Section 1 - FTSE

Section 1 - FTSE

Section 1 - FTSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SECURITIES LENDING: THE CUSTODIANS FIGHT BACK<br />

ISSUE SEVEN • MAY/JUNE 2005<br />

Euroclear leads<br />

on strategy<br />

Pharmaceuticals<br />

at the crossroads<br />

The glory–glory days<br />

of portfolio trading<br />

DOES TRANSITION MANAGEMENT NEED A CODE OF PRACTICE?

SECURITIES LENDING: THE CUSTODIANS FIGHT BACK<br />

ISSUE SEVEN • MAY/JUNE 2005<br />

Euroclear leads<br />

on strategy<br />

Pharmaceuticals<br />

at the crossroads<br />

The glory–glory days<br />

of portfolio trading<br />

DOES TRANSITION MANAGEMENT NEED A CODE OF PRACTICE?

EDITORIAL DIRECTOR:<br />

Francesca Carnevale, Tel + 44 [0] 20 7074 0008,<br />

email: francesca@berlinguer.com<br />

CONTRIBUTING EDITORS:<br />

Karen Jones, Neil O’Hara, David Simons.<br />

SPECIAL CORRESPONDENTS:<br />

Andrew Cavenagh, Rekha Menon, Tim Steele,<br />

Bill Stoneman, Angela May Ward, Paul Whitfield,<br />

Ian Williams, Benedict Mander<br />

<strong>FTSE</strong> EDITORIAL BOARD:<br />

Mark Makepeace [CEO], Carl Beckley,<br />

Graham Colbourne, Imogen Dillon-Hatcher, Paul<br />

Hoff, Marianne Huve-Allard, Stuart Ives, Paul<br />

McLean, Jerry Moskowitz, Gareth Parker,<br />

Jamie Perrett, Claire Spraggett, Sandra Steel<br />

PUBLISHING & SALES DIRECTOR:<br />

Paul Spendiff<br />

OVERSEAS REPRESENTATION:<br />

Adil Jilla [Middle East and North Africa],<br />

Faredoon Kuka, Ronni Mystry Associates Pvt [India],<br />

Ferda Akyürek [Turkey],<br />

Harold Leddy & Associates [United States]<br />

PUBLISHED BY:<br />

Berlinguer Ltd, 4-14 Tabernacle Street,<br />

London EC2A 4LU.<br />

Tel: + 44 [0] 20 7074 0021; www.berlinguer.com.<br />

ART DIRECTION AND PRODUCTION:<br />

Alphaprint, Hythe Hill, Colchester, Essex CO1 2LY.<br />

PRINTED BY:<br />

Southernprint - 17-21 Factory Road, Upton<br />

Industrial Estate, Poole, Dorset BH16 5SN<br />

DISTRIBUTION:<br />

Mailcom plc, Snowdon Drive,<br />

Winterhill, Milton Keynes MK6 1HQ<br />

<strong>FTSE</strong> Global Markets is published six times a year. No part<br />

of this publication may be reproduced or used in any form<br />

of advertising without prior permission of <strong>FTSE</strong> International<br />

Limited or Berlinguer Ltd.<br />

<strong>FTSE</strong> Global Markets is published by Berlinguer Ltd on<br />

behalf of <strong>FTSE</strong> International Limited.<br />

[Copyright © Berlinguer Ltd 2005. All rights reserved.]<br />

<strong>FTSE</strong> is a trade mark of the London Stock Exchange plc<br />

and the Financial Times Limited and is used by <strong>FTSE</strong><br />

International Limited under licence.<br />

<strong>FTSE</strong> International Limited would like to stress that the<br />

contents, opinions and sentiments expressed in the articles<br />

and features contained in <strong>FTSE</strong> Global Markets do not<br />

represent <strong>FTSE</strong> International Limited’s ideas and opinions.<br />

The articles are commissioned independently from <strong>FTSE</strong><br />

International Limited and represent only the ideas and<br />

opinions of the contributing writers and editors.<br />

All information is provided for information purposes only. Every<br />

effort is made to ensure that all information given in this<br />

publication is accurate, but no responsibility or liability can be<br />

accepted by <strong>FTSE</strong> International Limited for any errors or<br />

omissions or for any loss arising from use of this publication.<br />

All copyright and database rights in the <strong>FTSE</strong> Indices belong<br />

to <strong>FTSE</strong> International Limited or its licensors. Redistribution of<br />

the data comprising the <strong>FTSE</strong> Indices is not permitted. You<br />

agree to comply with any restrictions or conditions imposed<br />

upon the use, access, or storage of the data as may be<br />

notified to you by <strong>FTSE</strong> International Limited or Berlinguer Ltd<br />

and you may be required to enter into a separate agreement<br />

with <strong>FTSE</strong> International Limited or Berlinguer Ltd.<br />

ISSN: 1742-6650<br />

Journalistic code set by the Munich Declaration.<br />

ADVERTISING AND SUBSCRIPTION ENQUIRIES:<br />

Contact Paul Spendiff<br />

EM: paul.spendiff@berlinguer.com<br />

DL: + 44 [0] 20 7074 0021<br />

FX: + 44 [0] 20 7074 0022<br />

Subscription Price: £399 per annum [6 issues]<br />

<strong>FTSE</strong> GLOBAL MARKETS • MAY/JUNE 2005<br />

Outlook<br />

As part of our growing focus on the provision of investment<br />

services, we take an in-depth look at a number of key product<br />

areas in this issue – namely securities lending, sub-custody<br />

services and portfolio trading. The market in many areas of investment<br />

services is becoming increasingly crowded, diverse and complex. That<br />

complexity is also beginning to have consequences. The<br />

implementation of Basel II, for example, will have a long term impact<br />

on the provision of securities lending services and may encourage<br />

custodian lenders to fight back for market share lost to the successful<br />

and growing army of third party agency lenders and specialist auction<br />

services, such as ESecLending.<br />

In similar vein, our opening market leader feature focuses on a new<br />

initiative, promoted by Credit Suisse First Boston, that transition<br />

management providers adopt a code of practice, or T-Charter, as it is<br />

becoming increasingly known. As the transition management market<br />

becomes more competitive and diversified, clients reportedly find it<br />

difficult to make proper assessments of the services on offer. Some<br />

providers would have it that the time is ripe for clarity as to the proper<br />

definition of modern day transition management services and a<br />

requirement that transition managers provide basic performance<br />

guarantees. Others think a charter unworkable. We canvass the rising<br />

debate as to its value.<br />

There are myriad reasons why portfolio trading is gaining in<br />

prominence. Not least is a trend towards quantitative ‘top down’portfolio<br />

management and a growing requirement for asset managers to respond<br />

quickly to market movements. But even while portfolio trading grows<br />

apace, the sector is itself in flux. We take a long and detailed look at the<br />

opportunities and challenges facing this increasingly arcane business.<br />

Andrew Cavenagh meanwhile reviews the vicarious fortunes of the<br />

pharmaceuticals industry. The sector is undergoing a critically testing<br />

period. The share prices of leading US and European companies are in<br />

the doldrums, even while profits remain robust. Can they cope with the<br />

pressures of radical change demanded by today’s healthcare industry?<br />

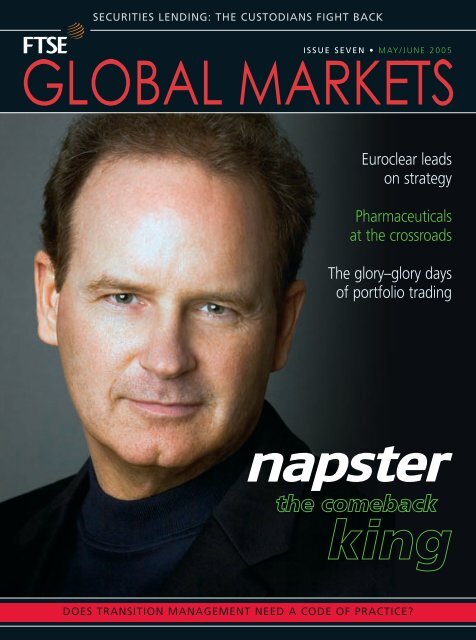

Our cover story however belongs to Chris Gorog, chairman and chief<br />

executive officer of digital-music service Napster. Gorog says the<br />

company’s newly launched Napster To Go portable subscription service<br />

will revolutionise the way we all listen to music and that he is willing and<br />

able to take on the mighty Apple Computer and its galactically popular<br />

iPod digital-music player. Dave Simons explains why Gorog thinks he<br />

has more than a fighting chance of success.<br />

Francesca Carnevale,<br />

Editorial Director<br />

May 2005<br />

1

2<br />

Contents<br />

COVER STORY<br />

REGULARS<br />

MARKET LEADER<br />

IN THE MARKETS<br />

REGIONAL REVIEW<br />

EQUITY REPORT<br />

INDEX REVIEW<br />

NAPSTER ..................................................................................................................Page 36<br />

