A Revolution in R&D

A Revolution in R&D

A Revolution in R&D

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A <strong>Revolution</strong> <strong>in</strong> R&D<br />

HOW GENOMICS AND GENETICS ARE TRANSFORMING<br />

THE BIOPHARMACEUTICAL INDUSTRY<br />

BCG REPORT

The Boston Consult<strong>in</strong>g Group is a general management consult<strong>in</strong>g firm<br />

that is a global leader <strong>in</strong> bus<strong>in</strong>ess strategy. BCG has helped companies<br />

<strong>in</strong> every major <strong>in</strong>dustry and market achieve a competitive advantage by<br />

develop<strong>in</strong>g and implement<strong>in</strong>g unique strategies. Founded <strong>in</strong> 1963, the<br />

firm now operates 51 offices <strong>in</strong> 34 countries. For further <strong>in</strong>formation,<br />

please visit our Web site at www.bcg.com.

A <strong>Revolution</strong> <strong>in</strong> R&D<br />

HOW GENOMICS AND GENETICS ARE TRANSFORMING<br />

THE BIOPHARMACEUTICAL INDUSTRY<br />

PETER TOLLMAN<br />

PHILIPPE GUY<br />

JILL ALTSHULER<br />

ALASTAIR FLANAGAN<br />

MICHAEL STEINER<br />

www.bcg.com<br />

NOVEMBER 2001

2<br />

© The Boston Consult<strong>in</strong>g Group, Inc. 2001. All rights reserved.<br />

For <strong>in</strong>formation or permission to repr<strong>in</strong>t, please contact BCG at:<br />

E-mail: imc-<strong>in</strong>fo@bcg.com<br />

Fax: 617-973-1339, attention IMC/Permissions<br />

Mail: IMC/Permissions<br />

The Boston Consult<strong>in</strong>g Group, Inc.<br />

Exchange Place<br />

Boston, MA 02109<br />

USA<br />

Credits: Left cover photo by Bob Waterston, Wash<strong>in</strong>gton University, St. Louis, Missouri. Used by permission.<br />

The photo shows a bird’s-eye view of one room <strong>in</strong> the DNA sequenc<strong>in</strong>g facility at the Whitehead Institute Center for<br />

Genome Research.

Table of Contents<br />

ABOUT THE AUTHORS 4<br />

FOREWORD 5<br />

EXECUTIVE SUMMARY 6<br />

INTRODUCTION 9<br />

CHAPTER 1: THE IMPACT OF GENOMICS 11<br />

Preface 11<br />

The Opportunities 12<br />

The Challenges 18<br />

A F<strong>in</strong>al Word 21<br />

CHAPTER 2: THE IMPACT OF GENETICS 24<br />

Preface 24<br />

Disease Genetics 27<br />

Pharmacogenetics 33<br />

A F<strong>in</strong>al Word 39<br />

CHAPTER 3: MANAGERIAL CHALLENGES 41<br />

Preface: Look<strong>in</strong>g Back and Look<strong>in</strong>g Forward 41<br />

Strategy—Search<strong>in</strong>g for Genomic Competitive Advantage 41<br />

Putt<strong>in</strong>g the Strategy <strong>in</strong>to Operation 49<br />

A F<strong>in</strong>al Word 56<br />

CONCLUSION 57<br />

METHODOLOGY 59<br />

3

4<br />

About the Authors<br />

About the Authors<br />

Peter Tollman is a vice president <strong>in</strong> the Boston office and leads BCG's biopharmaceutical R&D bus<strong>in</strong>ess.<br />

Philippe Guy is a senior vice president <strong>in</strong> the Paris office and leads the worldwide Health Care practice. Jill<br />

Altshuler is a manager <strong>in</strong> the Boston office and a key contributor to BCG’s genomics <strong>in</strong>itiative. Alastair<br />

Flanagan is a vice president <strong>in</strong> the London office and leads the U.K. Health Care practice. Michael Ste<strong>in</strong>er<br />

is a senior vice president <strong>in</strong> the Munich office and leads the German Health Care practice.<br />

Acknowledgments<br />

Sarah Cairns-Smith (Boston) pioneered BCG’s <strong>in</strong>vestigation of genomics. Samantha Gray (Boston) has made<br />

significant contributions throughout the research and writ<strong>in</strong>g phases of the report.<br />

The authors would like to thank the advisory team: Oliver Fetzer (Boston), Hamilton Moses (Wash<strong>in</strong>gton,<br />

D.C.), Niko Vrettos (Düsseldorf), and Craig Wheeler (Boston). The authors would also like to acknowledge<br />

the contributions of the project team: Dierk Beyer (Frankfurt), Markus Hild<strong>in</strong>ger (Boston), Raphael Lehrer<br />

(Wash<strong>in</strong>gton D.C.), Nancy Macmillan (Boston), Jonathan Montagu (London), and Joanne Smith-Farrell<br />

(Wash<strong>in</strong>gton, D.C.).<br />

For Further Contact<br />

The authors welcome your questions and comments. For <strong>in</strong>quiries about this report or BCG’s Health Care<br />

practice, please contact:<br />

Alastair Flanagan, London e-mail: flanagan.alastair@bcg.com<br />

Philippe Guy, Paris e-mail: guy.philippe@bcg.com<br />

Mark Lubkeman, Los Angeles e-mail: lubkeman.mark@bcg.com<br />

Michael Ste<strong>in</strong>er, Munich e-mail: ste<strong>in</strong>er.michael@bcg.com<br />

Mart<strong>in</strong> Reeves, Tokyo e-mail: reeves.mart<strong>in</strong>@bcg.com<br />

Peter Tollman, Boston e-mail: tollman.peter@bcg.com

Foreword<br />

To meet growth targets, pharmaceutical companies are go<strong>in</strong>g to have to <strong>in</strong>crease R&D productivity. By a fortunate<br />

co<strong>in</strong>cidence, that crisis <strong>in</strong> expectation is be<strong>in</strong>g counterbalanced by a surge of opportunity. Recent<br />

years have seen astonish<strong>in</strong>g advances <strong>in</strong> technology and explosions of data, which are driv<strong>in</strong>g two waves of<br />

change through the <strong>in</strong>dustry—a genomics wave and a genetics wave—and radically reshap<strong>in</strong>g R&D methods<br />

and economics <strong>in</strong> the process. Biopharmaceutical R&D is mov<strong>in</strong>g <strong>in</strong>to a new era: almost every l<strong>in</strong>k <strong>in</strong> the<br />

value cha<strong>in</strong> has the potential for tremendous boosts <strong>in</strong> efficiency or success.<br />

But these advances are not assured. Technological hurdles have yet to be overcome, particularly <strong>in</strong> the genetics<br />

wave. Moreover, because the productivity boosts are likely to be unequal and uncoord<strong>in</strong>ated, the value<br />

cha<strong>in</strong> itself will demand reconfigur<strong>in</strong>g. And so too, <strong>in</strong> consequence, will many traditional operational procedures<br />

and organizational structures. The repercussions of genomics, <strong>in</strong> other words, are go<strong>in</strong>g to reach the<br />

furthest recesses of corporate constitution and culture. A true revolution, <strong>in</strong> short—and one that is already<br />

well under way.<br />

BCG has evaluated deeply the economic and bus<strong>in</strong>ess implications of these disruptions. To bolster our <strong>in</strong>ternal<br />

understand<strong>in</strong>g, we gathered <strong>in</strong>formation and perspectives <strong>in</strong> an extensive program of <strong>in</strong>terviews with<br />

lead<strong>in</strong>g R&D scientists and executives. Our f<strong>in</strong>d<strong>in</strong>gs—based on the comb<strong>in</strong>ation of these <strong>in</strong>terviews, economic<br />

model<strong>in</strong>g, and client casework—form the substance of this report. Its three sections are devoted<br />

respectively to the impact of genomics, the impact of genetics, and some of the strategic and operational<br />

implications for biopharmaceutical firms.<br />

The first two sections have already been published separately. They generated considerable publicity, and—<br />

more important—considerable comment. We now look forward to your further responses to the report as a<br />

whole.<br />

Philippe Guy<br />

Senior Vice President<br />

5

6<br />

Executive Summary<br />

In the pharmaceutical <strong>in</strong>dustry’s struggle to reach<br />

the levels of growth expected of it, one of its key<br />

aims will be to <strong>in</strong>crease R&D productivity. And a key<br />

means of meet<strong>in</strong>g this challenge is to adopt some of<br />

the new technologies and approaches broadly<br />

def<strong>in</strong>ed as genomics. 1 That is bound to be a complicated,<br />

perilous, and often pa<strong>in</strong>ful process, but if<br />

companies get their strategy right and overcome<br />

the obstacles, they could, <strong>in</strong> the best case, as much<br />

as halve the cost of drug development.<br />

The report is divided <strong>in</strong>to three parts.<br />

The Impact of Genomics<br />

The first great advance of the genomics era is <strong>in</strong><br />

technology—above all, the <strong>in</strong>tegration of new highthroughput<br />

