Group Annual Report 2012 - ERGO Versicherungsgruppe AG

Group Annual Report 2012 - ERGO Versicherungsgruppe AG

Group Annual Report 2012 - ERGO Versicherungsgruppe AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong><br />

<strong>Group</strong> <strong>Annual</strong> <strong>Report</strong>

Management <strong>Report</strong><br />

Overview of <strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>2012</strong> 2011 Change previous<br />

year (%)<br />

Total premium income € million 18,562 20,270 − 8.4<br />

Gross premiums written € million 17,091 18,519 − 7.7<br />

Expenses for claims and benefits (gross) € million 17,556 17,369 1.1<br />

Investment result € million 5,262 4,116 27.8<br />

Operating result € million 951 806 17.9<br />

Consolidated result € million 289 349 − 17.2<br />

Investments € million 125,390 117,309 6.9<br />

Technical provisions (net) € million 120,859 113,977 6.0<br />

Equity € million 4,587 3,827 19.9<br />

Full-time representatives 17,862 19,087 − 6.4<br />

Salaried employees 29,768 31,311 − 4.9<br />

<strong>ERGO</strong> is one of the major insurance groups in Germany<br />

and Europe. We have a presence in more than 30 countries<br />

worldwide, but the focus of our activities is on the European<br />

and Asian regions. <strong>ERGO</strong> offers a broad range in<br />

insurance, pension provision and services, and is one<br />

of the leading insurers across all segments in its home<br />

market of Germany. Around 48,000 people work for our<br />

<strong>Group</strong>, either as salaried employees or as full-time selfemployed<br />

sales partners. In <strong>2012</strong>, premiums amounted to<br />

over € 18 billion and insurance benefits for our customers<br />

accounted for more than € 17 billion.<br />

Our customers determine the way we operate. <strong>ERGO</strong> is strictly<br />

geared towards the wishes and needs of its customers,<br />

and intends to improve this still further by pursuing a<br />

close dialogue with them. We are implementing our claim<br />

“To insure is to understand” by providing advice and<br />

products which meet the needs of our customers as well<br />

as understanding and picking up on customers’ personal<br />

concerns. This is enhanced by a clear and understandable<br />

communication, innovative services and swift support in<br />

the event of damage or loss.<br />

Our customers can choose which form of contact with<br />

<strong>ERGO</strong> suits them best, as we have the right sales channel<br />

for every customer: Self-employed insurance sales<br />

partners, staff working in direct sales, as well as insurance<br />

brokers and strong cooperation partners – both in Germany<br />

and abroad – respond to the needs of private and corporate<br />

customers alike. We maintain partnerships with the<br />

major European bank UniCredit <strong>Group</strong> and other banks,<br />

both in Germany as well as in various European countries.<br />

<strong>ERGO</strong> is part of Munich Re, one of the leading global reinsurers<br />

and risk carriers. Within Munich Re, <strong>ERGO</strong> is the<br />

specialist for primary insurance, i. e. for insuring private and<br />

corporate customers directly, both in Germany and abroad.<br />

The group’s investments of € 214 billion, of which € 125 billion<br />

is accounted for by <strong>ERGO</strong>, are managed primarily by the<br />

joint asset management and fund company ME<strong>AG</strong>.

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Group</strong> <strong>Annual</strong> <strong>Report</strong>

Contents<br />

3 Letter by the Chairman of the Board of Management<br />

6 <strong>Report</strong> of the Supervisory Board on the <strong>2012</strong> financial year<br />

Management <strong>Report</strong><br />

10 The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

14 The <strong>ERGO</strong> Insurance <strong>Group</strong> – Governing bodies<br />

16 Business environment<br />

19 Business performance<br />

23 Assets and financial position<br />

27 Other success factors<br />

31 Risk report<br />

42 Opportunities report<br />

44 Prospects<br />

Consolidated<br />

Financial Statements 48 Consolidated balance sheet as at 31 December <strong>2012</strong><br />

50 Consolidated income statement for the financial year <strong>2012</strong><br />

51 Statement of recognised income and expense<br />

52 <strong>Group</strong> statement of changes in equity<br />

54 Consolidated cash flow statement for the financial year <strong>2012</strong><br />

55 Principles of presentation and consolidation<br />

74 Notes to the consolidated balance sheet – assets<br />

95 Notes to the consolidated balance sheet – equity and liabilities<br />

110 Notes to the consolidated income statement<br />

118 Disclosures on risks from insurance contracts and financial<br />

instruments<br />

130 Other information<br />

136 List of shareholdings as at 31 December <strong>2012</strong> in accordance with<br />

Section 313 para. 2 of the German Commercial Code (HGB)<br />

148 Auditor’s report

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

3<br />

Letter by the Chairman of<br />

the Board of Management<br />

Dear Readers,<br />

“Rescue routine” was the German word of the year <strong>2012</strong>. This means that the top spot has<br />

been claimed for the third time in five years by a term reflecting the turbulence on the<br />

capital markets, following “financial crisis” in 2008 and “stress test” in 2011. This shows<br />

how much the unpredictability of the markets continues to affect our everyday lives. The<br />

effects of the financial and national debt crises for companies and citizens are becoming<br />

ever clearer. This makes special demands on us not only in the management of our investments<br />

but also increasingly in our core business as an insurer.<br />

Our major investment portfolio still features investments that yield higher rates of return<br />

than can currently be achieved. In addition, we took early action to hedge against the risk<br />

of falling interest rates which will enable us to hold out for a long time in a climate where<br />

low interest rates prevail. After all, we make promises of benefits to customers that often<br />

last a lifetime, so we have to be able to make good on our promises even if interest rates<br />

remain extremely low.<br />

Dr. Torsten Oletzky<br />

Chairman of the Board of Management<br />

<strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong><br />

As a result, sustainable security takes precedence over returns on investment. This is<br />

why we have continued to lower policyholders’ bonuses for new German life insurance<br />

contracts. And our new unisex tariffs for health insurance feature lower technical interest<br />

rates. As lower capital yields are already taken into account during the calculation process,<br />

premium rates are higher as a result.<br />

For many customers, life insurance remains the best route to pursue in terms of private<br />

old-age provision. However, due to low interest rates, they are no longer able to fulfil<br />

customer expectations as they once did. <strong>Annual</strong> guarantees are expensive and have an<br />

adverse impact on the rate of return. This is why we will provide new product concepts in<br />

the future. Our guarantees have the main task to fulfil our customers’ demands in terms<br />

of planning security for their old age. At the same time, we will make our new products<br />

more flexible so that they adapt more successfully to the different stages in a person’s life.<br />

The new product generation will be launched this year.<br />

The fact that we have lowered the conditions of single-premium life insurance policies<br />

out of prudence already for <strong>2012</strong> has affected our new business. A lower life insurance<br />

business and sales of daughter companies in the previous year led to a decrease of 8.4%<br />

in total premium income, down to € 18.6 billion (20.3 bn). By contrast, the operating result<br />

was up significantly by 17.9% to € 951 million (806 m). The investment result recorded a

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Letter by the Chairman of 4<br />

the Board of Management<br />

major increase to € 5.3 billion (4.1 bn), while net returns rose from 3.4% to 4.1%. One of the<br />

major reasons for this increase was the cessation of the adverse effects of the previous<br />

year. The combined ratio of 95.8 (94.4)% in the German non-life segment did not live up<br />

to our high demands. However, at 100.5 (105.1)%, the combined ratio for international<br />

business developed favourably. Overall, the operating performance corresponded to our<br />

expectations.<br />

At € 417 million, the consolidated result before provisions for restructuring costs was<br />

slightly above our target. Taking these provisions into account, we achieved a result of<br />

