Financial Reporting - Rexel

Financial Reporting - Rexel

Financial Reporting - Rexel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Under this share buy-back program, <strong>Rexel</strong> entered into a mandate with Natixis, complying with a Code of<br />

Ethics recognized by the Autorité des Marchés Financiers (AMF), the French securities regulator, to promote<br />

the liquidity of <strong>Rexel</strong> share transactions for an amount of €12.8 million.<br />

In addition, <strong>Rexel</strong> mandated Natixis in order to buy 1,975,000 treasury shares to serve its free share plans, in<br />

the fourth quarter 2011 for an amount of €23.7 million.<br />

On December 31, 2011, <strong>Rexel</strong> held 2,590,773 treasury shares (103,000 as of December 31, 2010) valued at<br />

an average price of €12.12 per share (€16.255 per share as of December 31, 2010) and recorded as a<br />

reduction in shareholders’ equity, for an amount of €31.4 million (€1.7 million as of December 31, 2010).<br />

Net capital losses realized on the sale of treasury shares in 2011 amounted to €0.6 million net of tax and<br />

were recognized as a decrease in shareholders’ equity (net capital gain of €1.3 million in 2010).<br />

15. | SHARE-BASED PAYMENTS<br />

15.1 | Bonus share plans<br />

In addition to its long-term profit sharing policy for employees, <strong>Rexel</strong> has bonus share plans in place, the<br />

principal characteristics of which are described below:<br />

Plans issued in 2011<br />

On May 12, 2011 and October 11, 2011, <strong>Rexel</strong> entered into free share plans for its top executives and key<br />

managers amounting to a maximum of 2,423,467 shares. According to these plans, these employees and<br />

executives will either be eligible to receive <strong>Rexel</strong> shares two years after the grant date (May 12, 2013 /<br />

October 11, 2013), these being restricted for an additional two-year period (until May 12, 2015 / October 11,<br />

2015), the so-called “2+2 Plan”, or four years after the granting date with no subsequent restrictions, the socalled<br />

“4+0 Plan”.<br />

The actual delivery of these bonus shares is subject to service and performance conditions set forth in the<br />

plan.<br />

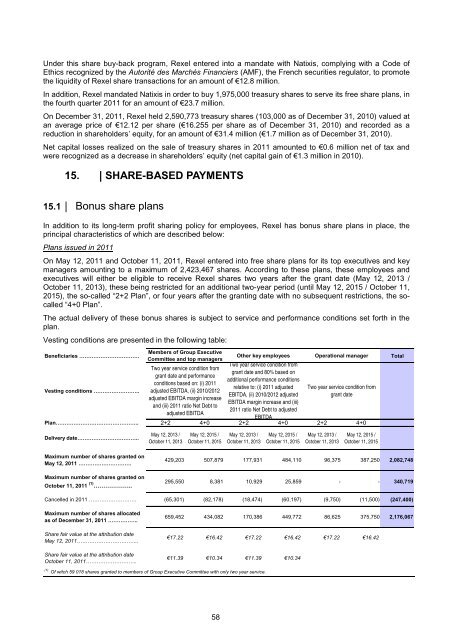

Vesting conditions are presented in the following table:<br />

Members of Group Executive<br />

Beneficiaries …………………………….<br />

Other key employees Operational manager<br />

Committee and top managers<br />

Two year service condition from<br />

Two year service condition from<br />

grant date and 80% based on<br />

grant date and performance<br />

additional performance conditions<br />

conditions based on: (i) 2011<br />

relative to: (i) 2011 adjusted Two year service condition from<br />

Vesting conditions …………………….. adjusted EBITDA, (ii) 2010/2012<br />

EBITDA, (ii) 2010/2012 adjusted<br />

grant date<br />

adjusted EBITDA margin increase<br />

EBITDA margin increase and (iii)<br />

and (iii) 2011 ratio Net Debt to<br />

2011 ratio Net Debt to adjusted<br />

adjusted EBITDA<br />

EBITDA<br />

Plan……………………………………….. 2+2 4+0 2+2 4+0 2+2 4+0<br />

Total<br />

Delivery date……………………………..<br />

Maximum number of shares granted on<br />

May 12, 2011 …………………………<br />

Maximum number of shares granted on<br />

October 11, 2011 (1) ………………..<br />

May 12, 2013 /<br />

October 11, 2013<br />

May 12, 2015 /<br />

October 11, 2015<br />

May 12, 2013 /<br />

October 11, 2013<br />

May 12, 2015 /<br />

October 11, 2015<br />

May 12, 2013 /<br />

October 11, 2013<br />

May 12, 2015 /<br />

October 11, 2015<br />

429,203 507,879 177,931 484,110 96,375 387,250 2,082,748<br />

295,550 8,381 10,929 25,859 - - 340,719<br />

Cancelled in 2011 ……………………… (65,301) (82,178) (18,474) (60,197) (9,750) (11,500) (247,400)<br />

Maximum number of shares allocated<br />

as of December 31, 2011 ……………..<br />

Share fair value at the attribution date<br />

May 12, 2011……………………………..<br />

Share fair value at the attribution date<br />

October 11, 2011………………………..<br />

659,452 434,082 170,386 449,772 86,625 375,750 2,176,067<br />

€17.22 €16.42 €17.22 €16.42 €17.22 €16.42<br />

€11.39 €10.34 €11.39 €10.34<br />

(1)<br />

Of witch 59 018 shares granted to members of Group Executive Committee with only two year service.<br />

58