Folie 1 - Oerlikon Barmag

Folie 1 - Oerlikon Barmag

Folie 1 - Oerlikon Barmag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

SAURER<br />

Company Presentation<br />

December 2005

Highlights<br />

� Saurer consists of two perfectly positioned divisions: No. 1 world market<br />

position in Textile Solutions with an average market share of 30%; No. 1 in<br />

specialities with Transmission Systems (Graziano Trasmissioni).<br />

� Significant growth potential in Textile Solutions (market consolidation) and<br />

Transmission Systems<br />

� Excellent position in Asia with integration capabilities (leverage for new<br />

business in Asia)<br />

� Strong balance sheet with EUR 600m financing capacities for acquisitions<br />

� Competent management team with experience in management of cyclical<br />

businesses

Saurer – two growth oriented businesses<br />

3<br />

Textile<br />

Solutions<br />

Sales: EUR 1209m<br />

EBIT: EUR 77m<br />

Employees : 5861<br />

We are the undisputed market<br />

leader for full service solutions in<br />

textile machinery – we<br />

continuously set new benchmarks<br />

for efficient textile production<br />

SAURER<br />

Transmission<br />

Systems<br />

Sales: EUR 384m<br />

EBIT: EUR 22m<br />

Employees: 2970<br />

We are the preferred supplier of<br />

transmissions, components and<br />

systems for defined specialty<br />

markets and set high standards in<br />

reliability, price performance and<br />

flexibility

4<br />

SAURER TEXTILE SOLUTIONS

Strong market position, broad product offer<br />

5<br />

Staple fiber<br />

spinning<br />

Main competitors<br />

Rieter, Toyoda,<br />

Murata, Savio<br />

Jingwei<br />

Market position<br />

Chemical fiber<br />

technology Nonwovens Embroidery<br />

TMT, Rieter,<br />

Filteco<br />

Reifenhäuser, Dilo,<br />

NSC<br />

1, 2 1 2,3 1<br />

Lässer, Tajima,<br />

Barudan

Position in the textile value chain<br />

Focus on Spinning<br />

6<br />

Filament<br />

Texturizing<br />

Air-jet<br />

Spinning<br />

Spinning preparation<br />

Twisting<br />

Rotor<br />

Spinning<br />

Weaving / Knitting<br />

Finishing<br />

Synthetic staple fiber<br />

Embroidery<br />

Manufacturing<br />

Saurer Saurer Partners<br />

Ring Spinning<br />

Winding<br />

Nonwoven

Present in the most important market: Asia<br />

7<br />

Sales<br />

split<br />

Textile<br />

Solutions<br />

°<br />

°<br />

°<br />

°<br />

30%<br />

17% 14%<br />

35%<br />

95 02 04 95 02 04 95 02 04<br />

°<br />

° ° °<br />

°° °<br />

° °<br />

°<br />

20% 14%<br />

� key market asia – over 70% of sales !<br />

°<br />

°<br />

°<br />

35%<br />

°<br />

72%<br />

63%<br />

°<br />

°<br />

°<br />

° °<br />

°<br />

°

Innovations and key products<br />

8<br />

� Saurer spends 6% - a very high figure in this industry - of sales in<br />

R&D each years to maintain its leading position; examples:<br />

� WinPro: Revolutionary long staple fiber spinning/twisting system with<br />

highest productivity and quality<br />

� Filament spinning: i-COON 20 end winder (<strong>Barmag</strong>) sets new productivity<br />

