KYRGYZSTAN TODAY Policy briefs on - Department of Geography

KYRGYZSTAN TODAY Policy briefs on - Department of Geography

KYRGYZSTAN TODAY Policy briefs on - Department of Geography

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

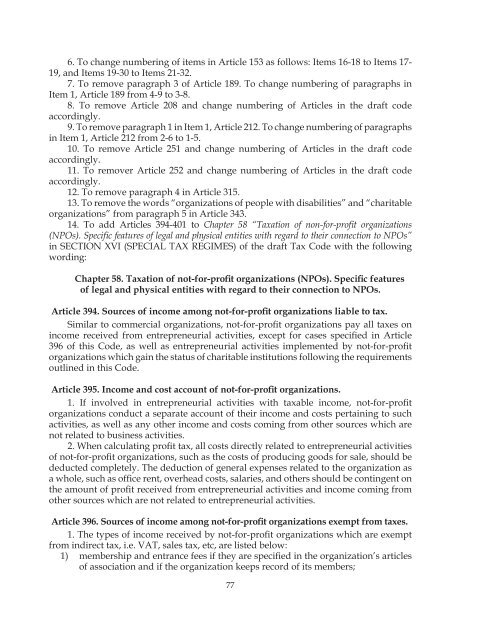

6. To change numbering <strong>of</strong> items in Article 153 as follows: Items 16-18 to Items 17-<br />

19, and Items 19-30 to Items 21-32.<br />

7. To remove paragraph 3 <strong>of</strong> Article 189. To change numbering <strong>of</strong> paragraphs in<br />

Item 1, Article 189 from 4-9 to 3-8.<br />

8. To remove Article 208 and change numbering <strong>of</strong> Articles in the draft code<br />

accordingly.<br />

9. To remove paragraph 1 in Item 1, Article 212. To change numbering <strong>of</strong> paragraphs<br />

in Item 1, Article 212 from 2-6 to 1-5.<br />

10. To remove Article 251 and change numbering <strong>of</strong> Articles in the draft code<br />

accordingly.<br />

11. To remover Article 252 and change numbering <strong>of</strong> Articles in the draft code<br />

accordingly.<br />

12. To remove paragraph 4 in Article 315.<br />

13. To remove the words “organizati<strong>on</strong>s <strong>of</strong> people with disabilities” and “charitable<br />

organizati<strong>on</strong>s” from paragraph 5 in Article 343.<br />

14. To add Articles 394-401 to Chapter 58 “Taxati<strong>on</strong> <strong>of</strong> n<strong>on</strong>-for-pr<strong>of</strong>it organizati<strong>on</strong>s<br />

(NPOs). Specific features <strong>of</strong> legal and physical entities with regard to their c<strong>on</strong>necti<strong>on</strong> to NPOs”<br />

in SECTION ХVI (SPECIAL TAX REGIMES) <strong>of</strong> the draft Tax Code with the following<br />

wording:<br />

Chapter 58. Taxati<strong>on</strong> <strong>of</strong> not-for-pr<strong>of</strong>it organizati<strong>on</strong>s (NPOs). Specific features<br />

<strong>of</strong> legal and physical entities with regard to their c<strong>on</strong>necti<strong>on</strong> to NPOs.<br />

Article 394. Sources <strong>of</strong> income am<strong>on</strong>g not-for-pr<strong>of</strong>it organizati<strong>on</strong>s liable to tax.<br />

Similar to commercial organizati<strong>on</strong>s, not-for-pr<strong>of</strong>it organizati<strong>on</strong>s pay all taxes <strong>on</strong><br />

income received from entrepreneurial activities, except for cases specified in Article<br />

396 <strong>of</strong> this Code, as well as entrepreneurial activities implemented by not-for-pr<strong>of</strong>it<br />

organizati<strong>on</strong>s which gain the status <strong>of</strong> charitable instituti<strong>on</strong>s following the requirements<br />

outlined in this Code.<br />

Article 395. Income and cost account <strong>of</strong> not-for-pr<strong>of</strong>it organizati<strong>on</strong>s.<br />

1. If involved in entrepreneurial activities with taxable income, not-for-pr<strong>of</strong>it<br />

organizati<strong>on</strong>s c<strong>on</strong>duct a separate account <strong>of</strong> their income and costs pertaining to such<br />

activities, as well as any other income and costs coming from other sources which are<br />

not related to business activities.<br />

2. When calculating pr<strong>of</strong>it tax, all costs directly related to entrepreneurial activities<br />

<strong>of</strong> not-for-pr<strong>of</strong>it organizati<strong>on</strong>s, such as the costs <strong>of</strong> producing goods for sale, should be<br />

deducted completely. The deducti<strong>on</strong> <strong>of</strong> general expenses related to the organizati<strong>on</strong> as<br />

a whole, such as <strong>of</strong>fice rent, overhead costs, salaries, and others should be c<strong>on</strong>tingent <strong>on</strong><br />

the amount <strong>of</strong> pr<strong>of</strong>it received from entrepreneurial activities and income coming from<br />

other sources which are not related to entrepreneurial activities.<br />

Article 396. Sources <strong>of</strong> income am<strong>on</strong>g not-for-pr<strong>of</strong>it organizati<strong>on</strong>s exempt from taxes.<br />

1. The types <strong>of</strong> income received by not-for-pr<strong>of</strong>it organizati<strong>on</strong>s which are exempt<br />

from indirect tax, i.e. VAT, sales tax, etc, are listed below:<br />

1) membership and entrance fees if they are specified in the organizati<strong>on</strong>’s articles<br />

<strong>of</strong> associati<strong>on</strong> and if the organizati<strong>on</strong> keeps record <strong>of</strong> its members;<br />

77