How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

How to Kill a Black Swan Remy Briand and David Owyong ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

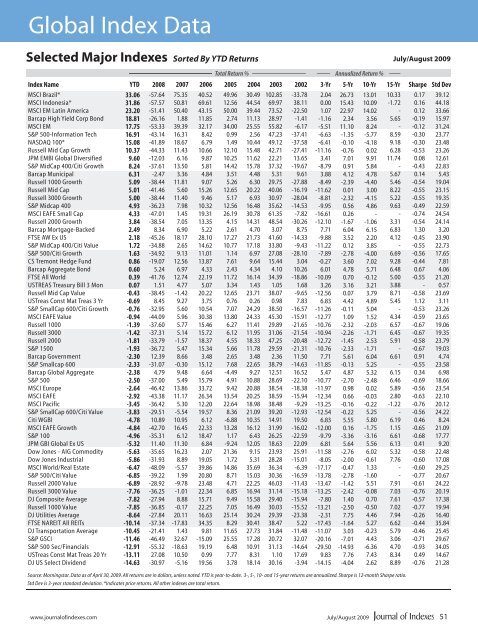

Global Index Data<br />

Selected Major Indexes Sorted By YTD Returns July/August 2009<br />

Total Return % Annualized Return %<br />

Index Name YTD 2008 2007 2006 2005 2004 2003 2002 3-Yr 5-Yr 10-Yr 15-Yr<br />

MSCI Brazil*<br />

MSCI Indonesia*<br />

MSCI EM Latin America<br />

Barcap High Yield Corp Bond<br />

MSCI EM<br />

S&P 500-Information Tech<br />

NASDAQ 100*<br />

Russell Mid Cap Growth<br />

JPM EMBI Global Diversified<br />

S&P MidCap 400/Citi Growth<br />

Barcap Municipal<br />

Russell 1000 Growth<br />

Russell Mid Cap<br />

Russell 3000 Growth<br />

S&P Midcap 400<br />

MSCI EAFE Small Cap<br />

Russell 2000 Growth<br />

Barcap Mortgage-Backed<br />

FTSE AW Ex US<br />

S&P MidCap 400/Citi Value<br />

S&P 500/Citi Growth<br />

CS Tremont Hedge Fund<br />

Barcap Aggregate Bond<br />

FTSE All World<br />

USTREAS Treasury Bill 3 Mon<br />

Russell Mid Cap Value<br />

USTreas Const Mat Treas 3 Yr<br />

S&P SmallCap 600/Citi Growth<br />

MSCI EAFE Value<br />

Russell 1000<br />

Russell 3000<br />

Russell 2000<br />

S&P 1500<br />

Barcap Government<br />

S&P Smallcap 600<br />

Barcap Global Aggregate<br />

S&P 500<br />

MSCI Europe<br />

MSCI EAFE<br />

MSCI Pacific<br />

S&P SmallCap 600/Citi Value<br />

Citi WGBI<br />

MSCI EAFE Growth<br />

S&P 100<br />

JPM GBI Global Ex US<br />

Dow Jones - AIG Commodity<br />

Dow Jones Industrial<br />

MSCI World/Real Estate<br />

S&P 500/Citi Value<br />

Russell 2000 Value<br />

Russell 3000 Value<br />

DJ Composite Average<br />

Russell 1000 Value<br />

DJ Utilities Average<br />

FTSE NAREIT All REITs<br />

DJ Transportation Average<br />

S&P GSCI<br />

S&P 500 Sec/Financials<br />

USTreas Const Mat Treas 20 Yr<br />

DJ US Select Dividend<br />

33.06<br />

31.86<br />

23.20<br />

18.81<br />

17.75<br />

16.91<br />

15.08<br />

10.37<br />

9.60<br />

8.24<br />

6.31<br />

5.09<br />

5.01<br />

5.00<br />

4.93<br />

4.33<br />

3.84<br />

2.49<br />

2.18<br />

1.72<br />

1.63<br />

0.86<br />

0.60<br />

0.39<br />

0.07<br />

-0.43<br />

-0.69<br />

-0.76<br />

-0.94<br />

-1.39<br />

-1.42<br />

-1.81<br />

-1.93<br />

-2.30<br />

-2.33<br />

-2.38<br />

-2.50<br />

-2.64<br />

-2.92<br />

-3.45<br />

-3.83<br />

-4.78<br />

-4.84<br />

-4.96<br />

-5.32<br />

-5.63<br />

-5.86<br />

-6.47<br />

-6.85<br />

-6.89<br />

-7.76<br />

