N.A 3 2<br />

Narang**<br />

Mr. Arun NED,ID 5 N.A 9 5<br />

Duggal**<br />

Dr. Pritam NED,ID 1 N.A 3 4<br />

Singh***<br />

Mr. Rajagopalan NED,ID 4 No N.A N.A<br />

Chandrasekhar****<br />

Mr. Laxmi PD,NED – No N.A N.A<br />

Narain<br />

Goel****<br />

Mr. Ashok PD,NED 18 Yes N.A N.A<br />

Kumar<br />

Goel****<br />

Mr. Punit PD,NED 18 Yes N.A N.A<br />

Goenka****<br />

* Appointed as Additional Director and also Managing Director w.e.f. January<br />

6, 20<strong>07</strong>.<br />

** Appointed as Additional Director w.e.f. January 6, 20<strong>07</strong>.<br />

*** Appointed as Additional Director w.e.f. April 27, 20<strong>07</strong>.<br />

****Resigned as Director w.e.f. January 6, 20<strong>07</strong>.<br />

PD: Promoter Director<br />

ED: Executive Director<br />

(b)<br />

NED: Non-Executive Director<br />

ID: Independent Director<br />

From April 1, <strong>2006</strong> till June 28, 20<strong>07</strong>, 26 meetings of the Board<br />

were held on April 11, <strong>2006</strong>, April 27, <strong>2006</strong>, May 10, <strong>2006</strong>, May<br />

18, <strong>2006</strong>, August 8, <strong>2006</strong>, August 18, <strong>2006</strong>, August 21, <strong>2006</strong>,<br />

August 25, <strong>2006</strong>, August 30, <strong>2006</strong>, September 25, <strong>2006</strong>, October<br />

4, <strong>2006</strong>, October 27, <strong>2006</strong>, November 4, <strong>2006</strong>, November 15,<br />

<strong>2006</strong>, November 24, <strong>2006</strong>, November 27, <strong>2006</strong>, December 1,<br />

<strong>2006</strong>, January 6, 20<strong>07</strong>, January 23, 20<strong>07</strong>, February 22, 20<strong>07</strong>,<br />

March 2, 20<strong>07</strong>, March 15, 20<strong>07</strong>, March 22, 20<strong>07</strong>, April 10, 20<strong>07</strong>,<br />

April 27, 20<strong>07</strong> and June 28, 20<strong>07</strong>. The intervening period between<br />

the Board Meetings were well within the maximum time gap<br />

prescribed under Companies Act, 1956 and Clause 49 of the<br />

Listing Agreement.<br />

Board Meetings of the Company are governed by a structured<br />

agenda. The Company Secretary in consultation with

Chairman/Managing Director drafts agenda of the Board<br />

Meetings. All major agenda items, backed up by<br />

comprehensive background information, are sent well in<br />

advance of the date of the Board meetings to enable the Board<br />

to take informed decision. Any Board member may, in<br />

consultation with the Chairman, bring up any matter for<br />

consideration by the Board. The Chief Executive Officer and<br />

Heads of Departments of Finance and Projects are normally<br />

invited to attend the Board meetings to provide necessary<br />

insights into the working of the Company and discussing<br />

corporate strategies.<br />

The Board periodically reviews Compliance <strong>Report</strong>s in respect<br />

of laws and regulations applicable to the Company.<br />

Brief profile of the Directors:<br />

1. Mr. Subhash Chandra : Mr. Chandra is the Chairman of Zee<br />

Entertainment Enterprises Limited and promoter of Essel<br />

Group of Companies. His leading industry businesses<br />

includes, television networks and film entertainment, cable<br />

systems, satellite communications, theme parks, flexible<br />

packaging, family entertainment centres and online gaming.<br />

Mr. Chandra leads the Board of Directors and works together<br />

with heads of various businesses and the corporate team<br />

to help set Zee's strategy.<br />

Mr. Chandra has been the recipient of numerous honorary<br />

degrees, industry awards and civic honours, including being<br />

named 'Global Indian Entertainment Personality of the Year'<br />

by FICCI for 2004, 'Business Standard's Businessman of<br />

the Year' in 1999, 'Entrepreneur of the Year' by Ernst &<br />

Young in 1999 and 'Enterprise CEO of the Year' by<br />

International Brand Summit. The Confederation of Indian<br />

Industry (CII) chose Mr. Chandra as the Chairman of the CII<br />

Media Committee for two successive years. Mr. Chandra<br />

has made his mark as an influential philanthropist in India.<br />

He set up TALEEM (Transnational Alternate Learning for<br />

Emancipation and Empowerment through Multimedia), an<br />

organisation which seeks to provide access to quality<br />

education and to promote research in various disciplines<br />

relating to health & family life, social & cultural<br />

anthropology, communication and media. He is also the<br />

trustee for the Global Vippassana Foundation a trust set up<br />

for helping people in spiritual upliftment.<br />

2. Mr. Jawahar Lal Goel : Mr. Goel took the position of<br />

Managing Director of the Company on January 6, 20<strong>07</strong>.<br />

Mr. Goel is actively involved in creation and expansion of<br />

Essel Group of Industries. He heads the business of <strong>Dish</strong><br />

<strong>TV</strong>. He has been a prophet in pioneering the Direct To Home<br />

(DTH) services in India and instrumental in establishing<br />

<strong>Dish</strong> <strong>TV</strong> as a prominent brand with India's most modern<br />

