State of the Art in Outsourcing

State of the Art in Outsourcing

State of the Art in Outsourcing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CROs<br />

<strong>State</strong> <strong>of</strong> <strong>the</strong> <strong>Art</strong> <strong>in</strong> Outsourc<strong>in</strong>g<br />

• Despite M&A disruption, long-term outsourc<strong>in</strong>g trends should rema<strong>in</strong> healthy.<br />

Faced with significant patent cliffs (>$110bn worth <strong>of</strong> drugs <strong>of</strong>f patent by 2015),<br />

<strong>in</strong>effective R&D, ris<strong>in</strong>g cl<strong>in</strong>ical trial costs, and more str<strong>in</strong>gent FDA requirements,<br />

biopharmaceutical companies have <strong>in</strong>creas<strong>in</strong>gly turned to M&A (PFE/WYE,<br />

MRK/SGP, Roche/DNA, etc.), pipel<strong>in</strong>e rationalization, and outsourced research to<br />

control costs and improve operat<strong>in</strong>g performance. With new management at <strong>the</strong><br />

helm <strong>of</strong> all major pharmaceutical companies, cost cutt<strong>in</strong>g (<strong>in</strong>cl. R&D) is expected to<br />

accelerate with <strong>the</strong> close <strong>of</strong> M&A deals over <strong>the</strong> next several quarters, although we<br />

expect <strong>the</strong> focus on outsourc<strong>in</strong>g to also <strong>in</strong>crease as companies look to embrace a<br />

more variable cost structure and rebuild anemic pipel<strong>in</strong>es.<br />

• From niche providers to strategic partners. Orig<strong>in</strong>ally positioned as niche service<br />

providers <strong>in</strong> <strong>the</strong> 1970s, contract research organizations (CROs) have expanded<br />

greatly <strong>in</strong> number and scope, although today <strong>the</strong> $22bn market for outsourced<br />

research is still under-penetrated (~29% <strong>of</strong> drug development spend<strong>in</strong>g outsourced),<br />

highly fragmented, and <strong>in</strong> our view ripe for share ga<strong>in</strong>s for more nimble and<br />

strategic providers. With expectations for low double-digit <strong>in</strong>dustry growth longer<br />

term, we believe that larger and more strategic precl<strong>in</strong>ical and cl<strong>in</strong>ical companies,<br />

such as CVD, CRL, ICLR, and PPDI, will be positioned to capture grow<strong>in</strong>g share,<br />

driven by economies <strong>of</strong> scale, more diversified revenue streams, and <strong>the</strong> f<strong>in</strong>ancial<br />

flexibility for M&A and asset transfer (i.e. CVD/LLY) at <strong>the</strong> expense <strong>of</strong> smaller<br />

CROs.<br />

• M&A, overcapacity, and pric<strong>in</strong>g rema<strong>in</strong> near-term but manageable, challenges.<br />

While companies such as PFE have openly discussed plans for additional R&D cuts<br />

(PFE is cutt<strong>in</strong>g at least $1.2bn <strong>in</strong> R&D as part <strong>of</strong> <strong>the</strong> WYE <strong>in</strong>tegration, most likely<br />

more), <strong>the</strong> upshot is that many companies are also embrac<strong>in</strong>g a more variable cost<br />

structure, <strong>in</strong>cl. evaluat<strong>in</strong>g a broader range <strong>of</strong> strategic outsourc<strong>in</strong>g opportunities.<br />

Look<strong>in</strong>g at <strong>the</strong> announced transactions, WYE, MRK, and SGP do little outsourc<strong>in</strong>g<br />

(MRK contracts out ~5% <strong>of</strong> R&D and began contract<strong>in</strong>g out phase III work a year<br />

ago), and as a result consolidation is likely to prove a tipp<strong>in</strong>g po<strong>in</strong>t, with a<br />

disproportionate number <strong>of</strong> projects flow<strong>in</strong>g to preferred vendors (<strong>the</strong> preferred part<br />

be<strong>in</strong>g key, as smaller CROs are <strong>of</strong>ten deemed unqualified). MRK and LLY have also<br />

shifted <strong>the</strong> bus<strong>in</strong>ess model from FIPCO (fully <strong>in</strong>tegrated pharmaceutical company)<br />

to FIPNET (fully <strong>in</strong>tegrated pharmaceutical network), which places a greater<br />

emphasis on external collaborations.<br />

• We <strong>in</strong>itiate coverage <strong>of</strong> Covance (CVD, $48.65) and ICON (ICLR, $22.50), both<br />

with an Overweight rat<strong>in</strong>g. We believe that best-<strong>in</strong>-breed CROs will emerge <strong>in</strong> a<br />

position <strong>of</strong> strength follow<strong>in</strong>g <strong>the</strong> close <strong>of</strong> major M&A transactions and accord<strong>in</strong>gly<br />

that <strong>the</strong> best approach is to own both CVD and ICLR, while <strong>in</strong> <strong>the</strong> near term we<br />