-7.82<br />

-7.85<br />

-8.64<br />

-10.14<br />

-10.45<br />

-11.46<br />

-12.91<br />

-13.11<br />

-14.63<br />

-57.64<br />

-57.57<br />

-51.41<br />

-26.16<br />

-53.33<br />

-43.14<br />

-41.89<br />

-44.33<br />

-12.03<br />

-37.61<br />

-2.47<br />

-38.44<br />

-41.46<br />

-38.44<br />

-36.23<br />

-47.01<br />

-38.54<br />

8.34<br />

-45.26<br />

-34.88<br />

-34.92<br />

-19.07<br />

5.24<br />

-41.76<br />

1.51<br />

-38.45<br />

8.45<br />

-32.95<br />

-44.09<br />

-37.60<br />

-37.31<br />

-33.79<br />

-36.72<br />

12.39<br />

-31.07<br />

4.79<br />

-37.00<br />

-46.42<br />

-43.38<br />

-36.42<br />

-29.51<br />

10.89<br />

-42.70<br />

-35.31<br />

11.40<br />

-35.65<br />

-31.93<br />

-48.09<br />

-39.22<br />

-28.92<br />

-36.25<br />

-27.94<br />

-36.85<br />

-27.84<br />

-37.34<br />

-21.41<br />

-46.49<br />

-55.32<br />

27.08<br />

-30.97<br />

75.35<br />

50.81<br />

50.40<br />

1.88<br />

39.39<br />

16.31<br />

18.67<br />

11.43<br />

6.16<br />

13.50<br />

3.36<br />

11.81<br />

5.60<br />

11.40<br />

7.98<br />

1.45<br />

7.05<br />

6.90<br />

18.17<br />

2.65<br />

9.13<br />

12.56<br />

6.97<br />

12.74<br />

4.77<br />

-1.42<br />

9.27<br />

5.60<br />

5.96<br />

5.77<br />

5.14<br />

-1.57<br />

5.47<br />

8.66<br />

-0.30<br />

9.48<br />

5.49<br />

13.86<br />

11.17<br />

5.30<br />

-5.54<br />

10.95<br />

16.45<br />

6.12<br />

11.30<br />

16.23<br />

8.89<br />

-5.57<br />

1.99<br />

-9.78<br />

-1.01<br />

8.88<br />

-0.17<br />

20.11<br />

-17.83<br />

1.43<br />

32.67<br />

-18.63<br />

10.50<br />

-5.16<br />

40.52<br />

69.61<br />

43.15<br />

11.85<br />

32.17<br />

8.42<br />

6.79<br />

10.66<br />

9.87<br />

5.81<br />

4.84<br />

9.07<br />

15.26<br />

9.46<br />

10.32<br />

19.31<br />

13.35<br />

5.22<br />

28.10<br />

14.62<br />

11.01<br />

13.87<br />

4.33<br />

22.19<br />

5.07<br />

20.22<br />

3.75<br />

10.54<br />

30.38<br />

15.46<br />

15.72<br />

18.37<br />

15.34<br />

3.48<br />

15.12<br />

6.64<br />

15.79<br />

33.72<br />

26.34<br />

12.20<br />

19.57<br />

6.12<br />

22.33<br />

18.47<br />

6.84<br />

2.07<br />

19.05<br />

39.86<br />

20.80<br />

23.48<br />

22.34<br />

15.71<br />

22.25<br />

16.63<br />

34.35<br />

9.81<br />

-15.09<br />

19.19<br />

0.99<br />

19.56<br />

49.96<br />

12.56<br />

50.00<br />

2.74<br />

34.00<br />

0.99<br />

1.49<br />

12.10<br />

10.25<br />

14.42<br />

3.51<br />

5.26<br />

12.65<br />

