Problem Set 5 - with solutions - iSites - Harvard University

Problem Set 5 - with solutions - iSites - Harvard University

Problem Set 5 - with solutions - iSites - Harvard University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

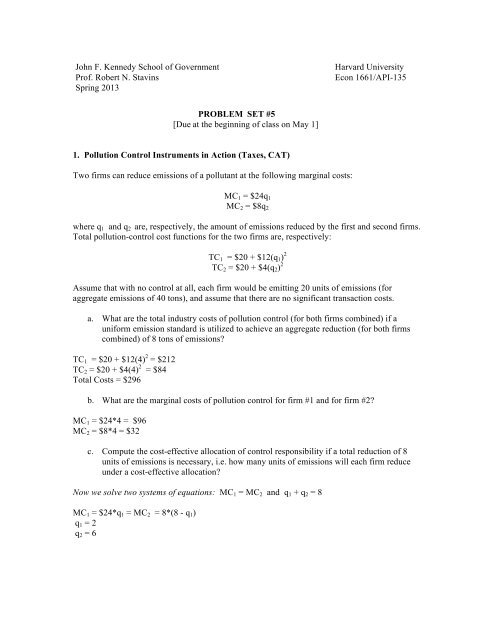

John F. Kennedy School of Government<br />

Prof. Robert N. Stavins<br />

Spring 2013<br />

<strong>Harvard</strong> <strong>University</strong><br />

Econ 1661/API-135<br />

PROBLEM SET #5<br />

[Due at the beginning of class on May 1]<br />

1. Pollution Control Instruments in Action (Taxes, CAT)<br />

Two firms can reduce emissions of a pollutant at the following marginal costs:<br />

MC 1 = $24q 1<br />

MC 2 = $8q 2<br />

where q 1 and q 2 are, respectively, the amount of emissions reduced by the first and second firms.<br />

Total pollution-control cost functions for the two firms are, respectively:<br />

TC 1 = $20 + $12(q 1 ) 2<br />

TC 2 = $20 + $4(q 2 ) 2<br />

Assume that <strong>with</strong> no control at all, each firm would be emitting 20 units of emissions (for<br />

aggregate emissions of 40 tons), and assume that there are no significant transaction costs.<br />

a. What are the total industry costs of pollution control (for both firms combined) if a<br />

uniform emission standard is utilized to achieve an aggregate reduction (for both firms<br />

combined) of 8 tons of emissions?<br />

TC 1 = $20 + $12(4) 2 = $212<br />

TC 2 = $20 + $4(4) 2 = $84<br />

Total Costs = $296<br />

b. What are the marginal costs of pollution control for firm #1 and for firm #2?<br />

MC 1 = $24*4 = $96<br />

MC 2 = $8*4 = $32<br />

c. Compute the cost-effective allocation of control responsibility if a total reduction of 8<br />

units of emissions is necessary, i.e. how many units of emissions will each firm reduce<br />

under a cost-effective allocation?<br />

Now we solve two systems of equations: MC 1 = MC 2 and q 1 + q 2 = 8<br />

MC 1 = $24*q 1 = MC 2 = 8*(8 - q 1 )<br />

q 1 = 2<br />

q 2 = 6

d. What are the total industry costs of pollution control (for both firms combined) <strong>with</strong> a<br />

cost-effective allocation of control responsibility?<br />

TC 1 = $20 + $12(2) 2 = $68<br />

TC 2 = $20 + $4(6) 2 = $164<br />

Total Costs = $232<br />

e. What equilibrium allocation of pollution-reduction responsibility will result <strong>with</strong> a<br />

tradable permit approach if firm #1 is freely allocated 14 tons of emissions permits and<br />

firm #2 is freely allocated 18 tons of emissions permits? How will the equilibrium<br />

allocation be affected by a change in the initial allocation?<br />

Under this scenario, there are 32 permits available. We know that aggregate emissions is 40<br />

units if there is no pollution control (20+20 from initial problem construction). This implies that<br />

under the permit system, we would need to reduce emissions by 8 units (40 – 32 = 8 units to<br />

control). This is the same amount of pollution control proposed under part (a). We know that for<br />

this amount of pollution control, the cost effective allocation is q 1 = 2 and q 2 = 6. Assuming no<br />

uncertainty and no transaction costs, a change in the initial allocation will not affect the costeffective<br />

reduction by individual firms.<br />

f. If the authority chose to reach its objective of 8 tons of aggregate reduction <strong>with</strong> an<br />

emission charge, what per-unit charge should be imposed? How much government<br />

revenue will the tax system generate, if the tax is levied on all units of emission?<br />

Emissions charge = MC 1 = $24q 1 = MC 2 = 8q 2 = $48<br />

Tax revenue = $48*(32) = $1536<br />

g. Which policy instrument taxes, tradeable permits, or a uniform standard would you<br />

expect private industry as a whole to prefer (assuming the same target for aggregate<br />

emission reductions in each case)? Why?<br />

Private industry would prefer (freely allocated) tradeable permits, since it minimizes the cost to<br />

industry. Both permits and taxes lead to the cost-effective reduction, but taxes require additional<br />

transfer payments from industry to government. A uniform standard is not cost-effective. Firm #2<br />

alone would prefer the standard, since its total cost is lower than under the permit system.<br />

However, the total cost to industry is minimized under the tradeable permit system.

2. Policy Design<br />

Explain whether the following statement is true, false, or uncertain (no more than one paragraph):<br />

When it comes to climate policy design, more policy instruments are better than fewer. For<br />

example, in the context of US climate change policy, a Federal cap-and-trade program combined<br />

<strong>with</strong> state-level renewable portfolio standards will necessarily lead to more emissions reductions<br />

at lower cost.<br />

False. It depends on how the policy instruments interact <strong>with</strong> each other. This depends on what<br />

types of instruments are being interacted, and whether they are neatly dovetailed (e.g. stringency<br />

increases to the overall cap to account for the inclusion of an RPS) or thrown together for<br />

political expediency.<br />

3. Cap and Trade<br />

Critics of cap-and-trade policies sometimes point out that allowance prices in programs like the<br />

SO 2 Market (Clean Air Act) or the EU ETS exhibit high volatility. Focusing on one of these two<br />

programs in particular, explain a few of the factors that may have contributed to allowance price<br />

volatility. Does this volatility imply that a price instrument would have been preferable from the<br />

standpoint of economic efficiency (in either case)? Please keep your answer to one half page.<br />

Responses could point to one of many possible factors for this question.<br />

- Legislative uncertainty in both cases, particularly in the SO2 program<br />

- Economic recession and reduced demand for permits due to reduced energy demand<br />

- Scientific uncertainty over climate damages and “true shadow price” of carbon<br />

- Policy uncertainty over other interacting policy instruments<br />

- Could also in principle reflect changing marginal abatement costs (or changing<br />

expectations thereof)<br />

Volatility in allowance prices does not necessarily imply that a price instrument would have been<br />

more efficient per se. Arguments can be made either way.<br />

For example, if firms make irreversible investments under uncertainty about the permit price,<br />

then we can make the case that a highly volatile cap and trade system has efficiency losses<br />

compared to a tax.