EMOBILE: the mobile broadband revolutionist - Huawei

EMOBILE: the mobile broadband revolutionist - Huawei

EMOBILE: the mobile broadband revolutionist - Huawei

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

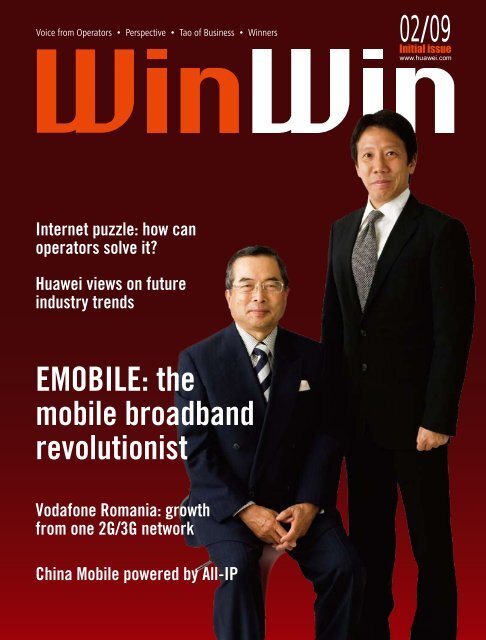

Voice from Operators<br />

Perspective<br />

Tao of Business<br />

Winners<br />

02/09<br />

Initial issue<br />

Internet puzzle: how can<br />

operators solve it?<br />

<strong>Huawei</strong> views on future<br />

industry trends<br />

<strong>EMOBILE</strong>: <strong>the</strong><br />

<strong>mobile</strong> <strong>broadband</strong><br />

<strong>revolutionist</strong><br />

Vodafone Romania: growth<br />

from one 2G/3G network<br />

China Mobile powered by All-IP

At <strong>Huawei</strong>, we know that simple ideas can lead to big things. In much <strong>the</strong><br />

same way a tiny acorn can grow into an oak tree, we strive to realize your<br />

full potential through innovative products and solutions.<br />

We devote 43% of our entire staff of over 82,000 people to R&D, which is<br />

just one of <strong>the</strong> reasons why <strong>the</strong> world’s top telecom network operators<br />

choose us as <strong>the</strong>ir partner.<br />

We are committed to looking after your needs every step of <strong>the</strong> way. B y<br />

putting you first, we grow your business to be as lasting and enduring as <strong>the</strong><br />

oak tree itself. That’s why at <strong>Huawei</strong>, we help you realize your potential from<br />

<strong>the</strong> simplest of ideas, to ultimate success.

02/09<br />

Initial issue<br />

Editorial<br />

Sponsor<br />

<strong>Huawei</strong> Technologies Co., Ltd.<br />

Publisher<br />

<strong>Huawei</strong> COMMUNICATE Editorial Board<br />

Consultants<br />

Hu Houkun, Xu Zhijun, Xu Wenwei<br />

Tao Jingwen, Huang Chaowen, Yu Xiangping<br />

Editor-in-Chief<br />

Gao Xianrui (sally@huawei.com)<br />

Editors<br />

Xue Hua, Pan Tao, Julia Yao<br />

Xu Ping, Xu Peng, Li Xuefeng<br />

Joy Zhou, Chen Yuhong, Liu Zhonglin<br />

Michael Huang, Joyce Fan, Wang Hongjun<br />

Mike Bossick, Gary Maidment<br />

Art Editor<br />

Zhou Shumin<br />

Contributors<br />

Zhu Yonggang, Hou Jinlong, Zhang Xinyu<br />

Lu Xingang, Xiong Wei, Xie Jingping<br />

Yan Yun, Zhang Qin, Mei Zheng<br />

Xu Yan, Cao Jianhui, Wu Yanning<br />

Sato Masako, Yang Xiaoxu, Robert Fox<br />

Tel: +86 755 28780808<br />

Fax: +86 755 28356180<br />

Address: A10, <strong>Huawei</strong> Industrial Base,<br />

Bantian, Longgang, Shenzhen,<br />

China 518129<br />

E-mail: HWtech@huawei.com<br />

Publication registration No.:<br />

Yue B No.10148<br />

The information contained in this document is for<br />

reference purpose only, and is subject to change<br />

or withdrawal according to specific customer<br />

requirements and conditions.<br />

Copyright © 2009 <strong>Huawei</strong> Technologies Co., Ltd.<br />

All Rights Reserved.<br />

No part of this issue may be reproduced or<br />

transmitted in any form or by any means without<br />

prior written consent of <strong>Huawei</strong> Technologies Co., Ltd.<br />

Winning <strong>the</strong> game<br />

Mushrooming growth, rushing revenue streams and skyrocketing share<br />

prices are <strong>the</strong> goals of most telecom companies. In pursuit of <strong>the</strong>se ideals,<br />

a close eye should be kept on development and market trends, <strong>the</strong>n select<br />

one or more successful enterprises in <strong>the</strong> industry as a benchmark, drawing<br />

upon <strong>the</strong> strength of o<strong>the</strong>rs to avoid costly and unnecessary mistakes.<br />

In <strong>the</strong> past decade, <strong>the</strong> telecom industry has experienced dynamic<br />

growth and rapid development. In spite of ups and downs, transformation<br />

has continued unabated. New concepts, technologies, and models<br />

emerge in an endless stream driving <strong>the</strong> industry into new realms of<br />

communication. In 2009, against <strong>the</strong> backdrop of a global economic<br />

downturn, <strong>the</strong> telecom industry needs to adapt to meet new challenges<br />

and seize all opportunities to create even broader development space.<br />

As a comprehensive telecom equipment and solution provider,<br />

<strong>Huawei</strong> pilots <strong>the</strong> same course as <strong>the</strong> operators. Development trends in<br />

communications technology, including full-service operations, <strong>mobile</strong>,<br />

<strong>broadband</strong>, and <strong>the</strong> Internet, expansion of communications networks<br />

around <strong>the</strong> world, increasing market competition and technology upgrades<br />

create tremendous pressure and numerous challenges for all of us in <strong>the</strong><br />

industry.<br />

There are many questions such as: What is <strong>the</strong> best way to ensure<br />

a smooth upgrade of current networks while protecting investment?<br />

How do you improve ARPU while reducing OPEX and CAPEX? How<br />

can materials, land, and man hours be saved while fulfilling <strong>the</strong> social<br />

responsibility of environmental protection, energy conservation and<br />

emissions reduction? How does a company enlarge <strong>the</strong> scale effect to cope<br />

with fierce competition in <strong>the</strong> global communications market? …<br />

To ring in <strong>the</strong> spring of 2009, we introduced this new publication, with<br />

a keen focus on creative solutions for dealing with <strong>the</strong> myriad of challenges<br />

in <strong>the</strong> current telecom operations market. Successful players in <strong>the</strong> global<br />

telecom market are invited to share <strong>the</strong>ir thoughts, reflections, and<br />

experiences in strategic conception, market operations, and technological<br />

choices. In <strong>the</strong> columns -Tao of Business and Perspective, senior industry<br />

experts are invited to elaborate on industry development trends and<br />

evolution. By probing a host of Winners around <strong>the</strong> world, we will share<br />

with you <strong>the</strong>ir wisdom, experience, and vision.<br />

We believe today’s rewarding practice promises to give you success<br />

recipes for <strong>the</strong> future.<br />

For electronic version and subscription,<br />

please visit www.huawei.com<br />

Kevin Tao<br />

President of <strong>Huawei</strong> Global<br />

Technical Sales Dept.