€ 289 million (349 m). The provisions were set up in order to provide for the restructuring<br />

of our sales organisations. In order to introduce a consistent advisory process, reduce<br />

complexity and save on overheads, we started to streamline structures in our sales<br />

department in <strong>2012</strong>.<br />

We intend to merge five German sales organisations into two units under the umbrella<br />

of an <strong>ERGO</strong> sales company which will enable us to manage and support our sales teams<br />

consistently, bundle recruitment and will ensure a more homogeneous brand appearance.<br />

All these are important requirements for the proper use of resources and for efficient<br />

workflows. However, the related cut of up to 700 salaried sales posts and 650 in-house<br />

posts has been a hard decision to make. In cooperation with our co-determination bodies,<br />

we are attempting to find fair, socially responsible solutions for those affected. I sincerely<br />

hope that we are able to find appropriate solutions.<br />

In <strong>2012</strong>, our sales representatives were also the focus in terms of implementing our brand<br />

promise “To insure is to understand”. The mutual development of a consistent advisory<br />

process means that customer requirements are taken into account in every respect. If our<br />

sales partners are able to provide advice and conduct sales at the same high level, our<br />

customers will obtain the best possible insurance for all situations in life. In my opinion,<br />

you do not need to be an independent advisor in order to provide excellent insurance<br />

advice.<br />

This year’s Customer <strong>Report</strong> will also focus on how our sales partners advise and support<br />

our customers. The report describes how we implement our brand promise in terms of<br />

sales and other areas, and puts the focus on customers and their queries. The positive<br />

feedback that followed the first <strong>ERGO</strong> Customer <strong>Report</strong> in May <strong>2012</strong> gave us the reassurance<br />

that we are on the right track with this approach.<br />

In <strong>2012</strong>, we continued to improve the clarity of our customer communication with further<br />

revisions to customer letters as well as to terms and conditions of insurance policies.<br />

We have a special committee to ensure that our communication remains clear. It is now<br />

easier than ever to understand what we cover and what we do not – so that our customers<br />

always know what to expect from us. This is only fair and also prevents misunderstandings<br />

from arising. We are particularly proud of our TÜV certification for “Clear Communication”.<br />

In order to attain this certification, all of our customer communication was subject to<br />

external auditing by the technical inspection agency TÜV Saarland.<br />

Our understanding of “To insure is to understand” also includes being ready to respond<br />

to criticism. In summer <strong>2012</strong>, we were subject to allegations that we did not fully report<br />

on instances of misconduct in our sales organisations. Even if not all allegations were<br />

substantiated, we learnt that we did not fulfil our own demands on transparency in every<br />

respect. As a consequence, we published the results of our internal audit into claims of<br />

misconduct on incentive trips and other sales events on our website in October <strong>2012</strong>.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Letter by the Chairman of 5<br />

the Board of Management<br />

We also listed the actions we have taken so that everyone can form an opinion on these<br />

events. We will continue to maintain this transparency and openness.<br />

When it comes to products, we are increasingly gearing them towards the expectations<br />

and requirements of our customers. Our new accident insurance package offers complete<br />

support with lots of assistance services and one-to-one advice. When developing the<br />

product, our colleagues listened closely to people who had experienced accidents to guide<br />

them. This approach has met with approval: the product has gone down well with our<br />

customers. And when we notice that a product no longer conforms to the expectations of<br />

our customers, we adapt it or discontinue it.<br />

As far as our international business is concerned, we are continuing to pursue our<br />

expansion in Asia and are increasingly benefiting from our years of preparation and local<br />

presence. After a five‐year preparatory period, a team has been working in the Chinese<br />

province of Shandong since spring <strong>2012</strong> to set up the <strong>ERGO</strong> China Life Insurance. The joint<br />

venture with the Shandong State-owned Assets Investment Holding Company as a strong<br />

local partner is intended to go into business this year as soon as the final approval has<br />

been obtained from the local authorities.<br />

In India, we agreed on a joint venture in life insurance in November <strong>2012</strong> with the wellpositioned<br />

Avantha <strong>Group</strong> conglomerate – an excellent addition to our successful market<br />

presence in non‐life insurance with the joint venture HDFC <strong>ERGO</strong>. By contrast, we have sold<br />

<strong>ERGO</strong> Daum Direct in the difficult South Korean market.<br />

These are the main topics that shaped <strong>2012</strong> for us, and we will continue to work on many<br />

of them this year too. Our employees and management alike have driven the Company<br />

onwards with their conscientious work, commitment and excellent ideas. Our expert sales<br />

partners are fully dedicated to our customers. I would like to thank each and every one of<br />

them for their hard work. I am sure that we have created a solid foundation for success<br />

both for this year and the years to come.<br />

As an insurer, we depend heavily on the trust our customers have in us. If people ask why<br />

we deserve this trust, I say to them: because customers are always our focus, and they<br />

sense how much we value them. Because we take on challenges and are prepared to<br />

change with the times. Because we think ahead, try to take action in good time, and learn<br />

from our mistakes.<br />

And we will do everything we can to earn and merit this trust in the future.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

6<br />

<strong>Report</strong> of the Supervisory Board<br />

on the <strong>2012</strong> financial year<br />

The Supervisory Board reviewed the Company’s situation in detail during the reporting<br />

period. It monitored the management’s activities in accordance with legislation and<br />

the Company’s Articles of Association and advised the Board of Management regarding<br />

management of the Company. We were also involved in all major decisions. The Board of<br />

Management informed us regularly and in detail about important topics such as corporate<br />

planning, business development and the Company’s current situation. We were also<br />

consulted concerning corporate strategy.<br />

Dr. Nikolaus von Bomhard<br />

Chairman of the Supervisory Board<br />

of <strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong><br />

In the year under review, the Supervisory Board convened for three scheduled and two<br />

extraordinary meetings, which were attended by almost all members. In addition, the<br />

various committees (Standing Committee, Audit Committee and Board Committee) met,<br />

and the respective Chairpersons regularly reported in detail on their work. They were<br />

also available to answer any questions. The Nomination Committee and the Conference<br />

Committee as decreed by Section 27, para. 3, of the German Co-Determination Act<br />

( MitbestG) did not have to meet.<br />

The Board of Management also informed us in between sessions about important issues<br />

and significant upcoming decisions. Furthermore, as Chairman of the Supervisory Board,<br />

I was in regular contact with the Chairman of the Board of Management and discussed<br />

with him <strong>ERGO</strong>’s strategy, risk and capital management as well as current business<br />

develop ments. The subject of these discussions included the allegations made against<br />

<strong>ERGO</strong> by the press again in summer <strong>2012</strong>. These allegations were made known in 2011<br />

and subsequently clarified in detail.<br />

Main issues<br />

During the balance sheet meeting held on 20 March <strong>2012</strong>, the Supervisory Board was<br />

given a detailed review of the 2011 financial statement as well as being informed of<br />

<strong>ERGO</strong>’s business development. The Chief Risk Officer also informed us in detail of <strong>ERGO</strong>’s<br />

risk strategy and risk situation. In addition, the Board of Management reported on<br />

preparations for the introduction of the new Solvency II regulatory system. During the<br />

session held on 3 August <strong>2012</strong> we debated the profitability of classic life insurance in the<br />

context of the current economic and political environment in Germany.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Supervisory Board report 7<br />

on the <strong>2012</strong> financial year<br />

We were told about the plans for a new <strong>ERGO</strong> life insurance product line, which is due to<br />

be launched in 2013. Finally, in its meeting on 4 December <strong>2012</strong>, the Supervisory Board<br />

discussed the reports by the Board of Management regarding the development and risk<br />

exposure of <strong>ERGO</strong>’s investments. Other topics included developments in the non‐life and<br />

international segments. We also discussed the Labour Director’s HR <strong>Report</strong>.<br />

