RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

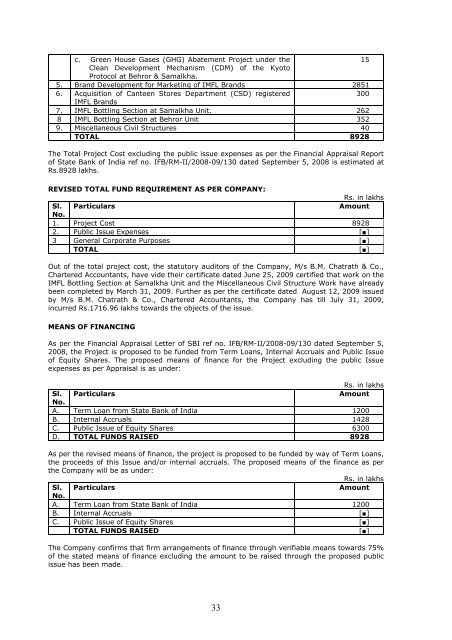

c. Green House Gases (GHG) Abatement Project under the 15 Clean Development Mechanism (CDM) of the Kyoto Protocol at Behror & Samalkha. 5. Brand Development for Marketing of IMFL Brands 2851 6. Acquisition of Canteen Stores Department (CSD) registered 300 IMFL Brands 7. IMFL Bottling Section at Samalkha Unit. 262 8 IMFL Bottling Section at Behror Unit 352 9. Miscellaneous Civil Structures 40 TOTAL 8928 The Total Project Cost excluding the public issue expenses as per the Financial Appraisal Report of State Bank of India ref no. IFB/RM-II/2008-09/130 dated September 5, 2008 is estimated at Rs.8928 lakhs. REVISED TOTAL FUND REQUIREMENT AS PER COMPANY: Rs. in lakhs Sl. Particulars Amount No. 1. Project Cost 8928 2. Public Issue Expenses [■] 3 General Corporate Purposes [■] TOTAL [■] Out of the total project cost, the statutory auditors of the Company, M/s B.M. Chatrath & Co., Chartered Accountants, have vide their certificate dated June 25, 2009 certified that work on the IMFL Bottling Section at Samalkha Unit and the Miscellaneous Civil Structure Work have already been completed by March 31, 2009. Further as per the certificate dated August 12, 2009 issued by M/s B.M. Chatrath & Co., Chartered Accountants, the Company has till July 31, 2009, incurred Rs.1716.96 lakhs towards the objects of the issue. MEANS OF FINANCING As per the Financial Appraisal Letter of SBI ref no. IFB/RM-II/2008-09/130 dated September 5, 2008, the Project is proposed to be funded from Term Loans, Internal Accruals and Public Issue of Equity Shares. The proposed means of finance for the Project excluding the public Issue expenses as per Appraisal is as under: Rs. in lakhs Sl. Particulars Amount No. A. Term Loan from State Bank of India 1200 B. Internal Accruals 1428 C. Public Issue of Equity Shares 6300 D. TOTAL FUNDS RAISED 8928 As per the revised means of finance, the project is proposed to be funded by way of Term Loans, the proceeds of this Issue and/or internal accruals. The proposed means of the finance as per the Company will be as under: Rs. in lakhs Sl. Particulars Amount No. A. Term Loan from State Bank of India 1200 B. Internal Accruals [■] C. Public Issue of Equity Shares [■] TOTAL FUNDS RAISED [■] The Company confirms that firm arrangements of finance through verifiable means towards 75% of the stated means of finance excluding the amount to be raised through the proposed public issue has been made. 33