5.17<br />

12.56<br />

26.19<br />

4.15<br />

2.61<br />

17.27<br />

10.77<br />

1.14<br />

7.61<br />

2.43<br />

11.72<br />

3.34<br />

12.65<br />

0.76<br />

7.07<br />

13.80<br />

6.27<br />

6.12<br />

4.55<br />

5.66<br />

2.65<br />

7.68<br />

-4.49<br />

4.91<br />

9.42<br />

13.54<br />

22.64<br />

8.36<br />

-6.88<br />

13.28<br />

1.17<br />

-9.24<br />

21.36<br />

1.72<br />

14.86<br />

8.71<br />

4.71<br />

6.85<br />

9.49<br />

7.05<br />

25.14<br />

8.29<br />

11.65<br />

25.55<br />

6.48<br />

7.77<br />

3.78<br />

30.49<br />

44.54<br />

39.44<br />

11.13<br />

25.55<br />

2.56<br />

10.44<br />

15.48<br />

11.62<br />

15.78<br />

4.48<br />

6.30<br />

20.22<br />

6.93<br />

16.48<br />

30.78<br />

14.31<br />

4.70<br />

21.73<br />

17.18<br />

6.97<br />

9.64<br />

4.34<br />

16.14<br />

1.43<br />

23.71<br />

0.26<br />

24.29<br />

24.33<br />

11.41<br />

11.95<br />

18.33<br />

11.78<br />

3.48<br />

22.65<br />

9.27<br />

10.88<br />

20.88<br />

20.25<br />

18.98<br />

21.09<br />

10.35<br />

16.12<br />

6.43<br />

12.05<br />

9.15<br />

5.31<br />

35.69<br />

15.03<br />

22.25<br />

16.94<br />

15.58<br />

16.49<br />

30.24<br />

30.41<br />

27.73<br />

17.28<br />

10.91<br />

8.31<br />

18.14<br />

102.85<br />

69.97<br />

73.52<br />

28.97<br />

55.82<br />

47.23<br />

49.12<br />

42.71<br />

22.21<br />

37.32<br />

5.31<br />

29.75<br />

40.06<br />

30.97<br />

35.62<br />

61.35<br />

48.54<br />

3.07<br />

41.60<br />

33.80<br />

27.08<br />

15.44<br />

4.10<br />

34.39<br />

1.05<br />

38.07<br />

0.98<br />

38.50<br />

45.30<br />

29.89<br />

31.06<br />

47.25<br />

29.59<br />

2.36<br />

38.79<br />

12.51<br />

28.69<br />

38.54<br />

38.59<br />

38.48<br />

39.20<br />

14.91<br />

31.99<br />

26.25<br />

18.63<br />

23.93<br />

28.28<br />

36.34<br />

30.36<br />

46.03<br />

31.14<br />

29.40<br />

30.03<br />

29.39<br />

38.47<br />

31.84<br />

20.72<br />

31.13<br />

1.10<br />

30.16<br />

-33.78<br />

38.11<br />

-22.50<br />

-1.41<br />

-6.17<br />

-37.41<br />

-37.58<br />

-27.41<br />

13.65<br />

-19.67<br />

9.61<br />

-27.88<br />

-16.19<br />

-28.04<br />

-14.53<br />

-7.82<br />

-30.26<br />

8.75<br />

-14.33<br />

-9.43<br />

-28.10<br />

3.04<br />

10.26<br />

-18.86<br />

1.68<br />

-9.65<br />

7.83<br />

-16.57<br />

-15.91<br />

-21.65<br />

-21.54<br />

-20.48<br />

-21.31<br />

11.50<br />

-14.63<br />

16.52<br />

-22.10<br />

-18.38<br />

