You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Xxxxxxxxxxx<br />

Contents<br />

3 Three new Eurocargoclass<br />

vessels deployed in<br />

the short sea network<br />

4 <strong>Grimaldi</strong> <strong>Group</strong> lays the<br />

foundation stone for the new<br />

terminal in the Port of Barcelona<br />

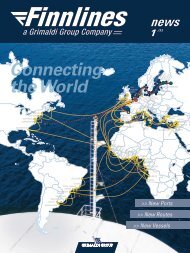

6 New services in<br />

Finnlines network<br />

Wallhamn the 2 nd largest<br />

port in Sweden<br />

7 MEX service further enhanced<br />

New <strong>Grimaldi</strong> offices in Benin<br />

8 GM recognises the <strong>Group</strong><br />

as a 2012 Supplier of the Year<br />

9 News<br />

10 Agents List<br />

11 Schedules<br />

- Mediterranean Short Sea Network<br />

- Finnlines (Baltic & North Sea)<br />

- Atlantic Network<br />

- ACL<br />

- Euro Med Network<br />

G r imaldi<br />

NE WS<br />

Direttore Responsabile / Editor in Chief<br />

Luciano Bosso<br />

Progetto grafico /Graphic design<br />

Marco Di Lorenzo<br />

Pubblicazione trimestrale<br />

Quarterly publication<br />

Reg. Trib. Napoli n. 5150 del 26/9/2000<br />

Stampa / Print: ROSSI srl - Nola (Napoli)<br />

Circulation 35,000 copies<br />

Printed on 6 June 2013<br />

GRIMALDI GROUP<br />

Via Marchese Campodisola, 13<br />

2 G<strong>NEWS</strong>80133 NAPOLI (Italy)<br />

<strong>Grimaldi</strong> News can be seen on<br />

line on www.grimaldi.napoli.it<br />

Editorial<br />

<strong>Grimaldi</strong> defies<br />

the crisis with<br />

record turnover<br />

Consolidated 2012 results for the companies under the <strong>Grimaldi</strong> <strong>Group</strong> umbrella make encouraging<br />

reading. Last year saw record turnover of just over Euro 2.7 billion, a Euro 200<br />

million improvement on 2011. Net profit was also up from around Euro 100 million in 2011<br />

to Euro 164 million.<br />

The <strong>Group</strong>’s Italian companies put in a particularly impressive performance; they were already doing<br />

well before we entered this era of seemingly endless crisis, and they’re still doing well today.<br />

Companies outside our home market, such Atlantic Container Line and Malta Motorways of the Sea,<br />

also performed satisfactorily. Management teams at Finnlines and Minoan Lines, meanwhile, have<br />

put in a good deal of hard work, though more remains to be done.<br />

Many Italians believe one’s virtues should be on public display, while one’s sins should remain<br />

private. But within our <strong>Group</strong> we seem to have inadvertently adopted the opposite policy. <strong>Grimaldi</strong>’s<br />

privately owned companies have become paragons of virtue, whereas the <strong>Group</strong>’s publicly listed<br />

companies were probably leveraged a little too highly when the crisis struck. There was not enough<br />

focus on profit, and this soon became apparent when market conditions softened.<br />

Balance sheet strengthening is now underway at Minoan and Finnlines via capital increases –<br />

around Euro 50 million and Euro 28 million respectively. Other measures have also been taken to<br />

remove costs. At Minoan, some vessels have been chartered out while at Finnlines, staffing levels<br />

in the company’s port business are being reduced by about 100. At both companies we have taken<br />

steps to lower fuel costs by investing in efficient design - changing propellers on certain Minoan<br />

vessels being just one example. The Finnlines headquarters have moved to a new portside location,<br />

enabling the old, more costly building to be handed back to its landlord.<br />

Finnlines has signed two sizeable contracts this year; one with a large forest products shipper, and<br />

another with a high-end car manufacturer. This summer, Finnlines vessels will be both transporting<br />

parts to the production line in Finland and bringing finished cars back out to the market place.<br />

Despite the extremely challenging conditions the <strong>Group</strong> continues to see adequate cash flow,<br />

which has paved the way for further investment. We are looking forward to the entry into service of<br />

some of the most impressive vessels ever to join the fleet – there are 16 in all under the current<br />

investment programme. The deepsea vessels destined for ACL services are twice as efficient in<br />

terms of fuel consumption as the ships they will replace, a fact that is sure to trigger better financial<br />

results. Where we could move 40 TEU with one tonne of fuel, we will soon be moving 80 TEU.<br />

The state-of-the-art vessels built at the Hyundai Mipo Shipyard in South Korea and the roll-on rolloff<br />

ships we purchased from Hong Kong-based Pacific Basin all bring welcome extra capacity to<br />

our worldwide network spanning North America, South America and West Africa. Recent purchases<br />

have all been made on very favourable terms – this is perhaps one of the few upsides to the severe<br />

recession with which many of our competitors continue to struggle.<br />

When you factor in upgrades to the Antwerp hub in Belgium for the ACL vessels and investment<br />

at the <strong>Grimaldi</strong> new terminal in Barcelona, Spain, you will surely agree that there are plenty of<br />

reasons for our customers, partners, staff and financial backers to trust in the future solidity of our<br />

<strong>Group</strong>.<br />

And to cap off this good news story we are proud to report that 2013 is also off to an impressive<br />

start. The <strong>Group</strong> as a whole is performing better than is was at this point last year. We plan to continue<br />

to defy the crisis.