- Page 1:

THE MUNICIPAL SECRETARY DESKTOP REF

- Page 4 and 5:

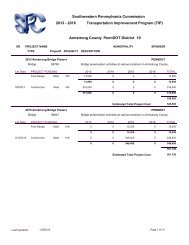

SOUTHWESTERN PENNSYLVANIA COMMISSIO

- Page 7 and 8:

THE MUNICIPAL SECRETARY’S DESKTOP

- Page 9 and 10:

SECTION: PAGE IX. MUNICIPAL PURCHAS

- Page 11 and 12:

SECTION: PAGE XV. RECORDS MANAGEMEN

- Page 13 and 14:

ACKNOWLEDGMENTS The Local Governmen

- Page 15 and 16:

PREFACE THE MUNICIPAL SECRETARY’S

- Page 17 and 18:

INTRODUCTION THE MUNICIPAL SECRETAR

- Page 19 and 20:

SECTION I RESPONSIBILITIES OF THE G

- Page 21 and 22:

SECTION I POLICIES TO EXPEDITE AND

- Page 23 and 24:

A. RESPONSIBILITIES OF THE MUNICIPA

- Page 25 and 26:

B. MUNICIPAL INVESTMENT POLICIES AN

- Page 27 and 28:

C. MUNICIPAL INTERNAL CONTROL POLIC

- Page 29 and 30:

D. MUNICIPAL BUDGETING Developing a

- Page 31 and 32:

E. CAPITAL IMPROVEMENT PROGRAMMING

- Page 33 and 34:

F. MUNICIPAL RISK MANAGEMENT A muni

- Page 35 and 36:

G. MUNICIPAL TRAINING PROGRAM If mu

- Page 37 and 38:

H. MUNICIPAL PURCHASING Effective a

- Page 39 and 40:

I. PERSONNEL RECORDS AND PERSONNEL

- Page 41 and 42:

J. MUNICIPAL RECORDS MANAGEMENT The

- Page 43 and 44:

K. MEETING AGENDA The adoption and

- Page 45 and 46:

MUNICIPAL HIRING POLICY For local g

- Page 47 and 48:

General Qualification - In order to

- Page 49 and 50:

___________________________ TOWNSHI

- Page 51 and 52:

service or product that a Preferred

- Page 53 and 54:

SECTION II SECRETARY'S CALENDAR REF

- Page 55 and 56:

SECTION II REPORTING CALENDAR Forew

- Page 57 and 58:

ANNUAL SECRETARY’S CALENDAR DATE

- Page 59 and 60:

SECTION III NETWORKING REFERENCES P

- Page 61 and 62:

SECTION III NETWORKING Foreword Suc

- Page 63 and 64:

PROFESSIONAL AFFILIATIONS This port

- Page 65 and 66:

PENNSYLVANIA LOCAL GOVERNMENT SECRE

- Page 67 and 68:

THE GOVERNMENT FINANCE OFFICERS ASS

- Page 69 and 70:

GOVERNMENTAL AGENCIES DIRECTORY Alt

- Page 71 and 72:

STATE AGENCIES AND OFFICES ATTORNEY

- Page 73 and 74:

STATE AGENCIES AND OFFICES (continu

- Page 75 and 76:

STATE AGENCIES AND OFFICES (continu

- Page 77 and 78:

PUBLIC EMPLOYEE RETIREMENT COMMISSI

- Page 79 and 80:

III-19 Revised May 2006

- Page 81 and 82:

District Office Contact Information

- Page 90 and 91:

III-30

- Page 92 and 93:

III-32

- Page 94 and 95:

Pennsylvania Regional Planning Comm

- Page 96 and 97:

OTHER REGIONAL ASSISTANCE (not publ

- Page 98 and 99:

DEPARTMENT OF PLANNING Advises coun

- Page 100 and 101:

III-40

- Page 102 and 103:

III-42

- Page 104 and 105:

IV-2

- Page 106 and 107:

IV-4

- Page 108 and 109:

IV-6

- Page 110 and 111:

THE PENNSYLVANIA MUNICIPAL TRAINING

- Page 112 and 113:

INTERNATIONAL CITY/COUNTY MANAGEMEN

- Page 114 and 115:

LOCAL GOVERNMENT ACADEMY The Local

- Page 116 and 117:

PENN STATE UNIVERSITY=S PENNSYLVANI

- Page 118 and 119:

CERTIFIED GOVERNMENTAL SECRETARY Th

- Page 120 and 121:

CERTIFIED BOROUGH OFFICIAL The Penn

- Page 122 and 123:

V-2

- Page 124 and 125:

V-4

- Page 126 and 127:

V-6

- Page 128 and 129:

V-8

- Page 130 and 131:

V-10

- Page 132 and 133:

V-12

- Page 134 and 135:

V-14

- Page 136 and 137:

V-16

- Page 138 and 139:

V-18

- Page 140 and 141:

V-20 Revised May 2006

- Page 142 and 143:

V-22 Revised May 2006

- Page 144 and 145:

V-24

- Page 146 and 147:

04 SUPERVISOR 04 SUPERVISOR _______

- Page 148 and 149:

DCED-CLGS-19-5 Report of Elected an

- Page 150 and 151:

V-30

- Page 152 and 153:

V-32

- Page 154 and 155:

V-34

- Page 156 and 157:

V-36 Revised July 2003

- Page 158 and 159:

V-38 Revised July 2003

- Page 160 and 161:

V-40 Revised July 2003

- Page 162 and 163:

V-42

- Page 164 and 165:

V-44 Revised July 2003

- Page 166 and 167:

V-46

- Page 168 and 169:

V-48

- Page 170 and 171:

V-50

- Page 172 and 173:

V-52

- Page 174 and 175:

V-54

- Page 176 and 177:

V-56

- Page 178 and 179:

V-58 Revised July 2003 Revised July

- Page 180 and 181:

V-60 Revised July 2003

- Page 182 and 183:

V-62

- Page 184 and 185:

V-64

- Page 186 and 187:

V-66

- Page 188 and 189:

V-68

- Page 190 and 191:

V-70

- Page 192 and 193:

V-72 Revised May 2006

- Page 194 and 195:

V-74

- Page 196 and 197:

V-76

- Page 198 and 199:

V-78

- Page 200 and 201:

V-80 Revised May 2006

- Page 202 and 203:

V-82

- Page 204 and 205:

V-84 Revised May 2006

- Page 206 and 207:

V-86 Revised May 2006

- Page 208 and 209:

VI-2

- Page 210 and 211:

VI-4

- Page 212 and 213:

VI-14

- Page 214 and 215:

VI-14

- Page 216 and 217:

VI-14

- Page 218 and 219:

VI-14

- Page 220 and 221:

VI-14

- Page 223 and 224:

SECTION VII NON-COMPETITIVE - ENTIT

- Page 225 and 226:

VII-5

- Page 227 and 228:

VII-7

- Page 229 and 230:

VII-9

- Page 231 and 232:

VII-11

- Page 233 and 234:

NOTES DEPARTMENT OF COMMUNITY AND E

- Page 235 and 236:

SECTION VIII MUNICIPAL BUDGET REFER

- Page 237 and 238:

SECTION VIII MUNICIPAL BUDGET Forew

- Page 239 and 240:

THE DO’S AND DON’TS OF MUNICIPA

- Page 241 and 242:

DO insist the real estate tax colle

- Page 243 and 244:

MUNICIPAL BUDGET CALENDAR OPERATING

- Page 245 and 246:

A BUDGET CALENDAR FOR THE SECRETARY

- Page 247 and 248:

Estimation of Revenues Factors to C

- Page 249 and 250:

CHECKLIST EXPENDITURE DATA REQUIRED

- Page 251 and 252:

VIII-17

- Page 253 and 254:

VIII-19

- Page 255 and 256:

VIII-21

- Page 257 and 258:

VIII-23

- Page 259 and 260:

Borough and Township Real Estate Ta

- Page 261 and 262:

NOTES THE ELEMENTS OF A FEE/SERVICE

- Page 263 and 264:

NOTES A FEE CHECKLIST QUESTIONS AND

- Page 265 and 266:

ANNUAL BUDGET MESSAGE The annual bu

- Page 267 and 268:

REVENUE The primary revenue source

- Page 269 and 270:

CHART OF ACCOUNTS In most municipal

- Page 271 and 272:

SECTION IX MUNICIPAL PURCHASING POL

- Page 273 and 274:

SECTION IX MUNICIPAL PURCHASING POL

- Page 275 and 276:

NOTES THE PURCHASING SEQUENCE I. Ad

- Page 277 and 278:

VII. Purchases over $10,000: User d

- Page 279 and 280:

IX-9

- Page 281 and 282:

NOTES GENERAL BID SPECIFICATIONS 1.