and advanced technological infrastructure.<br />

Mr. Goel is the President of Indian Broadcasting Foundation<br />

which takes up various issues relating to Broadcasting<br />

industry at various forums. He is active member on the<br />

Board of various committees and task force set up by<br />

Ministry of Information & Broadcasting, Government of India<br />

which takes care of several critical matters relating to the<br />

industry. He is a prime architect in establishing India's<br />

most modern and advanced technological infrastructure<br />

for the implementation of Conditional Access System (CAS)<br />

and Direct To Home (DTH) services through "HITS" which<br />

would bring a revolution in the distribution of various<br />

entertainment and electronic media products in India in<br />

the ensuing months and would enormously benefit<br />

consumers (<strong>TV</strong> viewers).<br />

3. Mr. B. D. Narang : Mr. Narang is a Post Graduate in<br />

Agricultural Economics and brings with him 32 years of<br />

Banking experience. During this period, he also held the<br />

coveted position of the Chairman and Managing Director<br />

of Oriental Bank of Commerce.<br />

Mr. Narang has handled special assignments viz. alternate<br />

Chairman of the Committee on Banking procedures set up<br />

by Indian Banks Association for the year 1997-98, Chaired a<br />

Panel on serious financial frauds appointed by R.B.I., Chaired<br />

a Panel on financial construction industry appointed by Indian<br />

Banks Association, Appointed as Chairman of Governing<br />

Council of National Institute of Banking Studies & Corporate<br />

Management, Elected Member Management Committee of<br />

Indian Banks Association, Member of the Advisory Council<br />

of Bankers Training College (RBI) Mumbai, Chairman of IBA's<br />

Advisory Committee on NPA Management, CDR Mechanism,<br />

DRT, ARC etc. Elected as a Fellow and Member of Governing<br />

Council of the Indian Institute of Banking & Finance, Mumbai,<br />

Elected as Deputy Chairman of Indian Banks Association,<br />

Mumbai and recipient of Business Standard "Banker of the<br />

Year" Award for 2004. Presently he is Independent Director<br />

on the Board of National Investment Fund, M/s Shivam<br />

Autotech Ltd., M/s IST Steel & Power Ltd., M/s Jubilee Hills<br />

Landmark Projects Ltd., Member of Expert group formed for<br />

examining problem of distressed farmers - nominated by<br />

RBI, Member of the Committee to oversee the working of<br />

National Education & Investor Fund - Nominated by Ministry<br />

of Co. Affairs, Goverment of India, Member Supervisory Board<br />

of NABARD. Beside this he is advisor on the Board of KARMA<br />

FOUD and Consultant of M/s Revathi Equipment Ltd. for private<br />

equity business, DSP Merrillynch for India related business<br />

and M/s Dhir & Dhir Associate Law Firm.<br />

4. Mr. Arun Duggal : Mr. Duggal, a Mechanical Engineer from<br />

the prestigious Indian Institute of Technology, Delhi and<br />

holds an MBA from the Indian Institute of Management,<br />

Ahmedabad. He teaches Banking & Finance at the Indian<br />

Institute of Management, Ahmedabad as a visiting<br />

Professor.<br />

Mr. Duggal, is an experienced international Banker,<br />

advising Corporations on Financial Strategy, M&A and<br />

Capital Raising areas and an International Advisor to a<br />

number of Corporations, major Financial Institutions and<br />

Private Equity firms.<br />

Mr. Duggal is the Vice Chairman (non executive) of<br />

International Asset Reconstruction, a de novo Company<br />

engaged in managing Non Performing Loan portfolios. He<br />

is on the Board of Directors of Jubilant Energy Ltd. Canada,<br />

23

GROUP<br />

24<br />

Patni Computer Systems Ltd. (Chairman, Audit Committee),<br />

Fidelity Fund Management, Petronet LNG (Nominee<br />

Director of Asian Development Bank and Chairman, Audit<br />

Committee), Manipal AcuNova (Chairman - Investment and<br />

Finance Committee), Zuari Industries, Pragati Capfin Ltd.,<br />

Info Edge (India) Ltd. (Chairman - Audit Committee), The<br />

Economist Intelligence Unit (India), Shriram Transport<br />

Finance Company (Chairman), Shriram Properties Ltd.<br />

(Chairman), Shriram City Union Finance Limited (Chairman)<br />

and Mundra Port & Special Economic Zone Ltd. He was<br />

also on the Board of Governors of the National Institute of<br />

Bank Management and erstwhile Chairman of the American<br />

Chamber of Commerce, India.<br />

5. Mr. Ashok Kurien : Mr. Kurien, is a well known personality<br />

in the advertising world. He is the Chairman of Ambience<br />

Publicis, Publicis India and Solutions-Publicis India. He is<br />

also the promoter-Director of Zee Entertainment Enterprises<br />

Limited (ZEEL) which has in its fold flagship channel Zee<br />

<strong>TV</strong>, India's first private satellite channel.<br />

6. Dr. Pritam Singh : Dr. Singh is an M.Com (BHU), MBA (USA),<br />

Ph.D. (BHU), and author of seven academically reputed<br />

books and published over 50 research papers.<br />

Dr. Singh is one of the pioneers of management education in<br />

India and abroad. He initiated a number of social projects<br />

focusing on Healthcare, Education, Water Management and<br />

Road Building for the surrounding community to improve<br />

the quality of life. Owing to his contributions towards building<br />

intellectual capital at Administrative Staff College and<br />

refocusing of IIM, Bangalore as a truly integrated management<br />

school, he is branded as a Change Master par excellence<br />

and a Renaissance leader. Currently he is on the Board of<br />

Shipping Corporation of India, Hero Honda Motors Limited,<br />

Parsvnath Developers Limited and Local Board of Reserve<br />

Bank of India. Dr. Singh’s distinguished services were<br />

acknowledged by the country when the President of India<br />

conferred on him the prestigious ‘Padma Shri’ in year 2003.<br />

He has also been conferred with many other prestigious<br />

management awards. Notable among them are ESCORT<br />

Award (1979 and 2002), FORE Award (1984), Best Motivating<br />

Professor IIM Bangalore Award (1993), Best Director Award<br />

of Indian Management Schools (1998), Outstanding CEO<br />

(Chief Executive Officer) National HRD Award (2001) UP<br />

RATNA Award (2001), Wisitex Foundation Award – Eminent<br />

Personality of the Decade (2002) TIEUP California USA<br />

Outstanding Entrepreneur Award (2002), IMM Outstanding<br />

Management Educator Award (2002), Managerial GRID<br />

Leadership Excellence Award (2002).<br />

Code of Conduct<br />

The Board of Directors at its meeting held on January 6,<br />

20<strong>07</strong> have approved and adopted Code of Conduct for<br />

Members of the Board of Directors and Senior Management<br />

of the Company. The Code has been posted on Company's<br />