standards<br />

� Autocoro 360: the most successful automatic rotor spinning machine for<br />

over a quarter of a century, with new features such as Corolab (cleaner)<br />

and fancy yarn unit<br />

� Nonwovens: Saurer offers all key nonwoven technologies from a single<br />

source; Saurer can now offer complete turn key plant for stapel fiber<br />

spinning, filament spinning and nonwovens

Operations in china secure proximity to<br />

customers and lower cost base<br />

Success<br />

factors<br />

9<br />

2003/4<br />

realized<br />

Sales &<br />

Service<br />

Organisation<br />

�10 local service<br />

centers in Asia<br />

�Local service<br />

and process<br />

engineers in<br />

India and China<br />

- can be<br />

deployed<br />

anywhere in the<br />

world<br />

Local<br />

production<br />

and sourcing<br />

�Lower costs<br />

base and<br />

natural hedge<br />

�Sourcing in<br />

Asia for Asia,<br />

but also for<br />

the rest of the<br />

world<br />

�Opening of<br />

Suzhou II in<br />

Q4 05<br />

China<br />

specific<br />

products<br />

�Modular<br />

concepts<br />

�China<br />

configurations<br />

�Total<br />

solutions<br />

approach<br />

Local talents<br />

& culture<br />

�Worldwide<br />

culture<br />

program<br />

�Over 1000<br />

people<br />

working in<br />

China<br />

Adaptation<br />

of European<br />

structure<br />

�Reduction of<br />

capacity<br />

�Site<br />

development<br />

programs

Textile mill consumption is increasing<br />

m tonnes<br />

ø<br />

growth:<br />

2.5-3.5%<br />

p.a.<br />

10<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

Manmade<br />

total<br />

Cotton<br />

Manmade<br />

staple<br />

Manmade<br />

filament<br />

5<br />

0<br />

Wool<br />

1970 1975 1980 1985 1990 1995 2000 2005 2010<br />

� But due to improved efficiency, market for textile machinery is overall slightly<br />

declining; growth must come from consolidation and entrance into new segments

Five companies were acquired in 2005<br />

11<br />

COMPANY BUSINESS FIELD SALES VOLUME [EUR m]<br />

(visible 2006)<br />

Autefa Nonwovens ~30<br />

Kortec Nonwovens ~ 3<br />

Fehrer Nonwovens ~30<br />

Ermafa Plastics ~ 6<br />

recycling

Success with mid-end twisting machine FOCUS<br />

12<br />

� Very successfully launched in<br />

2005<br />

� Developed within only 9 months,<br />

mainly for the Indian and Chinese<br />

market<br />

� Superior Saurer technology, but<br />

reduced to the maximum for the<br />

actual market needs<br />

� Can compete in pricing with local<br />

products

Management of market cycles is crucial<br />

13<br />

% change to previous quarter<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03<br />

Source: VDMA<br />

� Saurer has learned to manage the always shorter and steeper cycles of the textile<br />

market

Key management capabilities<br />

14<br />

Handling of cyclical markets<br />

� Low fixed cost basis, flexible working hours scheme, low vertical<br />

integration, superior, flexible logistics, broader product range…<br />

Doing business in key market Asia<br />

� Successful business in Asia and China – setting up new operations, access<br />

to market is “daily business”<br />

� Well trained local Chinese Management<br />

Experienced team<br />

� Management has been with Saurer for several years<br />

� Excellent business, market and technical know-how

Strategy for sustainable growth (MUSANGALA)<br />

15<br />

1<br />

2<br />

3<br />

4<br />

5<br />

Exploit our strong product and total solution<br />

leadership position<br />

Generate 30% growth from better understanding<br />

of customer and faster realization of new solution<br />

Expand market position and/or technology base<br />

by acquisition of leading companies<br />

Continuously improve process orientation,<br />

flexibility and low cost base<br />

Create a challenging and inspiring working<br />

climate that attracts talents

16<br />

SAURER TRANSMISSION<br />

SYSTEMS

Specialized supplier of transmissions<br />

17<br />

Agriculture Luxury and sports<br />

cars<br />

Main competitors<br />

- Captive business<br />

(OEMs)<br />

- ZF, Carraro<br />

Market position<br />

Dana<br />

Earth moving,<br />

Forklifts, other<br />

Getrag, Magma, ZF,<br />

Dana<br />

1 (Europe)<br />

1 1 - 3<br />

- no presence in<br />

US/Asia<br />

� Position as specialized supplier for transmissions and components for small series at<br />

