Private Label Strategy in Carrefour - Business Insights

Private Label Strategy in Carrefour - Business Insights

Private Label Strategy in Carrefour - Business Insights

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong><br />

<strong>in</strong> <strong>Carrefour</strong><br />

Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

<strong>in</strong> association with...<br />

Published August 2005<br />

New Management Report<br />

from<br />

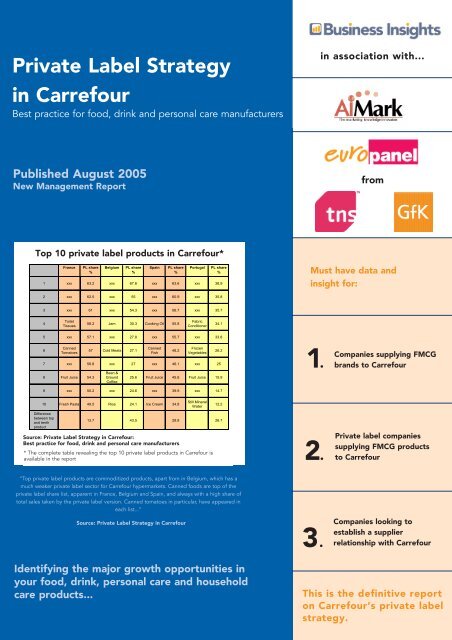

Top 10 private label products <strong>in</strong> <strong>Carrefour</strong>*<br />

France<br />

PL share<br />

%<br />

Belgium<br />

PL share<br />

%<br />

Spa<strong>in</strong><br />

PL share<br />

%<br />

Portugal<br />

PL share<br />

%<br />

1 xxx 63.2 xxx 67.6 xxx 63.6 xxx 38.9<br />

Must have data and<br />

<strong>in</strong>sight for:<br />

2 xxx 62.5 xxx 55 xxx 60.9 xxx 35.8<br />

3 xxx 61 xxx 54.3 xxx 56.7 xxx 35.7<br />

4<br />

Toilet<br />

Tissues<br />

58.2 Jam 30.3 Cook<strong>in</strong>g Oil 55.8<br />

Fabric<br />

Conditioner<br />

34.1<br />

5 xxx 57.1 xxx 27.8 xxx 55.7 xxx 33.8<br />

6<br />

Canned<br />

Tomatoes<br />

57 Cold Meats 27.1<br />

Canned<br />

Fish<br />

48.2<br />

Frozen<br />

Vegetables<br />

7 xxx 56.8 xxx 27 xxx 46.1 xxx 25<br />

8 Fruit Juice 54.3<br />

Bean &<br />

Ground<br />

Coffee<br />

26.2<br />

25.6 Fruit Juice 45.6 Fruit Juice 15.9<br />

9 xxx 50.2 xxx 24.6 xxx 39.9 xxx 14.7<br />

1.<br />

Companies supply<strong>in</strong>g FMCG<br />

brands to <strong>Carrefour</strong><br />

10 Fresh Pasta 49.5 Rice 24.1 Ice Cream 34.8<br />

Difference<br />

between top<br />

and tenth<br />

product<br />

Still M<strong>in</strong>eral<br />

Water<br />

12.2<br />

13.7 43.5 28.8 26.7<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong>:<br />

Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

* The complete table reveal<strong>in</strong>g the top 10 private label products <strong>in</strong> <strong>Carrefour</strong> is<br />

available <strong>in</strong> the report<br />

2.<br />

<strong>Private</strong> label companies<br />

supply<strong>in</strong>g FMCG products<br />

to <strong>Carrefour</strong><br />

“Top private label products are commoditized products, apart from <strong>in</strong> Belgium, which has a<br />

much weaker private label sector for <strong>Carrefour</strong> hypermarkets. Canned foods are top of the<br />

private label share list, apparent <strong>in</strong> France, Belgium and Spa<strong>in</strong>, and always with a high share of<br />

total sales taken by the private label version. Canned tomatoes <strong>in</strong> particular, have appeared <strong>in</strong><br />

each list...”<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

3.<br />

Companies look<strong>in</strong>g to<br />

establish a supplier<br />

relationship with <strong>Carrefour</strong><br />

Identify<strong>in</strong>g the major growth opportunities <strong>in</strong><br />

your food, dr<strong>in</strong>k, personal care and household<br />

care products...<br />

This is the def<strong>in</strong>itive report<br />

on <strong>Carrefour</strong>’s private label<br />

strategy.

1 Bus<strong>in</strong>ess <strong>Insights</strong><br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

What our clients say...<br />

“I found the report to be most<br />

useful, perhaps because it provided<br />

an overview from different category<br />

perspectives. I felt that the report<br />

benefited from the consultant<br />

approach and offered orig<strong>in</strong>al and<br />

considered th<strong>in</strong>k<strong>in</strong>g, rather than the<br />

'shot <strong>in</strong> the dark', naive approach I<br />

have seen <strong>in</strong> other reports...”<br />

Bus<strong>in</strong>ess Development Director<br />

Kraft Foods<br />

This new report provides exclusive gold standard data<br />

from AiMark and Europanel (from GfK and TNS) as<br />

well as trusted analysis from established private label<br />

experts from Bus<strong>in</strong>ess <strong>Insights</strong>.<br />

<strong>Carrefour</strong> is the world’s second largest retailer with a diverse range of private labels. Its<br />

