Draft FFIEC 009a reporting form

Draft FFIEC 009a reporting form

Draft FFIEC 009a reporting form

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NM 09-13-2013_v2_09:00<br />

Board of Governors of the Federal Reserve System OMB Number 7100-0035<br />

Federal Deposit Insurance Corporation OMB Number 3064-0017<br />

Office of the Comptroller of the Currency OMB Number 1557-0100<br />

DRAFT<br />

Approval expires April 30, 2015<br />

Page 1 of 2<br />

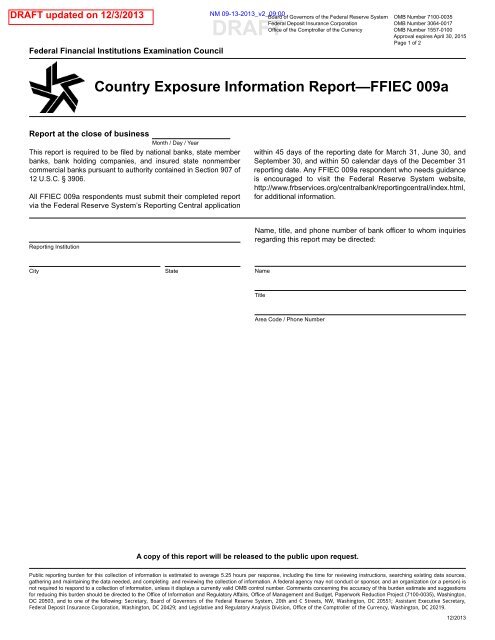

Federal Financial Institutions Examination Council<br />

Country Exposure In<strong>form</strong>ation Report—<strong>FFIEC</strong> <strong>009a</strong><br />

Report at the close of business<br />

Month / Day / Year<br />

This report is required to be filed by national banks, state member<br />

banks, bank holding companies, and insured state nonmember<br />

commercial banks pursuant to authority contained in Section 907 of<br />

12 U.S.C. § 3906.<br />

All <strong>FFIEC</strong> <strong>009a</strong> respondents must submit their completed report<br />

via the Federal Reserve System’s Reporting Central application<br />

within 45 days of the <strong>reporting</strong> date for March 31, June 30, and<br />

September 30, and within 50 calendar days of the December 31<br />

<strong>reporting</strong> date. Any <strong>FFIEC</strong> <strong>009a</strong> respondent who needs guidance<br />

is encouraged to visit the Federal Reserve System website,<br />

http://www.frbservices.org/centralbank/<strong>reporting</strong>central/index.html,<br />

for additional in<strong>form</strong>ation.<br />

Reporting Institution<br />

Name, title, and phone number of bank officer to whom inquiries<br />

regarding this report may be directed:<br />

City<br />

State<br />

Name<br />

Title<br />

Area Code / Phone Number<br />

A copy of this report will be released to the public upon request.<br />

Public <strong>reporting</strong> burden for this collection of in<strong>form</strong>ation is estimated to average 5.25 hours per response, including the time for reviewing instructions, searching existing data sources,<br />

gathering and maintaining the data needed, and completing and reviewing the collection of in<strong>form</strong>ation. A federal agency may not conduct or sponsor, and an organization (or a person) is<br />

not required to respond to a collection of in<strong>form</strong>ation, unless it displays a currently valid OMB control number. Comments concerning the accuracy of this burden estimate and suggestions<br />

for reducing this burden should be directed to the Office of In<strong>form</strong>ation and Regulatory Affairs, Office of Management and Budget, Paperwork Reduction Project (7100-0035), Washington,<br />

DC 20503, and to one of the following: Secretary, Board of Governors of the Federal Reserve System, 20th and C Streets, NW, Washington, DC 20551; Assistant Executive Secretary,<br />

Federal Deposit Insurance Corporation, Washington, DC 20429; and Legislative and Regulatory Analysis Division, Office of the Comptroller of the Currency, Washington, DC 20219.<br />

