RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

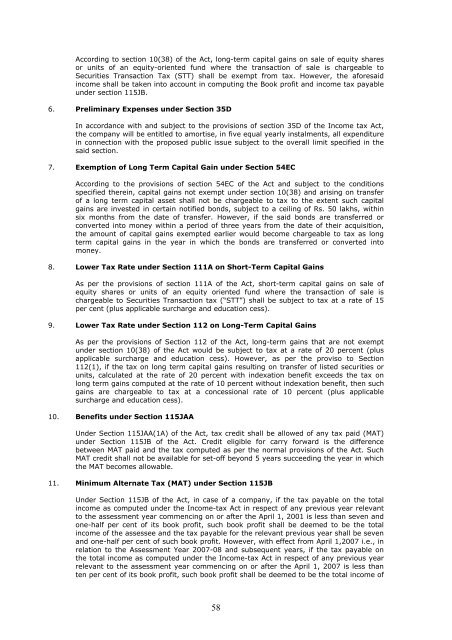

According to section 10(38) of the Act, long-term capital gains on sale of equity shares<br />

or units of an equity-oriented fund where the transaction of sale is chargeable to<br />

Securities Transaction Tax (STT) shall be exempt from tax. However, the aforesaid<br />

income shall be taken into account in computing the Book profit and income tax payable<br />

under section 115JB.<br />

6. Preliminary Expenses under Section 35D<br />

In accordance with and subject to the provisions of section 35D of the Income tax Act,<br />

the company will be entitled to amortise, in five equal yearly instalments, all expenditure<br />

in connection with the proposed public issue subject to the overall limit specified in the<br />

said section.<br />

7. Exemption of Long Term Capital Gain under Section 54EC<br />

According to the provisions of section 54EC of the Act and subject to the conditions<br />

specified therein, capital gains not exempt under section 10(38) and arising on transfer<br />

of a long term capital asset shall not be chargeable to tax to the extent such capital<br />

gains are invested in certain notified bonds, subject to a ceiling of Rs. 50 lakhs, within<br />

six months from the date of transfer. However, if the said bonds are transferred or<br />

converted into money within a period of three years from the date of their acquisition,<br />

the amount of capital gains exempted earlier would become chargeable to tax as long<br />

term capital gains in the year in which the bonds are transferred or converted into<br />

money.<br />

8. Lower Tax Rate under Section 111A on Short-Term Capital Gains<br />

As per the provisions of section 111A of the Act, short-term capital gains on sale of<br />

equity shares or units of an equity oriented fund where the transaction of sale is<br />

chargeable to Securities Transaction tax (“STT”) shall be subject to tax at a rate of 15<br />

per cent (plus applicable surcharge and education cess).<br />

9. Lower Tax Rate under Section 112 on Long-Term Capital Gains<br />

As per the provisions of Section 112 of the Act, long-term gains that are not exempt<br />

under section 10(38) of the Act would be subject to tax at a rate of 20 percent (plus<br />

applicable surcharge and education cess). However, as per the proviso to Section<br />

112(1), if the tax on long term capital gains resulting on transfer of listed securities or<br />

units, calculated at the rate of 20 percent with indexation benefit exceeds the tax on<br />

long term gains computed at the rate of 10 percent without indexation benefit, then such<br />

gains are chargeable to tax at a concessional rate of 10 percent (plus applicable<br />

surcharge and education cess).<br />

10. Benefits under Section 115JAA<br />

Under Section 115JAA(1A) of the Act, tax credit shall be allowed of any tax paid (MAT)<br />

under Section 115JB of the Act. Credit eligible for carry forward is the difference<br />

between MAT paid and the tax computed as per the normal provisions of the Act. Such<br />

MAT credit shall not be available for set-off beyond 5 years succeeding the year in which<br />

the MAT becomes allowable.<br />

11. Minimum Alternate Tax (MAT) under Section 115JB<br />

Under Section 115JB of the Act, in case of a company, if the tax payable on the total<br />

income as computed under the Income-tax Act in respect of any previous year relevant<br />

to the assessment year commencing on or after the April 1, 2001 is less than seven and<br />

one-half per cent of its book profit, such book profit shall be deemed to be the total<br />

income of the assessee and the tax payable for the relevant previous year shall be seven<br />

and one-half per cent of such book profit. However, with effect from April 1,2007 i.e., in<br />

relation to the Assessment Year 2007-08 and subsequent years, if the tax payable on<br />

the total income as computed under the Income-tax Act in respect of any previous year<br />

relevant to the assessment year commencing on or after the April 1, 2007 is less than<br />

ten per cent of its book profit, such book profit shall be deemed to be the total income of<br />

58