presence <strong>in</strong> 31 countries gives this new management report a huge breadth of coverage<br />

with <strong>in</strong>-depth private label data analysed <strong>in</strong> eight of the <strong>Carrefour</strong> group’s core European<br />

markets.<br />

Bus<strong>in</strong>ess <strong>Insights</strong> has teamed up with Europanel (from GfK and TNS) and AIMARK to br<strong>in</strong>g<br />

you this brand NEW unique report, <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong>: Best practice<br />

for food, dr<strong>in</strong>k and personal care manufacturers. This new report provides data for all<br />

the formats that the <strong>Carrefour</strong> group operate, <strong>in</strong>clud<strong>in</strong>g their discount stores - the ma<strong>in</strong><br />

driver for the growth <strong>in</strong> private label. The report is written for food, dr<strong>in</strong>k, personal<br />

care and household care manufacturers enabl<strong>in</strong>g you to ga<strong>in</strong> a unique <strong>in</strong>sight <strong>in</strong>to<br />

successful and unsuccessful food, dr<strong>in</strong>k, personal care and household care categories <strong>in</strong><br />

the <strong>Carrefour</strong> group reveal<strong>in</strong>g the threats and opportunities that you may face.<br />

Unique <strong>in</strong>formation from a panel of 178,000<br />

households analysed by private label experts<br />

The data and analysis <strong>in</strong> this report is based on consumer panels of Europanel<br />

(from GfK and TNS), used to derive exclusive <strong>in</strong>formation on category sizes, brand and<br />

private label market size, share and pric<strong>in</strong>g, retailer shares, household penetration and<br />

frequency of purchase.<br />

Price premium of national brands over<br />

private label <strong>in</strong> France<br />

With research and analysis conducted through 2004 and 2005, this report<br />

<strong>in</strong>corporates data from a survey of 25,000 consumers and a panel of 178,000<br />

households.<br />

Price Index branded/PL<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

Yogurts<br />

All retailers<br />

<strong>Carrefour</strong><br />

Champion<br />

Sweet Biscuits<br />

Pasta<br />

Mayonnaise<br />

Margar<strong>in</strong>e & Spreads<br />

Instant Coffee<br />

Fruit juice<br />

Colas<br />

Beer<br />

Still M<strong>in</strong>eral Water<br />

Sanitary Protection – Pads<br />

Shampoo<br />

<strong>Private</strong> <strong>Label</strong> <strong>in</strong> <strong>Carrefour</strong> - know your market<br />

The report provides:<br />

• Case studies of <strong>Carrefour</strong>’s private label ranges reveal<strong>in</strong>g their label<strong>in</strong>g, position<strong>in</strong>g<br />

and quality strategies.<br />

• Analysis of brand vulnerability and the price premium of national brands over<br />

private label <strong>in</strong> <strong>Carrefour</strong>.<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

“The product with the biggest difference <strong>in</strong> price<br />

between branded and private label <strong>in</strong> <strong>Carrefour</strong><br />

hypermarkets is colas. Branded colas are over twice as<br />

expensive as <strong>Carrefour</strong>'s private label colas.<br />

Consumers have an attachment to the two lead<strong>in</strong>g<br />

brands, Coca-Cola or Pepsi...”<br />

• Unique data on the private label share analys<strong>in</strong>g penetration, growth and success<br />

<strong>in</strong> the <strong>Carrefour</strong> group <strong>in</strong> France, Belgium, Spa<strong>in</strong>, Portugal, Czech Republic, Italy,<br />

Poland and Switzerland.<br />

• A breakdown of <strong>Carrefour</strong>’s private label strategy <strong>in</strong> each of its formats across<br />

europe.

Bus<strong>in</strong>ess <strong>Insights</strong><br />

2<br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

Key f<strong>in</strong>d<strong>in</strong>gs of this new report<br />

• In Portugal, <strong>Carrefour</strong> hypermarket’s share of private label sales are below<br />

market average. A large number of <strong>Carrefour</strong>’s customers <strong>in</strong> Portugal are over<br />

65. At this age, the consumer no longer has large families to provide for and<br />

therefore it is likely the discount concept of sav<strong>in</strong>g on cheaper private labels are<br />

not as important to them. <strong>Private</strong> label share is driven by M<strong>in</strong>ipreço where 43%<br />

of turnover is <strong>in</strong> this sector.<br />

• Overall, the fastest growth private label sector for <strong>Carrefour</strong> hypermarkets<br />

is household care products. In Portugal, <strong>Carrefour</strong> has experienced the most<br />

growth <strong>in</strong> this private label sector with a growth of 8.7% from 2000 to 2003.<br />

• In 2004, 38% of turnover <strong>in</strong> <strong>Carrefour</strong> hypermarkets was <strong>in</strong> non-food<br />

products. Therefore the <strong>Carrefour</strong> group are develop<strong>in</strong>g their non-food range <strong>in</strong><br />

the hypermarkets and supermarkets, worldwide.<br />

• In 2005, private labels had a share of 21% <strong>in</strong> dry grocery sales, national<br />

brands have a share of 74% and fight<strong>in</strong>g brands, which are the cheapest on<br />

display, have a share of 5% <strong>in</strong> <strong>Carrefour</strong>’s dry grocery sales.<br />

• <strong>Carrefour</strong>’s discount strategy carries a number of <strong>in</strong>herent risks, which<br />