In case of variations in the actual utilization of funds earmarked for the purposes set forth above, increased fund requirements for a particular purpose may be financed by surplus funds, if any, available in respect of the other purposes for which funds are being raised in this Issue. In the event the overall requirement of funds exceeds the cost of the project, the shortfall will be met through internal accruals. Any additional amount raised through this public issue, in view of it being offered through a book building process, shall be utilized by the Company for general corporate purposes. The amount of free reserves of the Company as at June 30, 2009 stood at Rs. 5429.18 lakhs. APPRAISAL The project has been financially appraised by State Bank of India as per their Letter No. IFB/RM- II/2008-09/130 dated September 5, 2008. State Bank of India has sanctioned a sum of Rs. 1200 lakhs for the Project vide its letter no. IFB/CREDIT/2009-10/90 dated 29.07.2009. State Bank of India in its Appraisal Report has not included any SWOT Analysis of the Company and its business. The SWOT Analysis given at page no. 104 of this Red Herring Prospectus is as envisaged by the management. CARE has vide their letter dated August 10, 2009 retained a CARE BBB+ rating to the long/medium term facilities of the Company. This rating is applicable to facilities having tenure of more than one year. Facilities with CARE BBB ratings are considered to offer moderate safety for timely servicing of Debt obligations. Further CARE has also vide their letter dated August 10, 2009 retained a PR2 rating to the short term facilities of the Company. This rating is applicable to facilities having tenure upto one year. Facilities with this rating would have adequate capacity for timely payment of short term debt obligations and carry higher credit risk as compared to facilities rated higher. Brief note on the term loan sanctioned for the current project and the accompanying terms and conditions of the loan: The Company has been sanctioned a term loan Rs. 1200 lakhs by State Bank of India, Industrial Finance Branch, Jawahar Vyapar Bhawan, 14 th Floor, 1 Tolstoy Marg, New Delhi – 110 001 vide its letter no. IFB/CREDIT/2009-10/90 dated 29.07.2009 to part-finance the proposed modernization and expansion project. The indicative terms of the Project Term Loan are as under: Limit Security Rs. 1200 lakhs Primary: 1 st charge on all fixed assets, including EM of two factory land and buildings at: • Samalkha, Haryana. • Behror, Rajasthan. Collateral: Extension of charge on all current assets of the Company. Personal Guarantee: Mr. Madhav Kumar Swarup Mr. Ajay Kumar Swarup Rate of Interest Financial Covenants Corporate Guarantee: M/s Chand Bagh Investments Ltd. SBAR, i.e. currently 11.75% p.a. at monthly rests (with reset after every 2 years). In terms of Bank’s extant instructions in the matter, it is stipulated that default in payment of interest or instalment on due date to the 34

- Page 9 and 10: Company/Industry Related Terms/Tech

- Page 11 and 12: NRE Account Non Resident External A

- Page 13 and 14: • Company’s ability to successf

- Page 15 and 16: The Company constantly endeavours t

- Page 17 and 18: The Company has reported a net nega

- Page 19 and 20: the Excise and liquor sourcing poli

- Page 21 and 22: Writ Petitions related to notificat

- Page 23 and 24: Northern India Alcohol Sales Pvt. L

- Page 25 and 26: 8. Dependence on agri products Mana

- Page 27 and 28: l. In addition to the BRLMs, the Co

- Page 29 and 30: enforced prohibition in 1996, but h

- Page 31 and 32: THE ISSUE Equity Shares offered: Fr

- Page 33 and 34: Particulars As on 31.03.2005 31.03.

- Page 35 and 36: Particulars For the Year/Period End

- Page 37 and 38: BOARD OF DIRECTORS Name of the Dire

- Page 39 and 40: Jawahar Vyapar Bhawan, 14th Floor 1

- Page 41 and 42: STATEMENT OF INTER SE ALLOCATION OF

- Page 43 and 44: The grading is however, constrained

- Page 45 and 46: Industry Outlook & Prospects The do

- Page 47 and 48: on a proportionate basis. For furth

- Page 49 and 50: CAPITAL STRUCTURE OF THE COMPANY Sh

- Page 51 and 52: others # 17.4.1995 $ 2,11,640 10 47

- Page 53 and 54: 1.11.1994 Acquisition 18,75,000 10

- Page 55 and 56: Category Code Category of Sharehold

- Page 57 and 58: 8. Mr. Ashok Kumar 33 0.0003 9. Mr.