Voice from Operators Perspective Tao of Business Winners<br />

02/09<br />

Initial issue<br />

Internet puzzle: how can<br />

operators solve it?<br />

<strong>Huawei</strong> views on future<br />

industry trends<br />

<strong>EMOBILE</strong>: <strong>the</strong><br />

<strong>mobile</strong> <strong>broadband</strong><br />

<strong>revolutionist</strong><br />

Vodafone Romania: growth<br />

from one 2G/3G network<br />

China Mobile powered by All-IP<br />

02/09<br />

Initial issue<br />

WHAT’S<br />

INSIDE<br />

Voice from Operators<br />

01<br />

Bharti Airtel: leading <strong>mobile</strong><br />

revolution through innovation<br />

Bharti Airtel is on a journey of<br />

excellence through innovation. This<br />

journey definitely has no destination.<br />

O<strong>the</strong>r than that Bharti Airtel will<br />

continue to be a catalyst to India’s<br />

economy and an engine for <strong>the</strong><br />

economic growth. –Manoj Kohli,<br />

CEO of Bharti Airtel<br />

07<br />

<strong>EMOBILE</strong>: <strong>the</strong> <strong>mobile</strong> <strong>broadband</strong><br />

<strong>revolutionist</strong><br />

<strong>EMOBILE</strong> is Japan’s newest and<br />

fastest growing <strong>mobile</strong> operator. In<br />

less than two years, it has already<br />

carved out a strong niche in <strong>mobile</strong><br />

<strong>broadband</strong>.What are its unique<br />

business model and future ambitions?<br />

Dr. Sachio Semmoto,<strong>the</strong> founder,<br />

Chairman and CEO, will tell us.<br />

Perspective<br />

11<br />

<strong>Huawei</strong> views on future industry<br />

trends

Tao of Business<br />

25<br />

AIS keeps Thailand smiling<br />

15<br />

Internet puzzle: how can<br />

operators solve it?<br />

Kevin Lee from In-Stat:<br />

Operators are in quite a<br />

predicament with value-added<br />

Internet services. But <strong>the</strong>y are<br />

too big and slow on <strong>the</strong> uptake,<br />

not able to move as quickly as<br />

<strong>the</strong> small companies. How can<br />

operators solve <strong>the</strong> puzzle?<br />

28<br />

31<br />

PCCW builds a CDMA<br />

<strong>broadband</strong> bridge<br />

Reliance: growth has no limit<br />

35<br />

Orange dreams come true<br />

18<br />

Winners<br />

21<br />

Inspiration from<br />

Internet business models<br />

Internet reinforces its leading<br />

position with a growing<br />

penetration rate and fast-increasing<br />

user base. Can telecom operators<br />

transplant <strong>the</strong> Internet-related<br />

technologies and successful<br />

business models, so as to find a<br />

new profit stream?<br />

Optus: opening up <strong>the</strong> outback<br />

39<br />

42<br />

45<br />

China Mobile powered<br />

by All-IP<br />

MegaFon transforms and<br />

prepares for 3G<br />

Vodafone Romania: growth<br />

from one 2G/3G network<br />

In April 2008, Vodafone Romania heaved a sigh<br />

of relief: They no longer had to deal with <strong>the</strong><br />

maintenance of independent and complicated 2G<br />

and 3G networks.

VOICE<br />

FROM OPERATORS<br />

Bharti Airtel<br />

leading <strong>mobile</strong> revolution<br />

through innovation<br />

“What is most innovative about Bharti Airtel in my opinion is <strong>the</strong>ir business model and how <strong>the</strong>y<br />

construct <strong>the</strong>ir company. It’s quite different from <strong>the</strong> rest of our industry,” recommended by Craig<br />

Ehrlich, former Chairman of GSMA. At GSMA Asian Congress in November 2008, Mr. Manoj Kohli,<br />

President and CEO of Bharti Airtel delivered a keynote speech <strong>the</strong>med Leading Mobile Revolution<br />

through Innovation, and shared with <strong>the</strong> industry peers <strong>the</strong>ir key to success.<br />

By Manoj Kohli, CEO of Bharti Airtel<br />

Seizing <strong>the</strong> huge potential<br />

India has <strong>the</strong> second largest population in <strong>the</strong> world.<br />

In a couple of decades, India will probably surpass<br />

China in population. The GDP growth rate, which<br />

was around 9% in India has marginally come down<br />

to about 7%. This is actually a sustainable growth rate,<br />

given <strong>the</strong> current global financial impact of today. The<br />

GDP of India is about USD1 trillion and grows at a rate<br />

of about 8% a year. In six years, we can double <strong>the</strong> GDP<br />

to USD2 trillion .<br />

The India telecom sector will be a catalyst to <strong>the</strong><br />

growing economy and continue to show healthy growth<br />

both in customers and traffic at a very speedy rate.<br />

Inflation has fortunately come down to 6% from a high of<br />

over 12%, meaning that <strong>the</strong>re is more and more disposable<br />

income coming to <strong>the</strong> telecom, media, and Internet<br />

services from o<strong>the</strong>r sectors. Luckily for Bharti Airtel, a<br />

zero-debt company, financing is not a problem. We can<br />

finance <strong>the</strong> growth and lead future growth in a very robust<br />

way.<br />

The <strong>mobile</strong> penetration is quite low at around 27%,<br />

with over 346 million <strong>mobile</strong> subscribers as of <strong>the</strong> end of<br />

December 2008, among <strong>the</strong>m over 84 million are Airtel<br />

(wireless) brand users. Unfortunately, <strong>the</strong> <strong>broadband</strong><br />

penetration is as low as 0.42% with over 5.3 million users.<br />

The good thing is that now <strong>the</strong> government is promoting<br />

<strong>broadband</strong>, targeting to reach 20 million <strong>broadband</strong><br />

subscribers by 2010. The <strong>broadband</strong> revolution is<br />

following <strong>the</strong> <strong>mobile</strong> revolution and <strong>the</strong> Indian economy.<br />

Clearly, India has deep domestic demand and fantastic<br />

potential for growth in <strong>the</strong> next few years.<br />

Key drivers of telecom growth<br />

Based on <strong>the</strong> prediction for <strong>the</strong> next five years for<br />

1<br />

Win-Win / FEB 2009

Bharti Airtel is on a<br />

journey of excellence through<br />

innovation. This journey<br />

definitely has no destination.<br />

O<strong>the</strong>r than that Bharti Airtel<br />

will continue to be a<br />

catalyst to India’s economy<br />

and an engine for <strong>the</strong><br />

economic growth.<br />

— Manoj Kohli, CEO of Bharti Airtel<br />

FEB 2009 / Win-Win<br />

2

VOICE<br />

FROM OPERATORS<br />

Under our unique business model, we assume <strong>the</strong> roles of supervisor, planner,<br />

governor and quality control inspector. By partnering with strong global partners,<br />

we are able to successfully develop and focus on <strong>the</strong> core competence.<br />

<strong>the</strong> Indian telecom industry, <strong>the</strong> wireless subscriber base<br />

should grow from around 350 million in 2008 to 500<br />

million in 2010. It is safe to say that India is <strong>the</strong> second<br />

largest market after China, but still a very large market<br />

with only a 61% projected penetration rate by 2012. The<br />

wireless revenue could be about USD37 billion in 2012.<br />

What are <strong>the</strong> key drivers for growth? The most<br />

important thing is an affordable tariff, which is about<br />

1.5 cents/minute. That is why <strong>the</strong> MOU in India is about<br />

513 minutes a month. Second, incomes are rising, not<br />

only in <strong>the</strong> urban areas, but also in <strong>the</strong> rural areas.<br />

Third, I can remember <strong>the</strong> handset price at <strong>the</strong><br />

beginning was USD200. We now have handsets that are<br />

USD20. This is definitely a big trigger of growth.<br />

Fourth, rural economic prosperity is certainly going<br />

up. In India, close to half of <strong>the</strong> economy is rural, and it<br />

is a cash economy. The money doesn’t go through banks.<br />

We have covered about 400 thousand out of a total of 600<br />

thousand villages.<br />

Fifth, <strong>the</strong> youth segment is going to develop. According<br />

to demographic analysis, young people are <strong>the</strong> highest<br />

percentage of <strong>the</strong> population in India. As many Asian<br />

countries are aging, <strong>the</strong> Indian population is becoming<br />

younger. The youth segment is important for all of <strong>the</strong><br />

telecom operators in India.<br />

Finally, new technologies like 3G are going to be<br />

launched in India in 2009, providing ano<strong>the</strong>r very good<br />

growth opportunity.<br />

The India telecom industry began taking off in 2003.<br />

During <strong>the</strong> last few months, we saw over 10 million net<br />

added subscribers per month in India. I don’t think any<br />

o<strong>the</strong>r countries in <strong>the</strong> world have achieved this kind of<br />

figure. It clearly shows that operators in India have rolled<br />

out <strong>the</strong> networks very swiftly and rolled out distribution<br />

close to customers, including <strong>the</strong>ir homes and offices.<br />

Innovation-Airtel’s key enabler<br />

India is <strong>the</strong> most competitive and a very hard-fought<br />

market in <strong>the</strong> telecom world. There are now about 11<br />

to 12 players in every state. In October 2008, three<br />

international brands including NTT DoCoMo, Telenor<br />

and Etisalat entered India and heated up <strong>the</strong> competition.<br />

We at Bharti Airtel welcome competition, and believe we<br />

can actually become stronger as new competition enters<br />

<strong>the</strong> marketplace.<br />

Bharti Airtel continues to lead <strong>the</strong> market, and our<br />

leadership is due to our commitment to affordability for<br />

Indian customers. Offering world-class, innovative and<br />

world’s most affordable tariffs at 1.5 cents/minute, we have<br />

achieved more than 33% of <strong>the</strong> regular GSM market share<br />

in India. More than half of our new customers are coming<br />

from <strong>the</strong> villages.<br />

Unique business model<br />

Innovation was not a choice for us, innovation was<br />

a necessity for us. For achieving <strong>the</strong> lowest costs for <strong>the</strong><br />