relatively low cost prevents fierce competition as in „mainstream“ car markets

Strong position in Europe – new potential in<br />

NAFTA and Asia<br />

18<br />

°<br />

°<br />

Sales<br />

Transmission<br />

°<br />

° °<br />

°<br />

°<br />

°<br />

19%18%<br />

11%<br />

Systems 95 02 04 95 02 04<br />

95 02 04<br />

America Europe Asia<br />

°<br />

86%<br />

78% 78%<br />

°<br />

°<br />

°<br />

3% 3 4%<br />

°<br />

°<br />

°

Agriculture and luxury cars: Two strongest<br />

segments<br />

TOTAL SALES 2004: EUR 384 m<br />

19<br />

Earth Moving<br />

9,1%<br />

Forklifts<br />

3,9%<br />

Sales by application field Sales by type of product<br />

Other Sectors<br />

13,1%<br />

Cars<br />

24,2%<br />

Agriculture<br />

49.7%<br />

4WD &<br />

Subassemblies<br />

(Groups)<br />

5,2%<br />

Synchronizers<br />

& Subsystems<br />

(Groups)<br />

16,9%<br />

Bevel<br />

Gears<br />

(Groups)<br />

11,5%<br />

Drive-Axles<br />

(Groups)<br />

8%<br />

Gearboxes<br />

(Systems)<br />

10,3%<br />

Spur Gears<br />

(Components)<br />

48,1%

Innovations and key products<br />

CARS<br />

AGRICULTURE<br />

OTHER<br />

20<br />

• Alfa Romeo 156:<br />

4WD system (rear diff. & front PTU)<br />

• Aston Martin DB9: manual gearbox<br />

and for the automatic transmission,<br />

the rear diff<br />

• Maserati Quattroporte and Ferrari<br />

Scaglietti: two new AMT gearbox<br />

applications<br />

• VW Transporter: front PTU for the<br />

4WD model<br />

• Magna Steyr: special synchronizer for<br />

Magna ITC (Integrated Transfer Case)<br />

• FENDT<br />

• CNH<br />

• JOHN DEERE<br />

• Transbus Dennis, new inverted portal<br />

axle for city bus<br />

� Project together with partner Prodrive<br />

� A new project for a new customer in<br />

the sport luxury car segment<br />

� Further development of the relationship<br />

with Ferrari Group<br />

� Further development of the relationship<br />

with VW<br />

� Special component development for Magna<br />

Steyr<br />

� Application of different GTG technologies<br />

� Several new project for components<br />

(gears)<br />

� New Client and new application of IPA<br />

technology

Transmission systems strategy: growth in<br />

specialties, mainly in NAFTA and Asia<br />

21<br />

1<br />

2<br />

3<br />

4<br />

Focus on specialties markets<br />

Cost effectiveness and flexibility to handle small and<br />

middle size specialties markets<br />

Acquisitions to consolidate specialty segments and<br />

technologies<br />

Geographical expansion in niche markets in NAFTA and<br />

Asia

22<br />

SAURER GROUP

With two divisions best in class<br />

23<br />

Textile<br />

Solutions<br />

Transmission<br />

Systems<br />

Two businesses with its own markets, strategy, knowhow,<br />

and competition – one goal: to be best in class<br />

� Know-how synergies<br />

- Experience e.g. in establishing business in China from Textile<br />

industry can be used in Transmission Systems business<br />

� Management synergies<br />

- Management of a cyclical industrial company<br />

� Financial synergies<br />

- Different cycles, cash management

Shareholder structure<br />

Free float<br />

- in the progress<br />

of transfer<br />

24<br />

36%<br />

Treasury<br />

shares<br />

1%<br />

15%<br />

42%<br />

Laxey Partners<br />

6%<br />

Zürcher<br />

Kantonalbank<br />

(ZKB)<br />

Free float<br />

- registered<br />

Corporate entities: 32%<br />

Individuals: 11%<br />

Shares in the<br />

progress of transfer: 57%<br />

(thereof 15% Laxey, 6% ZKB)<br />

� Saurer is interested in having a shareholder base with long-term horizon

25<br />

OUTLOOK

Short-term outlook (2005)<br />

26<br />

� End of multi-fiber agreement and soft-landing in China has caused a<br />

certain degree of uncertainty; we expect :<br />

- Lower volumes in Textile Solutions and<br />

- Higher volumes in Transmission Systems<br />

� Second half 2005 on level of first half with hope for improvement<br />

in textile business

Paradigma change from cost reduction to growth<br />

from:<br />

Looking inward<br />

- Consolidation<br />

- Risk reduction<br />

27<br />

to:<br />

Looking outward<br />

- Growth and innovation<br />

