Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

Comprehensive Annual Financial Report - Harford County Public ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HARFORD COUNTY PUBLIC SCHOOLS<br />

NOTES TO FINANCIAL STATEMENTS<br />

June 30, 2012<br />

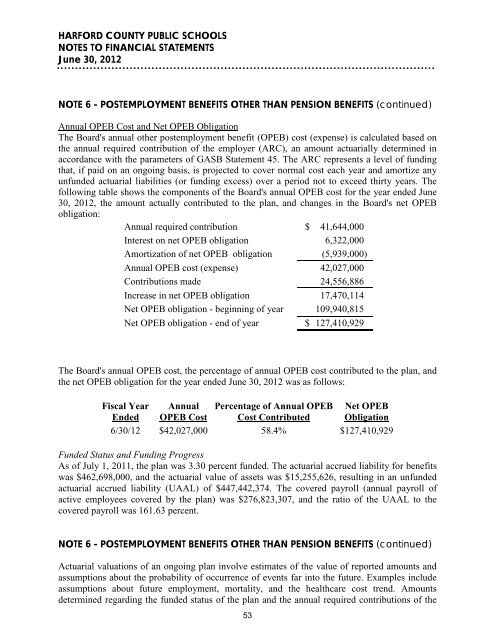

NOTE 6 - POSTEMPLOYMENT BENEFITS OTHER THAN PENSION BENEFITS (continued)<br />

<strong>Annual</strong> OPEB Cost and Net OPEB Obligation<br />

The Board's annual other postemployment benefit (OPEB) cost (expense) is calculated based on<br />

the annual required contribution of the employer (ARC), an amount actuarially determined in<br />

accordance with the parameters of GASB Statement 45. The ARC represents a level of funding<br />

that, if paid on an ongoing basis, is projected to cover normal cost each year and amortize any<br />

unfunded actuarial liabilities (or funding excess) over a period not to exceed thirty years. The<br />

following table shows the components of the Board's annual OPEB cost for the year ended June<br />

30, 2012, the amount actually contributed to the plan, and changes in the Board's net OPEB<br />

obligation:<br />

<strong>Annual</strong> required contribution $ 41,644,000<br />

Interest on net OPEB obligation 6,322,000<br />

Amortization of net OPEB obligation (5,939,000)<br />

<strong>Annual</strong> OPEB cost (expense) 42,027,000<br />

Contributions made 24,556,886<br />

Increase in net OPEB obligation 17,470,114<br />

Net OPEB obligation - beginning of year 109,940,815<br />

Net OPEB obligation - end of year $ 127,410,929<br />

The Board's annual OPEB cost, the percentage of annual OPEB cost contributed to the plan, and<br />

the net OPEB obligation for the year ended June 30, 2012 was as follows:<br />

Fiscal Year <strong>Annual</strong> Percentage of <strong>Annual</strong> OPEB Net OPEB<br />

Ended OPEB Cost Cost Contributed Obligation<br />

6/30/12 $42,027,000 58.4% $127,410,929<br />

Funded Status and Funding Progress<br />

As of July 1, 2011, the plan was 3.30 percent funded. The actuarial accrued liability for benefits<br />

was $462,698,000, and the actuarial value of assets was $15,255,626, resulting in an unfunded<br />

actuarial accrued liability (UAAL) of $447,442,374. The covered payroll (annual payroll of<br />

active employees covered by the plan) was $276,823,307, and the ratio of the UAAL to the<br />

covered payroll was 161.63 percent.<br />

NOTE 6 - POSTEMPLOYMENT BENEFITS OTHER THAN PENSION BENEFITS (continued)<br />

Actuarial valuations of an ongoing plan involve estimates of the value of reported amounts and<br />

assumptions about the probability of occurrence of events far into the future. Examples include<br />

assumptions about future employment, mortality, and the healthcare cost trend. Amounts<br />

determined regarding the funded status of the plan and the annual required contributions of the<br />

53