website viz. www.dishtv.in<br />

A declaration affirming compliance with the Code of Conduct<br />

by the members of the Board and Senior Management is<br />

annexed herewith and forms part of this report.<br />

Declaration<br />

All Directors and Senior Management of the Company<br />

have affirmed compliance with the Code of Conduct for<br />

the financial year ended March 31, 20<strong>07</strong>.<br />

Jawahar Lal Goel<br />

Managing Director<br />

Noida, June 28, 20<strong>07</strong><br />

BOARD COMMITTEES<br />

a) Audit Committee<br />

The Board has constituted the Audit Committee, all the Members<br />

of the Committee being Non-Executive Directors. The Chairman<br />

of the Committee, Mr. B. D. Narang, is an Independent Director.<br />

The role and the powers of the Audit Committee are as per the<br />

guidelines set out in the Listing Agreement with the Stock<br />

Exchanges and provisions of Section 292A of the Companies<br />

Act, 1956. The Committee meets periodically and reviews:<br />

Audited and unaudited financial results,<br />

Internal audit reports and report on internal control systems<br />

of the Company,<br />

Business plans, and various reports placed by the<br />

Management,<br />

Discusses the larger issues that could be of vital concern<br />

to the Company including adequacy of Internal Controls,<br />

reliability of financial statements/other management<br />

information, adequacy of provisions for liabilities and<br />

whether the audit tests are appropriate and scientifically<br />

carried out in accordance with Company's business and<br />

size of operations.<br />

The Audit Committee also reviews adequacy of disclosures and<br />

compliance with all relevant laws. In addition to the foregoing, in<br />

compliance with requirements of Clause 49 of the Listing<br />

Agreement, the Audit Committee reviews operations of subsidiary<br />

companies viz. its financial statement, significant related party<br />

transactions, statement of investments and minutes of meeting<br />

of the Board and Committees.<br />

During the period under review, Audit Committee met thrice i.e.<br />

on August 30, <strong>2006</strong>, February 22, 20<strong>07</strong> and June 28, 20<strong>07</strong>.<br />

Present composition of Audit Committee of the Board, in<br />

accordance with the applicable guidelines and rules, during the<br />

period under review is as follows:<br />

Name of Category Date of Date of<br />

Directors Appointment Cessation<br />

Mr. B. D. Non- January 6, NA<br />

Narang Executive- 20<strong>07</strong><br />

Independent<br />

Mr. Arun Non- January 6, NA<br />

Duggal Executive- 20<strong>07</strong><br />

Independent<br />

Mr. Ashok Non- January 6, April 27,<br />

Kurien Executive 20<strong>07</strong> 20<strong>07</strong><br />

Dr. Pritam Non- April 27, 20<strong>07</strong> NA<br />

Singh Executive-<br />

Independent

Statutory Auditors, Chief Executive Officer and Chief Financial<br />

Officer of the Company attend meetings of the Committee.<br />

The Company Secretary is the Secretary of the Audit<br />

Committee.<br />

b) Remuneration Committee and Policy<br />

The Remuneration Committee of the Company comprises of<br />

Mr. B. D. Narang, Non-Executive Independent Director as<br />

Chairman, Mr. Arun Duggal, Non-Executive Independent Director<br />

and Dr. Pritam Singh, Non-Executive Independent Director. The<br />

Company Secretary is the Secretary of the Committee.<br />

The terms of reference of the Remuneration Committee, inter alia,<br />

consist of reviewing the overall compensation policy, service<br />

agreements and other employment conditions of Executive<br />

Directors. The remuneration of Executive Directors is decided by<br />

the Board of Directors on the recommendation of the Remuneration<br />

Committee as per the remuneration policy of the Company within<br />

the overall ceiling approved by shareholders.<br />

During the period under review, Remuneration Committee met<br />

only once on January 6, 20<strong>07</strong>, which was attended by all<br />

members.<br />

Details of the remuneration paid to Managing Director till<br />

March 31, 20<strong>07</strong> :<br />

Name Position Remuneration (Rs.) Employer's<br />

Salary Contribution<br />

and to Provident<br />

Allowances Fund<br />

Mr. Jawahar Managing 1,225,613 68,129<br />

Lal Goel Director<br />

Remuneration payable to Non-Executive Director<br />

Within the limits specified under the Companies Act, 1956 and<br />

approved by the Board, all the Non-Executive Directors are entitled<br />

for sitting fees of Rs. 10,000/- per meeting for attending the<br />

Meetings of the Board, Audit and Remuneration Committee with<br />

effect from March, 20<strong>07</strong>.<br />

c) Share Transfer and Investor Grievance Committee<br />

The Share Transfer and Investors Grievance Committee of the<br />

Board comprises of Mr. Ashok Kurien, Non-Executive Director<br />

as Chairman and Mr. Jawahar Lal Goel, Managing Director as<br />

Member. The Company Secretary is the Secretary of the<br />

Committee.<br />

Main functions of the Share Transfer and Investor Grievance<br />

Committee is to supervise and ensure efficient transfer of shares<br />

and proper and timely attendance of investors' grievances.<br />

Mr. Jagdish Patra, Company Secretary is the Compliance Officer<br />

of the Company.<br />

During the period under review, Share Transfer and Investor<br />

Grievance Committee met once on May 30, 20<strong>07</strong>. The meeting<br />

was attended by all committee members.<br />

Details of number of requests/complaints received and resolved<br />

since listing till as on date:<br />

Nature of Received Replied/ Pending<br />

Correspondence<br />

Resolved<br />

Request for Transfer/ 9 9 –<br />

Transmission/Demat/Remat<br />

Non-receipt of Certificate 12 12 –<br />

Non-receipt of Warrant 4 4 –<br />

Miscellaneous Letters 37 37 –<br />

ANNUAL GENERAL MEETINGS<br />

The 19 th <strong>Annual</strong> General Meeting of the Company for the year 20<strong>07</strong><br />

will be held on Friday, the 3 rd day of August, 20<strong>07</strong> at Seven Seas, B-28,<br />

Ring Road, Lawrence Road, Industrial Area, Delhi-110 035 at 3 P. M.<br />

Details of <strong>Annual</strong> General Meetings held during last 3 years are as<br />

follows:<br />

Meeting Day, Date and Venue<br />

Time of the Meeting<br />

18th AGM Friday, September B-10, Lawrence<br />

29, <strong>2006</strong>, 1130 Hrs. Road, Industrial<br />

Area, Delhi - 110 035<br />

17th AGM Friday, September B-10, Lawrence<br />

30, 2005, 1130 Hrs. Road, Industrial<br />

Area, Delhi - 110 035<br />

16th AGM Thursday, September B-10, Lawrence<br />

30, 2004, 1130 Hrs. Road, Industrial<br />

Area, Delhi - 110 035<br />

No Special Resolution was passed during the last three <strong>Annual</strong> General<br />

