Bharti Airtel - Huawei

Bharti Airtel - Huawei

Bharti Airtel - Huawei

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

11/2012<br />

Issue 14<br />

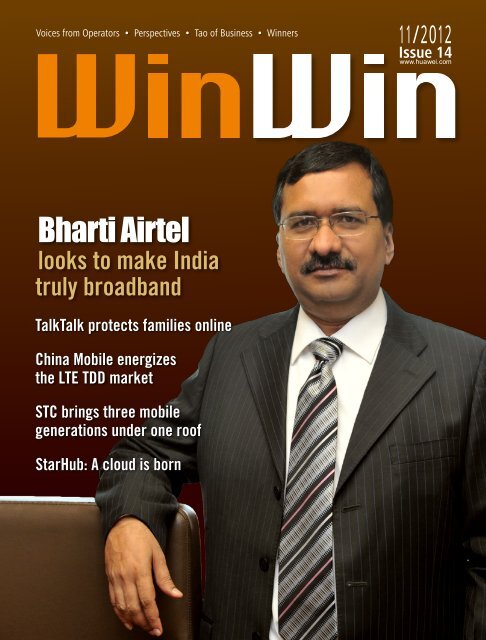

<strong>Bharti</strong> <strong>Airtel</strong><br />

looks to make India<br />

truly broadband<br />

TalkTalk protects families online<br />

China Mobile energizes<br />

the LTE TDD market<br />

STC brings three mobile<br />

generations under one roof<br />

StarHub: A cloud is born

Hear what operators want to share in person,<br />

see how peers succeed in a fierce marketplace,<br />

and delve into their secrets to success.<br />

At WinWin, it’s all about success.<br />

Sponsor<br />

<strong>Huawei</strong> Technologies Co., Ltd.<br />

Publisher<br />

<strong>Huawei</strong> COMMUNICATE Editorial Board<br />

Consultants<br />

Hu Houkun, Xu Zhijun, Ding Yun<br />

Yu Chengdong, Chen Wei<br />

Editor-in-Chief<br />

Gao Xianrui (sally@huawei.com)<br />

Editors<br />

Pearl Zhu, Xue Hua, Julia Yao, Jason Patterson<br />

Michael Huang, Joyce Fan, Linda Xu, Xu Ping<br />

Cao Zhihui, Li Xuefeng, Pan Tao<br />

Chen Yuhong, Zhou Shumin<br />

Contributors<br />

Deng Taihua, Qiu Heng, Yao Jiajian, Yu Xiangyang<br />

Zheng Yuanyuan, Liu Zhen, Yu Dan, Xu Caiming<br />

Izawa Michiko, Li Pengcheng, Cao Haichen<br />

Shi Tianlong, Lu Haomin<br />

E-mail: HWtech@huawei.com<br />

Tel: +86 755 28786665, 28787643<br />

Fax: +86 755 28788811<br />

Address: B1, <strong>Huawei</strong> Industrial Base,<br />

Bantian, Longgang, Shenzhen 518129, China<br />

Publication Registration No.:<br />

Yue B No.10148<br />

Copyright © <strong>Huawei</strong> Technologies Co., Ltd. 2012.<br />

All rights reserved.<br />

No part of this document may be reproduced or transmitted<br />

in any form or by any means without prior written consent of<br />

<strong>Huawei</strong> Technologies Co., Ltd.<br />

Disclaimer<br />

The contents of this document are for information purpose<br />

only, and provided “as is”. Except as required by applicable<br />

laws, no warranties of any kind, either express or implied,<br />

including but not limited to, the implied warranties of<br />

merchantability and fitness for a particular purpose, are made<br />

in relation to contents of this document. To the maximum<br />

extent permitted by applicable law, in no case shall <strong>Huawei</strong><br />

Technologies Co., Ltd be liable for any special, incidental,<br />

indirect, or consequential damages, or lost profits, business,<br />

revenue, data, goodwill or anticipated savings arising out of<br />

or in connection with any use of this document.<br />

ICT integration deepens<br />

OTT players have been encroaching on operators’ core services ever<br />

since Skype first went online, and their effect is ever growing, with users<br />

of WeChat (China’s answer to WhatsApp) passing 200 million this past<br />

September. A mobileSQUARED (a U.K. market research firm) 2011<br />

survey of 31 global mobile operators indicated that three-quarters of<br />

them were worried about losing revenue to these players, while onethird<br />

were already seeing declines in terms of both revenue and traffic.<br />

And what’s more, Google is no longer content to be just an OTT player,<br />

as the Internet giant recently started into the pipe business by launching<br />

a fiber network in Kansas City, which is claimed to offer broadband<br />

speeds “100 times faster than today’s broadband.”<br />

Needless to say, the lines are blurring as newcomers foray into telcos’<br />

core business domains, and their bottom lines will be even more affected<br />

as mobile Internet flourishes, networks transform to All-IP, smart<br />

terminals diversify, and personal computing gives way to the cloud, all<br />

of which represent a new phase of IT integration and development.<br />

Informatization is the name of the game, bringing telcos challenges and<br />

opportunities like never before.<br />

In the big data era, telcos should consolidate their network<br />

infrastructure and emphasize their pipes to the fullest, as neither<br />

industrial nor social development will advance without them. This<br />

means better planning and utilization of network resources, including<br />

copper, fiber, sites, and spectrum, and data centers, supplemented<br />

with the latest technologies. It also means the use of software-defined<br />

mechanisms that enhance intelligence at each network layer and shorten<br />

TTM so that operators can stay ahead of service providers of Internet<br />

and enterprise applications.<br />

Telcos should also fully utilize their scale and brand advantages in the<br />

ICT arena, so that they can actively promote and establish cooperative<br />

partnerships in the ICT industry, but this will require an open platform<br />

that fosters harmony in the ICT ecosystem.<br />

However, these steps alone will not determine who wins in the new<br />

value chain. Ultimately, it comes down to a superb user experience and<br />

who provides it. Telcos should be the ones filling this role, but this will<br />

require not just courage and determination but, more importantly,<br />

wisdom and vision.<br />

For electronic version and subscription,<br />

please visit www.huawei.com/winwin<br />

Bill Zhang<br />

President of Marketing & Solution<br />

Carrier Network Business Group

11/2012<br />

Issue 14<br />

WHAT’S<br />

INSIDE<br />

Voices from Operators<br />

01<br />

<strong>Bharti</strong> <strong>Airtel</strong> looks to make India<br />

“truly broadband”<br />

<strong>Bharti</strong> <strong>Airtel</strong> launched its LTE TDD<br />

services in April 2012, making it the first<br />

and only operator in India to utilize this<br />

technology. Considering the relatively<br />

undeveloped state of the local market, this<br />

move might seem premature, but not to<br />

Jagbir Singh, CTO & Director, Network<br />

Services Group, <strong>Airtel</strong> India & South Asia.<br />

06<br />

StarHub: A cloud is born<br />

Telcos play a large part in how new<br />

technologies play out, which makes their<br />

conspicuous absence from the ranks of cloud<br />

success stories all the more puzzling. Sunny<br />

Tan, Assistant Vice President of Enterprise<br />

Business Group – Solutions, StarHub, sits<br />

down with WinWin to discuss how the<br />

Singapore operator will remedy this.<br />

09<br />

NTT DOCOMO keeps Japan smart<br />

NTT DOCOMO is in the midst of<br />

enhancing its smartphone strategy,<br />

primarily by focusing on Android<br />

phones. Kiyohito Nagata, Senior Vice<br />

President and Member of the Board of<br />

Directors at NTT DOCOMO, discusses<br />

the company’s device strategy.

