How business, doctors and journalists prey on your food anxieties I

How business, doctors and journalists prey on your food anxieties I

How business, doctors and journalists prey on your food anxieties I

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATISTICAL SPOTLIGHT<br />

The ground floor<br />

Real estate investmenttrusts haven't participated<br />

in the market's rally, but some look like good buys .<br />

By Eric S . Hardy<br />

Priced to sell<br />

6VF -% r DO short-sellers <str<strong>on</strong>g>and</str<strong>on</strong>g> holders of<br />

real estate investment trusts have in<br />

comm<strong>on</strong>? Ther haven't benefited<br />

from the bull market .<br />

The s&? 600 sh<strong>on</strong>s a 12-m<strong>on</strong>th<br />

return, including reinvested dividends,<br />

of 27% through mid-Julr .<br />

An index of 220 IrtTS compiled by<br />

Nareit, a Washingt<strong>on</strong>, D .C .-based<br />

trade associati<strong>on</strong>, has around a 6%n<br />

return . This slump is particularly frustrating<br />

for tt21T holders because this<br />

interest-rsste-sensitiec sector has been<br />

knos+n to prosper «hen interest rares<br />

are Calling .<br />

What ails the market? Lack ofinvestor<br />

c<strong>on</strong>fidence is <strong>on</strong>e problem "The<br />

most recognized ne me in our industn'<br />

[Rockefeller Center Properties] went<br />

bankrupt . That really hurt," states<br />

Nareit President Lkfark Decker . But<br />

REITS are not without their supporters<br />

: "[nvesrors are either underestimating<br />

the growth potentiai [of<br />

~irs] or overestimating the risks,"<br />

says real estate arralvst Kevin Comer at<br />

Bankers Trust in New York C:n .<br />

In evahtating real estate trusts . net<br />

income counts less than any of various<br />

measures of cash generati<strong>on</strong> . One important<br />

measure is "fimds from ooerati<strong>on</strong>s,"<br />

which is defined as net income<br />

plus depreciati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> amortizati<strong>on</strong>,<br />

excluding gains (or lossesj ftom<br />

debt restructuring <str<strong>on</strong>g>and</str<strong>on</strong>g> sales of properties<br />

. ?nother measure is shown in<br />

the table as "cash flow," here defined<br />

to mean net income plus depreciati<strong>on</strong><br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> amortizati<strong>on</strong>, less preferred dividends<br />

. Either ~raN, vou are looking at<br />

a measure of profits before depreciati<strong>on</strong>,<br />

a charge that goes <strong>on</strong> the books<br />

but doesn't require the o%cner of the<br />

propern, to write out a check .<br />

As a group, RElrs are trading at ten<br />

times the funds from operati<strong>on</strong>s expeered<br />

br anahysts for 1995 .<br />

.U17s pay high disidends because<br />

they're required to distribute almost<br />

all their income to shareholders . This<br />

avoids double taxae<strong>on</strong>, but it also has<br />

a d<strong>on</strong>nside : Unlike most corporati<strong>on</strong>s,<br />

R&trs can't build up retained<br />

earnings . So you can't count <strong>on</strong> these<br />

stocks to hold their o«n against the<br />

overall market, although the best of<br />

them-in particular, New Plan Realn-have<br />

d<strong>on</strong>e so in the past .<br />

The table below lists ten 1tEi'rs with<br />

a%arving mix of real estate assets .<br />

Some have portfolios focused <strong>on</strong><br />

properties like malls, strip shopping<br />

cenrers <str<strong>on</strong>g>and</str<strong>on</strong>g> office buildings . Some<br />

ox~n assets that are a bit less mainstream-such<br />

as public storage N .arehouses-atd<br />

s<strong>on</strong>-te list aoartment<br />

buiidings am<strong>on</strong>g their holdings .<br />

The RPJTS listed in our table have<br />

veids of benveen 5% <str<strong>on</strong>g>and</str<strong>on</strong>g> 10% <str<strong>on</strong>g>and</str<strong>on</strong>g> sell<br />

