RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits RED HERRING PROSPECTUS Dated August 24 ... - Globus Spirits

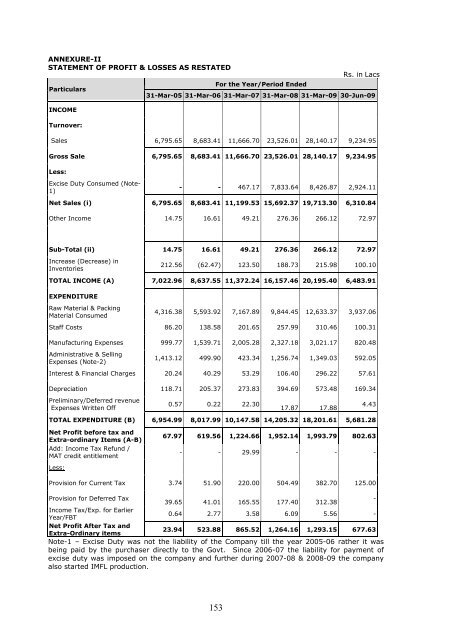

ANNEXURE-II STATEMENT OF PROFIT & LOSSES AS RESTATED Particulars INCOME Turnover: For the Year/Period Ended Rs. in Lacs 31-Mar-05 31-Mar-06 31-Mar-07 31-Mar-08 31-Mar-09 30-Jun-09 Sales 6,795.65 8,683.41 11,666.70 23,526.01 28,140.17 9,234.95 Gross Sale 6,795.65 8,683.41 11,666.70 23,526.01 28,140.17 9,234.95 Less: Excise Duty Consumed (Note- 1) - - 467.17 7,833.64 8,426.87 2,924.11 Net Sales (i) 6,795.65 8,683.41 11,199.53 15,692.37 19,713.30 6,310.84 Other Income 14.75 16.61 49.21 276.36 266.12 72.97 Sub-Total (ii) 14.75 16.61 49.21 276.36 266.12 72.97 Increase (Decrease) in Inventories 212.56 (62.47) 123.50 188.73 215.98 100.10 TOTAL INCOME (A) 7,022.96 8,637.55 11,372.24 16,157.46 20,195.40 6,483.91 EXPENDITURE Raw Material & Packing Material Consumed 4,316.38 5,593.92 7,167.89 9,844.45 12,633.37 3,937.06 Staff Costs 86.20 138.58 201.65 257.99 310.46 100.31 Manufacturing Expenses 999.77 1,539.71 2,005.28 2,327.18 3,021.17 820.48 Administrative & Selling Expenses (Note-2) 1,413.12 499.90 423.34 1,256.74 1,349.03 592.05 Interest & Financial Charges 20.24 40.29 53.29 106.40 296.22 57.61 Depreciation 118.71 205.37 273.83 394.69 573.48 169.34 Preliminary/Deferred revenue Expenses Written Off 0.57 0.22 22.30 17.87 17.88 4.43 TOTAL EXPENDITURE (B) 6,954.99 8,017.99 10,147.58 14,205.32 18,201.61 5,681.28 Net Profit before tax and Extra-ordinary Items (A-B) Add: Income Tax Refund / MAT credit entitlement Less: 67.97 619.56 1,224.66 1,952.14 1,993.79 802.63 - - 29.99 - - - Provision for Current Tax 3.74 51.90 220.00 504.49 382.70 125.00 Provision for Deferred Tax 39.65 41.01 165.55 177.40 312.38 - Income Tax/Exp. for Earlier Year/FBT 0.64 2.77 3.58 6.09 5.56 - Net Profit After Tax and Extra-Ordinary items 23.94 523.88 865.52 1,264.16 1,293.15 677.63 Note-1 – Excise Duty was not the liability of the Company till the year 2005-06 rather it was being paid by the purchaser directly to the Govt. Since 2006-07 the liability for payment of excise duty was imposed on the company and further during 2007-08 & 2008-09 the company also started IMFL production. 153