<strong>in</strong>clude switch<strong>in</strong>g customers from higher value to lower value private labels or<br />

from brands to private labels. Consumers will be trad<strong>in</strong>g down and may no<br />

longer see the value <strong>in</strong> premium products.<br />

Position<strong>in</strong>g of <strong>Carrefour</strong>'s private labels relative to<br />

price <strong>in</strong> biscuits<br />

Higher price<br />

Healthy<br />

<strong>Carrefour</strong><br />

Bio<br />

J’aime<br />

No.1<br />

Produits<br />

<strong>Carrefour</strong><br />

Discount<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

Escapades<br />

Gourmandes<br />

Reflets<br />

de<br />

France<br />

Gourmet<br />

“Produit <strong>Carrefour</strong> is the standard label analysed. The<br />

biscuits are 37% more expensive than No.1 at €0.52 per<br />

100g. Although not a gourmet product, the Produit<br />

<strong>Carrefour</strong> chocolate biscuits are priced identically to<br />

the premium positioned Reflets de France product. The<br />

price premium over No.1 also places the Produit<br />

<strong>Carrefour</strong> product as a standard/gourmet consumer<br />

product (everyday <strong>in</strong>dulgence)...”<br />

<strong>Carrefour</strong> shoppers vs competition: PL attractiveness<br />

-0.4 -0.3<br />

-0.2 -0.1 0 0.1<br />

0.2 0.3 0.4<br />

Actionable strategies to drive profit growth<br />

High Brand<br />

Trust and<br />

Price-Quality<br />

Inference<br />

ATAC<br />

CORA<br />

GEANT<br />

• Increase your market share by identify<strong>in</strong>g where the major growth<br />

opportunities lie <strong>in</strong> your food, dr<strong>in</strong>k, personal care and household care<br />

products by analys<strong>in</strong>g the success of private label categories, top 10 private<br />

label categories and the fast growth private label sectors <strong>in</strong> the 4 core markets of<br />

France, Spa<strong>in</strong>, Belgium and Portugal.<br />

SYSTEME U<br />

CHAMPION<br />

AUCHAN<br />

INTERMARCHE<br />

CARREFOUR<br />

Below average<br />

LECLERC<br />

Above average<br />

• Maximise your profit by analys<strong>in</strong>g the sectors where there are large<br />

premiums on branded products and uncover the price premium of national<br />

brands over private labels.<br />

• Discover whether <strong>Carrefour</strong>’s private label strategy will affect your brand<br />

sales by identify<strong>in</strong>g their short and long term strategies.<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

“The typical shoppers <strong>in</strong> <strong>Carrefour</strong> and Champion are less<br />

<strong>in</strong>cl<strong>in</strong>ed to buy private label than the typical shoppers <strong>in</strong><br />

Leclerc, Cora, Systeme U and Intermarché. This <strong>in</strong>dicates<br />

that these retailers' product offer<strong>in</strong>g and communication<br />

of private labels is more successful than <strong>Carrefour</strong>'s<br />

campaign...”

3 Bus<strong>in</strong>ess <strong>Insights</strong><br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

Hot issues covered <strong>in</strong> this report<br />

2003-4 growth (%)<br />

25<br />

20<br />

15<br />

10<br />

Turkey<br />

Greece<br />

Portugal<br />

Sales data, 2004<br />

Asia<br />

Czech Rep / Slovakia<br />

Spa<strong>in</strong><br />

5<br />

Poland<br />

Switzerland<br />

Americas<br />

Italy<br />

Belgium<br />

-<br />

0 5000 10000 15000 20000<br />

2004 sales, $m<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

France<br />

49782<br />

<strong>Carrefour</strong>'s private label strategy is undergo<strong>in</strong>g substantial change<br />

<strong>Carrefour</strong>'s private label strategy is at the forefront of its moves to rega<strong>in</strong> market share.<br />

The discount label, No.1 is be<strong>in</strong>g used by the retailer to drive footfall <strong>in</strong> store and<br />

<strong>in</strong>crease market share. However, market share has not grown as expected and now<br />

<strong>Carrefour</strong> are comprehensively review<strong>in</strong>g their private label strategy this year and their<br />

role as a premium private label and branded retailer.<br />

The key impact of discount<strong>in</strong>g on <strong>Carrefour</strong>'s strategy<br />

The grow<strong>in</strong>g presence of discounters has had a key impact on the <strong>Carrefour</strong> group’s<br />

private label strategy by offer<strong>in</strong>g their own private label ranges that price-match or are<br />

cheaper than the discounters. At the same time the group's discount fascias, Dia and<br />

M<strong>in</strong>ipreco, are mov<strong>in</strong>g more towards ma<strong>in</strong>stream supermarkets. The <strong>Carrefour</strong> group<br />

saw decreased PL share <strong>in</strong> Dia by 0.6 percentage po<strong>in</strong>ts to 55.7% and by 0.2<br />

percentage po<strong>in</strong>ts to 43% <strong>in</strong> M<strong>in</strong>ipreço.<br />

“The <strong>Carrefour</strong> group grew <strong>in</strong> sales by 3.1% from 2003<br />

to 2004, worldwide. The growth rate <strong>in</strong> <strong>Carrefour</strong>'s core<br />