In two extraordinary meetings held on 4 June and 30 October <strong>2012</strong>, the Supervisory Board<br />

discussed the results of the audits investigating allegations made against <strong>ERGO</strong> by the<br />

press as well as the measures adopted by the Board of Management in response to these<br />

allegations. The Board of Management presented the measures implemented so far and<br />

those to be adopted, along with more information about the topic of transparency on the<br />

<strong>ERGO</strong> website.<br />

In addition, during its meetings on 3 August and 4 December <strong>2012</strong>, the Supervisory Board<br />

discussed the “Future of Sales” Initiative, including the planned strategic realignment of<br />

<strong>ERGO</strong>’s sales organisations. In its meeting on 4 December <strong>2012</strong>, the Standing Committee<br />

approved and passed the transactions and measures concerning the <strong>Group</strong>’s organisation.<br />

Furthermore, the Board of Management informed us about a joint venture set up in China<br />

between <strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong> and life insurer <strong>ERGO</strong> Lebensversicherung <strong>AG</strong><br />

with a state investment company as a local partner, as well as a joint venture in the Life<br />

segment in India with the Avantha <strong>Group</strong>. It also outlined the sale of shares in <strong>ERGO</strong> Daum<br />

Direct in South Korea. In addition, we were told about the conclusion of a domination<br />

agreement between MunichFinancial<strong>Group</strong> GmbH – a 100% subsidiary of Münchener<br />

Rückversicherungs-Gesellschaft <strong>AG</strong> – and <strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong>. The contract was<br />

entered in the commercial register on 20 November and came into force on that date.<br />

Besides decisions regarding the extension of appointments to the Board of Management<br />

that were due to expire, we also addressed the topic of remuneration for the members<br />

of the Board of Management. The plenum made a decision on the amount of variable<br />

remuneration based on the annual performance in the 2011 financial year and for the<br />

2009 mid-term incentive plan. Furthermore, the assessment base and targets for variable<br />

remuneration were stipulated for the <strong>2012</strong> financial year. We also discussed changes to<br />

the remuneration system as of 1 January 2013 and passed the resolution accordingly.<br />

On this basis, we were able to establish the assessment base and targets for variable<br />

remuneration for the 2013 financial year.<br />

Corporate governance<br />

The <strong>ERGO</strong> Supervisory Board attaches great importance to good corporate governance.<br />

We took a close look at the efficiency of our operations by means of a questionnaire in the<br />

reporting year and discussed the various suggestions for improving the efficiency of the<br />

Supervisory Board.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Supervisory Board report 8<br />

on the <strong>2012</strong> financial year<br />

Company and <strong>Group</strong> financial statements<br />

KPMG Bayerische Treuhandgesellschaft Aktiengesellschaft Wirtschaftsprüfungs gesellschaft<br />

Steuerberatungsgesellschaft, Munich, audited the annual financial statements prepared<br />

by the Board of Management, including the management report and the consolidated<br />

financial statements, including the <strong>Group</strong> management report for the <strong>2012</strong> financial year,<br />

and awarded them an unqualified auditor’s opinion.<br />

At a meeting held on 11 March 2013, the Supervisory Board’s Audit Committee discussed<br />

these documents at length, having examined them in advance. We then discussed<br />

in detail the annual financial statements and the consolidated financial statements,<br />

the management report and the <strong>Group</strong> management report, along with the reports<br />

by the external auditor at the balance sheet meeting, which was also attended by<br />

representatives of the auditing company, who made a statement. We had no objections.<br />

We approved the annual financial statements and consolidated financial statements for<br />

<strong>2012</strong>, which have now been endorsed. We reviewed the Board of Management’s proposal<br />

for the appropriation of profits and have approved it.<br />

Changes to the Supervisory Board<br />

Ms Ira Gloe-Semler, Mr Hans-Peter Claußen and Mr Ralph Eisenhauer stepped down from<br />

the Supervisory Board either during the year under review or at the end of the year. We<br />

wish to thank them for their dedication and in some cases many years of service on<br />

our Board. Ms Martina Scholze, Dr. Anne Horstmann and Mr Volker Kallé have joined the<br />

Supervisory Board as their replacements or as legally appointed members.<br />

Our gratitude to the Board of Management and staff<br />

The Supervisory Board would like to thank the members of the Board of Management and<br />

all Company employees as well as the staff of all companies within the <strong>ERGO</strong> Insurance<br />

<strong>Group</strong> for their huge personal commitment in a reporting year that was shaped by many<br />

changes and challenges.<br />

Düsseldorf, 19 March 2013<br />

On behalf of the Supervisory Board<br />

Dr. Nikolaus von Bomhard<br />

Chairman of the Supervisory Board<br />

of <strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong>

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

10<br />

Management <strong>Report</strong><br />

The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>ERGO</strong> is one of the major insurance groups in Germany<br />

and Europe. We have a presence in more than 30 countries<br />

worldwide, but the focus of our activities is on European<br />

and Asian regions. <strong>ERGO</strong> offers a broad range of insurance,<br />

pension provisions and services. In its home market<br />

of Germany, <strong>ERGO</strong> ranks among the leading providers<br />

across all segments. Around 48,000 people work for our<br />

<strong>Group</strong>, either as salaried employees or as full-time selfemployed<br />

sales partners. In <strong>2012</strong>, premiums amounted to<br />

over € 18 billion and insurance benefits for our customers<br />

accounted for more than € 17 billion.<br />

Our customers can choose which form of contact with<br />

<strong>ERGO</strong> suits them best, as we have the right sales channel<br />

for every customer: self-employed insurance sales partners,<br />

staff working in direct sales, insurance brokers and strong<br />

cooperation partners – both in Germany and abroad –<br />

respond to the needs of private and corporate customers<br />

alike. We maintain sales partnerships with the major<br />

European bank UniCredit <strong>Group</strong> and other banks, both in<br />

Germany and other European countries.<br />

<strong>ERGO</strong> is part of Munich Re, one of the leading global<br />

reinsurers and risk carriers. Within Munich Re, <strong>ERGO</strong> is the<br />

specialist for primary insurance, i. e. for insuring private and<br />

corporate customers directly, both in Germany and abroad.<br />

The group’s investments of € 214 billion, of which € 125 billion<br />

is accounted for by <strong>ERGO</strong>, are managed primarily by the<br />

joint asset management and fund company ME<strong>AG</strong>.<br />

As an integral part of Munich Re, <strong>ERGO</strong> is integrated into<br />

the core processes of Munich Re in terms of regulatory and<br />

corporate law, e. g. group strategy and corporate policy,<br />

capital and financial planning, risk management, controlling,<br />

reporting and accounting, or in general regarding significant<br />

legal transactions and measures. In <strong>2012</strong>, a domination<br />

agreement was concluded between MunichReFinancial<strong>Group</strong><br />

GmbH – which is wholly owned by Münchener Rückversicherung<br />

<strong>AG</strong> – and <strong>ERGO</strong> Versicherungs gruppe <strong>AG</strong>. A group<br />

directive regulates the responsibilities and competences<br />

between the group executive management of Munich Re and<br />

<strong>ERGO</strong> in decisions of primary importance.<br />

This consolidated management report summarises the<br />

business activities of our <strong>Group</strong>. There is a general overview<br />