techniques with powerful new comput<strong>in</strong>g<br />

capabilities. The new technologies are active<br />

throughout R&D, most immediately at the drug discovery<br />

stage, and promise to enhance productivity<br />

by boost<strong>in</strong>g efficiency.<br />

The stagger<strong>in</strong>g <strong>in</strong>vestment needed to develop a<br />

drug—$880 million and 15 years is the pregenomics<br />

average—could be reduced by as much as<br />

$300 million and two years by apply<strong>in</strong>g genomics<br />

technologies. Productivity ga<strong>in</strong>s would be realized<br />

at every step <strong>in</strong> the value cha<strong>in</strong>. Potential obstacles<br />

abound, however. In particular, two broad challenges<br />

must be met to realize the sav<strong>in</strong>gs:<br />

•Target quality must be ma<strong>in</strong>ta<strong>in</strong>ed. Pursu<strong>in</strong>g new<br />

target classes could <strong>in</strong>volve unfamiliar costs <strong>in</strong>itially,<br />

and these could delay the rewards—though<br />

only temporarily. But to jeopardize target quality<br />

by withhold<strong>in</strong>g that early <strong>in</strong>vestment would be to<br />

risk higher failure rates downstream, and that<br />

would <strong>in</strong>volve far greater costs <strong>in</strong> the end.<br />

• Bottlenecks must be eased. Ow<strong>in</strong>g to the unevenness<br />

of the efficiency ga<strong>in</strong>s at different steps <strong>in</strong><br />

the value cha<strong>in</strong>, the pipel<strong>in</strong>e’s flow will be<br />

impeded at various chokepo<strong>in</strong>ts. If the requisite<br />

action is taken, an even flow should be restored<br />

and the promised rewards should be safeguarded.<br />

The Impact of Genetics<br />

The second great advance of the genomics era is <strong>in</strong><br />

the quantity and quality of data. From the data,<br />

<strong>in</strong>valuable <strong>in</strong>formation about <strong>in</strong>dividuals’ genetic<br />

variation can be extracted and exploited. In pharmaceutical<br />

R&D, genetics will be applied particularly<br />

to two tasks: identify<strong>in</strong>g genes whose carriers<br />

are susceptible to specific diseases (disease genetics);<br />

and subdivid<strong>in</strong>g patients <strong>in</strong> cl<strong>in</strong>ical trials<br />

accord<strong>in</strong>g to variations <strong>in</strong> drug response (pharma-<br />

1. Genomics <strong>in</strong> its narrow sense contrasts with genetics. Roughly, the former concerns itself with the common “standard” genetic makeup, the latter with<br />

the dist<strong>in</strong>ctive genetic makeup of <strong>in</strong>dividuals. But <strong>in</strong> its broader sense, genomics <strong>in</strong>cludes genetics. In this report, the context makes clear which sense is<br />

<strong>in</strong>tended.

cogenetics). The productivity ga<strong>in</strong>s will be realized<br />

mostly <strong>in</strong> later phases of the value cha<strong>in</strong>, through<br />

the boost<strong>in</strong>g of success rates.<br />

This genetics wave is still gather<strong>in</strong>g strength, but <strong>in</strong><br />

due course could make an even greater impact on<br />

R&D than the genomics wave. In an ideal scenario,<br />

the sav<strong>in</strong>gs would exceed half a billion dollars per<br />

drug. Several troubl<strong>in</strong>g hurdles would have to be<br />

negotiated first, however. These <strong>in</strong>clude:<br />

• Scientific and technical hurdles. For genetics<br />

approaches to work, the disease susceptibility or<br />

drug response has to be genetic <strong>in</strong> nature. The<br />

gene <strong>in</strong> question has to be identifiable and must<br />

lead to a drugable target and/or be found <strong>in</strong> time<br />

to streaml<strong>in</strong>e trials.<br />

• Economic and market hurdles. The cost of conduct<strong>in</strong>g<br />

genetics studies will need to drop, and<br />

the opportunity cost of a restricted label could<br />

offset the potential market upside of pharmacogenetics.<br />

Beyond these hurdles, other challenges will need to<br />

be addressed:<br />

• Difficult <strong>in</strong>vestment decisions will have to be<br />

made, weigh<strong>in</strong>g high risk aga<strong>in</strong>st potentially high<br />

rewards. Companies will need to decide exactly<br />

how to participate <strong>in</strong> genetics—whether to <strong>in</strong>vest<br />

<strong>in</strong> genetics approaches, and how deeply, consistent<br />

with their level of risk tolerance.<br />

• Unprecedented coord<strong>in</strong>ation between market<strong>in</strong>g<br />

and R&D will be necessary. Market<strong>in</strong>g will need to<br />

have a say <strong>in</strong> decid<strong>in</strong>g which markets and which<br />

genetic diseases R&D should concentrate on, and<br />

will need to become <strong>in</strong>volved earlier than ever.<br />

• Careful attention will need to be given to ethical<br />

considerations. Companies will have to ensure<br />

privacy of genetic material, and be prepared to<br />

address any concerns the public may have.<br />

Managerial Challenges<br />

With the new wealth of options and the <strong>in</strong>creased<br />

<strong>in</strong>terdependencies across the value cha<strong>in</strong>, strategic<br />

issues will prove more complex than <strong>in</strong> the past.<br />

Likewise operational issues: many traditional ways<br />

of do<strong>in</strong>g bus<strong>in</strong>ess will be disrupted by genomics<br />

technologies, and companies may need to restructure<br />

fairly drastically.<br />

The range of strategic options available to a<br />

company will be dictated by the company’s start<strong>in</strong>g<br />

position—its size, beliefs, aspirations, and capabilities.<br />

Given the magnitude of the opportunities and<br />

7

8<br />

the risks <strong>in</strong>volved, momentous <strong>in</strong>vestment decisions<br />

will need to be made, and at the very highest levels<br />

of the organization. And R&D executives will face a<br />

daunt<strong>in</strong>g new set of management responsibilities<br />

and challenges. These <strong>in</strong>clude:<br />

• Select<strong>in</strong>g an appropriate research focus—no<br />

longer just the therapeutic area or disease state of<br />

<strong>in</strong>terest, but also such dimensions as target class<br />

and treatment modality<br />

• Choos<strong>in</strong>g which technologies to implement and<br />

when and how to implement them—<strong>in</strong>-house, or<br />

through partner<strong>in</strong>g or licens<strong>in</strong>g<br />

• Rebalanc<strong>in</strong>g the value cha<strong>in</strong>—partly by reallocat<strong>in</strong>g<br />

resources but ma<strong>in</strong>ly by redesign<strong>in</strong>g processes<br />

and more actively plann<strong>in</strong>g and manag<strong>in</strong>g capacity<br />

• Establish<strong>in</strong>g a unified <strong>in</strong>formatics <strong>in</strong>frastructure—<strong>in</strong>clud<strong>in</strong>g<br />

a centralized knowledge management<br />

system<br />

• Establish<strong>in</strong>g the new organization—creat<strong>in</strong>g new<br />

<strong>in</strong>terfaces with<strong>in</strong> the R&D department, between<br />

departments, and even between corporations<br />

• Revis<strong>in</strong>g decision-mak<strong>in</strong>g procedures—fully<br />

exploit<strong>in</strong>g the latest data <strong>in</strong> order to select the<br />

most promis<strong>in</strong>g targets and compounds to move<br />

through the pipel<strong>in</strong>e and to optimize their relative<br />

resourc<strong>in</strong>g<br />

• Re<strong>in</strong>forc<strong>in</strong>g these various reforms by engag<strong>in</strong>g<br />

the emotional and behavioral issues as keenly as<br />

the operational ones<br />

All th<strong>in</strong>gs considered, companies cannot stand<br />

aside. Certa<strong>in</strong>ly there are risks <strong>in</strong> sign<strong>in</strong>g up for the<br />

revolution, but there is also a great risk <strong>in</strong> ignor<strong>in</strong>g<br />

it—the risk of becom<strong>in</strong>g uncompetitive. The revolution<br />

is real, and will leave no one untouched.