French market was 0.2% from 2003 to 2004 due to a<br />

developed and consolidated nature of the retail sector. It<br />

is likely that <strong>Carrefour</strong> will look to revitalise sales <strong>in</strong> their<br />

domestic market. One concept <strong>Carrefour</strong> has developed<br />

to encourage sales is the roll out of an aggressive pric<strong>in</strong>g<br />

strategy <strong>in</strong> all hypermarkets with their discount No.1<br />

private label range...”<br />

<strong>Carrefour</strong>'s private label timel<strong>in</strong>e<br />

1998<br />

Dest<strong>in</strong>ation Saveurs<br />

Risk of los<strong>in</strong>g high value customers<br />

<strong>Carrefour</strong> has reduced its promotion of premium and branded labels <strong>in</strong> order to focus<br />

on No.1. However it is vital for <strong>Carrefour</strong> to cont<strong>in</strong>ue to promote brands and premium<br />

private labels <strong>in</strong> order to ma<strong>in</strong>ta<strong>in</strong> appeal to high value customers because they are a<br />

higher value retailer. <strong>Carrefour</strong>'s current strategy risks the loss of high value customers<br />

as it cont<strong>in</strong>ues to focus strongly on discount<strong>in</strong>g.<br />

Eastern Europe as a focus of growth for <strong>Carrefour</strong><br />

<strong>Carrefour</strong> is actively <strong>in</strong>creas<strong>in</strong>g private label and market share <strong>in</strong> the Czech Republic.<br />

There was no private label share for the <strong>Carrefour</strong> group <strong>in</strong> the Czech Republic <strong>in</strong><br />

2003. In 2004 there was a rapid development <strong>in</strong> private label and <strong>Carrefour</strong>’s share<br />

<strong>in</strong>creased to 2%. In the overall market, the private label share <strong>in</strong>creased from 7% <strong>in</strong><br />

2003 to 14% <strong>in</strong> 2004. Suppliers should f<strong>in</strong>d an <strong>in</strong>creas<strong>in</strong>g consumer appetite for private<br />

labels.<br />

Reflets de France<br />

1976 1985 1993<br />

Produit Libres<br />

Produit <strong>Carrefour</strong><br />

Filière Qualité<br />

1996<br />

Escapades Gourmandes<br />

<strong>Carrefour</strong> Bio<br />

1997<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong><br />

2003<br />

No.1<br />

PCI<br />

2004<br />

J’aime<br />

2002<br />

Your questions answered<br />

• How successful is <strong>Carrefour</strong>'s discount<strong>in</strong>g strategy, and how does it vary by country?<br />

• Where are the ma<strong>in</strong> opportunities and threats from private label at a category level?<br />

• How will <strong>Carrefour</strong>’s strategy vary by country, format and fascia?<br />

“It appears as though the ma<strong>in</strong> concept of the more<br />

recent discount labels is to br<strong>in</strong>g discount led customers<br />

<strong>in</strong>to the store, and migrate them to the higher value labels.<br />

<strong>Carrefour</strong> is attempt<strong>in</strong>g to convey the price image of a<br />

cheaper store, but rema<strong>in</strong> a high value retailer to its current<br />

high value customers...”<br />

• How is <strong>Carrefour</strong> implement<strong>in</strong>g both pan European and local sourc<strong>in</strong>g <strong>in</strong> its private<br />

label assortments?<br />

• What impact will private label have on levels of discount<strong>in</strong>g and brand strategy?

Bus<strong>in</strong>ess <strong>Insights</strong><br />

4<br />

Table of contents<br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong>: Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

EXECUTIVE SUMMARY<br />

• The <strong>Carrefour</strong> group strategic overview<br />

• The fascias<br />

• <strong>Private</strong> label strategy<br />

• Price premium of national brands over private<br />

label<br />

• <strong>Private</strong> label attractiveness<br />

• Conclusions<br />

CHAPTER 1: THE CARREFOUR GROUP- STRATEGIC<br />

OVERVIEW<br />

• Summary<br />

• Introduction<br />

• Key issues for <strong>Carrefour</strong><br />

• <strong>Carrefour</strong>'s global position<br />

- Market share<br />

- Sales growth<br />

• <strong>Carrefour</strong>'s strategy<br />

- Discount strategy<br />

- Communication of price<br />

- Growth of non-food<br />

- Organic growth<br />

- Cost cutt<strong>in</strong>g<br />

- Dia<br />

• Slow-down of <strong>in</strong>ternational expansion<br />

- Plans for expansion and divestment<br />

- Other divestments<br />

• Buy<strong>in</strong>g policy<br />

• Market<strong>in</strong>g and customer loyalty<br />

- Promotion of the discount strategy<br />

- Customer loyalty <strong>in</strong> <strong>Carrefour</strong><br />

- Loyalty as an experience<br />

- The loyalty card<br />

- Competitors loyalty schemes <strong>in</strong> France<br />

CHAPTER 2: THE FASCIAS<br />

• Summary<br />

• Introduction<br />

• <strong>Carrefour</strong> hypermarkets<br />

- <strong>Private</strong> label strategy <strong>in</strong> the hypermarkets<br />

- Hypermarkets store layout<br />

- Consumer profile<br />

- <strong>Private</strong> label/branded share by country<br />

- <strong>Private</strong> label share of sales by country<br />

• Supermarkets<br />

- Champion<br />

- <strong>Private</strong> label strategy <strong>in</strong> the supermarkets<br />