Meetings of the Company.<br />

DISCLOSURES<br />

There are no materially significant related party transactions i.e.<br />

transaction material in nature, between the Company and its<br />

promoters, directors or management or their relatives etc. having<br />

any potential conflict with interests of the Company at large.<br />

Transactions with related parties are disclosed elsewhere in the <strong>Annual</strong><br />

<strong>Report</strong>.<br />

There has not been any non-compliance by the Company and no<br />

penalties or strictures imposed by SEBI or Exchanges or any statutory<br />

authority on any matter relating to capital markets, during the last<br />

three years.<br />

MEANS OF COMMUNICATION<br />

The Company has promptly reported all material information including<br />

declaration of financial results, press releases, etc. to all Stock<br />

Exchanges where the securities of the Company are listed. Such<br />

information is also simultaneously displayed immediately on the<br />

Company's website, www.dishtv.in. The financial results and other<br />

statutory information were communicated to the shareholders by way<br />

of an advertisement in a English daily and in a vernacular language<br />

newspaper as per requirements of the Stock Exchanges.<br />

Official news releases and presentations made to institutional<br />

investors or to the analysts are displayed on Company's<br />

website, www.dishtv.in.<br />

Management Discussions and Analysis <strong>Report</strong> forming part of <strong>Annual</strong><br />

<strong>Report</strong> is annexed separately.<br />

SHAREHOLDERS' INFORMATION<br />

The required information is provided in Shareholders' Information<br />

Section.<br />

25

GROUP<br />

AUDITORS’ CERTIFICATE<br />

To,<br />

The Members of<br />

<strong>Dish</strong> <strong>TV</strong> India Limited<br />

We have examined the compliance of conditions of Corporate Governance by <strong>Dish</strong> <strong>TV</strong> India Limited, for the period from April 1, <strong>2006</strong> to June<br />

28, 20<strong>07</strong> as stipulated in Clause 49 of the Listing Agreement of the said Company with the Stock Exchanges.<br />

The compliance of conditions of Corporate Governance is the responsibility of the management. Our examination was limited to procedures<br />

and implementation thereof, adopted by the Company for ensuring the compliance of the conditions of the Corporate Governance. It is neither<br />

an audit nor an expression of opinion on the financial statements of the Company.<br />

In our opinion and to the best of our information and according to the explanations given to us and the representations made by the management,<br />

we certify that the Company has complied with the conditions of Corporate Governance as stipulated in Clause 49 of the Listing Agreement.<br />

We state that generally no investor grievances are pending for a period exceeding 30 days against the Company as per the records maintained<br />

by the Company.<br />

We further state that such compliance is neither an assurance as to the future viability of the Company nor the efficiency or effectiveness with<br />

which the management has conducted the affairs of the Company.<br />

L. K. Shrishrimal<br />

Partner<br />

M. No. 72664<br />

For and on behalf<br />

MGB & Co.,<br />

Chartered Accountant<br />

Place : Noida<br />

Date : June 28, 20<strong>07</strong><br />

26

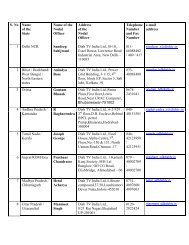

SHAREHOLDERS' INFORMATION<br />

1. Date, Time and Venue of Shareholders' Meeting Meeting : <strong>Annual</strong> General Meeting<br />

Day and Date : Friday, 3rd August, 20<strong>07</strong><br />

Time : 3 P. M.<br />

Venue : Seven Seas, B-28, Ring Road, Lawrence Road,<br />

Industrial Area, Delhi - 110 035<br />

2. Financial Year <strong>2006</strong>-20<strong>07</strong><br />

3. Date of Book Closure Monday, July 30, 20<strong>07</strong> to Friday, August 3, 20<strong>07</strong> (Both days inclusive)<br />

4. Registered Office B-10, Essel House, Lawrence Road, Industrial Area, Delhi -110 035<br />

Tel: +91 11 27101145, Fax: + 91 11 27186561, Website: www.dishtv.in<br />

5. Listing on Stock Exchanges The Bombay Stock Exchange Limited (BSE)<br />

The National Stock Exchange of India Limited (NSE)<br />

The Calcutta Stock Exchange Association Limited (CSE)<br />

6. Stock Code 532839 (Bombay Stock Exchange)<br />

DISH<strong>TV</strong> (National Stock Exchange)<br />

7. ISIN No. Equity - INE836F01026<br />

8. Registrar & Share Transfer Agent Sharepro Services (India) Pvt. Ltd.<br />

Unit: <strong>Dish</strong> <strong>TV</strong> India Ltd. Satam Estate, 3rd Floor, Above Bank of Baroda,<br />

Cardinal Gracious Road, Chakala, Andheri (E), Mumbai - 400 099<br />

Tel: +91 22 2821 5168/2832 9828 , Fax: +91 22 2839 2259/2837 5646<br />

Email: sharepro@vsnl.com<br />

9. Investor Relation Officer Mr. Ranjit Srivastava - Asst. Company Secretary<br />

<strong>Dish</strong> <strong>TV</strong> India Limited, FC-19, Sector 16 A, Noida - 201 301, U.P., India<br />

Tel: +91-120-2511064/78, Fax: +91-120-2488777, Email: cs@dishtv.in<br />

10. Change of Address<br />

Members holding equity shares in physical form are requested to notify the change of address, if any, to the Company's Registrar & Share<br />

Transfer Agent, at the address mentioned above.<br />

Members holding equity shares in dematerialised form are requested to notify the change of address if any, to their respective Depository<br />

Participant (DP).<br />

11. Share Transfer System<br />

Equity Shares sent for physical transfer or for dematerialisation are generally registered and returned within a period of 15 days from the<br />

date of receipt of completed and validly executed documents.<br />

12. Dematerialisation of Equity Shares & Liquidity<br />

As per extant guidelines Trading in equity shares of the Company is mandatory in dematerialised form. To facilitate trading in demat form,<br />

there are two depositories i.e. National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL).<br />

The Company has entered into agreements with both these depositories. Shareholders can open account with any of the Depository<br />

