4.4 Legal risk - Scor

4.4 Legal risk - Scor

4.4 Legal risk - Scor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

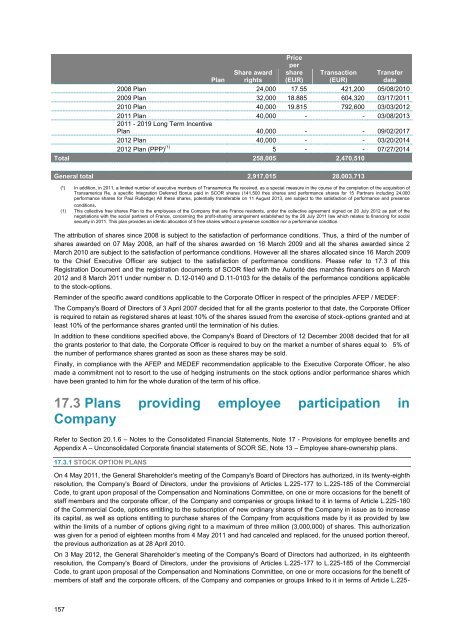

Plan<br />

Share award<br />

rights<br />

Price<br />

per<br />

share<br />

(EUR)<br />

Transaction<br />

(EUR)<br />

Transfer<br />

date<br />

2008 Plan 24,000 17.55 421,200 05/08/2010<br />

2009 Plan 32,000 18.885 604,320 03/17/2011<br />

2010 Plan 40,000 19.815 792,600 03/03/2012<br />

2011 Plan 40,000 - - 03/08/2013<br />

2011 - 2019 Long Term Incentive<br />

Plan 40,000 - - 09/02/2017<br />

2012 Plan 40,000 - - 03/20/2014<br />

2012 Plan (PPP) (1) 5 - - 07/27/2014<br />

Total 258,005 2,470,510<br />

General total 2,917,015 28,003,713<br />

(*) In addition, in 2011, a limited number of executive members of Transamerica Re received, as a special measure in the course of the completion of the acquisition of<br />

Transamerica Re, a specific Integration Deferred Bonus paid in SCOR shares (141,500 free shares and performance shares for 15 Partners including 24,000<br />

performance shares for Paul Rutledge) All these shares, potentially transferable on 11 August 2013, are subject to the satisfaction of performance and presence<br />

conditions.<br />

(1) This collective free shares Plan to the employees of the Company that are France residents, under the collective agreement signed on 20 July 2012 as part of the<br />

negotiations with the social partners of France, concerning the profit-sharing arrangement established by the 28 July 2011 law which relates to financing for social<br />

security in 2011. This plan provides an identic allocation of 5 free shares without a presence condition nor a performance condition.<br />

The attribution of shares since 2008 is subject to the satisfaction of performance conditions. Thus, a third of the number of<br />

shares awarded on 07 May 2008, an half of the shares awarded on 16 March 2009 and all the shares awarded since 2<br />

March 2010 are subject to the satisfaction of performance conditions. However all the shares allocated since 16 March 2009<br />

to the Chief Executive Officer are subject to the satisfaction of performance conditions. Please refer to 17.3 of this<br />

Registration Document and the registration documents of SCOR filed with the Autorité des marchés financiers on 8 March<br />

2012 and 8 March 2011 under number n. D.12-0140 and D.11-0103 for the details of the performance conditions applicable<br />

to the stock-options.<br />

Reminder of the specific award conditions applicable to the Corporate Officer in respect of the principles AFEP / MEDEF:<br />

The Company's Board of Directors of 3 April 2007 decided that for all the grants posterior to that date, the Corporate Officer<br />

is required to retain as registered shares at least 10% of the shares issued from the exercise of stock-options granted and at<br />

least 10% of the performance shares granted until the termination of his duties.<br />

In addition to these conditions specified above, the Company's Board of Directors of 12 December 2008 decided that for all<br />

the grants posterior to that date, the Corporate Officer is required to buy on the market a number of shares equal to 5% of<br />

the number of performance shares granted as soon as these shares may be sold.<br />

Finally, in compliance with the AFEP and MEDEF recommendation applicable to the Executive Corporate Officer, he also<br />

made a commitment not to resort to the use of hedging instruments on the stock options and/or performance shares which<br />

have been granted to him for the whole duration of the term of his office.<br />

17.3 Plans providing employee participation in<br />

Company<br />

Refer to Section 20.1.6 – Notes to the Consolidated Financial Statements, Note 17 - Provisions for employee benefits and<br />

Appendix A – Unconsolidated Corporate financial statements of SCOR SE, Note 13 – Employee share-ownership plans.<br />

17.3.1 STOCK OPTION PLANS<br />

On 4 May 2011, the General Shareholder’s meeting of the Company's Board of Directors has authorized, in its twenty-eighth<br />

resolution, the Company's Board of Directors, under the provisions of Articles L.225-177 to L.225-185 of the Commercial<br />

Code, to grant upon proposal of the Compensation and Nominations Committee, on one or more occasions for the benefit of<br />

staff members and the corporate officer, of the Company and companies or groups linked to it in terms of Article L.225-180<br />

of the Commercial Code, options entitling to the subscription of new ordinary shares of the Company in issue as to increase<br />

its capital, as well as options entitling to purchase shares of the Company from acquisitions made by it as provided by law<br />

within the limits of a number of options giving right to a maximum of three million (3,000,000) of shares. This authorization<br />

was given for a period of eighteen months from 4 May 2011 and had canceled and replaced, for the unused portion thereof,<br />

the previous authorization as at 28 April 2010.<br />

On 3 May 2012, the General Shareholder’s meeting of the Company's Board of Directors had authorized, in its eighteenth<br />

resolution, the Company's Board of Directors, under the provisions of Articles L.225-177 to L.225-185 of the Commercial<br />

Code, to grant upon proposal of the Compensation and Nominations Committee, on one or more occasions for the benefit of<br />

members of staff and the corporate officers, of the Company and companies or groups linked to it in terms of Article L.225-<br />

157