RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

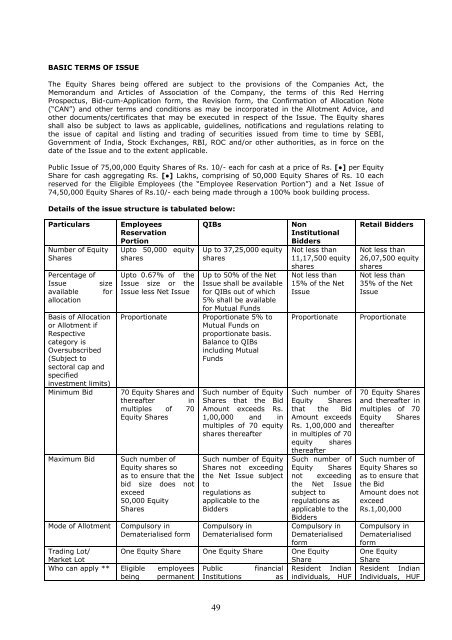

BASIC TERMS OF ISSUE The Equity Shares being offered are subject to the provisions of the Companies Act, the Memorandum and Articles of Association of the Company, the terms of this Red Herring Prospectus, Bid-cum-Application form, the Revision form, the Confirmation of Allocation Note (“CAN”) and other terms and conditions as may be incorporated in the Allotment Advice, and other documents/certificates that may be executed in respect of the Issue. The Equity shares shall also be subject to laws as applicable, guidelines, notifications and regulations relating to the issue of capital and listing and trading of securities issued from time to time by SEBI, Government of India, Stock Exchanges, RBI, ROC and/or other authorities, as in force on the date of the Issue and to the extent applicable. Public Issue of 75,00,000 Equity Shares of Rs. 10/- each for cash at a price of Rs. [●] per Equity Share for cash aggregating Rs. [●] Lakhs, comprising of 50,000 Equity Shares of Rs. 10 each reserved for the Eligible Employees (the “Employee Reservation Portion”) and a Net Issue of 74,50,000 Equity Shares of Rs.10/- each being made through a 100% book building process. Details of the issue structure is tabulated below: Particulars Number of Equity Shares Percentage of Issue size available for allocation Basis of Allocation or Allotment if Respective category is Oversubscribed (Subject to sectoral cap and specified investment limits) Minimum Bid Maximum Bid Mode of Allotment Employees Reservation Portion Upto 50,000 equity shares Upto 0.67% of the Issue size or the Issue less Net Issue Proportionate QIBs Up to 37,25,000 equity shares Up to 50% of the Net Issue shall be available for QIBs out of which 5% shall be available for Mutual Funds Proportionate 5% to Mutual Funds on proportionate basis. Balance to QIBs including Mutual Funds Non Institutional Bidders Not less than 11,17,500 equity shares Not less than 15% of the Net Issue Proportionate 70 Equity Shares and Such number of Equity Such number of thereafter in Shares that the Bid Equity Shares multiples of 70 Amount exceeds Rs. that the Bid Equity Shares 1,00,000 and in Amount exceeds multiples of 70 equity shares thereafter Rs. 1,00,000 and in multiples of 70 equity shares thereafter Such number of Such number of Equity Such number of Equity shares so Shares not exceeding Equity Shares as to ensure that the the Net Issue subject not exceeding bid size does not to the Net Issue exceed regulations as subject to 50,000 Equity applicable to the regulations as Shares Bidders applicable to the Bidders Compulsory in Compulsory in Compulsory in Dematerialised form Dematerialised form Dematerialised form One Equity Share One Equity Share One Equity Share Public financial Resident Indian Institutions as individuals, HUF Trading Lot/ Market Lot Who can apply ** Eligible employees being permanent Retail Bidders Not less than 26,07,500 equity shares Not less than 35% of the Net Issue Proportionate 70 Equity Shares and thereafter in multiples of 70 Equity Shares thereafter Such number of Equity Shares so as to ensure that the Bid Amount does not exceed Rs.1,00,000 Compulsory in Dematerialised form One Equity Share Resident Indian Individuals, HUF 49

