Course Outline: Financial and Managerial Accounting - Government ...

Course Outline: Financial and Managerial Accounting - Government ...

Course Outline: Financial and Managerial Accounting - Government ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

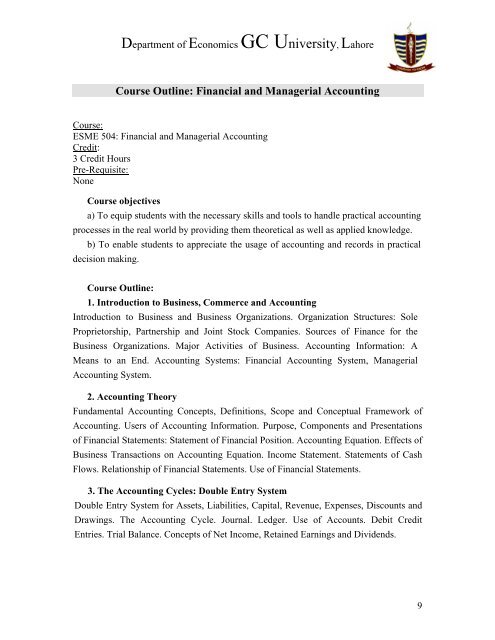

Department of Economics GC University, Lahore<br />

<strong>Course</strong> <strong>Outline</strong>: <strong>Financial</strong> <strong>and</strong> <strong>Managerial</strong> <strong>Accounting</strong><br />

<strong>Course</strong>:<br />

ESME 504: <strong>Financial</strong> <strong>and</strong> <strong>Managerial</strong> <strong>Accounting</strong><br />

Credit:<br />

3 Credit Hours<br />

Pre-Requisite:<br />

None<br />

<strong>Course</strong> objectives<br />

a) To equip students with the necessary skills <strong>and</strong> tools to h<strong>and</strong>le practical accounting<br />

processes in the real world by providing them theoretical as well as applied knowledge.<br />

b) To enable students to appreciate the usage of accounting <strong>and</strong> records in practical<br />

decision making.<br />

<strong>Course</strong> <strong>Outline</strong>:<br />

1. Introduction to Business, Commerce <strong>and</strong> <strong>Accounting</strong><br />

Introduction to Business <strong>and</strong> Business Organizations. Organization Structures: Sole<br />

Proprietorship, Partnership <strong>and</strong> Joint Stock Companies. Sources of Finance for the<br />

Business Organizations. Major Activities of Business. <strong>Accounting</strong> Information: A<br />

Means to an End. <strong>Accounting</strong> Systems: <strong>Financial</strong> <strong>Accounting</strong> System, <strong>Managerial</strong><br />

<strong>Accounting</strong> System.<br />

2. <strong>Accounting</strong> Theory<br />

Fundamental <strong>Accounting</strong> Concepts, Definitions, Scope <strong>and</strong> Conceptual Framework of<br />

<strong>Accounting</strong>. Users of <strong>Accounting</strong> Information. Purpose, Components <strong>and</strong> Presentations<br />

of <strong>Financial</strong> Statements: Statement of <strong>Financial</strong> Position. <strong>Accounting</strong> Equation. Effects of<br />

Business Transactions on <strong>Accounting</strong> Equation. Income Statement. Statements of Cash<br />

Flows. Relationship of <strong>Financial</strong> Statements. Use of <strong>Financial</strong> Statements.<br />

3. The <strong>Accounting</strong> Cycles: Double Entry System<br />

Double Entry System for Assets, Liabilities, Capital, Revenue, Expenses, Discounts <strong>and</strong><br />

Drawings. The <strong>Accounting</strong> Cycle. Journal. Ledger. Use of Accounts. Debit Credit<br />

Entries. Trial Balance. Concepts of Net Income, Retained Earnings <strong>and</strong> Dividends.<br />

9

Department of Economics GC University, Lahore<br />

4. Books of Original Entry<br />

Sales Journal <strong>and</strong> Ledger, Purchase Journal <strong>and</strong> Ledger, Return Journals. Cash Books.<br />

Petty Cash Books. General Journals.<br />

5. The <strong>Accounting</strong> Cycle: Adjustments before Final Accounts<br />

Adjusting Entries: Conversions of Assets to Expenses. Conversion of Liabilities to<br />

Revenues. Accrued Expenses <strong>and</strong> Revenues. Adjusting Entries <strong>and</strong> <strong>Accounting</strong><br />

