2013-03-14 PHFA Approved Board Minutes - Pennsylvania Housing ...

2013-03-14 PHFA Approved Board Minutes - Pennsylvania Housing ...

2013-03-14 PHFA Approved Board Minutes - Pennsylvania Housing ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

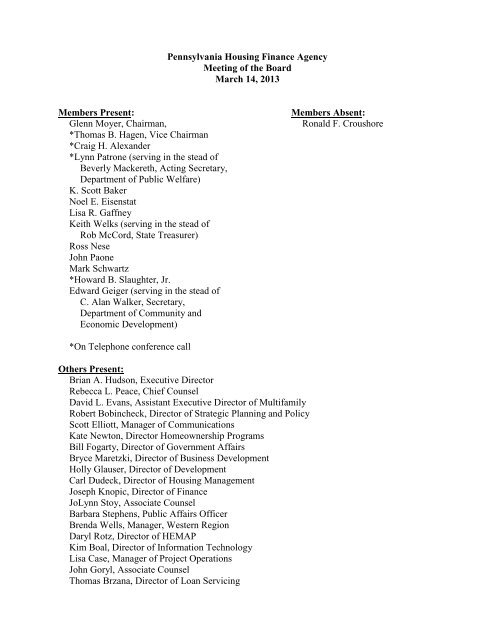

<strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency<br />

Meeting of the <strong>Board</strong><br />

March <strong>14</strong>, <strong>2013</strong><br />

Members Present:<br />

Glenn Moyer, Chairman,<br />

*Thomas B. Hagen, Vice Chairman<br />

*Craig H. Alexander<br />

*Lynn Patrone (serving in the stead of<br />

Beverly Mackereth, Acting Secretary,<br />

Department of Public Welfare)<br />

K. Scott Baker<br />

Noel E. Eisenstat<br />

Lisa R. Gaffney<br />

Keith Welks (serving in the stead of<br />

Rob McCord, State Treasurer)<br />

Ross Nese<br />

John Paone<br />

Mark Schwartz<br />

*Howard B. Slaughter, Jr.<br />

Edward Geiger (serving in the stead of<br />

C. Alan Walker, Secretary,<br />

Department of Community and<br />

Economic Development)<br />

Members Absent:<br />

Ronald F. Croushore<br />

*On Telephone conference call<br />

Others Present:<br />

Brian A. Hudson, Executive Director<br />

Rebecca L. Peace, Chief Counsel<br />

David L. Evans, Assistant Executive Director of Multifamily<br />

Robert Bobincheck, Director of Strategic Planning and Policy<br />

Scott Elliott, Manager of Communications<br />

Kate Newton, Director Homeownership Programs<br />

Bill Fogarty, Director of Government Affairs<br />

Bryce Maretzki, Director of Business Development<br />

Holly Glauser, Director of Development<br />

Carl Dudeck, Director of <strong>Housing</strong> Management<br />

Joseph Knopic, Director of Finance<br />

JoLynn Stoy, Associate Counsel<br />

Barbara Stephens, Public Affairs Officer<br />

Brenda Wells, Manager, Western Region<br />

Daryl Rotz, Director of HEMAP<br />

Kim Boal, Director of Information Technology<br />

Lisa Case, Manager of Project Operations<br />

John Goryl, Associate Counsel<br />

Thomas Brzana, Director of Loan Servicing

Page 2<br />

Michael Kosick, Director of Technical Services<br />

M. Steven O’Neill, Assistant Counsel<br />

Carla Falkenstein, Manager of <strong>Housing</strong> Services<br />

Chris Anderson, Communication Coordinator<br />

Lynette Davenport, Multifamily Research Development Assistant<br />

Gail Shull, Tax Credit Officer<br />

Sue Belles, Manager of Loan Programs<br />

Melissa Raffensperger, Policy Associate<br />

John Zapotocky, Manager of Finance<br />

LaKisha Thomas, Development Officer<br />

Sherry Heidelmark, Development Officer<br />

Brian Shull, Senior Development Officer<br />

William Bailey, Development Officer<br />

Ann Mermelstein, Senior Development Officer<br />

Douglas Haughton, Development Officer<br />

David Doray, Senior Development Officer<br />

Beth Silvick, Development Officer<br />

Eileen Demshock, Manager of Tax Credit Program<br />

Terri Zizzi, Sen.Pileggi’s Office<br />

Dan Rosen, Merrill Lynch<br />

Margaret Guarino, Bank of America<br />

Kimberly Welsh, Janney Montgomery Scott<br />

John Kelly, Janney Montgomery Scott<br />

George Limbert, HDC Mid-Atlantic<br />

Mark Johnston, Bank of New York Mellon<br />

Peter Cunningham, Bank of New York Mellon<br />

Christopher Dirr, NRP Group<br />

Lisa Yaffe, Commonwealth Development Strategies<br />

Jere Thompson, Ballard Spahr<br />

Kim Mahrini, Ballard Spahr<br />

Valarie Allen, Ballard Spahr<br />

Michael Baumrin, RBC<br />

Drew Lyons, Malody Wooten<br />

Michael Baird, RBC<br />

Jessica Fieldhouse, Mullin & Lonergan<br />

Brandon, Johnson, Monarch Development Group<br />

Alan Jaffe, JP Morgan<br />

Marie Boyer, PNC Bank<br />

Lohna Holst, PNC Bank<br />

Cindy Daley, <strong>Housing</strong> Alliance<br />

Charles Scalise, <strong>Housing</strong> & Neighborhood Development Service<br />

Louis Biacchi, Pugliese AssociatesGreg Brunner, M&T Bank<br />

Kim Shindle, <strong>Pennsylvania</strong> Association of Realtors<br />

*Alan Fair, Hunt Capital Partners<br />

Beth Beachy, Representative Curtis Thomas' Office<br />

Charlotte L. Nelson, Assistant Secretary<br />

Carrie M. Barnes, Secretary

Page 3<br />

A meeting of the Members of the <strong>Board</strong> of the <strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency<br />

was held on Thursday, March <strong>14</strong>, <strong>2013</strong>, at 10:30 a.m. at the offices of the <strong>Pennsylvania</strong> <strong>Housing</strong><br />

Finance Agency, 211 North Front Street, Harrisburg, <strong>Pennsylvania</strong>.<br />

In compliance with the provisions of the Sunshine Act, notification of this meeting<br />

appeared in the Legal Notices Section of The Patriot News in Harrisburg, Dauphin County on<br />

March 7, <strong>2013</strong>.<br />

1. CALL TO ORDER AND ROLL CALL<br />

The meeting was called to order by Chairman Moyer at 10:30 a.m. The roll was called<br />

and a quorum was present.<br />

2. APPROVAL OF THE MINUTES FROM THE FEBRUARY <strong>14</strong>, <strong>2013</strong> BOARD<br />

MEETING<br />

There were no additions or corrections to the minutes.<br />

Mr. Schwartz made a motion that the minutes from the February <strong>14</strong>, <strong>2013</strong><br />

<strong>Board</strong> meeting be approved as submitted. The motion was seconded Mr. Nese and<br />

was unanimously approved.<br />

3. PROGRAM DEVELOPMENT AND REVIEW COMMITTEE REPORT<br />

Ms. Gaffney, as Chair of the Program and Development Review Committee, reported<br />

that the Committee met prior to the <strong>Board</strong> meeting to discuss several issues, including the<br />

following agenda items.<br />

A. Review and Approval of the Low Income <strong>Housing</strong> Tax Credit Process and<br />

Allocation of Resources<br />

Ms. Glauser reported that the Agency received 47 applications requesting<br />

$43,650,000 in tax credits for this funding cycle which focused on projects located in<br />

urban communities. It is anticipated that the Agency's total Low Income <strong>Housing</strong><br />

Tax Credit authority for <strong>2013</strong> is approximately $28,000,000, less forward<br />

commitments from 2012 approvals of $2,400,000, plus any returned tax credits.<br />

Ms. Glauser reported that all applications have been reviewed thoroughly by<br />

staff and senior management and she noted that all developments have been ranked in<br />

accordance with the selection criteria. She briefly reviewed the criteria for the <strong>Board</strong>.<br />

Ms. Glauser thanked the Development, Technical Services and Management<br />

staffs of the Agency for their work in reviewing each of these projects. This review<br />

process was a total team effort.

