Report

Report

Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62 QUANTIFICATION OF BENEFITS FROM ECONOMIC COOPERATION IN SOUTH ASIA<br />

and skill difference between the home and the host<br />

economies. As trade cost increases in the host country,<br />

firms with vertical FDI will have to import goods from<br />

the host country at a higher cost (Joon 2007). If the<br />

difference in skill between the home and host countries<br />

increases however, relative wages for low skilled labor<br />

will decrease, thereby increasing the incentive for firms<br />

to exploit this lower production cost by producing in<br />

the low wage economy. Consequently, vertical FDI will<br />

increase as trade costs decrease and skill difference<br />

increases (Yeyati, Stein and Daude, 2003 and Lesher<br />

and Miroudot 2006). Based on the above, the<br />

Knowledge-Capital model, analyses the impact of the<br />

given factors (market size, trade costs and skill difference<br />

between the two countries) and their intersections.<br />

The Knowledge-Capital model was empirically<br />

tested by Carr et al. (2001), and one of the important<br />

results obtained was that trade costs positively impact<br />

FDI when the skill difference between home and host<br />

country is small and negatively impact FDI when large<br />

skill differences exist between the two countries. From<br />

their study one can infer that in the presence of small<br />

skill differences between parent and host economies, a<br />

rise in trade cost will result in the impact of an increase<br />

in horizontal FDI dominating the decrease in vertical<br />

FDI. In the presence of large skill differences. On the<br />

other hand, decrease in vertical FDI is larger than the<br />

increase in horizontal FDI, when trade costs rise.<br />

Jang (2007) defines decreased trade costs as an FTA<br />

and tries to test this relationship. According to the<br />

Knowledge-Capital model, one may expect the decrease<br />

in horizontal FDI to be greater than the increase in<br />

vertical FDI when trade costs declines in the presence<br />

of small skill differences between the parent and the<br />

host countries, and vice versa in the presence of large<br />

skill differences. Since vertical FDI dominates horizontal<br />

FDI in countries where skill difference is large, one<br />

should expect an FTA involving member countries with<br />

large differences in skill levels to have a positive impact<br />

on FDI. Similarly, reduced trade costs act as a disincentive<br />

for building plants in the host economy, which in<br />

the presence of small skill differences, causes a decrease<br />

in horizontal FDI to dominate the increase in vertical<br />

FDI. Therefore, FTAs with member countries with small<br />

skill differences can be expected to discourage FDI<br />

between those economies.<br />

Many empirical studies have tried to study the<br />

impact FTAs have on intra-regional and extra-regional<br />

FDI. Yeyati et al. (2003) find that regional integration<br />

on the whole contributes to attracting FDI. A study by<br />

Velde and Bezemer on the other hand, established that<br />

the impact on FDI would be different for different types<br />

of regions and the position of countries within a region<br />

would be pivotal for attracting FDI. In the context of<br />

Korea–US FTA, Kang and Park found that FTA<br />

increased FDI by 14–35% from member countries and<br />

by 28–35% from non-member countries. Baltagi et al.<br />

(2005) conducted a study on bilateral outward FDI<br />

stocks into Europe over 1989–2001 and found that an<br />

RTA increases FDI up to 78% among European<br />

countries.<br />

With respect to South Asia, very few studies have<br />

estimated the impact of intra-regional trade on inward<br />

and intra-regional FDI. One of the reasons for this is<br />

lack of bilateral data on FDI over time. This chapter<br />

attempts to estimate the impact of intra-regional trade<br />

on inward FDI into member countries of SAFTA and<br />

domestic investments in the member countries.<br />

TRENDS IN INWARD AND INTRA-REGIONAL<br />

FDI IN SOUTH ASIA<br />

Trends in Inward FDI in South Asia<br />

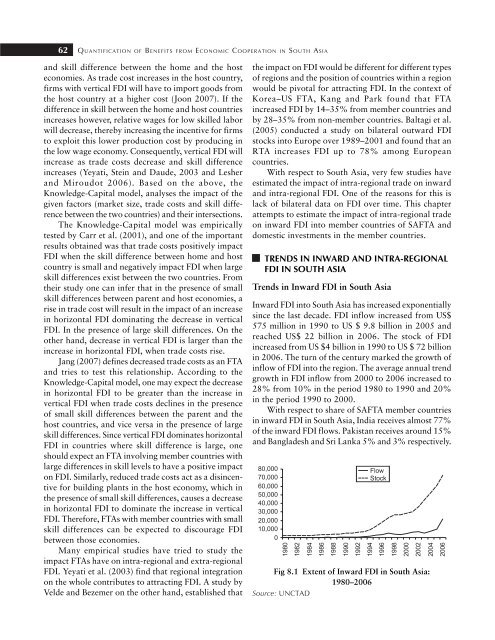

Inward FDI into South Asia has increased exponentially<br />

since the last decade. FDI inflow increased from US$<br />

575 million in 1990 to US $ 9.8 billion in 2005 and<br />

reached US$ 22 billion in 2006. The stock of FDI<br />

increased from US $4 billion in 1990 to US $ 72 billion<br />

in 2006. The turn of the century marked the growth of<br />

inflow of FDI into the region. The average annual trend<br />

growth in FDI inflow from 2000 to 2006 increased to<br />

28% from 10% in the period 1980 to 1990 and 20%<br />

in the period 1990 to 2000.<br />

With respect to share of SAFTA member countries<br />

in inward FDI in South Asia, India receives almost 77%<br />

of the inward FDI flows. Pakistan receives around 15%<br />

and Bangladesh and Sri Lanka 5% and 3% respectively.<br />

Fig 8.1 Extent of Inward FDI in South Asia:<br />

1980–2006<br />

Source: UNCTAD