Terms of Payment Margin Amount employee or the director(s) of the Company who is an Indian national based in India and is physically present in India on the date of submission of the Bid-cum-Application Form. Such person should be an employee or director(s) during the period commencing from the date of filing of the Red Herring Prospectus with RoC up to the Bid/Issue closing date. Individuals forming part of the Promoter /promoter group are not eligible to be treated as eligible employees Margin Amount applicable to Eligible Employees at the time of submission of Bid- cum- Application Form to the Member of the Syndicate Full Bid Amount on Bidding specified in Section 4A of the Companies Act, Scheduled Commercial bank, Mutual Fund registered with SEBI, Foreign Institutional Investor and subaccount registered with SEBI, other than a sub-account which is a foreign corporate or foreign individual, Multilateral and Bilateral Development Financial Institution, Venture Capital funds registered with SEBI, Foreign Venture Capital Investors registered with SEBI, State Industrial Development Corporations, Insurance Company registered with the Insurance Regulatory and Development Authority (IRDA), Provident Funds with minimum corpus of Rs. 2500 Lakhs and Pension Funds with minimum corpus of Rs. 2500 Lakhs in accordance with applicable law, National Investment Fund set up by resolution no. F. No. 2/3/2005-DDII dated November 23, 2005 of Government of India published in the Gazette of India, FIIs registered with SEBI, 10% of the Bid amount on Bidding (in the name of Karta) Companies, Corporate Bodies, Scientific Institutions, Societies and Trusts and NRIs (applying for an amount exceeding Rs.1, 00,000) Margin amount applicable to QIB Bidders at the time of submission of Bidcum-Application Form to the members of the Syndicate Margin Amount applicable to Non Institutional Bidders at the time of submission of Bid-cum- Application Form to the members of the Syndicate Full Bid Amount on Bidding (in the name of the Karta) and eligible NRIs applying for an amount up to Rs.1, 00,000. Margin Amount applicable to Retail Individual Bidder at the time of submission of Bid- cum- Application Form to the members of the Syndicate, Full Bid Amount on Bidding 50

- Page 25 and 26: 8. Dependence on agri products Mana

- Page 27 and 28: l. In addition to the BRLMs, the Co

- Page 29 and 30: enforced prohibition in 1996, but h

- Page 31 and 32: THE ISSUE Equity Shares offered: Fr

- Page 33 and 34: Particulars As on 31.03.2005 31.03.

- Page 35 and 36: Particulars For the Year/Period End

- Page 37 and 38: BOARD OF DIRECTORS Name of the Dire

- Page 39 and 40: Jawahar Vyapar Bhawan, 14th Floor 1

- Page 41 and 42: STATEMENT OF INTER SE ALLOCATION OF

- Page 43 and 44: The grading is however, constrained

- Page 45 and 46: Industry Outlook & Prospects The do

- Page 47 and 48: on a proportionate basis. For furth

- Page 49 and 50: CAPITAL STRUCTURE OF THE COMPANY Sh

- Page 51 and 52: others # 17.4.1995 $ 2,11,640 10 47

- Page 53 and 54: 1.11.1994 Acquisition 18,75,000 10

- Page 55 and 56: Category Code Category of Sharehold

- Page 57 and 58: 8. Mr. Ashok Kumar 33 0.0003 9. Mr.

- Page 59 and 60: OBJECTS OF THE ISSUE The Company pr

- Page 61 and 62: In case of variations in the actual

- Page 63 and 64: 1. Plant and Machinery for 35 KLPD

- Page 65 and 66: Taxes & Duties 127.00 Total 918.00

- Page 67 and 68: Franchise Fees - - - 4.00 Bond Fees

- Page 69 and 70: Mass Media options: • Hoardings 3

- Page 71 and 72: Alcobrew has vide its letter dated

- Page 73 and 74: K GENERAL CORPORATE PURPOSES: The l

- Page 75: FUNDS DEPLOYED As per the certifica

- Page 79 and 80: BASIS FOR ISSUE PRICE The Issue Pri

- Page 81 and 82: Note: The average return on net wor

- Page 83 and 84: STATEMENT OF TAX BENEFITS TAX BENEF

- Page 85 and 86: According to section 10(38) of the

- Page 87 and 88: As per the provisions of Section 11

- Page 89 and 90: Tax. However, the aforesaid income

- Page 91 and 92: SECTION IV: ABOUT THE ISSUER COMPAN

- Page 93 and 94: In India alcohol is largely produce

- Page 95 and 96: Government Policy & Regulations The

- Page 97 and 98: • Scotch rose by 7.0%. Scotch bra

- Page 99 and 100: substantial market share to India s

- Page 101 and 102: As the Company is increasing its In

- Page 103 and 104: Higher level of instrumentation has

- Page 105 and 106: II. ORDERS ALREADY PLACED: Sl. No 1

- Page 107 and 108: Engineering, Plot No. 65, Bhagwati

- Page 109 and 110: 2 nd Stage (Bio-composting) The was

- Page 111 and 112: converts the slurry into a hydrated

- Page 114 and 115: FLOW CHART OF FINISHING GOODS Recti

- Page 116 and 117: The availability of grain particula

- Page 118 and 119: Domestic - 10 KL Per Day TOTAL - 14

- Page 120 and 121: Power Generation Present Requiremen

- Page 122 and 123: The Spent Wash generated from disti

- Page 124 and 125: • White Lace Duet Gin GR 8 Times

BASIC TERMS OF ISSUE<br />

The Equity Shares being offered are subject to the provisions of the Companies Act, the<br />