Page 4<br />

Staff requests the <strong>Board</strong>'s approval of the tax credit allocation process as<br />

discussed with the Program and Development Review Committee.<br />

Ms. Gaffney made the motion that the <strong>Board</strong> approve the resolution<br />

regarding the allocation process and the authorization of certain Agency actions<br />

regarding Agency funding. This motion was seconded by Mr. Baker.<br />

Chairman Moyer understands that this was a huge undertaking in reviewing<br />

each proposal relating to all aspects of the review process. He stated that it is<br />

unfortunate there is not enough money to go around to fund all of the projects<br />

presented. He praised staff for their work and for the very informative presentation to<br />

the Committee members.<br />

Chairman Moyer called for a vote on the motion that the <strong>Board</strong> approve<br />

the resolution regarding the allocation process and the authorization of certain<br />

Agency actions regarding Agency funding.<br />

approved. (See Appendix 1 of these <strong>Minutes</strong>.)<br />

This motion was unanimously<br />

B. Multifamily Loan-To-Lender Financing Program Approval<br />

Mr. Evans reported that the Agency has been negotiating with Hunt Capital<br />

Partners, a multifamily property lender, to design a pilot "loan to lender" program to<br />

identify, renovate and finance certain multifamily projects in <strong>Pennsylvania</strong>. The<br />

Agency has a sizable amount of tax exempt volume cap which has been designated<br />

for its multifamily properties. By utilizing those funds, the Agency will be able to<br />

expand the number of rental units available to low and moderate income households<br />

under the low income housing tax credit program restrictive covenants for at least the<br />

minimum 15 year affordability period. Hunt Capital would take the lending risks of<br />

the portfolio, identify investors, and undertake the rehabilitation and construction<br />

risk.<br />

The Agency would enter into a trust indenture and sell tax exempt bonds to<br />

Hunt Capital to fund this program.<br />

Staff is requesting the <strong>Board</strong>'s approval of the framework of the bond sale so<br />

that the Hunt Capital can begin to identify properties in the Commonwealth, develop<br />

rehabilitation programs with their construction company and negotiate with investors<br />

for the debt and equity placement.<br />

Ms. Gaffney stated that the Program and Development Review Committee<br />

recommends approval for this program to the <strong>Board</strong>.

Page 5<br />

Ms. Gaffney made the motion that the <strong>Board</strong> approve the resolution<br />

authorizing the issuance of limited obligation multifamily development bonds for<br />

the purpose of funding certain residential rental facilities. This motion was<br />

seconded by Mr. Paone and was unanimously approved. (See Appendix 2 of<br />

these <strong>Minutes</strong>.)<br />

Mr. Fair of Hunt Capital thanked the <strong>Board</strong> for their support of this program and<br />

stated that they appreciate the opportunity to work in <strong>Pennsylvania</strong> with the Agency's<br />

staff.<br />

C. Other Business<br />

Ms Gaffney reported that the Program and Development Review Committee<br />

approved the transfer of partnership interests for the Hill Café Apartments located in<br />

Harrisburg, Dauphin County; Hudson Park located in York York County and<br />

Sassafras Terrace Apartments located in Mount Joy, Lancaster County.<br />

(See<br />

Appendices 3 and 4 of these <strong>Minutes</strong>.) No <strong>Board</strong> action is required on these transfers<br />

of ownership.<br />

There was no additional business to be brought before the <strong>Board</strong>.<br />

4. POLICY COMMITTEE REPORT<br />

Mr. Slaughter, as Chair of the Policy Committee, reported that the Committee met<br />

prior to the <strong>Board</strong> meeting and discussed the <strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and<br />

Rehabilitation Enhancement Fund (PHARE) Plan and its accompanying Request for<br />

Proposals.<br />

Mr. Maretzki gave a brief overview of the proposed plan for the <strong>Board</strong> noting that it<br />

is required by legislation. No comments have been received by the Agency regarding the<br />

<strong>2013</strong> proposed plan and the plan submitted to the <strong>Board</strong> is the final draft. Staff is<br />

requesting the <strong>Board</strong>'s approval at this time.<br />

Mr. Slaughter reported that the Policy Committee recommends approval to the <strong>Board</strong>.<br />

Mr. Slaughter made the motion that the <strong>Board</strong> approve the <strong>2013</strong> <strong>Pennsylvania</strong><br />

<strong>Housing</strong> Affordability and Rehabilitation Enhancement Fund (PHARE) Plan and the<br />

Request for Proposals.<br />

This motion was seconded by Mr. Baker and was<br />

unanimously approved. (See Appendices 5 and 6 of these <strong>Minutes</strong>.)<br />

There was no other business to be brought before the <strong>Board</strong>.<br />

5. INVESTMENT BANKER REPORT<br />

Mr. Baumrin of RBC Capital Markets distributed an Economic Outlook brochure.

Page 6<br />

RBC believes that the economy continues to mend itself and improve. Consumer<br />

confidence is at levels more consistent with a recession period rather than expansion;<br />

however, increased bank lending might provide a jolt to consumer spending.<br />

He reported that housing continues to show slow signs of recovering. While record<br />

low mortgage rates are still available, applications and sales have shown only gradual<br />

momentum. <strong>Housing</strong> prices in <strong>Pennsylvania</strong> have been slowly increasing. He reported that<br />

underwriting requirements indicate that improvement in the housing sector will take<br />

additional time. There has been an increase in demand for multifamily housing.<br />

It appears that the employment picture is beginning to rebound as the unemployment<br />

rate is down somewhat. He noted that wages have improved as well as worker productivity<br />

which is a good sign. RBC believes that the Federal Reserve may begin to take some<br />

action by the end of the year if the outlook continues to improve and the economy<br />

strengthens.<br />

Generally speaking, RBC believes that interest rates will continue their upward trend.<br />

There were no comments or questions from the <strong>Board</strong>.<br />

6. SUMMARY OF DEVELOPMENTS WITH AGENCY SUPPORT FUNDS<br />

There were no comments or questions from the <strong>Board</strong> on this report.<br />

7. DEVELOPMENT STATUS REPORT<br />

There were no comments or questions from the <strong>Board</strong> on this report.<br />

8. <strong>PHFA</strong> INVESTMENT REPORT<br />

There were no comments or questions from the <strong>Board</strong> on this report.<br />

9. OTHER BUSINESS<br />

A. NCSHA Legislative Conference<br />

Mr. Hudson reported that he, Mr. Fogarty and Ms. Raffensperger met with 15<br />

<strong>Pennsylvania</strong> legislative members and/or their staff members during this conference<br />

held in Washington on March 4-6. Topics of conversation included the Low Income<br />

<strong>Housing</strong> Tax Credit Program, the tax exempt volume cap, the HOME program and<br />

other items of interest to the Agency. They particularly wanted to meet with the new<br />

members of <strong>Pennsylvania</strong> delegation to inform them of <strong>PHFA</strong>'s presence and mission<br />

in the Commonwealth.<br />

Mr. Hudson noted that 44 states were represented at this legislative conference.<br />

There were 41 executive directors of housing finance agencies attending this year.