Note-2 – During the year 2003-04 and 2004-05 the Administrative and Selling expenses was higher as it includes the amount paid as royalty for bottling under franchise agreement with TDV (a UB Group co.). No such tie-up was there in the year 2005-06 and 2006-07. Again the co. has entered into bottling tie-up agreement with BDA Pvt. Ltd. for bottling their product during the year 2007-08, 2008-09 & 2009-10 resulting in higher Administrative & Selling expenses. ANNEXURE-III SIGNIFICANT ACCOUNTING POLICIES A. SIGNIFICANT ACCOUNTING POLICIES 1. ACCOUNTING CONVENTION The financial statements are prepared under the historical cost convention in accordance with the Accounting standards specified to be mandatory by the Institute of Chartered Accountants of India and the relevant provisions of the Companies Act, 1956. 2. FIXED ASSETS (including Intangible Asset) Fixed Assets and Intangible Assets are stated at cost less accumulated depreciation less impairment, if any. Cost of tangible fixed assets and intangible assets comprises the purchase price and any attributable cost of bringing the asset to working condition for its intended use. Insurance spares are capitalized with the related mother asset from the date such asset is put to use. 3. DEPRECIATION The company has charged the depreciation under the W.D.V. method in accordance with the Companies Act, 1956. 4. INVENTORY The basis of determining the cost of the various categories of inventories is as follows Stores, Spares and Fuel Raw material & Packing Material Finished Goods : Average cost : Average cost : Valued at cost or market price which ever is less 5. INVESTMENTS Investments are carried at lower of cost and fair value determined on an individual investment basis. Long-term investments are carried at cost. However, provision for diminution has not been made in the value of the investments. 6. REVENUE RECOGNITION 1. Revenue in respect of domestic sale of the goods and scrap material is recognized at the point of dispatch to the customers from warehouse 2. Sales are net of Sales return 3. Investment income: Income from investments is accounted for in the year in which right to receive such income is established 7. RETIREMENT BENEFITS Provisions for contribution to retirement benefits scheme are made as follows a) Provident fund on actual liability basis b) Provision for Gratuity and Leave encashment has been provided for as per actuary’s valuation method up to 30 th June, 2009 amounting to Rs.17,11,272/-. 8. EARNING PER SHARE Basic earnings per share are calculated by dividing the net profit or loss for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year. The Company has not issued any potential equity shares, and accordingly, the basic earnings per share and diluted earnings per share are the same. 9. IMPAIRMENT OF ASSETS 154

- Page 130 and 131: 6. Manufacturing Agreement Parties:

