Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

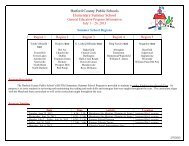

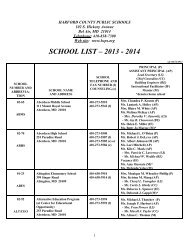

HARFORD COUNTY PUBLIC SCHOOLS<br />

NOTES TO FINANCIAL STATEMENTS<br />

June 30, 2012<br />

NOTE 6 - POSTEMPLOYMENT BENEFITS OTHER THAN PENSION BENEFITS (continued)<br />

Schedule of Funding Progress<br />

Value of<br />

Assets<br />

Accrued<br />

Liability<br />

(AAL)<br />

Unfunded<br />

AAL (UAAL)<br />

Funded<br />

Ratio<br />

Covered<br />

Payroll<br />

UAAL as a<br />

%<br />

of Covered<br />

Payroll<br />

July 1, 2008 $ 12,136,368 $ 589,795,000 $ 577,658,632 2.06% $ 278,038,509 207.76%<br />

July 1, 2009 $ 10,233,348 $ 626,155,000 $ 615,921,652 1.63% $ 278,636,614 221.05%<br />

July 1, 2010 $ 10,962,506 $ 534,277,000 $ 523,314,494 2.05% $ 278,479,993 187.92%<br />

July 1, 2011 $ 15,255,626 $ 462,698,000 $ 447,442,374 3.30% $ 276,823,307 161.63%<br />

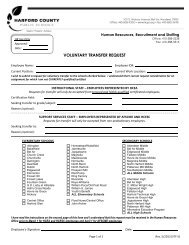

NOTE 7 - LONG-TERM LIABILITIES<br />

Long-term liability activity for the year ended June 30, 2012 was as follows:<br />

Balance at<br />

July 1, 2011 Increase Reductions<br />

Balance at<br />

June 30,<br />

2012<br />

Due Within<br />

One Year<br />

Capital lease $ 9,972,928 $ 10,016,647 $ 9,972,928 $ 10,016,647 $ -<br />

Compensated absence 28,464,371 4,574,167 4,942,815 28,095,723 4,846,031<br />

OPEB obligation 109,940,815 42,027,000 24,556,886 127,410,929 -<br />

Total Governmental Activities $ 148,378,114 $ 56,617,814 $ 39,472,629 $ 165,523,299 $ 4,846,031<br />

Compensated absences and net OPEB obligation have typically been liquidated by the General<br />

Fund in prior years.<br />

The Board entered into lease agreements as lessee in the amount of $11,400,223 to construct the<br />

administration building, which was completed in January 2007. The lease agreement is for a<br />

period of twenty-five years. The debt was refinanced in June of 2012 at a rate of 3.25%. The<br />

term of the debt was not extended. The asset acquired and capitalized under the capital lease is<br />

as follows:<br />

Building cost $ 10,852,395<br />

Less accumulated depreciation 1,410,811<br />

Net Book Value $ 9,441,584<br />

55