- Consumer profile<br />

- <strong>Private</strong> label/branded share by country<br />

- <strong>Private</strong> label share of sales by country<br />

• Discount stores<br />

- Dia<br />

- Ed<br />

- <strong>Private</strong> label strategy <strong>in</strong> Dia/Ed<br />

- Consumer profile<br />

- <strong>Private</strong> label/branded share by country<br />

- <strong>Private</strong> label share of sales by country<br />

• Convenience stores<br />

- Sherpa<br />

- Shopi, 8-à-Huit, Marché Plus and Proxi<br />

• Cash & carry<br />

• New formats<br />

- Small hyper and HyperChampion<br />

- Very urban Champion<br />

- Super discount- Maxi Dia<br />

• <strong>Private</strong> label share growth <strong>in</strong> the fascias<br />

• <strong>Private</strong> label share of sales vs. other retailers<br />

• <strong>Private</strong> label penetration <strong>in</strong> France<br />

CHAPTER 3: PRIVATE LABEL STRATEGY<br />

• Summary<br />

• Introduction<br />

• <strong>Private</strong> label ranges<br />

- <strong>Private</strong> label ranges<br />

- Filière Qualité <strong>Carrefour</strong><br />

- No. 1<br />

- Produits <strong>Carrefour</strong><br />

- PCI (Produits <strong>Carrefour</strong> Internationaux)<br />

- Reflets de France<br />

- Escapades Gourmandes<br />

- Dest<strong>in</strong>ation Saveurs<br />

- <strong>Carrefour</strong> Bio<br />

- J'aime<br />

- Non- food private labels<br />

• Case study of <strong>Carrefour</strong>'s private label ranges<br />

- Position<strong>in</strong>g of <strong>Carrefour</strong>'s private labels relative<br />

to price<br />

- No. 1<br />

- Produit <strong>Carrefour</strong><br />

- Reflets de France<br />

- Escapades Gourmandes<br />

- <strong>Carrefour</strong> Bio<br />

- J'aime

5 Bus<strong>in</strong>ess <strong>Insights</strong><br />

Table of contents cont<strong>in</strong>ued...<br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong>: Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

CHAPTER 4: PRICE PREMIUM OF NATIONAL BRANDS<br />

OVER PRIVATE LABEL<br />

• Summary<br />

• Introduction<br />

• Price premium of national brands over private label<br />

• Category specific price premium across countries<br />

- Yogurt<br />

- Beer<br />

- Shampoo<br />

CHAPTER 5: PRIVATE LABEL ATTRACTIVENESS<br />

• Summary<br />

• Introduction<br />

• <strong>Carrefour</strong>'s private label attractiveness <strong>in</strong> France<br />

• Top 10 private label categories<br />

- France<br />

- Belgium<br />

- Spa<strong>in</strong><br />

- Portugal<br />

• <strong>Private</strong> label success<br />

- France<br />

- Spa<strong>in</strong><br />

- Belgium<br />

- Portugal<br />

• Fast growth private label sectors<br />

CHAPTER 6: CONCLUSIONS<br />

• Summary<br />

• Introduction<br />

- France and Spa<strong>in</strong><br />

- Belgium and Portugal<br />

• <strong>Carrefour</strong>'s operations<br />

- Emerg<strong>in</strong>g markets<br />

- Market share<br />

- Discount threat<br />

• Discount strategy<br />

- Opportunities<br />

- Threats<br />

- Champion<br />

• Premiumisation<br />

• Move away from discounters<br />

• Format strategy<br />

CHAPTER 7: APPENDIX<br />

- Index<br />

LIST OF FIGURES<br />

• Sales by format <strong>in</strong> France (%), 2003-2004<br />

• Market share of <strong>Carrefour</strong> <strong>in</strong> 2003*<br />

• Sales data, 2004<br />

• Sales by category (%), 2003<br />

• <strong>Carrefour</strong>'s global operations<br />

• Reflets de France promotion <strong>in</strong> a <strong>Carrefour</strong> magaz<strong>in</strong>e<br />

• Filière Qualité <strong>Carrefour</strong> promotion<br />

• No.1 <strong>in</strong> store promotion <strong>in</strong> hypermarkets <strong>in</strong> France<br />

• Loyalty by country <strong>in</strong> <strong>Carrefour</strong>, 2004<br />

• In store signage <strong>in</strong>dicat<strong>in</strong>g discounts with the loyalty<br />

card<br />

• <strong>Private</strong> label strategy <strong>in</strong> <strong>Carrefour</strong> hypermarkets<br />

• Features of the <strong>Carrefour</strong> store layout<br />

• % expenditure of consumers <strong>in</strong> terms of age of house<br />

wife <strong>in</strong> <strong>Carrefour</strong> hypermarkets, 2003<br />

• % expenditure of consumers <strong>in</strong> terms of household size<br />

<strong>in</strong> <strong>Carrefour</strong> hypermarkets, 2003<br />

• <strong>Private</strong> label share for <strong>Carrefour</strong> hypermarkets, (%), 2003<br />

• <strong>Private</strong> label share growth for <strong>Carrefour</strong> by country,<br />