production of minutes in India, we need to have <strong>the</strong> lowest<br />

cost possible. We <strong>the</strong>refore launched in 2002 a unique<br />

business model featuring outsourcing <strong>the</strong> five big portions<br />

of our operations.<br />

First, we outsourced our network to leading<br />

international vendors. In <strong>the</strong> network partner selection, we<br />

began with a very innovative way of buying networks since<br />

we started in 2003. At that time, we were buying about<br />

2,000 black boxes. We didn’t understand many of those<br />

black boxes as we are not technologists. But we understood<br />

customers, people, and <strong>the</strong> market. So we started buying<br />

lines and capacity from our partners. We paid <strong>the</strong> partners<br />

by every user capacity in terms of lines. We also had<br />

3<br />

Win-Win / FEB 2009

managed services managed by vendors. Today, I can say<br />

that those vendors have given us <strong>the</strong> power to rollout up to<br />

3,000 towers per month. I think this innovative business<br />

model has been very successful.<br />

IT outsourcing is more innovative than network. IT<br />

is <strong>the</strong> backbone for any telecom company in <strong>the</strong> world,<br />

whe<strong>the</strong>r it is <strong>the</strong> billing system, IN system, or CRM<br />

system. So we went to IBM in 2003 and let <strong>the</strong>m run our<br />

IT systems end to end. Now, all hardware, software, and<br />

services are handled by <strong>the</strong> IBM employees who work for<br />

Bharti Airtel.<br />

IBM tailored 65 platforms for us and we pay IBM<br />

a percentage of our top line and revenue. There is no<br />

linkage with how many new services, new software, or new<br />

hardware has come online in a month. It is just simply<br />

linked to <strong>the</strong> top line and we pay this amount to IBM.<br />

There is a short case project for IBM globally. Based on <strong>the</strong><br />

project, IBM is getting many new contracts in <strong>the</strong> telecom<br />

sector across <strong>the</strong> globe.<br />

For customer service and call centers, we have five to six<br />

partners who are high quality global partners. We know<br />

that if every customer calls us each month, we will have<br />

80 million calls a month. So we need very large capacity<br />

call centers. 70% of our present call centers are outsourced<br />

to our partners who are very high-quality global partners.<br />

30% of <strong>the</strong> present call centers are being outsourced now<br />

and will be completed within <strong>the</strong> next six months or so.<br />

These partners focus on <strong>the</strong> output factor of <strong>the</strong> customers.<br />

If <strong>the</strong> customer satisfaction goes up, <strong>the</strong>se partners get<br />

more fees from us. If it goes down, <strong>the</strong>se partners have to<br />

suffer.<br />

By completely outsourcing <strong>the</strong> entire distribution of<br />

<strong>the</strong> company, we have built up <strong>the</strong> strongest distribution<br />

force in India. We have thousands of distributors and<br />

more than one million retail points in India. Our target is<br />

that by 2010, <strong>the</strong> number of retail points will reach close<br />

to 2 million. There is a match box distribution strategy in<br />

India–wherever a match is sold, Bharti Airtel’s services will<br />

also be sold. This will make our distribution <strong>the</strong> deepest<br />

in <strong>the</strong> world. We see that local retailer and local outlets<br />

are <strong>the</strong> best way to promote Bharti Airtel. Hence, we do<br />

not own <strong>the</strong> distribution of <strong>the</strong> company, including large<br />

showrooms with our exclusive Airtel Relationship Centres<br />

and o<strong>the</strong>r small showrooms that are not exclusively Airtel.<br />

Last but not least, <strong>the</strong> passive infrastructure is all<br />

open for sharing with o<strong>the</strong>r operators. I think it is very<br />

important that we collaborate when <strong>the</strong> competitive<br />

intensity is at a cut-throat level in India. With more<br />

operators sharing <strong>the</strong> infrastructure, <strong>the</strong> cost of our<br />

network operation actually is coming down steadily.<br />

A clear example is Indus Towers, where Bharti Airtel,<br />

Vodafone and Idea Cellular are <strong>the</strong> joint venture partners.<br />

I think in <strong>the</strong> coming few years, <strong>the</strong> average tendency will<br />

be that one tower is shared by 2-3 operators.<br />

In conclusion, under this unique business model,<br />

Bharti Airtel has assumed <strong>the</strong> roles of supervisor, planner,<br />

About Bharti Airtel Limited<br />

Bharti Airtel Limited, a group company of Bharti Enterprises, is Asia’s leading integrated telecom services provider with<br />

operations in India and Sri Lanka and has an aggregate of over 88 million customers as at <strong>the</strong> end of December 2008. Bharti<br />

Airtel Limited has been voted as India’s most innovative company, in a survey conducted by The Wall Street Journal.<br />

FEB 2009 / Win-Win<br />

4

VOICE<br />

FROM OPERATORS<br />

Bharti Airtel continues to lead <strong>the</strong> market, and our leadership is<br />

due to our commitment to affordability for Indian customers. Offering worldclass,<br />

innovative and world’s most affordable tariffs at 1.5 cents/minute, we have<br />

achieved more than 33% of <strong>the</strong> regular GSM market share in India.<br />

governor and quality control inspector. By partnering with<br />

strong global partners, Bharti Airtel is able to successfully<br />

develop and focus on <strong>the</strong> core competence.<br />

Product innovation<br />

Production innovation is a delightful journey which<br />

has allowed Bharti Airtel to win <strong>the</strong> hearts of millions<br />

of Indian customers. Bharti Airtel comes out with new<br />

ideas and new products every month. Although some new<br />

customers don’t use <strong>the</strong>m, customers like to feel that <strong>the</strong><br />

brand image of Bharti Airtel is innovative and really brings<br />

new ideas every day.<br />

Examples include <strong>the</strong> Micro Prepaid. We started it<br />

in 2004, and now all our million plus retailers offer this<br />

service. Through e-charging, low-educated or even illiterate<br />

retailers can use e-charging instead of a paper recharge<br />

card. This is a very good innovation that customers are<br />

delighted with because <strong>the</strong>y can buy talk-time near <strong>the</strong>ir<br />

offices or at home. Retailers are happy because <strong>the</strong>y don’t<br />

have to keep a large inventory on hand. Money is all kept<br />

on <strong>the</strong> phone, which is fantastic. More than USD5 billion<br />

in transactions happen on this system every year.<br />

Ano<strong>the</strong>r example is Lifetime Prepaid which we<br />

launched about two-and-half years ago. With <strong>the</strong> Easy<br />

Lifetime, a customer can stay <strong>mobile</strong> for his entire life by<br />

paying just about USD2 per month. Easy Lifetime is an<br />

unprecedented move in <strong>the</strong> Indian telecom sector. If you<br />

ask an Indian customer today which product he/she will<br />

buy, <strong>the</strong>y will invariably say, “I will buy Lifetime Prepaid<br />

from Bharti Airtel.” Lifetime has lots of benefits for <strong>the</strong><br />

millions of customers who are using it every month.<br />

On <strong>the</strong> content side, Indian people are really passionate<br />

about music, Bollywood, games and a lot of o<strong>the</strong>r content.<br />

We have been very innovative in this field and we believe<br />

that if we give more such exciting content to our customers<br />

that <strong>the</strong>y use, it will keep <strong>the</strong>m loyal to <strong>the</strong> brand.<br />

With all <strong>the</strong>se products launched, including Hello<br />

Tunes, Music on Demand, Easy Music, and Song Catcher<br />

where you can get somebody else’s ring back tones, Bharti<br />

Airtel has become <strong>the</strong> largest music company in India.<br />

We are not a music company, but by being a telecom<br />

company, we are <strong>the</strong> largest music company, because <strong>the</strong><br />

volume of downloaded music is <strong>the</strong> highest in India and<br />

more than any o<strong>the</strong>r music company.<br />

Innovation for <strong>the</strong> future<br />

We see <strong>the</strong> future very differently. We feel that in <strong>the</strong><br />

future, technology will give us speed. The service providers<br />

have to aggregate. Customers do not want to go to many<br />

brands, customers want to have one brand which <strong>the</strong>y<br />

like, and hence service providers have to aggregate and<br />

make it simple. Customers clearly want affordability and<br />

<strong>the</strong> differences between customers will vanish. If you<br />

move ahead, some customers want to use more music or<br />

data. The rural market is opening up, while <strong>the</strong> industry is<br />

seeing lots of convergence, including media, telecom, and<br />

<strong>the</strong> Internet.<br />

Exploiting rural and youth opportunities<br />

On <strong>the</strong> rural side, we are doing a lot of work at 400<br />

thousand villages in India. We are helping <strong>the</strong> farmers in<br />

India to get commodity prices, agricultural information<br />

and agricultural help lines for buying fertilizer and<br />

pesticide. We also help <strong>the</strong>m to learn English. We are<br />

helping <strong>the</strong> fertilizer co-operative reach <strong>the</strong> farmers. About<br />

