MO-5090 - Missouri Department of Revenue

MO-5090 - Missouri Department of Revenue

MO-5090 - Missouri Department of Revenue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

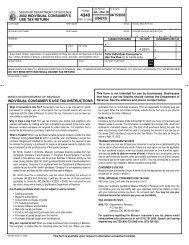

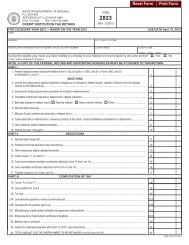

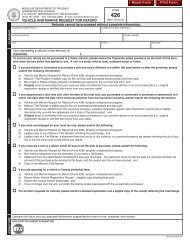

Form<br />

<strong>MO</strong>-<strong>5090</strong><br />

<strong>Missouri</strong> <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong><br />

Net Operating Loss Addition Modification Sheet<br />

Enclosure Sequence No. 1120-08<br />

Corporation Name <strong>Missouri</strong> Tax I.D. Number Charter Number Federal I.D. Number<br />

Year <strong>of</strong> Loss<br />

Year <strong>of</strong> Modification<br />

Complete this worksheet to compute the net operating loss (NOL) addition modification, pursuant to Section 143.431.4, RSMo. See back for instructions.<br />

Use this form if the corporation reported a net operating loss deduction on Federal Form 1120, Line 29a or on Federal Form 1139 or Federal Form 1120X<br />

for carryback years and in the year <strong>of</strong> the initial loss, used the loss to <strong>of</strong>fset <strong>Missouri</strong> net positive additions. If both do not apply, there is no net operating<br />

loss modification to compute. If both apply, then complete the net operating loss modification worksheet. If the NOL deduction is the sum <strong>of</strong> multiple years,<br />

you must complete a Form <strong>MO</strong>-<strong>5090</strong> for each loss year.<br />

Column 1 Column 2 Column 3 Column 4<br />

Modificatons<br />

1. Net operating loss deduction used in the current year.<br />

(Enter as a positive amount.)<br />

2a. State tax addback<br />

2b. State and local bond interest (except <strong>Missouri</strong>)<br />

2c. Fiduciary and partnership adjustment<br />

2d. <strong>Missouri</strong> depreciation basis adjustment<br />

2e. Donations claimed for the Food Pantry Tax Credit<br />

3. All required additions to federal taxable income, except for the<br />

net operating loss modification: add Lines 2a, 2b, 2c, 2d, and 2e<br />

4a. Interest on U.S. Government obligations<br />

4b. Federally taxable — <strong>Missouri</strong> exempt obligations<br />

4c. Reduction in gain due to basis difference<br />

4d. Previously taxed income<br />

4e. Amount <strong>of</strong> any state income tax refund included in federal<br />

taxable income<br />

4f. Capital gain exclusion from the sale <strong>of</strong> low income housing<br />

project<br />

4g. Fiduciary and partnership adjustment<br />

4h. <strong>Missouri</strong> depreciation basis adjustment<br />

4i. Net operating loss carryback previously disallowed for <strong>Missouri</strong><br />

4j. Depreciation recovery on qualified property that is sold<br />

4k. Build America and Recovery Zone Bond Interest<br />

4l. <strong>Missouri</strong> Public-Private Partnerships Transportation Act<br />

5. All required subtractions from federal taxable income:<br />

add Lines 4a through 4l<br />

6. Net addition modification (but not less than zero):<br />

Line 3 less Line 5<br />

7. Total net operating loss from the Loss Year<br />

___________ (Enter as a positive amount.)<br />

8. Net operating loss deductions utilized in all prior years<br />

(Enter as a positive amount.)<br />

9. Cumulative sum: Line 1 plus Line 8<br />

10. Sum: Line 6 plus Line 9<br />

11. Amount: Line 10 less Line 7 (but not less than zero)<br />

12. Net operating loss modification: lesser <strong>of</strong> Line 1 or Line 11.<br />

Enter the amount here and on Form <strong>MO</strong>-1120, Part 1, Line 3.<br />

Form <strong>MO</strong>-<strong>5090</strong> (Revised 10-2013)<br />

Visit http://dor.mo.gov/business/corporate/ for<br />

P.O. Box 3365 Fax: (573) 522-1721<br />

additional information.<br />

Jefferson City, <strong>MO</strong> 65105-3365 E-mail: corporate@dor.mo.gov<br />

Mail to: Taxation Division Phone: (573) 751-4541

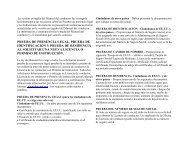

Net Operating Loss Addition Modification Sheet Instructions<br />

Use this form for corporations that 1) reported a net operating loss (NOL) deduction for carryback years on the Federal Form 1120 -Line<br />

29A, Federal Form 1139, or Federal Form 1120X and 2) used the loss to <strong>of</strong>fset <strong>Missouri</strong> net positive additions in the year <strong>of</strong> the initial loss.<br />

