A Revolution in R&D

A Revolution in R&D

A Revolution in R&D

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

Given these technological limitations, we estimate<br />

that less than 15 percent of drugs will be amenable<br />

to the application of pharmacogenetics.<br />

Desirability—Market Economics<br />

As already mentioned, there are circumstances <strong>in</strong><br />

which a company might have an <strong>in</strong>centive to shun<br />

pharmacogenetics entirely. After all, by exclud<strong>in</strong>g<br />

patients from trials, you are <strong>in</strong> effect giv<strong>in</strong>g the<br />

drug a restricted label when try<strong>in</strong>g to market it.<br />

Gaug<strong>in</strong>g the likely effect of a restricted label<br />

<strong>in</strong>volves some complex analysis. For a start, you<br />

need to consider two dist<strong>in</strong>ct groups of patients:<br />

those who take a prescription for the full course of<br />

treatment (which could last many years, or even the<br />

rema<strong>in</strong><strong>in</strong>g lifetime for those suffer<strong>in</strong>g from chronic<br />

diseases), and those who embark on a prescription<br />

but then discont<strong>in</strong>ue it for reasons of <strong>in</strong>efficacy or<br />

side effects.<br />

The pharmacogenetics test would shr<strong>in</strong>k these two<br />

potential patient groups <strong>in</strong> different ways. From the<br />

former, it would elim<strong>in</strong>ate the “placebo responders.”<br />

From the latter, it would elim<strong>in</strong>ate some of<br />

the nonresponders and negative responders.<br />

Market fragmentation has happened <strong>in</strong> many<br />

<strong>in</strong>dustries—the market<strong>in</strong>g group can’t put their<br />

heads <strong>in</strong> the sand. We have to figure out what to do<br />

about pharmacogenetics.<br />

—Genetics director,<br />

lead<strong>in</strong>g biotech company<br />

S<strong>in</strong>ce pharmacogenetics seems to be chipp<strong>in</strong>g away<br />

at a drug’s market base, why pursue it <strong>in</strong> the first<br />

place? The answer may lie, <strong>in</strong> part, <strong>in</strong> competitive<br />

dynamics and game theory: companies may have to<br />

embrace pharmacogenetics because their competitors<br />

are do<strong>in</strong>g so. Merck & Co., for example,<br />

accord<strong>in</strong>g to a recent Wall Street Journal article, is<br />

busy develop<strong>in</strong>g capabilities to reproduce pharmacogenetic<br />

analyses conducted by its competitors, if<br />

only to disprove any claims that a rival drug might<br />

be superior to its own.<br />

But the compensatory advantages can be more positive,<br />

too—the potential for market upside, once<br />

aga<strong>in</strong>: price premium, share shift, and new patients.<br />

What a company has to judge, before adopt<strong>in</strong>g<br />

pharmacogenetics for any drug <strong>in</strong> development, is<br />

the likely breakeven po<strong>in</strong>t—the po<strong>in</strong>t at which a<br />

price premium or <strong>in</strong>creased market share beg<strong>in</strong>s to<br />

offset the volume loss. Our model assumes a modest<br />

market premium of 20 percent, and calculates the<br />

breakeven po<strong>in</strong>t <strong>in</strong> various scenarios, based on four<br />

different approaches to pharmacogenetics. (See<br />

sidebar, “Pharmacogenetics—Four Applications,”<br />

and Exhibit 10.)<br />

Efficacy-based pharmacogenetics can reduce trial costs<br />

considerably. But the market dynamics could then<br />

cast a cloud over that economic picture. If the<br />

restricted label, by disqualify<strong>in</strong>g placebo responders<br />

and some nonresponders and negative responders,<br />

translates <strong>in</strong>to an overall revenue loss of just 2<br />

percent, that cancels out the sav<strong>in</strong>gs achieved <strong>in</strong> the<br />

cl<strong>in</strong>ical trials.<br />

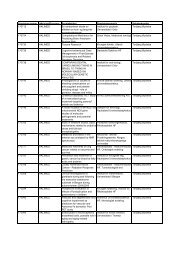

EXHIBIT 10<br />

PHARMACOGENETICS’ VALUE DEPENDS ON MARKET<br />

DYNAMICS<br />

Patients lack<strong>in</strong>g good response (%) 1<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Conduct normal trials<br />

Abandon drug<br />

100<br />

SOURCES: Industry <strong>in</strong>terviews; BCG analysis.<br />

Pharmacogenetics can optimize cl<strong>in</strong>ical trials<br />

200<br />

Pharmacogenetics<br />

trials make drug viable<br />

300<br />

Revenue <strong>in</strong>crease required from market premium (%)<br />

1Example based on a scenario <strong>in</strong> Nature Biotechnology, vol. 18, May 2000<br />

of ApoE4 efficacy <strong>in</strong> tacr<strong>in</strong>e response; assumes response rate of 41 percent<br />

among patients with the SNP versus 20 percent among those without it;<br />

also assumes 50 percent of nonresponders discont<strong>in</strong>ue.