of <strong>ERGO</strong>’s performance on pages 19–22, which includes<br />

information on the following divisions: Life Germany,<br />

Health, Property-Casualty Germany, Direct Insurance,<br />

Travel Insurance and International.<br />

Our brand strategy<br />

In our domestic market of Germany, we offer life and<br />

property-casualty products under the <strong>ERGO</strong> brand. This<br />

product range is supplemented by our specialist insurers –<br />

DKV for health insurance, D.A.S. for legal protection and<br />

ERV for travel insurance.<br />

We are primarily represented on the international market<br />

by the <strong>ERGO</strong> brand and are actively giving the brand a<br />

higher profile. In line with this strategy, we renamed<br />

companies in Austria, Slovenia, Croatia and the Czech<br />

Republic during the reporting period. Over the course of<br />

the current year, we merged companies in Hungary and<br />

Slovakia; the merged companies now operate under the<br />

<strong>ERGO</strong> brand.<br />

Our brand communicates a clear promise to our customers:<br />

“To insure is to understand.” This promise represents a<br />

consistent approach that takes customers’ requirements<br />

into account in all areas of business. It consists of needsbased<br />

advice which understands and picks up on the<br />

customers’ concerns along with clear and easy-to-understand<br />

communication, innovative services and prompt<br />

support in the event of loss or damage.<br />

At the same time we are working towards further fulfilling<br />

our customers’ expectations and invite them and others<br />

to give us feedback which we analyse self-critically. Using<br />

the online <strong>ERGO</strong> Customer Workshop or as a member of<br />

the <strong>ERGO</strong> Customer Advisory Board, consumers can help<br />

to shape our products and services by contributing their<br />

suggestions and wishes.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>11<br />

The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

During the reporting period we published the first <strong>ERGO</strong><br />

Customer <strong>Report</strong>. We have received numerous suggestions,<br />

ideas and criticism from consumers in the form of letters,<br />

conversations, e-mails,online feedback forms and via<br />

Facebook. These comments were condensed into 179<br />

questions, which we then answered.<br />

The <strong>ERGO</strong> Customer Advocate represents the interests of<br />

our customers within the Company. He takes on the role of<br />

mediator in cases where a customer feels that he has not<br />

been treated fairly and is not getting anywhere. Together<br />

with the <strong>Group</strong>’s size and financial strength, <strong>ERGO</strong>’s strong<br />

customer orientation makes it a long-term reliable partner<br />

for customers.<br />

Our management style and objectives<br />

Our Company is managed strictly with the customer, service<br />

and profitability in mind. The focus here is on integrated<br />

management of the divisions and their administrative<br />

processes, modern risk management comprising asset<br />

liability management, and value and risk-based management<br />

of all business activities.<br />

Our activities include various business models, providing<br />

all types of life, annuity and health cover and virtually all<br />

aspects of property-casualty insurance as well as legal<br />

protection cover.<br />

Value-based management<br />

Our objective is to analyse risks from every conceivable angle<br />

and to assess and diversify them, thereby creating lasting<br />

value for shareholders, customers and staff. The guiding<br />

principle of our entrepreneurial thinking and activity is to<br />

increase the value of our Company on a lasting basis, which<br />

also includes our active capital manage ment. We pursue this<br />

goal primarily by consistently applying value-based management<br />

systems which we constantly refine. Economic earnings<br />

are instrumental to answering the uestion of whether or<br />

not we have created value over a given period. They consider,<br />

for example, the costs of the relevant risk capital and the<br />

long-term nature of the business, and correspond to the<br />

change to the economic equity over a specified period of<br />

time.<br />

The framework for any business activity is our risk strategy,<br />

derived from the business strategy, from which we extract<br />

a detailed network of limitations and reporting thresholds.<br />

Besides value-based parameters, we observe a range of<br />

important additional conditions in managing our business.<br />

They include rules of local accounting systems, tax<br />

aspects, liquidity requirements and regulatory parameters.<br />

Our value-based management is characterised by the<br />

following aspects:<br />

• We assess business activities not only according to their<br />

earnings potential but also relative to the extent of the<br />

risks assumed, which is decisive in measuring added<br />

value as well. This is why we have implemented high<br />

quality standards for underwriting, pricing, cumulative<br />

controls and claims management. Only the risk–return<br />

relationship reveals how beneficial an activity is from<br />

the shareholder point of view.<br />

• With value-based performance indicators we ensure<br />

the economic view and the necessary comparability of<br />

alternative initiatives and prioritise these.<br />

• We closely link strategy and operative planning.<br />

Property-casualty insurance:<br />

combined ratio and economic earnings<br />

Across property-casualty insurance and other segments,<br />

which are by and large distinguished by their short-term<br />

business nature, we largely consider two factors: combined<br />

ratio and economic earnings.<br />

The combined ratio describes the percentage ratio<br />

between the sum of expenses for claims and benefits to<br />

customers (net) plus operating expenses (net) to earned<br />

premiums (net).<br />

When interpreting the combined ratio, the particular<br />

circumstances of the class of business in question have<br />

to be taken into account. The composition of the portfolio<br />

is of great significance, as is the degree to which the<br />

claims burden fluctuates over time. The time lag between<br />

premiums being received and claims being paid is of key<br />

significance. The more extended this period is, the longer<br />

the premiums received can be invested in the capital<br />

markets.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>12<br />

The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

Higher combined ratios in classes of business with comparatively<br />

late claims notifications and long claims settlement<br />

processes (e. g. liability insurance) regularly go hand<br />

in hand with higher results from investments, which in<br />

turn cover the provisions for outstanding claims. These<br />

returns are not reflected in the combined ratio. For this<br />

reason, while we aim to keep the combined ratio as low<br />

as possible, it is not a sufficiently significant variable when<br />

considered on its own.<br />

The economic value creation is of decisive importance,<br />

which cannot be described properly with the combined<br />

ratio alone. The economic value added is determined<br />

internally – in compliance with the prospective regulatory<br />

system “Solvency II” – using economic earnings. Value<br />

added is characterised by the fact that value creation is<br />

not evaluated on the basis of current and forecast profits<br />

alone, but also by taking into account the amount of<br />

risks taken.<br />

The starting point for calculating economic earnings is<br />

the change in economic equity within a period of time.<br />

Determining factors are primarily the IFRS result, the<br />

change to the balance sheet and off-balance sheet<br />

reserves on the assets and liability side, as well as risk<br />

capital costs for the risks insured. The change in economic<br />

equity is adjusted according to capital measures, such as<br />

dividends. Additional adjustments concern the change<br />

of items, which are not included in the economic capital,<br />

yet still bear influence on the economic value added.<br />

An example of this is the construction of goodwill value<br />

following an acquisition.<br />

Life and Health:<br />

market-consistent embedded value<br />

Life and health insurance products are characterised<br />

by their long-term nature and the distribution of results<br />

over the duration of the policies. For valuing such longterm<br />

portfolios whose performance cannot be reasonably<br />

measured on the basis of a single year, we follow<br />

the Principles of Market Consistent Embedded Value<br />

(MCEV) © , the current version of which was published by<br />

the European Insurance CFO Forum in October 2009.<br />

MCEV comprises a company’s equity and the value of<br />

in-force covered business. The latter is the present value of<br />

future net profits from the insurance portfolio and related<br />

investments calculated using financial and actuarial<br />

methods, taking into consideration the time value of<br />

the financial options and guarantees and the explicitly<br />

determined costs of capital.<br />

MCEV relates to the portfolio as at the valuation date. It<br />

encompasses more than 97% of our life insurance and<br />

long-term health insurance business. By contrast, MCEV<br />

does not include the value of future new business. However,<br />

the valuation is made under the assumption of<br />

continued operations. Options and guarantees – especially<br />

for the policyholders – are explicitly valued using stochastic<br />

simulations. MCEV reflects the present value of all cash<br />

flows for all important currency regions on the basis of the<br />

swap rates and the implicit volatilities at the valuation date<br />

of 31 December <strong>2012</strong>. Assets that are traded on the capital<br />

