Building for a brighter future - GHA Central

Building for a brighter future - GHA Central Building for a brighter future - GHA Central

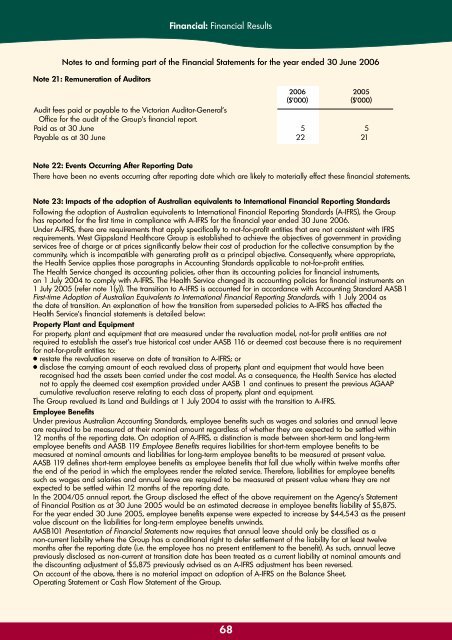

Financial: Financial Results Notes to and forming part of the Financial Statements for the year ended 30 June 2006 Note 21: Remuneration of Auditors 2006 2005 ($’000)($’000) Audit fees paid or payable to the Victorian Auditor-General's Office for the audit of the Group's financial report. Paid as at 30 June 5 5 Payable as at 30 June 22 21 Note 22: Events Occurring After Reporting Date There have been no events occurring after reporting date which are likely to materially effect these financial statements. Note 23: Impacts of the adoption of Australian equivalents to International Financial Reporting Standards Following the adoption of Australian equivalents to International Financial Reporting Standards (A-IFRS), the Group has reported for the first time in compliance with A-IFRS for the financial year ended 30 June 2006. Under A-IFRS, there are requirements that apply specifically to not-for-profit entities that are not consistent with IFRS requirements. West Gippsland Healthcare Group is established to achieve the objectives of government in providing services free of charge or at prices significantly below their cost of production for the collective consumption by the community, which is incompatible with generating profit as a principal objective. Consequently, where appropriate, the Health Service applies those paragraphs in Accounting Standards applicable to not-for-profit entities. The Health Service changed its accounting policies, other than its accounting policies for financial instruments, on 1 July 2004 to comply with A-IFRS. The Health Service changed its accounting policies for financial instruments on 1 July 2005 (refer note 1(y)). The transition to A-IFRS is accounted for in accordance with Accounting Standard AASB1 First-time Adoption of Australian Equivalents to International Financial Reporting Standards, with 1 July 2004 as the date of transition. An explanation of how the transition from superseded policies to A-IFRS has affected the Health Service’s financial statements is detailed below: Property Plant and Equipment For property, plant and equipment that are measured under the revaluation model, not-for profit entities are not required to establish the asset’s true historical cost under AASB 116 or deemed cost because there is no requirement for not-for-profit entities to: ● restate the revaluation reserve on date of transition to A-IFRS; or ● disclose the carrying amount of each revalued class of property, plant and equipment that would have been recognised had the assets been carried under the cost model. As a consequence, the Health Service has elected not to apply the deemed cost exemption provided under AASB 1 and continues to present the previous AGAAP cumulative revaluation reserve relating to each class of property, plant and equipment. The Group revalued its Land and Buildings at 1 July 2004 to assist with the transition to A-IFRS. Employee Benefits Under previous Australian Accounting Standards, employee benefits such as wages and salaries and annual leave are required to be measured at their nominal amount regardless of whether they are expected to be settled within 12 months of the reporting date. On adoption of A-IFRS, a distinction is made between short-term and long-term employee benefits and AASB 119 Employee Benefits requires liabilities for short-term employee benefits to be measured at nominal amounts and liabilities for long-term employee benefits to be measured at present value. AASB 119 defines short-term employee benefits as employee benefits that fall due wholly within twelve months after the end of the period in which the employees render the related service. Therefore, liabilities for employee benefits such as wages and salaries and annual leave are required to be measured at present value where they are not expected to be settled within 12 months of the reporting date. In the 2004/05 annual report, the Group disclosed the effect of the above requirement on the Agency’s Statement of Financial Position as at 30 June 2005 would be an estimated decrease in employee benefits liability of $5,875. For the year ended 30 June 2005, employee benefits expense were expected to increase by $44,543 as the present value discount on the liabilities for long-term employee benefits unwinds. AASB101 Presentation of Financial Statements now requires that annual leave should only be classified as a non-current liability where the Group has a conditional right to defer settlement of the liability for at least twelve months after the reporting date (i.e. the employee has no present entitlement to the benefit). As such, annual leave previously disclosed as non-current at transition date has been treated as a current liability at nominal amounts and the discounting adjustment of $5,875 previously advised as an A-IFRS adjustment has been reversed. On account of the above, there is no material impact on adoption of A-IFRS on the Balance Sheet, Operating Statement or Cash Flow Statement of the Group. 68

