US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

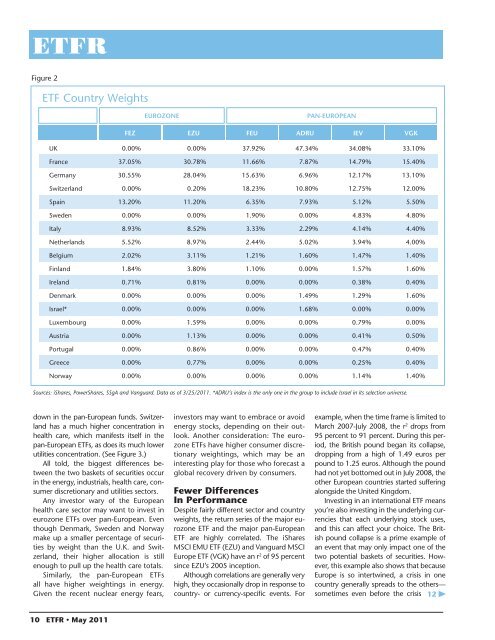

Figure 2<br />

ETF Country Weights<br />

EUROZONE<br />

PAN-EUROPEAN<br />

FEZ EZU FEU ADRU IEV VGK<br />

UK 0.00% 0.00% 37.92% 47.34% 34.08% 33.10%<br />

France 37.05% 30.78% 11.66% 7.87% 14.79% 15.40%<br />

Germany 30.55% 28.04% 15.63% 6.96% 12.17% 13.10%<br />

Switzerl<strong>and</strong> 0.00% 0.20% 18.23% 10.80% 12.75% 12.00%<br />

Spain 13.20% 11.20% 6.35% 7.93% 5.12% 5.50%<br />

Sweden 0.00% 0.00% 1.90% 0.00% 4.83% 4.80%<br />

Italy 8.93% 8.52% 3.33% 2.29% 4.14% 4.40%<br />

Netherl<strong>and</strong>s 5.52% 8.97% 2.44% 5.02% 3.94% 4.00%<br />

Belgium 2.02% 3.11% 1.21% 1.60% 1.47% 1.40%<br />

Finl<strong>and</strong> 1.84% 3.80% 1.10% 0.00% 1.57% 1.60%<br />

Irel<strong>and</strong> 0.71% 0.81% 0.00% 0.00% 0.38% 0.40%<br />

Denmark 0.00% 0.00% 0.00% 1.49% 1.29% 1.60%<br />

Israel* 0.00% 0.00% 0.00% 1.68% 0.00% 0.00%<br />

Luxembourg 0.00% 1.59% 0.00% 0.00% 0.79% 0.00%<br />

Austria 0.00% 1.13% 0.00% 0.00% 0.41% 0.50%<br />

Portugal 0.00% 0.86% 0.00% 0.00% 0.47% 0.40%<br />

Greece 0.00% 0.77% 0.00% 0.00% 0.25% 0.40%<br />

Norway 0.00% 0.00% 0.00% 0.00% 1.14% 1.40%<br />

Sources: iShares, PowerShares, SSgA <strong>and</strong> Vanguard. Data as of 3/25/2011. *ADRU’s index is the only one in the group <strong>to</strong> include Israel in its selection universe.<br />

down in the pan-European funds. Switzerl<strong>and</strong><br />

has a much higher concentration in<br />

health care, which manifests itself in the<br />

pan-European <strong>ETFs</strong>, as does its much lower<br />

utilities concentration. (See Figure 3.)<br />

All <strong>to</strong>ld, the biggest differences between<br />

the two baskets of securities occur<br />

in the energy, industrials, health care, consumer<br />

discretionary <strong>and</strong> utilities sec<strong>to</strong>rs.<br />

Any inves<strong>to</strong>r wary of the European<br />

health care sec<strong>to</strong>r may want <strong>to</strong> invest in<br />

eurozone <strong>ETFs</strong> over pan-European. Even<br />

though Denmark, Sweden <strong>and</strong> Norway<br />

make up a smaller percentage of securities<br />

<strong>by</strong> weight than the U.K. <strong>and</strong> Switzerl<strong>and</strong>,<br />

their higher allocation is still<br />

enough <strong>to</strong> pull up the health care <strong>to</strong>tals.<br />

Similarly, the pan-European <strong>ETFs</strong><br />

all have higher weightings in energy.<br />

Given the recent nuclear energy fears,<br />

inves<strong>to</strong>rs may want <strong>to</strong> embrace or avoid<br />

energy s<strong>to</strong>cks, depending on their outlook.<br />

Another consideration: The eurozone<br />

<strong>ETFs</strong> have higher consumer discretionary<br />

weightings, which may be an<br />

interesting play for those who forecast a<br />

global recovery driven <strong>by</strong> consumers.<br />

Fewer Differences<br />

In Performance<br />

Despite fairly different sec<strong>to</strong>r <strong>and</strong> country<br />

weights, the return series of the major eurozone<br />

ETF <strong>and</strong> the major pan-European<br />

ETF are highly correlated. The iShares<br />

MSCI EMU ETF (EZU) <strong>and</strong> Vanguard MSCI<br />

Europe ETF (VGK) have an r 2 of 95 percent<br />

since EZU’s 2005 inception.<br />

Although correlations are generally very<br />

high, they occasionally drop in response <strong>to</strong><br />

country- or currency-specific events. For<br />

example, when the time frame is limited <strong>to</strong><br />

March 2007-July 2008, the r 2 drops from<br />

95 percent <strong>to</strong> 91 percent. During this period,<br />

the British pound began its collapse,<br />

dropping from a high of 1.49 euros per<br />

pound <strong>to</strong> 1.25 euros. Although the pound<br />

had not yet bot<strong>to</strong>med out in July 2008, the<br />

other European countries started suffering<br />

alongside the United Kingdom.<br />

Investing in an international ETF means<br />

you’re also investing in the underlying currencies<br />

that each underlying s<strong>to</strong>ck uses,<br />

<strong>and</strong> this can affect your choice. The British<br />

pound collapse is a prime example of<br />

an event that may only impact one of the<br />

two potential baskets of securities. However,<br />

this example also shows that because<br />

Europe is so intertwined, a crisis in one<br />

country generally spreads <strong>to</strong> the others—<br />

sometimes even before the crisis 12<br />

10 ETFR • May 2011