markets are valued on the basis of the market values<br />

observed at the valuation date.<br />

The development of the insurance portfolio is modelled<br />

by applying the current expectations for biometrics (e. g.<br />

mortality and morbidity), lapses and costs. The participation<br />

of policyholders in surplus is modelled according to the<br />

current planning and in line with the statutory regulations,<br />

and these are included in the valuation. For the individual<br />

companies, we use tax rates and calculations based on<br />

national regulations; tax loss carry-forwards are also<br />

included in the calculation. The cost of capital essentially<br />

includes costs for the not explicitly modelled risks of the<br />

business.<br />

The change in MCEV within one year – excluding effects<br />

of exchange-rate fluctuations, acquisition and sale of<br />

companies, dividends and capital injections – is shown<br />

as the total embedded value earnings. These are used<br />

under the term Economic Earnings to manage life and<br />

health insurance. If the total embedded value earnings<br />

are adjusted by also including the influences of changes<br />

in capital market parameters, such as changes to the rate<br />

of interest, the term is known as the operating embedded<br />

value earnings, which are a measure of the operative<br />

business performance for one year.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>13<br />

The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

Managing investments<br />

The main focus of our investment strategy is assetliability<br />

management, in which we take into account key<br />

characteristics of underwriting and other liabilities in<br />

structuring our investment portfolio and measure investment<br />

risks not only in absolute terms, but also in relation<br />

to changes of value in our liabilities. Changes in economic<br />

factors are likely to influence the value of our capital<br />

investments, just as they will have an impact on the value<br />

of technical provisions and liabilities. This reduces our<br />

vulnerability to the effect of capital market fluctuations<br />

and stabilises our own equity. For this purpose, we mirror<br />

important features of the liabilities, such as maturity<br />

patterns, currency structures, and inflation sensitivities, on<br />

the assets side of the balance sheet by acquiring investments<br />

with similar characteristics if possible. In terms<br />

of currency positioning, exchange-rate fluctuations thus<br />

affect assets and liabilities in equal measure. Currency<br />

conversion losses on assets are largely offset economically<br />

by gains made by converting technical liabilities. In<br />

this approach, any deviations from the structure of our<br />

liabilities are made consciously taking due account of our<br />

risk-bearing capacity and the risk spreads achievable. To<br />

a limited extent, we also align our investment portfolio<br />

in such a way that it increases in value in line with rising<br />

inflation rates. To achieve this, we invest in inflationsensitive<br />

asset classes such as inflation-linked bonds and<br />

inflation-linked swaps, as well as real assets.<br />

Non-financial performance measures<br />

In addition to these purely financial performance factors,<br />

non-financial performance measures such as innovation,<br />

speed of processes, staff-training level as well as customer<br />

satisfaction, sales service and productivity also play a<br />

part. A company can only be successful over the long<br />

term if it operates sustainably and takes account of such<br />

future- oriented qualitative factors. This is why our strategic<br />

management focuses on the five target groups, namely<br />

customers, sales partners, staff, society and investors.<br />

We promote an entrepreneurial culture among our staff<br />

through the clear allocation of responsibility and accountability,<br />

making clear how much the individual, unit and<br />

field of business contribute to increasing value. Our incentive<br />

systems for executives and the Board of Management<br />

therefore also encourage value creation: the higher a staff<br />

member or executive is positioned in the management<br />

hierarchy, the more dependent their remuneration is on<br />

performance. <strong>ERGO</strong> Insurance <strong>Group</strong> Board members and<br />

executives have targets according to economic earnings.<br />

Furthermore, the customer satisfaction index, Net Promotor<br />

Score, is a key controlling variable for <strong>ERGO</strong> which extends<br />

into the targets and awarding of bonuses to members of<br />

the Board of Management.<br />

To configure our economic asset-liability management<br />

as effectively as possible, we also use derivative financial<br />

instruments to hedge against fluctuations in the interest<br />

rate, equity and currency markets. Under IFRS accounting,<br />

we recognise these in profit or loss, i. e. as income or<br />

expense in the income statement. This type of recording<br />

is not done with related underlying trans actions. Despite<br />

our economically well-balanced insurance and investment<br />

portfolios, accounting inconsistencies of this kind and other<br />

differences between the economic and balance sheet<br />

perspectives can give rise to considerable fluctuations in<br />

our IFRS investment, currency and consolidated results,<br />

particularly in times of greater volatility on the capital<br />

markets. Financial derivatives are explained in further detail<br />

in the notes on the consolidated financial statements [6l].

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

14<br />

Management <strong>Report</strong><br />

The <strong>ERGO</strong> Insurance <strong>Group</strong> – Governing bodies<br />

Supervisory Board<br />

Dr. Nikolaus von Bomhard, Chairman<br />

Chairman of the Board of Management of<br />

Münchener Rückversicherungs-Gesellschaft <strong>AG</strong><br />

Michael David, Deputy Chairman<br />

Insurance employee<br />

Dr. Christine Bortenlänger<br />

Managing Director of<br />

Deutsches Aktieninstitut in Frankfurt<br />

Hans-Peter Claußen, until 31 August <strong>2012</strong><br />

Insurance employee<br />

Ralph Eisenhauer, until 31 December <strong>2012</strong><br />

Executive employee<br />

Frank Fassin<br />

District Chairman Financial Services ver.di NRW<br />

Prof. Dr. Nadine Gatzert<br />

Professor for Insurance Economics at the<br />

Friedrich-Alexander University in Erlangen-Nuremberg<br />

Ira Gloe-Semler, until 20 March <strong>2012</strong><br />

Associated Union of Workers Secretary ver.di<br />

Dr. Heiner Hasford<br />

Member of the Board of Management of<br />

Münchener Rückversicherungs-Gesellschaft <strong>AG</strong> (retired)<br />

Dieter Herzog<br />

Insurance employee<br />

Dr. Anne Horstmann, since 1 September <strong>2012</strong><br />

Insurance employee<br />

Dr. Lothar Meyer<br />

Chairman of the Board of Management of<br />

<strong>ERGO</strong> <strong>Versicherungsgruppe</strong> <strong>AG</strong> (retired)<br />

Dr. Markus Miele<br />

Managing Partner of Miele & Cie. KG<br />

Silvia Müller<br />

Insurance employee<br />

Marco Nörenberg<br />

Insurance employee<br />

Bernd Otten<br />

Head of Corporate Office Münchener Rückversicherungs-<br />

Gesellschaft <strong>AG</strong><br />

Prof. Dr. Bernd Raffelhüschen<br />

Director of the Institute of Public Finance of the<br />

Albert-Ludwigs-University of Freiburg<br />

Martina Scholze, since 27 April <strong>2012</strong><br />

Trade Union Secretary of Financial Services <strong>Group</strong> of ver.di<br />