Flush with $100m in available cash, in February of this year Napster chairman and<br />

CEO Christopher Gorog finally unveiled Napster To Go, a portable subscription music<br />

service that very well may revolutionise the way we listen to music. Dave Simons<br />

finds out about the man and the company that made one of the music industry’s most<br />

dramatic comebacks.<br />

TEETH AND THE T-CHARTER ..............................................................Page 6<br />

Does the transition management market really need a code of practice?<br />

We tell you why it does and why it doesn’t.<br />

SYNDICATED LENDING AT THE MARGINS ........................Page 14<br />

Pricing, structure, documentation and covenant packages are all under pressure.<br />

LIFETIME SUPPORT ......................................................................................Page 17<br />

Neil O’Hara reports on the mounting demand for annuities.<br />

THE IMPORTANCE OF BEING ICB ................................................Page 18<br />

The battle to provide a seminal industry classification benchmark<br />

TIMED IN, TIMED OUT ............................................................................Page 20<br />

Neil O’Hara explains why investors should consider their voting rights.<br />

IS MEXICO LOSING IT’S APPEAL? ................................................Page 22<br />

Benedict Mander explains why investors are chary of Mexico.<br />

TAIWAN’S GLOBAL ROADSHOW ................................................Page 25<br />

Ian Williams outlines the island’s key selling points.<br />

INVESTING IN SOUTH AFRICA ........................................................Page 28<br />

Ian Williams assesses the market’s appeal.<br />

AXA’S BENDAHAN TOPS FUNDS IN EUROPE ..................Page 32<br />

New fund manager performance league table is launched.<br />

CUKUROVA SETS THE PACE ..............................................................Page 34<br />

How four big sell-offs will affect investor appetite for Turkish risk.<br />

SUB-CUSTODY: A RACE TO THE FINISH................................Page 46<br />

Tim Steele reports on the outlook for sub-custodian services in Europe.<br />

REITS FIND A HOME IN EUROPE ..................................................Page 80<br />

The growing appeal of REITs as an investment vehicle.<br />

Market Reports by <strong>FTSE</strong> Research ................................................................................Page 86<br />

Companies in this issue ..................................................................................................Page 85<br />

Calendar ............................................................................................................................Page 96<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

INTEREST RATES<br />

AGRICULTURAL<br />

EQUITIES<br />

MARKET DATA<br />

METALS<br />

CBOT<br />

100 oz<br />

Gold<br />

ZGG5<br />

Last:<br />

Change:<br />

Time:<br />

Jan 20, 2005 10:05:00 AM<br />

422.1<br />

-1.3<br />

10:05:00<br />

BUY ORDERS SELL ORDERS<br />

QTY PRICE QTY PRICE<br />

36 422.0 10 422.2<br />

66 421.9 2 422.3<br />

115 421.8 7 422.4<br />

124 421.7 68 422.5<br />

6 421.6 115 422.6<br />

1 420.5 100 422.7<br />

5 420.0 10 422.8<br />

2 418.1 1 423.2<br />

1 418.0 2 423.5<br />

1 417.7 1 423.9<br />

The Chicago Board of Trade offers precious metals<br />

traders a 100% electronic trading platform for<br />

full-sized and mini-sized metals futures contracts. The<br />

CBOT ® Metals Complex grew over 300% from 2003<br />

– our book is the marketplace of the future.<br />

Choose the CBOT for Your Precious Metals Trading!<br />

CBOT<br />

mini-sized<br />

Gold<br />

YGG5<br />

Last:<br />

Change:<br />

Time:<br />

Jan 20, 2005 10:05:00 AM<br />

422.1<br />

- 1.3<br />

10:05:00<br />

BUY ORDERS SELL ORDERS<br />

QTY PRICE QTY PRICE<br />

110 422.0 9 422.3<br />

121 421.9 112 422.4<br />

103 421.8 113 422.5<br />

203 421.7 115 422.6<br />

3 421.5 200 422.7<br />

2 421.4 1 422.9<br />

9 421.3 4 423.0<br />

3 421.0 3 423.4<br />

2 420.6 1 423.8<br />

3 420.5 8 424.0<br />

THE NEW GOLD STANDARD<br />

VIEW THIS LIVE QUOTE BOOK AT WWW.CBOT.COM/METALS<br />

STRENGTH. INNOVATION. TRANSPARENCY.<br />

100% Electronic Marketplace<br />

Real-time Trade Matching<br />

Liquid Markets<br />

Global Access<br />

Full-sized Contracts<br />

Mini-sized Contracts<br />

Straight-thru-processing<br />

For more information visit: www.cbot.com/metals<br />

The information herein is taken from sources believed to be reliable. However, it is<br />

intended for purposes of information and education only and is not guaranteed by<br />

the Chicago Board of Trade as to accuracy, completeness, nor any trading result,<br />

and does not constitute trading advice or constitute a solicitation of the purchase<br />

or sale of any futures or options. The Rules and Regulations of the Chicago<br />

Board of Trade should be consulted as the authoritative source on all current<br />

contract specifications and regulations.<br />

©2005 Board of Trade of the City of Chicago, Inc.<br />

All Rights Reserved<br />

www.cbot.com

4<br />

Contents<br />

FEATURES<br />

EUROCLEAR ON THE FAST TRACK ............................................Page 41<br />

Armed with a new corporate structure Euroclear is quietly confident of the<br />

applicability and efficacy of its two-pronged forward business strategy. At its heart, the<br />

plan calls for a single platform for all five markets in Euroclear, plus Euroclear Bank.<br />

Francesca Carnevale talks to Pierre Francotte, CEO of Euroclear.<br />

STP’s NEW FOCUS ........................................................................................Page 50<br />

These days firms now focus on the business objectives underlying STP, such as<br />

increasing efficiency between trade counterparties, improving margins, reducing<br />

transaction costs and minimising failed trades. By Rekha Menon<br />

PORTFOLIO TRADING: UPSIDE ALL THE WAY ..............Page 54<br />

These are golden days for portfolio traders, backed by better technology, a solid business<br />

pipeline supplied by transition managers and the growing popularity of ‘top down’<br />

portfolio management. Trading strategies, benchmarks and the market structure are all<br />

set to become even more sophisticated and competitive.<br />

SECURITIES LENDING ..................................................................................Page 60<br />

The big changes in the securities lending market have already happened. Competition<br />

from new lenders cut the ties that bound securities lending to custodians and now the<br />

market is living with the consequences. But custodians are fighting back. Francesca<br />

Carnevale explains how and why.<br />

PHARMACEUTICALS ....................................................................................Page 67<br />

The pharmaceutical industry is facing a crisis of confidence. Following a spectacular<br />

bull run between 1994 and 2001, US and European pharmaceutical company share<br />

prices have stagnated as investor confidence has fallen away. Even so, profits remain<br />

high. What’s the answer? Andrew Cavenagh reports.<br />

LIFESTYLE FUNDS ............................................................................................Page 71<br />

Only a few years ago, 401(k) plan participants were clamouring for more investment<br />

choice. Plan sponsors then added more products, but too quickly everyone<br />

complained they had so many choices they could not decide what to do. Enter the life<br />

cycle fund, a product that is taking the 401(k) world by storm. Neil A. O'Hara reports.<br />

HEDGE FUNDS REPORT ............................................................................Page 74<br />

So far small but constantly growing institutional investor allocations, proposed<br />

Securities and Exchange Commission regulations and new management strategies are<br />

subtlety changing the $480bn US hedge fund industry. By Karen Jones<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

Citigroup<br />

basketuk@citigroup.com<br />

Portfolio trading<br />

is not a commodity<br />

business. Let us<br />

show you how<br />

we stand out.<br />

© 2005 Citigroup Global Markets Limited. CITIGROUP and the Umbrella Device are trademarks and service marks of Citicorp and its affiliates and are used<br />

and registered throughout the world. This advertisement has been approved for distribution in the UK by Citigroup Global Markets Limited, which is authorised<br />

and regulated by FSA.

