EAST CENTRAL RAILWAY - Indian Railways

EAST CENTRAL RAILWAY - Indian Railways

EAST CENTRAL RAILWAY - Indian Railways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page -09 of 40<br />

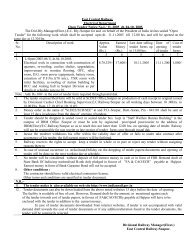

ELIGIBILITY CRITERIA FOR TENDER COSTING ABOVE 10.00 LAKH<br />

1 Should have completed in the<br />

last three financial years( i.e.<br />

current year and three previous<br />

years)<br />

2. Total contract amount received<br />

during the last 3(Three)<br />

financial years and in the<br />

current financial year.<br />

At least one similar single work for a minimum value of 35% of<br />

advertised Tender value of work.<br />

Should be a minimum of 150% of the advertised tender value.<br />

Tender Committee would satisfy themselves about the<br />

authenticity of the certificates produced by the tenderer(s) to this<br />

effect which may be an attested certificate from the employer/<br />

client , audited balance sheet duly certified by the chartered<br />

Accountant etc. The details about the certificate to be accepted in<br />

regard to the turnover.<br />

(A)List of work completed in the last three financial years giving description of work,<br />

organization for whom executed , approximate value of contract at the time of award<br />

and date of scheduled completion of work. Date of actual start, actual completion and<br />

final value of contract should also be given.<br />

(B)List of work on hand indicating description of work, contract value, approximate<br />

value of balance work yet to be done , date of award of work and payment received till<br />

date from the same contract.<br />

NOTE: (1) For (A) and (B) above related documents/certificates from the<br />

organizations<br />

with whom they worked /are working should be enclosed.<br />

(2) Certificates from private individuals for whom such work are executed<br />

/being executed shall not be accepted.<br />

SPECIAL CONDITION FOR RECOVERY OF TAXES<br />

1. Income Tax @ 2% (Two percent) on the Gross amount of each bill , with a<br />

surcharge of 15% (Fifteen percent ) on the Income Tax deducted, will be recovered<br />

from all the bills of the contractors in terms of Section-194 ( C) of Income Tax Act-<br />

1961 and Ministry of Finance circular No. 593 dtd. 05.02.1991.<br />

In case of any revision / alteration in taxes, received from the Income Tax<br />

Department, the same will be taken into account as per the directives.<br />

2. Sales Tax will be recovered from the contractors’ bills as per the rule, circulated by<br />

the concerned state Government.<br />

……………………………………<br />

(Signature)<br />

Signature of Tenderer(s)<br />

Date…………………………<br />

………..…………………………………<br />

(Designation