55 million farmers are going digital, including doctors<br />

5<br />

Win-Win / FEB 2009

We also focus on new business opportunities to gain higher share.<br />

Now we are focusing on <strong>the</strong> telecom wallet share. We are an integrated<br />

company, so we will pick up <strong>the</strong> entire wallet of our customers, whe<strong>the</strong>r it is for<br />

<strong>the</strong> Internet, media, satellite TV or IPTV.<br />

on call, health care givers, animal husbandry workers,<br />

veterinarians, etc. We really are impacting rural India in a<br />

very big way.<br />

Moving ahead, we also focus a lot on youth in India.<br />

They like chatting, dating, gaming, voice SMS. As an<br />

example, voice MSM simplifies <strong>the</strong> communication. We<br />

want to make our products and services a simple service<br />

like voice MSM that is close to <strong>the</strong> heart of our customers.<br />

Mobile commerce is also a big potential area. In India,<br />

we have domestic money transfers amounting to about<br />

USD40 billion and international remittances around<br />

USD42 billion, so we have more than USD80 billion in<br />

money transfers that we can do in India. Recently, Bill<br />

Gates was in India and helped us to get <strong>the</strong> automation<br />

done for money transfers. I think <strong>the</strong> bank is helping<br />

us, and GSMA is helping us as well. Mobile commerce<br />

actually will be a big part.<br />

Half <strong>the</strong> economy in India is a cash economy and we<br />

would like to help <strong>the</strong> consumers to transfer <strong>the</strong>ir money<br />

from one place to ano<strong>the</strong>r, maybe from cities to villages,<br />

in a very secure fashion, so that people will have no worry<br />

of losing money at any time. We are helping customers go<br />

<strong>mobile</strong> with <strong>the</strong>ir transactions. For paying bills, money<br />

transfers, recharging and everything else, <strong>the</strong> <strong>mobile</strong><br />

should be <strong>the</strong> only instrument needed instead of so many<br />

cards.<br />

Innovation is core<br />

Innovation is <strong>the</strong> core of success of Bharti Airtel. We<br />

will leverage <strong>the</strong> existing core capabilities to exploit rural<br />

and youth opportunities. We also focus on new business<br />

opportunities to gain higher share. Now we are focusing on<br />

<strong>the</strong> telecom wallet share. We are an integrated company,<br />

so we will pick up <strong>the</strong> entire wallet of our customers,<br />

whe<strong>the</strong>r it is for <strong>the</strong> Internet, media, satellite TV or IPTV.<br />

We are continuously redefining our business model so<br />

that we can become more and more viable, and our cost<br />

structure should come down more and more in <strong>the</strong> years<br />

to come. Of course, we are doing mass customization of<br />

<strong>the</strong> backend systems. The backend system is a big strength<br />

of our company.<br />

Innovation has to be based on “<strong>the</strong> smell of customers”.<br />

If you do not smell <strong>the</strong> customers, it is very difficult to<br />

innovate, because <strong>the</strong> innovation has to start from outside,<br />

and <strong>the</strong>n into <strong>the</strong> company. You should know what <strong>the</strong><br />

customers’ aspirations are for <strong>the</strong> next few years. We need<br />

to listen to customers and look beyond Airtel customers<br />

and even listen to non-Airtel customers too. We also<br />

have institutionalized <strong>the</strong> innovation framework within<br />

<strong>the</strong> company as <strong>the</strong> culture. Innovation can not be a<br />

department’s job, a function’s job, or a CEO’s job. It has<br />

to be carried out through <strong>the</strong> company. We have set up<br />

customer labs and we have rewards and recognitions for<br />

<strong>the</strong> people who really help us strongly in innovation.<br />

Our vision is simple and clear. By 2010 Bharti Airtel<br />

will be <strong>the</strong> most admired brand in India across all product<br />

and service lines, loved by <strong>the</strong> most customers, targeted<br />

by top talents, and benchmarked by more businesses. Our<br />

passion to innovate actually continues. We are confident<br />

that this vision and its excellent execution will be able to<br />

achieve sustainable performance for many years to come.<br />

Bharti Airtel is on a journey of excellence through<br />

innovation and through <strong>the</strong> employees’ passion. This<br />

journey definitely has no destination. O<strong>the</strong>r than that<br />

Bharti Airtel will continue to be a catalyst to India’s<br />

economy and an engine for <strong>the</strong> economic growth.<br />

Editor: Gao Xianrui sally@huawei.com<br />

FEB 2009 / Win-Win<br />

6

VOICE<br />

FROM OPERATORS<br />

We are confident<br />

in providing a pipe.<br />

It is a pipe, but it<br />

is a GREAT pipe.<br />

High speed, flat-rate<br />

<strong>mobile</strong> <strong>broadband</strong><br />

data is in itself a<br />

differentiated service.<br />

—Dr. Sachio Semmoto,<br />

<strong>EMOBILE</strong> Chairman and CEO<br />

Left: Dr. Sachio Semmoto, <strong>EMOBILE</strong> Chairman and CEO<br />

Right: Eric Gan, <strong>EMOBILE</strong> President and COO<br />

(Photo courtesy of <strong>EMOBILE</strong>)<br />

7<br />

Win-Win / FEB 2009

<strong>EMOBILE</strong><br />

<strong>the</strong> <strong>mobile</strong> <strong>broadband</strong><br />

<strong>revolutionist</strong><br />

<strong>EMOBILE</strong>, Japan’s newest and fastest growing <strong>mobile</strong> operator entered <strong>the</strong> market in March 2007.<br />

Skeptics thought <strong>the</strong>y could not compete with <strong>the</strong> well-established and powerful big three operators<br />

–NTT DoCoMo, KDDI and SOFTBANK MOBILE. Yet, in less than two years, it has already carved out<br />

a strong niche in <strong>mobile</strong> <strong>broadband</strong>, and at <strong>the</strong> same, dramatically changed <strong>the</strong> existing <strong>mobile</strong><br />

landscape. In January 2009, <strong>EMOBILE</strong> attracted <strong>the</strong> second largest number of newly added <strong>mobile</strong><br />

subscribers, bringing its total to 1.19 million customers. <strong>EMOBILE</strong> founder, Chairman & CEO, Dr. Sachio<br />

Semmoto and President & COO, Eric Gan unveiled <strong>the</strong>ir unique business model and future ambitions in<br />

an exclusive interview with Win-Win.<br />

By Julia Yao<br />

Dr. Semmoto can be proud of his record as an<br />

entrepreneur. He is one of <strong>the</strong> co-founders of<br />

DDI (today part of KDDI), and founded <strong>the</strong><br />

ADSL provider eAccess in Japan. In 2005, when<br />

he founded <strong>EMOBILE</strong>–<strong>the</strong> first new <strong>mobile</strong> operator<br />

in 13 years, Dr. Semmoto imbued <strong>the</strong> company with<br />

his entrepreneurial spirit and said, “<strong>EMOBILE</strong> is totally<br />

different from <strong>the</strong> incumbents. We are entrepreneurs. We<br />

are a start-up. We are a venture. We are a totally different<br />

species. You have to change your mindset. O<strong>the</strong>rwise, you<br />

can not understand our company.”<br />

A born <strong>revolutionist</strong><br />

<strong>EMOBILE</strong> was a different species at birth. Unlike<br />

traditional operators in <strong>the</strong> market, <strong>EMOBILE</strong> started as<br />

a pure <strong>mobile</strong> data operator. With a strong belief that <strong>the</strong><br />

whole <strong>broadband</strong> market in Japan would be <strong>the</strong> <strong>mobile</strong><br />