Introduction<br />

Throughout the pharmaceutical <strong>in</strong>dustry, executives<br />

are worried. They fear they will not be able to<br />

meet the double-digit annual growth expectations<br />

implied by high market capitalizations. The requisite<br />

new drugs will not be forthcom<strong>in</strong>g: R&D just<br />

cannot deliver them all.<br />

One standard response to this problem is to scale<br />

up—that has been the basis of many a recent<br />

merger—but while scale can pay off <strong>in</strong> commercialization,<br />

global development, market<strong>in</strong>g, and distribution,<br />

it is unlikely that scale alone can solve the<br />

R&D problem. Another standard response is to buy<br />

<strong>in</strong> drug candidates. Such a Band-Aid approach cannot<br />

work <strong>in</strong>def<strong>in</strong>itely, and is a risky one anyway,<br />

given that the price of these deals will cont<strong>in</strong>ue to<br />

rise as demand for them grows.<br />

The only sure way to address the problem is to<br />

<strong>in</strong>crease R&D productivity. And the way to ensure<br />

that is either to <strong>in</strong>crease efficiency (lower cost or<br />

higher speed) or reduce failure rates along the<br />

value cha<strong>in</strong>. Many companies have <strong>in</strong>creased productivity<br />

over the past decade, specifically by<br />

reeng<strong>in</strong>eer<strong>in</strong>g the development phase. That optimization<br />

may be reach<strong>in</strong>g its limits, however. As for<br />

the discovery phase, it has long been less amenable<br />

to such improvements. So the problem of produc-<br />

tivity persists. Traditional approaches cannot provide<br />

an answer, but genomics can. (See Exhibit 1.)<br />

It will not be easy, of course. There are some difficult<br />

obstacles en route—difficult, but not <strong>in</strong>surmountable.<br />

By mak<strong>in</strong>g <strong>in</strong>formed strategic choices,<br />

companies can overcome the obstacles and reap the<br />

productivity rewards. Those that embrace the revolution<br />

most boldly could potentially halve the cost<br />

and time it takes to develop a new drug—if they<br />

meet certa<strong>in</strong> challenges successfully.<br />

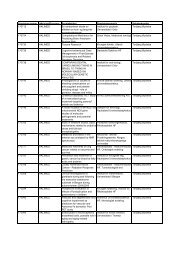

EXHIBIT 1<br />

GENOMICS IMPROVES R&D PRODUCTIVITY<br />

Cost (time)<br />

spent<br />

Failed targets/<br />

candidates<br />

Successful<br />

drug<br />

SOURCE: BCG analysis.<br />

Total cost to develop a drug<br />

Reduce<br />

failure<br />

Improve<br />

efficiency<br />

Total cost (time) per step<br />

9

Chapter 1: The Impact of Genomics<br />

Preface<br />

As the science of genomics has advanced, so has the<br />

def<strong>in</strong>ition. When the term was co<strong>in</strong>ed <strong>in</strong> 1986, it<br />

referred ma<strong>in</strong>ly to the study of the mammalian<br />

genome—specifically, the mapp<strong>in</strong>g, sequenc<strong>in</strong>g,<br />

and analyz<strong>in</strong>g of all its genes. The scope soon<br />

expanded, focus<strong>in</strong>g not just on the genes’ structure<br />

but on their function as well. More recently, the<br />

scope of the term has broadened further, focus<strong>in</strong>g<br />

no longer just on knowledge of the genome but also<br />

on the exploitation of that knowledge, especially<br />

for health care.<br />

Go<strong>in</strong>g beyond dictionary def<strong>in</strong>itions, our <strong>in</strong>terest is<br />

<strong>in</strong> what genomics means for the economics of pharmaceutical<br />

R&D. On the basis of our extensive<br />

research and many discussions with prom<strong>in</strong>ent people<br />

throughout the <strong>in</strong>dustry, we suggest characteriz<strong>in</strong>g<br />

genomics, for the purposes of this study, as the<br />

confluence of two <strong>in</strong>terdependent trends that are<br />

fundamentally chang<strong>in</strong>g the way R&D is conducted:<br />

<strong>in</strong>dustrialization (creat<strong>in</strong>g vastly higher throughputs,<br />

and hence a huge <strong>in</strong>crease <strong>in</strong> data), and <strong>in</strong>formatics<br />

(computerized techniques for manag<strong>in</strong>g and<br />

analyz<strong>in</strong>g those data). The surge of data—generated<br />

by the former, and processed by the latter—is<br />

of a different order from the data yields of the pregenomics<br />

era.<br />

To elaborate. The new high-tech <strong>in</strong>dustrialization<br />

has <strong>in</strong>creased the efficiency of certa<strong>in</strong> activities<br />

beyond recognition. Instead of assign<strong>in</strong>g <strong>in</strong>dividual<br />

scientists to work manually on modest <strong>in</strong>dividual<br />

experiments, companies now <strong>in</strong>voke automation<br />

and parallel process<strong>in</strong>g to conduct experiments<br />

much larger <strong>in</strong> scale and complexity, and at a much<br />

faster pace.<br />

Look around this lab—you have to search high<br />

and low to f<strong>in</strong>d a human heartbeat. Now robots<br />

can do the menial th<strong>in</strong>gs we did <strong>in</strong> grad school.<br />

—Research leader,<br />

lead<strong>in</strong>g biotech company<br />

The data that emerge are immensely greater both<br />

<strong>in</strong> quantity and <strong>in</strong> richness. Enormous databases—<br />

detail<strong>in</strong>g gene expression, for example, or homologous<br />

genes across species, or prote<strong>in</strong> structures—<br />

afford unprecedented comprehensive views of<br />

biological processes. Increas<strong>in</strong>gly, researchers can<br />

understand properties of the system rather than<br />

just <strong>in</strong>dividual parts, and that holds out the promise<br />

of a more rational approach to drug discovery.<br />

The new technology of <strong>in</strong>formatics serves to handle<br />

and process all these data. Without it, the data<br />

would rema<strong>in</strong> raw material. Informatics was nurtured<br />

by several co<strong>in</strong>cid<strong>in</strong>g factors: the ever-accelerat<strong>in</strong>g<br />

power of computers, ref<strong>in</strong>ed algorithms, the<br />

<strong>in</strong>tegration of data and technology platforms, and<br />

the versatility of the Internet. The effect is that<br />

overwhelm<strong>in</strong>g masses of <strong>in</strong>formation can now be<br />

marshaled, managed, and analyzed as never before.<br />

Data are transformed <strong>in</strong>to knowledge.<br />

We could never have achieved drug development<br />

that fast with traditional techniques. No way—<br />

without the computers we didn’t have a chance.<br />

—VP of chemistry,<br />

biotech company<br />

11

12<br />

The Opportunities<br />

What is the impact of genomics on the economics<br />

of R&D? To what extent will genomics improve productivity<br />

overall, and what will its effects be when<br />

applied at various po<strong>in</strong>ts of the value cha<strong>in</strong>? What<br />

other <strong>in</strong>cidental advantages might genomics br<strong>in</strong>g<br />

<strong>in</strong> its wake?<br />

These crucial questions have received a great deal<br />

of attention of late, and a wide variety of responses.<br />

To address the questions <strong>in</strong> a rigorous, fact-based<br />

way, we built an economic model of the entire R&D<br />

value cha<strong>in</strong>, grounded <strong>in</strong> a program of discussions<br />

with<strong>in</strong> the <strong>in</strong>dustry (more than 100 meet<strong>in</strong>gs with<br />

more than 60 scientists and executives from nearly<br />

50 companies and academic <strong>in</strong>stitutions.) (See the<br />

methodology section at the end of this report.)<br />

Realiz<strong>in</strong>g Sav<strong>in</strong>gs<br />

Before genomics technology, develop<strong>in</strong>g a new<br />

drug has cost companies on average $880 million,<br />

and has taken about 15 years from start to f<strong>in</strong>ish,<br />

that is, from target identification 2 through regulatory<br />

approval. (See Exhibit 2.) Of this cost, about 75<br />

percent can be attributed to failures along the way.<br />

By apply<strong>in</strong>g genomics technology, companies could<br />

on average realize sav<strong>in</strong>gs of nearly $300 million<br />

and two years per drug, largely as a result of efficiency<br />

ga<strong>in</strong>s. That represents a 35 percent cost and<br />

15 percent time sav<strong>in</strong>gs. (And those are the sav<strong>in</strong>gs<br />

possible with technologies that are available today;<br />

when new or improved genomics technologies<br />

emerge, the sav<strong>in</strong>gs will be even greater.) If companies<br />

wish to stay competitive, they have no choice:<br />

they must implement genomics technologies. (See<br />

Exhibit 3.)<br />

Do<strong>in</strong>g so, however, will hardly produce such huge<br />

sav<strong>in</strong>gs immediately, or automatically. It will take a<br />

few years, and many deft decisions, for the sav<strong>in</strong>gs<br />

to be realized. The early years of implementation<br />

may <strong>in</strong> fact <strong>in</strong>volve an <strong>in</strong>crease <strong>in</strong> costs as the learn<strong>in</strong>g<br />

curve is negotiated for novel targets—specifi-<br />

EXHIBIT 2<br />

DRUG R&D IS EXPENSIVE AND TIME-CONSUMING<br />

Cost: $880 million total<br />

Approximate cost ($M)<br />

165<br />

205<br />

Time: 14.7 years total<br />

Approximate time (yrs)<br />

1<br />

Biology<br />

2<br />

Target ID Target Validation<br />

40<br />

0.4<br />

Chemistry<br />

cally, as the necessary quality controls are established—and<br />

as major strategic decisions (about<br />

personnel and processes, for <strong>in</strong>stance) are confirmed<br />

or revised.<br />

More on these challenges later. But first, we will<br />

take a closer look at the long-term upside, detail<strong>in</strong>g<br />

the sav<strong>in</strong>gs at various steps along the value cha<strong>in</strong>.<br />