- Page 283 and 284:

Finally, in the event of cancellati

- Page 285 and 286:

IX-15

- Page 287 and 288:

Written/Telephonic Price Quotations

- Page 289 and 290:

IX-19

- Page 291 and 292:

OFFICIAL BID NOTICE TOWNSHIP Sealed

- Page 293 and 294:

IX-23

- Page 295 and 296:

NOTES WRITING A BID ADVERTISEMENT T

- Page 297 and 298:

NOTES CONTRACT PURCHASING STEPS Whe

- Page 299 and 300:

NOTES INTERGOVERNMENTAL PURCHASING

- Page 301 and 302:

This program, The Local Piggyback P

- Page 303 and 304:

TOTAL PRICE AND F.O.B. CONTRACTS. P

- Page 305 and 306:

IX-35

- Page 307 and 308:

LIQUID FUELS TAX FUNDS REV A Accept

- Page 309 and 310:

PennDOT's Agility Program PennDOT h

- Page 311 and 312:

IX-41 Revised May 2006

- Page 313 and 314:

SECTION X MUNICIPAL PERSONNEL MANAG

- Page 315 and 316:

SECTION X PERSONNEL MANAGEMENT Fore

- Page 317 and 318:

PERSONNEL RECORDS GENERAL Employees

- Page 319 and 320:

FAIR LABOR STANDARDS ACT The Fair L

- Page 321 and 322:

RECORDS RETENTION REQUIREMENTS Comp

- Page 323 and 324:

X-11

- Page 325 and 326:

X-13 Revised July 2003

- Page 327 and 328:

Employee: Department: RECORD OF EMP

- Page 329 and 330:

X-17

- Page 331 and 332:

X-19

- Page 333 and 334:

X-21

- Page 335 and 336:

X-23

- Page 337 and 338:

X-25

- Page 339 and 340:

Nondiscrimination Equal Opportunity

- Page 341 and 342:

Sexual Harassment Basic Policy The

- Page 343 and 344:

Sample 1 Nepotism To minimize possi

- Page 345 and 346:

Accidents must be reported without

- Page 347 and 348:

Grievances Small Municipality Proce

- Page 349 and 350:

Benefits Note: Most insurance-type

- Page 351 and 352:

Personnel Policy Compendium Drug-Fr

- Page 353 and 354:

Personnel Policy Compendium Drug-Fr

- Page 355 and 356:

Personnel Policy Compendium Drug-Fr

- Page 357 and 358:

Personnel Policy Compendium Drug-Fr

- Page 359 and 360:

X-47 Revised May 2006

- Page 361 and 362:

NEW HIRE PROCEDURE ALL EMPLOYEES: _

- Page 363 and 364:

SECTION XI MUNICIPAL INVESTMENT POL

- Page 365 and 366:

SECTION XI MUNICIPAL INVESTMENT POL

- Page 367 and 368:

THE MUNICIPAL INVESTMENT POLICY AND

- Page 369 and 370:

NOTES INVESTMENT INSTRUMENTS PERMIT

- Page 371 and 372:

A CASH FLOW ANALYSIS FOR INVESTMENT

- Page 373 and 374:

A Sample of a Municipal Cash Flow A

- Page 375 and 376:

PUBLIC INVESTMENT POOLS Pennsylvani

- Page 377 and 378:

TREASURER=S INVESTMENT POOLS There

- Page 379 and 380:

X-17

- Page 381 and 382:

X-19

- Page 383 and 384:

SECTION XII MUNICIPAL FINANCIAL MAN

- Page 385 and 386:

SECTION XII MUNICIPAL FINANCIAL MAN

- Page 387 and 388:

NOTES INTERNAL CONTROLS BASIC PRINC

- Page 389 and 390:

Sound Procedures for Authorizing, R

- Page 391 and 392:

2.3 Monitor compliance with interna

- Page 393 and 394:

10. The bank statement balance, les

- Page 395 and 396:

NOTES CREATING PETTY CASH/CHANGE FU

- Page 397 and 398:

FORM A XII-15 Revised May 2006

- Page 399 and 400:

NOTES FINANCIAL AND AUDIT REPORT Th

- Page 401 and 402:

NOTES DEPRECIATION A municipality w

- Page 403 and 404:

EXHIBIT A STRAIGHT LINE DEPRECIATIO

- Page 405 and 406:

When a jurisdiction disposes (sells

- Page 407 and 408:

Step One - Inventory Records This p

- Page 409 and 410:

XII-27

- Page 411 and 412:

XII-29

- Page 413 and 414:

NOTES FINANCIAL STATEMENTS The tota

- Page 415 and 416:

XII-33

- Page 417 and 418:

XII-35

- Page 419 and 420:

XII-37

- Page 421 and 422:

XII-39

- Page 423 and 424:

XII-41

- Page 425 and 426:

XII-43

- Page 427 and 428:

SECTION XIII MANAGING MUNICIPAL MEE

- Page 429 and 430:

SECTION XIII MEETING MANAGEMENT For

- Page 431 and 432:

MEETING AGENDA* The adoption and us

- Page 433 and 434:

A MODEL AGENDA* A common order of b

- Page 435 and 436:

BASIC MEETING PROCEDURE 1. A member

- Page 437 and 438:

MEETING DO=S AND DON=TS DO create a

- Page 439 and 440:

SAMPLE MINUTES Supervisors= Meeting

- Page 441 and 442:

XIII-15

- Page 443 and 444:

Takes place the first Monday in Jan

- Page 445 and 446:

THE SUNSHINE ACT The following sect

- Page 447 and 448:

DATE: April 12, 2005 NAME- PLEASE P

- Page 449 and 450:

DISCLOSURE OF CONFLICT OF INTEREST

- Page 451 and 452:

SECTION XIV MUNICIPAL RISK MANAGEME

- Page 453 and 454:

SECTION XIV MUNICIPAL RISK MANAGEME

- Page 455 and 456:

A Risk Management Policy for Small

- Page 457 and 458:

NOTES MUNICIPAL INSURANCE * A. GENE

- Page 459 and 460:

MUNICIPAL INSURANCE - Pennsylvania

- Page 461 and 462:

C. WORKERS= COMPENSATION Intended t

- Page 463 and 464:

H. PROPERTY INSURANCE 1. Protects a

- Page 465 and 466:

2. Deductibles a. Review annually b

- Page 467 and 468:

7. Self-insurance a. True self-insu

- Page 469 and 470:

INSURANCE REGISTER* Type of Coverag

- Page 471 and 472:

XIV-21

- Page 473 and 474:

NOTES RISK MANAGEMENT* A SAFETY CHE

- Page 475 and 476:

NOTES STEPS TO BEGIN A BASIC RISK M

- Page 477 and 478:

XIV-27

- Page 479 and 480:

Dear Township Resident: Recently we

- Page 481 and 482:

XIV-31 Revised May 2006

- Page 483 and 484:

XIV-33 Revised May 2006

- Page 485 and 486:

SECTION XV MUNICIPAL RECORDS MANAGE

- Page 487 and 488:

SECTION XV MUNICIPAL RECORDS MANAGE

- Page 489 and 490:

XV-5

- Page 491 and 492:

Records Inventory Form Inventoried

- Page 493 and 494:

NOTES CONTROLLING AND MANAGING RECO

- Page 495 and 496:

(3) Improving quality. Almost any i

- Page 497 and 498:

i ii iii iv v vi vii Elimination of

- Page 499 and 500:

XV-15

- Page 501 and 502:

CHECKLIST FILES CONTROL Problem Too

- Page 503 and 504:

CHECKLIST COPY CONTROL ____________

- Page 505 and 506:

XV-21

- Page 507 and 508:

XV-23

- Page 509 and 510:

XV-25

- Page 511 and 512:

XV-27

- Page 513 and 514:

XV-29

- Page 515 and 516:

XV-31

- Page 517 and 518:

XV-33

- Page 519 and 520:

XV-35

- Page 521 and 522:

XV-37

- Page 523 and 524:

XV-39

- Page 525 and 526:

XV-41

- Page 527 and 528:

XV-43

- Page 529 and 530:

XV-45

- Page 531 and 532:

XV-47

- Page 533 and 534:

CHAPTER S I X GENERAL FINANCIAL AND

- Page 535 and 536:

XV-51

- Page 537 and 538:

XV-53

- Page 539 and 540:

XV-55

- Page 541 and 542:

XV-57

- Page 543 and 544:

XV-59

- Page 545 and 546:

XV-61

- Page 547 and 548:

XV-63

- Page 549 and 550:

XV-65

- Page 551 and 552:

XV-67

- Page 553 and 554:

XV-69

- Page 555 and 556:

XV-71

- Page 557 and 558:

RESOLUTION NO. 21-2002 OPEN RECORDS

- Page 559 and 560:

RECORD REQUEST DATE _______________

- Page 561 and 562:

MUNICIPAL RECORDS SCHEDULE RETENTIO

- Page 563 and 564:

APPENDIX B Example of Resolution In

- Page 565 and 566:

Revised May 2006 XV-81 Revised May

- Page 567 and 568:

Page 1 of 3 ELECTRONIC RECORDS POLI

- Page 569 and 570:

Page 3 of 3 b. E-mail messages shal

- Page 571 and 572:

RECORDS MANAGEMENT GRANTS The Penns

- Page 573 and 574:

SECTION XVI PENNSYLVANIA LOCAL GOVE

- Page 575 and 576:

SECTION XVI PENNSYLVANIA LOCAL GOVE

- Page 577 and 578:

PENNSYLVANIA LOCAL GOVERNMENT 1 A B

- Page 579 and 580:

Home Rule The Pennsylvania 1874 Con

- Page 581 and 582:

The borough council, the township c

- Page 583 and 584:

The duties of the offices of solici

- Page 585 and 586:

Policy and legislative powers shoul

- Page 587 and 588:

Municipal Authorities Municipal aut

- Page 589 and 590:

As voluntary associations, members

- Page 591 and 592:

XVI-19

- Page 593 and 594:

XVI-21

- Page 595 and 596:

XVI-23

- Page 597 and 598: XVI-25

- Page 599 and 600: NOTES Responsibilities of a Municip

- Page 601 and 602: 8. To attend all meetings of (board

- Page 603 and 604: K. To make recommendations to the c

- Page 605 and 606: SECTION XVII MUNICIPAL REFERENCE LI

- Page 607 and 608: SECTION XVII MUNICIPAL REFERENCE LI

- Page 609 and 610: Alternative Service Delivery Approa

- Page 611 and 612: Cash Management for Small Governmen

- Page 613 and 614: PERSONNEL MANAGEMENT Developing Wor

- Page 615 and 616: A Guide for Local Government: Prote

- Page 617 and 618: Also to be published in September,

- Page 619 and 620: PUBLISHING ORGANIZATIONS American A

- Page 621 and 622: PENNSYLVANIA CENTER FOR LOCAL GOVER

- Page 623 and 624: APPENDIX A STANDARDS FOR EFFECTIVE

- Page 625 and 626: STANDARDS FOR EFFECTIVE LOCAL GOVER

- Page 627 and 628: GENERAL MUNICIPAL GOVERNANCE, LEADE

- Page 629 and 630: GENERAL MUNICIPAL GOVERNANCE, LEADE

- Page 631 and 632: FACTOR: PROVIDING FOR COMPETENT MUN

- Page 633 and 634: privately, or interfere with operat

- Page 635 and 636: 8. The governing body or charter de

- Page 637 and 638: 7. For issues or problems expected

- Page 639 and 640: 6. The local governing body, manage

- Page 641 and 642: MUNICIPAL FINANCIAL MANAGEMENT STAN

- Page 643 and 644: FINANCIAL MANAGEMENT STANDARDS FOR

- Page 645 and 646: Commentary The proposed capital spe

- Page 647: FACTOR: REVENUE COLLECTION Standard

- Page 651 and 652: Commentary At a minimum, these cont

- Page 653 and 654: MUNICIPAL PERSONNEL MANAGEMENT STAN

- Page 655 and 656: PERSONNEL MANAGEMENT STANDARDS FOR

- Page 657 and 658: FACTOR: EMPLOYEE PRODUCTIVITY, EVAL

- Page 659 and 660: 2. The municipality has written pro

- Page 661 and 662: DEFINITIONS The following is a comp

- Page 663 and 664: the local government officials or a

- Page 665 and 666: credit ratings-Concerned with the c

- Page 667 and 668: errors and omissions-Type of insura

- Page 669 and 670: improvements-Those physical changes

- Page 671 and 672: mandamus-(writ of) An order compell

- Page 673 and 674: performance audit-An independent, t

- Page 675 and 676: esolution-A decision, opinion, poli

- Page 677 and 678: tax increment financing-A means to

- Page 679 and 680: LEGISLATIVE ACTS This information w

- Page 681 and 682: Pennsylvania Municipalities Plannin

- Page 683 and 684: ABBREVIATIONS The following are abb

- Page 685 and 686: INDEX - KEY WORDS Accident form, IV

- Page 687 and 688: Secretary, duties of, XVI 30; XVII

- Page 689 and 690: FUNCTIONAL INDEX BUDGET PROCESS Bud

- Page 691 and 692: GOVERNMENT OFFICES (continued) Dept

- Page 693 and 694: PURCHASING PROCESS (continued) Pigg