- Seize business opportunities

Outlook 2008: Substantial growth potential in<br />

textile an transmission systems<br />

28<br />

Textile Systems Solutions<br />

Transmission Systems<br />

New organic<br />

growth<br />

Acquisition<br />

Textile<br />

Business as<br />

usual<br />

New organic<br />

growth<br />

Acquisition<br />

Transmission<br />

Business as<br />

usual

29<br />

BACK-UP

TEXTILE MARKET POSITION<br />

30<br />

STAPLE FIBER<br />

Market Volume Market Saurer<br />

Brands in CHF m Share Pos. Main Competitors<br />

Ringspinning Zinser 500-1000 25% 2,1 Rieter, Toyoda, Marzoli,<br />

LMW<br />

Winding Schlafhorst 500-800 35% 1,2 Murata, Savio, Jingwei<br />

Rotor Spinning Schlafhorst 400-800 60% 1 Rieter, Savio<br />

FILAMENT<br />

Filament Spinning <strong>Barmag</strong> 650-1000 40% 1 TMT, Rieter<br />

Synth. Staple fiber Neumag 200-400 40% 1 Lurgi Zimmer, HILLS, Fare<br />

Texturing <strong>Barmag</strong> 350-500 35% 1 TMT, Rieter, Jingwei<br />

TWISTING<br />

Twisting Allma, Hamel, 500-750 30% 1 Murata, Rieter, Leewa,<br />

Systems Volkmann Savio, Rifa<br />

EMBROIDERY<br />

Embroidery Saurer 300-500 50% 1 Lässer,<br />

Systems Melco (excl. multihead) Tajima, Barudan<br />

NONWOVENS<br />

Airlaid/Spunbond Neumag 400-600 10-50% 3 Reifenhäuser, Rieter,<br />

Fleissner

SAURER TEXTILE GLOSSARY<br />

WEAVING AND KNITTING YARNS<br />

Yarn type Filament Staple<br />

Saurer Processes (Filament-) Spinning Ring spinning<br />

Texturing Winding<br />

Twisting Rotor spinning<br />

Twisting<br />

Chemical staple fiber plants<br />

Materials Chemical fiber: Natural fiber:<br />

- Polyester - Cotton<br />

- Polyamide - Wool<br />

- Polypropylene Chemical fiber:<br />

- Acrylic - Polyester - Polyamide<br />

- Elastane - Polypropylene - Acrylic<br />

- Viscose<br />

Blends<br />

NONWOVENS<br />

Yarn type Filament Staple<br />

Saurer Processes Spunbond Air-laid<br />

Materials Chemical fiber Chemical fiber<br />

31<br />

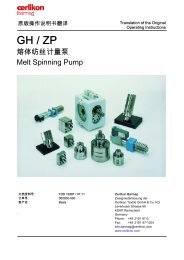

Filament Spinning: After heating the polymer, the<br />

melt is spun to endless yarn (filament) via spin packs.<br />

The yarn is drawn and taken up. Saurer Brands:<br />

<strong>Barmag</strong>, Neumag<br />

Texturing: Mechanical or thermal processing of<br />

filament to achieve properties similar to those of natural<br />

fibers; mainly for textile applications. Saurer Brand:<br />

<strong>Barmag</strong>.<br />

Twisting: Twisting of one or several yarns into a ply<br />

yarn. This can be done with filament as well as with<br />

staple yarns. Saurer Brands: Allma, Volkmann<br />

Ring spinning: By drafting and twisting, staples are<br />

spun into ring yarn. Process is always followed by<br />

winding. Saurer Brand: Zinser<br />

Winding: The ring yarn is winded from the cops to<br />

large bobbins. Thereby is quality check is executed.<br />

Saurer Brand: Schlafhorst<br />

Rotor spinning: Also called open-end spinning; with<br />

suction, the staples are drawn to a rotor and thereby<br />

spun to a rotor yarn. Saurer Brand: Schlafhorst<br />

Chemical staple fiber plants: Process analog to<br />

filament spinning, but after the spinning, staples of<br />

defined length are cut. These staple serve as input<br />

material for the ring or rotor spinning process. Saurer<br />

Brand: Neumag<br />

Nonwovens: The filaments or staples which build the<br />

fabric are bonded with thermal, chemical, or mechanical<br />

forces. There is no weaving/knitting process. Saurer<br />

Brand: Neumag

SAURER HISTORY<br />

32<br />

� 1853: Founded by Franz Saurer in a village close to St. Gallen, Switzerland<br />

� 1866: Franz Saurer moves to Arbon; marriage with Paulina Stoffel, owner of a successful manufacturing business<br />

� 1869: Installation of first Saurer embroidery machine<br />

� 1903: Start of production of trucks, major sales abroad<br />

� 1920: Saurer becomes a limited company<br />

� Up to 1953: Success story, strong growth mainly in vehicles business<br />

� 1973: Oil crisis marks turning point – vehicle production starts to lose competitiveness – definitive end of vehicle<br />

production activities in 1990<br />

� From 1988 on: Consequent textile oriented strategy; start of a series of acquisitions:<br />