Richard Sommer<br />

Former Head of the Federal <strong>Group</strong> Insurance of ver.di<br />

Dr. Theodor Weimer<br />

Spokesman of the Board of Management<br />

of Unicredit Bank <strong>AG</strong><br />

Heinz Wink<br />

IT employee<br />

Prof. Dr. Klaus L. Wübbenhorst<br />

Managing Director of WB Consult GmbH<br />

Volker Kallé, since 1 January 2013<br />

Executive employee

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>15<br />

The <strong>ERGO</strong> Insurance <strong>Group</strong><br />

Governing bodies<br />

Audit Committee<br />

Dr. Heiner Hasford<br />

Dr. Theodor Weimer<br />

Heinz Wink<br />

Board Committee<br />

Dr. Nikolaus von Bomhard<br />

Hans-Peter Claußen, until 30 April <strong>2012</strong><br />

Dieter Herzog, since 1 May <strong>2012</strong><br />

Dr. Markus Miele<br />

Nomination Committee<br />

Dr. Nikolaus von Bomhard<br />

Dr. Lothar Meyer<br />

Dr. Markus Miele<br />

Standing Committee<br />

Dr. Nikolaus von Bomhard<br />

Michael David<br />

Dr. Lothar Meyer<br />

Dr. Markus Miele<br />

Marco Nörenberg<br />

Conference Committee<br />

Dr. Nikolaus von Bomhard<br />

Michael David<br />

Dr. Heiner Hasford<br />

Richard Sommer<br />

Board of Management<br />

Dr. Torsten Oletzky, Chairman<br />

<strong>Group</strong> Development<br />

Communications<br />

<strong>ERGO</strong> Customer Advocate<br />

Legal Affairs, Compliance<br />

Internal Auditing<br />

Dr. Bettina Anders<br />

IT Germany as well as Comprehensive Questions<br />

of Principle, Customer Service, Company Organisation<br />

Dr. Daniel von Borries<br />

Finances and Investments<br />

Life Insurance Germany<br />

ME<strong>AG</strong>/<strong>ERGO</strong>-Interface<br />

Christian Diedrich<br />

Non-Life Insurance<br />

(Property-Casualty, Legal Protection) Germany<br />

Dr. Ulf Mainzer, Labour Director<br />

Domestic Human Resources as well as<br />

Comprehensive Questions of Principle,<br />

General Services, Facility and Materials<br />

Management/Purchasing and Logistics<br />

Germany<br />

Dr. Jochen Messemer<br />

International Operations<br />

(except for Travel Insurance)<br />

Dr. Clemens Muth<br />

Health Insurance (including Travel Insurance)<br />

Dr. Rolf Wiswesser<br />

Sales Germany, Competence Centre Bank Sales Germany,<br />

Marketing, Brand Management<br />

Dr. Christoph Jurecka<br />

Accounting, Taxes, Planning and Controlling,<br />

Risk Management

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

16<br />

Management <strong>Report</strong><br />

Business environment<br />

Our business environment is being shaped by a number of<br />

global trends with a long-term impact. Demographic shifts<br />

are giving rise to fundamental developments and posing<br />

enormous challenges for social security and healthcare<br />

systems, particularly in industrialised countries. Increasing<br />

life expectancy is placing a burden on pay-as-you-go social<br />

security systems, a situation aggravated further by falling<br />

birth rates. Europeans will therefore only be able to maintain<br />

their old-age provision and first-class medical care in<br />

the medium term if they take out additional private cover.<br />

This presents a great opportunity for the private insurance<br />

industry. However, consistently low interest rates are<br />

threatening the success of long-term savings.<br />

Developing and emerging countries are experiencing rapid<br />

population growth and, at the same time, a swift rise in<br />

prosperity among large sections of the population. As a<br />

result, the emerging Asian economies in particular are gaining<br />

in global importance. Correspondingly, the economic and<br />

geopolitical weight of industrialised countries is declining.<br />

Worldwide economic integration, technological progress and<br />

digitalisation are accelerating the globalisation of capital<br />

flows and supply chains, and increasing the complexity of<br />

the world economy.<br />

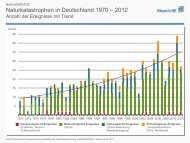

In this environment, we are seeing a rising number of<br />

major events which impact on the insurance industry.<br />

Insured losses are rising disproportionately to economic<br />

activity. We believe that climate change is responsible,<br />

alongside advancing urbanisation and a concentration<br />

of assets in exposed regions. This is producing new risk<br />

potentials and accumulation risks that make it imperative<br />

to constantly refine our underwriting.<br />

Companies like <strong>ERGO</strong>, which are among the leaders in<br />

terms of risk management, are able to take advantage of<br />

the opportunities arising from this global trend. With our<br />

sound risk awareness, we are able to hold our ground even<br />

in a complex and volatile environment.<br />

General economic trend<br />

Global economic growth weakened for a further consecutive<br />

year in <strong>2012</strong>, due in large part to the still-smouldering<br />

state debt and banking crisis in the Eurozone. The eurozone<br />

as a whole had already slid into a recession in late 2011<br />

from which it was unable to free itself during the period of<br />

review. Budget consolidation measures curbed growth, and<br />

at the same time the rate of unemployment continued to<br />

rise, reaching a record level.<br />

Chinese economic growth slowed down considerably, due<br />

in part to receding global demand for export. The performance<br />

of the Japanese economy also weakened over the<br />

course of the year. Meanwhile, the moderate economic<br />

growth of the USA buttressed the global economy.<br />

At the beginning of the year, the Euvrozone crisis appeared<br />

to have very little impact on the German economy, though<br />

the economy faltered in the second half of the year.<br />

German price-adjusted GDP rose by just 0.7% in <strong>2012</strong><br />

( provisional estimate from the Federal Bureau of Statistics<br />

of 15 January 2013). The trend on the German employment<br />

market, however, remained positive. The average unemployment<br />

rate for the year was 6.8%. Average inflation on<br />

consumer prices in Germany was 2.0% in <strong>2012</strong>.<br />

Capital market trends<br />

Political events, particularly within the European Economic<br />

and Monetary Union, and measures adopted by the central<br />

banks were the driving forces behind capital market<br />

develop ments, including large fluctuations. Periods of high<br />

demand for high-risk securities alternated with periods of<br />

risk aversion. Overall, for most of the asset classes trends<br />

were positive.<br />

Over the past year, the overall positive development for<br />

virtually all types of securities belied the major fluctuations<br />

of <strong>2012</strong>. The main driving force behind these fluctuations<br />

in the international markets was the ongoing state debt

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>17<br />

Business environment<br />

crisis in the Eurozone. At the beginning of the year, some<br />

government bonds in countries on the European periphery<br />

recorded considerable gains. We attribute this development<br />

to the generous provision of liquidity from the<br />

European Central Bank (ECB), which also greatly benefited<br />

high-risk securities such as shares. However, the crisis<br />

intensified in the second quarter due to uncertainty about<br />

the outcome of the Greek elections, the adjustment of the<br />

goals to reduce Spain’s budget deficit and debates on the<br />

possibility of certain countries leaving the euro. As a result,<br />

the returns on most “safe haven” bonds reached new lows.<br />

Plans to set up a Eurozone banking union and the ECB’s<br />

announcement of its intention to possibly buy up all shortterm<br />

government bonds from countries on the European<br />

periphery led to lower returns on peripheral bonds and a<br />

marked recovery on the stock market in the second half of<br />

the year. All in all, <strong>2012</strong> was a positive year for shares. The<br />

