A Revolution in R&D

A Revolution in R&D

A Revolution in R&D

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22<br />

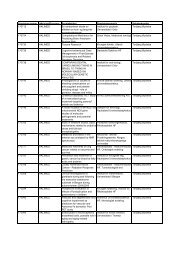

UPSTART START-UPS—THE COMPETITORS CLASSIFIED<br />

As the e-commerce revolution has demonstrated,<br />

disruptive technologies tend to spawn start-ups that<br />

aim to exploit the disruption, either as suppliers to,<br />

or as replacements for, <strong>in</strong>cumbents disoriented by a<br />

chang<strong>in</strong>g world. In the case of genomics, the <strong>in</strong>cumbents<br />

are easy to identify: the traditional pharmaceutical<br />

companies and the larger fully <strong>in</strong>tegrated<br />

biotech companies. But who are the start-ups?<br />

Genomics companies can be classified <strong>in</strong> three<br />

broad groups, on the basis of how closely or distantly<br />

they are related to the actual develop<strong>in</strong>g and<br />

market<strong>in</strong>g of drugs.<br />

The group furthest away conta<strong>in</strong>s the companies<br />

that supply enabl<strong>in</strong>g technologies, <strong>in</strong> the form of<br />

hardware or software. These companies resemble<br />

the merchants of the California gold rush who sold<br />

pickaxes to the m<strong>in</strong>ers, or more recently, companies<br />

such as Cisco and Sun Microsystems that have been<br />

provid<strong>in</strong>g the necessary <strong>in</strong>frastructure for the multitude<br />

of e-commerce practitioners. Examples of such<br />

companies are PE Biosystems, the supplier of highthroughput<br />

sequenc<strong>in</strong>g mach<strong>in</strong>es, and Affymetrix,<br />

the preem<strong>in</strong>ent gene-chip manufacturer and supplier.<br />

The second broad group conta<strong>in</strong>s the companies<br />

supply<strong>in</strong>g <strong>in</strong>formation and knowledge, <strong>in</strong>clud<strong>in</strong>g<br />

those companies that generate proprietary databases<br />

and offer access to them through subscriptions or<br />

fee-per-use bus<strong>in</strong>ess models. One of the best-known<br />

examples is Celera, which sells subscription-based<br />

access to human and animal model-sequence data.<br />

The group also <strong>in</strong>cludes companies that are attempt<strong>in</strong>g<br />

to <strong>in</strong>tegrate and exploit those databases to conduct<br />

<strong>in</strong> silico R&D. An example is LION Bioscience,<br />

which <strong>in</strong>tegrates <strong>in</strong>formation from public and private<br />

sources <strong>in</strong>to a s<strong>in</strong>gle platform to make targets and<br />

leads easier to identify and analyze.<br />

F<strong>in</strong>ally, there is the group of companies that develop<br />

and sell more traditional “physical” drug <strong>in</strong>termediates—targets<br />

and lead compounds. We call these<br />

platform and orchestrator companies.<br />

Platform companies deploy proprietary technology <strong>in</strong><br />

the quest for promis<strong>in</strong>g targets and leads. One such<br />

company is Aurora Biosciences, which has developed<br />

proprietary high-throughput screen<strong>in</strong>g technology<br />

to exploit an opportunity <strong>in</strong> screen<strong>in</strong>g and chemical<br />

genomics. Another example is MorphoSys,<br />

which has developed a platform for rapid development<br />

of high-aff<strong>in</strong>ity antibodies, for use <strong>in</strong> target validation<br />

and therapeutic antibody discovery.<br />

Go<strong>in</strong>g one step further are orchestrator companies,<br />

which str<strong>in</strong>g together adjacent platforms to create<br />

optimized segments of the R&D value cha<strong>in</strong>. As the<br />

orchestrators extend their value cha<strong>in</strong>, they can sell<br />

drug candidates that have progressed further and<br />

further downstream—and have thus become more<br />

and more valuable. Although these companies are<br />

still sell<strong>in</strong>g only <strong>in</strong>termediates, they show every sign<br />

of graduat<strong>in</strong>g <strong>in</strong>to fully <strong>in</strong>tegrated drug companies.<br />

Millennium has already made that transition: concentrat<strong>in</strong>g<br />

<strong>in</strong>itially on genomics target discovery, it<br />

has subsequently developed a full R&D pipel<strong>in</strong>e <strong>in</strong><br />

its own right.<br />

What is the outlook of each of these groups? The<br />

first two (the pure suppliers, either of enabl<strong>in</strong>g technologies<br />

or of <strong>in</strong>formation and knowledge) would<br />

appear to be well positioned if they target areas of<br />

scarcity (that is, bottlenecks) with proprietary prod-