Participant registered with any of these two depositories. As on date 57.69% of the equity shares of the Company are in the dematerialised<br />

form.<br />

13. Shareholders' Correspondence<br />

We endeavour to reply all letters received from the shareholders within a period of 7 working days.<br />

All correspondence may be addressed to the Registrar & Share Transfer Agent at the address given above. In case any shareholder is not<br />

satisfied with the response or do not get any response within reasonable period, they may approach the Investor Relation Officer at the<br />

address given above.<br />

27

GROUP<br />

14. Stock Market Data Relating to Shares Listed in India<br />

a. Monthly high and low quotations and volume of shares traded on Bombay Stock Exchange and National Stock Exchange for the<br />

period April, May and June 20<strong>07</strong> (upto June 28, 20<strong>07</strong>) are:<br />

BSE<br />

NSE<br />

Month High Low High Low<br />

(Rs.) (Rs.) (Rs.) (Rs.)<br />

April 20<strong>07</strong> 120 97.25 117 96.5<br />

May 20<strong>07</strong> 142.8 1<strong>07</strong>.5 142.8 1<strong>07</strong>.5<br />

June 20<strong>07</strong> 136.2 100.7 135.85 101.00<br />

Distribution of Shareholding as on June 22, 20<strong>07</strong><br />

No. of Equity Shares<br />

Shareholders<br />

No. of Shares<br />

Number % of Holders Number % of Shares<br />

Up to 5000 117465 99.32 14759351 3.45<br />

5001-10000 319 0.27 2266195 0.53<br />

10001-20000 135 0.11 1941023 0.45<br />

20001-30000 70 0.06 1710425 0.40<br />

30001-40000 29 0.03 1026959 0.24<br />

40001-50000 25 0.02 1147852 0.27<br />

50001-100000 44 0.04 3136212 0.73<br />

100001 and Above 180 0.15 402234786 93.93<br />

TOTAL 118267 100.00 428222803 100.00<br />

Categories of Shareholders as on June 22, 20<strong>07</strong><br />

Category No. of Shares held % of Shareholding<br />

Promoters 248335772 57.99<br />

Individuals 15580873 3.64<br />

Domestic Companies 16532773 3.86<br />

FIs, Mutual Funds and Banks 38548738 9.00<br />

FIIs, OCBs & NRI 109224647 25.51<br />

TOTAL 428222803 100.00<br />

28

Top ten (10) Shareholders as on June 22, 20<strong>07</strong><br />

Sr. No. Name No. of Shares held % of Shareholding<br />

1. Veena Investments Pvt. Ltd. 76497825 17.86<br />

2. Afro-Asian Satellite Communications 35172125 8.21<br />

3. Jayneer Capital Pvt. Ltd. 34399354 8.03<br />

4. Charu Trading Co. Pvt. Ltd. 26858508 6.27<br />

5. Ganjam Trading Co. Pvt. Ltd. 16876987 3.94<br />

6. Premier Finance & Leasing Ltd. 12859855 3.00<br />

7. Prajatama Trading Co. Pvt. Ltd. 11998875 2.80<br />

8. Life Insurance Corporation of India 11719541 2.74<br />

9. Oppenheimer Funds Inc. A/c Oppenheimer 10934339 2.55<br />

10. Delgrada Limited 10420293 2.43<br />

TOTAL 247737702 57.85<br />

DISH <strong>TV</strong> SHARE PATTERN AS ON JUNE 22, 20<strong>07</strong><br />

25.51<br />

Promoters<br />

Individuals<br />

9.00<br />

3.86<br />

3.64<br />

57.99<br />

Domestic Companies<br />

Fls, Mutual Funds & Banks<br />

Flls, OCBs & NRI<br />

SHAREHOLDERS SERVICES<br />

Compliance Officer<br />

Jagdish Patra<br />

Company Secretary & Compliance Officer<br />

<strong>Dish</strong> <strong>TV</strong> India Ltd.<br />

FC-19, Sector 16 A, Noida - 201 301, U.P., India<br />

Tel. : +91-120-2511064<br />

Fax : +91-120-2488777.<br />

29

GROUP<br />

MANAGEMENT DISCUSSION AND ANALYSIS REPORT<br />

Your Directors are pleased to present the Management Discussion<br />

and Analysis <strong>Report</strong> for the year ended March 31, 20<strong>07</strong>.<br />

DISH <strong>TV</strong> - AN OVERVIEW<br />

The total number of <strong>TV</strong> owning households in India is estimated at 117<br />

million. This represents a 54% penetration of <strong>TV</strong> in Indian households.<br />

Out of this, Cable and Satellite households are 68 million. The DTH<br />

industry is currently pegged at 2.6 million subscribers. India is also<br />

one of the fastest growing and largest television markets in the world.<br />

Television households are estimated to grow to 165 million in 2011,<br />

resulting in an annual compounded growth rate of 6.5% p.a. The Indian<br />

Entertainment & Media Industry is estimated to be Rs. 450 billion and<br />

is on a growth overdrive, with a conservative projected compounded<br />

annual growth rate of 18% over the next 5 years. The DTH Industry<br />

revenue is expected to grow @ 80% compounded per annum over the<br />

next 5 years and will be in the range of Rs.100 billion in 2011.<br />

Due to the continued buoyancy in the Indian economy and an annual<br />

growth rate of over 9%, the country's Gross Domestic Product is<br />

touching US$ One trillion. This, coupled with increasing penetration<br />

of <strong>TV</strong>s, will give a boost to the demand for better quality products like<br />

DTH. In terms of sheer numbers, DTH subscribers are expected to<br />

touch 27 million in 2011 and 61 million in 2015.<br />

The industry will move towards adoption of best business practices<br />

due to enhanced consumer awareness about the quality of content,<br />

convergence, customisation, configuration, digitalisation, dynamic<br />

pricing, product innovation and contemporary global viewing<br />

experiences. Customers will increasingly demand content from<br />

content providers, that they can engage and relate with and which has<br />

relevance to their social and leisure lifestyle.<br />

Going forward, in the years to come, key drivers for the DTH industry<br />

will be Brand Strategy, Service Excellence, Content, Distribution reach<br />

across all corners of the country, Digitalisation of the industry, Strong<br />

high end television growth, Events like the Olympics and<br />

Commonwealth games, Robust international football and cricket<br />

calendar, improvement in the electricity generation situation and<br />

multiple service providers who between them are likely to spend<br />

anything between Rs.10-15 billion per annum on advertising and<br />

sales promotion. All these things, coupled with enormous consumer<br />

education, will result in the market opening up.<br />

Challenges to DTH providers will be largely in the form of higher<br />

subscriber acquisition costs, high content costs, long gestation and<br />

profit break even periods, stiff competition among various DTH<br />

platforms and from the cable industry, high tax regime, frequent<br />

regulatory changes and non availability of transponder capacity.<br />

SWOT ANALYSIS<br />

STRENGTHS<br />

<strong>Dish</strong> <strong>TV</strong> has the first mover advantage on account of being the first<br />