Perspectives<br />

13<br />

15<br />

On <strong>Huawei</strong>’s Pipe Strategy<br />

Cyber security perspectives<br />

Eric Xu, <strong>Huawei</strong> EVP: The pipe strategy<br />

is <strong>Huawei</strong>’s core, and the pipe business<br />

will remain our focus. As the digital flood<br />

approaches, we commit ourselves to<br />

enhanced pipe capacity, strengthened pipe<br />

enablers, and optimized pipe management,<br />

to deliver ever wider and more ubiquitous<br />

pipes, and an even better user experience.<br />

Winners<br />

35<br />

39<br />

TalkTalk provides online protection<br />

for families<br />

China Mobile energizes the LTE TDD<br />

market<br />

China Mobile has been a champion of LTE TDD<br />

in recent years, through efforts such as the LTE<br />

TDD service debut at the World Expo in Shanghai,<br />

and its trial network in Hangzhou city.<br />

17 LTE TDD goes mainstream<br />

Tao of Business<br />

23 <strong>Huawei</strong> knows LTE TDD inside & out<br />

43<br />

SoftBank’s LTE TDD network<br />

impresses in Japan<br />

At ten months after its launch, the SoftBank<br />

group’s LTE TDD network attracted more than<br />

260,000 customers, and this number will continue<br />

to grow as its coverage expands.<br />

27<br />

Monetizing the NBN: Strategies & services<br />

47<br />

China Telecom takes the drive out<br />

of testing in Hangzhou<br />

31<br />

Frenemies: How can telcos get a piece<br />

of the OTT pie?<br />

51<br />

STC brings three generations<br />

under one roof

VOICES<br />

FROM OPERATORS<br />

<strong>Bharti</strong> <strong>Airtel</strong> looks to<br />

make India “truly broadband”<br />

<strong>Bharti</strong> <strong>Airtel</strong> launched its LTE TDD services in April of this year over broadband wireless access (BWA)<br />

spectrum, making it the first and only operator in India to utilize this technology. Jagbir Singh (CTO<br />

& Director, Network Services Group, <strong>Airtel</strong> India & South Asia) recently sat down with WinWin to<br />

discuss the latest trends in the Indian telecom industry and how they have motivated the operator<br />

to press forward into LTE.<br />

By Jason Patterson<br />

A billion mobile users<br />

WinWin: What is the wireless technology roadmap<br />

for the Indian telecom sector?<br />

Singh: Presently, the Indian telecom sector is<br />

undergoing a major transformation. The last decade has<br />

seen an exponential growth of mobile users from a few<br />

million to near a billion today. This growth was driven<br />

by a latent demand for voice traffic. We are now moving<br />

from a voice-only network to a “voice also” network which<br />

will see huge consumption of data volumes, adoptions of<br />

new applications & content-rich services, and a bigger<br />

penetration of smartphones. Translating this to wireless<br />

technology, this will mean a service-aware network that<br />

is elastic for varying customer needs, and is flatter with<br />

highly-scalable backhaul capabilities.<br />

Given the spectrum pricing and the infrastructure<br />

required for backhaul, the roadmap for the Indian telecom<br />

sector is going to be a mix of technologies serving the<br />

varying needs of the customer. Scarcity of spectrum will<br />

cause a significant migration towards more localized<br />

networks such as femtocells, picos, and Wi-Fi. This will<br />

also require an infinitely expandable wired backhaul that<br />

feeds into the core network. The service providers will<br />

strive to serve the customer with the technology that is<br />

most spectrally efficient and that can adapt to the customer<br />

requirements. How to manage the seamless movement of<br />

customers across technologies is also another challenge<br />

that the industry will need to address.<br />

WinWin: In what ways do you think regulators can<br />

drive mobile broadband forward in India?<br />

Singh: The key requirements for mobile broadband<br />

are the availability of spectrum at affordable rates and<br />

the availability of backhaul infrastructure to carry large<br />

amounts of data traffic. Rational spectrum pricing &<br />

regulation simplicity for issues like ROW (Right of Way),<br />

as well as infrastructure sharing for both passive & active<br />

1<br />

NOV 2012

As the first operator to launch<br />

LTE TDD service in India, <strong>Bharti</strong><br />

<strong>Airtel</strong> is leading the way in<br />

bringing advanced technologies<br />

to developing countries in an<br />

affordable manner.<br />

— Jagbir Singh, CTO & Director, Network<br />

Services Group, <strong>Airtel</strong> India & South Asia<br />

NOV 2012<br />

2

VOICES<br />

FROM OPERATORS<br />

The Indian user is just getting to know the power of<br />

mobile broadband with the advent of 3G services. Given the limited<br />

spectrum available for 3G services in India, LTE TDD technology, which can<br />

utilize alternate spectrum, is an obvious way forward.<br />

elements, would be the key drivers for broadband growth.<br />

Laying and maintaining multi-terabyte fiber backhaul<br />

networks is a huge investment and is also inevitable. The<br />

stakeholders have yet to reach an agreement that can contain<br />

the costs in this area. Possibilities could include formation<br />

of consortiums similar to those existing in the international<br />

arena or formation of a government-funded subsidy similar<br />

to the Universal System Obligation Fund (an Indian mandate<br />

that levies telco revenues) for taking connectivity to upcountry<br />

locations. As far as ROW is concerned, there are no pan-<br />

India guidelines and every municipality and state government<br />

makes decisions for its own reasons. However, this impacts<br />

the national agenda of “connecting the unconnected,” so<br />

there is a need to consolidate the laws around ROW.<br />

WinWin: How would you envisage the mobile<br />

broadband landscape over the next 2-3 years in India?<br />

Singh: As per recently published results, mobile data<br />

traffic in India is up by 54 percent in the first half of 2012.<br />

With more than 100 million Internet users as of today, the<br />

growth of data consumption is going to be exponential<br />

both in terms of number of users and usage per customer.<br />

Also, the National Telecom Policy 2012 envisages<br />

“broadband for all” at a minimum download speed of<br />

2Mbps. With the way smartphone adoption, data usage,<br />

and app adoption trends are moving, it seems that very<br />

soon even 2Mbps is not going to be enough, especially for<br />

early adopters of technology in major cities.<br />

Ready or not for LTE?<br />

WinWin: As the market leader in India and the<br />

world’s fifth-largest carrier, how is <strong>Bharti</strong> <strong>Airtel</strong><br />

contributing to LTE TDD ecosystem development?<br />

Singh: We are a founding member and active<br />

participant in the GTI (Global TD-LTE Initiative)<br />

forum, through which we keep meeting and exchanging<br />

knowledge with our peers from across the globe. Also, as<br />

the first operator to launch the service in India, we are<br />

leading the way in bringing advanced technologies to<br />

developing countries in an affordable manner. We are also<br />

engaging with device and chip manufacturers to influence<br />

the availability of affordable devices for our customers.<br />

WinWin: How do you foresee LTE TDD developing<br />

on a global scale vis-à-vis LTE FDD?<br />

Singh: Globally, the choice of technology by operators<br />

is mainly governed by the relevance of technology with<br />

respect to spectrum availability. Since both FDD and<br />

TDD are at a very nascent stage of tech maturity, I believe<br />

that the respective geographies will drive the evolution<br />

of both FDD and TDD in parallel on a medium-term<br />

horizon.<br />

As of now, both the technologies seem to have gathered<br />

equal momentum and operators worldwide are selecting<br />

either of them based on the spectrum they manage to<br />

acquire and the overall ecosystem development in their<br />

country/region.<br />

WinWin: Given that 3G is still in its infancy in<br />

India, do you think the Indian market is ready for 4G?<br />

Singh: The GSMA predicts that by 2016 India will be<br />

the second largest wireless broadband market. This is not<br />

unnatural, as fixed broadband penetration is not good<br />

enough in India due to several factors like poor copper<br />

coverage, high cost of laying the infrastructure, etc. This<br />

pent up demand for data, especially in the youth and<br />

3<br />

NOV 2012

<strong>Airtel</strong> is placed at a very advantageous position by virtue of<br />