TRANSITION MANAGEMENT<br />

6<br />

Market Leader<br />

TEETH & THE<br />

T-CHARTER<br />

Enjoying boom times, the transition management<br />

(TM) market is increasingly crowded and complex.<br />

While competition has increased service levels and<br />

choice (and helped push down fees), the selection<br />

process for transition management has become more<br />

difficult. In the search for consistency, the elimination<br />

of conflicts of interest and even double charging,<br />

leading providers have come up with the idea of<br />

launching a code of practice, or ‘T-Charter’ as it is<br />

becoming known. Is it a force for good? Francesca<br />

Carnevale tries to find some answers.<br />

IN DECEMBER 2004, at a<br />

Euromoney conference on The<br />

Future of Transition Management an<br />

end-of-session discussion panel<br />

delivered rather more than the<br />

conference delegates had bargained<br />

for. The panel – chaired by Tim<br />

Wilkinson, managing director,<br />

transition management at Citigroup –<br />

included TM doyen Graham Dixon,<br />

managing director, transition services<br />

at Credit Suisse First Boston (CSFB)<br />

and Andrew Williams, investment<br />

consultant at Mercer Investment<br />

Consulting. Dixon boldly threw aside<br />

the anodyne discussion topic and<br />

invited everyone to get down to a more<br />

meaningful discussion. There was an<br />

important question facing TM, he said.<br />

“Is it time for the market to finally<br />

agree standards of practice?”he asked.<br />

From that spur of the moment talkshop,<br />

a comprehensive market<br />

consultation exercise on the need for<br />

a code of practice [the so-called<br />

T-Charter] was kick-started that could<br />

have significant repercussions for the<br />

transition management sector. Dixon,<br />

like many other transition managers,<br />

Graham Dixon,<br />

managing director,<br />

transition services<br />

at Credit Suisse<br />

First Boston<br />

believes the time is ripe for the<br />

charter. And, he thinks, it is imperative<br />

for market practitioners themselves to<br />

lead the effort towards self-regulation.<br />

“Many users of TM services do not<br />

have the weapon of withholding<br />

repeat business,” explains Dixon, “we<br />

would like a charter to protect the<br />

non-expert user, for example, a<br />

corporate pension fund which does<br />

not have the technology and means to<br />

monitor and measure portfolio<br />

transactions. Professional users, for<br />

example a fund management dealing<br />

desk, do not need this protection.<br />

They already have a level battleground<br />

for business and weapons of mass<br />

destruction if required.”<br />

The debate over the usefulness of a<br />

T-Charter hangs on the mounting<br />

complexity of the TM offering. A big<br />

change has occurred as investment<br />

banks, such as Lehman Brothers and<br />

specialist brokers, such as Instinet and<br />

ITG, as well as integrated offerings<br />

from JP Morgan and Citigroup have<br />

taken on the big custodian houses,<br />

such as Bank of New York, State<br />

Street, Mellon and Northern Trust.The<br />

result is a patchwork of service<br />

providers, often with differing<br />

definitions of TM itself. In the context<br />

of the United Kingdom market, says<br />

Mercer’s Williams, “five years ago<br />

when we started researching<br />

transition managers we were looking<br />

at six or seven firms, now it involves at<br />

least 16 major players and the<br />

different approaches to the business<br />

mean different business models on<br />

offer. It is harder for clients and<br />

consultants to choose the right<br />

transition manager.”<br />

It is not an issue of competition,<br />

expands Citigroup’s Wilkinson,“it is a<br />

question of competence and<br />

delivering an efficient solution to the<br />

client. Even looking at the most<br />

simplistic scenario of moving $100m<br />

from one manager to another, the<br />

Fund could lose between 100 and 150<br />

basis points of performance if the<br />

portfolio transition is not managed<br />

properly; versus typically 25 to 30<br />

basis points if it is.”<br />

Jody Windmiller, director of transition<br />

management at UBS stresses: “If it is<br />

implemented, the T-Charter will go a<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