120<br />

2.7<br />

Screen<strong>in</strong>g Optimization<br />

90<br />

1.6<br />

Development<br />

260<br />

7<br />

Precl<strong>in</strong>ical Cl<strong>in</strong>ical<br />

SOURCES: BCG analysis; <strong>in</strong>dustry <strong>in</strong>terviews; scientific literature; public<br />

f<strong>in</strong>ancial data; Lehman Brothers; PAREXEL’S Pharmaceutical R&D<br />

Statistical Sourcebook 2000.<br />

NOTE: Cost to drug <strong>in</strong>cludes failures. Target identification <strong>in</strong>cludes <strong>in</strong>itial<br />

experiments that companies may have outsourced to academic research<br />

<strong>in</strong>stitutions.<br />

2. Includes <strong>in</strong>itial experiments to identify potential targets. Traditionally, companies have sourced much of this research from academia.

EXHIBIT 3<br />

GENOMICS CAN YIELD SIGNIFICANT SAVINGS<br />

Cost to drug<br />

Pre-genomics<br />

Post-genomics<br />

target ID<br />

Plus <strong>in</strong> silico<br />

chemistry<br />

Plus precl<strong>in</strong>ical and<br />

cl<strong>in</strong>ical advances 1<br />

Time to drug<br />

Pre-genomics<br />

Post-genomics<br />

target ID<br />

Plus <strong>in</strong> silico<br />

chemistry<br />

Plus precl<strong>in</strong>ical and<br />

cl<strong>in</strong>ical advances 1<br />

ID Biology<br />

Target ID Target Validation<br />

0<br />

0<br />

200<br />

Cost ($M)<br />

Target Discovery/Biology<br />

The identification of targets is be<strong>in</strong>g <strong>in</strong>dustrialized—through<br />

the use of technology such as gene<br />

chips to perform gene expression analysis, for<br />

example—and then further enhanced by bio<strong>in</strong>formatics.<br />

Scientists can now use a s<strong>in</strong>gle gene chip to<br />

compare the expression of thousands of genes, <strong>in</strong><br />

diseased and healthy tissue alike, all at once, and<br />

can then use <strong>in</strong>formatics technology to f<strong>in</strong>d follow-<br />

5<br />

Chemistry<br />

400<br />

Screen<strong>in</strong>g Optimization<br />

600<br />

10<br />

610<br />

590<br />

800<br />

740<br />

13.0<br />

12.7<br />

880<br />

13.8<br />

15<br />

Time (years)<br />

Development<br />

Precl<strong>in</strong>ical Cl<strong>in</strong>ical<br />

SOURCES: BCG analysis; <strong>in</strong>dustry <strong>in</strong>terviews; scientific literature; public<br />

f<strong>in</strong>ancial data; Lehman Brothers; PAREXEL’S Pharmaceutical R&D<br />

Statistical Sourcebook 2000.<br />

1,000<br />

14.7<br />

1Includes surrogate marker sav<strong>in</strong>gs from early elim<strong>in</strong>ation of unpromis<strong>in</strong>g<br />

candidates, not from early FDA approval; does not <strong>in</strong>clude potential sav<strong>in</strong>gs<br />

from pharmacogenetics.<br />

up <strong>in</strong>formation, on these or related genes, <strong>in</strong> databases<br />

around the world. (Target validation, however,<br />

seems difficult to <strong>in</strong>dustrialize, ow<strong>in</strong>g to the<br />

“slow” biology of whole-animal systems still<br />

<strong>in</strong>volved, and is not yet show<strong>in</strong>g significant productivity<br />

ga<strong>in</strong>s.)<br />

In all, the potential sav<strong>in</strong>gs per drug are on average<br />

about $140 million and just under one year of time<br />

to market, achieved entirely through improved efficiency.<br />

That would add about $100 million <strong>in</strong> value<br />

per drug (assum<strong>in</strong>g an “average” drug with peak<br />

annual sales of $500 million). So for this step <strong>in</strong> the<br />

value cha<strong>in</strong>, productivity would <strong>in</strong>crease vastly: it<br />

would be six times as high as before, assum<strong>in</strong>g the<br />

same level of <strong>in</strong>vestment. A sixfold <strong>in</strong>crease <strong>in</strong> the<br />

number of potential targets!<br />

Several companies have already benefited handsomely<br />

from this w<strong>in</strong>dfall. Take the case of<br />

Millennium, which was an early adopter of <strong>in</strong>dustrialized<br />

biology. The company, anticipat<strong>in</strong>g an overabundance<br />

of targets, established a bus<strong>in</strong>ess model<br />

<strong>in</strong> which it sells off much its output and uses that<br />

<strong>in</strong>come to fund <strong>in</strong>ternal research. Start<strong>in</strong>g from its<br />

early genomics platform, Millennium has strategically<br />

acquired or partnered with other platform<br />

companies to establish an <strong>in</strong>tegrated drug discovery<br />

value cha<strong>in</strong>. From the other perspective, pharmaceutical<br />

companies such as Bayer and Aventis<br />

have made deals with Millennium, <strong>in</strong> the expectation<br />

of profit<strong>in</strong>g from the new abundance of targets<br />

they can choose to pursue.<br />

Lead Discovery/Chemistry<br />

Chemistry is be<strong>in</strong>g revolutionized by <strong>in</strong> silico (that<br />

is, computer-aided) technology—specifically, virtual<br />

screen<strong>in</strong>g supported by chemo<strong>in</strong>formatics. In<br />

virtual screen<strong>in</strong>g, potential lead chemicals are<br />

assessed with computer algorithms to test how likely<br />

they are to <strong>in</strong>teract with a target. Chemo<strong>in</strong>formatics<br />

provides the necessary platform for virtual screen<strong>in</strong>g,<br />

us<strong>in</strong>g data and analysis from high-throughput<br />

screen<strong>in</strong>g (HTS) and other chemistry activities.<br />

This approach <strong>in</strong>creases efficiency by focus<strong>in</strong>g compound<br />

synthesis, reduc<strong>in</strong>g the number of assays,<br />

<strong>in</strong>creas<strong>in</strong>g the parallelization of screen<strong>in</strong>g steps,<br />

13

14<br />

and generally help<strong>in</strong>g to optimize screen<strong>in</strong>g. The<br />

power of this approach is expected to <strong>in</strong>crease dramatically<br />

with the availability of larger data sets for<br />

ref<strong>in</strong><strong>in</strong>g the predictive algorithms. (At the moment,<br />

however, <strong>in</strong> silico chemistry has one notable shortcom<strong>in</strong>g:<br />

it looks as if it will be suitable for only<br />

about 30 percent of targets—the rest fail to yield<br />

the requisite structural <strong>in</strong>formation—and even<br />

then might prove difficult to apply until lead optimization.<br />

Our sav<strong>in</strong>gs are calculated for those targets<br />

where <strong>in</strong> silico technology can be applied.)<br />

The potential sav<strong>in</strong>gs are on average about $130<br />

million and nearly one year per drug. That would<br />

add about $90 million <strong>in</strong> value per drug. For this<br />

step of the value cha<strong>in</strong>, then, productivity would<br />

double, assum<strong>in</strong>g the same level of <strong>in</strong>vestment.<br />

As a beneficiary of these advances, a good case <strong>in</strong><br />

po<strong>in</strong>t is Vertex. Start<strong>in</strong>g from an IDD (<strong>in</strong> silico drug<br />

design) platform <strong>in</strong> chemistry, the company has<br />

gone on to develop an <strong>in</strong>tegrated value cha<strong>in</strong> <strong>in</strong> its<br />

own right. In silico models have allowed more efficient<br />

design of small-molecule drugs than a purely<br />

traditional approach, and the company’s discovery<br />

focus has been on certa<strong>in</strong> target classes that benefit<br />

most from proprietary <strong>in</strong> silico technologies. This<br />

approach has met with considerable success, culm<strong>in</strong>at<strong>in</strong>g<br />