Page 7<br />

B. National Association of Homebuilders Mortgage Roundtable<br />

Mr. Hudson reported that he attended this mortgage roundtable at the invitation<br />

of the national homebuilders on March 12, also in Washington DC.<br />

C. <strong>PHFA</strong> <strong>Housing</strong> Forum<br />

Mr. Hudson encouraged <strong>Board</strong> members to attend <strong>PHFA</strong>'s <strong>Housing</strong> Forum<br />

scheduled for May 2 and 3 at the Harrisburg Hilton. <strong>Board</strong> members wishing to<br />

attend should contact the Secretary as soon as possible.<br />

D. Ethics Act<br />

Ms. Peace informed <strong>Board</strong> members that they must complete a Statement of<br />

Financial Interest form which must be filed with the State Ethics Commission. These<br />

forms were distributed to all <strong>Board</strong> members. Any <strong>Board</strong> member with questions<br />

should contact Ms. Peace. The deadline for the filing of these forms is May 1, <strong>2013</strong>.<br />

10. ADJOURNMENT<br />

There being no further business to be discussed, a motion was made and seconded that<br />

the meeting be adjourned. The motion was unanimously approved. Chairman Moyer<br />

adjourned the meeting of the <strong>Board</strong> at 11:05 a.m.<br />

The next regularly scheduled meeting of the Members of the <strong>Board</strong> of the <strong>Pennsylvania</strong><br />

<strong>Housing</strong> Finance Agency will be held on Thursday, April 11, <strong>2013</strong>, at 10:30 a.m. at the offices of<br />

the Agency, 211 North Front Street, Harrisburg, <strong>Pennsylvania</strong>.<br />

Respectfully submitted,<br />

Carrie M. Barnes<br />

Carrie M. Barnes<br />

Secretary

RESOLUTION OF THE PENNSYLVANIA HOUSING FINANCE AGENCY<br />

APPROVING THE YEAR <strong>2013</strong> FEDERAL LOW INCOME RENTAL HOUSING TAX CREDIT<br />

ALLOCATION PROCESS AND AUTHORIZING CERTAIN AGENCY ACTIONS REGARDING<br />

AGENCY FUNDING<br />

WHEREAS, the <strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency (the "Agency") exists and operates by<br />

virtue of and pursuant to the housing finance agency law, (1959, Dec. 3, P.L. 1688, as amended, 35 P.S.<br />

1680.101, et seq.) (hereinafter, "the Act"); and<br />

WHEREAS, pursuant to Executive Order 87-9, the Agency is designated as the tax credit<br />

allocating agency of the Commonwealth of <strong>Pennsylvania</strong>; and<br />

WHEREAS, pursuant to Section 42(m) of the Internal Revenue Code of 1986, as amended, (the<br />

"Code"), the Agency adopted a qualified allocation plan (the "Year <strong>2013</strong> Plan") authorizing the low<br />

income rental housing tax credit program (the "Year <strong>2013</strong> Program"), sought and received approval by<br />

the Governor of the Year <strong>2013</strong> Plan and made Year <strong>2013</strong> Plan and applications available to interested<br />

applicants; and<br />

WHEREAS, in approving the Year <strong>2013</strong> Plan, the <strong>Board</strong> of the Agency directed staff to present<br />

the results of the ranking and scoring process undertaken in the Year <strong>2013</strong> Program to the <strong>Board</strong> for<br />

review prior to announcing preliminary reservations of federal low income tax credits to projects; and<br />

WHEREAS, staff has outlined and reviewed with the <strong>Board</strong> the process undertaken in evaluating<br />

Year <strong>2013</strong> Program applicants in Cycle 1; and<br />

WHEREAS, the Agency expects to have available funds in an amount not to exceed $1M from<br />

Keystone Communities funds through an agreement with DCED (as may be amended), certain funds<br />

available for rental housing through applications in eligible communities submitted through the PHARE<br />

program and funds in an amount not to exceed $5.5M available through the federal HOME program for<br />

funding of projects in nonparticipating jurisdictions (collectively "Agency Funds").<br />

NOW THEREFORE, be it resolved by the <strong>Board</strong> of the <strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency<br />

on the <strong>14</strong> th day of March, <strong>2013</strong>, as follows:<br />

Section 1. The <strong>Board</strong> has determined that the staff has properly applied the ranking and<br />

scoring process adopted by the <strong>Board</strong> for allocation of tax credits in the Year <strong>2013</strong> Program.<br />

Section 2. Staff is authorized to take all steps to implement the Year <strong>2013</strong> Program<br />

reservations derived therefrom and to make conditional forward commitments of Year <strong>2013</strong> tax credits to<br />

ensure that all <strong>2013</strong> tax credit resources are allocated and that <strong>PHFA</strong> is eligible for national pool<br />

consideration.<br />

Section 3. Staff shall administer the allocation of Agency Funds and shall provide ongoing<br />

reports to the <strong>Board</strong> of the pipeline of developments supported by tax credits and Agency Funds.<br />

Section 4.<br />

This Resolution shall take effect immediately.

RESOLUTION OF THE MEMBERS OF THE PENNSYLVANIA HOUSING<br />

FINANCE AGENCY AUTHORIZING THE ISSUANCE OF LIMITED OBLIGATION<br />

MULTIFAMILY DEVELOPMENT BONDS, ISSUE <strong>2013</strong> (LOAN TO LENDER)<br />

FOR THE PURPOSE OF FUNDING CERTAIN RESIDENTIAL RENTAL FACILITIES<br />

WHEREAS, pursuant to the <strong>Housing</strong> Finance Agency Law, 35 P.S. Section 1680.101 et seq.,<br />

"the Agency has the power...as authorized from time to time by resolution of the members and subject to<br />

the written approval of the Governor to issue its negotiable bonds...and notes in such principal amount<br />

as... shall be necessary to provide sufficient funds for achieving its corporate purposes...at such price or<br />

prices as the Agency shall determine..."; and<br />

WHEREAS, the Agency issued its Year <strong>2013</strong> Tax Exempt Qualified Residential Rental Facilities<br />

Seeking Private Activity Bond Allocation Request For Proposals inviting developers to secure issuing<br />

authority for qualified properties; and<br />

WHEREAS, Hunt Capital Partners, LLC has submitted an application to the Agency requesting<br />

that the Agency provide conduit financing for the acquisition and permanent financing of certain<br />

properties which meet the requirements of the Internal Revenue Code and of the parameters of the<br />

Agency's financing program; and<br />

WHEREAS, subject to all requisite approvals and conditions, the Agency will provide financing<br />

for the facilities through the issuance of its Limited Obligation Multifamily Development Bonds, Issue<br />

<strong>2013</strong> (Loan to Lender) in accordance with a bond resolution (the "Issue <strong>2013</strong> Resolution") to be attached<br />

hereto and made a part hereof; and<br />

WHEREAS, the Agency intends to use some of the proceeds of the Limited Obligation<br />

Multifamily Development Bonds, Issue <strong>2013</strong> (Loan to Lender) to reimburse itself, Hunt Capital Partners,<br />

