Financial Reporting - Rexel

Financial Reporting - Rexel

Financial Reporting - Rexel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

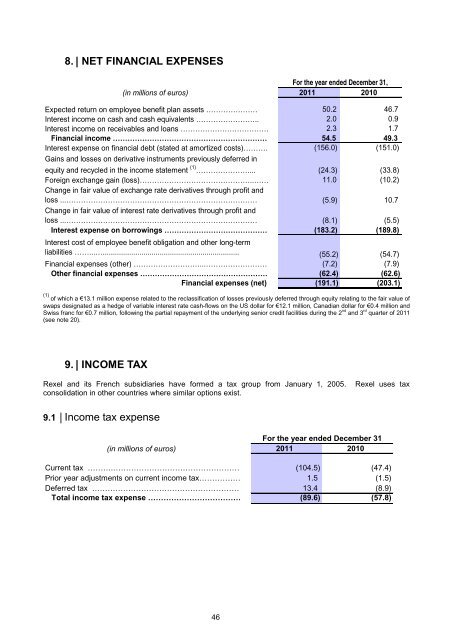

8. | NET FINANCIAL EXPENSES<br />

For the year ended December 31,<br />

(in millions of euros) 2011 2010<br />

Expected return on employee benefit plan assets ………………… " " 50.2 46.7<br />

Interest income on cash and cash equivalents …………………….. " " 2.0 0.9<br />

Interest income on receivables and loans ……………………………… " " 2.3 1.7<br />

<strong>Financial</strong> income ……………………………………………………… " " 54.5 49.3<br />

Interest expense on financial debt (stated at amortized costs)…………" " (156.0) (151.0)<br />

Gains and losses on derivative instruments previously deferred in<br />

equity and recycled in the income statement (1) ………………….... " " (24.3) (33.8)<br />

Foreign exchange gain (loss)………………………………………..…… " " 11.0 (10.2)<br />

Change in fair value of exchange rate derivatives through profit and<br />

loss ...…………………………………………………………………… " " (5.9) 10.7<br />

Change in fair value of interest rate derivatives through profit and<br />

loss ...…………………………………………………………………… " " (8.1) (5.5)<br />

Interest expense on borrowings …………………………………… " " (183.2) (189.8)<br />

Interest cost of employee benefit obligation and other long-term<br />

" "<br />

liabilities ……...…...................................................................<br />

(55.2) (54.7)<br />

<strong>Financial</strong> expenses (other) ………………………...………………………" " (7.2) (7.9)<br />

Other financial expenses ………………………………………………" " (62.4) (62.6)<br />

<strong>Financial</strong> expenses (net) " " (191.1) (203.1)<br />

(1) of which a €13.1 million expense related to the reclassification of losses previously deferred through equity relating to the fair value of<br />

swaps designated as a hedge of variable interest rate cash-flows on the US dollar for €12.1 million, Canadian dollar for €0.4 million and<br />

Swiss franc for €0.7 million, following the partial repayment of the underlying senior credit facilities during the 2 nd and 3 rd quarter of 2011<br />

(see note 20).<br />

9. | INCOME TAX<br />

<strong>Rexel</strong> and its French subsidiaries have formed a tax group from January 1, 2005. <strong>Rexel</strong> uses tax<br />

consolidation in other countries where similar options exist.<br />

9.1 | Income tax expense<br />

For the year ended December 31<br />

(in millions of euros) 2011 2010<br />

Current tax ……….……………………………………………" " (104.5) (47.4)<br />

Prior year adjustments on current income tax………………" " 1.5 (1.5)<br />

Deferred tax ………………………………………………… " " 13.4 (8.9)<br />

Total income tax expense ………………………………" " (89.6) (57.8)<br />

46