<strong>in</strong> one of the biggest biotech alliances so far<br />

(with Novartis, and worth $813 million). Vertex can<br />

fairly claim to have the strongest small-molecule<br />

drug pipel<strong>in</strong>e with<strong>in</strong> the biotech <strong>in</strong>dustry. With one<br />

drug on the market and twelve candidates <strong>in</strong> development,<br />

it compares favorably with some of the big<br />

pharmaceutical pipel<strong>in</strong>es.<br />

Serious money can be saved for the target classes<br />

where <strong>in</strong> silico chemistry works.<br />

—Director of chemistry,<br />

major pharmaceutical company<br />

Development<br />

Three key genomics advances look set to <strong>in</strong>crease<br />

capacity here. In silico ADME/tox (absorption, distribution,<br />

metabolism, and excretion/toxicity) and<br />

high-throughput <strong>in</strong> vitro toxicology are revolutioniz<strong>in</strong>g<br />

the precl<strong>in</strong>ical phase through their power to<br />

predict drug properties. And surrogate markers<br />

(physiological markers that correlate with elements<br />

of drug response), applied <strong>in</strong> both precl<strong>in</strong>ical and<br />

cl<strong>in</strong>ical trials, evaluate drug effects more efficiently<br />

than before: they are quick to identify fail<strong>in</strong>g compounds,<br />

and once regulatory approval is granted,<br />

will be used to identify pass<strong>in</strong>g compounds too.<br />

In comb<strong>in</strong>ation, the potential sav<strong>in</strong>gs available <strong>in</strong><br />

the short term are on the order of $20 million and<br />

0.3 years per drug. That would add about $15 million<br />

<strong>in</strong> value per drug. But these approaches will<br />

become even more valuable as cl<strong>in</strong>ical data on the<br />

relationship between genes, gene expression, and<br />

disease accumulate and regulatory agencies beg<strong>in</strong><br />

to accept cl<strong>in</strong>ical-marker data: the potential sav<strong>in</strong>gs<br />

could rise to $70 million.<br />

These technologies are be<strong>in</strong>g adopted by forwardlook<strong>in</strong>g<br />

chemistry companies, and are enabl<strong>in</strong>g<br />

them to pull certa<strong>in</strong> precl<strong>in</strong>ical activities <strong>in</strong>to the<br />

chemistry part of the value cha<strong>in</strong>. For example,<br />

ArQule has recently acquired Camitro to <strong>in</strong>corporate<br />

an <strong>in</strong>tegrated <strong>in</strong> vitro and <strong>in</strong> silico ADME/tox<br />

platform <strong>in</strong>to its own set of capabilities.<br />

These are not the only advances likely to transform<br />

productivity dur<strong>in</strong>g the development phase. Pharmacogenomics—through<br />

its power to identify subgroups<br />

of patients who respond differently to a<br />

drug under study—offers the promise of streaml<strong>in</strong><strong>in</strong>g<br />

cl<strong>in</strong>ical trials; we explore this topic <strong>in</strong> more<br />

detail later. Beyond genomics (and beyond the<br />

scope of the current report), “e-technologies,” such<br />

as electronic patient recruitment and monitor<strong>in</strong>g<br />

via the Internet, are expected to speed up the<br />

launch and completion of cl<strong>in</strong>ical trials.<br />

Beyond the Traditional Value Cha<strong>in</strong>:<br />

Chemical Genomics<br />

The various productivity ga<strong>in</strong>s just outl<strong>in</strong>ed occur<br />

with<strong>in</strong> specific steps of the value cha<strong>in</strong>. But suppose<br />

you could transcend the traditional value cha<strong>in</strong>, or<br />

refashion it to streaml<strong>in</strong>e R&D. That is one of the<br />

revolutionary prospects now open<strong>in</strong>g up. The key is<br />

chemical genomics, and the way it will dissolve the<br />

old boundaries is by <strong>in</strong>troduc<strong>in</strong>g <strong>in</strong>to the value<br />

cha<strong>in</strong> a k<strong>in</strong>d of parallel process<strong>in</strong>g. (See sidebar,<br />

“Chemical Genomics—Forward or Reverse.”)

CHEMICAL GENOMICS—FORWARD OR REVERSE<br />

When companies say they are pursu<strong>in</strong>g chemical<br />

genomics, they are usually referr<strong>in</strong>g to large-scale<br />

reverse chemical genetics. (That is how the term is<br />

used <strong>in</strong> our report.) This approach <strong>in</strong>volves f<strong>in</strong>d<strong>in</strong>g<br />

chemical compounds that b<strong>in</strong>d to a known target.<br />

Companies often perform this task for entire target<br />

classes; it is especially popular for prote<strong>in</strong> classes<br />

that are known to be highly drugable, such as Gprote<strong>in</strong><br />

coupled receptors (GPCRs). The assay for<br />

b<strong>in</strong>d<strong>in</strong>g does not need to provide functional <strong>in</strong>formation<br />

relevant to a specific disease state—biological<br />

function can be assessed <strong>in</strong> validation experiments.<br />

The alternative is forward chemical genetics. This<br />

approach beg<strong>in</strong>s with functional knowledge. A<br />

library of compounds is screened <strong>in</strong> an assay that<br />

tests for changes <strong>in</strong> a specific biological function.<br />

One immediate result would be to process the glut<br />

of identified targets more quickly: <strong>in</strong>stead of jo<strong>in</strong><strong>in</strong>g<br />

the logjam at the validation stage, a great many<br />

of them can now be diverted directly to screen<strong>in</strong>g.<br />

If they fail there, they can be discarded right away,<br />

and thus simply bypass most of the validation stage<br />

altogether. In other words, screen<strong>in</strong>g moves up the<br />

value cha<strong>in</strong> to rest alongside validation, <strong>in</strong> a parallel<br />

rather than consecutive position. By bracket<strong>in</strong>g<br />

the <strong>in</strong>dustrialized steps of target identification and<br />

chemical screen<strong>in</strong>g, chemical genomics has given<br />

the value cha<strong>in</strong> a remarkable makeover.<br />

The key is to move lengthy, messy biology far downstream<br />

where you know it’s worth pursu<strong>in</strong>g. Many<br />

targets aren’t drugable, so just validate the smaller<br />

drugable subset.<br />

—SVP of discovery,<br />

lead<strong>in</strong>g biotech company<br />

The effect of this new value cha<strong>in</strong> is dramatic: time<br />

to drug is cut by a further two years (that’s on top<br />

of the year already saved by us<strong>in</strong>g genomic target<br />

identification). On the other hand, there is a large<br />

3. In July 2001, Aurora Biosciences was acquired by Vertex Pharmaceuticals.<br />

The <strong>in</strong>tention is to screen a library aga<strong>in</strong>st all expressed<br />

genes <strong>in</strong> the system under <strong>in</strong>vestigation.<br />

This approach has the tremendous advantage of allow<strong>in</strong>g<br />

the identification of targets without any presumptions<br />

as to their function. Additionally, these<br />

targets can help to elucidate the mechanism of disease,<br />

thereby reveal<strong>in</strong>g other potential targets <strong>in</strong> relevant<br />

pathways. The drawback is that forward chemical<br />

genetics has not yet been <strong>in</strong>dustrialized, and<br />

throughput levels are therefore very low. Accord<strong>in</strong>g<br />

to our model, implement<strong>in</strong>g it today would <strong>in</strong>crease<br />

costs to more than $1 billion per drug, ow<strong>in</strong>g to the<br />

use of “slow” biology, which is needed to set up the<br />

screen<strong>in</strong>g assays <strong>in</strong> chemistry. The expert estimate is<br />

that forward chemical genetics is still as much as<br />

five years away from be<strong>in</strong>g economically feasible.<br />

<strong>in</strong>crease <strong>in</strong> cost, offsett<strong>in</strong>g all cost sav<strong>in</strong>gs from target<br />

identification. But the tradeoff is still positive.<br />

In a highly competitive market, where new entrants<br />

are cont<strong>in</strong>uously erod<strong>in</strong>g share, chemical genomics<br />

can add more than $200 million <strong>in</strong> value per drug.<br />

(In less competitive conditions, the value added<br />

may be as little as $20 million.)<br />

No doubt chemical genomics costs more—but you<br />

take the loss to ga<strong>in</strong> the speed. Time is money.<br />

—SVP of discovery and technology,<br />

major pharmaceutical company<br />

One important drawback of chemical genomics is<br />

this: it is limited ma<strong>in</strong>ly to known target classes.<br />

With targets of unknown function, results become<br />

very difficult to <strong>in</strong>terpret. The proxy assays used for<br />

screen<strong>in</strong>g—heat-stability assays, for <strong>in</strong>stance—tend<br />

to yield both false positives and false negatives.<br />

Nevertheless, chemical genomics is already be<strong>in</strong>g<br />

pursued throughout the <strong>in</strong>dustry. Several big pharmaceutical<br />

companies have adopted it, and genomics<br />

companies such as Aurora Biosciences 3 and<br />

15

16<br />

Cellomics are well positioned to exploit the expected<br />

result<strong>in</strong>g demand for screen<strong>in</strong>g resources.<br />