LLC, its affiliated entities and/or the borrowers for qualifying expenditures paid prior to the date of<br />

issuance of the Limited Obligation Multifamily Development Bonds, Issue <strong>2013</strong> (Loan to Lender); and<br />

WHEREAS, pursuant to a resolution of the Agency adopted June 13, 1991 and entitled<br />

"RESOLUTION OF THE PENNSYLVANIA HOUSING FINANCE AGENCY DELEGATING TO THE<br />

FINANCE COMMITTEE CERTAIN SPECIFIC AUTHORITY RELATING TO AGENCY BOND<br />

ISSUES," the Agency has determined to delegate to the Finance Committee of the <strong>Board</strong> of the Agency,<br />

within the perimeters established herein, the authorization to negotiate the final terms of such series of<br />

bonds.<br />

NOW, THEREFORE, be it resolved by the members of the <strong>Pennsylvania</strong> <strong>Housing</strong> Finance<br />

Agency on this <strong>14</strong>th day of March, <strong>2013</strong> as follows:<br />

Section 1. Staff is hereby authorized to take all necessary actions to provide an allocation of<br />

volume cap from amounts available to the Agency pursuant to a carry forward of unused 2012 cap in an<br />

aggregate amount not to exceed $100,000,000 principal amount to finance up to ten (10) qualified<br />

residential rental facilities (through the use of a Loan to Lender Program with Hunt Companies, Inc. and<br />

its affiliated entities including Hunt Capital Partners, LLC) subject to the following conditions: a.)<br />

submission, review and approval of all documentation necessary for the construction and permanent loan<br />

financing; b.) satisfactory evidence that all qualifications relating to Section 42 of the Code and all<br />

applicable requirements of the Tax Credit Program have been met; c.) satisfactory evidence that all<br />

qualifications relating to Section <strong>14</strong>2 (and related sections) of the Code have been met; d.) evidence of<br />

commitment of and appropriate guaranties from all parties to the conduit financing transaction; and e.)<br />

evidence of the satisfaction of all project closing requirements.<br />

Section 2. Adoption of the Issue <strong>2013</strong> Resolution and Forms of Documents. The Issue <strong>2013</strong><br />

Resolution authorizing the issuance of and security for the Agency's Limited Obligation Multifamily<br />

Development Bonds, Issue <strong>2013</strong> (Loan to Lender) (the "Bonds") is hereby incorporated herein by

eference and is adopted by the Agency, upon final completion of its terms and conditions by the Finance<br />

Committee, as set forth below.<br />

Section 3. Delegation of Authorization to Negotiate Final Terms. (a) Subject to the provisions of<br />

subparagraphs (a) and (b) of this Section 3, the Finance Committee is hereby authorized and directed to<br />

negotiate, prepare or accept, execute, deliver and distribute, for and on behalf of the Agency and in the<br />

name thereof, a contract of purchase and/or agreement and memorandum of understanding, which<br />

outlines terms of final pricing, interest rates, tender and redemption provisions, bond maturities, payment<br />

of associated costs of issuance appropriate for the financing (including reasonable compensation for<br />

applicable structuring and fees related thereto), and such documents as may be necessary for the<br />

transaction, including offering and disclosure documents (if any) and all documents relating to the<br />

issuance of, security for and investment mechanisms relating to the Bonds, including senior and<br />

subordinate trust indentures, tax regulatory agreements and loan agreements in such form as shall be<br />

finally agreed upon by counsel to the Agency. At the time such final terms have been negotiated on<br />

behalf of the Agency, such final terms shall be incorporated into the Issue <strong>2013</strong> Resolution, which, with<br />

such final terms so incorporated, shall constitute the Issue <strong>2013</strong> Resolution of the Agency authorizing the<br />

issuance of the Bonds.<br />

(b) The final terms of the Bonds shall be as negotiated by the Finance Committee, provided,<br />

however, as follows: (i) the principal amount of the Bonds in one or more series shall not exceed<br />

$100,000,000, net of original issue discount, if any, (ii) the final maturity of the Bonds shall be no later<br />

than 2054; and (iii) the initial interest rate or rates on the Bonds (Series A) shall be a rate or rates resulting<br />

in a net interest cost ("NIC") of not higher than 7% per annum and the Bonds (Series B) (Subordinate)<br />

shall be a rate or rates resulting in NIC of not higher than 12% per annum.<br />

Section 4. Official Intent. In accordance with Treasury Reg. §1.150-2, the Agency hereby<br />

confirms its intentions that a portion of the proceeds of the obligations authorized by this Resolution will<br />

be used to reimburse itself, Hunt Capital Partners, LLC and/or the borrowers for qualifying expenditures<br />

paid prior to the date of issuance of the obligations authorized by this Resolution. All original<br />

expenditures to be reimbursed will be capital expenditures (as defined in Treas. Reg. §1.150-1(b)) and<br />

other amounts permitted to be reimbursed pursuant to Treas. Reg. §1.150-2(d)(3) and (f).<br />

Section 5. The action taken by the Agency is hereby declared to be an affirmative official act of<br />

the Agency toward the issuance of tax exempt or taxable notes and/or bonds to provide necessary funds to<br />

finance each of the above described residential rental facilities sponsored by and through Hunt Capital<br />

Partners, LLC or its related entities in the aggregate principal amounts set forth above, provided that in no<br />

event shall this official act by the <strong>Board</strong> be construed as an acceptance of any liability on behalf of the<br />

Agency.<br />

Section 6. This Resolution shall take effect immediately.

RESOLUTION OF THE MEMBERS OF THE BOARD<br />

OF THE PENNSYLVANIA HOUSING FINANCE AGENCY<br />

APPROVING TRANSFER OF OWNERSHIP<br />

HILL CAFE APARTMENTS, <strong>PHFA</strong> NO. H-0049<br />

WHEREAS, Hill Cafe Apartments, located in Dauphin County, <strong>Pennsylvania</strong> (the<br />

"Development"), was originally financed in 1989 through a $260,000 primary mortgage loan and<br />

a $483,750 support mortgage loan; and<br />

WHEREAS, the current ownership entity of the Development, Hill Café Partners, a<br />

<strong>Pennsylvania</strong> limited partnership, has requested Agency approval of the transfer of ownership;<br />

and<br />

WHEREAS, the Development is subject to Agency approval of any change in the nature<br />

or character of the ownership entity throughout the term of the Agency mortgage loan; and<br />

WHEREAS, the new owner will assume the existing mortgage and will continue to<br />

operate the Development and shall be responsible for the fiscal and physical condition of the<br />

Development; and<br />

WHEREAS, the new owner will obtain additional financing to rehabilitate the<br />

development and is requesting that the Agency subordinate its existing support mortgage lien;<br />

and<br />

WHEREAS, staff recommends approval of the transfer of ownership of the Development<br />

to Hill Café 1249 LP, a <strong>Pennsylvania</strong> limited partnership, and subordination of the support<br />

mortgage lien subject to the conditions set forth below.<br />

NOW, THEREFORE, be it resolved by the Members of the <strong>Board</strong> of the <strong>Pennsylvania</strong><br />

<strong>Housing</strong> Finance Agency on this <strong>14</strong>th day of March, <strong>2013</strong>, as follows:<br />

Section 1. The Agency approves the conveyance of Hill Café Apartments to Hill Café<br />

1249 LP, a <strong>Pennsylvania</strong> limited partnership, which will assume the outstanding balance of the<br />

Agency support loan and the subordination of the Agency’s support mortgage lien.<br />

Section 2. The Executive Director, Assistant Executive Director and other Agency staff<br />

are authorized and directed to take all actions necessary to effectuate the transfer of ownership<br />

and subordination of the Agency’s support mortgage lien; subject to review and approval of the<br />

appropriate documents for the transaction.<br />

Section 3. This resolution shall take effect immediately.