-15.94<br />

-9.29<br />

-12.93<br />

19.50<br />

-16.02<br />

-22.59<br />

22.09<br />

25.91<br />

-15.01<br />

-6.39<br />

-16.59<br />

-11.43<br />

-15.18<br />

-15.94<br />

-15.52<br />

-23.38<br />

5.22<br />

-11.48<br />

32.07<br />

-14.64<br />

17.69<br />

-3.94<br />

2.04<br />

0.00<br />

1.07<br />

-1.16<br />

-5.51<br />

-6.63<br />

-6.41<br />

-11.16<br />

3.41<br />

-8.79<br />

3.88<br />

-8.49<br />

-11.62<br />

-8.81<br />

-9.95<br />

-16.61<br />

-12.10<br />

7.71<br />

-9.88<br />

-11.22<br />

-7.89<br />

-0.27<br />

6.01<br />

-10.09<br />

3.26<br />

-12.56<br />

6.83<br />

-11.26<br />

-12.77<br />

-10.76<br />

-10.94<br />

-12.72<br />

-10.76<br />

7.71<br />

-11.85<br />

5.47<br />

-10.77<br />

-11.97<br />

-12.34<br />

-13.25<br />

-12.54<br />

6.83<br />

-12.00<br />

-9.79<br />

6.81<br />

-11.58<br />

-8.05<br />

-17.17<br />

-13.78<br />

-13.47<br />

-13.25<br />

-7.80<br />

-13.21<br />

-2.31<br />

-17.43<br />

-11.07<br />

-20.16<br />

-29.50<br />

9.83<br />

-14.15<br />

26.73<br />

15.43<br />

22.97<br />

2.34<br />

11.10<br />

-1.35<br />

-0.10<br />

-0.76<br />

7.01<br />

0.91<br />

4.12<br />

-2.39<br />

0.01<br />

-2.32<br />

0.56<br />

0.26<br />

-1.67<br />

6.04<br />

3.52<br />

0.12<br />

-2.78<br />

3.60<br />

4.78<br />

0.70<br />

3.16<br />

0.07<br />

4.42<br />

-0.11<br />

1.09<br />

-2.32<br />

-2.26<br />

-1.45<br />

-2.33<br />

5.61<br />

-0.13<br />

4.87<br />

-2.70<br />

0.98<br />

0.66<br />

-0.16<br />

-0.22<br />

5.55<br />

0.16<br />

-3.36<br />

5.64<br />

-2.76<br />

-2.00<br />

-0.47<br />

-2.78<br />

-1.42<br />

-2.42<br />

1.40<br />

-2.50<br />

7.75<br />

-1.64<br />

3.03<br />

-7.01<br />

-14.93<br />

7.76<br />

-4.04<br />

13.01<br />

10.09<br />

14.02<br />

3.56<br />

8.24<br />

-5.77<br />

-4.18<br />

0.02<br />

9.91<br />

5.84<br />

4.78<br />

-4.40<br />

3.00<br />

-4.15<br />

4.86<br />

-<br />

-1.06<br />

6.15<br />

2.20<br />

3.85<br />

-4.00<br />

7.02<br />

5.71<br />

-0.12<br />

3.21<br />

3.79<br />

4.89<br />

5.04<br />

1.52<br />

-2.03<br />

-1.71<br />

2.53<br />

-1.71<br />

6.04<br />

5.25<br />

5.32<br />

-2.48<br />

0.02<br />

-0.03<br />

-0.22<br />

5.25<br />

5.80<br />

-1.75<br />

-3.16<br />

5.56<br />

6.02<br />

-0.61<br />

1.33<br />

-1.60<br />

5.51<br />

-0.08<br />

0.70<br />

-0.50<br />

4.46<br />

5.27<br />

-0.23<br />

4.43<br />

-6.36<br />

7.43<br />

2.62<br />

10.33<br />

-1.72<br />

-<br />

5.65<br />