Euro Stoxx 50 price index was up by 13.8% and the DAX<br />

performance index increased by 29.1%.<br />

Yet demand remained high for safe-haven securities, such<br />

as German government bonds. The already low return on<br />

ten-year German government bonds fell a further 50 basis<br />

points to 1.3% by the end of the year. This change in<br />

interest rates made some considerable gains possible on<br />

the bond markets.<br />

Central banks outside the Eurozone also relaxed their<br />

monetary policy due to weak economic growth on a<br />

global scale. The US Federal Reserve announced a further<br />

bond-purchasing programme, which will be maintained<br />

until the situation on the employment market improves<br />

substantially.<br />

The trend in the insurance industry<br />

At the end of <strong>2012</strong>, insurers in several EU countries introduced<br />

the new unisex tariffs, meaning that gender is no<br />

longer a factor in the calculation of premiums and benefits<br />

in terms of risk differentiation, following a verdict passed<br />

by the European Court of Justice in 2011. The court viewed<br />

different premiums for men and women as undue discrimination.<br />

For example, life insurance companies may<br />

no longer take into account the observed difference in life<br />

expectancies of men and women. This ruling is valid for all<br />

policies signed since 21 December <strong>2012</strong>.<br />

The overall economic trend has a strong effect on the<br />

development of premiums in the insurance industry, especially<br />

for property-casualty insurance. In the case of life<br />

and health insurance, additional important factors are the<br />

influence of capital markets and changes to the legal and<br />

tax frameworks. This means that the European insurance<br />

markets operate according to very different parameters.<br />

In line with the focal point of our business, the following<br />

sections take a closer look at trends in our domestic market<br />

of Germany.<br />

On the whole, insurance premiums in Germany rose by 1.5%<br />

in <strong>2012</strong>. The figures here and below are based on provisional<br />

estimates provided by the German Insurance Association<br />

and the German Association of Private Health Insurers.<br />

The market figures are based on gross figures established<br />

in accordance with the German Commercial Code (HGB),<br />

meaning they are not necessarily comparable with figures<br />

calculated according to IFRS or net of reinsurance.<br />

Life insurance in <strong>2012</strong><br />

Life insurance in Germany (including pension and retirement<br />

funds) continued to suffer from the adverse conditions<br />

experienced on the capital markets in <strong>2012</strong>. Persistently<br />

low interest rates have led to a reduction of bonus rates<br />

across the industry. This particularly influenced the market<br />

for single-premium products. New business with regular<br />

premiums was also down on last year. Widespread economic<br />

uncertainty has prompted customers to be cautious<br />

of long-term commitments. New business was down by 2%<br />

across the market. The top priority for customers is the security<br />

of their private old-age provision, making guaranteed<br />

components very important to them. Insurance against the<br />

financial impact of occupational disability and the need for<br />

nursing care also recorded a marked increase in business.<br />

Total premium income was up slightly by 0.8% to € 83.8 billion<br />

(83.2 bn) across the industry, due to a lower number of<br />

policies expiring. The previous year saw a large amount of<br />

scheduled maturities. Many of these policies were taken out<br />

in 1999 because of the planned tax reforms at that time.<br />

The amount paid out to life insurance customers therefore<br />

dropped to € 75 billion 85 bn).

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>18<br />

Business environment<br />

The German Federal Court of Justice ruled against various<br />

life insurers, rendering certain terms of insurance invalid<br />

in several verdicts during the period covered by this report.<br />

These included terms governing the surrender value,<br />

cancellation fee and the calculation of acquisition costs<br />

applied to new policies from 2002 to 2007. The cancellation<br />

fee clause may also affect tariffs from 2008 onwards.<br />

Private health insurance in <strong>2012</strong><br />

The share of private health insurance in the wider health<br />

insurance market stabilised in <strong>2012</strong> despite difficult market<br />

conditions. According to initial provisional forecasts, private<br />

health insurance achieved growth of 3.4% in premium<br />

income, amounting to € 35.9 billion (34.7 bn). Private health<br />

insurers’ benefits, including settlement expenses, rose by<br />

around 4.8% to € 23.9 billion (22.8 bn).<br />

The new amendments to the law governing financial<br />

services mediation and property include a limit on commission<br />

amounts paid to agents and an extension of the<br />

cancellation liability periods, both of which have been in<br />

force since 1 April <strong>2012</strong>. In addition, the state has been<br />

paying the premiums on behalf of the disadvantaged<br />

directly to the respective private health insurer since this<br />

date. In return, the insurance companies have agreed in<br />

recognition of regulatory admissibility to forego premiums<br />

payable by 31 January <strong>2012</strong> due to the extent of the gap in<br />

statutory cover.<br />

Property-casualty insurance in <strong>2012</strong><br />

Since the economic situation of private households and<br />

businesses continues to improve, property-casualty insurance<br />

recorded a healthy rise of 3.7% in premium income<br />

in <strong>2012</strong> to € 58.7 billion (56.6 bn). Once again, all lines of<br />

business made a contribution. However, this was mainly<br />

due to rises in premium rates and adjustments to clauses<br />

rather than an increase in the number of insured risks.<br />

Motor insurance grew by an impressive 5.1%, although it<br />

still has a way to go before producing a technical profit.<br />

The rates of growth of liability insurance (+ 2.0%), legal<br />

protection insurance (+ 1.5%) and accident insurance<br />

(+ 1.0%) were all below average. Premium income recorded<br />

for transport and aviation insurance was up by 3.5%,<br />

property insurance lines of business rose by 4.3%.<br />

Claims expenditure rose proportionately to the increase in<br />

premiums. On the one hand, damages related to natural<br />

hazards in <strong>2012</strong> were down on the previous year. On the<br />

other, extreme frost in February and a number of other<br />

major damaging events caused a great deal of destruction.<br />

An explosion in a chemical factory has been the largest<br />

single insurance claim in Germany to date. The combined<br />

ratio across the market is expected to remain virtually<br />

unchanged at 98%.

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

19<br />

Management <strong>Report</strong><br />

Business performance<br />

<strong>2012</strong> was a year dominated by challenging economic<br />

conditions and good progress in major projects for <strong>ERGO</strong><br />

Insurance <strong>Group</strong>. The state debt crisis in the Eurozone has<br />

continued, leading to shrinking economies in certain countries,<br />

including some where we are active, such as Greece.<br />

Interest rates fell yet further for government bonds which<br />

have been considered safe by market participants.<br />

In our home market of Germany, we have begun an<br />

extensive reorganisation of our sales forces. We aim to<br />

introduce a uniform advisory procedure, reducing complexity<br />

and therefore cutting costs. This major project is set<br />

to be completed during the course of the next two years.<br />

This will result in savings from as early as 2014; from 2015<br />

these should amount to over € 160 million gross per year.<br />

The project, however, has placed the current year’s result<br />

under considerable strain. In the fourth quarter of <strong>2012</strong>,<br />

we booked the provisions for the restructuring costs which<br />

impacted our net result by an amount of €− 128 million.<br />

We have considerably increased profits in our international<br />

business. Our operating result abroad has more than<br />

doubled, leading to a considerable net result. Our restructuring<br />

measures of the past few years are now yielding<br />

results.<br />

The consolidated result for <strong>ERGO</strong> Insurance <strong>Group</strong><br />

amounted to € 289 million (349 m). We had aimed for<br />

around € 400 million and would have achieved this figure,<br />

but for the one-off costs of restructuring. This is clearly<br />

shown in the stark increase in operating profit, up by 17.9%<br />

to € 951 million (806 m).<br />

We determine figures for long-term business in the<br />

life and health insurance segments according to strict<br />

market-consistent methods. We still do not apply interest<br />

surcharges or liquidity premiums. The market-consistent<br />

embedded value (MCEV) determined in this way, rose to<br />

€ 2.7 billion (0.9 bn). Contributing to this was the fact that<br />

risk premiums recorded on fixed interest-bearing securities,<br />

especially those for government bonds in peripheral Eurozone<br />

countries, had fallen at the end of <strong>2012</strong>. An additional<br />

factor was the first-time inclusion of <strong>ERGO</strong> Direkt Krankenversicherung<br />

in the MCEV calculation. The total embedded<br />

value earnings came to € 1.5 billion (− 3.0 bn). The value of<br />

new business climbed to € 146 million (37 m).<br />

Premium income<br />

<strong>ERGO</strong> Insurance <strong>Group</strong>’s total premium income was 8.4%<br />

lower in the reporting year than the preceding year, at<br />

€ 18.6 billion (€ 20.3 bn). This significant drop is as much<br />

a result of disposals as it is due to organic effects. By the<br />

end of 2011 we had sold our international health insurer to<br />

Munich Health Holding <strong>AG</strong>. We had also sold our Portuguese<br />

subsidiaries by the end of 2011, and in October <strong>2012</strong>, we sold<br />

