South Africa - International Franchise Association

South Africa - International Franchise Association South Africa - International Franchise Association

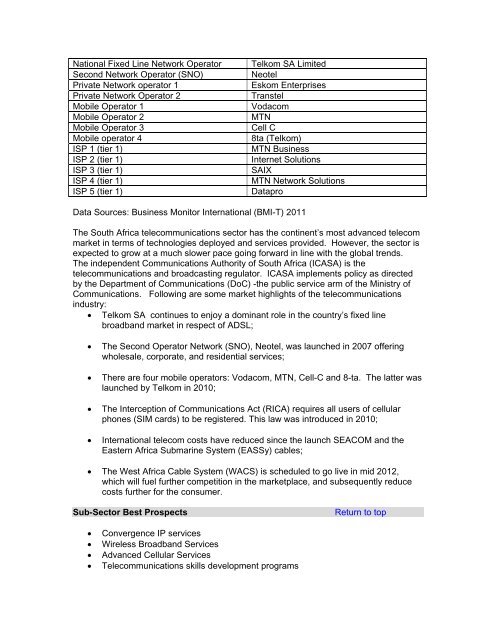

National Fixed Line Network Operator Telkom SA Limited Second Network Operator (SNO) Neotel Private Network operator 1 Eskom Enterprises Private Network Operator 2 Transtel Mobile Operator 1 Vodacom Mobile Operator 2 MTN Mobile Operator 3 Cell C Mobile operator 4 8ta (Telkom) ISP 1 (tier 1) MTN Business ISP 2 (tier 1) Internet Solutions ISP 3 (tier 1) SAIX ISP 4 (tier 1) MTN Network Solutions ISP 5 (tier 1) Datapro Data Sources: Business Monitor International (BMI-T) 2011 The South Africa telecommunications sector has the continent’s most advanced telecom market in terms of technologies deployed and services provided. However, the sector is expected to grow at a much slower pace going forward in line with the global trends. The independent Communications Authority of South Africa (ICASA) is the telecommunications and broadcasting regulator. ICASA implements policy as directed by the Department of Communications (DoC) -the public service arm of the Ministry of Communications. Following are some market highlights of the telecommunications industry: • Telkom SA continues to enjoy a dominant role in the country’s fixed line broadband market in respect of ADSL; • The Second Operator Network (SNO), Neotel, was launched in 2007 offering wholesale, corporate, and residential services; • There are four mobile operators: Vodacom, MTN, Cell-C and 8-ta. The latter was launched by Telkom in 2010; • The Interception of Communications Act (RICA) requires all users of cellular phones (SIM cards) to be registered. This law was introduced in 2010; • International telecom costs have reduced since the launch SEACOM and the Eastern Africa Submarine System (EASSy) cables; • The West Africa Cable System (WACS) is scheduled to go live in mid 2012, which will fuel further competition in the marketplace, and subsequently reduce costs further for the consumer. Sub-Sector Best Prospects Return to top • Convergence IP services • Wireless Broadband Services • Advanced Cellular Services • Telecommunications skills development programs

Opportunities Return to top • market demand for lower cost high-speed data services • convergence of bundled uncapped broadband Exhibitions & Conferences • Satcom 2012 • www.terrapinn.com/2012/satcom-africa • Africom 2012 • http://africa.comworldseries.com/ • MediaTech 2013 • http://www.biztradeshows.com/trade-events/mediatech-africa.html Web Resources Return to top Department of Communications (DoC) www.doc.gov.za Independent Communications Authority of South Africa (ICASA) www.icasa.org.za Telkom www.telkom.co.za Neotel www.neotel.co.za Vodacom www.vodacom.co.za MTN www.mtn.co.za Cell C www.cellc.co.za SEACOM http://www.seacom.mu/ EASSy http://www.eassy.org/ Mining Equipment Return to top Overview Return to top 2010 2011 2012 (estimated) Unit: USD thousands 2013 (estimated)

- Page 1 and 2: Doing Business in South Africa- 201

- Page 3 and 4: South Africa is well integrated int

- Page 5 and 6: • Telecommunications Equipment; a

- Page 7 and 8: Return to table of contents Chapter

- Page 9 and 10: DRC Congo Gabon Gambia Guinea Lesot

- Page 11 and 12: Close Corporations: Close corporati

- Page 13 and 14: local, provincial, and national —

- Page 15 and 16: BEE Codes of Good Practice and othe

- Page 17 and 18: distributors who sell to wholesaler

- Page 19 and 20: Trade Promotion and Advertising Ret

- Page 21 and 22: U.S. trademark and patent registrat

- Page 23 and 24: • For more information about regi

- Page 25 and 26: Return to table of contents Chapter

- Page 27 and 28: electricity producers in the world.