home<br />

Wherever you settle should feel like<br />

Demands for a single European<br />

capital market have set<br />

harmonisation in motion.<br />

We are convinced of the benefits<br />

of harmonised financial markets<br />

in Europe and are committed to<br />

removing barriers to cross-border<br />

securities settlement.<br />

DELIVERING A DOMESTIC<br />

MARKET FOR EUROPE

TRANSITION MANAGEMENT<br />

8<br />

Market Leader<br />

Tim Wilkinson, managing director, transition<br />

management at Citigroup<br />

long way to raising awareness of the<br />

services and processes involved in<br />

transitions. That includes knowing the<br />

right questions to ask of your transition<br />

service provider. It is an assurance of a<br />

baseline level of integrity.”<br />

Since the publication of seminal<br />

research, undertaken by Bob Werner,<br />

at Frank Russell Securities, Inc. back<br />

in 1999 revealed a surprisingly wide<br />

gap between promised cost estimates<br />

and delivered performance in the<br />

portfolio transition management<br />

business, there has been a simmering<br />

and unresolved tension in the<br />

market. Werner conducted a study of<br />

more than 100 pension funds in the<br />

United States, Canada, Australia and<br />

Europe between 1999 and the first<br />

quarter of 2001 to see if low-cost<br />

estimates resulted in low cost<br />

transitions for clients.<br />

Werner found that “they do not, and<br />

clients generally were unaware that<br />

such a substantial gap exists.” The<br />

research also raised other issues, such<br />

as the supply of unreasonable estimates<br />

by providers simply to win business. It<br />

also highlighted the mis-selling of<br />

services where so-called TM specialists,<br />

or what Dixon refers to dismissively as<br />

“part-time transition managers,” who<br />

in practice provide portfolio trading<br />

services instead of the distinctive and<br />

specialist portfolio TM offering.<br />

Werner claimed he also found<br />

conflicts of interest rife in the business,<br />

with some large investment banks<br />

bidding low on TM project fees, only to<br />

make up the revenue shortfall through<br />

trading activity via their proprietary<br />

accounts. As Citibank’s Wilkinson<br />

posits: “it is the ultimate conflict. Can<br />

you act for the client and the bank at<br />

the same time?” Index funds, Werner<br />

continued, also have a strong incentive<br />

to maximise crosses with their internal<br />

funds, regardless of the impact on the<br />

transition client’s destination portfolio.<br />

That would imply therefore that while<br />

many transition managers play fair –<br />

some do not and it is harming business.<br />

“The very fact that one of the stated<br />

objectives of the T-Charter is to ‘protect<br />

clients from poor or questionable<br />

practices’ indicates that implication to<br />

be correct,”says Windmiller.<br />

In January this year, Dixon invited<br />

10 or so major providers in the market<br />

to a meeting where he set out his<br />

ideas and where he asked them to<br />

help him thrash out a draft code of<br />

practice, or T-Charter which could, in<br />

the words of State Street’s European<br />

TM team “have teeth,” be widely<br />

adopted by the market and at the<br />

same time give a large degree of<br />

comfort to clients.<br />

Perhaps it was the time of the<br />

month with little business to transit,<br />

or perhaps it was the fact that<br />

frustration with certain market<br />

practices had built up to boiling<br />

point. Whatever the reason, the kickoff<br />

meeting was packed, according to<br />

attendees. It included Dixon,<br />

Wilkinson, Williams and Windmiller,<br />

Paul Samuel of Barclays Global<br />

Investors, Julie Dickson from Mellon,<br />

Josephine Defty of Russell<br />

Investment Group, Rakesh Manani<br />

from Goldman Sachs, Peter Walker<br />

from Merrill Lynch Investment<br />

Managers (MLIM), Rick Di Mascio<br />

from Inalytics, John Minderides from<br />

JP Morgan, Lachlan French from<br />

State Street, Alex Johnstone from<br />

Bank of New York and Tony Nash<br />

from Deutsche Bank. The meeting<br />

was chaired by another doyen of the<br />

TM market Nigel Foster, who built<br />

up his market reputation at<br />

ECrossnet and MLIM. Foster was<br />

brought on board as a sort of<br />

“respected elder statesman” says<br />

Dixon, “who is ensuring the market<br />

is properly lobbied and canvassed for<br />

input and opinions.”<br />

A number of people and<br />

institutions came under fire at the<br />

meeting. With the first flush of<br />

frustration articulated, people at the<br />

meeting soon found a more proper<br />

direction and some 12 marketcritical<br />

issues were hammered out<br />

into a draft charter that would be the<br />

basis of extensive market<br />

consultation. Comprehensive<br />

meeting notes were sent out to<br />

participant and non-participating<br />

firms, asking for comment and<br />

suggestions. A second meeting was<br />

arranged for February, and while<br />

fewer institutions turned up to that<br />

follow-up meeting, a more<br />

substantive form to the elements of a<br />

possible charter began to emerge<br />

and the “twelve points were reduced<br />

to a more manageable eight,” says<br />

Dixon (please refer to Box 1: What<br />

the T-Charter might contain).<br />

The market reaction to the<br />

proposed charter is mixed. As<br />

Wilkinson says, “all non-investment<br />

banks are likely to be very<br />

supportive of this charter.”<br />

Meanwhile Simon Hutchinson, head<br />

of European transition management<br />

at Northern Trust says “Realistically,<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

it is not too controversial and we are<br />

not massively surprised about what<br />

is in there.”<br />

Questions about the efficacy of the<br />

charter rest on various points. First<br />

that it might be too prescriptive and<br />

“create a rod for our own backs,”<br />

according to one leading transition<br />

manager. Dixon counters with “if the<br />

charter is causing you to do<br />

something not in the interests of the<br />

client, then we will change it. We are<br />

deliberately trying not to be too<br />

prescriptive. It is the spirit of what we<br />

are trying to do that is important.”<br />

UBS’s Windmiller concurs.“It is a fine<br />

balance though,” she warns. “The<br />

<strong>FTSE</strong> GLOBAL MARKETS • MAY/JUNE 2005<br />

initial draft was certainly too<br />

prescriptive. There are so many<br />

different types of transition managers<br />

and it was important that the charter<br />

be seen not to favour one business<br />

model over another. A key<br />

consideration behind the initiative<br />

was that clients had more choice,<br />

rather than less.”<br />

John Minderides, managing<br />

director, transition management at JP<br />

Morgan acknowledges that the draft<br />

charter is, “more constructive than I<br />

thought it might be.”He explains that<br />

TM specialists already work in a highly<br />

regulated environment. “Pre-hedging,<br />

for instance, is already covered by the<br />

Partnership and Trust<br />

As Ireland’s premier provider of third party custody and administration services, you can trust us<br />

to deliver outstanding service through our partnership approach. Building on our success<br />

achieved to date, we have extended our services to cover hedge funds (Irish and non-Irish<br />

domiciled). Should you wish to obtain more information on our services please contact:<br />

Liam Butler (Dublin) at +353 1 670 0300. Email: info.boiss@boi.ie Web: www.boiss.ie<br />

Financial Services Authority (FSA)<br />

rules anyway. It not an issue unique to<br />

transitions in a primary way.”<br />

A third element is that it is too UK<br />

centric. Again, Dixon counters with<br />

the fact that the principles of the<br />

charter have a global application.“We<br />

weren’t thinking of anything other<br />

than immediate market concerns<br />

when this came up. However we are<br />

seeing interest from the US about its<br />

applicability.” UBS’s Windmiller<br />

acknowledges that the charter is<br />

“probably UK-centric at the<br />

moment.” However, she points out<br />

that there are more transitions<br />

undertaken in the UK than elsewhere<br />

9

TRANSITION MANAGEMENT<br />

10<br />

Market Leader<br />

in Europe, although, “we are seeing<br />

more interest from European clients<br />

and eventually the charter will<br />

become a global phenomenon.”<br />

“Off the record” transition<br />

managers mention other concerns<br />

such as one broker TM specialist who<br />

says “I doubt many transition<br />

managers will be able to get their<br />

signature on the charter without some<br />

substantial input from their firm’s<br />

compliance people, and that may<br />

ultimately take the teeth out of the<br />

initiative.”“I worry about that,” says<br />

Dixon, who explains that that<br />

particular requirement flows from the<br />

consensus view that the T- Charter<br />

“has teeth.” He also points out that<br />

the FSA, which may be supportive of<br />

the self-regulatory element in the<br />

draft charter, is the natural institution<br />

with which compliance officers can<br />

have a productive dialogue.<br />

Others point out that while there is<br />

a strong belief that some houses are<br />

winning business falsely “there is no<br />

WHAT THE T-CHARTER MIGHT CONTAIN<br />

connection between that and post<br />

event performance,” although the<br />

same transition manager concurs<br />

that “people should be more honest<br />

about measuring post trade.<br />

Guarantees about crossing, for<br />

instance, are nonsense [sic].” Others<br />

question the need for a separate<br />

team saying,“How can you possibly<br />

leverage the broader expertise of<br />

your bank by ring-fencing transition<br />

management?” Then again says<br />

another provider,“given that a lot of<br />

the issues are aimed at pension fund<br />

trustees, it may be that the National<br />

Association of Pension Funds (NAPF)<br />

should also be involved, rather than<br />

the FSA, which covers even market<br />

professionals who do not actually<br />

need this charter.”<br />

Some critics see the charter as an<br />

indirect marketing exercise by the<br />

people who raised the issue “giving<br />

added credibility to the people who<br />

are associated with it”; others say it<br />

that in important essentials, it still<br />

AT THIS STAGE of the market consultation process eight guiding<br />

principles have been suggested as the basis for a workable T-charter.<br />

Transition managers:<br />

• Must disclose any potential conflicts of interest when they submit bids to<br />

clients and explain how those conflicts will be managed.<br />

• Should guarantee confidentiality to the client and show or prove how<br />

they will keep confidentiality.<br />

• Should confirm that the required experience, resources and processes<br />

are in place for each transition assignment.<br />

• Should specify the performance benchmark that reflects the objectives<br />

of the transition and track records carefully.<br />

• Should confirm that systems are accurate and timely.<br />

• Should present cost estimates in the same way. The layout of specific<br />

costings should be common to all TM bids, so that clients can<br />

compare bids side by side.<br />

• Must disclose all fees ahead of the transition and provide detailed<br />

calculations of fees after the transition has taken place.<br />

• Should follow appropriate dealing practices on pre-hedging, crossing and<br />

foreign exchange.<br />

Simon Hutchinson, head<br />

of European transition<br />

management at Northern Trust<br />

remains light.“In some ways it brings<br />

the lowest common denominator of<br />

capability to the fore,” says another<br />

transition manager. TM providers<br />

should be accountable not only for<br />

their performance in safeguarding<br />

portfolio profitability but also, where<br />

relevant, the activities of third party<br />

agents, that are trading out the<br />

portfolio.” Windmiller jumps to the<br />

defence. “I understand the concern<br />

about the charter achieving the<br />

lowest common denominator, but<br />

that can still be a very high standard<br />

indeed. In addition clients will be<br />

assured of this baseline level of<br />

integrity. That’s a really good thing. It<br />

has to be said that if a TM manager<br />

does not sign up, there should be a<br />

compelling reason why.”<br />

According to Mercer’s Williams,<br />

where the T-Charter really breaks new<br />

ground is in the area of cost<br />

estimation. There is a real drive to<br />

formulate a standard template, where<br />

every assumption made in a bid is<br />

stated “so that when you receive bids<br />

from a request for proposal they can<br />

be compared on a like basis or, at least<br />

you should know where all the<br />

assumptions have originated,”he says.<br />

Northern Trust’s Hutchinson thinks<br />

that as the nature of the business<br />

changes, and client’s grow in<br />

sophistication and they themselves set<br />

the level of demand for more<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