-<br />

8.59<br />

9.18<br />

6.28<br />

11.74<br />

-<br />

5.67<br />

5.46<br />

8.22<br />

5.22<br />

9.63<br />

-<br />

3.31<br />

6.83<br />

4.12<br />

-<br />

6.69<br />

9.28<br />

6.48<br />

5.00<br />

3.88<br />

8.71<br />

5.45<br />

-<br />

4.34<br />

6.57<br />

6.45<br />

5.91<br />

-<br />

6.61<br />

-<br />

6.15<br />

6.46<br />

5.89<br />

2.80<br />

-1.22<br />

-<br />

6.19<br />

1.15<br />

6.61<br />

6.13<br />

5.32<br />

7.76<br />

-<br />

-<br />

7.91<br />

7.03<br />

7.61<br />

7.02<br />

7.94<br />

6.62<br />

5.79<br />

3.06<br />

4.70<br />

8.34<br />

8.89<br />

Source: Morningstar. Data as of April 30, 2009. All returns are in dollars, unless noted. YTD is year-<strong>to</strong>-date. 3-, 5-, 10- <strong>and</strong> 15-year returns are annualized. Sharpe is 12-month Sharpe ratio.<br />

Std Dev is 3-year st<strong>and</strong>ard deviation. *Indicates price returns. All other indexes are <strong>to</strong>tal return.<br />

Sharpe<br />

0.17<br />

0.16<br />

0.12<br />

-0.19<br />

-0.12<br />

-0.30<br />

-0.30<br />

-0.53<br />

0.08<br />

-0.43<br />

0.14<br />

-0.54<br />

-0.55<br />

-0.55<br />

-0.49<br />

-0.74<br />

-0.54<br />

1.30<br />

-0.45<br />

-0.55<br />

-0.56<br />

-0.44<br />

0.67<br />

-0.55<br />

-<br />

-0.58<br />

1.12<br />

-0.53<br />

-0.59<br />

-0.67<br />

-0.67<br />

-0.58<br />

-0.67<br />

0.91<br />

-0.55<br />

0.34<br />

-0.69<br />

-0.56<br />

-0.63<br />

-0.76<br />

-0.56<br />

0.46<br />

-0.65<br />

-0.68<br />

0.41<br />

-0.58<br />

-0.60<br />

-0.60<br />

-0.77<br />

-0.61<br />

-0.76<br />

-0.57<br />

-0.77<br />

-0.26<br />

-0.44<br />

-0.46<br />

-0.71<br />

-0.93<br />

0.49<br />

-0.76<br />

Std Dev<br />

39.12<br />

44.18<br />

33.66<br />

15.97<br />

31.24<br />

23.77<br />

23.48<br />

23.26<br />

12.61<br />

22.83<br />

5.43<br />

19.04<br />

23.15<br />

19.35<br />

22.59<br />

24.54<br />

24.14<br />

3.20<br />

23.90<br />

22.73<br />

17.65<br />

7.81<br />

4.06<br />

21.20<br />

0.57<br />

23.69<br />

3.11<br />

23.26<br />

23.65<br />

19.06<br />

19.35<br />

23.79<br />

19.03<br />

4.74<br />

23.58<br />

6.98<br />

18.66<br />

23.54<br />

22.10<br />

20.12<br />

24.22<br />

8.24<br />

21.09<br />

17.77<br />

9.20<br />

22.48<br />

17.08<br />

29.25<br />

20.67<br />

24.22<br />

20.19<br />

17.38<br />

19.94<br />

16.40<br />

35.84<br />

25.45<br />

29.67<br />

34.05<br />

14.67<br />

21.28<br />

www.journalofindexes.com July/August 2009<br />

51