Aurora is a likely w<strong>in</strong>ner <strong>in</strong> the race to resolve chemical<br />

genomics-related bottlenecks, s<strong>in</strong>ce it boasts<br />

some of the most advanced screen<strong>in</strong>g and assay<br />

technologies <strong>in</strong> the <strong>in</strong>dustry. It has an unusual bus<strong>in</strong>ess<br />

model, <strong>in</strong> that it provides tools and discovery<br />

services but does not engage <strong>in</strong> any drug discovery<br />

of its own.<br />

* * *<br />

So much for the imm<strong>in</strong>ent efficiency sav<strong>in</strong>gs across<br />

the R&D value cha<strong>in</strong>. They are hardly the end of<br />

TECHNOLOGIES IN WAITING—OTHER TECHNOLOGIES EXAMINED,<br />

BUT OMITTED FROM OUR REPORT<br />

In this report we have focused on the technologies<br />

and approaches that are hav<strong>in</strong>g the greatest impact<br />

on R&D economics today. Several other excit<strong>in</strong>g advances<br />

appear likely to make a comparable impact<br />

beyond the next three to five years (too far ahead for<br />

<strong>in</strong>clusion <strong>in</strong> our analysis for this report), <strong>in</strong> particular,<br />

the use of proteomics <strong>in</strong> target identification,<br />

conditional gene <strong>in</strong>hibition <strong>in</strong> target validation, and<br />

<strong>in</strong>dustrialized structural biology <strong>in</strong> screen<strong>in</strong>g and<br />

drug design.<br />

Proteomics is the study of prote<strong>in</strong> expression and<br />

prote<strong>in</strong>-prote<strong>in</strong> <strong>in</strong>teractions. Its aim is an understand<strong>in</strong>g,<br />

and ultimately exploitation, of prote<strong>in</strong> function.<br />

Identify<strong>in</strong>g prote<strong>in</strong>s through sequence or structure<br />

homology has recently become much more efficient,<br />

thanks to bio<strong>in</strong>formatics’ role <strong>in</strong> analyz<strong>in</strong>g largescale<br />

experiments. One example of a genomics company<br />

apply<strong>in</strong>g proteomics is Oxford Glycosciences,<br />

which is engaged <strong>in</strong> identify<strong>in</strong>g targets and surrogate<br />

markers, both <strong>in</strong> collaboration with pharmaceutical<br />

companies and <strong>in</strong> an <strong>in</strong>dependent pipel<strong>in</strong>e. But proteomics<br />

is not really <strong>in</strong>dustrialized yet, and has high<br />

hurdles to overcome before it is.<br />

We exam<strong>in</strong>ed the economics of proteomic expression<br />

studies us<strong>in</strong>g two-dimensional gel analysis, followed<br />

the story, of course. Other technological advances<br />

are bound to improve R&D productivity further <strong>in</strong><br />

due course. Important emerg<strong>in</strong>g technologies<br />

<strong>in</strong>clude proteomics, partial target <strong>in</strong>hibition, and<br />

structural biology. (See sidebar, “Technologies <strong>in</strong><br />

Wait<strong>in</strong>g.”)<br />

Improv<strong>in</strong>g Decision Mak<strong>in</strong>g<br />

The economics of R&D h<strong>in</strong>ge on success rates, and<br />

success rates depend largely on a cascade of decisions<br />

that have to be made aga<strong>in</strong> and aga<strong>in</strong>:<br />

whether or not to pursue a target or lead, and if so,<br />

how—to what extent and with what approach.<br />

by identification of <strong>in</strong>terest<strong>in</strong>g prote<strong>in</strong>s through mass<br />

spectrometry.<br />

Under optimal conditions today, this approach has<br />

the potential to save about as much <strong>in</strong> cost as<br />

genomics-based approaches do, though not as much<br />

<strong>in</strong> time (about six months less). As the technology<br />

becomes <strong>in</strong>dustrialized, proteomics could well surpass<br />

genomics-based approaches, but that is still<br />

several years away.<br />

The aim of the second promis<strong>in</strong>g technology we<br />

<strong>in</strong>vestigated, conditional gene <strong>in</strong>hibition, is to overcome<br />

a common problem <strong>in</strong> target validation. Here<br />

is the background. A standard technique for target<br />

validation uses “target knockouts.” The potential target<br />

is removed, or “knocked out,” from an animal at<br />

conception; this results <strong>in</strong> the total <strong>in</strong>hibition of the<br />

target’s function from embryo to adult. The trouble is<br />

that drugs work differently. Very seldom do they<br />

<strong>in</strong>hibit target function fully, and they are taken only<br />

after genes have already fulfilled their developmental<br />

role <strong>in</strong> utero. So the use of target knockouts as a target<br />

validation technique does run the risk of creat<strong>in</strong>g<br />

false negatives (<strong>in</strong> some cases <strong>in</strong>dicated by death,<br />

because of the unnatural disruption of embryonic<br />

development). What is needed <strong>in</strong>stead of total gene

Genomics may offer an opportunity for companies<br />

to make the correct decision more often than<br />

before. For one th<strong>in</strong>g, genomics can ultimately provide<br />

more, better, and earlier <strong>in</strong>formation, and<br />

good <strong>in</strong>formation translates ultimately <strong>in</strong>to high<br />

success rates. For another, the implementation of<br />

genomics approaches will force companies to<br />

reth<strong>in</strong>k their <strong>in</strong>ternal decision-mak<strong>in</strong>g processes.<br />

Genomics-based <strong>in</strong>formation, together with the<br />

ability to m<strong>in</strong>e it productively, gives a company an<br />

enormous advantage. Such a company will now be<br />

able to make and execute decisions on targets and<br />

<strong>in</strong>hibition, therefore, is conditional gene <strong>in</strong>hibition,<br />

which mimics the partial <strong>in</strong>hibitory effect of a drug.<br />

Several promis<strong>in</strong>g approaches have emerged, <strong>in</strong>clud<strong>in</strong>g<br />

forward genetics, chemical genomics, and<br />

molecular switches that modulate gene expression,<br />

but their practicality has still to be proved.<br />

Examples abound of genomics companies engaged <strong>in</strong><br />

develop<strong>in</strong>g these target-validation techniques. Lexicon<br />

Genetics, Exelixis, and Ingenium, for <strong>in</strong>stance,<br />

are us<strong>in</strong>g mass mutagenesis on animals such as mice<br />

and zebrafish. In a more focused project, Hypnion is<br />

us<strong>in</strong>g forward genetics and other approaches to<br />

understand sleep-wake disorders <strong>in</strong> mammals.<br />

What benefits lie <strong>in</strong> wait? By elim<strong>in</strong>at<strong>in</strong>g the false<br />

negatives associated with the current knockout technique,<br />

these new technologies could double or even<br />

triple the number of validated targets, and <strong>in</strong> that<br />

way save up to $200 million per drug. At the<br />

moment, however, these new k<strong>in</strong>ds of validation<br />

(with the exception of certa<strong>in</strong> chemical genomics<br />

approaches, discussed <strong>in</strong> the ma<strong>in</strong> text) are still<br />

ma<strong>in</strong>ly limited to “slow” biology.<br />

F<strong>in</strong>ally, structural biology is used for generat<strong>in</strong>g and<br />

analyz<strong>in</strong>g the three-dimensional structure of targets<br />

leads with greater speed and consistency than<br />

before. Guided by more rigorous selection criteria,<br />

the company should go on to improve its success<br />

rates and hence its productivity.<br />

A mere 10 percent improvement <strong>in</strong> accuracy of<br />

decisions at any stage would confer disproportionately<br />

large benefits. Consider, for example, all the<br />

target/lead pairs that fail just before cl<strong>in</strong>ical trials:<br />

if a company were able to decide <strong>in</strong> just one out of<br />

ten such cases aga<strong>in</strong>st pursu<strong>in</strong>g the target <strong>in</strong> the<br />

first place, it would save as much as $100 million<br />

per drug on average. As for INDs that fail cl<strong>in</strong>ical<br />

for virtual screen<strong>in</strong>g, and is essential to <strong>in</strong> silico drug<br />

design. Unfortunately, it currently entails prote<strong>in</strong><br />

crystallization (to prepare the prote<strong>in</strong>s for visualization<br />

by X-ray diffraction), which is a difficult, labor<strong>in</strong>tensive<br />

manual process. Speedier alternatives,<br />

such as NMR spectroscopy, cannot predict overall<br />

prote<strong>in</strong> shape adequately, be<strong>in</strong>g restricted to prote<strong>in</strong><br />

subsegments. As a result, <strong>in</strong> silico model<strong>in</strong>g rema<strong>in</strong>s<br />

limited <strong>in</strong> its applicability: the algorithms cannot<br />

boast really high precision for target classes where<br />

no example structures are available.<br />

Several projects, both public and private, are under<br />

way to upgrade structural biology platforms to the<br />

po<strong>in</strong>t where they will achieve <strong>in</strong>dustrialized scale.<br />