2002-03<br />

• Champion private label strategy<br />

• % expenditure of consumers <strong>in</strong> terms of age of house<br />

wife <strong>in</strong> <strong>Carrefour</strong> supermarkets, 2003<br />

• % expenditure of consumers <strong>in</strong> terms of household size<br />

<strong>in</strong> <strong>Carrefour</strong> supermarkets, 2003<br />

• <strong>Private</strong> label share for supermarkets, (%), 2003<br />

• Supermarkets private label share growth vs. the rest of<br />

the market, 2002-03<br />

• Dia, <strong>in</strong>-store, private label strategy<br />

• % expenditure of consumers <strong>in</strong> terms of age of house<br />

wife <strong>in</strong> <strong>Carrefour</strong> discounters, 2003<br />

• % expenditure of consumers <strong>in</strong> terms of household size<br />

<strong>in</strong> <strong>Carrefour</strong> discounters, 2003<br />

• <strong>Private</strong> label share for discounters, (%), 2003<br />

• Discounter private label share growth vs. the rest of the<br />

market, 2002-03<br />

• <strong>Private</strong> label share growth vs. other retailers <strong>in</strong> France,<br />

2002-2003<br />

• <strong>Private</strong> label share growth vs. other retailers <strong>in</strong> Belgium,<br />

2002-2003<br />

• <strong>Private</strong> label share growth vs. other retailers <strong>in</strong> Spa<strong>in</strong>,<br />

2002-2003<br />

• <strong>Private</strong> label share growth vs. other retailers <strong>in</strong> Portugal,<br />

2002-2003<br />

• <strong>Private</strong> label share of sales vs other retailers <strong>in</strong> France,<br />

2003<br />

• <strong>Private</strong> label share of sales vs other retailers <strong>in</strong> Belgium,<br />

2003<br />

• <strong>Private</strong> label share of sales vs other retailers <strong>in</strong> Spa<strong>in</strong>,<br />

2003<br />

• <strong>Private</strong> label share of sales vs other retailers <strong>in</strong> Portugal,<br />

2003

Bus<strong>in</strong>ess <strong>Insights</strong><br />

6<br />

Table of contents cont<strong>in</strong>ued...<br />

<strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong> <strong>in</strong> <strong>Carrefour</strong>: Best practice for food, dr<strong>in</strong>k and personal care manufacturers<br />

• Number of customer transactions <strong>in</strong> French<br />

hypermarkets, 2003-2004<br />

• <strong>Private</strong> label penetration relative to private label share &<br />

market share <strong>in</strong> France, 2003<br />

• Summary of <strong>Carrefour</strong>'s private labels<br />

• Same product, different label<br />

• Filière Qualité <strong>Carrefour</strong> <strong>in</strong> Poland<br />

• No.1 <strong>in</strong> Czech Republic<br />

• Produit <strong>Carrefour</strong><br />

• Position<strong>in</strong>g of <strong>Carrefour</strong>'s private labels relative to price<br />

<strong>in</strong> biscuits<br />

• No.1 packag<strong>in</strong>g analysis<br />

• Produit <strong>Carrefour</strong> packag<strong>in</strong>g analysis<br />

• Reflets de France packag<strong>in</strong>g analysis<br />

• Escapades Gourmandes packag<strong>in</strong>g analysis<br />

• <strong>Carrefour</strong> Bio packag<strong>in</strong>g analysis<br />

• J'aime packag<strong>in</strong>g analysis<br />

• Brand<strong>in</strong>g criteria of <strong>Carrefour</strong> private labels<br />

• Price premium of national brands over private label <strong>in</strong><br />

France<br />

• Comparison of a basket of private label goods<br />

compared to branded equivalents<br />

• Comparison of the price premium of yogurt by country<br />

• Comparison of the price of beer<br />

• Comparison of the price of shampoo<br />

• <strong>Carrefour</strong> shoppers vs competition: PL attractiveness<br />

• France PL propensity matrix<br />

• <strong>Carrefour</strong> PL success matrix <strong>in</strong> France<br />

• Champion PL success matrix <strong>in</strong> France<br />

• Spa<strong>in</strong> PL propensity matrix<br />

• <strong>Carrefour</strong> PL success matrix <strong>in</strong> Spa<strong>in</strong><br />

• Dia PL success matrix <strong>in</strong> Spa<strong>in</strong><br />

• Belgium PL propensity matrix<br />

• <strong>Carrefour</strong> PL success matrix <strong>in</strong> Belgium<br />

• Champion PL success matrix <strong>in</strong> Belgium<br />

• Portugal PL propensity matrix<br />

• <strong>Carrefour</strong> PL success matrix <strong>in</strong> Portugal<br />

• M<strong>in</strong>ipreço PL success matrix <strong>in</strong> Portugal<br />

• Share trend for private label sectors <strong>in</strong> <strong>Carrefour</strong>,<br />

2000-03<br />

• <strong>Carrefour</strong>'s operat<strong>in</strong>g environment, by core country<br />

• <strong>Carrefour</strong>'s private label timel<strong>in</strong>e<br />

LIST OF TABLES<br />

• The world's lead<strong>in</strong>g grocery retailers<br />

• Key f<strong>in</strong>ancials ($m), 1999-2004<br />

• Sales <strong>in</strong>clud<strong>in</strong>g VAT per country, ($m), 2004<br />