- Page 59: OBJECTS OF THE ISSUE The Company pr

- Page 63 and 64: 1. Plant and Machinery for 35 KLPD

- Page 65 and 66: Taxes & Duties 127.00 Total 918.00

- Page 67 and 68: Franchise Fees - - - 4.00 Bond Fees

- Page 69 and 70: Mass Media options: • Hoardings 3

- Page 71 and 72: Alcobrew has vide its letter dated

- Page 73 and 74: K GENERAL CORPORATE PURPOSES: The l

- Page 75 and 76: FUNDS DEPLOYED As per the certifica

- Page 77 and 78: Terms of Payment Margin Amount empl

- Page 79 and 80: BASIS FOR ISSUE PRICE The Issue Pri

- Page 81 and 82: Note: The average return on net wor

- Page 83 and 84: STATEMENT OF TAX BENEFITS TAX BENEF

- Page 85 and 86: According to section 10(38) of the

- Page 87 and 88: As per the provisions of Section 11

- Page 89 and 90: Tax. However, the aforesaid income

- Page 91 and 92: SECTION IV: ABOUT THE ISSUER COMPAN

- Page 93 and 94: In India alcohol is largely produce

- Page 95 and 96: Government Policy & Regulations The

- Page 97 and 98: • Scotch rose by 7.0%. Scotch bra

- Page 99 and 100: substantial market share to India s

- Page 101 and 102: As the Company is increasing its In

- Page 103 and 104: Higher level of instrumentation has

- Page 105 and 106: II. ORDERS ALREADY PLACED: Sl. No 1

- Page 107 and 108: Engineering, Plot No. 65, Bhagwati

- Page 109 and 110: 2 nd Stage (Bio-composting) The was

c. Green House Gases (GHG) Abatement Project under the<br />

15<br />

Clean Development Mechanism (CDM) of the Kyoto<br />

Protocol at Behror & Samalkha.<br />

5. Brand Development for Marketing of IMFL Brands 2851<br />

6. Acquisition of Canteen Stores Department (CSD) registered<br />

300<br />

IMFL Brands<br />

7. IMFL Bottling Section at Samalkha Unit. 262<br />

8 IMFL Bottling Section at Behror Unit 352<br />

9. Miscellaneous Civil Structures 40<br />

TOTAL 8928<br />

The Total Project Cost excluding the public issue expenses as per the Financial Appraisal Report<br />

of State Bank of India ref no. IFB/RM-II/2008-09/130 dated September 5, 2008 is estimated at<br />

Rs.8928 lakhs.<br />

REVISED TOTAL FUND REQUIREMENT AS PER COMPANY:<br />

Rs. in lakhs<br />

Sl. Particulars<br />

Amount<br />

No.<br />

1. Project Cost 8928<br />

2. Public Issue Expenses [■]<br />

3 General Corporate Purposes [■]<br />

TOTAL<br />

[■]<br />

Out of the total project cost, the statutory auditors of the Company, M/s B.M. Chatrath & Co.,<br />

Chartered Accountants, have vide their certificate dated June 25, 2009 certified that work on the<br />

IMFL Bottling Section at Samalkha Unit and the Miscellaneous Civil Structure Work have already<br />

been completed by March 31, 2009. Further as per the certificate dated <strong>August</strong> 12, 2009 issued<br />

by M/s B.M. Chatrath & Co., Chartered Accountants, the Company has till July 31, 2009,<br />

incurred Rs.1716.96 lakhs towards the objects of the issue.<br />

MEANS OF FINANCING<br />

As per the Financial Appraisal Letter of SBI ref no. IFB/RM-II/2008-09/130 dated September 5,<br />

2008, the Project is proposed to be funded from Term Loans, Internal Accruals and Public Issue<br />

of Equity Shares. The proposed means of finance for the Project excluding the public Issue<br />

expenses as per Appraisal is as under:<br />

Rs. in lakhs<br />

Sl. Particulars<br />

Amount<br />

No.<br />

A. Term Loan from State Bank of India 1200<br />

B. Internal Accruals 1428<br />

C. Public Issue of Equity Shares 6300<br />

D. TOTAL FUNDS RAISED 8928<br />

As per the revised means of finance, the project is proposed to be funded by way of Term Loans,<br />

the proceeds of this Issue and/or internal accruals. The proposed means of the finance as per<br />

the Company will be as under:<br />

Rs. in lakhs<br />

Sl. Particulars<br />

Amount<br />

No.<br />

A. Term Loan from State Bank of India 1200<br />

B. Internal Accruals [■]<br />

C. Public Issue of Equity Shares [■]<br />

TOTAL FUNDS RAISED<br />

[■]<br />

The Company confirms that firm arrangements of finance through verifiable means towards 75%<br />

of the stated means of finance excluding the amount to be raised through the proposed public<br />

issue has been made.<br />

33