792-Dr. J. K. Patel Institute Of Management - Gujarat Technological ...

792-Dr. J. K. Patel Institute Of Management - Gujarat Technological ... 792-Dr. J. K. Patel Institute Of Management - Gujarat Technological ...

PETRO CHEMICAL INDUSTRY OF UAE Petrochemical Industry Profile and Evolution Petrochemical Cluster The Supreme Petroleum Council (SPC) was established in 1988 as the superior authority responsible fort he petroleum industry in the emirate of Abu Dhabi. The Ruler of Abu Dhabi chairs SPC that formulates and oversees the implementation of Abu Dhabi's petroleum policy and follows up its implementation across all areas of the petroleum industry through Abu Dhabi National Oil Company (ADNOC), its National Oil Company Abu Dhabi has the world’s fourth largest oil reserves (97.8 thousands million barrels) and 5th largest natural gas reserves 6 trillion cubic meters (BP, 2011). The evolution of oil and gas industry in Abu Dhabi is illustrated in the above Figure. It started with the first concession that was awarded to Petroleum Development (Trucial Coast) on 11th January 1939, a non-national company, but geological work and exploratory drilling started in February 1950, the first commercial oil discovery was made on 1960 at Bab oil field, and the first shipment of crude was exported from Jebel Dhanna terminal in 1963 prior to the formation of the federation of the United Arab Emirates. In 1971 The Abu Dhabi National Oil Company (ADNOC) was established Parul Institute of Management and Research - 792 Page 88

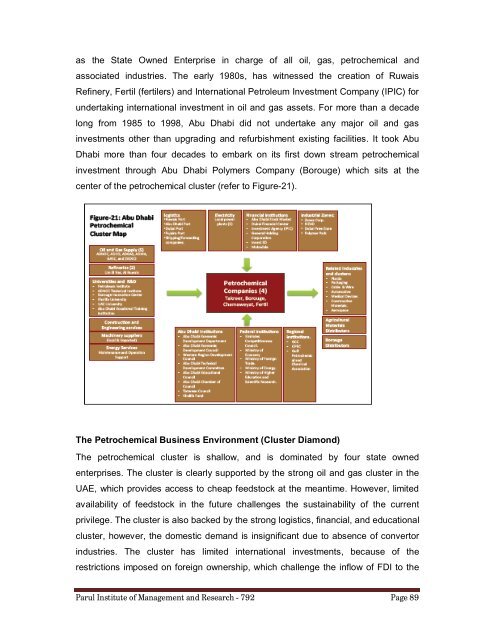

as the State Owned Enterprise in charge of all oil, gas, petrochemical and associated industries. The early 1980s, has witnessed the creation of Ruwais Refinery, Fertil (fertilers) and International Petroleum Investment Company (IPIC) for undertaking international investment in oil and gas assets. For more than a decade long from 1985 to 1998, Abu Dhabi did not undertake any major oil and gas investments other than upgrading and refurbishment existing facilities. It took Abu Dhabi more than four decades to embark on its first down stream petrochemical investment through Abu Dhabi Polymers Company (Borouge) which sits at the center of the petrochemical cluster (refer to Figure-21). The Petrochemical Business Environment (Cluster Diamond) The petrochemical cluster is shallow, and is dominated by four state owned enterprises. The cluster is clearly supported by the strong oil and gas cluster in the UAE, which provides access to cheap feedstock at the meantime. However, limited availability of feedstock in the future challenges the sustainability of the current privilege. The cluster is also backed by the strong logistics, financial, and educational cluster, however, the domestic demand is insignificant due to absence of convertor industries. The cluster has limited international investments, because of the restrictions imposed on foreign ownership, which challenge the inflow of FDI to the Parul Institute of Management and Research - 792 Page 89

- Page 37 and 38: Values Integrity, Solidarity, Credi

- Page 39 and 40: Sub-brand D’damas offers D’dama

- Page 41 and 42: TEXTILE INDUSTRY OF UAE The textile

- Page 43 and 44: Having a presence can provide consi

- Page 45 and 46: Parul Institute of Management and R

- Page 47 and 48: Industrial Sector: Education Sector

- Page 49 and 50: Import Licensing: India has liberal

- Page 51 and 52: industry is the biscuit promote, wh

- Page 53 and 54: IFFCO VISION AND VALUE VISION Creat

- Page 55 and 56: 2. Choose suppliers, partners, agen

- Page 57 and 58: Impulse foods: 1. Impulse foods 2.