• Discount retailers <strong>in</strong> France, 2003<br />

• Sales by product hypermarkets <strong>in</strong> France (%), 1999-2003<br />

• Sales by region, (%), 1999-2003<br />

• Number of stores worldwide, 2003-2004<br />

• Competitors loyalty schemes <strong>in</strong> France<br />

• Format data of the <strong>Carrefour</strong> group 2003-2004<br />

• Total hypermarket stores <strong>in</strong> France, 1999-2004<br />

• Sales area of hypermarkets <strong>in</strong> France (m²), 1999-2004<br />

• <strong>Carrefour</strong> sales performance <strong>in</strong> France ($m), 1999-2004<br />

• <strong>Private</strong> label share for <strong>Carrefour</strong> hypermarkets, (%), 2003<br />

• <strong>Carrefour</strong>'s private label share growth vs. the rest of the<br />

market, 2002-03<br />

• Number of Champion stores <strong>in</strong> France, 1999-2004<br />

• Size of Champion stores <strong>in</strong> France, (m²), 1999-2004<br />

• Champion sales performance <strong>in</strong> France, ($m), 1999-2004<br />

• Supermarkets private label share growth vs. the rest of<br />

the market, 2002-03<br />

• Total Ed stores <strong>in</strong> France, 1999-2004<br />

• Sales area of Ed stores <strong>in</strong> France, (m²), 1999-2004<br />

• Ed sales performance <strong>in</strong> France, ($m), 1999-2004<br />

• Discounter private label share growth vs. the rest of the<br />

market, 2002-03<br />

• <strong>Private</strong> label penetration relative to private label share &<br />

market share <strong>in</strong> France, 2003<br />

• <strong>Private</strong> labels relative to price<br />

• Top 10 private label products <strong>in</strong> <strong>Carrefour</strong><br />

• Share trend for private label sectors <strong>in</strong> <strong>Carrefour</strong>,<br />

2000-03<br />

• Key f<strong>in</strong>ancials for France, ($m), 1999-2004<br />

• Sales by format <strong>in</strong> France (%), 1999-2004<br />

• Format data for France, 2003-2004<br />

• Number of <strong>Carrefour</strong> stores by region

7 Bus<strong>in</strong>ess <strong>Insights</strong><br />

Sample Information<br />

Chapter 3: <strong>Private</strong> <strong>Label</strong> <strong>Strategy</strong><br />

Summary of <strong>Carrefour</strong>'s private labels<br />

Brand<br />

Produit <strong>Carrefour</strong><br />

No. 1<br />

Reflets de France<br />

Position<strong>in</strong>g/Sector<br />

Ma<strong>in</strong>stream fascia brand <strong>in</strong> food and<br />

non-food<br />

Discount products <strong>in</strong> food and non-food<br />

Food from the various regions of France<br />

Filiére Qualitié <strong>Carrefour</strong><br />

Fresh food<br />

Escapades Gourmandes<br />

Gourmet products<br />

Dest<strong>in</strong>ation Saveurs<br />

Ethnic food<br />

<strong>Carrefour</strong> Bio<br />

Organic products<br />

<strong>Private</strong> label ranges<br />

Accord<strong>in</strong>g to the <strong>Carrefour</strong> group, private labels have a share of<br />

21% <strong>in</strong> dry grocery sales, national brands have a share of 74%<br />

and fight<strong>in</strong>g brands, which are the cheapest on display, have a<br />

share of 5% <strong>in</strong> <strong>Carrefour</strong> hypermarket's dry grocery sales.<br />

<strong>Carrefour</strong>'s private label strategy for 2005 <strong>in</strong>cludes ensur<strong>in</strong>g that<br />

its own brands are much more visible on the shelf, and that they<br />

are develop<strong>in</strong>g the sub-brands such as <strong>Carrefour</strong> Bio. The<br />

<strong>Carrefour</strong> group's private label strategy is to "strengthen its<br />

commercial dynamics." This has resulted <strong>in</strong> a whole new<br />

reposition<strong>in</strong>g of the various product assortments by price range.<br />

In an <strong>in</strong>terview <strong>in</strong> LSA magaz<strong>in</strong>e <strong>in</strong> 2004, former CEO Bernard<br />

Dunand, stated that:<br />

J’aime<br />

Firstl<strong>in</strong>e<br />

Healthy products<br />

Household appliances<br />

1. No.1 of Prices have to be 6% to 7% cheaper than discount<br />

Topbike<br />

Tex<br />

Bikes<br />

Cloth<strong>in</strong>g<br />

2. PCI (Produits <strong>Carrefour</strong> Internationaux) are to be at discount<br />

prices<br />

Source: <strong>Private</strong> <strong>Label</strong> <strong>in</strong> <strong>Carrefour</strong><br />

Bluesky<br />

Electrical Products<br />

3. National Brands have to be less numerous and cheaper than<br />

presently.<br />

<strong>Carrefour</strong> customers still have many product choices: Bio,<br />

ethnic, ethical, eco-friendly, and regional. <strong>Carrefour</strong> <strong>in</strong>tends to keep <strong>in</strong> its stores its entire private label ranges <strong>in</strong> these segments.<br />

These segments and the discount labels represent the diversification <strong>in</strong> <strong>Carrefour</strong>'s private label strategy. The strategy consists of<br />

two core themes:<br />

• Discount<strong>in</strong>g<br />

• Premiumisation<br />

The <strong>Carrefour</strong> group has a vast portfolio of private labels. Apart from the <strong>Carrefour</strong> own label which offers an alternative to almost<br />

any manufacturer's brand, there is a wide range of specialist ranges, from exotic to local specialities, organic and health food,<br />

no-name discount products and of course the 'Filière Qualité <strong>Carrefour</strong>' range, which covers hundreds of items <strong>in</strong> fresh food,<br />

under <strong>Carrefour</strong>'s total control "from the field to the plate." Other l<strong>in</strong>es are:<br />