RESOLUTION OF THE MEMBERS OF THE BOARD<br />

OF THE PENNSYLVANIA HOUSING FINANCE AGENCY<br />

APPROVING TRANSFER OF OWNERSHIP AND PREPAYMENT<br />

HUDSON PARK, <strong>PHFA</strong> NO. O-13 AND<br />

SASSAFRAS TERRACE APARTMENTS, <strong>PHFA</strong> NO. O-79<br />

WHEREAS, Hudson Park, located in York County, <strong>Pennsylvania</strong>, was originally financed in 1989<br />

through a $812,463 primary mortgage loan and a $900,000 support mortgage loan and Sassafras Terrace<br />

Apartments, located in Lancaster County <strong>Pennsylvania</strong>, was originally financed in 1990 through a<br />

$1,264,362 primary loan and a $946,839 support loan (collectively referred to as the “Developments”); and<br />

WHEREAS, the Agency provided Smart Rehab loans in the amount of $1<strong>03</strong>,778 (Hudson Park) and<br />

$73,801 (Sassafras Terrace Apartment) for weatherization improvements to the Developments in 2011; and<br />

WHEREAS, the current ownership entities of the Developments are <strong>Pennsylvania</strong> limited<br />

partnerships with John Meeder and PFG Capital Corporation as the general partners, who have requested<br />

Agency approval of the transfer of ownership of the Developments and prepayment of the primary loans, as<br />

follows:<br />

a. Hudson Park – $191,206.64 (outstanding principal $182,101.56) with an additional payment of<br />

$9,105.08 for lost economic value.<br />

b. Sassafras Terrace Apartments - $389,325.37 (outstanding principal $370,786.07) with an<br />

additional payment of $18,539.30 for lost economic value.<br />

WHEREAS, the Developments are subject to Agency approval of any change in the nature or<br />

character of the ownership entities throughout the term of the Agency mortgage loans; and<br />

WHEREAS, the new owner will assume the existing support loan mortgages and Smart Rehab loans<br />

and will continue to operate the Developments and shall be responsible for the fiscal and physical conditions<br />

of the Developments and is requesting that the Agency subordinate its existing mortgage liens; and<br />

WHEREAS, staff recommends approval of the transfer of ownership of the Developments to TCB<br />

Central <strong>Pennsylvania</strong> MF LLC, a <strong>Pennsylvania</strong> limited liability company, subject to the conditions set forth<br />

below.<br />

NOW, THEREFORE, be it resolved by the Members of the <strong>Board</strong> of the <strong>Pennsylvania</strong> <strong>Housing</strong><br />

Finance Agency on this <strong>14</strong>th day of March, <strong>2013</strong>, as follows:<br />

Section 1. The Agency approves the transfer of ownership of Hudson Park and Sassafras Terrace<br />

Aparatments to TCB Central <strong>Pennsylvania</strong> MF LLC, a <strong>Pennsylvania</strong> limited liability company, assumption<br />

of the outsanding balance of the support loans and Smart Rehab loans and subordination of the Agency’s<br />

existing mortgage liens as well as the prepayment of the primary loans for Hudson Park (outstanding<br />

principal $182,101.56 with an additional payment of $9,105.08 for lost economic value) and Sassafras<br />

Terrace Apartements (outstanding principal $370,786.07 with an additional payment of $18,539.30 for lost<br />

economic value).<br />

Section 2. The Executive Director, Assistant Executive Director and other Agency staff are<br />

authorized and directed to take all actions necessary to effectuate the transfer of ownership interests,<br />

assumption of of the outstanding balances of the support loans and Smart Rehab loans, subordination of the<br />

Agency’s existing mortgage liens and prepayment of the outstanding balances of the primary loans with<br />

additional payments for lost economic value; subject to review and approval of the appropriate documents<br />

for the transactions.<br />

Section 3. This resolution shall take effect immediately.

<strong>2013</strong><br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and Rehabilitation Enhancement<br />

Fund (PHARE) Plan<br />

Principles and Elements of Plan<br />

Background<br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and Rehabilitation Enhancement Fund (PHARE)<br />

The PHARE Fund was established by Act 105 of 2010 (the "PHARE Act") to provide the mechanism by<br />

which certain allocated state or federal funds, as well as funds from other outside sources, would be<br />

used to assist with the creation, rehabilitation and support of affordable housing throughout the<br />

Commonwealth.<br />

The PHARE Act did not allocate any funding but did outline specific requirements that include<br />

preferences, considerations, match funding options and obligations to utilize a percentage of the funds<br />

to assist households below 50% of the median area income. The PHARE Act provides a fairly broad<br />

canvas regarding the types of programs and the specific uses of any funding to allow flexibility in<br />

working with other state and federal acts and programs.<br />

Marcellus Shale Impact Fee<br />

The Marcellus Shale impact fee legislation, Act 13 of 2012, (the "Impact Fee Act") specifically allocates<br />

certain amounts from the impact fee into the PHARE Fund to address the following needs, including;<br />

<br />

<br />

<br />

support for projects that increase the availability of affordable housing for low and moderate<br />

income persons and families, persons with disabilities and elderly persons in counties where<br />

unconventional gas wells have been drilled (regardless of production levels),<br />

provide rental assistance, in counties where unconventional gas wells have been drilled, for<br />

persons or families whose household income does not exceed the area median income, and<br />

Specifies that no less than 50% of the funds are to be used in fifth, sixth, seventh and eighth<br />

class counties.<br />

Direct Allocation-PHARE Fund will receive a direct yearly allocation from the portion of funds set aside<br />

for local distribution. The direct allocation is as follows: $5.0 million each fiscal year beginning in 2012<br />

and thereafter.<br />

Windfall/Spillover Funds-Additional funds may become available because the Impact Fee Act limits<br />

amounts allocated to qualifying municipalities (as defined in the Impact Fee Act) and provides that any

money remaining, after all allocations have been made to qualified municipalities, would also be<br />

deposited into the PHARE Fund.<br />

Purpose<br />

The PHARE Act provides the mechanism to address the housing needs in impacted<br />

counties/communities of the Marcellus Shale region.<br />

Principles<br />

In accordance with the PHARE Act and the Impact Fee Act, the monies will be used to address significant<br />

housing needs in impacted counties and communities with the following additional criteria:<br />

<br />

<br />

50% of the funds must be spent in 5 th through 8 th class counties;<br />

30% of the funds must benefit persons/families below 50% of the median area income.<br />

#1) Maximize resource leveraging – to the greatest extent possible, the resources allocated will be used<br />

as leverage for other public and private resources. Additionally, local non-financial assets should be<br />

identified and leveraged where possible – including transportation, schools, recreation, employment,<br />

health, community and economic development support and other amenities. Preference: Applications<br />

that also include Optional Affordable <strong>Housing</strong> funds (under 53 PaCS, Ch.60) and/or local share portions<br />

of the impact fee.<br />

#2) Address greatest need – the monies will be allocated in communities where the greatest housing<br />

needs are identified based on housing needs studies and assessments, interviews, real estate price<br />

factors, housing stock analysis, market studies and consideration of the extent of gas wells drilled and<br />

related activity. The limited resources available should be used to meet the most significant and<br />

pressing housing needs but may also be used to address longer term housing needs. Preference:<br />