DTH service provider in India. Being a part of the Essel Group, there<br />

is strong promoter backing and committed investment. <strong>Dish</strong> <strong>TV</strong> is<br />

also India's only truly national DTH brand, with presence in over<br />

4,000 towns and with an equally strong representation in both Urban<br />

and Rural markets. Sales and Distribution infrastructure is one of the<br />

Company's key strengths. The Company has an extremely cost<br />

conscious culture that has resulted in multiple cost management<br />

initiatives making it one of the lowest cost service providers. Strong<br />

technology partnerships with organisations like Conax (Norway) and<br />

Open <strong>TV</strong> (USA) have helped/continue to help in providing cutting edge<br />

features and in maintaining technological leadership. Advance planning<br />

has resulted in adequate transponder capacity to meet the new channel<br />

launch requirements of the Company. This is an area where all other<br />

operators are likely to feel challenged over the next two years.<br />

OPPORTUNITIES<br />

GDP growth of almost 9% over the last four years has resulted in<br />

India's huge middle class flexing its muscles and an explosion in<br />

consumerism. With net disposable incomes on the rise, Indians are<br />

spending like never before on acquiring the latest products and<br />

products that are aspirational in nature. DTH, with its superior quality<br />

and wide ranging maneuverability and flexibility - Active services,<br />

Interactive services, multipoint channel viewing, gaming, Electronic<br />

Program Guide etc. - is increasingly being adopted by those who<br />

want great quality <strong>TV</strong> viewing experience. So far the Company has<br />

concentrated on household customers but a wide scope exists in<br />

areas relating to Multi Dwelling Units, Institutions, Guest Houses,<br />

Restaurants, Hotels and other Commercial establishments. Further,<br />

the emergence of large retail format stores across the country is<br />

creating a totally new opportunity. These will become more important<br />

as the retail industry in India goes through a consolidation phase,<br />

from its current highly fragmented disposition. As the Industry matures,<br />

value added services will give a boost to ARPU.<br />

WEAKNESSES<br />

The DTH Industry in India is an intrinsically low ARPU market, with<br />

one of the lowest rates in the world. This poses a challenge to the<br />

profitability of operators. This will continue till exclusive content<br />

becomes a reality, till people are willing to pay for more content and<br />

till value added services catch on with consumers. In all these areas,<br />

the Company has clearly defined strategies to increase ARPU.<br />

THREATS<br />

India will have between 4 to 5 operators in the DTH space. While this<br />

will help in expanding the market, as happened in mobile telephony, it<br />

will also result in higher subscriber acquisition costs by way of<br />

increase in promotional spends and higher subsidy on set top boxes.<br />

IP <strong>TV</strong> is also likely to come in, but is unlikely to be a major threat. With<br />

increasing competition management of churn and quality of subscriber<br />

acquisitions will also be a challenge.<br />

BUSINESS STRATEGY<br />

In the face of the opportunity that lies ahead, as well as the challenges<br />

with respect to the competitive environment, it would be paramount<br />

to sustain high paced growth and long-term viability of the business<br />

model. On a broader scale, the Media and Television industry is also<br />

going through a dynamic phase, therefore flexibility, adaptability and<br />

growth remain key concerns of the management. Going forward, we<br />

would build our business strengths, on the following strategies:<br />

(I) Brand Building: <strong>Dish</strong> <strong>TV</strong> is already considered a pioneer and<br />

30

(II)<br />

leader in the DTH segment. Efforts will be on, to make the brand<br />

a force to reckon with, that carves a niche for itself in the consumers'<br />

mind-space and life. Further, it will be the task of marketing<br />

to educate consumers, about the relevance of this technology<br />

to their entertainment needs, which will drive faster adoption.<br />

Value added services, will become more aspirational and<br />

find higher usage, as the product penetration expands. These<br />

services will drive not just brand stature but add to the revenue<br />

prospects as well.<br />

Subscriber and Revenue Growth: The Company has created a<br />

Zonal structure comprising of seven zones to create a wide<br />

spread distribution muscle across the length and breadth of<br />

the country. Apart from traditional retail outlets in the durable<br />

and telecom categories, the product will also find presence in<br />

multi brand national and regional modern trade chain stores.<br />

These stores that attract large volume traffic will add to our<br />

sales numbers in the present year, apart from giving us a<br />

commanding brand presence in the market. Moreover, large<br />

Corporates are being approached for bulk sales for their employees,<br />

vendor gifts, trade schemes and the like. Whilst acquiring<br />

new subscribers would remain one of the primary drivers<br />

for growth, retention of existing customers would also be a<br />

key focus area. Distinct emphasis is being laid to build capability<br />

in the team to develop subscriber relationship management<br />

and CRM calendars that will help in reducing churn and<br />

boosting revenues through timely collection and upgrade offers.<br />

(III) Service Capability: Recognising that service would be a key<br />

differentiator for this business, a commendable service team<br />

has been set up, over the last year, to take care of both the front<br />

end service management in the field and a back end support<br />

from the enhanced call centre capabilities. 93 <strong>Dish</strong> Care Centres<br />