12/2013

Country Exposure In<strong>form</strong>ation Report<br />

Part A<br />

NM 09-13-2013_v2_09:00<br />

DRAFT<br />

In<strong>form</strong>ation on exposure (as defined for Column 4) to any country that exceeds 1 percent of the <strong>reporting</strong> institution's total assets or 20 percent of its total capital, whichever is less.<br />

<strong>FFIEC</strong> <strong>009a</strong><br />

Page 2 of 2<br />

U.S. Dollar Amounts in Millions<br />

Country<br />

CEX59209<br />

CEXA<br />

Amount of<br />

Crossborder<br />

Claims<br />

Outstanding<br />

After<br />

Mandated<br />

Adjustments<br />

for Transfer<br />

of Exposure<br />

(Excluding<br />

Derivative<br />

Products)<br />

5215<br />

Amount of<br />

Foreign<br />

Office<br />

Claims on<br />

Local<br />

Residents<br />

(Excluding<br />

Derivative<br />

Products)<br />

M881<br />

Amount of<br />

Gross<br />

Claims<br />

Outstanding<br />

from<br />

Derivative<br />

Products<br />

after<br />

Mandated<br />

Adjustments<br />

for Transfer<br />

of Exposure<br />

M882<br />

Total of<br />

Columns (1)<br />

Plus (2)<br />

Plus (3)<br />

4254<br />

Gross<br />

Foreign-<br />

Office<br />

Liabilities<br />

M883<br />

Banks<br />

M884<br />

By Type of Borrower<br />

Public<br />

M885<br />

Distribution of Amounts in Column 1 and 2 (Except Column 13)<br />

NBFIs<br />

M886<br />

Other<br />

M887<br />

By Maturity<br />

One Year<br />

and Under<br />

M888<br />

Over One<br />

Year<br />

M889<br />

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)<br />

Trading Assets<br />

Trading<br />

Assets<br />

M956<br />

(12)<br />

Offsetting<br />

Positions for<br />

Trading Book<br />

M874<br />

(13)<br />

Securities<br />

(HTM and<br />

AFS)<br />

M869<br />

(14)<br />

Collateral Held Against Claims With No Risk Transfer<br />

(Reported in Columns 1 and 2—By Counterparty)<br />

Total<br />

Collateral<br />

M870<br />

(15)<br />

Of Which,<br />

Cash<br />

M871<br />

(16)<br />

Of Which,<br />

Same<br />

Country<br />

M872<br />

(17)<br />

Of Which,<br />

Resale<br />

Agreements<br />

and<br />

Securities<br />

Lending<br />

(Counterparty)<br />

M873<br />

(18)<br />

Cross-Border and Foreign-<br />

Office Commitments and<br />

Guarantees<br />

Unused<br />

Commitments<br />

C936<br />

(19)<br />

Guarantees<br />

(Excluding<br />

Credit<br />

Derivatives<br />

Sold)<br />

M875<br />

(20)<br />

Total Credit<br />

Derivatives<br />

Purchased<br />

M876<br />

(21)<br />

Credit Derivatives (By Reference Entity)<br />

Gross-Gross<br />

Total Credit<br />

Derivatives<br />

Sold<br />

M877<br />

(22)<br />

Total Credit<br />

Derivatives<br />

Purchased<br />

M878<br />

(23)<br />

Gross-Net<br />

Total Credit<br />

Derivatives<br />

Sold<br />

M879<br />

(24)<br />

Part B<br />

In<strong>form</strong>ation on exposures (as defined in Part A, Column 4) to any country not listed in Part A, where exposure exceeds 0.75 percent but does not exceed 1 percent of the <strong>reporting</strong> institution's assets or is between 15 percent and 20 percent of its total<br />

capital, whichever is less.<br />

Names of countries where exposures meet the <strong>reporting</strong> criteria stated for Part B:<br />

Statement by management of the <strong>reporting</strong> institution concerning the in<strong>form</strong>ation reported above (optional). (CEXA 5224)<br />

Total amount of exposure to all of the countries listed in Part B .......................... CEXA 5223 $<br />

Management's statement will not be edited or screened by the supervisory agencies. Disclosure of the statement shall not signify that any federal supervisory agency has verified or confirmed the accuracy of the in<strong>form</strong>ation<br />

contained therein.<br />

12/2013