having a significant footprint in the wireline domain which most<br />

of the operators lack. LTE rollout would marry this footprint seamlessly<br />

into the greater wireless architecture.<br />

corporate segments, will be a big driver towards growth<br />

of data for a mobile broadband bearer. With a limited 3G<br />

spectrum, it is only natural that a more scalable option is<br />

explored that can seamlessly handle this growth.<br />

From a technology perspective, India has adopted<br />

3G a little later than the rest of the world, which has<br />

the advantage of creating a network with tried & tested<br />

technology. Also, 4G, as a technology, is rapidly being<br />

adopted in other markets and has obvious advantages<br />

of efficiency and scale. Also, like I mentioned earlier, all<br />

the technologies will have to coexist to enhance spectral<br />

efficiency.<br />

An uphill climb<br />

WinWin: How will <strong>Bharti</strong> balance/prioritize 3G and<br />

BWA (LTE TDD) network investment in the short-tomedium-term?<br />

Singh: In the recent past, India has been moving<br />

very fast on the digitization curve; this fact highlights<br />

the growth potential for data services, especially mobile<br />

broadband services. The Indian user is just getting to<br />

know the power of mobile broadband with the advent of<br />

3G services. Given the limited spectrum available for 3G<br />

services in India, LTE TDD technology, which can utilize<br />

alternate spectrum, is an obvious way forward.<br />

LTE TDD, as a technology, is not as mature as 3G and<br />

to tap the full potential of this technology, it makes sense<br />

to start deploying it in a controlled manner, not only to<br />

validate the capabilities, but also to influence the evolution<br />

path which is suited to growing markets like India. With<br />

increasing urbanization and mobility in metropolitan<br />

areas, very soon even the typical 3G speeds will not suffice.<br />

We plan to create a layered architecture in the metros with<br />

coexistent 2G-3G-LTE-Wi-Fi mesh networks.<br />

WinWin: What has been <strong>Bharti</strong> <strong>Airtel</strong>’s strategy on<br />

the LTE TDD network rollout front?<br />

Singh: LTE is one of the cornerstones when it comes to<br />

true convergence of network architecture and topology, the<br />

best of both wireless and wireline architecture, and a flatter<br />

and more scalable transport network with ubiquitous radio<br />

coverage augmented by a focused microcell mesh that<br />

pushes the limits of the network closer to the user.<br />

<strong>Airtel</strong> is placed at a very advantageous position by virtue<br />

of having a significant footprint in the wireline domain<br />

which most of the operators lack. LTE rollout would<br />

marry this footprint seamlessly into the greater wireless<br />

architecture, thereby creating a world class network<br />

capable of providing a “truly broadband” user experience.<br />

WinWin: What key challenges have <strong>Bharti</strong> <strong>Airtel</strong><br />

encountered in network rollout and how has it tackled<br />

them?<br />

Singh: Readiness and maturity in a robust product line<br />

for LTE TDD is the foremost challenge at present. This<br />

fact, coupled with a lack of available devices and challenges<br />

around ROW for scalable backhaul architecture, are some<br />

issues that we continue to face as we expand our LTE<br />

rollout.<br />

As is the case with any new technology, the learning<br />

curve is very steep and the pace of innovation has<br />

increased dramatically in the last decade. LTE is being<br />

launched globally in several spectra and FDD/TDD<br />

versions; add to this the complexity of coexistent 2G, 3G<br />

and Wi-Fi networks, and you have a continuously evolving<br />

technology landscape, which is a challenge in itself,<br />

NOV 2012<br />

4

VOICES<br />

FROM OPERATORS<br />

The future of telecommunication is data and LTE TDD is an investment<br />

in that direction. We are fully convinced that the growth in data is bound to<br />

happen and this platform is an enabler for data to take off in a big way.<br />

especially when augmenting a new technology onto a live<br />

network, because you don’t want to disrupt the existing<br />

services.<br />

We underwent detailed interoperability tests in order<br />

to ensure minimal glitches in the launch of 4G services<br />

and smooth integration with the existing network. From<br />

an infrastructure point of view, the rollout so far has been<br />

relatively less challenging as compared to the greenfield rollout<br />

of 2G since most of our initial 4G sites were co-located with<br />

existing sites. However, the launch of LTE needed a complete<br />

upgrade and modernization of the backhaul system, which<br />

meant laying new fiber in the cities and creating more sites to<br />

support microcell layer architecture.<br />

WinWin: What lessons/experiences from 3G service<br />

development have <strong>Bharti</strong> <strong>Airtel</strong> found relevant for<br />

promoting LTE services?<br />

Singh: Making a heterogeneous network scale, interoperate,<br />

and deliver the requisite quality of service is a<br />

great experience we have picked up from our 3G launch.<br />

We have learned how to connect and manage network<br />

elements that cut across a wide range of technologies,<br />

manufacturers, and standards. Handling a disproportionate<br />

amount of data traffic growth is also a good problem<br />

to have when it comes to creating a mobile broadband<br />

network.<br />

These lessons will go a long way in establishing a<br />

4G network footprint that is service-aware, seamlessly<br />

managed across vendor ecosystems, and scalable to handle<br />

the data explosion which is about to hit India.<br />

From a business perspective, after the launch of<br />

3G services, the industry has been facing a “multiterabit<br />

challenge” in which revenues are not growing<br />

proportionately with traffic, unlike what used to happen<br />

in the voice business. While the revenues don’t increase<br />

proportionately, the spectrum requirement is proportional<br />

to the data growth and becomes very expensive.<br />

Another critical aspect on which we are working with<br />

the regulators and government agencies is the ROW<br />

permissions for laying fiber in the cities. Without a robust<br />

and scalable backhaul infrastructure, it will not be possible<br />

to deliver the speeds that the customers expect when they<br />

adopt technologies like LTE.<br />

WinWin: How does <strong>Bharti</strong> <strong>Airtel</strong> position its LTE<br />

service and what will be the key factors driving LTE<br />

uptake in the country?<br />

Singh: The future of telecommunication is data and<br />

this is an investment in that direction. We are fully<br />

convinced that the growth in data is bound to happen and<br />

this platform is an enabler for data to take off in a big way.<br />

As of now, we are delivering 4G services via CPE<br />

(customer premises equipment) and dongle. Apart from<br />

the availability of the service, the other important factors<br />

that will drive 4G uptake in the country are the content<br />

and device ecosystem.<br />

WinWin: How would you evaluate <strong>Huawei</strong>’s skills as<br />

a vendor and as a partner for BWA (LTE TDD) network<br />

rollout?<br />

Singh: <strong>Huawei</strong> has been our partner in launching 3G<br />

and then 4G in Bangalore and I would say that overall,<br />

the experience has been quite satisfactory. <strong>Airtel</strong> has also<br />

awarded <strong>Huawei</strong> projects for building a nationwide highcapacity<br />

expressway. In addition to this, <strong>Huawei</strong> has also<br />

supplied packet core for our network. I would rate my overall<br />

experience of working with <strong>Huawei</strong> as satisfactory.<br />

Editor: Gao Xianrui sally.gao@huawei.com<br />

5<br />

NOV 2012

StarHub: A cloud is born<br />

Telcos play a large part in how new technologies play out, which makes their conspicuous absence<br />

from the ranks of cloud success stories all the more puzzling. “How did we let a bookseller corner the<br />

market?” asks Sunny Tan, Assistant Vice President of Enterprise Business Group – Solutions, StarHub<br />

(Singapore’s second-largest info-communications operator) and the head of its business solutions.<br />