- Page 29 and 30: Meanwhile, a significant pipeline o

- Page 31 and 32: The U.S. Commercial Service in Joha

- Page 33: The Department of Communications So

- Page 37 and 38: power generation constraints in Sou

- Page 39 and 40: Other matters that are enjoying clo

- Page 41 and 42: visit our website: http://www.buyus

- Page 43 and 44: For More Information The U.S. Comme

- Page 45 and 46: Web Resources Return to top Green B

- Page 47 and 48: Date: October, 2013 Venue: NASREC,

- Page 49 and 50: http://www.transnetnationalportsaut

- Page 51 and 52: Most of the precision agriculture e

- Page 53 and 54: Foreign Agricultural Service U.S. E

- Page 55 and 56: In the 2010-marketing year, South A

- Page 57 and 58: In volume, “mechanically deboned

- Page 59 and 60: transaction value approximates the

- Page 61 and 62: Zero-value invoices are not accepte

- Page 63 and 64: • Goods are to be returned to ori

- Page 65 and 66: Please also read the Labeling and M

- Page 67 and 68: All SABS standards have been rename

- Page 69 and 70: Accreditation Return to top The fol

- Page 71 and 72: Web Resources Return to top ATA Car

- Page 73 and 74: Return to table of contents Chapter

- Page 75 and 76: dimension is weighted, with ownersh

- Page 77 and 78: Racially discriminatory property la

- Page 79 and 80: Development Program (APDP). It will

- Page 81 and 82: A proposal to amend the four pieces

- Page 83 and 84: long-awaited spectrum auction, ensu

National Fixed Line Network Operator Telkom SA Limited<br />

Second Network Operator (SNO) Neotel<br />

Private Network operator 1 Eskom Enterprises<br />

Private Network Operator 2 Transtel<br />

Mobile Operator 1 Vodacom<br />

Mobile Operator 2 MTN<br />

Mobile Operator 3 Cell C<br />

Mobile operator 4 8ta (Telkom)<br />

ISP 1 (tier 1) MTN Business<br />

ISP 2 (tier 1) Internet Solutions<br />

ISP 3 (tier 1) SAIX<br />

ISP 4 (tier 1) MTN Network Solutions<br />

ISP 5 (tier 1) Datapro<br />

Data Sources: Business Monitor <strong>International</strong> (BMI-T) 2011<br />

The <strong>South</strong> <strong>Africa</strong> telecommunications sector has the continent’s most advanced telecom<br />

market in terms of technologies deployed and services provided. However, the sector is<br />

expected to grow at a much slower pace going forward in line with the global trends.<br />

The independent Communications Authority of <strong>South</strong> <strong>Africa</strong> (ICASA) is the<br />

telecommunications and broadcasting regulator. ICASA implements policy as directed<br />

by the Department of Communications (DoC) -the public service arm of the Ministry of<br />

Communications. Following are some market highlights of the telecommunications<br />

industry:<br />

• Telkom SA continues to enjoy a dominant role in the country’s fixed line<br />

broadband market in respect of ADSL;<br />

• The Second Operator Network (SNO), Neotel, was launched in 2007 offering<br />

wholesale, corporate, and residential services;<br />

• There are four mobile operators: Vodacom, MTN, Cell-C and 8-ta. The latter was<br />

launched by Telkom in 2010;<br />

• The Interception of Communications Act (RICA) requires all users of cellular<br />

phones (SIM cards) to be registered. This law was introduced in 2010;<br />

• <strong>International</strong> telecom costs have reduced since the launch SEACOM and the<br />

Eastern <strong>Africa</strong> Submarine System (EASSy) cables;<br />

• The West <strong>Africa</strong> Cable System (WACS) is scheduled to go live in mid 2012,<br />

which will fuel further competition in the marketplace, and subsequently reduce<br />

costs further for the consumer.<br />

Sub-Sector Best Prospects Return to top<br />

• Convergence IP services<br />

• Wireless Broadband Services<br />

• Advanced Cellular Services<br />

• Telecommunications skills development programs