Among the private endeavors is the Novartis Institute<br />

for Functional Genomics, founded by Novartis to<br />

identify and characterize targets us<strong>in</strong>g high-throughput<br />

technologies. In the biotech field, Structural<br />

Genomix aims to become a platform provider and<br />

generate revenues by sell<strong>in</strong>g prote<strong>in</strong> structures; the<br />

company may also decide to exploit its data <strong>in</strong>house,<br />

and extend <strong>in</strong>to <strong>in</strong> silico drug design. But it<br />

might be several years before technologies have<br />

developed far enough for the necessary scale effects<br />

to be realized.<br />

17

18<br />

trials, if the company were able to decide <strong>in</strong> just one<br />

out of ten such cases to abandon development earlier,<br />

it could save an additional $100 million per<br />

drug.<br />

Improv<strong>in</strong>g decision mak<strong>in</strong>g to that extent will take<br />

more than simply acquir<strong>in</strong>g and implement<strong>in</strong>g the<br />

new genomics technologies and approaches. It will<br />

take some serious strategic reth<strong>in</strong>k<strong>in</strong>g too, and possibly<br />

major organizational changes. Whether to keep<br />

all activities <strong>in</strong>-house, or seek partners, or buy <strong>in</strong> targets<br />

or leads. How to redistribute resources, reassign<br />

personnel, and revise l<strong>in</strong>es of communication and<br />

cha<strong>in</strong>s of command. Such operational and organizational<br />

quandaries will be addressed <strong>in</strong> detail <strong>in</strong> the<br />

f<strong>in</strong>al chapter of this report.<br />

We implemented a fast-<strong>in</strong>/fast-out decision policy<br />

about projects—if we didn’t have optimal conditions<br />

met <strong>in</strong> 18 months, we killed it. That made all<br />

the difference.<br />

—Former executive,<br />

lead<strong>in</strong>g pharmaceutical company<br />

Even the basic bus<strong>in</strong>ess skill of decision mak<strong>in</strong>g,<br />

then, is not immune to the <strong>in</strong>fluence of genomics<br />

technology. Whatever other benefits it br<strong>in</strong>gs,<br />

genomics serves as a wake-up call across the <strong>in</strong>dustry,<br />

even for companies try<strong>in</strong>g to shelter from the<br />

genomics revolution.<br />

The Challenges<br />

Although implement<strong>in</strong>g genomics offers companies<br />

great opportunities, it also presents them with<br />

formidable challenges. One of these is to ensure<br />

that the quality of the pipel<strong>in</strong>e rema<strong>in</strong>s uncompromised.<br />

Another is to put the new technologies <strong>in</strong>to<br />

efficient operation.<br />

Ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g Quality<br />

If the potential productivity ga<strong>in</strong>s are to be fully<br />

realized, the post-genomics R&D pipel<strong>in</strong>e will need<br />

to reta<strong>in</strong> or improve its pre-genomics quality. Any<br />

decl<strong>in</strong>e <strong>in</strong> quality—the quality of targets and<br />

leads—would obviously have an adverse effect on<br />

productivity. The ma<strong>in</strong> threat to quality derives<br />

from the unorthodoxy, the unfamiliar nature, of so<br />

many new targets. Entire target classes, previously<br />

unknown, will need <strong>in</strong>vestigat<strong>in</strong>g. The temptation<br />

to pursue leads prematurely is bound to arise, and<br />

quality control will need to be rigorously enforced<br />

to uphold the pipel<strong>in</strong>e’s usual success rates.<br />

In any given experiment, 70 percent of what I see is<br />

completely new. It could be a gold rush, or it could<br />

be junk—-there’s no way to tell until I sit at the<br />

bench and do more work.<br />

—Director of research,<br />

lead<strong>in</strong>g biotech company<br />

To appreciate the threat accurately, we need a<br />

proper def<strong>in</strong>ition of the term quality.<br />

The “<strong>in</strong>tr<strong>in</strong>sic quality” of a target or lead amounts<br />

to its likelihood of success, which is based on factors<br />

such as cl<strong>in</strong>ical relevance and drugability.<br />

Companies can do little to alter this type of quality.<br />

The “provisional quality” (or “<strong>in</strong>formational quality”)<br />

of a target or lead is based on the amount of<br />

data available on it at any given time—how much is<br />

known about its cl<strong>in</strong>ical relevance, drugability, and<br />

so on. (This <strong>in</strong>formational quality helps to predict<br />

success rates, but does not <strong>in</strong>fluence them.)<br />

Companies can alter this type of quality, by spend<strong>in</strong>g<br />

appropriately, and <strong>in</strong> that way can improve their<br />

ability to predict downstream success rates.<br />

This dist<strong>in</strong>ction is crucial. But it has at times been<br />

overlooked, result<strong>in</strong>g <strong>in</strong> some confusion <strong>in</strong> the<br />

<strong>in</strong>dustry. A widely publicized concern has been that<br />

novel targets identified through genomics would<br />

tend to be of <strong>in</strong>herently lower quality than pregenomics<br />

targets, and thus more likely to fail at<br />

some costly phase downstream. That <strong>in</strong>ference is an<br />

oversimplification, and is mislead<strong>in</strong>g.<br />

Certa<strong>in</strong>ly genomics proposes many more novel targets<br />

(as much as 60 to 70 percent of potential targets,<br />

<strong>in</strong> our <strong>in</strong>terviewees’ experience, may belong<br />

to previously unknown target classes), and their<br />

<strong>in</strong>formational quality at that early stage is duly modest.<br />

But that says noth<strong>in</strong>g about their <strong>in</strong>tr<strong>in</strong>sic quality.<br />

Any prudent company, no matter how bold, will<br />

strive to learn more about novel targets before<br />

decid<strong>in</strong>g to pursue them downstream. In our analysis,<br />

<strong>in</strong>vestments made to raise a novel target’s <strong>in</strong>for-

mational quality to the level of a known target’s<br />

would be more than recouped <strong>in</strong> due course.<br />

The overall cost of these novel targets—rais<strong>in</strong>g<br />

their <strong>in</strong>formational quality and then pursu<strong>in</strong>g them<br />

down the value cha<strong>in</strong>—is bound to rise <strong>in</strong>itially.<br />

However, with<strong>in</strong> three to five years from the <strong>in</strong>itial<br />

discovery of a target <strong>in</strong> a novel class, accord<strong>in</strong>g to<br />

our model, the overall cost <strong>in</strong>crease per novel-class<br />

drug could return to average.<br />

Where do the added costs come from? And what<br />

must happen to offset them?<br />

The Cost of Quality Control<br />

Our model predicts that the typical <strong>in</strong>crease will be<br />

about $200 million and more than one year per<br />

drug (that is, a total cost of $790 million versus<br />

$590 million, and a total time to drug of 13.8 years<br />

versus 12.7 years). The <strong>in</strong>crease is ma<strong>in</strong>ly attributable<br />

to the extra time needed to understand target<br />

function and develop appropriate assays <strong>in</strong> target<br />

validation and screen<strong>in</strong>g; also, to the need to screen<br />

a higher proportion of compounds, s<strong>in</strong>ce an appropriate<br />

subset of a larger library cannot be selected<br />

<strong>in</strong> advance.<br />

Chemical optimization costs would <strong>in</strong>crease only if<br />

the novel target required a novel compound (by no<br />

means a necessary requirement, though certa<strong>in</strong>ly a<br />

possible one occasionally). Our model exam<strong>in</strong>es<br />

this worst-case scenario explicitly. If a novel target<br />

does happen to require a novel compound, or a<br />

compound unfamiliar to the medic<strong>in</strong>al chemists,<br />

the potential efficiency loss causes a further<br />

<strong>in</strong>crease of $290 million and more than two years<br />

per drug (that is, a total cost of about $1.1 billion<br />

versus $590 million, and a total time to drug of 15<br />

years versus 12.7 years). The additional <strong>in</strong>creases<br />

here would be due to the extra time needed now for<br />

medic<strong>in</strong>al chemists to learn how to modify the compound<br />

and atta<strong>in</strong> specific properties through trial<br />

and error. But this worst-case scenario should not<br />

be very common.<br />

Mov<strong>in</strong>g further still down the value cha<strong>in</strong>, to the<br />

precl<strong>in</strong>ical and cl<strong>in</strong>ical phases, costs are not<br />

expected to <strong>in</strong>crease. The downstream success rate<br />

for novel compounds or targets should turn out to<br />

be much the same as that for known compounds or<br />

targets, as long as the same standards are applied.<br />

There should be no significant <strong>in</strong>crease <strong>in</strong> toxicity<br />

or decrease <strong>in</strong> efficacy, other than <strong>in</strong> very unlikely<br />

circumstances—for <strong>in</strong>stance, if exist<strong>in</strong>g animal<br />

models somehow proved less suitable, or if drugs<br />

for novel target classes were to <strong>in</strong>teract with metabolic<br />

pathways <strong>in</strong> utterly unfamiliar ways.<br />

Offsett<strong>in</strong>g the Costs<br />

Rais<strong>in</strong>g the <strong>in</strong>formational quality of novel targets<br />

