4.4 Legal risk - Scor

4.4 Legal risk - Scor

4.4 Legal risk - Scor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

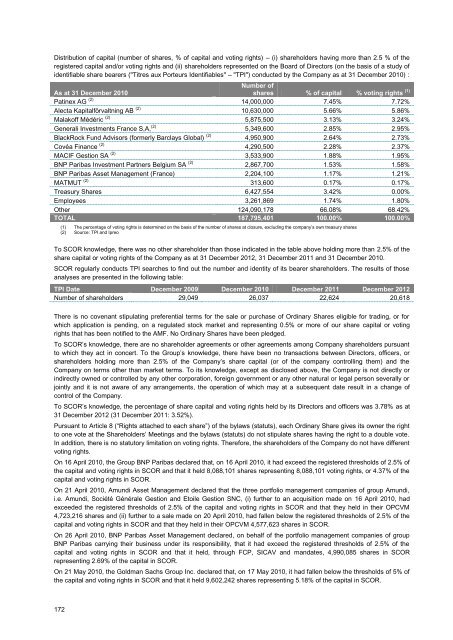

Distribution of capital (number of shares, % of capital and voting rights) – (i) shareholders having more than 2.5 % of the<br />

registered capital and/or voting rights and (ii) shareholders represented on the Board of Directors (on the basis of a study of<br />

identifiable share bearers ("Titres aux Porteurs Identifiables" – "TPI") conducted by the Company as at 31 December 2010) :<br />

As at 31 December 2010<br />

Number of<br />

shares % of capital % voting rights (1)<br />

Patinex AG (2) 14,000,000 7.45% 7.72%<br />

Alecta Kapitalförvaltning AB (2) 10,630,000 5.66% 5.86%<br />

Malakoff Médéric (2) 5,875,500 3.13% 3.24%<br />

Generali Investments France S,A, (2) 5,349,600 2.85% 2.95%<br />

BlackRock Fund Advisors (formerly Barclays Global) (2) 4,950,900 2.64% 2.73%<br />

Covéa Finance (2) 4,290,500 2.28% 2.37%<br />

MACIF Gestion SA (2) 3,533,900 1.88% 1.95%<br />

BNP Paribas Investment Partners Belgium SA (2) 2,867,700 1.53% 1.58%<br />

BNP Paribas Asset Management (France) 2,204,100 1.17% 1.21%<br />

MATMUT (2) 313,600 0.17% 0.17%<br />

Treasury Shares 6,427,554 3.42% 0.00%<br />

Employees 3,261,869 1.74% 1.80%<br />

Other 124,090,178 66.08% 68.42%<br />

TOTAL 187,795,401 100.00% 100.00%<br />

(1) The percentage of voting rights is determined on the basis of the number of shares at closure, excluding the company’s own treasury shares<br />

(2) Source: TPI and Ipreo<br />

To SCOR knowledge, there was no other shareholder than those indicated in the table above holding more than 2.5% of the<br />

share capital or voting rights of the Company as at 31 December 2012, 31 December 2011 and 31 December 2010.<br />

SCOR regularly conducts TPI searches to find out the number and identity of its bearer shareholders. The results of those<br />

analyses are presented in the following table:<br />

TPI Date December 2009 December 2010 December 2011 December 2012<br />

Number of shareholders 29,049 26,037 22,624 20,618<br />

There is no covenant stipulating preferential terms for the sale or purchase of Ordinary Shares eligible for trading, or for<br />

which application is pending, on a regulated stock market and representing 0.5% or more of our share capital or voting<br />

rights that has been notified to the AMF. No Ordinary Shares have been pledged.<br />

To SCOR’s knowledge, there are no shareholder agreements or other agreements among Company shareholders pursuant<br />

to which they act in concert. To the Group’s knowledge, there have been no transactions between Directors, officers, or<br />

shareholders holding more than 2.5% of the Company’s share capital (or of the company controlling them) and the<br />

Company on terms other than market terms. To its knowledge, except as disclosed above, the Company is not directly or<br />

indirectly owned or controlled by any other corporation, foreign government or any other natural or legal person severally or<br />

jointly and it is not aware of any arrangements, the operation of which may at a subsequent date result in a change of<br />

control of the Company.<br />

To SCOR’s knowledge, the percentage of share capital and voting rights held by its Directors and officers was 3.78% as at<br />

31 December 2012 (31 December 2011: 3.52%).<br />

Pursuant to Article 8 (“Rights attached to each share”) of the bylaws (statuts), each Ordinary Share gives its owner the right<br />

to one vote at the Shareholders’ Meetings and the bylaws (statuts) do not stipulate shares having the right to a double vote.<br />

In addition, there is no statutory limitation on voting rights. Therefore, the shareholders of the Company do not have different<br />

voting rights.<br />

On 16 April 2010, the Group BNP Paribas declared that, on 16 April 2010, it had exceed the registered thresholds of 2.5% of<br />

the capital and voting rights in SCOR and that it held 8,088,101 shares representing 8,088,101 voting rights, or 4.37% of the<br />

capital and voting rights in SCOR.<br />

On 21 April 2010, Amundi Asset Management declared that the three portfolio management companies of group Amundi,<br />

i.e. Amundi, Société Générale Gestion and Etoile Gestion SNC, (i) further to an acquisition made on 16 April 2010, had<br />

exceeded the registered thresholds of 2.5% of the capital and voting rights in SCOR and that they held in their OPCVM<br />

4,723,216 shares and (ii) further to a sale made on 20 April 2010, had fallen below the registered thresholds of 2.5% of the<br />

capital and voting rights in SCOR and that they held in their OPCVM 4,577,623 shares in SCOR.<br />

On 26 April 2010, BNP Paribas Asset Management declared, on behalf of the portfolio management companies of group<br />

BNP Paribas carrying their business under its responsibility, that it had exceed the registered thresholds of 2.5% of the<br />

capital and voting rights in SCOR and that it held, through FCP, SICAV and mandates, 4,990,085 shares in SCOR<br />

representing 2.69% of the capital in SCOR.<br />

On 21 May 2010, the Goldman Sachs Group Inc. declared that, on 17 May 2010, it had fallen below the thresholds of 5% of<br />

the capital and voting rights in SCOR and that it held 9,602,242 shares representing 5.18% of the capital in SCOR.<br />

172