rema<strong>in</strong> cautious on earlier stage CROs <strong>in</strong> our universe (CRL, WX) given limited<br />

visibility on a return to early stage fund<strong>in</strong>g.<br />

North America Equity Research<br />

16 July 2009<br />

Medical & Life Science<br />

Technology<br />

Tycho W. Peterson AC<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

Sung Ji Nam<br />

(1-212) 622-4958<br />

sung.j.nam@jpmchase.com<br />

Abigail Darby<br />

(1-212) 622-6628<br />

abigail.w.darby@jpmorgan.com<br />

J.P. Morgan Securities Inc.<br />

See page 47 for analyst certification and important disclosures.<br />

J.P. Morgan does and seeks to do bus<strong>in</strong>ess with companies covered <strong>in</strong> its research reports. As a result, <strong>in</strong>vestors should be aware that <strong>the</strong> firm may<br />

have a conflict <strong>of</strong> <strong>in</strong>terest that could affect <strong>the</strong> objectivity <strong>of</strong> this report. Investors should consider this report as only a s<strong>in</strong>gle factor <strong>in</strong> mak<strong>in</strong>g <strong>the</strong>ir<br />

<strong>in</strong>vestment decision. Customers <strong>of</strong> J.P. Morgan <strong>in</strong> <strong>the</strong> United <strong>State</strong>s can receive <strong>in</strong>dependent, third-party research on <strong>the</strong> company or companies<br />

covered <strong>in</strong> this report, at no cost to <strong>the</strong>m, where such research is available. Customers can access this <strong>in</strong>dependent research at<br />

www.morganmarkets.com or can call 1-800-477-0406 toll free to request a copy <strong>of</strong> this research.

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

2<br />

North America Equity Research<br />

16 July 2009<br />

Table <strong>of</strong> Contents<br />

Key Investment Po<strong>in</strong>ts .............................................................3<br />

CRO Industry Overview ...........................................................4<br />

Understand<strong>in</strong>g Drug Development .........................................9<br />

Precl<strong>in</strong>ical ....................................................................................................................9<br />

Cl<strong>in</strong>ical.......................................................................................................................10<br />

Near-term CRO <strong>in</strong>dustry challenges..........................................................................18<br />

O<strong>the</strong>r trends to watch.................................................................................................28<br />

Competitive Landscape .........................................................34<br />

Precl<strong>in</strong>ical ..................................................................................................................35<br />

Cl<strong>in</strong>ical.......................................................................................................................37<br />

The author acknowledges <strong>the</strong> contribution <strong>of</strong> Navneet Chahal <strong>of</strong> J.P. Morgan<br />

Services India Private Ltd., Mumbai, to this report.

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

Key Investment Po<strong>in</strong>ts<br />

Underly<strong>in</strong>g CRO trends should rema<strong>in</strong> healthy longer term<br />

Despite <strong>the</strong> challenges <strong>of</strong> pharmaceutical restructur<strong>in</strong>g, M&A (Pfizer/Wyeth,<br />

Merck/Scher<strong>in</strong>g, etc.), and a difficult f<strong>in</strong>anc<strong>in</strong>g environment for biotech companies,<br />

<strong>the</strong> $22 billion market for precl<strong>in</strong>ical and cl<strong>in</strong>ical research organizations, or CROs,<br />

rema<strong>in</strong>s under-penetrated, fragmented, and ripe for share ga<strong>in</strong>s for more nimble and<br />

strategically positioned providers. Reimbursement pressure and pend<strong>in</strong>g patent cliffs<br />

(over $110 billion worth <strong>of</strong> drugs go<strong>in</strong>g <strong>of</strong>f patent by 2015) have fur<strong>the</strong>r exacerbated<br />

<strong>the</strong> challenge for drug developers, as have <strong>the</strong> ris<strong>in</strong>g costs <strong>of</strong> cl<strong>in</strong>ical trials, although<br />

with new management at <strong>the</strong> helm <strong>of</strong> all major pharmaceutical companies, we expect<br />

<strong>the</strong> shift toward outsourc<strong>in</strong>g will cont<strong>in</strong>ue. As such, despite <strong>the</strong> near-term disruption<br />

<strong>of</strong> R&D cuts, we rema<strong>in</strong> favorably biased on <strong>the</strong> underly<strong>in</strong>g trends and, longer-term,<br />

toward early stage providers, which should ultimately benefit as capacity utilization<br />

beg<strong>in</strong>s to normalize and <strong>the</strong> pendulum sw<strong>in</strong>gs back to basic research, although this<br />

may take at least a year, if not more.<br />

Flight to quality expected to cont<strong>in</strong>ue<br />

Despite near-term headw<strong>in</strong>ds, we believe that <strong>the</strong> CRO <strong>in</strong>dustry rema<strong>in</strong>s positioned<br />

for at least 7-8% growth (and potentially low double0digit growth) over <strong>the</strong> next<br />

several years, with better positioned companies such as Covance, Charles River,<br />

