A Revolution in R&D

A Revolution in R&D

A Revolution in R&D

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46<br />

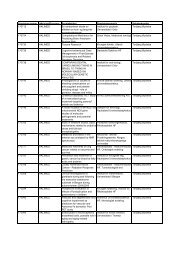

INDUSTRY CHANGES<br />

The genomics landscape features many small startups<br />

amid the larger genomics companies and the<br />

genomics divisions of big pharmaceutical corporations.<br />

But that landscape is chang<strong>in</strong>g. The number<br />

of deals—of genomics companies comb<strong>in</strong><strong>in</strong>g with<br />

each other or be<strong>in</strong>g taken over by big pharmaceutical<br />

firms—has been grow<strong>in</strong>g steadily. What is driv<strong>in</strong>g<br />

this tendency toward consolidation?<br />

The Pressure to Extend Scope<br />

Increas<strong>in</strong>gly, genomics companies are aspir<strong>in</strong>g to<br />

become full-fledged drug companies. No specialized<br />

company, it seems, has yet succeeded <strong>in</strong> build<strong>in</strong>g a<br />

truly stable competitive position as a drug-<strong>in</strong>dustry<br />

supplier; <strong>in</strong>tellectual-property statutes do not<br />

appear to be enough to guarantee long-term protection;<br />

and the chances of proprietary advantage are<br />

be<strong>in</strong>g nullified by the trend toward public-private<br />

partnerships or consortia, underwritten by big pharmaceutical<br />

companies.<br />

Wall Street appears to place a far higher value on<br />

<strong>in</strong>tegrated drug producers than on pure technology<br />

companies (if only because the drug sector has traditionally<br />

enjoyed such high profits and such high<br />

regard among <strong>in</strong>vestors). Accord<strong>in</strong>g to a recent USB<br />

Warburg study, the average <strong>in</strong>tegrated drug company<br />

has been able to raise $870 million, as aga<strong>in</strong>st<br />

a mere $330 million for the average technology<br />

company. (The study noted a further <strong>in</strong>terest<strong>in</strong>g<br />

divergence among technology companies themselves:<br />

biology companies—those focused on target<br />

identification and validation—raised $480 million<br />

on average, whereas companies <strong>in</strong> the chemistry<br />

area—those focused on screen<strong>in</strong>g and lead optimization—raised<br />

on average only $170 million.)<br />

In keep<strong>in</strong>g with this expansionist aspiration, most of<br />

the recent deals have consisted of acquisitions of<br />

downstream drug-development capabilities. Witness<br />

LION’s acquisition of Trega (for $35 million),<br />

Celera’s acquisition of AxyS (for $173 million), and<br />

Lexicon’s acquisition of Coelacanth (for $32 million).<br />

The Pressure to Achieve Scale<br />

As sections of the value cha<strong>in</strong> have become <strong>in</strong>dustrialized,<br />

the value of scale <strong>in</strong> R&D has ga<strong>in</strong>ed<br />

prom<strong>in</strong>ence. And for genomics platform companies<br />

and pharmaceutical companies alike, it may appear<br />

quicker and neater to achieve scale through a merger<br />

than through pa<strong>in</strong>stak<strong>in</strong>g <strong>in</strong>-house upscal<strong>in</strong>g. (Of<br />

course, pharmaceutical companies might have other<br />

reasons to acquire genomics companies: to jumpstart<br />

their genomics efforts, for <strong>in</strong>stance, or to<br />

acquire otherwise rare capabilities.)<br />

Sure enough, most of the recent mergers and acquisitions<br />

have clearly been <strong>in</strong>itiated for the sake of<br />

<strong>in</strong>creas<strong>in</strong>g scale: Sequenom’s acquisition of Gem<strong>in</strong>i<br />

Genomics (for $238 million), for example, or<br />

Sangamo’s acquisition of Gendaq (for $40 million).<br />

These scale deals have been primarily <strong>in</strong> target identification<br />

and validation rather than <strong>in</strong> chemistry—a<br />

reflection of the urgency of the land grab.<br />

The Pressure to Spend<br />

Whatever the <strong>in</strong>ducements to merge, there is a traditional<br />

impediment—lack of wherewithal. The spirit<br />

is will<strong>in</strong>g but the purse is weak. That is certa<strong>in</strong>ly not<br />

a constra<strong>in</strong>t, however, on some of the large<br />

genomics companies at the moment. In mid-2001,<br />

three top companies—Human Genome Sciences,<br />

Celera, and Millennium—boasted over $4 billion <strong>in</strong><br />

cash between them, represent<strong>in</strong>g about 25 percent<br />

of their comb<strong>in</strong>ed market capitalizations. Idle money<br />

cries out to be spent—probably, for these companies,<br />

on diversification more than on scal<strong>in</strong>g.<br />

Market expectations, a sense of urgency, an abundance<br />

of funds: all signs po<strong>in</strong>t<strong>in</strong>g to cont<strong>in</strong>ued consolidation<br />

<strong>in</strong> the near term.