Annual Report 2011 - Watercare

Annual Report 2011 - Watercare

Annual Report 2011 - Watercare

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Watercare</strong> Services Limited<br />

<strong>2011</strong> ANNUAL REPORT<br />

FINANCIAL COMMENTARY<br />

The financial result for the year was a net deficit after tax of $12.3 million, compared with a budgeted net deficit of $0.58 million (2010 – Net<br />

deficit after tax of $27.7 million). The deficit was primarily due to the unfavourable revaluation of the company’s interest rate swap contracts to<br />

market value of $13.6 million and the change in deferred tax due to the reduction of the tax depreciation rates to zero on buildings with useful<br />

lives greater than 50 years which were integrated from the previous local network operators.<br />

Key Points<br />

• On 1 November 2010, the company acquired the water and wastewater businesses conducted by Metrowater Limited, Manukau Water Limited,<br />

North Shore City Council, Waitakere City Council, Rodney District Council and Franklin District Council in accordance with the Local Government<br />

(Tamaki Makaurau Reorganisation) Act 2009, the Local Government (Auckland Council) Act 2009 and the Local Government (Auckland<br />

Transitional Provisions) Act 2010. The company now provides total water and wastewater services to the Auckland region and as a result,<br />

the assets, liabilities, revenues and costs of the company have increased significantly in the financial year to 30 June <strong>2011</strong>.<br />

• During the year the company’s Standard & Poor’s corporate credit rating was raised to ‘A’ long-term and ‘A-1’ short-term, with a positive outlook.<br />

The credit rating on the company’s long-term debt was raised to ‘AA’, consistent with the change to Auckland Council’s long-term credit rating.<br />

Subsequent to year end, Standard & Poor’s raised the company’s corporate credit rating to ‘AA-‘ long-term and ‘A-1+’ short term with a stable<br />

outlook (refer to note 27 for further detail).<br />

• A $150 million medium-term note issue was completed in February <strong>2011</strong>. The notes were for a term of four years, and the proceeds were<br />

largely used to refinance maturing intercompany loans from Auckland Council.<br />

• No price adjustment was paid in the <strong>2011</strong> year (2010 – $nil).<br />

• Under NZ IFRS, the company has chosen to revalue its interest rate swaps and forward foreign exchange contracts to fair value. These resulted<br />

in a decrease in current year operating surplus from trading operations by $13.6 million (2010 – decrease in operating surplus from trading<br />

operations by $20.5 million).<br />

• Operating costs were 6.0% lower than budget due to savings in asset operating costs, maintenance and overheads.<br />

• The deferred taxation liability has been adjusted to integrate the previous deferred taxation positions of Metrowater and Manukau Water.<br />

Additionally an adjustment was required to reflect the reduction of the tax depreciation rates to zero on buildings with useful lives greater<br />

than 50 years which were inherited at integration date.<br />

• This financial commentary includes the budget for the <strong>2011</strong> year and notes on significant variances. Comparisons are also provided to<br />

last year being a period where <strong>Watercare</strong> was the wholesale provider of water and wastewater services which is reflected in revenue,<br />

costs, assets and liabilities all being significantly lower. The 2012 budget is also provided as a reference point and reflects higher revenue<br />

and costs as <strong>Watercare</strong> only provided retail water and wastewater services for eight months in this financial year, being the period since<br />

integration on 1 November 2010.<br />

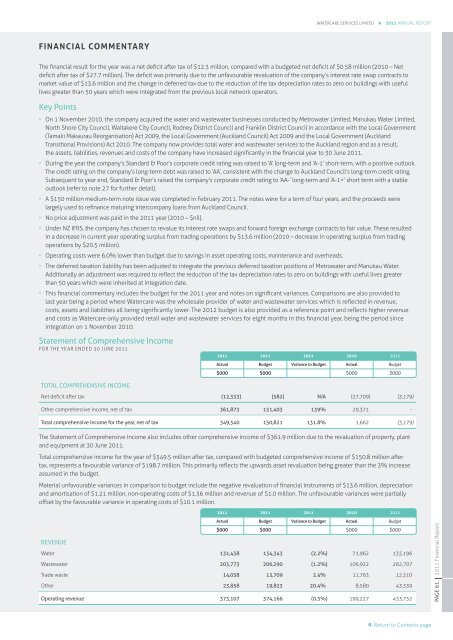

Statement of Comprehensive Income<br />

FOR THE YEAR ENDED 30 JUNE <strong>2011</strong><br />

Total Comprehensive income<br />

<strong>2011</strong> <strong>2011</strong> <strong>2011</strong> 2010 2012<br />

actual budget Variance to Budget Actual Budget<br />

$000 $000 $000 $000<br />

Net deficit after tax (12,333) (582) N/A (27,709) (3,179)<br />

Other comprehensive income, net of tax 361,873 151,403 139% 29,371 -<br />

Total comprehensive income for the year, net of tax 349,540 150,821 131.8% 1,662 (3,179)<br />

The Statement of Comprehensive Income also includes other comprehensive income of $361.9 million due to the revaluation of property, plant<br />

and equipment at 30 June <strong>2011</strong>.<br />

Total comprehensive income for the year of $349.5 million after tax, compared with budgeted comprehensive income of $150.8 million after<br />

tax, represents a favourable variance of $198.7 million. This primarily reflects the upwards asset revaluation being greater than the 3% increase<br />

assumed in the budget.<br />

Material unfavourable variances in comparison to budget include the negative revaluation of financial instruments of $13.6 million, depreciation<br />

and amortisation of $1.21 million, non-operating costs of $1.36 million and revenue of $1.0 million. The unfavourable variances were partially<br />

offset by the favourable variance in operating costs of $10.1 million.<br />

<strong>2011</strong> <strong>2011</strong> <strong>2011</strong> 2010 2012<br />

actual budget Variance to Budget Actual Budget<br />

$000 $000 $000 $000<br />

Revenue<br />

Water 131,438 134,343 (2.2%) 71,962 135,196<br />

Wastewater 203,773 206,290 (1.2%) 106,922 262,707<br />

Trade waste 14,038 13,709 2.4% 11,763 12,510<br />

Other 23,858 19,823 20.4% 8,580 43,339<br />

Operating revenue 373,107 374,166 (0.3%) 199,227 453,752<br />

<strong>2011</strong> Financial <strong>Report</strong><br />

PAGE 61<br />

Return to Contents page