Projects/programs that: 1. Assist with the rehabilitation of blighted, abandoned or otherwise at risk<br />

housing and the reuse of vacant land where housing was once located; or 2. Provide funding for owneroccupied<br />

rehabilitation, first time homebuyers, and rental assistance.<br />

#3) Foster partnerships – the funds should be used to maximize sustainable partnerships that will be<br />

committed to addressing the housing needs in these communities over a significant period of time.<br />

While the funds are to be used to directly support housing to meet the needs in the impacted<br />

communities, the projects should also help establish capacity to address those needs over the longer<br />

term. Preference: Projects/programs that incorporate social service entities that offer additional<br />

services to the residents within the community where the project/program is taking place.<br />

#4) Effective and efficient – ensure that the resources are used effectively and efficiently to meet the<br />

housing needs of the impacted communities. Given the expectation that demand for many types of<br />

housing will greatly exceed the funds available, it will be critical to maximize the effectiveness and<br />

2

efficiency for housing investments by the PHARE Fund. Preference: Projects/programs that assist the<br />

residents with the greatest need in that particular region.<br />

#5) Equitable and transparent – create a plan and allocation process that will equitably meet the<br />

housing needs in impacted communities and establish a process that provides transparency to all<br />

stakeholders. Funding decisions and reporting will be done in accordance with the legislative<br />

requirements.<br />

Elements of the Plan<br />

Analysis of Need – one of the most critical components of the plan is to continually assess housing need<br />

in these communities. From both a quantitative and qualitative perspective the requirement to have<br />

accurate, reliable data from which funding decisions can be made is imperative.<br />

It is important to recognize that this data will need to be municipality-specific to capture the unique and<br />

likely different housing needs in the various communities. In addition, the housing/real estate markets<br />

are diverse across the impacted communities and the analysis of need will require an understanding<br />

(qualitative and quantitative) of individual markets to make appropriate resource allocation decisions.<br />

Building upon analysis already undertaken by the Agency and the Commonwealth, additional analysis<br />

may be performed to assess specific housing issues in the impacted communities and to identify housing<br />

needs (persons with special needs, elderly, larger households, physical disabilities, homeless, etc.) to<br />

appropriately target PHARE Fund resources to those in greatest need of housing, especially due to the<br />

impact of the Marcellus Shale development. In addition to types of housing analysis, <strong>PHFA</strong> will<br />

consider different income levels, nature of housing stock and the housing needs of those across a broad<br />

spectrum (homeless, near homeless, very low income, low income, temporary and seasonal workers,<br />

and permanent work force, etc.)<br />

Understanding of real estate market dynamics – the plan for the utilization of these resources has been<br />

developed to address and continuously reevaluate the specific housing real estate markets in each<br />

community. The “micro” markets could be significantly different in the impacted communities and the<br />

plan is sufficiently flexible to address those differences.<br />

The housing and real estate development “capacity” will also have significant impact on the ability of<br />

these funds to be used effectively and efficiently to meet the needs of the communities. Based on the<br />

preliminary finding from the Lycoming College research<br />

http://www.phfa.org/forms/housing_study/2011/marcellus_report.pdf, <strong>PHFA</strong> has some insight into the<br />

existing housing development capacity in some of the impacted communities. This will serve as a<br />

foundation for investment in increasing the capacity. There will be need for ongoing analysis of capacity<br />

(private, non-profit, public) as part of the plan. In some of these communities there has been no<br />

significant housing market in decades while in others there is a robust market that may be addressing<br />

some part of the housing needs. The plan will help determine where additional housing development<br />

capacity may be necessary, or where other strategies may be implemented for meeting the housing<br />

needs in those communities.<br />

3

Allocation and use – The funding vehicle’s allocation process, created by the plan, must also be<br />

supportive of and responsive to the needs of the housing and real estate development market and<br />

should foster coordinated local trust fund plans and resources. Funds may be used to support<br />

predevelopment, site acquisition and infrastructure development, planning and preconstruction activity<br />

in addition to direct support of development and operation of projects and housing programs including<br />

employee assisted housing programs. Funds may be provided in various forms designed to best<br />

support the particular activity including grants; market rate, amortizing, balloon, bridge or soft loans;<br />

capital contributions; capital financing subsidy support; operating and supportive service reserve<br />

funding; rental or homeowner assistance. Funds may be specifically allocated to address timing issues<br />

presented in the development of affordable housing projects, when other financing is available,<br />

construction season, local zoning or other approvals. In addition, funding may be directed for<br />

administration by the Agency for certain projects approved for low income housing tax credits or other<br />

<strong>PHFA</strong> resources. Preliminary allocations may be made for projects/programs awaiting approval of<br />

additional resources. Projects/programs that do not commence within 1 year may have the preliminary<br />

allocation withdrawn.<br />

High quality design and construction – a vital element of the plan will be the development of housing<br />

that is both of good quality design and construction and will be sustainable over a long period of time.<br />

The opportunity to meet the growing housing needs in these communities will necessitate that this<br />

housing be available as an asset for the community for many generations. In order to meet that<br />

objective it will require that projects funded with these resources meet the highest design and<br />

construction quality standards available and that all projects ensure sustainability to the long term (both<br />

financial and physical). Funds may be specifically allocated to support green and renewable energy<br />

sources and as leverage to consumer programs available through utility companies or other business<br />

partners.<br />

Targeting of resources – It is likely that the funds in this program will not be sufficient to meet all the<br />

housing needs and mitigate every housing impact created by the shale gas development; therefore<br />

investment decisions will target the limited funds to projects that meet the principles outlined above<br />

and most comprehensively address the elements of the plan.<br />

Where possible these funds will be targeted and stay focused on mitigating the very specific housing<br />

impacts created by the shale development in the impacted and designated communities. This element<br />

will likely result in the determination that while there may be worthy housing projects that could be<br />

funded with these resources, the focus of development will be on most comprehensively addressing the<br />

direct and tangible housing impacts. Priority may be given to target resources in tandem with approved<br />

county housing trust fund plans and/or plans for the utilization of local share impact fee funds.<br />

Stakeholder input – the plan for allocation of resources will provide for broad stakeholder input<br />

concerning the principles and elements of the plan.<br />

There are many diverse interests that are concerned about the anticipated housing impact and<br />

therefore how these resources will be allocated to address the need. To the greatest extent possible<br />

4

opportunities should be created for relevant and legitimate stakeholders to comment and advise the<br />

plan. This element will need to be managed for practicality and efficiency in order to maximize input.<br />

Preference: Applicants who provide a process where members of the community and other<br />

stakeholders may provide input on the application prior to submission.<br />

Application/Allocation Process<br />

Based on both the legislative requirements of the PHARE Act and the Impact Fee Act, <strong>PHFA</strong> has<br />

developed an application/RFP for eligible applicants interested in applying for the funds.<br />

Eligible applicants include counties that have adopted impact fees as well as municipalities who have<br />

further contributed to PHARE via windfall/spill over funds from the impact fee. While only eligible<br />

applicants may apply, nonprofit and for profit organizations may be part of the application process.<br />

The elements of the application and allocation process include;<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Adoption of “plan” for managing the anticipated funds by <strong>PHFA</strong>.<br />