<strong>ERGO</strong> Daum Direct in South Korea. This divestment explains<br />

6.1% percentage points of the drop. Furthermore, we sold<br />

considerably less single-premium life insurance policies in<br />

Germany and Austria and underwrote a significantly lower<br />

volume of the single-premium MaxiZins product in direct<br />

insurance. This is due to low interest rates and fiscal changes<br />

in Austria. Gross premiums written – in contrast to total<br />

premiums they do not include the savings premiums from<br />

unit-linked life insurance and capitalisation products – was<br />

€ 17.1 billion (€ 18.5 bn), a drop of 7.7%.<br />

<strong>ERGO</strong> Insurance <strong>Group</strong> <strong>2012</strong><br />

€ million<br />

2011<br />

€ million<br />

Change<br />

%<br />

Total premium income 18,562 20,270 − 8.4<br />

Gross premiums written 17,091 18,519 − 7.7<br />

Investment result 5,262 4,116 27.8<br />

Net insurance benefits 1 16,744 16,703 0.2<br />

Net operating expenses 3,512 3,814 − 7.9<br />

Consolidated result 289 349 − 17.2<br />

1 Incl. policyholders’ profit participation

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>20<br />

Business performance<br />

Total premium income <strong>2012</strong><br />

€ million<br />

2011<br />

€ million<br />

Change<br />

%<br />

Life Germany 4,754 4,955 − 4.1<br />

Health 4,932 5,975 − 17.4<br />

Property-casualty Germany 3,138 3,087 1.6<br />

Direct insurance 1,212 1,422 − 14.8<br />

Travel insurance 460 485 − 5.2<br />

International 4,066 4,346 − 6.4<br />

Total premiums 18,562 20,270 − 8.4<br />

For business within Germany, total premium income reached<br />

€ 14.2 billion (€ 14.6 bn) (− 2.3%), while gross premiums<br />

written in accordance with IFRS were € 13.2 billion (€ 13.3 bn)<br />

(− 0.9%). For international business, total premium income<br />

stood at € 4.3 billion (€ 5.7 bn) (− 24.1%), while gross premiums<br />

written in accordance with IFRS were € 3.9 billion (5.2 bn)<br />

(− 24.9%).<br />

The German life insurance business saw gross premiums<br />

written fall by 5.6% to € 3.9 billion (€ 4.2 bn). Both this and<br />

the 4.1% drop in total premiums can be largely traced<br />

back to less single-premium business. Due to the low rate<br />

of interest, we are very cautious about the conditions we<br />

offer our customers. Overall, single-premium business was<br />

down by 11.5% to € 939 million (1,061 m). The continuing<br />

economic uncertainty and the drop in the technical interest<br />

rate to 1.75% as of 1 January <strong>2012</strong> was also reflected<br />

in new business based on regular premiums: reaching only<br />

€ 307 million (€ 314 m), it was 2.0% down on last year’s<br />

figures. When measured in terms of APE (annual premium<br />

equivalent, i. e. regular premiums plus a tenth of single<br />

premiums), new business fell by 4.4%.<br />

As a result of the aforementioned divestment of international<br />

health subsidiaries, gross premiums written in the<br />

health segment were 17.4% lower. The remaining domestic<br />

business grew slightly by 0.5% to € 4.93 billion (€ 4.91 bn).<br />

Premium rate adjustments in <strong>2012</strong> were very low – something<br />

our customers were very pleased about. At € 176 million<br />

(225 m), the new business was significantly lower<br />

than last year’s figures (− 21.6%). In 2011, the abolition<br />

of the three-year waiting period when taking out health<br />

insurance has had a positive impact on the number of<br />

new intakes in comprehensive health insurance at the<br />

beginning of the year.<br />

In Germany, gross premiums written for property- casualty<br />

insurance increased by 1.6%. At 6.0%, commercial/<br />

industrial insurance business once again recorded the<br />

highest rise. In the area of private property insurance,<br />

we registered a 1.9% increase in premiums and a 0.4%<br />

increase in motor insurance. Despite a slight decrease of<br />

1.2% in the number of insured vehicles, the profitability of<br />

the portfolio has improved overall. There were also slight<br />

decreases in premium income in the areas of legal protection<br />

insurance (− 0.4%) and in personal accident insurance<br />

(− 1.6%). The latter was primarily due to lower premiums<br />

in personal accident insurance with premium refunds<br />

(ROP). We discontinued this product in late <strong>2012</strong> because<br />

we wanted our accident insurance products to focus more<br />

on ensuring quality of life with their extensive assistance<br />

services. This is no longer possible for ROP products as a<br />

result of the low interest-rate income currently achievable<br />

on investments.<br />

Total premium income for the direct insurance business was<br />

down by 14.8%. This is due to the MaxiZins capitalisation<br />

product: to reflect the low interest rates on the capital<br />

markets, we also lowered interest, which alone resulted in a<br />

decrease in premium income of € 242 million as compared to<br />

the previous year. By contrast, gross premiums written were<br />

up by 3.5% to € 957 million (€ 924 m). Total premium income<br />

from life insurance fell by 25.9%. The only health insurance<br />

we offer as direct insurance is supplementary, an area<br />

which registered solid growth of 15.7%, primarily as a result<br />

of premium rate adjustments. Property-casualty insurance<br />

increased by 1.0%.<br />

Gross premiums written for travel insurance were 5.2% less<br />

than the previous year, also because unprofitable contracts<br />

were not extended. In Germany, a decline of 1.2% was<br />

recorded, while international business fell by 8.1%.<br />

The fact that total premium income in the International<br />

business was lower than the previous year (− 6.4%) is due<br />

to the effects described above, namely, sale of daughter

<strong>ERGO</strong> Insurance <strong>Group</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Management <strong>Report</strong>21<br />

Business performance<br />

Investment result <strong>2012</strong><br />

€ million<br />

2011<br />

€ million<br />

Change<br />

%<br />

Regular income 4,813 5,042 − 4.5<br />

Write-ups/write-downs 109 − 1,041 110.4<br />

Realised gains/losses 35 708 − 95.1<br />

Other income/expenses 305 − 594 151.3<br />

Total 5,262 4,116 27.8<br />

companies, lower single-premium business and strictly<br />

profit-oriented underwriting. Total premium income was<br />

therefore 8.5% down on the previous year for life insurance<br />

and 4.8% lower for property-casualty insurance.<br />

Benefits and costs<br />

Benefits for our clients in the reporting year amounted<br />