- Page 59 and 60: • A certificate of insurance •

- Page 61 and 62: that keep them ahead in the industr

- Page 63 and 64: Telecommunications Infrastructure D

- Page 65 and 66: Smart buildings Etisalat Abu Dhabi

- Page 67 and 68: Towers and Rose Rotana, and is curr

- Page 69 and 70: as the Almas Tower, Princess Tower,

- Page 71 and 72: RETAIL INDUSTRY OF UAE Retail indus

- Page 73 and 74: Based on a Moderate Growth scenario

- Page 75 and 76: Retail Brands: Centre point: Centre

- Page 77 and 78: LIFESTYLE: Well-defined idea store

- Page 79 and 80: LANDMARK INTERNATIONAL: Landmark In

- Page 81 and 82: CANDELITE Confectionary Make life s

- Page 83 and 84: fruits & vegetables, meat & fish, k

- Page 85 and 86: Gloria Jean's Coffees: initially es

- Page 87: They're huge fans of greatness in u

- Page 91 and 92: increase of demand for electricity

- Page 93 and 94: Borouge is also investing in plants

- Page 95 and 96: There are a number of joint venture

- Page 97 and 98: to assess the demand for caustic-ch

- Page 99 and 100: TOURISM INDUSTRY OF UAE The United

- Page 101 and 102: Mission Consolidation of efforts be

- Page 103 and 104: worn under the headdress or guttrah

- Page 105 and 106: Sharjah ‣ Green Belt Park ‣ Al

- Page 107 and 108: ‣ Bull Butting ‣ Fujairah Fort

- Page 109 and 110: 3. Burj Al Arab Hotel This is one a

- Page 111 and 112: 5. Desert safari and beaches The Du

- Page 113 and 114: A festival which attracts visitors

- Page 115 and 116: stakeholders in tourism development

- Page 117 and 118: ‣ The meeting reviewed the final

- Page 119 and 120: Strictly speaking sharing a private

- Page 121 and 122: over the next 10 years, generating

- Page 123 and 124: The Gross Domestic Product (GDP) in

- Page 125 and 126: guest is well taken care of through

- Page 127 and 128: CONCLUSIONS & SUMMARY Conclusion (D

- Page 129 and 130: Thus, what we can finally conclude

- Page 131 and 132: - http://www.gjepc.org/news/8947/wo

- Page 133 and 134: - http://abudhabienergy.com/ - http

- Page 135 and 136: http://researchcommons.waikato.ac.n

- Page 137 and 138: http://lhc-workshop-2005.web.cern.c

as the State Owned Enterprise in charge of all oil, gas, petrochemical and<br />

associated industries. The early 1980s, has witnessed the creation of Ruwais<br />

Refinery, Fertil (fertilers) and International Petroleum Investment Company (IPIC) for<br />

undertaking international investment in oil and gas assets. For more than a decade<br />

long from 1985 to 1998, Abu Dhabi did not undertake any major oil and gas<br />

investments other than upgrading and refurbishment existing facilities. It took Abu<br />

Dhabi more than four decades to embark on its first down stream petrochemical<br />

investment through Abu Dhabi Polymers Company (Borouge) which sits at the<br />

center of the petrochemical cluster (refer to Figure-21).<br />

The Petrochemical Business Environment (Cluster Diamond)<br />

The petrochemical cluster is shallow, and is dominated by four state owned<br />

enterprises. The cluster is clearly supported by the strong oil and gas cluster in the<br />

UAE, which provides access to cheap feedstock at the meantime. However, limited<br />

availability of feedstock in the future challenges the sustainability of the current<br />

privilege. The cluster is also backed by the strong logistics, financial, and educational<br />

cluster, however, the domestic demand is insignificant due to absence of convertor<br />

industries. The cluster has limited international investments, because of the<br />

restrictions imposed on foreign ownership, which challenge the inflow of FDI to the<br />

Parul <strong>Institute</strong> of <strong>Management</strong> and Research - <strong>792</strong> Page 89