If both do not apply, there is no net operating loss modification. If both apply, then complete the net operating loss addition modification<br />

worksheet. If the NOL deduction is the sum <strong>of</strong> multiple years, you must complete a Form <strong>MO</strong>-<strong>5090</strong> for each loss year.<br />

1. Enter on Line 1, Columns 1 and 4, the amount <strong>of</strong> the net operating loss deduction attributable to the loss year from Federal<br />

Form 1120, Line 29a <strong>of</strong> the carryover year or from Federal Form 1139 or Federal Form 1120X for carryback years. This is the<br />

amount <strong>of</strong> the deduction utilized in the current year.<br />

2. Enter on Lines 2a through 2e all required additions from the loss year to federal taxable income, except for the net operating<br />

loss modification. See Section 143.121.2(3), RSMo regarding the <strong>Missouri</strong> depreciation basis adjustment for Line 2d.<br />

3. Add Lines 2a through 2d and enter the total on Line 3 to compute all required additions from the loss year to federal taxable<br />

income.<br />

4. Enter on Lines 4a through 4l all required subtractions from federal taxable income from the loss year. See<br />

Section 143.121.3(2), RSMo and 12 CSR 10-2.020 regarding the reduction in gain due to basis difference for Line 4c. See<br />

Section 143.121.3(7), RSMo regarding the <strong>Missouri</strong> depreciation basis for Line 4h. See Section 143.121.2(4), RSMo<br />

regarding the net operating loss carryback previously disallowed for <strong>Missouri</strong> on Line 4i. See Section 143.121.3(9), RSMo<br />

regarding the depreciation recovery on qualified property that is sold for Line 4j. See Section 108.1020, RSMo regarding the<br />

build America and recovery zone bond interest for Line 4k. See Section 227.646, RSMo regarding the <strong>Missouri</strong><br />

Public-Private Partnerships Transportation Act for Line 4l.<br />

5. Add Lines 4a through 4l and enter the total on Line 5 to compute all required subtractions from the loss year from federal taxable<br />

income.<br />

6. Subtract Line 5 from Line 3 and enter on Line 6 (but not less than zero). This will give you the net addition modification, as the<br />

amount that all required additions exceeds all required subtractions.<br />

7. Enter the total amount <strong>of</strong> the net operating loss from Federal Form 1120, Line 30 <strong>of</strong> the loss year in Column 3 and enter the tax<br />

year <strong>of</strong> the net operating loss in the blank provided.<br />

8. Enter the amount <strong>of</strong> the net operating loss deduction utilized in prior years from Federal Form 1120, Line 29a from all prior carryover<br />

years <strong>of</strong> this loss year or from Federal Form 1139 or Federal Form 1120X from the carryback years.<br />

9. Add Lines 1 and 8 and enter on Line 9<br />

10. Add Lines 6 and 9 and enter on Line 10.<br />

11. Subtract Line 7 from Line 10 (but not less than zero) and enter on Line 11.<br />

12. Enter the lesser <strong>of</strong> Line 1 or 11 on Line 12 and also on Form <strong>MO</strong>-1120, Part 1, Line 3.<br />

Note: You must specifically identify each loss year that is part <strong>of</strong> the net operating loss deduction and a separate Form <strong>MO</strong>-<strong>5090</strong> must<br />

be completed for each loss year.<br />

Note: The above items are each considered to be a positive amount for purposes <strong>of</strong> this calculation. If the result <strong>of</strong> combining amounts<br />

is negative, use zero.<br />

Frequently Asked Questions<br />

1. If a taxpayer has incurred a net operating loss, when is a net operating loss addition modification computed?<br />

A net operating loss addition modification is computed when a net operating loss deduction is claimed. If there was a net<br />

operating loss for the tax year 2012 and the taxpayer carried it back two years and claimed a net operating loss deduction on<br />

an amended federal return for tax year 2010, then a net operating loss addition modification would be computed for the 2010<br />

amended <strong>Missouri</strong> return.<br />

2. Is the Net Operating Loss Addition Modification computed for the year <strong>of</strong> the loss?<br />

No, it is computed for the year a net operating loss deduction is used.<br />

3. If a taxpayer has claimed a net operating loss deduction on its federal return and in the year the initial loss was incurred,<br />

its <strong>Missouri</strong> addition modifications are less than its subtraction modifications, does it have to compute a net operating loss<br />

modification?<br />

No, there is no net operating loss addition modification attributable to that net operating loss because in the year <strong>of</strong> the initial<br />

loss, the <strong>Missouri</strong> addition modifications were less than the <strong>Missouri</strong> subtraction modifications.<br />

4. If the net operating loss deduction is composed <strong>of</strong> net operating loss amounts from more than one year, is there more than one<br />

net operating loss addition modification?<br />

Yes, a net operating loss addition modification must be computed for each net operating loss included in the net operating loss<br />

deduction.<br />

5. If more than one net operating loss addition modification is computed, in what order are the amounts computed?<br />

The net operating loss addition modifications are computed in the same order the net operating losses are used as net operating<br />

loss deductions for federal income tax purposes.<br />

Form <strong>MO</strong>-<strong>5090</strong> (Revised 10-2013)