By Julia Yao<br />

Better late than never<br />

Nobody who reads this magazine needs to be<br />

reminded of the promise of cloud computing,<br />

and yet, the key names in cloud computing<br />

presently are either Internet or IT firms, not<br />

telcos. Amazon Web Services hosts some of the world’s<br />

most prominent sites, such as Netflix, Farmville, and<br />

Foursquare, and its cloud service revenue is poised to top<br />

USD1 billion in 2012, according to IDC.<br />

So how did telcos miss the boat? Tan attributes this to<br />

cultural barriers and a lack of profit pressure during the<br />

key window of opportunity ten years ago. “Telcos used<br />

to have a quite handsome profit margin in the traditional<br />

businesses. Added to that is the cultural difference (telcos<br />

are slower to act than Internet companies) in a highly<br />

regulated market. So, the majority of telcos didn’t really<br />

think innovatively enough to enter this market,” he says.<br />

As an IT veteran, he has discovered that the skill sets in<br />

the IT and telco worlds are different. “It’s almost like<br />

talking a different language.”<br />

However, despite this, he is very upbeat about the<br />

competitive advantage that the telco industry enjoys. “Our<br />

network touches everything. We telcos are in the center of the<br />

connectivity space, without which a lot of the cloud services<br />

wouldn’t exist today. SLA is our DNA. For wide adoption of<br />

cloud, whether by consumers or enterprises, you really need<br />

to have carrier-grade reliability. Besides, we have multiple<br />

customer service and support touchpoints. Finally, we have<br />

the billing relationships and aggregator abilities… for ISVs<br />

(Independent Software Vendors), this is one clear advantage<br />

when working with a telco. A lot of ISVs cannot simply scale<br />

if they do not partner with someone like a telco and enter<br />

into a billing relationship with the customers.”<br />

Sunny Tan, Assistant Vice President of<br />

Enterprise Business Group - Solutions (StarHub)<br />

NOV 2012<br />

6

VOICES<br />

FROM OPERATORS<br />

Our network touches everything. We telcos are in<br />

the center of the connectivity space, without which a lot of<br />

the cloud services wouldn’t exist today. SLA is our DNA.<br />

Opportunity arises<br />

StarHub is a quadruple-play carrier that operates<br />

solely in Singapore, where two-thirds of its business is<br />

in the consumer space. Compared with the incumbent,<br />

StarHub previously had limited fixed access to commercial<br />

buildings, greatly hindering its enterprise business. But<br />

in 2010, an opportunity arose in the form of Singapore’s<br />

Next-Generation Nationwide Broadband Network<br />

(NGNBN), which has the laudable goal of wiring the<br />

city-state with ultra high-speed broadband access of up to<br />

1Gbps. Fiber rollout is scheduled to reach 95% coverage<br />

by mid-2012. For businesses, this means choice, reduced<br />

costs, and increased redundancy. For StarHub, it “levels<br />

the playing field for us. We can have complete coverage<br />

and access a bigger pool of customers, particularly business<br />

customers.” With this impressive leap in bandwidth,<br />

StarHub started to provide more data-heavy services, such<br />

as telepresence and cloud computing. “We actually timed<br />

the launch of our cloud computing initiatives until the<br />

NGNBN was in the midst of rollout because you simply<br />

cannot run a lot of cloud services on ADSL.”<br />

For StarHub, the decision to enter the cloud was more<br />

evolution than revolution. “It was a natural extension<br />

of our data center business. We already had the space,<br />

the facility; we knew how to build data centers and<br />

redundancy. We saw a lot of telco-IT convergence; in<br />

terms of customer purchase behavior, they wanted to buy<br />

solutions from us instead of hardware and connectivity<br />

separately. StarHub is a local trusted brand in Singapore.<br />

Especially in the SMB space, familiarity with the brand is<br />

very important. We have found that many customers are<br />

actually coming to us, asking for SaaS applications as well<br />

as infrastructure as a service (IaaS).” One ingredient in<br />

StarHub’s recipe for consumer success is what the operator<br />

calls “hubbing” (service combination). “By bundling<br />

connectivity, IT services, and SaaS, we are adding a<br />

differentiator via cloud hubbing.”<br />

Getting started<br />

StarHub took its first steps into the cloud in 2010<br />

through the offering of SaaS solutions, including<br />

accounting, HRM, and sales systems delivered through<br />

a utility model to small businesses (SBs) and small-tomedium<br />

businesses (SMBs). “Our success was OK, not<br />

fantastic. We knew here was still room for improvement,<br />

for example, an email/collaboration suite which would<br />

be the central identity of the user.” StarHub beefed up<br />

its portfolio later with the necessary security elements, so<br />

that its customers could sleep easier. Education was also<br />

necessary to win over the uninitiated. “We went through a<br />

lot of trouble explaining to SBs and SMBs, especially those<br />

that were not very familiar with IT, what cloud computing<br />

was and how they could benefit.”<br />

StarHub reached a milestone in 2011 when it entered<br />

into a syndication partnership with Microsoft that allows<br />

the operator to bundle Office 365 with its enterprise<br />

broadband services, Microsoft’s second such partnership<br />

in Asia. “This is a key step for us, because it allowed us to<br />

provide a very important piece called Office 365. In a lot<br />

of cloud service brokerage models, one of the critical pieces<br />

is the email collaboration portion. This is clearly the first<br />

piece any small business or even a mid-market business<br />

will ask for when they go into a cloud.”<br />

The market takeup for this caught Tan and his team by<br />

surprise. “Even though we targeted the product at SMBs<br />

initially, a fair number of customers are in the larger midmarkets.<br />

For example, a well-known hospitality and resort<br />

chain headquartered in Singapore, with operations all over<br />

the world, actually deployed Office 365 throughout the<br />

Asia-Pacific, covering multiple resorts and hotels.” Tan is<br />

7<br />

NOV 2012

more excited about the new business opportunities this<br />

application signifies. “When the hotel HQ’s purchasing<br />

decision is done in Singapore, we are in a good position<br />

to provide services to the entire footprint that they have.<br />

Only cloud enables us to do this… without cloud, we will<br />

not be able to sell software, for example, to overseas markets.<br />

So this is also changing how we address our market.”<br />

The public cloud is advancing<br />

StarHub’s pursuit in the cloud space has not stopped at<br />

SaaS. In February 2012, StarHub, in collaboration with<br />

<strong>Huawei</strong>, made a big step into the public cloud space by<br />

launching their public IaaS cloud, branded as Argonar.<br />

When asked about this name, Tan explained that the<br />

element Argon glows green when ignited, rather like the<br />

StarHub theme color. Argonar offers on-demand scalability<br />

in computing and storage with carrier-grade connectivity.<br />

“Thanks to the collaboration with <strong>Huawei</strong>, we now have<br />

a highly-scalable public IaaS cloud suitable for all sorts of<br />

cloud computing purposes. Combined with telco’s reliable<br />

network connectivity and security, a lot of customers will<br />

find it very advantageous to host mission critical services<br />

with Argonar,” Tan adds confidently.<br />

The service is primarily targeted at the SBs and SMBs,<br />

allowing them to manage their computer resources with<br />

ease without the hefty costs of infrastructure. While this<br />

may sound familiar to anyone who has been exposed to<br />

the hype of cloud computing, StarHub has added a telco<br />

flavor to the service through innovative billing. “One way<br />

to sell cloud services is that you go on a pure utility model<br />

in which customers bill for every resource they use.”<br />

Through experience and extensive interaction with some of<br />

the customers and potential customers, StarHub found that<br />

customers were not quite sure how much they would consume.<br />

In fact, they were quite worried that the cloud would end up<br />

costing more than traditional leasing or acquisition of hardware.<br />

“So we decided that, while retaining some flexibility<br />

in the utility model, we would use tiered plans similar to<br />

mobile phone plans… for example, we have plans such as<br />

744 computing units per month, which roughly translates<br />

to a certain number of services running continuously for<br />

24/7. IT managers would roughly know their normal<br />

consumption, and pick the suitable tier. In case of a surge<br />

in demand, they can subscribe to a turbo plan and pay<br />

more for the excessive usage (similar to what a mobile<br />

phone user would do).” This billing model has proven very<br />

popular with customers. “It’s quite unique in the Singapore<br />

market. For now, at least,” Tan adds with a smile.<br />

Looking back at the public cloud journey, Tan feels very<br />

fortunate to have had <strong>Huawei</strong> as a partner. As StarHub is<br />

relatively new to the cloud, it was beneficial to have <strong>Huawei</strong>’s<br />

support throughout the more than one-year journey from<br />

preliminary business case validation to implementation to<br />

post-launch marketing consultation. “<strong>Huawei</strong> worked with us<br />

closely to develop the cloud infrastructure as well as our goto-market<br />

strategy. As every operator is different, so is every<br />

market and segment. We wanted to have a system that is not<br />

too simple so that we can respond to certain demands; we<br />

also didn’t want a system that is overly complex that would<br />

drive up the costs. We eventually ended up with a system that<br />

was just right… one thing that we were particularly happy<br />

about was that <strong>Huawei</strong> was accommodating to changes.<br />

As we learned more about the market, we decided to make<br />

certain tweaks to our business model, which actually required<br />

<strong>Huawei</strong> to change a fair bit, in terms of implementation of<br />