Financial: Certification West Gippsland Healthcare Group Certification We certify that the attached financial statements for the West Gippsland Healthcare Group have been prepared in accordance with Part 4.2 of the Standing Directions of the Minister for Finance under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting standards and other mandatory professional reporting requirements. We further state that, in our opinion, the information set out in the operating statement, balance sheet, statement of recognised income and expense, cash flow statement and notes to and forming part of the financial statements, presents fairly the financial transactions for the year ended 30 June 2006 and the financial position of the Group as at 30 June 2006. At the date of signing the financial statements we are not aware of any circumstances which would render any particulars included in the financial statements to be misleading or inaccurate. 69

- Page 19 and 20: Our People: Occupational Health and

- Page 21 and 22: Review of Operations: Environment a

- Page 23 and 24: Review of Operations: Quality Repor

- Page 25 and 26: Review of Operations: Quality Repor

- Page 27 and 28: Review of Operations: Quality Repor

- Page 29 and 30: Review of Operations: Acute (Hospit

- Page 31 and 32: Review of Operations: Acute (Hospit

- Page 33 and 34: Review of Operations: Aged Care Ser

- Page 35 and 36: Review of Operations: Community Ser

- Page 37 and 38: Review of Operations: Allied Health

- Page 39 and 40: Our Community: Volunteers We enjoy

- Page 41 and 42: Our Community: Donations and Sponso

- Page 43 and 44: Staff List: Our Staff Allied Health

- Page 45 and 46: Financial: Financial Results OPERAT

- Page 47 and 48: Financial: Financial Results STATEM

- Page 49 and 50: Financial: Financial Results Notes

- Page 51 and 52: Financial: Financial Results Notes

- Page 53 and 54: Financial: Financial Results Notes

- Page 55 and 56: Financial: Financial Results Notes

- Page 58 and 59: Financial: Financial Results Notes

- Page 60 and 61: Financial: Financial Results Notes

- Page 62 and 63: Financial: Financial Results Notes

- Page 64 and 65: Financial: Financial Results Notes

- Page 66 and 67: Financial: Financial Results Notes

- Page 68 and 69: Financial: Financial Results Notes

- Page 72 and 73: Financial: Auditor General’s Repo

- Page 74 and 75: Appendices Statement of Fees and Ch

- Page 76 and 77: Appendices Compliance Index Financi

- Page 78 and 79: Index A Aboriginal Services 32 Acce

- Page 80: Head Office: West Gippsland Hospita

Financial: Financial Results<br />

Notes to and <strong>for</strong>ming part of the Financial Statements <strong>for</strong> the year ended 30 June 2006<br />

Note 21: Remuneration of Auditors<br />

2006 2005<br />

($’000)($’000)<br />

Audit fees paid or payable to the Victorian Auditor-General's<br />

Office <strong>for</strong> the audit of the Group's financial report.<br />

Paid as at 30 June 5 5<br />

Payable as at 30 June 22 21<br />

Note 22: Events Occurring After Reporting Date<br />

There have been no events occurring after reporting date which are likely to materially effect these financial statements.<br />

Note 23: Impacts of the adoption of Australian equivalents to International Financial Reporting Standards<br />