Principles. Effects of Adjusting Entries. Use of Worksheet.<br />

6. The <strong>Accounting</strong> Cycles: Reporting <strong>Financial</strong> Results.<br />

Preparing <strong>Financial</strong> Statements. Relationship among the <strong>Financial</strong> Statements. Closing<br />

the Temporary Equity <strong>Accounting</strong>. After Closing Trial Balance. Published Accounts.<br />

<strong>Financial</strong> Analysis.<br />

7. <strong>Accounting</strong> for Merch<strong>and</strong>ising Activities<br />

Merch<strong>and</strong>ising Companies, Their Operating Cycle <strong>and</strong> Income Statement. General<br />

Ledger <strong>and</strong> Subsidiary Ledger Accounts. Perpetual <strong>and</strong> Periodic Inventory System.<br />

Modifying an <strong>Accounting</strong> System. Transactions Relating To Purchases <strong>and</strong> Sales.<br />

Evaluating the Performance of Merch<strong>and</strong>ising Company.<br />

8. <strong>Financial</strong> Assets.<br />

Cash Management <strong>and</strong> Bank Reconciliation Statement. Short Term Investments.<br />

<strong>Accounting</strong> for Marketable Securities. Management <strong>and</strong> <strong>Accounting</strong> for Accounts<br />

Receivables. <strong>Accounting</strong> for Notes Receivables <strong>and</strong> Interest Revenues. <strong>Financial</strong><br />

Analysis.<br />

9. Inventories <strong>and</strong> Cost of Goods Sold.<br />

The Flow of Inventory Costs <strong>and</strong> Cost Flow Assumptions: Specific Identification,<br />

Average Costing, FIFO. LIFO Methods <strong>and</strong> Its JIT Inventory Systems. Taking a Physical<br />

Inventory. Treatment of Shrinkage <strong>and</strong> Losses of Inventory. Techniques for Estimating<br />

CGS <strong>and</strong> Ending Inventory. <strong>Financial</strong> Analysis.<br />

10: Plant <strong>and</strong> Intangible Assets.<br />

Major Categories of Plant Assets. Acquisition of Plant Assets. Methods of Deprecation;<br />

Straight Line, Declining Balance Method, the Units of Output Method, Sum of Years'<br />

Digit Method. Disposal of Plant <strong>and</strong> Equipment. Intangible Assets: Amortization;<br />

10

Department of Economics GC University, Lahore<br />

Goodwill, Patents, Trade Marks, Franchises, Copyrights, R&D Costs. Natural Resources.<br />

<strong>Financial</strong> Analysis.<br />

11. Liabilities:<br />

Current Liabilities. Long Term Liabilities. <strong>Accounting</strong> for Notes Payable <strong>and</strong> Bond<br />

Payables. Special Types of Liabilities. Evaluating the Safety of Creditor's Claims.<br />

Estimated Liabilities <strong>and</strong> Loss Contingencies. <strong>Financial</strong> Analysis.<br />

12. Stockholder's Equity: Paid in Capital<br />

Formation of Corporations. Paid-in-Capital of a Corporation. <strong>Accounting</strong> for Issuing<br />

Shares at Face Values, Premium <strong>and</strong> Discount. <strong>Accounting</strong> Purchase <strong>and</strong> Sale of<br />

Treasury Stock. Market vs. Book Value of Stocks. Treasury Stocks. Stock Splits.<br />

<strong>Financial</strong> Analysis.<br />

13 <strong>Financial</strong> Statement Analysis.<br />

Tools of Analysis. Measures of Liquidity <strong>and</strong> Credit Risk: Working Capital, Current<br />

Ratio, Quick Ratio. Debt Ratio, Evaluating <strong>Financial</strong> Ratios. Measures of Profitability:<br />

Classifications in the Income Statement, Earning Per Share, Price-Earning Ratio, Return<br />

On Investment (ROI), Return On Assets (ROA), Return On Equity (ROE).<br />

Recommended Books:<br />

1- <strong>Financial</strong> <strong>and</strong> <strong>Managerial</strong> <strong>Accounting</strong>: The Basis For Business Decisions( Latest<br />

Edition Available) by Williams J.R., Haka S.F., Bettner M.S., Meigs R.F. McGraw-<br />

HilI Irwin.<br />

2- College <strong>Accounting</strong>: A Practical Approach (9th Edition) by Slatter. Prentice Hall<br />

Business Publishing.<br />

3- Business <strong>Accounting</strong> I (15th Edition) by FrankWood <strong>and</strong> Alan Songster.<br />

4- College <strong>Accounting</strong> (1st Edition) by Haddock, Brock, Hahn And Reed.<br />

11