the cloud. We are quite happy that this was done very quickly<br />

and nicely. As a result, we were able to launch a product<br />

which met all our requirements.”<br />

More to come<br />

So what’s next for StarHub? “<strong>Huawei</strong> has a very advanced<br />

roadmap in enhancing (public cloud) services. We will be<br />

working with <strong>Huawei</strong> on the enhancements, particularly on<br />

storage as a service, through the second half of the year…<br />

our customers can also expect more exciting SaaS solutions<br />

targeted at verticals in both SMBs and enterprise base.”<br />

Looking at the big picture, Singapore has proven<br />

very receptive to cloud computing. The government has<br />

been advocating cloud computing’s expected boost to<br />

productivity, and formulated a strategy as part of a wider<br />

effort under Singapore’s new e-Government masterplan<br />

(eGov2015). “We were recently selected to be one of the<br />

public service providers for the Singapore government.<br />

That actually requires us, together with <strong>Huawei</strong>, to<br />

go beyond the quality requirements and respond to<br />

clarification requirements of the Singapore government.”<br />

Tan concludes with lessons learned that he would like to<br />

share with fellow telcos. “Know your customers and routes<br />

to market. We focused on particular segments and sizes<br />

of customers. So when we built our cloud services, they<br />

were really for particular use. There is really no “one size<br />

fits all.” We didn’t want to launch a cloud with enterprise<br />

VM-based kinds of offerings. We wanted something that is<br />

open, scalable, and ISV-friendly. Also worthy to note is that<br />

cloud offers the telcos long-tail profit. In a cloud brokerage<br />

model, you can have one app in your platform as SaaS and<br />

it’s still profitable for you as a telco. Don’t miss the long-tail<br />

opportunities.” One final note he adds, “Although it is not<br />

the early days, it is not yet too late.”<br />

Editor: Jason jason.patterson@huawei.com<br />

NOV 2012<br />

8

VOICES<br />

FROM OPERATORS<br />

NTT DOCOMO<br />

keeps Japan smart<br />

Japan’s smartphone market is expanding rapidly. Users open to new things have adopted<br />

smartphones, and operators are finding ways to make users of feature phones join them. NTT<br />

DOCOMO is in the midst of enhancing its smartphone strategy, primarily by focusing on Android<br />

phones. Kiyohito Nagata, Senior Vice President and Member of the Board of Directors at NTT<br />

DOCOMO, discusses the company’s device strategy.<br />

By Pan Jiesun<br />

A smartphone market in flux<br />

Smartphones have developed rapidly in Japan, with<br />

sales volumes far exceeding operators’ expectations.<br />

As a leading player in the industry, NTT<br />

DOCOMO planned to sell six million smartphones<br />

in 2011, but ended up selling more than eight million.<br />

Nagata noted, “While our sales volume of smartphones<br />

far exceeds expectations, the growth of sales volume is<br />

normalizing. It will become very difficult to maintain this<br />

annual growth rate in the future. Smartphones have been<br />

very popular among innovators and early adopters. In the<br />

future, it is imperative to expand user groups.”<br />

To this end, NTT DOCOMO has adopted a strategy<br />

oriented around particular lineups. In 2011, the company<br />

divided smartphones into the NEXT and with series, to<br />

clearly distinguish target users, high-end and mid-range,<br />

respectively. Nagata admitted that “some may prefer the<br />

idea of meeting all user requirements with one product,<br />

but we think otherwise. To attract mainstream users,<br />

NTT DOCOMO launched the with series. Apart from<br />

functions and specifications, smartphones should integrate<br />

emotional and fashionable elements, and I believe users<br />

will love this direction.”<br />

In the feature phone era, NTT DOCOMO divided its<br />

products into five series targeted at different user categories,<br />

and this sort of strategic segmentation has continued into the<br />

smartphone era, allowing users to choose the model that is<br />

right for them. Although smartphones introduced by outside<br />

vendors swelled the Japanese market for some time, this<br />

wave eventually receded, as most recent bestsellers have been<br />

domestic. These models integrate features rare outside Japan,<br />

such as e-wallet, 1 SEG (a Japanese mobile TV service), and<br />

infrared communications. And while the advanced state of the<br />

Japanese market certainly puts it in Japanese vendors’ favor,<br />

Nagata argues that “overseas vendors share the same competitive<br />

environment with their Japanese counterparts. Indeed, the<br />

recent market situation provides many opportunities for<br />

Japanese vendors. However, in the era of i-mode (launched in<br />

1999), vendors only needed to develop products according to<br />

Japanese users’ requirements, while in the era of smartphones,<br />

they must adopt global basic technologies as a basis and try<br />

to add relevant functions. In this sense, overseas vendors with<br />

global technologies now have more opportunities in Japan.”<br />

NTT DOCOMO has been working with both Japanese<br />

and overseas cell phone vendors; speed and cost are what<br />

is expected from the latter. In Nagata’s view, most Japanese<br />

vendors are not competitive internationally, as they are<br />

losing their vitality, while overseas vendors’ comprehensive<br />

strength looks more attractive to operators. “Overseas<br />

vendors hold absolute advantages in resource allocation.<br />

In terms of sales volume alone, overseas vendors have<br />

outstanding cost competitiveness and strong fundamentals<br />

in terms of development capabilities.”<br />

In other words, the global vendors have an edge in being<br />

9<br />

NOV 2012

Some may prefer the idea of<br />

meeting all user requirements<br />

with one product, but we think<br />

otherwise. Apart from functions and<br />

specifications, smartphones should<br />

integrate emotional and fashionable<br />

elements, and I believe users will<br />

love this direction.<br />

— Kiyohito Nagata, Senior Vice President and<br />

Member of the Board of Directors at NTT DOCOMO<br />

NOV 2012<br />

10

VOICES<br />

FROM OPERATORS<br />

In the globalized market, what is important is how many high-end<br />

products a manufacturer makes and sells. Smartphones are a brand-new product<br />

category, where experience counts.<br />

able to utilize the industry’s fundamental technologies to<br />

develop and customize their products, even in a highly<br />

diversified marketplace, while Japanese vendors hold the<br />

advantage in terms of customization for the local market,<br />

but they have weaknesses in terms of cost and development<br />

capability. Nonetheless, Nagata deems it meaningless to<br />

distinguish vendors by nationality. “This is no longer about<br />

the difference between Japanese vendors and overseas<br />

vendors; rather, the difference lies in whether they see a<br />

global market or not.” Nagata added that in the future, cell<br />

phone vendors should focus on R&D capability, develop<br />

fundamental technologies that can be applied worldwide,<br />

and add localized elements as needed. This last element<br />

might require the same amount of investment from both the<br />

overseas and Japanese vendors, so the key to competition lies<br />

in boosting cost competitiveness in the basic technologies.<br />

Experience counts with smartphones<br />

In the Japanese market, users expect the best, and they<br />

purchase products from Japanese vendors believing that<br />

they are so. However, Nagata thinks that this belief does<br />

not extend to smartphones. “We can no longer assume<br />

that Japanese products are high-quality while those from<br />

overseas vendors are poor. In the globalized market, what is<br />

important is how many high-end products a manufacturer<br />

makes and sells. Smartphones are a brand-new product<br />

category, where experience counts.”<br />

Nagata would go on to note that the Japanese are<br />

expected to be demanding when it comes to quality, and<br />

yet in other developed countries, requirements for highend<br />

smartphones are also very high. In Nagata’s opinion,<br />

smartphones are a high-end product, so manufacturing<br />

skills determine quality; vendors that take the lead and<br />

develop new products in the global market and have a lot<br />

of experience in mass production can manufacture highquality<br />

smartphones more easily.<br />

Another potential challenge for overseas vendors is the fact<br />

that the Japanese are highly brand-conscious. In Nagata’s view,<br />

it is difficult for overseas vendors to build brands in Japan, but<br />

there are still ample opportunities. In the past, when Japanese<br />

vendors were focused solely on phones intended for use only<br />

in Japan, some overseas vendors launched cell phones with<br />

GSM roaming functions, while others rolled out low-priced<br />

phones to compete while the terminal prices of the Japanese<br />

products remained high. Those overseas vendors succeeded<br />

in boosting brand awareness and overcame the barriers in<br />

branding by emphasizing unique advantages. Nagata notes<br />

that “building a brand is indeed no easy job. However, in<br />

the last few years, overseas vendors have successfully built<br />

some brand awareness in Japan. By continuing to provide<br />

outstanding products, they have been embraced by the<br />

Japanese market. Compared with before, the Japanese are<br />

now more receptive to overseas brands.”<br />

At present, the Japanese market is basically saturated;<br />

new subscribers will not grow sharply. At this point, the<br />

opportunity for overseas vendors is to provide products<br />

with a unique personality that other companies do not<br />

offer. In other words, Japanese consumers are looking for<br />

something different.<br />

<strong>Huawei</strong> has withstood globalization<br />

<strong>Huawei</strong> is gaining a foothold in NTT DOCOMO’s<br />

product lineup thanks to the personality reflected in its<br />

products. <strong>Huawei</strong> started providing digital photo frames<br />

for NTT DOCOMO in December 2009, and unveiled the<br />

HW-02C handset for children in September 2011, which<br />

offered simple and limited functionality as well as increased<br />

security. According to Nagata, “In the area of devices<br />

11<br />

NOV 2012

In the area of devices oriented towards children, although NTT DOCOMO<br />

is a latecomer, with <strong>Huawei</strong>’s help, it is able to roll out products of satisfactory<br />