Following the adoption of Australian equivalents to International Financial Reporting Standards (A-IFRS), the Group<br />

has reported <strong>for</strong> the first time in compliance with A-IFRS <strong>for</strong> the financial year ended 30 June 2006.<br />

Under A-IFRS, there are requirements that apply specifically to not-<strong>for</strong>-profit entities that are not consistent with IFRS<br />

requirements. West Gippsland Healthcare Group is established to achieve the objectives of government in providing<br />

services free of charge or at prices significantly below their cost of production <strong>for</strong> the collective consumption by the<br />

community, which is incompatible with generating profit as a principal objective. Consequently, where appropriate,<br />

the Health Service applies those paragraphs in Accounting Standards applicable to not-<strong>for</strong>-profit entities.<br />

The Health Service changed its accounting policies, other than its accounting policies <strong>for</strong> financial instruments,<br />

on 1 July 2004 to comply with A-IFRS. The Health Service changed its accounting policies <strong>for</strong> financial instruments on<br />

1 July 2005 (refer note 1(y)). The transition to A-IFRS is accounted <strong>for</strong> in accordance with Accounting Standard AASB1<br />

First-time Adoption of Australian Equivalents to International Financial Reporting Standards, with 1 July 2004 as<br />

the date of transition. An explanation of how the transition from superseded policies to A-IFRS has affected the<br />

Health Service’s financial statements is detailed below:<br />

Property Plant and Equipment<br />

For property, plant and equipment that are measured under the revaluation model, not-<strong>for</strong> profit entities are not<br />

required to establish the asset’s true historical cost under AASB 116 or deemed cost because there is no requirement<br />

<strong>for</strong> not-<strong>for</strong>-profit entities to:<br />

● restate the revaluation reserve on date of transition to A-IFRS; or<br />

● disclose the carrying amount of each revalued class of property, plant and equipment that would have been<br />

recognised had the assets been carried under the cost model. As a consequence, the Health Service has elected<br />

not to apply the deemed cost exemption provided under AASB 1 and continues to present the previous AGAAP<br />

cumulative revaluation reserve relating to each class of property, plant and equipment.<br />

The Group revalued its Land and <strong>Building</strong>s at 1 July 2004 to assist with the transition to A-IFRS.<br />

Employee Benefits<br />

Under previous Australian Accounting Standards, employee benefits such as wages and salaries and annual leave<br />

are required to be measured at their nominal amount regardless of whether they are expected to be settled within<br />

12 months of the reporting date. On adoption of A-IFRS, a distinction is made between short-term and long-term<br />

employee benefits and AASB 119 Employee Benefits requires liabilities <strong>for</strong> short-term employee benefits to be<br />

measured at nominal amounts and liabilities <strong>for</strong> long-term employee benefits to be measured at present value.<br />

AASB 119 defines short-term employee benefits as employee benefits that fall due wholly within twelve months after<br />

the end of the period in which the employees render the related service. There<strong>for</strong>e, liabilities <strong>for</strong> employee benefits<br />

such as wages and salaries and annual leave are required to be measured at present value where they are not<br />

expected to be settled within 12 months of the reporting date.<br />

In the 2004/05 annual report, the Group disclosed the effect of the above requirement on the Agency’s Statement<br />

of Financial Position as at 30 June 2005 would be an estimated decrease in employee benefits liability of $5,875.<br />

For the year ended 30 June 2005, employee benefits expense were expected to increase by $44,543 as the present<br />

value discount on the liabilities <strong>for</strong> long-term employee benefits unwinds.<br />

AASB101 Presentation of Financial Statements now requires that annual leave should only be classified as a<br />

non-current liability where the Group has a conditional right to defer settlement of the liability <strong>for</strong> at least twelve<br />

months after the reporting date (i.e. the employee has no present entitlement to the benefit). As such, annual leave<br />

previously disclosed as non-current at transition date has been treated as a current liability at nominal amounts and<br />

the discounting adjustment of $5,875 previously advised as an A-IFRS adjustment has been reversed.<br />

On account of the above, there is no material impact on adoption of A-IFRS on the Balance Sheet,<br />

Operating Statement or Cash Flow Statement of the Group.<br />

68