<strong>broadband</strong> market in <strong>the</strong> future, <strong>EMOBILE</strong> focused solely<br />

on <strong>the</strong> 100 million user strong Japanese <strong>mobile</strong> <strong>broadband</strong><br />

market.<br />

Eric Gan explained, “We started off with data<br />

customers and slowly moved into <strong>the</strong> voice market. That’s<br />

very different from traditional carriers for whom voice is<br />

<strong>the</strong> main business, and if <strong>the</strong>y have some time, <strong>the</strong>y do<br />

some data. The <strong>mobile</strong> data market is a very new area. We<br />

were very fortunate to have <strong>the</strong> new spectrum and to have<br />

built a new network with HSPA from scratch in record<br />

time.”<br />

<strong>EMOBILE</strong> began offering voice services starting from<br />

March 2008, but it is not a pure voice strategy.<br />

He continued, “We are focusing our voice service on<br />

<strong>the</strong> data product, like SmartPhone and PDA types, which<br />

FEB 2009 / Win-Win<br />

8

VOICE<br />

FROM OPERATORS<br />

We started off with data customers and slowly moved into<br />

<strong>the</strong> voice market. It’s not a pure voice technology. That’s very different from<br />

traditional carriers for whom voice is <strong>the</strong> main business.<br />

people are willing to carry as a second handset. Voice will<br />

be included in <strong>the</strong> data service. Like our new data modem,<br />

it’s a data card, but we put a voice function inside <strong>the</strong><br />

data card. So, when people use it for data, if <strong>the</strong>y lose <strong>the</strong><br />

battery in <strong>the</strong> main handset, <strong>the</strong>y can use <strong>the</strong> data card as<br />

<strong>the</strong> voice handset.”<br />

When speaking of <strong>mobile</strong> <strong>broadband</strong>, content is often<br />

said to be king, and traditional wisdom warns operators<br />

not to become a dumb data pipe. Yet, <strong>EMOBILE</strong><br />

deliberately adopts <strong>the</strong> open platform strategy for both<br />

devices and application. Customers can choose from<br />

a great variety of terminals that can serve all kinds of<br />

PC functions, at <strong>the</strong> same time, <strong>the</strong>y are free to enjoy<br />

streaming content, financials, interactive game and security<br />

services etc.<br />

Regarding <strong>the</strong> open platform strategy, Dr. Semmoto<br />

said, “We are confident in providing a pipe. It is a pipe,<br />

but it is a GREAT pipe. High speed, flat-rate <strong>mobile</strong><br />

<strong>broadband</strong> data is in itself a differentiated service.”<br />

Market leader in <strong>mobile</strong><br />

speed and price<br />

The “great” pipe delivers <strong>the</strong> fastest speeds coupled with<br />

<strong>the</strong> lowest flat-rate plans in Japan.<br />

According to Eric Gan, “<strong>EMOBILE</strong>’s customers are<br />

very speed sensitive as <strong>the</strong>y basically use <strong>the</strong> <strong>mobile</strong> for<br />

a PC connection. So <strong>EMOBILE</strong> positions speed as its<br />

biggest differentiator. We are ahead of our competition<br />

in 7.2Mbps HSDPA product. On Nov. 20, 2008, we<br />

launched our HSUPA product with speeds up to 1.4Mbps,<br />

which was <strong>the</strong> first time in Japan. We just have to be <strong>the</strong><br />

first one in Japan to do all <strong>the</strong>se new services, compared to<br />

<strong>the</strong> existing operators.”<br />

<strong>EMOBILE</strong> offers not only <strong>the</strong> fastest speeds, but also<br />

<strong>the</strong> lowest price. “We are also <strong>the</strong> first in Japan to launch<br />

flat-rate in 2007.” The flat-rate plan Eric Gan mentioned<br />

is as cheap as USD10 a month, considerably less than its<br />

rivals’ wireless-<strong>broadband</strong> offerings which normally range<br />

from USD40 to USD80 for equivalent speeds.<br />

In addition to <strong>the</strong> lowest flat-rate, <strong>EMOBILE</strong> launched<br />

a revolutionary new data card bundling service with <strong>the</strong><br />

UMPCs (Ultra Mobile PC) in July 2008. With a twoyear<br />

<strong>EMOBILE</strong> contract, <strong>the</strong> PC is priced at USD1 to<br />

USD200, compared with USD2000 to USD3000 for some<br />

big name brand PCs and customers can pay in installments<br />

for 24 months. “This changes drastically <strong>the</strong> business model<br />

for selling PCs for first time in Japan. The market actually<br />

exploded.” commented Dr. Semmoto, “This is extremely<br />

good considering <strong>the</strong> financial crisis. Consumers spend less,<br />

our network has <strong>the</strong> cheapest flat-rate, and you can get PC<br />

for USD1, or USD100. This is perfect.”<br />

To ensure <strong>EMOBILE</strong>’s ability to always lead in <strong>mobile</strong><br />

speed and price in <strong>the</strong> future, Dr. Semmoto maintains<br />

that it is important to go for <strong>the</strong> mainstream technologies.<br />

“I doubt <strong>the</strong> future of CDMA2000, PHS and WiMAX,<br />

because major worldwide operators are moving to GSM/<br />

WCDMA/LTE as <strong>the</strong> mainstream technology. We are now<br />

using HSDPA, and we just started with HSUPA. MIMO<br />

EHSPA (HSPA+) might join <strong>the</strong> stream, and LTE is<br />

coming, but <strong>the</strong> issue is when and how.”<br />

Competitive price structure<br />

To provide <strong>the</strong> lowest price without sacrificing <strong>the</strong><br />

9<br />

Win-Win / FEB 2009

Now aided by very small, briefcase-sized radio units, you can even<br />

hang <strong>the</strong> equipment on <strong>the</strong> wall. So <strong>the</strong> price to build is just one tenth of <strong>the</strong><br />

traditional base station, and we can build <strong>the</strong>m very quickly.<br />

fastest speed, Dr. Semmoto explained, “We are very costconscious<br />

compared with <strong>the</strong> incumbent companies. We<br />

have a lot of wisdom in regard to cutting costs. That’s why<br />

we have much lower costs and prices.”<br />

One of <strong>the</strong> pearls of cost-saving wisdom is to keep <strong>the</strong><br />

headcount as small as possible. “You don’t want to be a big<br />

company. Smaller is better. It’s <strong>the</strong> leader’s management<br />

philosophy. If you run <strong>the</strong> company like <strong>the</strong> incumbents,<br />

it’s a group of bureaucrats like government or big telecom<br />

companies.”<br />

<strong>EMOBILE</strong> has a surprisingly small headcount with<br />

only 560 employees, and new graduates comprise more<br />

than half of <strong>the</strong> total number.<br />

Eric Gan also highlighted <strong>the</strong> cost benefits by using<br />

small-sized Node B, “I think capital spending is <strong>the</strong><br />

function of how to build <strong>the</strong> network. The radio station is<br />

<strong>the</strong> major cost for a <strong>mobile</strong> carrier. When deploying base<br />

station, operators normally put a huge cabinet in a big<br />

room with air conditioning. Also, it incurs more running<br />

costs, uses more electric power, consumes more rent and<br />

requires a higher backbone as well.”<br />

“Now with <strong>the</strong> latest technology, aided by very<br />

small, briefcase-sized radio units, you can even hang <strong>the</strong><br />

equipment on <strong>the</strong> wall. So <strong>the</strong> price to build is just one<br />

tenth of <strong>the</strong> traditional base station, and we can build<br />

<strong>the</strong>m very quickly. In Japan, we have earthquakes. A<br />

lighter base station to put on <strong>the</strong> rooftop is always easier to<br />

negotiate than <strong>the</strong> traditional one. Running costs are much<br />

cheaper, because we pay less rent and use less electricity.”<br />

Eric Gan added.<br />

The base station mentioned above is <strong>the</strong> distributed<br />

Node B designed and produced for <strong>EMOBILE</strong> by<br />

<strong>Huawei</strong>.<br />

A robust future<br />

Dr. Semmoto is quite positive about future market<br />

potential and said, “Although more than 80% of <strong>the</strong><br />

Japanese population owns a <strong>mobile</strong> phone, <strong>the</strong>re is<br />

evidence of an increasing demand for second handsets. We<br />

estimate combined demand in Japan is about 30 million<br />

additional subscribers. <strong>EMOBILE</strong> is focusing on this<br />

growth opportunity.”<br />

While <strong>the</strong> current financial crisis brings a lot of fear to<br />

<strong>the</strong> industry, <strong>EMOBILE</strong> actually sees great opportunity.<br />