quality, color, and size at preferential prices, with excellent results.<br />

required by us at the cost agreed upon, eventually becoming<br />

our trusted partner. <strong>Huawei</strong> leads the world in cost and<br />

R&D cycle. It has many impressive methods, such as those<br />

for adding development resources, and in the use of human<br />

resources, that have stood the tests of globalization.”<br />

Looking forward to <strong>Huawei</strong>’s next hit<br />

HW-02C, handset for children<br />

oriented towards children, although NTT DOCOMO is<br />

a latecomer, with <strong>Huawei</strong>’s help, NTT DOCOMO is able<br />

to roll out products of satisfactory quality, color, and size at<br />

preferential prices. The products are highly competitive in<br />

sales, with excellent results.”<br />

Nagata would also add that “at first we were not totally<br />

confident as <strong>Huawei</strong> was a relatively new company in the<br />

Japanese market, but the results proved we made the right<br />

decision.” By partnering with <strong>Huawei</strong>, “We were able to<br />

reduce the overall cost to the point where it would be difficult<br />

to achieve it with our traditional partners. This enabled us to<br />

offer our services at a price embraced by customers.”<br />

“When introducing premier offerings, NTT DOCOMO<br />

teams up with <strong>Huawei</strong> to provide quality functionality. When<br />

rolling out a service that holds no particular advantage<br />

at the moment, NTT DOCOMO utilizes <strong>Huawei</strong>’s fast<br />

development model, resulting in net increases in subscribers<br />

and contributions to the growth of sales revenue.”<br />

When speaking of the partnership between NTT<br />

DOCOMO and <strong>Huawei</strong>, Nagata noted that “despite<br />

differences between the two sides in terms of development<br />

philosophy and language, <strong>Huawei</strong> provided the quality<br />

Now, NTT DOCOMO is pivoting towards its LTE<br />

business under the Xi (crossy) brand name. “Compared<br />

with other companies, NTT DOCOMO introduced LTE<br />

smoothly. This is our advantage. Users will understand<br />

LTE’s unparalleled speed of Internet access once they<br />

experience it. We are stepping up publicity of Xi as a<br />

flagship offering. DOCOMO is aiming to achieve 40<br />

million smartphone subscribers by FY2015, and this will<br />

expedite the expansion of the Xi product lineup.”<br />

At CES 2012, <strong>Huawei</strong> unveiled the Ascend P1s, then<br />

the world’s thinnest smartphone at only 6.68mm thick,<br />

as well as a selection of LTE models. At the event, Nagata<br />

was deeply impressed by the Ascend P1s. “The attitude<br />

of fighting to reduce a mere 0.1 mm shows <strong>Huawei</strong>’s<br />

enterprising spirit. <strong>Huawei</strong> understands what it should do<br />

in the world market and puts it into practice. A latecomer as<br />

it is, <strong>Huawei</strong> is very competitive in the smartphone market.<br />

What comments and support the Ascend series will receive<br />

around the world are very much worthy of expectation.”<br />

As for <strong>Huawei</strong>’s future development, Kiyohito Nagata is<br />

looking forward to any “surprising products” it might offer.<br />

“The surprise may come from the creative way that <strong>Huawei</strong><br />

incorporates our requirements for the services we provide in<br />

Japan into its global models, or in the form of a thoroughly<br />

customized model for the Japanese market. Either way, we<br />

are looking forward to a big surprise from <strong>Huawei</strong>.”<br />

Editor: Gao Xianrui sally.gao@huawei.com<br />

NOV 2012<br />

12

Perspectives<br />

On <strong>Huawei</strong>’s Pipe Strategy<br />

Everything that we do will be about making the pipe wider in itself<br />

and ubiquitous in its coverage, so that both our customers and ourselves have<br />