(DCC) and service franchisees have been set up across major<br />

cities to provide on-site customer service, in the likelihood of<br />

such a service requirement. A large team of experienced<br />

professionals have been hired across regions, to build a service<br />

infrastructure that is commensurate with the growth in subscriber<br />

base and to steer the service function ongoingly. Call centre<br />

infrastructure has also been upgraded to cater to the demands of<br />

our growing base. Emphasis is placed on ease of access, instant<br />

customer responsiveness, quality of call centre interactions and<br />

fast resolution time. The objective being to build customer loyalty<br />

and an overall feeling pride of possession among the <strong>Dish</strong> <strong>TV</strong><br />

subscribers.<br />

(IV) Corporate Governance and Value Creation : We strongly believe<br />

that group corporate governance and management best practices<br />

are critical for long-term sustainable growth and for building<br />

resilience to competition. It will drive and ensure accountability,<br />

transparency, professionalism and risk containment. The<br />

recent restructure exercise will create more value and build a<br />

focused business approach that will go a long way in creating<br />

value for the stakeholders.<br />

CORPORATE STRUCTURE AFTER MERGER<br />

Integrated Subscriber<br />

Management Services<br />

Limited (wholly owned Subsidiary<br />

Company of SITI) (Now wholly owned<br />

subsidiary of <strong>Dish</strong> <strong>TV</strong>)<br />

New Era Entertainment<br />

Network Limited<br />

(NEEL) (Subsidiary of SITI)<br />

Zee Entertainment<br />

Enterprises Ltd. (ZEEL)<br />

SITI Cable Network<br />

Limited (SITI)<br />

(Subsidiary of ZEEL)<br />

Direct Consumer<br />

Services Business<br />

undertaking(DCS)<br />

<strong>Dish</strong> <strong>TV</strong> India Ltd.<br />

(Formerly ASC Enterprises<br />

Limited)<br />

● DCS business was merged with <strong>Dish</strong> <strong>TV</strong> and in lieu of such<br />

Merger, <strong>Dish</strong> <strong>TV</strong> issued 5.75 shares of Re. 1/- each for every 10<br />

shares held by ZEEL shareholders.<br />

Reorganisation of Share Capital:<br />

(Rs. in Crore)<br />

Equity Share Capital before 71.56<br />

reorganisation<br />

99.72 crores shares of Re.1/- each <strong>full</strong>y paid up equity<br />

was issued in the ratio of 23 shares for every 10 shares<br />

of ZEEL.<br />

Reduction of 99.72 crores shares by cancelling of 3<br />

shares for every 4 shares held and issue of 24.93<br />

crores shares to ZEEL shareholders.<br />

Therefore final equity of <strong>Dish</strong> <strong>TV</strong> India Ltd. is as under:<br />

1. Shares issued to ZEEL shareholders 24.93<br />

2. Reduction of existing equity of 71.56<br />

(In the ratio of 3 equity shares for every 4 17.89<br />

equity shares)<br />

Total share capital 42.82<br />

31

GROUP<br />

INTERNAL CONTROL SYSTEMS AND THEIR ADEQUACY<br />

The Company believes in formulating adequate and effective internal<br />

control systems and implementing the same to ensure that the assets<br />

and interests of the Company are safeguarded and reliability of<br />

accounting data and its accuracy are ensured with proper checks and<br />

balances.<br />

The Company has a strong internal audit programme, which examines<br />

and evaluates the adequacy and effectiveness of Internal control<br />

systems. The internal audit ensures that the systems designed and<br />

implemented, provide adequate internal control, commensurate with<br />

the size and operations of the Company. Management Information<br />

System (MIS) forms an int egral part of the Company's control<br />

mechanism, where all operating parameters are monitored and<br />

controlled. An effective budgetary control on all capital expenditure<br />

ensures that the actual spends are in line with the capital budget.<br />

The Audit Committee of the Board, Statutory Auditors and the Top<br />

Management are regularly apprised of internal audit findings. The<br />

Audit Committee of the Company consisting of Non-Executive<br />

Independent Directors, periodically reviews and recommends the<br />

financial statements of the Company.<br />

HUMAN CAPITAL<br />

Since inception, we have endeavoured to establish ourselves as a<br />

progressive organisation, continuously monitoring and anticipating<br />

the changing market trends and evolving market dynamics. With this<br />

approach, we have been the change leader in the industry, setting<br />

what can be termed as “Industry Benchmark”.<br />

Human capital in the organisation has always remained the constant<br />

appreciating assets, which have propelled the organisation to its<br />

present status. The organisation aims to post a consistent and healthy<br />

growth in the DTH spectrum. The attraction, preservation and<br />

development of high caliber people is the source of competitive<br />

advantage for our business.<br />

Over the last 6 months, it was felt imperative to undertake an in-depth<br />

diagnostic and climate study with the purpose of aligning the<br />

aspirations, goals, structure, capabilities, processes and people with<br />

the organisation and most importantly bring about cultural change<br />

and uniformity across varied spectrums internally as well as with the<br />

industry. The entire exercise was to be followed by development of a<br />

Human Capital strategy and undertake various Human Capital<br />

initiatives for implementation across the organisation.<br />

The task to realign and transform the organisation along with the<br />

building process has been greatly challenging. However, it has<br />

provided clarity on what an individual/employee is expected to do,<br />

the interdependencies and interfaces in the organisation structure<br />

and the requisite capabilities and the behaviour required.<br />

Defining scope and responsibilities of the jobs and conducting job<br />

evaluation exercise for the whole organisation has been helpful to<br />

create clarity of structures, job roles and contributions resulting in<br />

effective implementation of organisation strategies and career and<br />

succession planning.<br />

Identification of key and critical positions and identifying individuals<br />

with leadership skills and nurturing them as future leaders, has been<br />

a continuous process.<br />

The organisation has also seen employee engagement initiatives like<br />

open houses, fun events, employee community building and<br />

recognition activities, which have build a sense of well being and<br />

excitement in the work environment. Training and development<br />

initiatives planned are focused towards increasing organisation's<br />

effectiveness and health through planned interventions in the<br />

processes, skills and competencies.<br />

There have also been a lot of efforts spent in pruning and streamlining<br />

the PMS, employee MIS and HR services systems and processes.<br />

The process is being advised by Hay Group. The objective of human<br />

resources is to build and develop a Human Capital geared up to face<br />

the challenges of the business.<br />

TALENT IDENTIFICATION<br />

The Company's talent Identification process is aimed at identifying<br />

employees who have the aptitude, capabilities and qualities necessary<br />

to undertake work, involving greater responsibility and skill levels,<br />

than their current one. Another aspect of talent identification is to<br />

create a talent pool by identifying individuals with leadership qualities<br />

and nurturing them as future leaders. A proactive and an effective<br />

succession management is in place, to nurture the talent pool.<br />

Individual development plans have been drawn detailing the career<br />

steps of the individual.<br />

CAUTIONARY STATEMENT<br />

Statements in this report describing the Company's objectives,<br />

expectations or predictions may be forward looking within the meaning<br />

of applicable laws and regulations. The actual results may differ<br />

materially from those expressed in this statement.<br />

32

AUDITORS' REPORT<br />

To,<br />

The Members,<br />

<strong>Dish</strong> <strong>TV</strong> India Limited<br />

1. We have audited the attached Balance Sheet of <strong>Dish</strong> <strong>TV</strong> India<br />

Limited (formerly ASC Enterprises Limited) as at March 31,<br />

20<strong>07</strong> and also the Profit and Loss Account and the Cash Flow<br />