“We are very fortunate that we completed full funding<br />

of USD1.4 billion in 2006 for <strong>the</strong> following 5 years until<br />

2011, before <strong>the</strong> current worldwide financial crisis.” More<br />

importantly is that, because of <strong>the</strong> financial crisis, people<br />

tend to be more careful with <strong>the</strong>ir spending, which brings<br />

great opportunity for <strong>EMOBILE</strong>. Eric Gan added, “People<br />

may not want to pay for an expensive fixed line. Instead,<br />

<strong>the</strong>y may opt to use a <strong>mobile</strong> phone with a modem inside<br />

just to cut cost. This fits perfectly with our strategy to<br />

target at <strong>the</strong> price sensitive users.”<br />

Operators can not succeed all by <strong>the</strong>mselves. To form<br />

strong partnerships with capable and devoted partners<br />

is imperative for sustainable growth. Dr. Semmoto has<br />

appreciated <strong>the</strong> collaboration and cooperation with<br />

<strong>Huawei</strong>. “<strong>Huawei</strong> from day one has been an excellent<br />

partner to us. In <strong>the</strong> past, <strong>Huawei</strong> was totally a stranger<br />

in <strong>the</strong> Japanese market. You have grown enormously in<br />

<strong>the</strong> last 20 years. You have now become one of <strong>the</strong> leaders<br />

in <strong>the</strong> telecom arena. I think that jointly <strong>EMOBILE</strong> and<br />

<strong>Huawei</strong> can be prosperous if we stay very entrepreneurial,<br />

very challenging and take risks.”<br />

Editor: Gao Xianrui sally@huawei.com<br />

FEB 2009 / Win-Win<br />

10

11<br />

Win-Win / FEB 2009

Perspective<br />

<strong>Huawei</strong> Views on<br />

Future Industry Trends<br />

Over <strong>the</strong> last ten years, <strong>the</strong> telecom industry has<br />

grown and begun changing from <strong>the</strong> familiar<br />

patterns of <strong>the</strong> past. These changes have been<br />

driven by customer needs, technology changes<br />

and <strong>the</strong> emergence of new business models.<br />

As <strong>the</strong> industry enters 2009, <strong>the</strong> global financial<br />

turmoil adds a new dimension to an already complicated<br />

picture and deepens <strong>the</strong> existing challenges. The ability<br />

of <strong>the</strong> operators and <strong>the</strong>ir partners to rapidly seize new<br />

opportunities, anticipate customer demands and be able<br />

to quickly modify strategies will determine <strong>the</strong> ongoing<br />

success of <strong>the</strong> telecom industry.<br />

<strong>Huawei</strong> is in a unique position to have insights into <strong>the</strong><br />

divergent global telecom markets and this paper shares our<br />

vision of where <strong>the</strong> industry is going and our views of <strong>the</strong><br />

key trends that will impact success.<br />

Vision – networked world<br />

The concept of a Networked World has been discussed<br />

for some time, but we are now seeing <strong>the</strong> results in<br />

everyday life. Driven by <strong>the</strong> rapid deployment of new<br />

technologies and emerging user requirements, <strong>the</strong> boundary<br />

between software, IT and communications has become<br />

blurred. Added to <strong>the</strong> traditional telecom operators are<br />

service and content providers from <strong>the</strong> Internet, media<br />

and entertainment industries and <strong>the</strong>se players will have<br />

a major impact on <strong>the</strong> industry. <strong>Huawei</strong> believes that <strong>the</strong><br />

future Networked World will be profoundly influenced by:<br />

Mobile penetration saturation<br />

At <strong>the</strong> end of 2008, <strong>the</strong> number of <strong>mobile</strong> subscribers<br />

topped 3.5 billion and projections show that it will reach<br />

5 billion in just a few years, equaling <strong>the</strong> total number of<br />

potential users. Over 1 billion of those new users will come<br />

from emerging markets and this will result in a world which<br />

is fully interconnected and able to bridge <strong>the</strong> digital divide.<br />

Ubiquitous <strong>broadband</strong><br />

The next few years will see <strong>the</strong> rapid deployment of<br />

high-speed <strong>mobile</strong> <strong>broadband</strong> and a major shift to higher<br />

speeds for fixed <strong>broadband</strong>. By 2013, 300 million new<br />

fixed <strong>broadband</strong> users will be added, doubling today’s total<br />

and, through <strong>the</strong> deployment of FTTx, <strong>the</strong>y will have<br />

access to massive amounts of data. On <strong>the</strong> <strong>mobile</strong> side,<br />

1.2 billion new users will be added to <strong>the</strong> 200 million<br />

current users as <strong>the</strong> result of <strong>the</strong> HSPA technologies.<br />

The availability of this <strong>broadband</strong> will allow “3 Screen”<br />

(TV, PC and <strong>mobile</strong> handset) convergence with exciting<br />

opportunities for always-on networking.<br />

Cloud computing<br />

As high-speed data connections become common for<br />

both fixed and <strong>mobile</strong> users, <strong>the</strong> opportunity exists to<br />

provide previously unavailable services from “The Cloud”.<br />

The opportunities from what is becoming known as Cloud<br />

Computing will be enormous. The ability to offer end-users<br />

access to sophisticated information services without <strong>the</strong> need<br />

to buy expensive software and hardware, similar to <strong>the</strong> way<br />

we use electricity today without <strong>the</strong> need to buy our own<br />

generators and diesel oil, will abolish <strong>the</strong> boundaries between<br />

have and have-not information societies. In <strong>the</strong> next few<br />

years, cloud computing will go beyond <strong>the</strong> discussion of<br />

concepts and technologies and become widely available.<br />

A digital flood<br />

In <strong>the</strong> 5,000 years of recorded history, mankind<br />

generated <strong>the</strong> equivalent of 5 exabytes (10 18 bytes)<br />

of written information, but during 2006, over 280<br />

exabytes of digital content were generated. Driven by<br />

high-definition, three-dimensional and user-generated<br />

content, <strong>the</strong> annual volume By of Wang digital Kening information & Ling will Yun<br />

FEB 2009 / Win-Win<br />

12

Perspective<br />

soon reach 1,000 exabytes, a veritable Digital Flood.<br />

The ramifications to <strong>the</strong> information infrastructure and<br />

backbone networks will be immense, with annual traffic<br />

growing by 10 or even 100 times.<br />

Ten future industry trends<br />

As we move to this Networked World, <strong>the</strong> factors<br />

discussed above will have real, practical impacts on <strong>the</strong><br />

telecom industry. Emerging markets will become a major<br />

factor in industry expansion, but decreasing ARPU will<br />

act as stimulation for creative solutions. Uncovering <strong>the</strong>se<br />

opportunities, providing products, services and support<br />

to operators as <strong>the</strong>y deal with <strong>the</strong> emerging trends and<br />

successfully managing <strong>the</strong> impacts will be <strong>the</strong> key to future<br />

success. <strong>Huawei</strong> views <strong>the</strong> top 10 trends as being:<br />

All-IP transformation<br />

Operators are spending billions of dollars each year for<br />

network expansion, but are still not able to keep ahead<br />

of demand. We believe that <strong>the</strong> only way to build costeffective,<br />

flexible and expandable networks is to move<br />

quickly to All-IP for <strong>broadband</strong>. This applies to both fixedline<br />

networks, where high-capacity fiber-copper integration<br />

will become common, and to wireless networks, where<br />

single IP backbones will handle voice, data, media and<br />

signaling. In both cases, moving to All-IP control layers is<br />

also required to flatten <strong>the</strong> network and achieve CAPEX<br />

and OPEX goals.<br />

Carrier-grade IP<br />

As networks move to All-IP, it is becoming apparent that<br />

common Internet-oriented IP technology does not meet <strong>the</strong><br />

needs of real-time delivery demanded by voice networks. In<br />

order to meet <strong>the</strong>se requirements, a new class of solutions<br />

will be required. These solutions will ensure end-to-end<br />

high-quality voice-grade communications with carrier-grade<br />

reliability and maintainability. Without <strong>the</strong>se advances, it will<br />

not be possible for operators to create <strong>the</strong> All-IP networks<br />

needed to meet <strong>the</strong> challenges of a Networked World.<br />

ARPU deterioration<br />

With most of <strong>the</strong> future growth coming from emerging<br />

markets, <strong>the</strong> low ARPU requirements of <strong>the</strong>se markets will<br />

force operators to adopt creative solutions to capture <strong>the</strong><br />

market while still maintaining profitability. As an example,<br />

72% of <strong>the</strong> Indian population is in rural areas, where <strong>the</strong><br />

current telecom penetration is only 13%. This is a wonderful<br />

opportunity, but <strong>the</strong> ARPU is USD3-5 per month! Clearly,<br />

low cost networks and low cost terminals will be key factors<br />

for operators to develop services and make profits.<br />

Mobile <strong>broadband</strong> delivery<br />

Exploding use of <strong>mobile</strong> devices for high-speed data<br />

connections is one of <strong>the</strong> most exciting frontiers in telecom.<br />