TRANSITION MANAGEMENT<br />

12<br />

Market Leader<br />

transparency and better practice.<br />

“Increasingly clients are looking for<br />

deeper service relationships with<br />

transition managers. The fact that the<br />

business is much more complex than<br />

simply trading out of one portfolio<br />

structure into another, means that<br />

clients are looking for a much<br />

deeper understanding of their<br />

strategies and preference and are<br />

looking for a relationship which<br />

covers regular assignments.”<br />

The latest draft charter is currently<br />

with the FSA for guidance and<br />

feedback. So far, reports Dixon, the<br />

feedback is extremely positive. “The<br />

FSA is interested and supportive and<br />

have asked to be kept informed of<br />

progress. The syndication to the<br />

investment consultants has uncovered<br />

100% support, and three firms have<br />

agreed to collaborate on the T-Charter<br />

Who’s leading the Investment Pack?<br />

cost estimation template,” he states.<br />

The next round of talks with transition<br />

management providers is scheduled<br />

for May.<br />

Dixon is also waiting on further<br />

input from clients, investment<br />

consultants and transition managers<br />

on the latest draft. The most valuable<br />

element of the consultation so far<br />

adds Mercer’s Williams is “having<br />

the majority of transition managers<br />

in a single room, discussing<br />

important market issues. It’s been<br />

pretty powerful.”<br />

It is still too early to say whether<br />

the charter will undergo further<br />

modification and streamlining and<br />

whether it will come into formal<br />

existence some time soon.<br />

“Something that makes the industry<br />

more transparent for everyone can<br />

only be a good thing,” says JP<br />

Morgan’s Minderides.<br />

Windmiller at UBS is sure that<br />

“bidding for business will become<br />

more standardised,” if the T-charter is<br />

adopted. She cautions, however,<br />

against the charter putting too much<br />

emphasis on costs.“Teamwork, clarity<br />

of process, reporting capability and<br />

depth of resources across asset classes<br />

are equally important considerations.<br />

There are several different business<br />

models, evincing the different<br />

strengths and expertise,”she explains.<br />

“Having that choice available is good<br />

for the client.” The last word should,<br />

perhaps, go to Dixon who says,“As an<br />

absolute minimum, the duty of any<br />

transition manager is to act in the<br />

client’s interests, in good faith, with<br />

due skill and care, and in accordance<br />

with best execution rules. Is it too<br />

much to ask?”<br />

24/7 Surveillance<br />

There are plenty of companies that rank investment fund performance -<br />

but only one that tracks fund manager performance: Citywire.<br />

Citywire has compiled the career histories of more than 3,000 fund<br />

managers in the UK and across Europe, taking into account when they<br />

change funds or move jobs.<br />

We do this because we believe it is the managers who add value for their<br />

investors over the long term.<br />

We crunch the data to provide league tables of the best performing<br />

managers and award them coveted Citywire Ratings based on their<br />

risk-adjusted performance.<br />

The whole process is mathematically based and actuarially approved. Who<br />

comes out on top is entirely down to how they perform; not whether they<br />

spin a good story, are charismatic or forceful personalities or pay us a fee.<br />

To find out more about Citywire please visit our website<br />

www.citywire.co.uk where you will also find news, commentary and<br />

analysis on the top fund managers and the companies they invest in,<br />

or email rlander@citywire.co.uk<br />

www.citywire.co.uk<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

EM Applications<br />

analysis into action<br />

Looking for new<br />

perspectives on risk?<br />

EM Applications takes you beyond tracking error,<br />

delivering a better understanding of the risk characteristics<br />

of your equity and fixed income portfolios<br />

■ See how tracking error depends on market conditions<br />

■ Observe the consequences of future scenarios<br />

■ View risk attributions through industry standard or<br />

custom classification schemes<br />

If you would like an improved insight into the risks<br />

you are taking, please contact us<br />

www.emapplications.com/<strong>FTSE</strong><br />

Telephone: +44 (0) 20 7397 8395<br />

Email: enquiry@emapplications.com<br />

The EM Applications risk model is based on original work by Al Stroyny

SYNDICATED LOANS<br />

14<br />

In the Markets<br />

Bumper syndicated<br />

lending extracts its price<br />

Investor appetite is allowing borrowers to procure competitive terms<br />

across the debt markets, with public and private bond spreads also<br />

narrowing during 2004 and the beginning of this year. For syndicated<br />

loans, however, it is not only pricing that is under pressure but also<br />

structure, documentation and covenant packages. Ian Fitzgerald,<br />

director and head of loan syndication at Lloyds TSB Capital Markets,<br />

looks at the market’s prospects for the rest of this year.<br />

BUMPER LENDING VOLUME<br />

in 2004, including substantial<br />

increases in leveraged loans, has<br />

left the syndicated loan market finely<br />

balanced. But it has failed to stem<br />

growing competition between banks<br />

and that continues to drive down<br />

pricing. Given that balance-sheet<br />

lending decisions – both for<br />

investment-grade and loans further<br />

down the credit curve – are now<br />

supported by sophisticated riskengagement<br />

mechanisms, (including<br />

a new generation of credit risk<br />

instruments) it is not clear how this<br />

pricing cycle will compare with<br />

previous cycles. Neither is it clear<br />

which banks will manage to stay in<br />

the market when pricing finally<br />

bottoms out.<br />

Investor appetite is allowing<br />

borrowers to procure competitive<br />

terms across the debt markets, with<br />

public and private bond spreads<br />

narrowing – a trend begun last year. It<br />

is not only pricing that is under<br />

pressure but also the structure,<br />

documentation and covenant<br />

packages attached to transactions.This<br />

is especially true for more creditworthy<br />

borrowers in the market and<br />

particularly the continental markets.<br />

Veolia and RWE, for example, tapped<br />

the French and German markets<br />

respectively with few or weakened<br />

financial covenants. Although some<br />

bankers argue that such lending is<br />

evidence instead of unusually strong<br />

banking relationships.<br />

There is also a wider trend in the<br />

European market to leverage deal<br />

structure against credit quality. In the<br />

more conservative United Kingdom<br />

market this has manifested itself in<br />

efforts to fix financial covenants<br />

against a single criterion – rather than<br />

the traditional two or three – for some<br />

investment-grade borrowers. But<br />

pricing, covenants and structure are all<br />

ultimately factors within the<br />

relationship between the borrowing<br />

company and the lending banks. As<br />

such, lending decisions will remain a<br />

response to the credit strength of the<br />

1999<br />

1st half<br />

1999<br />

2nd half<br />

2000<br />

1st half<br />

2000<br />

2nd half<br />

2001<br />

1st half<br />

2001<br />

2nd half<br />

company and its need for wider<br />

banking support.<br />

The combined effect of both this<br />

structural compression and the<br />

pressure on margins is a narrowing in<br />

pricing differentiation between<br />

stronger and weaker credits. This is<br />

partly why banks are putting<br />

resources into widening their<br />

marketing franchises to focus more<br />

closely on mid-cap and regionallybased<br />

companies. Another area that is<br />

benefiting substantially from the<br />

depressed major M&A market is, of<br />

course, the private equity-led<br />

acquisition finance business. The level<br />

of LBO/MBO loan transactions was<br />

up by 78% across Europe last year –<br />

again, encouraged by fierce<br />

competition between banks taking<br />

place against a relatively stable<br />

economic background.<br />

In the longer run, this combination<br />

may mean the market will contract to<br />

the extent that only the strongest<br />

international banks can compete in the<br />

investment-grade lending market. By<br />

Figure 1: Transaction volumes in European syndicated lending 1999-2004<br />

Volume ($bn)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Source: Dealogic<br />