Announcement of application and possible training/information session concerning the<br />

elements of the application.<br />

Applications accepted and reviewed by <strong>PHFA</strong> staff based on the application and plan<br />

requirements.<br />

Project recommendations reviewed by <strong>PHFA</strong>.<br />

Announcement of preliminary funding approval.<br />

<strong>PHFA</strong> will establish an annual application process that will allow the agency to address housing<br />

needs in the impacted communities.<br />

<strong>PHFA</strong> may amend the plan, application and the allocation process at any time, upon written<br />

publication of such amendments.<br />

<strong>PHFA</strong>, as part of the RFP process, will require all applicants to target a minimum of 30% of their<br />

funding to support households with incomes below 50% of median area income.<br />

<strong>PHFA</strong> will require applicants to include information on how the county is using its Act 137 (Local<br />

<strong>Housing</strong> Trust Fund) monies to address housing needs in the community. This will be included<br />

as part of the Comprehensive Plan section of the RFP.<br />

Preliminary approval and funding of applications is contingent upon receipt of funds under Act 13 of<br />

2012.<br />

5

211 North Front Street<br />

P.O. Box 8029<br />

Harrisburg, PA 17105-8029<br />

<strong>2013</strong> Request for Proposals<br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and Rehabilitation Enhancement Fund<br />

(PHARE ) / Act 13 of 2012 Impact Fee Act<br />

The <strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency (<strong>PHFA</strong> or Agency) announces a Request for<br />

Proposals (RFP) inviting applications to participate in the <strong>Pennsylvania</strong> <strong>Housing</strong><br />

Affordability and Rehabilitation Enhancement Fund (“PHARE”). The PHARE Fund was<br />

established by Act 105 of 2010 to provide a mechanism by which certain funds would be<br />

used to assist with the creation, rehabilitation and support of affordable housing<br />

throughout the Commonwealth.<br />

The Marcellus Shale impact fee legislation (“Impact Fee Act”), Act 13 of 2012, makes<br />

specific allocations to the PHARE Fund to address housing needs in counties with<br />

unconventional gas wells that have adopted a local impact fee.<br />

Eligible applicants include counties in which unconventional gas wells are located,<br />

that have adopted impact fees as well as municipalities which have further<br />

contributed to PHARE through windfall/spill over funds from the impact fee.<br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and Rehabilitation Enhancement Fund<br />

Goals<br />

A. Increase safe, affordable housing opportunities in areas of the Commonwealth<br />

impacted by the development of the Marcellus Shale.<br />

B. Utilize funds to address the most significant and persistent housing needs in the<br />

most effective and efficient manner.<br />

C. Maximize the leveraging of resources to the greatest extent possible.<br />

D. Foster sustainable partnerships that will be committed to addressing the housing<br />

needs over a significant period of time.<br />

E. Ensure that resources are used in an effective and efficient manner to meet the<br />

housing needs of communities impacted by the Marcellus Shale.

F. Establish an application, allocation and reporting process that provides<br />

transparency to all stakeholders.<br />

G. Provide opportunities for safe, affordable housing to those within a range of<br />

incomes. In order to ensure this, each application must provide at least thirty<br />

percent (30%) of the PHARE funds to assist persons (or families) below fifty<br />

percent (50%) of the median area income (described below) for the county in<br />

which the project/program will be operated. At no point may funds benefit<br />

persons (or families) with incomes above two hundred percent (200%) of the<br />

median area income for the county in which they reside.<br />

Median area income is determined annually by the U.S. Department of<br />

<strong>Housing</strong> and Urban Development. County median area income figures are<br />

available at the below website: (select <strong>Pennsylvania</strong> and then identify the<br />

specified county.) The county median income figure will be used in determining<br />

household eligibility.<br />

http://www.huduser.org/portal/datasets/il/il<strong>2013</strong>/select_Geography.odn<br />

The Agency may adjust any of these benchmarks to maximize project ability to<br />

participate in federally subsidized program opportunities.<br />

For further details pertaining to preferences and program<br />

requirements, please refer to the final <strong>2013</strong> PHARE Plan.

The <strong>2013</strong> <strong>Pennsylvania</strong> <strong>Housing</strong> Affordability and Rehabilitation<br />

Enhancement Fund (PHARE)<br />

Proposal Requirements<br />

This section outlines the specific requirements for proposals under the <strong>Pennsylvania</strong><br />

<strong>Housing</strong> Affordability and Rehabilitation Enhancement Fund (“PHARE Fund”).<br />

Proposals must be numbered with the information submitted in the same order as<br />

indicated below.<br />

1. Narrative: A summary description of the proposal, its scope, the need for and<br />

the expected impact of the funding. All key features of the proposal, including<br />

targeting, impact, and how the funds will make safe, quality housing affordable<br />

and more readily available should be addressed in this section. Include a<br />

description of the existing local housing market (rental and for sale) and how the<br />

proposal would address the present needs while also providing stability for<br />

residents in the future.<br />

Applicants are encouraged to supply sufficient market information<br />

regarding need for the program/project. If not provided, market study information<br />

and analysis may be requested or obtained elsewhere by staff in evaluating the<br />

application.<br />

2. Financing: A detailed plan including all of the following, if applicable;<br />

a. A list of sources of matching and/or leveraging funds including percentage<br />

of funding support from all other sources;<br />

b. The status of the funding availability (requested/committed) including a<br />

timeline for access to matching or leveraging funds;<br />

c. Letters evidencing commitment of financing from relevant funding<br />

sources must be included.<br />

3. Partnership: While counties and municipalities which have contributed to the<br />

PHARE Fund through windfall/spill over funds must be the designated applicant,<br />

nonprofit and for profit organizations may be part of the application process. If a<br />

partnership has been formed, including those among multiple municipalities,<br />

organizations, agencies, or departments, include a description of the role each<br />

partner will play in the program/project.<br />

4. Timeline: Proposals must show an overall timeline for the utilization of the<br />

funds. Programs/projects should be prepared to commence within one year of<br />

application.

5. Comprehensive Plan:<br />

a. For proposals involving the development of new homes or rehabilitation<br />

of vacant properties for sale or rent, please provide:<br />

i. Evidence of site control or of the ability to acquire the proposed<br />

site in a timely manner.<br />

ii. Evidence that the proposal complies with zoning ordinances and<br />

local land development plans.<br />

iii. A map of the site and the neighborhood identifying proposed<br />

municipal improvements and any private development not part of<br />

the proposal.<br />

iv. A current appraisal of the property/properties to be included in the<br />

proposed project may be required. If one has already been<br />

completed, please include a copy.<br />

v. A complete development budget, including sources and uses.<br />

vi. Delineation of the income group(s) being targeted for rent or<br />

purchase of the homes and the number of units being targeted to<br />

each income group. Provide evidence that this targeting is needed<br />

within the market and that proposed rents or purchase prices will<br />

be affordable to such populations.<br />

b. For proposals involving all other uses of PHARE Funds, please provide<br />

the following:<br />

i. A detailed description of the existing program or new program<br />

being proposed.<br />

ii. Name of the department/agency/entity/organization that will be<br />

charged with administering the program and a description of their<br />

experience administering a program of this nature.<br />

iii. A geographical description of where the program will operate.<br />

iv. Delineation of the income group(s) targeted by the program.<br />

Please provide evidence that this targeting is needed within the<br />

market and that the proposed program will be affordable to the<br />

targeted households.<br />

v. For existing programs, provide a copy of the prior year’s budget,<br />

as approved by the governing body of the entity administering the<br />

program.<br />

vi. For new programs being proposed, provide a document outlining<br />

how funding is anticipated to be spent, including a timeline for<br />

disbursements.<br />

6. Act 137 (County <strong>Housing</strong> Trust Funds): If your county has adopted a local<br />

ordinance to create a county-based housing trust fund (Act 137), please provide a<br />

description of the funds available over the past five (5) years (or since the<br />

inception of the fund, if less) and a narrative/listing of the types of projects that<br />

have been awarded these monies.