greater market opportunities to seize.<br />

By Eric Xu, Executive Vice President, <strong>Huawei</strong><br />

C<br />

ompanies choose to position themselves<br />

differently in the global ICT (Information<br />

and Communications Technology) ecosystem.<br />

Some focus on chips, some on basic software,<br />

some on consumer devices, some on content, and others<br />

on service operation. <strong>Huawei</strong>, however, chooses to focus<br />

on the pipe, which will direct the development and<br />

consolidation of all our businesses.<br />

And by pipe we mean a digital pipe system for carrying<br />

information, oriented by technology and sector (the<br />

ICT sector). China’s water system makes for an effective<br />

analogy. Network devices such as mobile phones can be<br />

thought of as the taps. When a tap is open, water flows<br />

through, with information generated and consumed.<br />

Enterprise networks are like the tributaries or urban water<br />

supply systems, while enterprise data centers function as<br />

reservoirs. If these intermediate waterways are broad and<br />

uncluttered, more water can be channeled into the main<br />

pipe, enabling more information exchange and aiding the<br />

proliferation of information technologies in the business<br />

world. Mobile and fixed broadband networks (MBB and<br />

FBB) are the principal rivers, like the Yellow and Yangtze,<br />

while data center solutions function as flood basins such as<br />

Dongting Lake. And finally, the backbone network is the<br />

Pacific Ocean, processing and transmitting information<br />

that flows in from tributaries. Together, these elements<br />

form a complete pipeline that encompasses the generation,<br />

aggregation, transmission, and switching of information,<br />

all the way to an “Information Pacific.” In this system,<br />

the services business also takes a part as they help manage,<br />

maintain, and optimize the pipe network so that it runs<br />

smoothly.<br />

IP Video and SDP (Service Delivery Platform) are<br />

enabling platforms that help customers generate revenue<br />

from their information pipes, while BSS (Business Support<br />

System) facilitates pipe operation and service billing.<br />

Network power systems get the flow started and keep<br />

it moving. All have a role to play in this pipe network,<br />

making it easier to manage and use so that customers<br />

enjoy enhanced revenue.<br />

<strong>Huawei</strong> will focus unswervingly on the pipe. It is our<br />

primary area of future investment. Some investments<br />

will be made in products and solutions that enlarge<br />

it, and support its effective billing, management, and<br />

maintenance. We will not, however, invest in the content<br />

itself (the water within the pipe).<br />

At <strong>Huawei</strong>, we endorse the idea of “broadband for all.”<br />

We are working towards a zero-wait customer experience<br />

that features high bandwidth and service diversity. We also<br />

actively support and participate in the cloud and M2M<br />

ecosystem. Everything that we do will be about making<br />

the pipe wider in itself and ubiquitous in its coverage, so<br />

that both our customers and ourselves have greater market<br />

opportunities to seize.<br />

<strong>Huawei</strong>’s pipe strategy is a focused one. For consumers,<br />

we only provide network devices that generate and<br />

consume traffic; non-networked electronics are not our<br />

business. For enterprises and industry verticals, we focus<br />

on ICT infrastructure and position ourselves as a product<br />

provider; we will not develop industry-specific application<br />

software. For carrier networks, our focus is architecture,<br />

from end to end, so that a high-caliber pipe that channels<br />

surging traffic is achieved. The objective of carrier network<br />

solutions is to deliver a zero-wait experience with high<br />

bandwidth and diverse services.<br />

<strong>Huawei</strong> has established three different business groups<br />

(BGs) to provide ICT solutions to different customer<br />

segments – carriers, enterprises/industries, and consumers.<br />

However, network devices, enterprise networks, carrier<br />

networks, and data center solutions are closely linked and<br />

complement one another. Also, technologies used across<br />

segments are vertically integrated and can all be traced to the<br />

same origin, the digital logic design. Wireless technologies<br />

are used for both base stations on carrier networks and<br />

13<br />

NOV 2012

<strong>Huawei</strong> will focus unswervingly on the pipe.<br />

It is our primary area of future investment. We will not, however,<br />

invest in the content itself (the water within the pipe).<br />

handsets used by consumers, while IT technologies are<br />

applied to both enterprise servers and specialized equipment<br />

(e.g., MSC and HLR) on carrier networks. The integration<br />

and sharing of technologies makes it possible for us to<br />

deliver more competitive products and solutions to each<br />

of the three customer segments, at a higher return on<br />

investment and lower cost. From this perspective, there are<br />

two driving forces that fuel our company’s development.<br />

One is customer need, which lies at the core of every<br />

solution that we deliver, thus moving our company forward;<br />

the other is technology, in that constant technical evolution<br />

brings a better experience and lower cost, propelling the<br />

industry ahead. These two drivers are interdependent and<br />

complementary; neither can be ignored.<br />

<strong>Huawei</strong> is committed to building a pipe oriented<br />

towards technology and sector. We are also committed<br />

to serving various types of customers that need such<br />

pipes. The world we live in is ever changing, and so are<br />

our customer base and their needs. While carriers will<br />

certainly continue to invest in the pipe, the Internet<br />

service providers may also build their own large-scale pipe<br />

systems; enterprises and industry verticals will accelerate<br />

their ICT investments as well.<br />

<strong>Huawei</strong> continues to focus on the customer through<br />

the quality that we provide and the services that we deliver,<br />

to all customers who need a pipe and can build a win-win<br />

relationship with us.<br />

<strong>Huawei</strong>’s pipe strategy is the company’s core, and<br />

the pipe business will remain our focus. As the digital<br />

flood approaches, we commit ourselves to enhanced pipe<br />

capacity, strengthened pipe enablers, and optimized pipe<br />

management, to deliver ever wider and more ubiquitous<br />

pipes, and an even better user experience. <strong>Huawei</strong><br />

is striving to build a connected society with endless<br />

possibilities – a society where our life and work are greatly<br />

enriched, made easier through communication.<br />

Editor: Jason jason.patterson@huawei.com<br />

Eric Xu, Executive Vice President, <strong>Huawei</strong><br />

NOV 2012<br />

14

Perspectives<br />

Cyber security perspectives<br />

21st century technology and security – a difficult marriage<br />

By John Suffolk, SVP of Global Cyber Security, <strong>Huawei</strong><br />

Our world has become truly connected.<br />

During the past twenty years, we have<br />

witnessed the blossoming of the commercial<br />

Internet, which planted the seed of an<br />

interconnected and global digital network that has made<br />

such things from email to telemedicine to browsing and<br />

social networks to online banking and retailing ubiquitous<br />

and affordable.<br />

Cyberspace is a new strategic domain, but it is unlike<br />

the physical territory which we are used to. It has gradually<br />

become the “nervous system” through which society<br />

operates. Countries now attach significant importance<br />

to the development of cyberspace technologies. The<br />

development of networks helped to advance social<br />

progress. Open networks have encouraged information<br />

flow and sharing, provided more opportunities for<br />

innovations, lowered the costs of innovation, and helped<br />

improve the world’s health, wealth and prosperity.<br />

Network technologies have turned out to be remarkable<br />

innovations. Open networks have made it easier to<br />

obtain and share information and have created untold<br />

opportunities for people to invent. As technologies become<br />

more pervasive, the costs of innovation are lowered which<br />

means that consumer, small and medium-sized enterprises<br />

and micro-enterprises have the opportunity to innovate on<br />

the same platform as large enterprises.<br />

The development of interconnected networks has<br />

encouraged investment and has enabled new consumption<br />

models that have driven global economic growth and fueled<br />

the global economy. Open networks connect the world,<br />

facilitate economic exchanges across regions, and promote<br />

global trade. Information technology has become a key<br />

driver behind economic growth. As reported by the World<br />

Bank, for every 10% increase in broadband penetration, the<br />

GDP in developing countries will increase 1.38%.<br />

With the substantial growth in data and the use of<br />

technology, we must adopt a positive attitude towards “data<br />

floods” and technology – not merely looking at the ills or<br />

Cyber Security Perspectives<br />

21 st century technology and security<br />

– a difficult marriage<br />

John Suffolk<br />

complexities that they create. We must utilize information<br />

to bridge the digital divide, provide more people with<br />

access to communications and information systems, and<br />

allocate information resources more appropriately, so<br />

that everyone on the planet can benefit from the use of<br />

technology. The openness of networks makes it possible<br />

for people to have equal access to information, improve<br />

social justice, and balance development across regions. The<br />

openness of networks has promoted cultural exchanges<br />

and helped to soften many of the misunderstandings, acts<br />

of discrimination, and cultural conflicts that exist between<br />

people with different cultural backgrounds.<br />

Yet, notwithstanding the monumental personal, social,<br />

15<br />

NOV 2012

Cyber security is not a single country or specific company issue.<br />

All stakeholders – governments and industry alike – need to recognise<br />

that cyber security is a shared global problem.<br />

and enterprise-oriented benefits that we have realised as<br />

a result of the digital and broadband revolutions, ageold<br />

real-world evils ranging from vandalism, theft, and<br />

disruption to espionage and wilful destruction have<br />

naturally gravitated to the new digital environment.<br />

<strong>Huawei</strong>, a global organization doing business in<br />

over 140 countries and connecting almost one-third of<br />

the planet’s population, is actively engaged in meeting<br />

these challenges head-on. As one of the world’s leading<br />

ICT solution providers, <strong>Huawei</strong> has deep technical<br />

