Financial Reporting - Rexel

Financial Reporting - Rexel

Financial Reporting - Rexel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

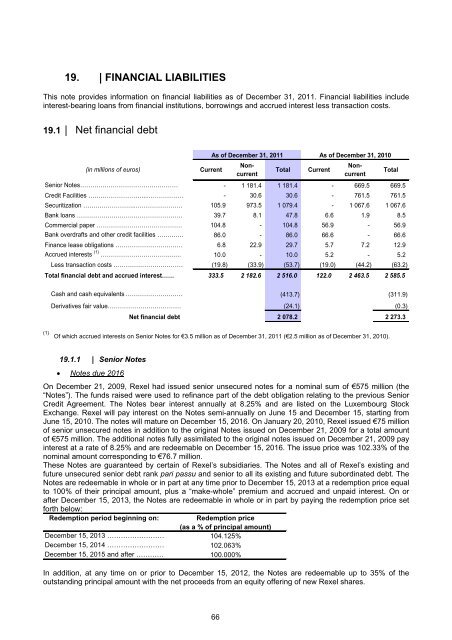

19. | FINANCIAL LIABILITIES<br />

This note provides information on financial liabilities as of December 31, 2011. <strong>Financial</strong> liabilities include<br />

interest-bearing loans from financial institutions, borrowings and accrued interest less transaction costs.<br />

19.1 | Net financial debt<br />

(in millions of euros)<br />

Current<br />

As of December 31, 2011 As of December 31, 2010<br />

Senior Notes………………………………………… " " - 1 181.4 1 181.4 - 669.5 669.5<br />

Credit Facilities ………………………...………………" " - 30.6 30.6 - 761.5 761.5<br />

Securitization ……………………..……………………" " 105.9 973.5 1 079.4 - 1 067.6 1 067.6<br />

Bank loans ……………………….…………………… " " 39.7 8.1 47.8 6.6 1.9 8.5<br />

Commercial paper …………………………………… " " 104.8 - 104.8 56.9 - 56.9<br />

Bank overdrafts and other credit facilities ……………" " 86.0 - 86.0 66.6 - 66.6<br />

Finance lease obligations …………………………… " " 6.8 22.9 29.7 5.7 7.2 12.9<br />

Accrued interests (1) ……………………………...…. " " 10.0 - 10.0 5.2 - 5.2<br />

Less transaction costs ………………………………" " (19.8) (33.9) (53.7) (19.0) (44.2) (63.2)<br />

Total financial debt and accrued interest…… " " 333.5 2 182.6 2 516.0 122.0 2 463.5 2 585.5<br />

Total<br />

Current<br />

Noncurrent<br />

Noncurrent<br />

Total<br />

Cash and cash equivalents …………………………" " (413.7) (311.9)<br />

Derivatives fair value……………………………… " " (24.1) (0.3)<br />

Net financial debt<br />

2 078.2 2 273.3<br />

(1)<br />

Of which accrued interests on Senior Notes for €3.5 million as of December 31, 2011 (€2.5 million as of December 31, 2010).<br />

19.1.1 | Senior Notes<br />

Notes due 2016<br />

On December 21, 2009, <strong>Rexel</strong> had issued senior unsecured notes for a nominal sum of €575 million (the<br />

“Notes”). The funds raised were used to refinance part of the debt obligation relating to the previous Senior<br />

Credit Agreement. The Notes bear interest annually at 8.25% and are listed on the Luxembourg Stock<br />

Exchange. <strong>Rexel</strong> will pay interest on the Notes semi-annually on June 15 and December 15, starting from<br />

June 15, 2010. The notes will mature on December 15, 2016. On January 20, 2010, <strong>Rexel</strong> issued €75 million<br />

of senior unsecured notes in addition to the original Notes issued on December 21, 2009 for a total amount<br />

of €575 million. The additional notes fully assimilated to the original notes issued on December 21, 2009 pay<br />

interest at a rate of 8.25% and are redeemable on December 15, 2016. The issue price was 102.33% of the<br />

nominal amount corresponding to €76.7 million.<br />

These Notes are guaranteed by certain of <strong>Rexel</strong>’s subsidiaries. The Notes and all of <strong>Rexel</strong>’s existing and<br />

future unsecured senior debt rank pari passu and senior to all its existing and future subordinated debt. The<br />

Notes are redeemable in whole or in part at any time prior to December 15, 2013 at a redemption price equal<br />

to 100% of their principal amount, plus a “make-whole” premium and accrued and unpaid interest. On or<br />

after December 15, 2013, the Notes are redeemable in whole or in part by paying the redemption price set<br />

forth below:<br />

Redemption period beginning on:<br />

Redemption price<br />

(as a % of principal amount)<br />

December 15, 2013 ……………………… 104.125%<br />

December 15, 2014 ……………………… 102.063%<br />

December 15, 2015 and after ………… 100.000%<br />

In addition, at any time on or prior to December 15, 2012, the Notes are redeemable up to 35% of the<br />

outstanding principal amount with the net proceeds from an equity offering of new <strong>Rexel</strong> shares.<br />

66