Memorandum and Articles of Association of the Company, the terms of this Red Herring<br />

Prospectus, Bid-cum-Application form, the Revision form, the Confirmation of Allocation Note<br />

(“CAN”) and other terms and conditions as may be incorporated in the Allotment Advice, and<br />

other documents/certificates that may be executed in respect of the Issue. The Equity shares<br />

shall also be subject to laws as applicable, guidelines, notifications and regulations relating to<br />

the issue of capital and listing and trading of securities issued from time to time by SEBI,<br />

Government of India, Stock Exchanges, RBI, ROC and/or other authorities, as in force on the<br />

date of the Issue and to the extent applicable.<br />

Public Issue of 75,00,000 Equity Shares of Rs. 10/- each for cash at a price of Rs. [●] per Equity<br />

Share for cash aggregating Rs. [●] Lakhs, comprising of 50,000 Equity Shares of Rs. 10 each<br />

reserved for the Eligible Employees (the “Employee Reservation Portion”) and a Net Issue of<br />

74,50,000 Equity Shares of Rs.10/- each being made through a 100% book building process.<br />

Details of the issue structure is tabulated below:<br />

Particulars<br />

Number of Equity<br />

Shares<br />

Percentage of<br />

Issue size<br />

available for<br />

allocation<br />

Basis of Allocation<br />

or Allotment if<br />

Respective<br />

category is<br />

Oversubscribed<br />

(Subject to<br />

sectoral cap and<br />

specified<br />

investment limits)<br />

Minimum Bid<br />

Maximum Bid<br />

Mode of Allotment<br />

Employees<br />

Reservation<br />

Portion<br />

Upto 50,000 equity<br />

shares<br />

Upto 0.67% of the<br />

Issue size or the<br />

Issue less Net Issue<br />

Proportionate<br />

QIBs<br />

Up to 37,25,000 equity<br />

shares<br />

Up to 50% of the Net<br />

Issue shall be available<br />

for QIBs out of which<br />

5% shall be available<br />

for Mutual Funds<br />

Proportionate 5% to<br />

Mutual Funds on<br />

proportionate basis.<br />

Balance to QIBs<br />

including Mutual<br />

Funds<br />

Non<br />

Institutional<br />

Bidders<br />

Not less than<br />

11,17,500 equity<br />

shares<br />

Not less than<br />

15% of the Net<br />

Issue<br />

Proportionate<br />

70 Equity Shares and Such number of Equity Such number of<br />

thereafter in Shares that the Bid Equity Shares<br />

multiples of 70 Amount exceeds Rs. that the Bid<br />

Equity Shares<br />

1,00,000 and in Amount exceeds<br />

multiples of 70 equity<br />

shares thereafter<br />

Rs. 1,00,000 and<br />

in multiples of 70<br />

equity shares<br />

thereafter<br />

Such number of Such number of Equity Such number of<br />

Equity shares so Shares not exceeding Equity Shares<br />

as to ensure that the the Net Issue subject not exceeding<br />

bid size does not to<br />

the Net Issue<br />

exceed<br />

regulations as<br />

subject to<br />

50,000 Equity applicable to the regulations as<br />

Shares<br />

Bidders<br />

applicable to the<br />

Bidders<br />

Compulsory in Compulsory in<br />

Compulsory in<br />

Dematerialised form Dematerialised form Dematerialised<br />

form<br />

One Equity Share One Equity Share One Equity<br />

Share<br />

Public financial Resident Indian<br />

Institutions as individuals, HUF<br />

Trading Lot/<br />

Market Lot<br />

Who can apply ** Eligible employees<br />

being permanent<br />

Retail Bidders<br />

Not less than<br />

26,07,500 equity<br />

shares<br />

Not less than<br />

35% of the Net<br />

Issue<br />

Proportionate<br />

70 Equity Shares<br />

and thereafter in<br />

multiples of 70<br />

Equity Shares<br />

thereafter<br />

Such number of<br />

Equity Shares so<br />

as to ensure that<br />

the Bid<br />

Amount does not<br />

exceed<br />

Rs.1,00,000<br />

Compulsory in<br />

Dematerialised<br />

form<br />

One Equity<br />

Share<br />

Resident Indian<br />

Individuals, HUF<br />

49