7. Overview:<br />

a. For proposals involving the development of new housing units or<br />

rehabilitation of vacant properties, complete Appendix A – Fact Sheet.<br />

b. For proposals involving all other programmatic requests, complete<br />

Appendix B – Fact Sheet.<br />

8. Use of PHARE Funds: No more than 5% of the total amount of PHARE<br />

Funds awarded to an applicant, may be used for administrative purposes.<br />

9. Reporting: Semi-annual reports will be required in a form and timeframe<br />

sufficient to allow <strong>PHFA</strong> to comply with the provisions of the PHARE Act.<br />

Actual reporting requirements will vary based upon the nature of the<br />

project/program and will be included in the contract documents.

All proposals and supporting documentation must be<br />

received by <strong>PHFA</strong> no later than<br />

2:00pm on Friday, June 7 th , <strong>2013</strong>.<br />

The Proposal Submission Process<br />

All questions must be submitted in writing only to Bryce Maretzki at either the<br />

address below or via e-mail at Bmaretzki@phfa.org<br />

Bryce Maretzki<br />

Director of Business Development<br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency<br />

211 North Front Street, P.O. Box 8029<br />

Harrisburg, PA 17105-8029<br />

No phone calls will be accepted.<br />

<strong>PHFA</strong> will try to make all questions and answers available on its website. All<br />

applicants are urged to check the website from time to time for available updates<br />

and guidance. <strong>PHFA</strong> reserves the right to contact any applicant for clarification<br />

and information and to make adjustments to applications necessary to fulfill the<br />

PHARE Plan requirements. In addition, <strong>PHFA</strong> may amend, suspend, terminate or<br />

otherwise withdraw this RFP invitation and the process described at any time.<br />

<strong>PHFA</strong> shall incur no liability to any entity for any aspect of its submission. All<br />

information submitted shall belong to <strong>PHFA</strong> and shall be subject to public<br />

inspection.<br />

Preliminary approval and funding of applications is contingent upon receipt of<br />

funds under Act 13 of 2012.<br />

All proposals must be in three-ring binders and arranged numerically to comply<br />

with the requirements above.<br />

Submit one (1) complete “hard” copy, in a three-ring binder, and a complete<br />

electronic copy of the proposal to:<br />

Melissa Raffensperger<br />

Office of Strategic Planning and Policy<br />

<strong>Pennsylvania</strong> <strong>Housing</strong> Finance Agency<br />

211 North Front Street, P.O. Box 8029<br />

Harrisburg, PA 17105-8029 (zip code for express deliveries is 17101)<br />

All applications must comply in all ways with the PHARE Plan available at:<br />

http://www.phfa.org/forms/phare_plan/2012Plan.pdf

APPENDIX A<br />

Fact Sheet<br />

(Please note: All information provided in this fact sheet will be the final information<br />

used during the funding decision process.)<br />

1. Project/Development Name _________________________<br />

2. Amount of PHARE funding requested _________________________<br />

3. Total Project/Development cost _________________________<br />

4. Identify the amount of PHARE funds that will benefit persons/families<br />

BELOW fifty percent (50%) of the median area income (“MAI”):<br />

$____________________<br />

5. Identify the targeted populations to be served by the program<br />

(Example: 50% of the PHARE Funds will assist persons/households below<br />

50% of the county MAI; the remaining 50% of the PHARE Funds will assist<br />

persons/households between 50% and 100% of the county MAI)<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

6. Total number of homes/units ________________________<br />

Number of new construction homes/units ______________<br />

One bedroom __________ bath __________ Sq. Ft. __________<br />

Two bedroom __________ bath __________ Sq. Ft. __________<br />

Three bedroom __________ bath __________ Sq. Ft. __________<br />

Four bedroom __________ bath __________ Sq. Ft. __________<br />

Number of rehabilitated homes/units ______________<br />

One bedroom __________ bath __________ Sq. Ft. __________<br />

Two bedroom __________ bath __________ Sq. Ft. __________<br />

Three bedroom __________ bath __________ Sq. Ft. __________<br />

Four bedroom __________ bath __________ Sq. Ft. __________<br />

Number VisitAble __________ Number Accessible __________<br />

7. Any additional amenities:<br />

__________________________________________________________________<br />

__________________________________________________________________

8. Proposed sale or rent prices<br />

One bedroom _______________<br />

Three bedroom_______________<br />

Two bedroom _______________<br />

Four bedroom _______________<br />

9. Property address(es) with nine digit zip code(s)<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

10. Contact information for all entities (municipality, developers, non-profits, etc.<br />

that are involved in the project/development)<br />

Name: ____________________________________________________________<br />

Address: ____________________________________________________________<br />

____________________________________________________________<br />

Phone: ____________________________________________________________<br />

E-mail: ____________________________________________________________<br />

Name: ____________________________________________________________<br />

Address: ____________________________________________________________<br />

____________________________________________________________<br />

Phone: ____________________________________________________________<br />

E-mail: ____________________________________________________________<br />

11. Contact information for the individual overseeing the project/development<br />

Name: ____________________________________________________________<br />

Title: ____________________________________________________________<br />

Address: ____________________________________________________________<br />

____________________________________________________________<br />

Phone: ____________________________________________________________<br />

E-mail: ____________________________________________________________<br />

12. Contact information of the individual completing the application<br />

Name: ____________________________________________________________<br />

Title: ____________________________________________________________<br />

Address: ____________________________________________________________<br />

____________________________________________________________<br />

Phone: ____________________________________________________________<br />

E-mail: ____________________________________________________________<br />

Please attach additional pages as necessary.

APPENDIX B<br />

Fact Sheet<br />

(Please note: All information provided in this fact sheet will be the final information<br />

used during the funding decision process.)<br />

1. Program Name _________________________<br />

2. Amount of PHARE funding requested _________________________<br />

3. Total program budget _________________________<br />

4. Number of persons (families) expected to be assisted<br />

________________________<br />

5. Average amount expected to be awarded per household<br />

________________________<br />

6. Identify the amount of PHARE funds that will benefit persons/families<br />

BELOW fifty percent (50%) of the median area income (“MAI”):<br />

$____________________<br />

7. Identify the targeted populations to be served by the program<br />

(Example: 50% of the PHARE Funds will assist persons/households below<br />

50% of the county MAI; the remaining 50% of the PHARE Funds will assist<br />

persons/households between 50% and 100% of the county MAI)<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

8. Brief description of the types of activities proposed<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

9. Contact information for all entities participating in the program<br />

Name: ____________________________________________________________<br />

Address:__________________________________________________________<br />

Phone:____________________________________________________________<br />

E-mail:___________________________________________________________

Name: ____________________________________________________________<br />

Address:__________________________________________________________<br />

Phone:____________________________________________________________<br />

E-mail:___________________________________________________________<br />

10. Contact information for the individual administering the program<br />

Name: ____________________________________________________________<br />

Title:_____________________________________________________________<br />

Address:__________________________________________________________<br />

Phone:____________________________________________________________<br />

E-mail:___________________________________________________________<br />

11. Contact information of the individual completing the application<br />

Name: ____________________________________________________________<br />

Title:_____________________________________________________________<br />

Address:__________________________________________________________<br />

Phone:____________________________________________________________<br />

E-mail:___________________________________________________________<br />

Please attach additional pages as necessary.