EAST CENTRAL RAILWAY - Indian Railways

EAST CENTRAL RAILWAY - Indian Railways

EAST CENTRAL RAILWAY - Indian Railways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

or to the employment under the contractor has been obtained by the tenderer the Engineer or an<br />

Officer as the case may be from the President of India or any Officer duly authorised by him in<br />

this behalf-shall clearly stated in writing at the time of submission of the tender. Tenders without<br />

the information’s above referred tender a statement to the effect that no such retired Engineer or<br />

retired Gazzetted Officer is also associated with the tenders as the case may be/shall be rejected.<br />

34. Sales Tax where leviable if intended to be claimed from the purchasers shall be distinctly shown<br />

along with the price quoted in which case the Rly. administration accepts the liability for payment<br />

of Sales Tax provided however such tax is leviable under the exist laws on the supply of the items<br />

included in this contract by the contractors to the Rly. administration. The Contractors must<br />

satisfied the Railway administration in this matter by producing the Sales<br />

Tax Registration certificate to indicate that they are registered deal for the purpose of assessment<br />

of Sales Tax. The actual payment of Sale Tax will be made as leviable under the rules for such<br />

supply. The contractors will be required to transmit the actual payment so received in respect of<br />

Sales tax relating to this contract as leviable under the existing rules to the appropriate authority<br />

of the State Govt. concerned and furnish a certificate to the Rly. Administration, to this effect. It is<br />

distinctly under-steed that not with standing any thing contained in the tender documents and or<br />

the agreement the Railway Admn. shall not be bound to final up the contract and refund security<br />

deposit even if the same is or has become otherwise refundable and to pay up or settle his dues in<br />

other respect until the contractors have furnished to the Railway Administration a certificate<br />

aforesaid, where it is not clearly shows that the Sales Tax is to be claimed from the Railway. No<br />

Claim for Sales Tax will be admitted in any later stage and on any ground whatsoever.<br />

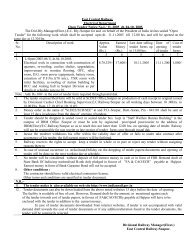

35. The successful tenderer must deposit a sum towards Security Deposit at the rates mentioned<br />

below :-<br />

(i) For contracts upto Rs.1 lakh 10% of the value of the contract.<br />

(ii)<br />

(iii)<br />

For contracts costing more than Rs.1<br />

lakh and upto Rs.2.00 lakhs.<br />

For contracts costing more than Rs.2<br />

lakhs and upto Rs.2 Crores.<br />

10% of the first Rs.1 lakhs and 7 ½ % of the<br />

balance.<br />

10% of the first 1 lakhs, 7 ½ % for the next<br />

Rs.1 lakhs and 5% for the balance subject to<br />

maximum of rupees three lakhs.<br />

(iv) For contracts above Rs.2 Crores. 5% of the contract value. The amount over<br />

and above Rs.3 lakhs to be recovered from the<br />

progressive bills of the contractors % 10% till<br />

it reaches 5% of the contract value.<br />

36. The security deposit may be collected by deducting from the on account bills of the Contractor at<br />

the rates mentioned above. For this purpose, a deduction of 10% shall be made from each on<br />

account bill until the sum so deducted plus the amount of earnest money already deposited<br />

(subsequently converted into security deposit), makes upto the total security deposit as per the<br />

above scale and shall be retained by the Railway free of interest for due performance and<br />

observance of the terms and conditions of this contract. This does not, however, preclude the<br />

contractor from depositing the security deposit in cash or in other accepted forms of payment.<br />

37. The Security deposit shall, however, be refunded to the Contractor only on satisfactory<br />

compliance of condition No. 51(2) at Page-9 of the General conditions of contract and standard<br />

specifications (followed by Work Hand Book Part 1 & 2 GCC Feb, 2001 with upto date<br />

amendment thereto), on which the schedule of rates is based.