Policy Wording - Insure me 4

Policy Wording - Insure me 4

Policy Wording - Insure me 4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

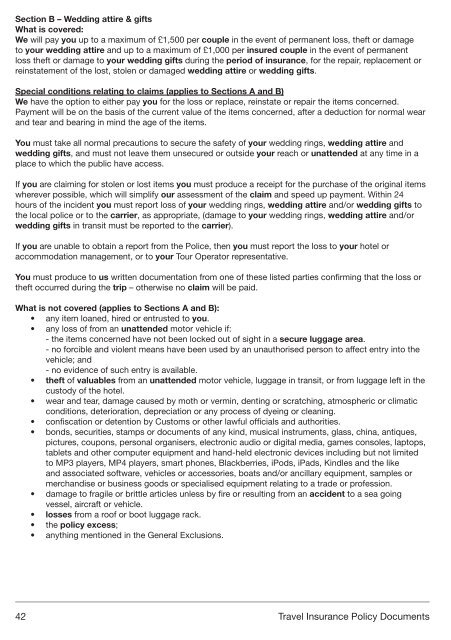

Section B – Wedding attire & gifts<br />

What is covered:<br />

We will pay you up to a maximum of £1,500 per couple in the event of permanent loss, theft or damage<br />

to your wedding attire and up to a maximum of £1,000 per insured couple in the event of permanent<br />

loss theft or damage to your wedding gifts during the period of insurance, for the repair, replace<strong>me</strong>nt or<br />

reinstate<strong>me</strong>nt of the lost, stolen or damaged wedding attire or wedding gifts.<br />

Special conditions relating to claims (applies to Sections A and B)<br />

We have the option to either pay you for the loss or replace, reinstate or repair the items concerned.<br />

Pay<strong>me</strong>nt will be on the basis of the current value of the items concerned, after a deduction for normal wear<br />

and tear and bearing in mind the age of the items.<br />

You must take all normal precautions to secure the safety of your wedding rings, wedding attire and<br />

wedding gifts, and must not leave them unsecured or outside your reach or unattended at any ti<strong>me</strong> in a<br />

place to which the public have access.<br />

If you are claiming for stolen or lost items you must produce a receipt for the purchase of the original items<br />

wherever possible, which will simplify our assess<strong>me</strong>nt of the claim and speed up pay<strong>me</strong>nt. Within 24<br />

hours of the incident you must report loss of your wedding rings, wedding attire and/or wedding gifts to<br />

the local police or to the carrier, as appropriate, (damage to your wedding rings, wedding attire and/or<br />

wedding gifts in transit must be reported to the carrier).<br />

If you are unable to obtain a report from the Police, then you must report the loss to your hotel or<br />

accommodation manage<strong>me</strong>nt, or to your Tour Operator representative.<br />

You must produce to us written docu<strong>me</strong>ntation from one of these listed parties confirming that the loss or<br />

theft occurred during the trip – otherwise no claim will be paid.<br />

What is not covered (applies to Sections A and B):<br />

• any item loaned, hired or entrusted to you.<br />

• any loss of from an unattended motor vehicle if:<br />

- the items concerned have not been locked out of sight in a secure luggage area.<br />

- no forcible and violent <strong>me</strong>ans have been used by an unauthorised person to affect entry into the<br />

vehicle; and<br />

- no evidence of such entry is available.<br />

• theft of valuables from an unattended motor vehicle, luggage in transit, or from luggage left in the<br />

custody of the hotel.<br />

• wear and tear, damage caused by moth or vermin, denting or scratching, atmospheric or climatic<br />

conditions, deterioration, depreciation or any process of dyeing or cleaning.<br />

• confiscation or detention by Customs or other lawful officials and authorities.<br />

• bonds, securities, stamps or docu<strong>me</strong>nts of any kind, musical instru<strong>me</strong>nts, glass, china, antiques,<br />

pictures, coupons, personal organisers, electronic audio or digital <strong>me</strong>dia, ga<strong>me</strong>s consoles, laptops,<br />

tablets and other computer equip<strong>me</strong>nt and hand-held electronic devices including but not limited<br />

to MP3 players, MP4 players, smart phones, Blackberries, iPods, iPads, Kindles and the like<br />

and associated software, vehicles or accessories, boats and/or ancillary equip<strong>me</strong>nt, samples or<br />

<strong>me</strong>rchandise or business goods or specialised equip<strong>me</strong>nt relating to a trade or profession.<br />

• damage to fragile or brittle articles unless by fire or resulting from an accident to a sea going<br />

vessel, aircraft or vehicle.<br />

• losses from a roof or boot luggage rack.<br />

• the policy excess;<br />

• anything <strong>me</strong>ntioned in the General Exclusions.<br />

42 Travel Insurance <strong>Policy</strong> Docu<strong>me</strong>nts