September 12, 2005 Pursuant to your request, attached herewith is ...

September 12, 2005 Pursuant to your request, attached herewith is ...

September 12, 2005 Pursuant to your request, attached herewith is ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Frederick Memorial Hospital, Inc. And Subsidiaries<br />

Notes To Consolidated Financial Statements<br />

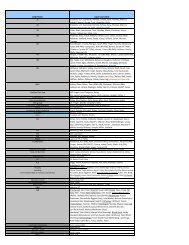

Note 8. Intangible Assets<br />

Intangible assets cons<strong>is</strong>t of the following at June 30:<br />

Description <strong>2005</strong> 2004<br />

Goodwill $ 1,254,<strong>12</strong>4 $ 1,254,<strong>12</strong>4<br />

Intangible pension asset (Note 10) 418,831<br />

-<br />

$ 1,672,955 $<br />

1,254,<strong>12</strong>4<br />

Note 9. Long-Term Debt<br />

MHHEFA Revenue Bonds:<br />

(a) During 1994, the Hospital obtained a loan of $55,060,000 in Maryland Health and Higher Educational Facility<br />

Authority (MHHEFA) Revenue Bonds, Frederick Memorial Hospital Issue, Series 1993. The Series 1993 Bonds are<br />

net of original <strong>is</strong>sue d<strong>is</strong>counts of $3,<strong>12</strong>6,313, which are being amortized over the life of the bonds using the yield<br />

method. Accumulated amortization was $1,498,021 and $1,380,142, at June 30, <strong>2005</strong> and 2004, respectively. The<br />

average annual interest rate on the bond loan <strong>is</strong> 5%. Interest <strong>is</strong> payable semi-annually on January 1 and July 1. The<br />

balance on these bonds, net of unamortized original <strong>is</strong>sue d<strong>is</strong>count, was $45,251,708 and $46,<strong>12</strong>3,945 at June 30,<br />

<strong>2005</strong> and 2004, respectively.<br />

The MHHEFA Series 1993 Bonds were <strong>is</strong>sued <strong>to</strong> refinance certain Frederick County loans and <strong>to</strong> finance and<br />

refinance costs of acqu<strong>is</strong>ition, construction, renovation and equipping certain Hospital facilities. In connection with<br />

the bond <strong>is</strong>suance, the Hospital was required <strong>to</strong> deposit as collateral, in a trusteed Debt Service Reserve Fund, an<br />

amount equal <strong>to</strong> the maximum annual debt service on the Series 1993 Bonds of $3,409,810.<br />

The Series 1993 Bonds (other than those maturing on July 1, 2008 and July 1, 2013 aggregating $10,485,000)<br />

maturing on or after July 1, 2004 are subject <strong>to</strong> redemption prior <strong>to</strong> maturity beginning on July 1, 2003 at the option of<br />

the Authority as outlined in the agreement dated November <strong>12</strong>, 1993.<br />

Under the prov<strong>is</strong>ions of the bond agreement, the Hospital has granted <strong>to</strong> the Authority a security interest in all<br />

receipts now owned and hereafter acquired.<br />

The bond agreement contains certain financial covenants.<br />

(b) In August 2002, the Hospital obtained a loan of $71,715,000 in MHHEFA Revenue Bonds, Frederick Memorial<br />

Hospital Issue, Series 2002. The MHHEFA Series 2002 Bonds were <strong>is</strong>sued <strong>to</strong> finance and refinance costs of<br />

construction, renovation and equipping certain Hospital facilities. The Series 2002 Bonds are net of original <strong>is</strong>sue<br />

d<strong>is</strong>counts of $2,361,175 which are being amortized over the life of the bonds using the yield method. Accumulated<br />

amortization was $272,803 and $179,270 at June 30, <strong>2005</strong> and 2004, respectively. The annual interest rate on the<br />

bond loan ranges between 3.25% and 5.<strong>12</strong>5%. Interest <strong>is</strong> payable semiannually on each January 1 and July 1,<br />

through July 1, 2035. The balance on these bonds, net of unamortized original <strong>is</strong>sue d<strong>is</strong>count, was $69,626,628 and<br />

$69,533,095 at June 30, <strong>2005</strong> and 2004, respectively.<br />

15