Custom Information Paper (13) 24 - HM Revenue & Customs

Custom Information Paper (13) 24 - HM Revenue & Customs Custom Information Paper (13) 24 - HM Revenue & Customs

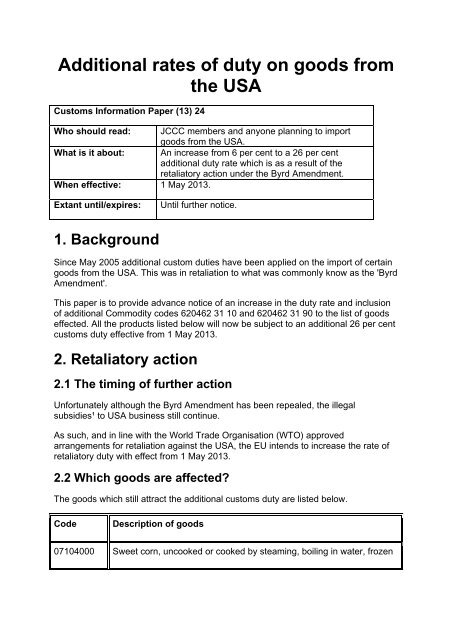

Additional rates of duty on goods from the USA Customs Information Paper (13) 24 Who should read: JCCC members and anyone planning to import goods from the USA. What is it about: An increase from 6 per cent to a 26 per cent additional duty rate which is as a result of the retaliatory action under the Byrd Amendment. When effective: 1 May 2013. Extant until/expires: Until further notice. 1. Background Since May 2005 additional custom duties have been applied on the import of certain goods from the USA. This was in retaliation to what was commonly know as the 'Byrd Amendment'. This paper is to provide advance notice of an increase in the duty rate and inclusion of additional Commodity codes 620462 31 10 and 620462 31 90 to the list of goods effected. All the products listed below will now be subject to an additional 26 per cent customs duty effective from 1 May 2013. 2. Retaliatory action 2.1 The timing of further action Unfortunately although the Byrd Amendment has been repealed, the illegal subsidies¹ to USA business still continue. As such, and in line with the World Trade Organisation (WTO) approved arrangements for retaliation against the USA, the EU intends to increase the rate of retaliatory duty with effect from 1 May 2013. 2.2 Which goods are affected? The goods which still attract the additional customs duty are listed below. Code Description of goods 07104000 Sweet corn, uncooked or cooked by steaming, boiling in water, frozen

Additional rates of duty on goods from<br />

the USA<br />

<strong>Custom</strong>s <strong>Information</strong> <strong>Paper</strong> (<strong>13</strong>) <strong>24</strong><br />

Who should read: JCCC members and anyone planning to import<br />

goods from the USA.<br />

What is it about: An increase from 6 per cent to a 26 per cent<br />

additional duty rate which is as a result of the<br />

retaliatory action under the Byrd Amendment.<br />

When effective: 1 May 20<strong>13</strong>.<br />

Extant until/expires:<br />

Until further notice.<br />

1. Background<br />

Since May 2005 additional custom duties have been applied on the import of certain<br />

goods from the USA. This was in retaliation to what was commonly know as the 'Byrd<br />

Amendment'.<br />

This paper is to provide advance notice of an increase in the duty rate and inclusion<br />

of additional Commodity codes 620462 31 10 and 620462 31 90 to the list of goods<br />

effected. All the products listed below will now be subject to an additional 26 per cent<br />

customs duty effective from 1 May 20<strong>13</strong>.<br />

2. Retaliatory action<br />

2.1 The timing of further action<br />

Unfortunately although the Byrd Amendment has been repealed, the illegal<br />

subsidies¹ to USA business still continue.<br />

As such, and in line with the World Trade Organisation (WTO) approved<br />

arrangements for retaliation against the USA, the EU intends to increase the rate of<br />

retaliatory duty with effect from 1 May 20<strong>13</strong>.<br />

2.2 Which goods are affected?<br />

The goods which still attract the additional customs duty are listed below.<br />

Code<br />

Description of goods<br />

07104000 Sweet corn, uncooked or cooked by steaming, boiling in water, frozen

6204623110 Of denim, hand-printed by the batik method<br />

6204623190 Of denim, other<br />

87051000 Crane lorries (exc breakdown lorries)<br />

9003190010 Frames and mountings for spectacles, goggles or the like, of base<br />

metals<br />

3. Contacts<br />

To obtain the current rate of duty please ring the VAT, Excise and <strong>Custom</strong>s Helpline<br />

with the correct customs tariff classification code between 8.00 am to 6.00 pm on<br />

0845 010 9000.<br />

If you are unsure of the classification code the Tariff Classification Helpline is<br />

available from 9.00 am to 5.00 pm Monday to Thursday and 9.00 am to 4.30 pm<br />

Friday on Tel 01702 366 077. You may have up to three goods classified per phone<br />

call.<br />

For information on the retaliatory rate of duties please contact:<br />

Jane Murrells: Tel 01702 367301<br />

Tariff Management email: jane.murrells@hmrc.gsi.gov.uk<br />

Issued 18 April 20<strong>13</strong> by the JCCC Secretary, <strong>HM</strong> <strong>Revenue</strong> & <strong>Custom</strong>s, Excise,<br />

<strong>Custom</strong>s, Stamps & Money Directorate.<br />

If you have a question about the content of this paper please use the details provided<br />

in the Contacts section. For general <strong>HM</strong> <strong>Revenue</strong> & <strong>Custom</strong>s queries speak to the<br />

VAT, Excise and <strong>Custom</strong>s Helpline on Tel 0845 010 9000.<br />

To find out what you can expect from us and what we expect from you have a look at<br />

Your Charter.<br />

¹ The World Trade Organisation ruling in 2004