2002<br />

1st half<br />

2002<br />

2nd half<br />

2003<br />

1st half<br />

2003<br />

2nd half<br />

2004<br />

1st half<br />

2004<br />

2nd half<br />

Volume $bn No. of transactions<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS<br />

0<br />

Number of transactions

the same token, smaller regional banks<br />

are being forced to refocus on their<br />

home or preferred markets. It is clear<br />

that banks without a certain critical<br />

mass in their balance sheet are finding<br />

it harder to compete with those that<br />

have built a strong franchise,<br />

underpinned by the support structures<br />

and products to sustain volumes.<br />

Indeed, a consolidation is now<br />

underway that has resulted in most<br />

UK investment-grade market liquidity<br />

being provided by the top 12 banks.<br />

And in the western European market<br />

as a whole, a similar proportion is<br />

provided by a mere 20 top tier banks.<br />

But even as this polarisation takes<br />

<strong>FTSE</strong> GLOBAL MARKETS • MAY/JUNE 2005<br />

Figure 2: Refinancings dominate European syndicated lending<br />

Source: Dealogic<br />

France Germany UK<br />

place, a question mark still hovers<br />

above pricing. How long will lenders<br />

continue to fund at what are<br />

increasingly tight rates? With pricing<br />

approaching its cyclical low point –<br />

and given that such a high percentage<br />

Refinancing M&A LBO/MBO Other<br />

We set the standard. Now we’re raising the bar.<br />

of borrowers have completed or are<br />

completing recent refinancings – one<br />

has to wonder where the market is<br />

headed. While uncertainty lingers<br />

over a possible resurgence in big ticket<br />

M&A, the market could remain<br />

Welcome to a new era in alternative investment administration. DPM Mellon is dedicated to providing new<br />

and better ways to help make your job easier. Whether you are a hedge fund manager, trader, fund of<br />

funds, institutional investor, or proprietary trader, DPM Mellon creates tailored solutions to the complex<br />

challenges of valuation, risk assessment and transparency. We gather, reconcile and value trade data on<br />

any financial instrument, in any currency, in any electronic format, and provide you with a customized<br />

report on trade date. We pride ourselves on being one of the most flexible administrators in the industry.<br />

Two Worlds Fair Drive Somerset, NJ 08873<br />

732.563.0030 Fax: 732.563.1193 www.dpmmellon.com<br />

15

SYNDICATED LOANS<br />

16<br />

In the Markets<br />

vulnerable to pricing shocks. And, as<br />

pricing begins to bottom out,<br />

relationship histories are becoming an<br />

increasingly vital consideration for<br />

banks. They are also becoming more<br />

important for companies as they<br />

consider where they might raise funds<br />

to participate in a potential M&A<br />

surge. As such, companies are likely to<br />

benefit by selecting their core liquidity<br />

providers with care.<br />

Exactly what will happen for the<br />

rest of 2005 is difficult to predict.<br />

Generally speaking, UK corporate<br />

balance-sheets are in good shape – so<br />

the big questions remain whether<br />

cash rich large-cap companies will<br />

indeed approach an amenable loan<br />

market for more aggressive M&Arelated<br />

purposes and where the bulk<br />

of that demand will rest – in<br />

continental Europe or, as in the past,<br />

firmly in the UK.<br />

It is also clear, however, that loan<br />

market pricing has not yet reached the<br />

low levels that the market suffered<br />

during 1995 and 1996 – or even<br />

RECORD LENDING IN 2004<br />

throughout the years of 1987 and<br />

1988. And while banks continue to<br />

voice their concerns over returns and<br />

relationship profitability, there is<br />

substantial liquidity embedded within<br />

the system and no real signs of a<br />

change in current market trends.<br />

History tells us that these trends do at<br />

some point reverse, but what will be<br />

the trigger? Ultimately the market is<br />

being driven by a seemingly robust<br />

global economy. This is augmented by<br />

the steady release of strong corporate<br />

sector results, continued bank<br />

liquidity and a stable geopolitical<br />

outlook. For this situation to change<br />

dramatically will, I believe, require a<br />

major shift in at least one or more of<br />

these factors. And in the absence of<br />

these shifts, current market dynamics<br />

make this an excellent time for<br />

borrowers to raise debt finance.<br />

European syndicated loan volume by country 1999 to 2004<br />

Volume ($bn)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Source: Dealogic<br />

1999<br />

1st half<br />

1999<br />

2nd half<br />

Had anyone said in January last year that a new record in syndicated lending would be set by the end of 2004<br />

they would have received short shrift. Back then bank liquidity far exceeded demand and margins continued to<br />

narrow even as deal volume and numbers remained largely flat. By mid summer however, that changed. The French<br />

and German markets led the pack, with demand driven by industrial and utility refinancing and they even seemed<br />

ready challenge the UK’s historical dominance. In France, for example, 39 of the CAC 40 companies refinanced,<br />

while in the UK only 38 of the <strong>FTSE</strong> 100 refinanced or restructured. The £2bn Land Securities transaction – itself for<br />

a restructuring and notable for its innovative securitisation structure – was a high-profile exception to this.<br />

In a late rally however, a substantial number of UK borrowers finally began to come to market, taking advantage of<br />

competitive conditions. Another area that provided a rich appetite for new loans – both in the UK and on the<br />

continent – was sponsor-driven leveraged buyouts. The largest of the leveraged transactions in the market was to<br />

support the acquisition of the AA by CVC Capital Partners and Permira Europe. These trends also exposed a greater<br />

degree of investor appetite than many previously assumed. Equally, it highlighted the fact that market conditions had<br />

expanded further than expected to accommodate the demand. In the UK for instance, expansion came via a<br />

substantial increase in mid-market, rather than big-ticket corporate borrowing. The average transaction size in the UK<br />

was $550m, compared to the average combined deal size in France and Germany of $950m. Larger transaction<br />

sizes on the continent reflected deeper demand for new money and ultimately pushed up overall volumes. European<br />

lending volumes rose to $887.7bn–up 44% on 2003, while volume was up in France by a whopping 139%, in<br />

Germany by 39%, and in the UK by 42%.<br />

2000<br />

1st half<br />

2000<br />

2nd half<br />

2001<br />

1st half<br />

United Kingdom<br />

2001<br />

2nd half<br />

2002<br />

1st half<br />

2002<br />

2nd half<br />

2003<br />

1st half<br />

2003<br />

2nd half<br />

2004<br />

1st half<br />

2004<br />

2nd half<br />

France Germany Italy Netherlands Spain Others<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