for less than 19 times latest fiscal vear<br />

funds from operati<strong>on</strong>s . All these<br />

stocks .shoatotal debt that is no<br />

higher than 75%ofequity, when equity<br />

is measured by stock market value .<br />

Bruce Garris<strong>on</strong>, who follows RE1?s<br />

for PaineWebber in New Yorlc, likes<br />

Bradley Real Estate, which is accumu-<br />

!ating a portfolio of shopping malls in<br />

the,sSidwest<str<strong>on</strong>g>and</str<strong>on</strong>g>tiemEngl<str<strong>on</strong>g>and</str<strong>on</strong>g> . Bradev<br />

vields 8% <str<strong>on</strong>g>and</str<strong>on</strong>g> sells for nine times<br />

1995 estimated funds from operati<strong>on</strong>s<br />

. Garris<strong>on</strong> also likes New Plan<br />

Rcalty Trust, «itich has raised its dividend<br />

for 64 c<strong>on</strong>secuti%e quarters <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

nearly tripled its book % alue over the<br />

past decade. ~<br />

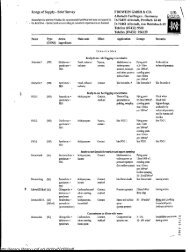

i REIHpcmaryassets P r mary R ecent °rice divided b y<br />

Yield Debt as % Revenues'<br />

regi<strong>on</strong> price book<br />

value<br />

earnings fundsfrom<br />

operati<strong>on</strong>s<br />

cash<br />

flow<br />

of market<br />

value<br />

($mip<br />

.<br />

Berkshire Realty/s~tppping centers ; apadmeots SoutheasPWest 9% 6,9 23 .5 9E 3. : 9 .4% 74% $72<br />

Bradley Real Estate/shaap'mg aanters 411dwest ;5 . 1 .4 15,4 i0 .5 9.3 8 .4 51 34<br />

Duke Realty Investmentallndust^al & pftice parks Midwest 28 13 ls .l 13 .6 :IA 6-7 45 108<br />

FranchiseFinanceofAmerica/rastaurans nati<strong>on</strong>wide 21% 1 .7 32,4 ! 15 7.8 8.4 Il 97<br />

JP Realry/shooolcg oenter ; malls West 2011s 2.1 !7 .8 97 9.2 7 .9 39 54<br />

zsz<br />

Merry L<str<strong>on</strong>g>and</str<strong>on</strong>g> & Investment/apartme bulldings S)utheast 20% 1 .5 's86 124 11.3 68 26 !16 O<br />

MGIProperties/warehousavaprtrcents East 1416 0 .9 105 9 .2 7 .fi 65 43 43 J."<br />

New Plan Realty/shecpirg centers, aeadments Eas; 21Y. 2 .0 18 .6 184 15,4 6 .3 :1 i23 ~<br />

StorageEquitles/tempcrarystmagefacPilies nat :<strong>on</strong>wce IB'h 1 .3 15 .9 112 7 .8 5 .3 14 157 ~<br />

Washingt<strong>on</strong> REIT/ptfice hwltlings : anartments R'asaingt<strong>on</strong>.9.i. 14°/s 2 .6 17,3 15.8 14 .7 70 8 47 ~i<br />

'Lares:l2 m<strong>on</strong>tFs . Suumes . Mataet Gulae via Gnesource Intormatmn Serc,ces : .van<strong>on</strong>al Assx ;atmn of Real Estere rnvestment?msts INarertJ .<br />

These REITs pay decent yields <str<strong>on</strong>g>and</str<strong>on</strong>g> are r eas<strong>on</strong>ably priced relative to the cash gen erated by th eir propert ies . t .:.<br />

Forbes . August ! 4 . 1995 185<br />

http://legacy.library.ucsf.edu/tid/agf97d00/pdf