Statement of the Company for the year ended on that date, annexed<br />

thereto. These financial statements are the responsibility of the<br />

Company's management. Our responsibility is to express an<br />

opinion on these financial statements based on our audit.<br />

2. We conducted our audit in accordance with the auditing standards<br />

generally accepted in India. Those standards require that we plan<br />

and perform the audit to obtain reasonable assurance about<br />

whether the financial statements are free of material misstatement.<br />

An audit includes examining, on a test basis, evidence supporting<br />

the amounts and disclosures in the financial statements. An audit<br />

also includes assessing the accounting principles used and<br />

significant estimates made by management, as well as evaluating<br />

the overall financial statement presentation. We believe that our<br />

audit provides a reasonable basis for our opinion.<br />

3. As required by the Companies (Auditor’s <strong>Report</strong>) Order, 2003<br />

(hereinafter referred to as "the Order") issued by the Central<br />

Government of India in terms of Section 227(4A) of the Companies<br />

Act, 1956 ("the Act"), on the basis of such checks as we<br />

considered appropriate and according to the information and<br />

explanations given to us during the course of our audit, we annex<br />

hereto a statement on the matters specified in paragraph 4 and<br />

5 of the said Order.<br />

4. We draw reference to<br />

a) Note 21 regarding the Scheme of Arrangement sanctioned<br />

by the High Court of Judicature at Bombay on 12th January,<br />

20<strong>07</strong> and High Court of Judicature at New Delhi on 18th<br />

December, <strong>2006</strong>, effect of which has been given in these<br />

financial statements, except allotment of equity shares and<br />

reorganisation of the share capital.<br />

b) Note 23 regarding preparation of these financial statements<br />

on going concern basis.<br />

5. Further to our comments in the annexure referred to in paragraph<br />

(3) above, we report that:<br />

a) We have obtained all the information and explanations,<br />

which to the best of our knowledge and belief were<br />

necessary for the purposes of our audit;<br />

b) In our opinion, proper books of accounts as required by<br />

law have been kept by the Company, so far as appears<br />

from our examination of those books;<br />

c) The Balance Sheet, Profit and Loss Account and Cash Flow<br />

Statement dealt with by this report are in agreement with<br />

the books of account;<br />

d) In our opinion, the Balance Sheet, Profit and Loss Account<br />

and Cash Flow Statement complies with the accounting<br />

standards referred to in sub-section (3C) of Section 211 of<br />

the Act;<br />

e) On the basis of written representations received from the<br />

directors, and taken on record by the Board of Directors,<br />

we report that none of the directors are disqualified as on<br />

March 31, 20<strong>07</strong> from being appointed as a director in terms<br />

of clause (g) of sub-section (1) of Section 274 of the<br />

Companies Act, 1956;<br />

f) In our opinion and to the best of our information and<br />

according to the explanations given to us, the said accounts<br />

read with the significant accounting policies and notes<br />

thereon subject to Note 30.10.2 regarding managerial<br />

remuneration amounting to Rs.1,293,742 paid to managing<br />

director pending approval of Central Government, give the<br />

information required by the Act in the manner so required<br />

and give a true and fair view in conformity with the<br />

accounting principles generally accepted in India:<br />

i) In the case of the Balance Sheet, of the state of affairs<br />

of the Company as at March 31, 20<strong>07</strong>;<br />

ii) In the case of the Profit and Loss Account, of the loss<br />

of the Company for the year ended on that date; and<br />

iii) In the case of Cash Flow Statement, of the cash flows<br />

for the year ended on that date.<br />

L.K. Shrishrimal<br />

M. No. 72664<br />

Partner<br />

For and on behalf of<br />

MGB & Co.<br />

Chartered Accountants<br />

Place : Noida<br />

Date : June 28, 20<strong>07</strong><br />

ANNEXURE REFERRED TO IN PARAGRAPH 3 OF AUDITORS' REPORT<br />

TO THE MEMBERS OF DISH <strong>TV</strong> INDIA LIMITED ON THE ACCOUNTS<br />

FOR THE YEAR ENDED MARCH 31, 20<strong>07</strong>.<br />

(i) (a) The Company has maintained proper records showing <strong>full</strong><br />

particulars including quantitative details and situation of<br />

its fixed assets.<br />

(b) According to the information and explanations given to us,<br />

there is a phased program of physical verification of fixed<br />

assets except for consumer premises equipments installed<br />

at the customers premises,, which in our opinion is<br />

reasonable having regard to the size of the Company and<br />

nature of its assets. Pursuant to the program, the physical<br />

verification of certain assets was carried out during the<br />

year. The reconciliation of the fixed assets physically verified<br />

with the books is in progress and differences, if any, will<br />

be accounted on its determination.<br />

33

GROUP<br />

(c) In our opinion, the Company has not disposed of substantial<br />

part of the fixed assets during the year.<br />

(ii) (a) The inventory has been physically verified by the<br />

management at the end of the year. In our opinion, the<br />

frequency of such verification is reasonable.<br />

(b) The procedures of physical verification of inventories<br />

followed by the management are reasonable and adequate<br />

in relation to the size of the Company and the nature of its<br />

business.<br />

(c) The Company is maintaining proper records of the inventory<br />

and no discrepancy were noticed on physical verification<br />

as compared to book records.<br />

(iii) (a) According to the information and explanations given to us,<br />

the Company has granted unsecured loan to one company<br />

covered in the register maintained under Section 301 of<br />

the Act. The maximum amount involved during the year<br />

was aggregated to Rs. 1,239.82 Lacs and the year end<br />

balance of such loan amounted to Rs. 1,239.82 Lacs.<br />

(b) In our opinion and according to the information and<br />