Lifetime support<br />

Demand is expected to rise for immediate annuities, which convert<br />

lump sums into income streams guaranteed for life – though sales<br />

to date remain meagre. Neil A. O'Hara investigates a product that<br />

may finally be about to realise its potential in the US market.<br />

TRADITIONAL PENSION<br />

INCOME annuities may soon be<br />

an endangered species. Recent<br />

US Department of Labor figures, show<br />

the number of private sector employees<br />

covered by defined benefit plans<br />

dropped from 30.1m in 1980 to 22.6m in<br />

1999, while defined contribution plan<br />

coverage rose from 14.4m to 46.9m over<br />

the same period. In addition, many<br />

defined benefit plan participants now<br />

can and do, choose a lump sum<br />

distribution at retirement. “There is an<br />

increasing need for guaranteed lifetime<br />

income because of fewer defined benefit<br />

pension plans, the uncertainty of social<br />

security, earlier retirements and longer<br />

life spans,” says Jac Herschler, vice<br />

president of Prudential Annuities, a unit<br />

of Prudential Financial, Inc., “To date,<br />

the solutions have not been the<br />

annuitisation of those assets.”<br />

Shared risk lies at the heart of any<br />

annuity pool. An insurance company<br />

will make higher payments to<br />

survivors because life expectancy for<br />

the group is more predictable than for<br />

individual participants. Yet research<br />

conducted by Prudential shows that<br />

Americans prefer to retain control over<br />

their retirement savings.“It’s a visceral<br />

negative reaction to sharing risk when<br />

it comes to payout,” says Herschler,<br />

“People have an aversion to the idea<br />

that those who die early make lifetime<br />

payments to the ones who live<br />

longer.”In contrast, consumers readily<br />

accept shared risk when they buy life<br />

insurance, which has opposite cash<br />

flows: the long-lived fund lump sum<br />

<strong>FTSE</strong> GLOBAL MARKETS • MAY/JUNE 2005<br />

payments to those who die young.<br />

Unlike immediate annuities,<br />

deferred annuities, which are primarily<br />

used for tax-sheltered accumulation,<br />

do not participate in a risk pool unless<br />

the holders elect to do so when<br />

withdrawals start. Until then, the assets<br />

remain under the holders' control.<br />

Some insurers now permit deferred<br />

variable annuity holders to make<br />

regular withdrawals without joining a<br />

pool. Those contracts retain the<br />

liquidity of a deferred annuity while<br />

generating income similar to an<br />

immediate annuity – but there is a<br />

catch. “It falls short of the immediate<br />

annuity because once you are out of<br />

money, you are out of money,” says<br />

John Meyer, a senior vice president in<br />

charge of the individual annuity<br />

department at New York Life Insurance<br />

Company, “That is the beauty of<br />

immediate annuities. Once you make<br />

the bet, you are guaranteed to get that<br />

payment for the rest of your life.”<br />

Herschler does not believe<br />

consumers are ready to embrace<br />

annuitisation yet. “The breakthrough<br />

for the industry in addressing longevity<br />

risk is going to come from an<br />

accumulation vehicle from which you<br />

can take withdrawals,” he says.<br />

Prudential now offers an optional<br />

guarantee on its deferred variable<br />

annuities that will continue minimum<br />

payments for life even if poor<br />

investment performance and<br />

withdrawals deplete the account and<br />

the holder never chose to annuitise.<br />

The company charges a fee for the<br />

insurance, but upon death the account<br />

balance – if any – passes to a<br />

designated beneficiary or the holder's<br />

estate. If Prudential’s guarantee catches<br />

on, it will attract more money to<br />

deferred variable annuities. These<br />

flexible vehicles allow investors to<br />

select among asset classes in subaccounts<br />

that operate like mutual<br />

funds. Without a guarantee, payouts<br />

under a variable annuity reflect the<br />

investment performance of the chosen<br />

sub-accounts, which are typically<br />

managed by mutual fund advisers.<br />

Immediate annuities with terms<br />

similar to Prudential's guaranteed<br />

contract offer higher income in<br />

exchange for ceding control of the<br />

assets. That should be a powerful<br />

selling point, but annuity providers<br />

have failed to get the message across to<br />

consumers. Financial advisers, through<br />

whom annuities are sold, resist the<br />

idea. Advisers who charge a percentage<br />

of assets face a drop in revenue if clients<br />

buy immediate annuities; some refer to<br />

it as “annuicide”, according to Michael<br />

Henkel, president of Ibbotson<br />

Associates, a research and consulting<br />

firm that focuses on asset management.<br />

Annuity providers who spy an<br />

opportunity in the guaranteed income<br />

market are trying to storm the<br />

barricades. In August 2003, New York<br />

Life introduced its latest immediate<br />

annuity, which gives consumers more<br />

flexibility and allows advisers to<br />

choose a lower commission rate that<br />

lasts 10 years instead of a one-time<br />

payment. The product attracted<br />

$292m in 2004, about 5% of New York<br />

Life’s total annuity sales compared<br />

with 2% to 3% for most providers.“We<br />

see that growing pretty rapidly over<br />

the next 5 to10 years,”says Meyer.<br />

A recent NASD rule change could<br />

jump start immediate annuity sales: for<br />

the first time, broker-dealers may use<br />

statistical simulations as well as straight<br />

line projections in sales materials.<br />

17

INDUSTRIAL CLASSIFICATION BENCHMARKS<br />

18<br />

In the Markets<br />

ICB builds up<br />

market share<br />

It is often stated that the benchmark used to describe an asset<br />

class or investment opportunity is one of the most basic<br />

assumptions in the creation of an investment programme, from<br />

asset allocation decisions to performance evaluation. Inevitably<br />

then, competition to provide the investment market’s preferred<br />

industry classification system is heating up.<br />

IN EARLY MARCH, Thomson<br />

Financial (TF), an operating unit of<br />

the Thomson Corporation<br />

announced it would adopt the recently<br />

launched Industry Classification<br />

Benchmark (ICB) as its standard<br />

classification tool across a range of its<br />

global data products and services.<br />

Thomson Financial is the first global<br />

data provider to adopt the new<br />

classification system from <strong>FTSE</strong> Group<br />

and Dow Jones Indexes. Launched<br />

jointly in January 2005 by Dow Jones<br />

Indexes and <strong>FTSE</strong> Group, ICB is<br />

beginning to establish itself as a<br />

seminal classification system,<br />

classifying some 40,000 companies<br />

and 45,000 securities around the<br />

world. “It represents a truly global<br />

solution to our clients’ classification<br />

needs,”said Sarah Dunn, chief content<br />

officer at Thomson Financial in March.<br />

The desire to provide a<br />

comprehensive industry classification<br />

system has been underway for<br />

decades, since the US government<br />

established industry classification<br />

systems to organise industries into<br />

more definable categories back in the<br />

1930s. In the US the Census Bureau<br />

traditionally used the Standard<br />

Industrial Classification (SIC) system.<br />

That changed when Congress passed<br />

the North American Free Trade<br />

Agreement (NAFTA), and the US,<br />

Canada and Mexico jointly developed<br />

a newer system called the North<br />

American Industry Classification<br />

System (NAICS). Regardless of the<br />

system type, industry classifications<br />

can be an effective method for<br />

extracting industry information and<br />

generating prospect lists. Today index<br />

providers have joined the search for<br />

optimal industry classification by<br />

providing accurate and transparent<br />

sector definitions.<br />

<strong>FTSE</strong> Group originally developed its<br />

Global Classification System in the<br />

spring of 1999 and was quickly taken<br />

up by stock exchanges in Athens,<br />

Cyprus, Egypt, Johannesburg, London<br />

and Madrid, as well as Goldman<br />

Sachs, Hang Seng, HSBC, ING<br />

Barings, Nicholas Applegate Capital<br />

Management, Reuters and US-based<br />

investment consultants Frank Russell.<br />

This original classification allocated<br />

companies to an industrial sub sector<br />

that most closely defines the nature of<br />

its business. In its first iteration, this<br />

was determined by the proportion of<br />

overall profit arising from each<br />

business area within a company. The<br />

system comprised 10 economic<br />

groups, 39 industrial sectors and 102<br />

industry sub-sectors.<br />

Over time the investment industry<br />

has witnessed a growing requirement<br />

for an internationally accepted<br />

industry classification system. One<br />

that allocates a clear economic activity<br />

description to one and only one class.<br />

It is necessary to achieve this, so that<br />

economic activity can be accurately<br />

measured, without fear of duplication.<br />

Without such a classification and a<br />

complementary integrated statistical<br />

infrastructure some economic activity<br />

