Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I MPACT OF SAFTA ON INWARD AND OUTWARD FOREIGN DIRECT INVESTMENTS 69<br />

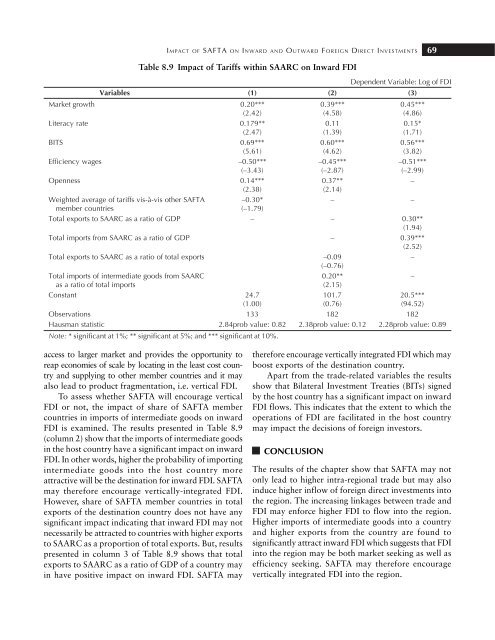

Table 8.9 Impact of Tariffs within SAARC on Inward FDI<br />

Dependent Variable: Log of FDI<br />

Variables (1) (2) (3)<br />

Market growth 0.20*** 0.39*** 0.45***<br />

(2.42) (4.58) (4.86)<br />

Literacy rate 0.179** 0.11 0.15*<br />

(2.47) (1.39) (1.71)<br />

BITS 0.69*** 0.60*** 0.56***<br />

(5.61) (4.62) (3.82)<br />

Efficiency wages –0.50*** –0.45*** –0.51***<br />

(–3.43) (–2.87) (–2.99)<br />

Openness 0.14*** 0.37** –<br />

(2.38) (2.14)<br />

Weighted average of tariffs vis-à-vis other SAFTA –0.30* – –<br />

member countries (–1.79)<br />

Total exports to SAARC as a ratio of GDP – – 0.30**<br />

(1.94)<br />

Total imports from SAARC as a ratio of GDP – 0.39***<br />

(2.52)<br />

Total exports to SAARC as a ratio of total exports –0.09 –<br />

(–0.76)<br />

Total imports of intermediate goods from SAARC 0.20** –<br />

as a ratio of total imports (2.15)<br />

Constant 24.7 101.7 20.5***<br />

(1.00) (0.76) (94.52)<br />

Observations 133 182 182<br />

Hausman statistic 2.84prob value: 0.82 2.38prob value: 0.12 2.28prob value: 0.89<br />

Note: * significant at 1%; ** significant at 5%; and *** significant at 10%.<br />

access to larger market and provides the opportunity to<br />

reap economies of scale by locating in the least cost country<br />

and supplying to other member countries and it may<br />

also lead to product fragmentation, i.e. vertical FDI.<br />

To assess whether SAFTA will encourage vertical<br />

FDI or not, the impact of share of SAFTA member<br />

countries in imports of intermediate goods on inward<br />

FDI is examined. The results presented in Table 8.9<br />

(column 2) show that the imports of intermediate goods<br />

in the host country have a significant impact on inward<br />

FDI. In other words, higher the probability of importing<br />

intermediate goods into the host country more<br />

attractive will be the destination for inward FDI. SAFTA<br />

may therefore encourage vertically-integrated FDI.<br />

However, share of SAFTA member countries in total<br />

exports of the destination country does not have any<br />

significant impact indicating that inward FDI may not<br />

necessarily be attracted to countries with higher exports<br />

to SAARC as a proportion of total exports. But, results<br />

presented in column 3 of Table 8.9 shows that total<br />

exports to SAARC as a ratio of GDP of a country may<br />

in have positive impact on inward FDI. SAFTA may<br />

therefore encourage vertically integrated FDI which may<br />

boost exports of the destination country.<br />

Apart from the trade-related variables the results<br />

show that Bilateral Investment Treaties (BITs) signed<br />

by the host country has a significant impact on inward<br />

FDI flows. This indicates that the extent to which the<br />

operations of FDI are facilitated in the host country<br />

may impact the decisions of foreign investors.<br />

CONCLUSION<br />

The results of the chapter show that SAFTA may not<br />

only lead to higher intra-regional trade but may also<br />

induce higher inflow of foreign direct investments into<br />

the region. The increasing linkages between trade and<br />

FDI may enforce higher FDI to flow into the region.<br />

Higher imports of intermediate goods into a country<br />

and higher exports from the country are found to<br />

significantly attract inward FDI which suggests that FDI<br />

into the region may be both market seeking as well as<br />

efficiency seeking. SAFTA may therefore encourage<br />

vertically integrated FDI into the region.