<strong>in</strong>volves a heavy <strong>in</strong>vestment, but it is a wise <strong>in</strong>vestment.<br />

And a fairly quick one: knowledge about<br />

one novel target quickly elucidates other potential<br />

targets <strong>in</strong> the same class. Thanks to feedback<br />

loops, knowledge <strong>in</strong>creases geometrically. As more<br />

is learned, the level of <strong>in</strong>vestment can tail off<br />

accord<strong>in</strong>gly.<br />

In any case, the alternatives to mak<strong>in</strong>g that early<br />

<strong>in</strong>vestment <strong>in</strong> <strong>in</strong>formational quality are far from<br />

attractive. On the one hand, dropp<strong>in</strong>g the targets<br />

would be terribly short-sighted: companies would<br />

be forgo<strong>in</strong>g the opportunity to discover and exploit<br />

untapped sources of revenue. On the other hand,<br />

push<strong>in</strong>g novel targets onward without adequate<br />

<strong>in</strong>formation on them would almost certa<strong>in</strong>ly result<br />

<strong>in</strong> a higher failure rate downstream, with all the<br />

associated implications for cost. An <strong>in</strong>creased failure<br />

rate of just 10 percent across chemical optimization<br />

and all of development would on average<br />

<strong>in</strong>crease costs by about $200 million per drug.<br />

To sum up, then: costs <strong>in</strong>curred early <strong>in</strong> the value<br />

cha<strong>in</strong> (by <strong>in</strong>formation gather<strong>in</strong>g) look preferable<br />

to those that would otherwise be <strong>in</strong>curred later (as<br />

the result of a higher downstream failure rate). All<br />

the more so, given that the early costs should soon<br />

beg<strong>in</strong> fall<strong>in</strong>g (<strong>in</strong>vestment <strong>in</strong> <strong>in</strong>formation is almost<br />

always associated with an experience curve): as<br />

novel target classes become <strong>in</strong>creas<strong>in</strong>gly familiar, it<br />

will become <strong>in</strong>creas<strong>in</strong>gly efficient and economical<br />

to pursue new targets with<strong>in</strong> those classes. So with<br />

proper handl<strong>in</strong>g, the burden of that early cost<br />

<strong>in</strong>crease is just a short-term one, and the productivity<br />

of genomics-driven R&D should soon return<br />

19

20<br />

almost to that of more familiar target classes. We<br />

estimate the time required for this is about three to<br />

five years from the discovery of a novel target,<br />

which is the amount of time it should take to complete<br />

validation and early screen<strong>in</strong>g (assay development).<br />

(See Exhibit 4.)<br />

Putt<strong>in</strong>g the New Technology <strong>in</strong>to Operation<br />

It is one th<strong>in</strong>g to acquire and <strong>in</strong>stall new capabilities<br />

and another to get them to function as they are<br />

meant to. The challenge of mak<strong>in</strong>g genomics technologies<br />

operational has two major components:<br />

eas<strong>in</strong>g the bottlenecks that will develop, and resolv<strong>in</strong>g<br />

the personnel conundrums that are sure to<br />

arise.<br />

The Problem of Bottlenecks<br />

The bottlenecks result, <strong>in</strong> effect, from the unevenness<br />

of the efficiency ga<strong>in</strong>s at different po<strong>in</strong>ts <strong>in</strong> the<br />

value cha<strong>in</strong>. (See Exhibit 5.)<br />

Consider the sixfold <strong>in</strong>crease <strong>in</strong> target identification<br />

described above. This escalat<strong>in</strong>g quantity of<br />

targets could turn out to be not so much a glorious<br />

profusion as an exasperat<strong>in</strong>g glut. Unless there is<br />

some correspond<strong>in</strong>g <strong>in</strong>crease <strong>in</strong> the capacity to<br />

process them downstream, these targets will simply<br />

EXHIBIT 4<br />

IMPACT OF QUALITY ON COST TO DRUG<br />

Pre-genomics Post-genomics<br />

Mix of novel and<br />

known targets<br />

Novel targets only<br />

Novel targets and<br />

novel compounds only<br />

Benefits of experience<br />

over 3-5 years<br />

SOURCES: BCG analysis; <strong>in</strong>dustry <strong>in</strong>terviews.<br />

590<br />

590<br />

790<br />

880<br />

1,080<br />

Approximate cost ($M)<br />

EXHIBIT 5<br />

UNEVEN PRODUCTIVITY GAINS CREATE IMBALANCE<br />

Number today<br />

to get one drug<br />

Not to scale<br />

2,400 1<br />

Potential<br />

targets<br />

400<br />

Potential<br />

targets<br />

108<br />

Validated<br />

targets<br />

Increased<br />

productivity<br />

138<br />

Lead<br />

candidates<br />

loiter at their source <strong>in</strong> a wasteful logjam. Or consider<br />

chemical genomics. Implement<strong>in</strong>g this<br />

approach will build up huge pressure on screen<strong>in</strong>g<br />

resources: send<strong>in</strong>g unvalidated targets for screen<strong>in</strong>g<br />

could <strong>in</strong>volve a 120-fold <strong>in</strong>crease. So too with<br />

efficiency ga<strong>in</strong>s at other po<strong>in</strong>ts <strong>in</strong> the value cha<strong>in</strong>:<br />

without the necessary downstream adjustments,<br />

bottlenecks will <strong>in</strong>evitably develop.<br />

Our capacity to do functional experiments was<br />

completely choked by potential targets.<br />

—VP of discovery,<br />

major pharmaceutical company<br />

But the problem is a dynamic one, and accord<strong>in</strong>gly<br />

very awkward to deal with. Ease one bottleneck and<br />

you often create another downstream. Or ease it<br />

too much and you convert it <strong>in</strong>to a bulge—over-<br />

72<br />

Drug<br />

candidates<br />

Required<br />

productivity 2<br />

Targets Compounds<br />

30<br />

7<br />

INDs Drug<br />

ID Biology<br />

Chemistry<br />

Development<br />

Target ID Target Validation<br />

Screen<strong>in</strong>g Optimization<br />

Precl<strong>in</strong>ical Cl<strong>in</strong>ical<br />

SOURCES: BCG analysis; <strong>in</strong>dustry <strong>in</strong>terviews.<br />

NOTE: Does not <strong>in</strong>clude impact of pharmacogenetics, to be addressed <strong>in</strong><br />

next <strong>in</strong>stallment.<br />

1Number of targets identified by <strong>in</strong>vest<strong>in</strong>g same resources post-genomics as<br />

pre-genomics.<br />

2 Productivity required to exploit all potential targets from target identification.

esourced <strong>in</strong> relation to the flow from upstream,<br />

and hence wasteful once aga<strong>in</strong>. It will take some<br />

adroit adjustment of resources and processes along<br />

the value cha<strong>in</strong> to restore a smooth flow.<br />

This imbalance will affect <strong>in</strong>cumbents—<strong>in</strong>tegrated<br />

companies with established value cha<strong>in</strong>s—worst of<br />

all. They have resources and processes <strong>in</strong> place;<br />

changes are likely to be difficult and disruptive. To<br />

implement the new genomics technologies is troublesome<br />

enough, but then to have to redistribute<br />

resources along the entire value cha<strong>in</strong> will take real<br />

determ<strong>in</strong>ation. (To other companies, by contrast,<br />

bottlenecks might represent very favorable opportunities.<br />

In particular, genomics companies could<br />

benefit. (See sidebar, “Upstart Start-ups—the<br />

Competitors Classified.”)<br />

The Human Factor<br />

To flourish <strong>in</strong> the new genomics era, and possibly<br />

even to survive, companies are go<strong>in</strong>g to have to<br />

engage the new realities. It will not be easy. Some of<br />

the new technologies will tend to overstretch or<br />

even defy exist<strong>in</strong>g capabilities and organizational<br />

structures. All along the value cha<strong>in</strong>, processes and<br />

resources are go<strong>in</strong>g to have to be adjusted.<br />

The resources <strong>in</strong> question <strong>in</strong>clude human resources,<br />

and retrench<strong>in</strong>g, reassign<strong>in</strong>g, or supplement<strong>in</strong>g talented<br />

personnel is a far from straightforward procedure.<br />

But it will have to be done. Organizational<br />

restructur<strong>in</strong>g is likely to entail distress<strong>in</strong>g upheavals<br />

for corporate culture and personnel alike. The<br />

strategies adopted for manag<strong>in</strong>g it will require constant<br />

monitor<strong>in</strong>g and f<strong>in</strong>e-tun<strong>in</strong>g. New modes of<br />

cross-functional collaboration may need to be <strong>in</strong>stituted,<br />