could be double-counted or not<br />

counted at all. It is also useful for interindustry<br />

comparisons of key economic<br />

performance measures. More<br />

pertinently for the investment<br />

industry, classifications aim to enhance<br />

the investment research and asset<br />

management process for financial<br />

professionals worldwide. In response,<br />

leading index providers have worked<br />

hard to develop an optimal industrial<br />

classification system.<br />

In an effort to provide a superior<br />

classification system, <strong>FTSE</strong> Group<br />

and Dow Jones Indexes announced<br />

that they would merge their industry<br />

classification systems in February last<br />

year and created ICB. The system was<br />

fully operational by January 2005.<br />

Major index providers including the<br />

Hang Seng (HSI) in Hong Kong, the<br />

Russell 3000 Index family in the US<br />

and the <strong>FTSE</strong> Xinhua (FXI) in China,<br />

have already adopted the industry<br />

classification system, and STOXX Ltd<br />

uses ICB for its indices across Europe.<br />

The Financial Times, The Wall Street<br />

Journal, CNBC, SmartMoney Magazine<br />

and Dow Jones Newswires also use<br />

the classification system, while<br />

exchanges such as NASDAQ, the<br />

MAY/JUNE 2005 • <strong>FTSE</strong> GLOBAL MARKETS

James Cemprola,<br />

managing director, ICB<br />

New York Stock Exchange (NYSE),<br />

Euronext, the Swiss Exchange and<br />

the Johannesburg Stock Exchange<br />

are expected to take up the<br />

classification imminently.<br />

Not everyone uses the same system<br />

and competition is rising between ICB<br />

and the Global Industry Classification<br />

System (GICS). GICS was developed<br />

by Morgan Stanley Capital<br />

International (MSCI) and Standard &<br />

Poor’s (S&P). The GICS structure<br />

consists of 10 sectors, 24 industry<br />

groups, 64 industries and 139 subindustries<br />

and which are reviewed<br />

annually. Most notably perhaps,<br />

NOREX, the strategic alliance of eight<br />

Northern European securities<br />

exchanges, implemented GICS as the<br />

official standard for the classification of<br />

listed securities a couple of years ago.<br />

Transparent and Rules-Driven<br />

ICB represents a Global Industry<br />

Classification solution for the<br />

investment community, says James<br />

Cemprola, Managing Director, ICB,<br />

“our role is to bring a market leading<br />

product to bear, that accurately and<br />

comprehensively classifies companies<br />

and securities.”The main benefit is the<br />

sheer reach of the system, which<br />

<strong>FTSE</strong> GLOBAL MARKETS • MAY/JUNE 2005<br />

incorporates 40,000 companies and<br />

45,000 securities (equity based),<br />

explains Cemprola. It allows speed in<br />

delivery. He adds,“if you are planning<br />

an IPO for example, we can deliver the<br />

appropriate classification within 48<br />

hours.” The applicability is also<br />

appreciated by the custodians, “who<br />

require a strong standardised product,<br />

and which allows consistent reporting<br />

within industrial sectors.”<br />

The merger of <strong>FTSE</strong> Group’s and<br />

Dow Jones’s systems resulted in a<br />

“dramatic increase in coverage,”<br />

continues Cemprola. It is a<br />

development firmly in line with<br />

market requirements, he says as “for<br />

global investment services providers,<br />

such as Goldman Sachs, State Street<br />

and Northern Trust, for example, you<br />

need to provide an extensive and<br />

global system that more than matches<br />

their operational scale, while for<br />

exchanges such as the London Stock<br />

Exchange, or the Athens Stock<br />

Exchange, there is the benefit that<br />

everyone is utilising the same system.”<br />

Thomson Financial deciding to use<br />

ICB was an important strategic step for<br />

the classification system, explains<br />

Cemprola. “ICB will be utilised across<br />

a broad range of TF products including<br />

Thomson One, Datastream,<br />

Worldscope and First Call, and TF<br />

clients also have the opportunity to<br />

sign up for the full ICB universe<br />

product on a pass through basis.”<br />

What makes ICB interesting, says<br />

Cemprola is that it contains four<br />

classification levels, which includes<br />

10 separate industries to help<br />

investors monitor broad industry<br />

trends, 18 special Supersectors that<br />

can be used for trading, 39 sectors<br />

and 104 sub sectors which “if you<br />

utilise a bottom up investment<br />

strategy, you can screen using the<br />

granular sub sector classification,”he<br />

adds. Companies within sectors are<br />

assigned on a primary revenue basis,<br />

rather than the old methodology<br />

which determined a company’s<br />

classification by the proportion of<br />

overall profit arising from each<br />

business area within a company.<br />

“ICB is an important development for<br />

both Dow Jones Indexes and <strong>FTSE</strong><br />

Group and the marketplace. Many of<br />

our clients are adopting and organising<br />

around the new system, and ICB<br />

represents a comprehensive and global<br />

industry classification solution for use<br />

throughout the investment community,”<br />

adds Cemprola.<br />

19

NORTH AMERICA<br />

20<br />

Regional Review<br />

AN SEC PROPOSAL to<br />

enforce a 16.00 hour<br />

deadline for mutual<br />

fund orders has drawn flak<br />

from the industry because, in<br />

practice, it would impose a<br />

much earlier deadline for<br />

investors in 401(k) plans.<br />

“Many investors use<br />

intermediaries to receive the<br />

orders,” says SEC<br />

Commissioner Roel C.<br />

Campos, “I think it is safe to<br />

say we will have a hard close<br />

4pm rule. It is a matter of to<br />

whom does the order run?”He<br />

appears to favour a clearing<br />

house that collects all orders<br />

over an audit trail to verify that<br />

investors entered orders before<br />

the market close.<br />

Next day pricing of mutual<br />

funds would be a cheaper and<br />

more effective alternative,<br />

according to Richard Herring,<br />

Jacob Safra Professor of<br />

International Banking at<br />

Wharton Business School. “It<br />

makes market timing harder,<br />

day trading becomes hopeless,<br />

and it is easier to avoid late<br />

trading as well,”he said. Funds<br />

that welcome market timers,<br />

such as some Rydex funds<br />

(which are index and sector<br />

funds that are designed to<br />

match a specific benchmark with no<br />

trading costs) could opt out as long as<br />

they disclosed their policies and<br />

applied them to all investors alike.<br />

Ken Griffin, founder and CEO of<br />

Citadel Investment Group, believes<br />

state-of-the-art technology can<br />

eliminate market timing. “The ability<br />

to create same day straight through<br />

processing of mutual fund trades is a<br />

matter of will,” he says, “It is a much<br />

simpler solution, which does not<br />

require people to understand that they<br />

bought at tomorrow's price. That is<br />

very confusing to retail investors.” He<br />

JUSTICE<br />

DELAYED<br />

Eighteen months after the market timing<br />

scandal broke, the Securities and Exchange<br />

Commission (SEC) is still debating how best<br />

to curb the practice. Neil A. O'Hara reports.<br />

expressed strong support for a hard<br />

4pm close. The SEC softened another<br />

deterrent to market timing when it<br />

backed away from mandatory 2%<br />

redemption fees on short-term mutual<br />

fund trades; the final rule leaves<br />

redemption fees to the fund board's<br />

discretion. “We were concerned<br />

mandatory redemption fees might<br />

make retail investors feel this was<br />

somehow a more costly way to invest,”<br />

said Commissioner Campos at a recent<br />

Harvard Business School seminar, who<br />

felt the change reflected the agency’s<br />

rulemaking flexibility.<br />

That cuts no ice with<br />

Brandon Becker, a partner at<br />

Wilmer Cutler Pickering Hale<br />

& Dorr, who argues that SEC<br />

enforcement actions affect the<br />

outcome. “If you do your<br />

rulemaking after you have<br />

already sewn up the leading<br />

firms with settlement orders<br />

you have chilled that<br />

conversation going forward,”<br />

he said. Firms that have<br />

already committed to new<br />

procedures in settlements<br />

have no reason to oppose a<br />

rule extending those<br />

procedures to other players<br />

who might otherwise gain a<br />

competitive edge.<br />

Market timing arbitrage<br />

opportunities would vanish if<br />

mutual fund prices reflected<br />

fair value, the “ultimate<br />

solution” according to<br />

Commissioner Campos,<br />

although he acknowledges it<br />

has practical limitations.<br />

“That is an art,” he says, “We<br />

have asked the industry to<br />

price at fair value where<br />

appropriate.” Portfolios with<br />

large positions in Asian and<br />

European securities are<br />

particularly vulnerable to<br />

stale prices from different<br />

time zones, Griffin notes.<br />

“Those funds should look at<br />

appropriate countermeasures for<br />

short term traders,” he adds, “US<br />

equity portfolios are not an efficient<br />

vehicle for market timing.”<br />

“Fair value pricing is a scary place<br />

to go,” says Herring, “It is very<br />

subjective.” Only half in jest, he<br />

suggests the SEC should have<br />