• Standard or cheap (Produit <strong>Carrefour</strong> and No.1;<br />

• <strong>Label</strong>s for organic products (<strong>Carrefour</strong> Bio);<br />

• Local (Reflets de France);<br />

• International (Dest<strong>in</strong>ation Saveurs) specialties;<br />

• Delicatessen (Escapades Gourmandes).<br />

• There are also special own brands for the retailer's Cash and Carry and food service operations (Promocash), and a range of<br />

products available for <strong>in</strong>dependent retailers (Grand Jury).<br />

The <strong>Carrefour</strong> group sells private labels <strong>in</strong> all of the markets it operates <strong>in</strong>. Produit <strong>Carrefour</strong> is the same as Produit Champion. The<br />

standard private label is mirrored by correspond<strong>in</strong>g labels, such as "GS" and "GB," <strong>in</strong> the respective fascias. The rebadg<strong>in</strong>g of the<br />

same product by retail fascia show's <strong>Carrefour</strong>'s commitment to a centralised buy<strong>in</strong>g process for the Group.

About Bus<strong>in</strong>ess <strong>Insights</strong><br />

Bus<strong>in</strong>ess <strong>Insights</strong> appreciate the importance of accurate, up-to-date <strong>in</strong>cisive<br />

market and company analysis and our aim therefore is to provide a s<strong>in</strong>gle,<br />

off-the-shelf, objective source of data, analysis and market <strong>in</strong>sight.<br />

www.globalbus<strong>in</strong>ess<strong>in</strong>sights.com<br />

FAX BACK TO: +44 (0) 207 900 6688<br />

or scan and e-mail to<br />

market<strong>in</strong>g@globalbus<strong>in</strong>ess<strong>in</strong>sights.com<br />

I would like to order the follow<strong>in</strong>g report(s)... 1<br />

Company details 3<br />

(Please use BLOCK CAPITALS)<br />

1.____________________________________________________<br />

2.____________________________________________________<br />

3.____________________________________________________<br />

Company name: ________________________________________________________<br />

EU companies (except UK) must supply VAT / BTW / MOMS / MWST / IVA / FPA number:<br />

_____________________________________________________________________________________________<br />

Purchase Order Number (if required)_____________________________________<br />

Order<strong>in</strong>g Multiple reports:<br />

2<br />

Multiple report discounts<br />

Enter total price below<br />

1 report ___________________________<br />

2 reports - save 15% ___________________________<br />

3 reports - save 20% ___________________________<br />

Payment method<br />

Please <strong>in</strong>dicate your preferred currency: GB£ EUR US$<br />

Total order value is ____________________________<br />

I will forward a check payable to Bus<strong>in</strong>ess <strong>Insights</strong> Limited.<br />

Please <strong>in</strong>voice my company (please complete <strong>in</strong>voice address below)<br />

4<br />

1. Price is for a ‘S<strong>in</strong>gle User’ licence<br />

2. Discount applied to sum of total list price. Cannot be used <strong>in</strong> conjunction with other offers.<br />

3. Contact market<strong>in</strong>g@globalbus<strong>in</strong>ess<strong>in</strong>sights.com for more <strong>in</strong>formation on regional/global licences<br />

I would like to pay by bank transfer (email address required)<br />

Debit my credit/charge card: Amex Visa Mastercard<br />

Hard Copy<br />

Please fill out recipient derails below if you wish<br />

to order a pr<strong>in</strong>ted version of your report(s).<br />

- Add £50/€75/$95per report<br />

- Please allow 28 days for delivery<br />

‘Interactive’ Version<br />

A new, <strong>in</strong>novative way to view our publications<br />

Customize, search, translate, contrast,<br />

manipulate and extract report content.<br />

- Add £50/€75/$95per report<br />

Card No________________________________________________________________________<br />

Expiry Date _________ / _________<br />

Signature ______________________________<br />

Communications Feedback<br />

Please let us know if any of the follow<strong>in</strong>g factors <strong>in</strong>fluenced your purchase...<br />

Email/Fax/Postal promotion Trade Press<br />

Brochure<br />

My Account Manager<br />

Table of Contents<br />

Conference materials<br />

Colleague Recommendation Website/web search<br />

Recipient details (If different from Payor)<br />

Title: Mr/Mrs/Ms<br />

(Please use BLOCK CAPITALS)<br />

First Name:<br />

Last Name:<br />

Payor details 5<br />

Title: Mr/Mrs/Ms<br />

(Please use BLOCK CAPITALS)<br />

First Name:<br />

Last Name:<br />

Email<br />

Job Title<br />

Department<br />

Address<br />

Email<br />

Job Title<br />

Department<br />

Address<br />

City<br />

Country<br />

Tel<br />

State/Prov<strong>in</strong>ce<br />

Post Code/ZIP<br />

Fax<br />

City<br />

State/Prov<strong>in</strong>ce<br />

Country<br />

Post Code/ZIP<br />

Tel<br />

Fax<br />

Sign here to confirm your order:<br />

ORDERS WITHOUT A SIGNATURE CANNOT BE PROCESSED<br />

<br />

⌨