understanding of how networks operate, and how<br />

technology fundamentally underpins and drives the health,<br />

wealth, safety and prosperity of citizens around the world.<br />

Yet not a day goes by that we do not read or hear<br />

politically – or competitor-inspired negative commentary<br />

about cyber security. While worry about breaches of cyber<br />

security is understandable and legitimate, the rhetoric risks<br />

distracting from the wide range of challenges our industry<br />

faces. Achieving an effective, global, industry-wide solution<br />

is going to demand sober and fact-based dialogue, not<br />

commercial or political jousting.<br />

In a world where over 87% of the planet’s population<br />

are mobile users, where the Apple App Store has seen over<br />

25 billion downloads, and where the downloads of Google<br />

Play Application Store have exceeded 20 billion, the stark<br />

reality is that cyber security is a growing global challenge<br />

demanding rational and universal solutions.<br />

No longer is technology designed, developed and<br />

deployed only in one country. No longer can any country<br />

or large company claim to rely on a single sourcing<br />

model, and no longer is it possible, with today’s complex<br />

technology ecosystem and architecture, that we can stop<br />

all threats from all threat actors.<br />

As governments, enterprises, and consumers have<br />

become increasingly reliant on ICT solutions that integrate<br />

inputs designed, developed, coded, and manufactured by<br />

multiple suppliers around the world, the scale of the cyber<br />

security challenge has grown exponentially.<br />

Cyber security is not a single country or specific company<br />

issue. All stakeholders – governments and industry alike<br />

– need to recognise that cyber security is a shared global<br />

problem requiring risk-based approaches, best practices and<br />

international cooperation to address the challenge.<br />

With the recent publications of threats such as Stuxnet<br />

and Flame, the world has reached a decision point: Does it<br />

continue on its current path whereby any misguided actor,<br />

regardless of motive, can operate freely in an unregulated<br />

world and develop malware for any purpose? If we accept<br />

this route, then we must stop complaining and accept the<br />

consequences of the cyber race to the bottom of the pit and<br />

the return of the Wild West. Or should we collectively step<br />

back from the precipice, as we have done in other forms of<br />

warfare, and establish laws, norms, standards and protocols<br />

– accepting that trust has to be earned and continually<br />

validated and also accepting that a lack of trust exists<br />

between some stakeholders when it comes to cyber security.<br />

In this scenario we must be realistic but determined.<br />

This paper favours and supports international<br />

collaboration, openness and verifiable trust as the<br />

foundation for a world where technology can continue to<br />

drive economic and social improvement for the majority of<br />

the 7 billion citizens on the planet. We hope you support<br />

this option too. At <strong>Huawei</strong> we make this commitment:<br />

We will support and adopt any internationally agreed<br />

standard or best practice for cyber security in its broadest<br />

sense. We will support any research effort to improve cyber<br />

defences. We will continue to improve and adopt an open<br />

and transparent approach enabling governments to review<br />

<strong>Huawei</strong>’s security capabilities. And finally, as we have<br />

done to date, we warmly welcome the assistance from our<br />

customers in enhancing our processes, our technology, and<br />

our approach to cyber security so that we can provide even<br />

greater benefits to them and their customers...<br />

The complete <strong>Huawei</strong> whitepaper is available at:<br />

http://www.huawei.com/ilink/en/download/HW_187368<br />

NOV 2012<br />

16

Perspectives<br />

LTE TDD goes mainstream<br />

Mobile ecosystem puts support behind the standard<br />

LTE TDD has gained wide ecosystem acceptance and backing from leading infrastructure and device vendors. LTE<br />

TDD holds promise when it comes to providing small cell backhaul and fixed broadband service. Its biggest market<br />

opportunity, however, should be in helping mobile operators meet the growing demand for data network capacity.<br />

By Daryl Schoolar, Principal Analyst, Infrastructure, Ovum<br />

LTE TDD applications<br />

Currently, operators<br />

looking to deploy<br />

LTE TDD are<br />

focused on three<br />

areas – mobile broadband,<br />

fixed broadband access, and<br />

backhaul.<br />

Mobile broadband<br />

The application that will<br />

drive the largest market<br />

opportunities for LTE TDD<br />

is support of fully mobile networks. China Mobile plans<br />

to deploy LTE TDD for its 4G network, and to grow its<br />

trial network to 20,000 base stations in 2012 and extend<br />

it to 200,000 base stations by the end of 2013. Some<br />

mobile operators, such as SoftBank (Japan), STC (Saudi<br />

Arabia), Optus (Australia), Hi3G (Denmark & Sweden),<br />

and China Mobile HK (Hong Kong), either currently<br />

have or plan to support both LTE FDD and TDD along<br />

with their existing GSM or WCDMA networks. <strong>Bharti</strong><br />

<strong>Airtel</strong> has launched LTE TDD as its primary 4G network<br />

technology. Clearwire (U.S.) and Mobily (Saudi Arabia)<br />

provide good examples of operators migrating from<br />

WiMAX to LTE TDD to take advantage of the bigger<br />

ecosystem the technology can bring them. The availability<br />

of LTE (FDD & TDD)/WCDMA/GSM smartphones<br />

later on this year will be the catalyst for mobile broadband<br />

development.<br />

Fixed wireless broadband access<br />

Many areas of the world still lack wireline networks,<br />

and many of these areas will never see copper or fiber<br />

deployments. For these areas, wireless networks remain<br />

the best option. Operators such as UK Broadband, SkyTV<br />

(Brazil), Zodafones (Nigeria), and Blueline (Madagascar)<br />

are using LTE TDD to build out fixed-line networks.<br />

Small cell backhaul<br />

It is LTE TDD’s support of point-to-multipoint that<br />

has some operators looking at the technology as a backhaul<br />

solution. Plus, as LTE TDD is part of the larger LTE<br />

ecosystem, it should also provide cost savings through the<br />

overall economies of scale expected to come from LTE.<br />

Other point-to-multipoint backhaul systems don’t have<br />

this benefit because they are proprietary systems. Backhaul<br />

may not be the biggest application for LTE TDD, but it<br />

should play a role in helping the technology to scale.<br />

TDD spectrum: An untapped resource<br />

Spectrum is a finite resource; there is only so much<br />

available. AT&T’s failed acquisition of T-Mobile was<br />

driven by AT&T’s desire to increase its spectrum holdings.<br />

The LTE standard, while more spectrally efficient than<br />

WCDMA or HSPA, still isn’t enough on its own to meet<br />

the spectrum needs of all operators. Small cells are one way<br />

of dealing with this issue.<br />

Small cells help operators deal with spectrum<br />

limitations through carrier Wi-Fi solutions and through<br />

increased spectrum reuse with pico- and microcells using<br />

licensed spectrum.<br />

The most obvious method for an operator to expand<br />

its spectrum position is through the acquisition of more<br />

FDD spectrum. This, however, is not always that easy.<br />

17<br />

NOV 2012

Spectrum is a finite resource; there is only so much available. The LTE standard,<br />

while more spectrally efficient than WCDMA or HSPA, still isn’t enough on its own<br />

to meet the spectrum needs of all operators.<br />

Government regulators, as in the case of AT&T and<br />

T-Mobile, may block the deal. Purchasing spectrum at<br />

an auction may not always be an option because of either<br />

the cost or the availability. Another option, and one more<br />

operators are looking at, is deploying LTE TDD over<br />

unpaired spectrum.<br />

Mobile operators can deploy a multi-mode LTE<br />

network to increase their overall network capacity. LTE<br />

TDD can be deployed in dense metro areas to provide<br />

capacity injection into areas where the LTE FDD network<br />

is strained. Part of the capacity benefits LTE TDD bring<br />

comes in the size of available spectrum blocks.<br />

Unpaired or TDD spectrum bands often come in large<br />

blocks. It isn’t unusual to see TDD spectrum auctioned<br />

off in 30MHz slices. From a capacity perspective, this is<br />

an advantage over the typical 2x10MHz configuration<br />

found in FDD spectrum. LTE Release 8 has a theoretical<br />

maximum speed of 16bps per hertz; the more hertz an<br />

operator has, the faster the network.<br />

TDD spectrum costs much less<br />

The biggest advantage of TDD over FDD spectrum is<br />

its cost. Mobile operators have historically been able to<br />

purchase TDD spectrum at a lower price than FDD. This<br />

has primarily been due to the fact that mobile operators<br />

have had limited options for using TDD spectrum.<br />

Until now, many of the systems that were available for<br />

TDD spectrum were proprietary, and not part of a larger<br />

ecosystem. Even with lower spectrum costs, the proprietary<br />

nature of those network systems that used unpaired<br />

spectrum have limited operators’ interest in networks using<br />

TDD. LTE TDD is changing that.<br />

With LTE TDD, operators can use lower cost unpaired<br />

spectrum with a networking technology that is part of a<br />

larger ecosystem than that for paired spectrum. This makes<br />

the overall cost of the network lower than those using<br />

paired spectrum. From a competitive position, this lower<br />

cost can make it easier for an operator to rollout a network<br />

and achieve a return on its investment. It can also use the<br />

lower cost of network ownership to offer lower-priced<br />

service and gain a competitive advantage in the market.<br />

However, mobile operators do need to be aware that the<br />

current spectrum cost advantage may not last. As interest<br />

in LTE TDD increases, so too, most likely, will the cost of<br />

unpaired spectrum.<br />

LTE FDD spectrum challenges<br />

Despite the popularity of FDD spectrum, it comes<br />

with many challenges. One of those challenges is that<br />

unused spectrum suitable for LTE FDD may not be<br />

readily available. In the U.S. there are ongoing LTE<br />

FDD deployments in 700MHz. This spectrum band’s<br />

propagation characteristics provide good coverage over<br />

large geographic areas. However, 700MHz is not readily<br />

available in all markets.<br />

In some markets, TV signals still transmit over<br />

the 700MHz band. It will take time for those bands<br />

to be cleared out and made available for mobile<br />

communications. Competition for FDD frequency brings<br />

its own problems as well. The most obvious problem<br />

competition brings to FDD spectrum is cost. As has<br />

been discussed already, bidding on prime FDD spectrum<br />