Functionality which was previously only available from<br />

wired <strong>broadband</strong> connections can now be used from <strong>mobile</strong><br />

devices, opening up new applications that are based on<br />

location, status or even <strong>the</strong> proximity of friends. Delivering<br />

this high-speed data experience to <strong>mobile</strong> users has a<br />

number of challenges which must be overcome. When<br />

<strong>the</strong> network bandwidth reaches 100M, <strong>the</strong> density of base<br />

stations will increase by 50 times. Our consultations with<br />

operators has underscored that <strong>the</strong> increased complexity of<br />

site selection, backhaul transmission, signaling schemes and<br />

operation & maintenance is becoming a serious burden.<br />

Optimizing <strong>the</strong> coverage of a Metrozone, base station<br />

minimization, packet transmission and level transmission, as<br />

well as organization of networks, etc. have <strong>the</strong> potential to<br />

restrict <strong>the</strong> development of <strong>mobile</strong> <strong>broadband</strong>. Since 2006,<br />

<strong>Huawei</strong> had been focused on base station minimization,<br />

support for packet-based backhaul transmission and plugand-play<br />

of self-organizing networks. These capabilities<br />

have been successful in solving <strong>the</strong> coverage problems of<br />

Metrozones.<br />

SingleRAN advances<br />

Continued rapid growth in users, along with <strong>the</strong> growth in<br />

<strong>mobile</strong> <strong>broadband</strong> requirements and advances in <strong>broadband</strong><br />

technology will result in a very complex radio network<br />

environment. While operators will support market demand by<br />

quickly deploying new radio technologies, such as LTE, <strong>the</strong>y<br />

must continue to support <strong>the</strong> existing GSM, EDGE, UMTS<br />

and HSPA networks for many years. Ra<strong>the</strong>r than building<br />

a complex “vertical” network of separate radios, <strong>the</strong> need is<br />

for a “horizontal” integrated radio network that supports<br />

voice, narrowband data and <strong>mobile</strong> <strong>broadband</strong>. <strong>Huawei</strong> has<br />

championed <strong>the</strong> “SingleRAN” concept to meet this need.<br />

With around 10,000 of <strong>the</strong>se 4th-generation base stations<br />

deployed by O2 in Germany, <strong>the</strong> TCO savings of up to 30%<br />

and <strong>the</strong> smooth evolution capabilities are quickly proving to<br />

be a winning combination.<br />

Tera-scale networks<br />

Surging growth in data traffic continues to exceed <strong>the</strong><br />

capacity capabilities of traditional telecom networks. Network<br />

modeling for developed countries in Western Europe suggests<br />

that data growth and network transformation to flat, All-<br />

IP architecture will soon require end-to-end Tera-bit bearer<br />

networks. The appetite for capacity will be even greater for<br />

countries like China and US that have large populations and<br />

13<br />

Win-Win / FEB 2009

equire broad geographic coverage. We believe that building<br />

a Tera-Scale bearer network will become a competitive<br />

requirement for leading global operators.<br />

With extremely high extendibility, <strong>Huawei</strong> IPTime<br />

Solution has <strong>the</strong> capability of 80T as Router Cluster System,<br />

which will reach even higher with <strong>the</strong> development of 100G<br />

interface technologies. Its adoption of unified control plane<br />

enables seamless interactions between <strong>the</strong> IP layer and <strong>the</strong><br />

optical layer. Such architecture can offer higher transport<br />

efficiency, increasing return on investment and enhancing<br />

operators’ core competitiveness in <strong>the</strong> era of <strong>broadband</strong>.<br />

New voice business models<br />

Current <strong>mobile</strong> network operators receive 70% of <strong>the</strong>ir<br />

revenue from voice services, a market category that is<br />

being pressured by a continual decrease in ARPU. There is<br />

a natural shift in focus towards <strong>the</strong> more attractive revenue<br />

from data services, but this overlooks a critical element of<br />

user preference. Voice represents <strong>the</strong> most natural, efficient<br />

and convenient way of acquiring information that suits all<br />

scenarios and surroundings. How to capitalize on this and<br />

how to leverage voice as a new channel for communication<br />

and information acquisition, such as with <strong>the</strong> web, has<br />

turned into one of <strong>the</strong> most-debated and most difficult<br />

technical propositions. It is our belief that <strong>the</strong>re is huge<br />

market potential to tap in voice.<br />

New business models are <strong>the</strong> answers to this need. A<br />

good illustration would be <strong>the</strong> “Best Tone” service offered<br />

by China Telecom. An industry-leading innovation and<br />

a fast growing service, Best Tone has become a significant<br />

driver for <strong>the</strong> operator’s voice revenue growth.<br />

Value creation in <strong>broadband</strong><br />

While Moore’s Law will help decrease <strong>the</strong> cost, size and<br />

power of <strong>the</strong> equipment required to handle <strong>the</strong> massive<br />

increases in <strong>broadband</strong> data traffic, it can not keep up<br />

with <strong>the</strong> projected growth. The growth of <strong>the</strong> required<br />

equipment will result in significant increases in both capital<br />

and operational expenses, which can not be recovered<br />

from <strong>the</strong> revenue of passing basic data traffic. To tackle this<br />

challenge, operators will need intelligent traffic management<br />

to enhance bandwidth utilization, coupled with traffic-based<br />

user behavior analysis to generate additional revenue streams<br />

through targeted advertising or o<strong>the</strong>r new models.<br />

Content and media services<br />

To d a y t h e n e t w o r k i s t r a n s i t i o n i n g f r o m a<br />

communications vehicle into an infrastructure that sustains<br />

all elements of society. This will lead to a new trillion-<br />

USD market for businesses who provide <strong>the</strong>ir services<br />

over <strong>the</strong> Internet. As <strong>the</strong> new potential is unfolding,<br />

leading operators are all looking to transforming to add<br />

content and media services, on top of <strong>the</strong>ir traditional<br />

pipe offerings. The content and media arenas require new<br />

capabilities, skills and levels of user interaction that will<br />

challenge traditional operators. The service experience,<br />

development methodology and business model are<br />

dramatically different and community-based interactions<br />

are emerging as <strong>the</strong> fundamental trait of future services.<br />

User-driven and user generated content will be <strong>the</strong><br />

prevailing <strong>the</strong>me and a large number of personalized<br />

offerings will enter <strong>the</strong> market based on <strong>the</strong> long tail<br />

<strong>the</strong>ory. These offerings will be nurtured by <strong>the</strong> changing<br />

character of <strong>the</strong> network, where sharp declines in <strong>the</strong> cost<br />

of services will make it possible for “niche offerings” to<br />

win. Take publishing for example: traditionally <strong>the</strong> cost<br />

of a book could be recovered only if multiple thousands<br />

of copies were sold. With new network capabilities,<br />

<strong>the</strong> digital world increases competition, resulting in<br />

an ecosystem characterized by radical cost reductions,<br />

sometimes to zero, making on-line books profitable even<br />

with a small volume.<br />

Virtual computing<br />

The ability to deliver high-speed data connections<br />

anywhere allows <strong>the</strong> world of computing to shift from<br />

“buying products” (computers, storage and software) to<br />

“buying services” (IaaS, PaaS, and SaaS). This obviously is<br />

disruptive to conventional software and hardware vendors,<br />

but it also is disruptive to telecom operators because it<br />

provides an opportunity to re-think <strong>the</strong> boundaries of<br />

<strong>the</strong>ir networks. The network “cloud” can now include not<br />

only physical data centers, but also <strong>the</strong> virtualization of<br />

service capabilities that can be delivered along with dial<br />

tone to improve users’ lives. If we compare network traffic<br />

to rivers in <strong>the</strong> digital world, <strong>the</strong>n data centers will be <strong>the</strong><br />

future “reservoirs”. These new-generation data centers will<br />

require revolutionary shifts technologically, providing <strong>the</strong><br />

capacity for massive data processing at a low cost.<br />

Even in areas where economies are experiencing a slump,<br />

<strong>the</strong> telecom industry is still able to maintain and even<br />

accelerate its growth. Successful societies are going to require<br />

greater connectivity, placing <strong>the</strong> social responsibility of<br />

bridging <strong>the</strong> digital gap on <strong>the</strong> telecom industry. During <strong>the</strong><br />

last ten years, an information world has taken shape. Over<br />

<strong>the</strong> next few years, <strong>the</strong> universal spread of high-speed, lowcost,<br />

anywhere connectivity will be <strong>the</strong> driving force for <strong>the</strong><br />

telecom industry’s development.<br />

In this process, innovation and transformation is an<br />

everlasting topic. Working toge<strong>the</strong>r, we will create a truly<br />

connected world where people can have equal access to<br />

communications.<br />

Editor: Joy Zhou zhouhj@huawei.com<br />

FEB 2009 / Win-Win<br />

14

Tao of Business<br />

Internet puzzle<br />

How can operators solve it?<br />

Operators are in quite a predicament with value-added Internet services. By and large, <strong>the</strong>y are too big and<br />

slow on <strong>the</strong> uptake, not able to move as quickly as <strong>the</strong> small and lean development companies. Cooperation<br />

is <strong>the</strong>ir only option if <strong>the</strong>y want to thrive in this ever changing and progressive environment.<br />

