Excerpts from the depositions - Wall Street Journal

Excerpts from the depositions - Wall Street Journal

Excerpts from the depositions - Wall Street Journal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Case 2:11-cv-10549-MRP-MAN Document 254-1 Filed 03/28/13 Page 16 of 35 Page ID<br />

#:16605<br />

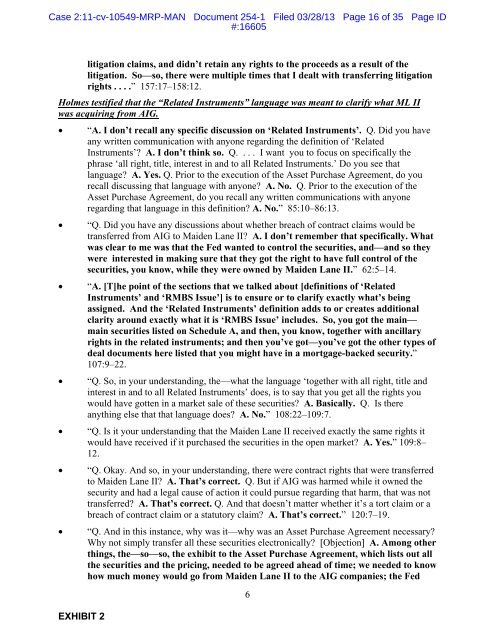

litigation claims, and didn’t retain any rights to <strong>the</strong> proceeds as a result of <strong>the</strong><br />

litigation. So—so, <strong>the</strong>re were multiple times that I dealt with transferring litigation<br />

rights . . . .” 157:17–158:12.<br />

Holmes testified that <strong>the</strong> “Related Instruments” language was meant to clarify what ML II<br />

was acquiring <strong>from</strong> AIG.<br />

• “A. I don’t recall any specific discussion on ‘Related Instruments’. Q. Did you have<br />

any written communication with anyone regarding <strong>the</strong> definition of ‘Related<br />

Instruments’? A. I don’t think so. Q. . . . I want you to focus on specifically <strong>the</strong><br />

phrase ‘all right, title, interest in and to all Related Instruments.’ Do you see that<br />

language? A. Yes. Q. Prior to <strong>the</strong> execution of <strong>the</strong> Asset Purchase Agreement, do you<br />

recall discussing that language with anyone? A. No. Q. Prior to <strong>the</strong> execution of <strong>the</strong><br />

Asset Purchase Agreement, do you recall any written communications with anyone<br />

regarding that language in this definition? A. No.” 85:10–86:13.<br />

• “Q. Did you have any discussions about whe<strong>the</strong>r breach of contract claims would be<br />

transferred <strong>from</strong> AIG to Maiden Lane II? A. I don’t remember that specifically. What<br />

was clear to me was that <strong>the</strong> Fed wanted to control <strong>the</strong> securities, and—and so <strong>the</strong>y<br />

were interested in making sure that <strong>the</strong>y got <strong>the</strong> right to have full control of <strong>the</strong><br />

securities, you know, while <strong>the</strong>y were owned by Maiden Lane II.” 62:5–14.<br />

• “A. [T]he point of <strong>the</strong> sections that we talked about [definitions of ‘Related<br />

Instruments’ and ‘RMBS Issue’] is to ensure or to clarify exactly what’s being<br />

assigned. And <strong>the</strong> ‘Related Instruments’ definition adds to or creates additional<br />

clarity around exactly what it is ‘RMBS Issue’ includes. So, you got <strong>the</strong> main—<br />

main securities listed on Schedule A, and <strong>the</strong>n, you know, toge<strong>the</strong>r with ancillary<br />

rights in <strong>the</strong> related instruments; and <strong>the</strong>n you’ve got—you’ve got <strong>the</strong> o<strong>the</strong>r types of<br />

deal documents here listed that you might have in a mortgage-backed security.”<br />

107:9–22.<br />

• “Q. So, in your understanding, <strong>the</strong>—what <strong>the</strong> language ‘toge<strong>the</strong>r with all right, title and<br />

interest in and to all Related Instruments’ does, is to say that you get all <strong>the</strong> rights you<br />

would have gotten in a market sale of <strong>the</strong>se securities? A. Basically. Q. Is <strong>the</strong>re<br />

anything else that that language does? A. No.” 108:22–109:7.<br />

• “Q. Is it your understanding that <strong>the</strong> Maiden Lane II received exactly <strong>the</strong> same rights it<br />

would have received if it purchased <strong>the</strong> securities in <strong>the</strong> open market? A. Yes.” 109:8–<br />

12.<br />

• “Q. Okay. And so, in your understanding, <strong>the</strong>re were contract rights that were transferred<br />

to Maiden Lane II? A. That’s correct. Q. But if AIG was harmed while it owned <strong>the</strong><br />

security and had a legal cause of action it could pursue regarding that harm, that was not<br />

transferred? A. That’s correct. Q. And that doesn’t matter whe<strong>the</strong>r it’s a tort claim or a<br />

breach of contract claim or a statutory claim? A. That’s correct.” 120:7–19.<br />

• “Q. And in this instance, why was it—why was an Asset Purchase Agreement necessary?<br />

Why not simply transfer all <strong>the</strong>se securities electronically? [Objection] A. Among o<strong>the</strong>r<br />

things, <strong>the</strong>—so—so, <strong>the</strong> exhibit to <strong>the</strong> Asset Purchase Agreement, which lists out all<br />

<strong>the</strong> securities and <strong>the</strong> pricing, needed to be agreed ahead of time; we needed to know<br />

how much money would go <strong>from</strong> Maiden Lane II to <strong>the</strong> AIG companies; <strong>the</strong> Fed<br />

EXHIBIT 2<br />

6