Adobe PDF - California Department of Housing and Community ...

Adobe PDF - California Department of Housing and Community ...

Adobe PDF - California Department of Housing and Community ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

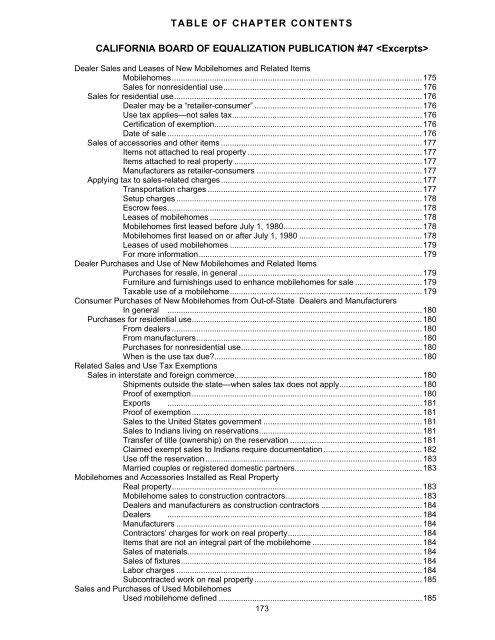

TABLE OF CHAPTER CONTENTS<br />

CALIFORNIA BOARD OF EQUALIZATION PUBLICATION #47 <br />

Dealer Sales <strong>and</strong> Leases <strong>of</strong> New Mobilehomes <strong>and</strong> Related Items<br />

Mobilehomes ................................................................................................................ 175<br />

Sales for nonresidential use ......................................................................................... 176<br />

Sales for residential use ............................................................................................................... 176<br />

Dealer may be a “retailer-consumer” ........................................................................... 176<br />

Use tax applies—not sales tax ..................................................................................... 176<br />

Certification <strong>of</strong> exemption ............................................................................................. 176<br />

Date <strong>of</strong> sale .................................................................................................................. 176<br />

Sales <strong>of</strong> accessories <strong>and</strong> other items .......................................................................................... 177<br />

Items not attached to real property .............................................................................. 177<br />

Items attached to real property .................................................................................... 177<br />

Manufacturers as retailer-consumers .......................................................................... 177<br />

Applying tax to sales-related charges .......................................................................................... 177<br />

Transportation charges ................................................................................................ 177<br />

Setup charges .............................................................................................................. 178<br />

Escrow fees .................................................................................................................. 178<br />

Leases <strong>of</strong> mobilehomes ............................................................................................... 178<br />

Mobilehomes first leased before July 1, 1980 .............................................................. 178<br />

Mobilehomes first leased on or after July 1, 1980 ....................................................... 178<br />

Leases <strong>of</strong> used mobilehomes ...................................................................................... 179<br />

For more information .................................................................................................... 179<br />

Dealer Purchases <strong>and</strong> Use <strong>of</strong> New Mobilehomes <strong>and</strong> Related Items<br />

Purchases for resale, in general .................................................................................. 179<br />

Furniture <strong>and</strong> furnishings used to enhance mobilehomes for sale .............................. 179<br />

Taxable use <strong>of</strong> a mobilehome ...................................................................................... 179<br />

Consumer Purchases <strong>of</strong> New Mobilehomes from Out-<strong>of</strong>-State Dealers <strong>and</strong> Manufacturers<br />

In general .................................................................................................................. 180<br />

Purchases for residential use ....................................................................................................... 180<br />

From dealers ................................................................................................................ 180<br />

From manufacturers ..................................................................................................... 180<br />

Purchases for nonresidential use ................................................................................. 180<br />

When is the use tax due? ............................................................................................. 180<br />

Related Sales <strong>and</strong> Use Tax Exemptions<br />

Sales in interstate <strong>and</strong> foreign commerce .................................................................................... 180<br />

Shipments outside the state—when sales tax does not apply ..................................... 180<br />

Pro<strong>of</strong> <strong>of</strong> exemption ....................................................................................................... 180<br />

Exports .................................................................................................................. 181<br />

Pro<strong>of</strong> <strong>of</strong> exemption ....................................................................................................... 181<br />

Sales to the United States government ....................................................................... 181<br />

Sales to Indians living on reservations ......................................................................... 181<br />

Transfer <strong>of</strong> title (ownership) on the reservation ........................................................... 181<br />

Claimed exempt sales to Indians require documentation ............................................ 182<br />

Use <strong>of</strong>f the reservation ................................................................................................. 183<br />

Married couples or registered domestic partners......................................................... 183<br />

Mobilehomes <strong>and</strong> Accessories Installed as Real Property<br />

Real property ................................................................................................................ 183<br />

Mobilehome sales to construction contractors ............................................................. 183<br />

Dealers <strong>and</strong> manufacturers as construction contractors ............................................. 184<br />

Dealers .................................................................................................................. 184<br />

Manufacturers .............................................................................................................. 184<br />

Contractors’ charges for work on real property ............................................................ 184<br />

Items that are not an integral part <strong>of</strong> the mobilehome ................................................. 184<br />

Sales <strong>of</strong> materials ......................................................................................................... 184<br />

Sales <strong>of</strong> fixtures ............................................................................................................ 184<br />

Labor charges .............................................................................................................. 184<br />

Subcontracted work on real property ........................................................................... 185<br />

Sales <strong>and</strong> Purchases <strong>of</strong> Used Mobilehomes<br />

Used mobilehome defined ........................................................................................... 185<br />

173