By Kevin Lee from In-Stat<br />

After <strong>the</strong> rousing success of<br />

<strong>the</strong> iTunes model of “Device<br />

+ Connected Service”, Apple<br />

keeps playing to a full house<br />

around <strong>the</strong> world. One month<br />

after <strong>the</strong> service was launched,<br />

users of <strong>the</strong> Apple Store, <strong>the</strong><br />

a p p l i c a t i o n a n d s o f t w a re<br />

platform of iPhone, downloaded<br />

more than 60 million programs,<br />

generating a total of about<br />

USD30 million in sales (1 million dollars a day average).<br />

By <strong>the</strong> third quarter 2008, Apple sold 6.9 million<br />

iPhones, with sales of USD4.6 billion and became <strong>the</strong><br />

third largest handset maker in <strong>the</strong> world after Nokia and<br />

Samsung. A remarkable achievement considering <strong>the</strong>y did<br />

it by offering only two handset models.<br />

Also, 77% of iPhone users say that <strong>the</strong>y use more<br />

<strong>mobile</strong> Internet services than before due to having an<br />

iPhone; and among <strong>the</strong> top 10 services frequently used,<br />

six are <strong>mobile</strong> Internet applications. It is safe to say that<br />

iPhone is <strong>the</strong> frontrunner in <strong>the</strong> <strong>mobile</strong> Internet race with<br />

operators trailing behind.<br />

Evolution of Internet consumption<br />

When talking about <strong>mobile</strong> Internet services, it is<br />

important to understand <strong>the</strong> eco-system and <strong>the</strong> evolution<br />

of consumption patterns.<br />

Fragmentation of time: Most people have limited<br />

time and increasingly more content is trying to attract<br />

attention. The number of media types has grown from<br />

four in <strong>the</strong> 1980s to eighteen now. That is a lot of different<br />

media trying to capture <strong>the</strong> web surfer.<br />

Voluntary evolution: If you carefully study <strong>the</strong><br />

differences between telecom networks and Internet<br />

networks, you will find that <strong>the</strong> two types of networks<br />

are like “voluntary evolution” vs. “intelligent design”.<br />

The nature of <strong>the</strong> Internet resembles Darwin’s Theory of<br />

Evolution, which emphasizes <strong>the</strong> “survival of <strong>the</strong> fittest”,<br />

while <strong>the</strong> telecom environment is suitable for intelligent<br />

design.<br />

The Internet generally uses some basic tools like IP,<br />

HTML, XML, etc. for diversified terminal applications.<br />

Only a few applications will evolve on a large scale and <strong>the</strong><br />

speed of extinction is just as rapid as expansion. Voluntary<br />

evolution can be controlled by no one. It is characterized<br />

by progressive evolution, local evolution, a prosperity<br />

period and an outbreak period. O<strong>the</strong>r characteristics<br />

include: genetic drift, such as VoIP coming from IM;<br />

evolution under environmental pressures, for example,<br />

rich Internet content leads to <strong>the</strong> prevalence of search and<br />

community networks.<br />

Google clearly sees <strong>the</strong> life cycle of “born and die” on<br />

<strong>the</strong> Internet and encourages small engineering teams to<br />

develop new applications and test <strong>the</strong>m in <strong>the</strong> Google<br />

Labs. An application will graduate if it has sufficient users,<br />

or it will be left to die; survival of <strong>the</strong> fittest in action.<br />

Internet survival: The Internet has indisputably<br />

become <strong>the</strong> first media. This is particularly true along with<br />

<strong>the</strong> emergence of video sites, and users can find a lot of<br />

15<br />

Win-Win / FEB 2009

interesting video content on <strong>the</strong> Internet. Currently, more<br />

users are on <strong>the</strong> Internet than watching TV during prime<br />

time every day. It is no wonder that many professionals<br />

have an email complex. The first thing <strong>the</strong>y do at a place<br />

with a network connection is to check <strong>the</strong>ir emails.<br />

Grassroots: In <strong>the</strong> <strong>mobile</strong> Internet field, operators have<br />

limited strength. It is not viable for operators to depend<br />

on <strong>the</strong>ir own resources for innovation. True innovation<br />

comes from <strong>the</strong> grassroots and a large number of small<br />

companies. Currently, users are not satisfied with only<br />

getting content from <strong>the</strong> Internet. They produce content<br />

of <strong>the</strong>ir own; examples include <strong>the</strong> content, editing,<br />

ranking and reviews on some most popular video websites.<br />

Grassroots involvement pools <strong>the</strong> wisdom of ordinary<br />

Internet users. One example is Goldcorp, a mining<br />

company based in Toronto that was having trouble<br />

locating exploitable gold and launched <strong>the</strong> “Goldcorp<br />

Challenge”. Contestants found 110 possible mining<br />

claims, 50 percent of which had not been previously<br />

identified by <strong>the</strong> company. Over 80 percent of <strong>the</strong> new<br />

claims yielded substantial quantities of gold. In fact, since<br />

<strong>the</strong> challenge was initiated, an astounding eight million<br />

ounces of gold have been found.<br />

Social networking: Since Internet content is so rich,<br />

users ga<strong>the</strong>r as communities and conduct and interact on<br />

specific topics. This is <strong>the</strong> basis of <strong>the</strong> wildly-popular social<br />

networking. For instance, an active user of Facebook on<br />

average, stays in <strong>the</strong> community for over 3 hours, far more<br />

than <strong>the</strong> time he or she spends on traditional portals.<br />

Internet predicament<br />

The changes in Internet consumption modes have<br />

brought new challenges to operators. Operators have<br />

endeavored to take <strong>the</strong> lead in <strong>mobile</strong> Internet services, for<br />

example, proactive promotion of handset customization<br />

(from hardware, operating system to chipsets). However,<br />

operators have little control over terminals. Innovation<br />

and operation related to handsets are controlled by<br />

handset makers. The appearance of <strong>the</strong> iPhone remarkably<br />

improved <strong>the</strong> use of <strong>the</strong> <strong>mobile</strong> Internet for users, but<br />

operators do not have <strong>the</strong> ability to realize <strong>the</strong>ir ambitions.<br />

Most operators lack comprehensive knowledge of<br />

<strong>the</strong> Internet industry and <strong>the</strong> operation of <strong>the</strong> Internet<br />

industrial chain. Moreover, operators lack <strong>the</strong> ability to<br />

innovate and cannot offer standardized products to meet<br />

<strong>the</strong> needs of <strong>the</strong> majority of <strong>the</strong>ir subscribers. Customers<br />

place more importance on participation and information<br />

selection. Operators have to cope with <strong>the</strong> “Long Tail” of<br />

<strong>the</strong> Internet.<br />

In fact, <strong>the</strong> Internet usage habits are established and<br />

<strong>the</strong> emerging <strong>mobile</strong> Internet merely uses ano<strong>the</strong>r display<br />

and transmission pipe. Therefore, operators have to<br />

depend on cooperating with terminal manufacturers. For<br />

instance, China Mobile works with Samsung making<br />

custom terminals and even wants to launch its own<br />

handset operating system called <strong>the</strong> “Ophone”. In this<br />

environment, handset makers are given more power when<br />

negotiating with operators. Once handsets are in <strong>the</strong><br />

hands of consumers, <strong>the</strong> manufacturers can use <strong>the</strong>m to<br />

promote <strong>the</strong>ir own services, without paying attention to<br />

<strong>the</strong> operators, like <strong>the</strong> Apple Store does.<br />

On <strong>the</strong> o<strong>the</strong>r hand, operators have to take advantage of<br />

being <strong>the</strong> transmission pipe. Mobile operators dislike being<br />

called data pipes. While <strong>the</strong>y suspect that certain risks on<br />

<strong>the</strong> Internet will cause <strong>the</strong>m to only be data pipes, just<br />

providing <strong>the</strong> connection for handset users to access data<br />