- Page 132 and 133: its distinct identity in the Countr

- Page 134 and 135: PROPERTY A. Properties owned by the

- Page 136 and 137: Date of Agreement: 25.3.1995 vide D

- Page 138 and 139: Date of Agreement: 12.1.1995 vide D

- Page 140 and 141: 27. M/s Globus Agronics Limited Dat

- Page 142 and 143: Parties Sub-Lessor Associated Disti

- Page 144 and 145: Class 33 (Thirty Three) Applicant G

- Page 146 and 147: Sr. No Mark Registration Number Cla

- Page 148 and 149: BRIEF HISTORY AND OTHER CORPORATE M

- Page 150 and 151: 22.08.1995 • Change in Authorised

- Page 152 and 153: DIN: 00769308 01.08.2009) Term: 3 y

- Page 154 and 155: Limited in 1983 and later promoted

- Page 156 and 157: Industrial Engineer where he was re

- Page 158 and 159: If at any time the director ceases

- Page 160 and 161: CORPORATE GOVERNANCE CORPORATE GOVE

- Page 162 and 163: 1. To scrutinize the Share transfer

- Page 164 and 165: Further, the Directors are also int

- Page 166 and 167: Chart 1: BEHROR UNIT, RAJASTHAN 139

- Page 168 and 169: 141

- Page 170 and 171: joined Radico Khaitan Limited in 19

- Page 172 and 173: PROMOTERS Mr. Ajay Kumar Swarup and

- Page 174 and 175: Sl. No. Name of Shareholder No. of

- Page 176 and 177: Related Party Transactions For deta

- Page 178 and 179: estatements and regroupings as cons

- Page 182 and 183: At each balance sheet an assessment

- Page 184 and 185: Particulars Key Management Personal

- Page 186 and 187: Particulars Associates Key Manageme

- Page 188 and 189: ENA BL 44.93 1477.37 14.06 1080.81

- Page 190 and 191: AS ON PARTICULARS 31-Mar-05 31-Mar-

- Page 192 and 193: guaranteed by Sh. Madhav K. Swarup

- Page 194 and 195: ANNEXURE-XI STATEMENT OF CURRENT LI

- Page 196 and 197: Note: ** Information pertaining to

- Page 198 and 199: EXISTING BORROWING FACILITIES The C

- Page 200 and 201: Prepayment Charges: 2% of the Prepa

- Page 202 and 203: losses and deferred expenditure not

- Page 204 and 205: There are no defaults in meeting an

- Page 206 and 207: 3. Networth means aggregate of valu

- Page 208 and 209: SHAREHOLDING Sl. No. Name of Shareh

- Page 210 and 211: horticulture and agriculture in all

- Page 212 and 213: There are no defaults in meeting an

- Page 214 and 215: Ajay Swarup) together hold 100% sha

- Page 216 and 217: 3. Networth means aggregate of valu

- Page 218 and 219: MANAGEMENT’S DISCUSSION AND ANALY

- Page 220 and 221: Interest & Finance Charge 40.29 53.

- Page 222 and 223: Interest and Finance Expenses The i

- Page 224 and 225: Similarly, for consumers like fuel

- Page 226 and 227: (b). Recovery Suits 1. Globus Agron

- Page 228 and 229: SB. Civil Writ Petition No. 3454 of

ANNEXURE-II<br />

STATEMENT OF PROFIT & LOSSES AS RESTATED<br />

Particulars<br />

INCOME<br />

Turnover:<br />

For the Year/Period Ended<br />

Rs. in Lacs<br />

31-Mar-05 31-Mar-06 31-Mar-07 31-Mar-08 31-Mar-09 30-Jun-09<br />

Sales 6,795.65 8,683.41 11,666.70 23,526.01 28,140.17 9,234.95<br />

Gross Sale 6,795.65 8,683.41 11,666.70 23,526.01 28,140.17 9,234.95<br />

Less:<br />

Excise Duty Consumed (Note-<br />

1)<br />

- - 467.17 7,833.64 8,426.87 2,9<strong>24</strong>.11<br />

Net Sales (i) 6,795.65 8,683.41 11,199.53 15,692.37 19,713.30 6,310.84<br />

Other Income 14.75 16.61 49.21 276.36 266.12 72.97<br />

Sub-Total (ii) 14.75 16.61 49.21 276.36 266.12 72.97<br />

Increase (Decrease) in<br />

Inventories<br />

212.56 (62.47) 123.50 188.73 215.98 100.10<br />

TOTAL INCOME (A) 7,022.96 8,637.55 11,372.<strong>24</strong> 16,157.46 20,195.40 6,483.91<br />

EXPENDITURE<br />

Raw Material & Packing<br />

Material Consumed<br />

4,316.38 5,593.92 7,167.89 9,844.45 12,633.37 3,937.06<br />

Staff Costs 86.20 138.58 201.65 257.99 310.46 100.31<br />

Manufacturing Expenses 999.77 1,539.71 2,005.28 2,327.18 3,021.17 820.48<br />

Administrative & Selling<br />

Expenses (Note-2)<br />

1,413.12 499.90 423.34 1,256.74 1,349.03 592.05<br />

Interest & Financial Charges 20.<strong>24</strong> 40.29 53.29 106.40 296.22 57.61<br />

Depreciation 118.71 205.37 273.83 394.69 573.48 169.34<br />

Preliminary/Deferred revenue<br />

Expenses Written Off<br />

0.57 0.22 22.30<br />

17.87 17.88<br />

4.43<br />

TOTAL EXPENDITURE (B) 6,954.99 8,017.99 10,147.58 14,205.32 18,201.61 5,681.28<br />

Net Profit before tax and<br />

Extra-ordinary Items (A-B)<br />

Add: Income Tax Refund /<br />

MAT credit entitlement<br />

Less:<br />

67.97 619.56 1,2<strong>24</strong>.66 1,952.14 1,993.79 802.63<br />

- - 29.99 - - -<br />

Provision for Current Tax 3.74 51.90 220.00 504.49 382.70 125.00<br />

Provision for Deferred Tax<br />

39.65 41.01 165.55 177.40 312.38<br />

-<br />

Income Tax/Exp. for Earlier<br />

Year/FBT<br />

0.64 2.77 3.58 6.09 5.56 -<br />

Net Profit After Tax and<br />

Extra-Ordinary items<br />

23.94 523.88 865.52 1,264.16 1,293.15 677.63<br />

Note-1 – Excise Duty was not the liability of the Company till the year 2005-06 rather it was<br />

being paid by the purchaser directly to the Govt. Since 2006-07 the liability for payment of<br />

excise duty was imposed on the company and further during 2007-08 & 2008-09 the company<br />

also started IMFL production.<br />

153