OES Annual Report 2012 - Ocean Energy Systems

OES Annual Report 2012 - Ocean Energy Systems

OES Annual Report 2012 - Ocean Energy Systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

123<br />

05 / DEVELOPMENT OF THE INTERNATIONAL<br />

OCEAN ENERGY INDUSTRY: PERFORMANCE<br />

IMPROVEMENTS AND COST REDUCTIONS<br />

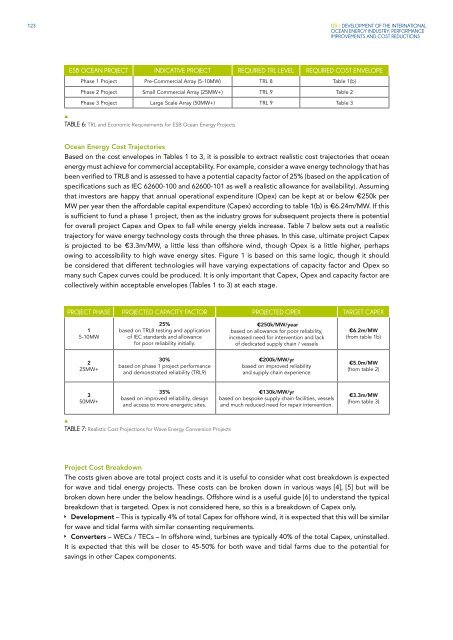

ESB OCEAN PROJECT INDICATIVE PROJECT REQUIRED TRL LEVEL REQUIRED COST ENVELOPE<br />

Phase 1 Project Pre-Commercial Array (5-10MW) TRL 8 Table 1(b)<br />

Phase 2 Project Small Commercial Array (25MW+) TRL 9 Table 2<br />

Phase 3 Project Large Scale Array (50MW+) TRL 9 Table 3<br />

TABLE 6: TRL and Economic Requirements for ESB <strong>Ocean</strong> <strong>Energy</strong> Projects<br />

<strong>Ocean</strong> <strong>Energy</strong> Cost Trajectories<br />

Based on the cost envelopes in Tables 1 to 3, it is possible to extract realistic cost trajectories that ocean<br />

energy must achieve for commercial acceptability. For example, consider a wave energy technology that has<br />

been verified to TRL8 and is assessed to have a potential capacity factor of 25% (based on the application of<br />

specifications such as IEC 62600-100 and 62600-101 as well a realistic allowance for availability). Assuming<br />

that investors are happy that annual operational expenditure (Opex) can be kept at or below €250k per<br />

MW per year then the affordable capital expenditure (Capex) according to table 1(b) is €6.24m/MW. If this<br />

is sufficient to fund a phase 1 project, then as the industry grows for subsequent projects there is potential<br />

for overall project Capex and Opex to fall while energy yields increase. Table 7 below sets out a realistic<br />

trajectory for wave energy technology costs through the three phases. In this case, ultimate project Capex<br />

is projected to be €3.3m/MW, a little less than offshore wind, though Opex is a little higher, perhaps<br />

owing to accessibility to high wave energy sites. Figure 1 is based on this same logic, though it should<br />

be considered that different technologies will have varying expectations of capacity factor and Opex so<br />

many such Capex curves could be produced. It is only important that Capex, Opex and capacity factor are<br />

collectively within acceptable envelopes (Tables 1 to 3) at each stage.<br />

PROJECT PHASE PROJECTED CAPACITY FACTOR PROJECTED OPEX TARGET CAPEX<br />

1<br />

5-10MW<br />

25%<br />

based on TRL8 testing and application<br />

of IEC standards and allowance<br />

for poor reliability initially.<br />

€250k/MW/year<br />

based on allowance for poor reliability,<br />

increased need for intervention and lack<br />

of dedicated supply chain / vessels<br />

€6.2m/MW<br />

(from table 1b)<br />

2<br />

25MW+<br />

30%<br />

based on phase 1 project performance<br />

and demonstrated reliability (TRL9)<br />

€200k/MW/yr<br />

based on improved reliability<br />

and supply chain experience<br />

€5.0m/MW<br />

(from table 2)<br />

3<br />

50MW+<br />

35%<br />

based on improved reliability, design<br />

and access to more energetic sites.<br />

€130k/MW/yr<br />

based on bespoke supply chain facilities, vessels<br />

and much reduced need for repair intervention.<br />

€3.3m/MW<br />

(from table 3)<br />

TABLE 7: Realistic Cost Projections for Wave <strong>Energy</strong> Conversion Projects<br />

Project Cost Breakdown<br />

The costs given above are total project costs and it is useful to consider what cost breakdown is expected<br />

for wave and tidal energy projects. These costs can be broken down in various ways [4], [5] but will be<br />

broken down here under the below headings. Offshore wind is a useful guide [6] to understand the typical<br />

breakdown that is targeted. Opex is not considered here, so this is a breakdown of Capex only.<br />

ÌÌ<br />

Development – This is typically 4% of total Capex for offshore wind, it is expected that this will be similar<br />

for wave and tidal farms with similar consenting requirements.<br />

ÌÌ<br />

Converters – WECs / TECs – In offshore wind, turbines are typically 40% of the total Capex, uninstalled.<br />

It is expected that this will be closer to 45-50% for both wave and tidal farms due to the potential for<br />

savings in other Capex components.