- 1988, Carl Hamel AG, Arbon, Switzerland, twisting machines<br />

- 1990, Volkmann GmbH, Krefeld, Germany, twisting machines<br />

- 1991, Schlafhorst, Mönchengladbach, Germany, rotor spinning and winding machines, and Zinser<br />

Textilmachinen GmbH, Ebersbach, Germany, ring spinning machines<br />

- 2000, <strong>Barmag</strong> AG, Remscheid, and Neumag, Neumünster, both Germany, chemical fiber filament spinning<br />

and texturing, chemical staple fiber machines<br />

- 2003: M&J Fibretech and Ason, Denmark/USA, Nonwovens machinery<br />

� 1992: Integration of Graziano Trasmissioni (Transmission Systems) into Saurer by means of a stock swap – focus<br />

on two business pillars textile machines and transmission systems as strategic complements<br />

� 2003/4: Divestment of Surface Technology activities – Saurer has become the world’s leading textile machinery<br />

supplier and the leading manufacturer of transmissions for agricultural, earth moving and special vehicles, and<br />

luxury sports cars

VALUE GENERATION SAURER TEXTILE SOLUTIONS<br />

33<br />

Time to money Sales Fulfillment After sales<br />

Product leadership Premium supplier Logistic champion Customer intimacy<br />

High R&D efforts to<br />

maintain product<br />

leadership position<br />

Innovation based on<br />

deepest knowledge<br />

of customer leads to<br />

product<br />

differentiation and<br />

price premium<br />

S u p p o r t p r o c e s s e s – Facilitation Champion<br />

Selling with price<br />

premium due to<br />

superior total<br />

solution offer<br />

Strong logistics<br />

lead to quick<br />

quality delivery<br />

and a minimum<br />

of capital<br />

employed<br />

Local around the<br />

clock around the<br />

world services

VALUE GENERATION TRANSMISSION SYSTEMS<br />

34<br />

Time to money Sales Fulfillment<br />

Top technology applications<br />

for niches<br />

Co-developments<br />

with customers and<br />

partners to generate<br />

reliable, high<br />

performing and<br />

cost effective<br />

products<br />

Strength in design<br />

and manufacturing of<br />

small series products<br />

Premium supplier in defined<br />

niches for high class modules<br />

S u p p o r t p r o c e s s e s – Facilitation Champion<br />

Customer intimacy<br />

leads to long and<br />

good margin<br />

contracts<br />

Manufacturing champion<br />

for small volumes<br />

High flexibility and<br />

cost effectiveness to<br />

manage the wide<br />

range of products with<br />

perfect on time<br />

delivery and with the<br />

demanded quality

KEY FIGURES (II)<br />

in EUR 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995<br />

Sales 1'614<br />

EBITDA 189<br />

35<br />

1'746<br />

166<br />

1'698<br />

149<br />

1'593<br />

100<br />

1'426<br />

151<br />

867<br />

23<br />

1'152<br />

110<br />

1'250<br />

136<br />

1'114<br />

91<br />

1'151<br />

in % of sales 11.7% 9.5% 8.8% 6.3% 10.6% 2.7% 9.5% 10.9% 8.2% -0.7%<br />

Cash Op.Activities 165<br />

Capital Expenditures 61<br />

Free Cash Flow 1) 104<br />

Net Debt (Cash) (141)<br />

Equity incl. minority int. 519<br />

Intangible Assets (98)<br />

Tangible Cap.Employed 280<br />

Turns of Cap.Employed 4.9<br />

1) Before proceeds from sale of assets<br />

125<br />

50<br />

75<br />

32<br />

471<br />

(120)<br />

383<br />

4.4<br />

145<br />

52<br />

93<br />

106<br />

433<br />

(129)<br />

410<br />

3.7<br />

117<br />

64<br />

53<br />

208<br />

426<br />

(138)<br />

496<br />

3.3<br />

110<br />

74<br />

36<br />

189<br />

481<br />

(190)<br />

480<br />

3.1<br />

(9)<br />

63<br />

(72)<br />

75<br />

412<br />

(38)<br />

449<br />

2.0<br />

90<br />

93<br />

(3)<br />

(21)<br />

503<br />

(46)<br />

435<br />

2.8<br />

119<br />

52<br />

67<br />

(71)<br />

508<br />

(49)<br />

387<br />

3.2<br />

82<br />

46<br />

36<br />

(47)<br />

481<br />

(37)<br />

397<br />

2.6<br />

(8)<br />

(25)<br />

47<br />

(71)<br />

(23)<br />

506<br />

(39)<br />

445<br />

2.3