ICON, and PPDI able to capture market share. Key to our <strong>the</strong>sis is <strong>the</strong> view that<br />

larger precl<strong>in</strong>ical and cl<strong>in</strong>ical CROs will cont<strong>in</strong>ue to benefit from economies <strong>of</strong> scale,<br />

diversified revenue streams, strong reputations, and <strong>the</strong> f<strong>in</strong>ancial flexibility for M&A<br />

and asset transfer (e.g., Covance/Eli Lilly). As customers move toward more variable<br />

cost structures, we also expect <strong>the</strong> natural wean<strong>in</strong>g process to accelerate, putt<strong>in</strong>g<br />

additional pressure on smaller service providers (MPI, WIL, Pharmanet, PRAI, etc.).<br />

M&A, overcapacity, and pric<strong>in</strong>g rema<strong>in</strong> near-term, but manageable, challenges<br />

While companies such as Pfizer have openly discussed plans for additional R&D cuts<br />

(Pfizer is cutt<strong>in</strong>g at least $1.2 billion <strong>in</strong> R&D as part <strong>of</strong> <strong>the</strong> Wyeth <strong>in</strong>tegration, most<br />

likely more), <strong>the</strong> upshot is that many companies are also embrac<strong>in</strong>g a more variable<br />

cost structure, <strong>in</strong>clud<strong>in</strong>g evaluat<strong>in</strong>g a broader range <strong>of</strong> strategic outsourc<strong>in</strong>g<br />

opportunities. Look<strong>in</strong>g at <strong>the</strong> announced transactions, Wyeth, Merck and Scher<strong>in</strong>g do<br />

little outsourc<strong>in</strong>g (Merck contracts out ~5% <strong>of</strong> R&D and only began contract<strong>in</strong>g out<br />

phase III work a year ago), and as a result consolidation is likely to prove a tipp<strong>in</strong>g<br />

po<strong>in</strong>t, with a disproportionate number <strong>of</strong> projects flow<strong>in</strong>g to preferred vendors (<strong>the</strong><br />

preferred part be<strong>in</strong>g key, as smaller CROs are <strong>of</strong>ten deemed unqualified). Merck and<br />

Eli Lilly have also shifted <strong>the</strong> bus<strong>in</strong>ess model from FIPCO (fully <strong>in</strong>tegrated<br />

pharmaceutical company) to FIPNET (fully <strong>in</strong>tegrated pharmaceutical network),<br />

which places a greater emphasis on external collaborations.<br />

We <strong>in</strong>itiate coverage <strong>of</strong> Covance (CVD, $48.65) and ICON (ICLR, $22.50), both<br />

with an Overweight rat<strong>in</strong>g<br />

We believe that best-<strong>in</strong>-breed CROs will emerge <strong>in</strong> a position <strong>of</strong> strength follow<strong>in</strong>g<br />

<strong>the</strong> close <strong>of</strong> major M&A transactions and accord<strong>in</strong>gly that <strong>the</strong> best approach is to<br />

own both Covance and ICON, while <strong>in</strong> <strong>the</strong> near term we rema<strong>in</strong> cautious on earlier<br />

stage CROs <strong>in</strong> our universe (Charles River, WuXi) given limited visibility on a<br />

return to early stage fund<strong>in</strong>g.<br />

3

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

4<br />

North America Equity Research<br />

16 July 2009<br />

CRO Industry Overview<br />

Contract research organizations (CROs) provide an <strong>in</strong>creas<strong>in</strong>gly broad range <strong>of</strong><br />

research and development services for pharmaceutical, biotech, medical, and<br />

academic customers, <strong>in</strong>clud<strong>in</strong>g product development and formulation, cl<strong>in</strong>ical trial<br />

management, central laboratory services, and data management for regulatory fil<strong>in</strong>gs<br />

(IND, NDA, etc.).<br />

Drug sponsors typically contract CROs to assist <strong>in</strong> tak<strong>in</strong>g products from early stage<br />

development through trials (precl<strong>in</strong>ical through phase IV), FDA approval, and <strong>in</strong><br />

some cases post market surveillance, with <strong>the</strong> primary value drivers be<strong>in</strong>g a shift<br />

from fixed to variable costs and added expertise across select <strong>the</strong>rapeutic areas.<br />

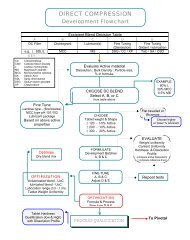

Figure 1: CRO Market Summary<br />

Total R&D<br />

Spend:<br />

~$110 Billion<br />

Research<br />

~$36B<br />

Development<br />

~$74B<br />

Source: Covance. 2008 data.<br />

Development<br />

Spend:<br />

~$74 Billion<br />

Internal<br />

~$53B<br />

Outsourced<br />

~$21.5B<br />

CRO<br />

Industry:<br />

~$21.5 Billion<br />

“O<strong>the</strong>r”<br />

Late-Stage<br />

Development<br />

~$12.4B<br />

Early<br />

Development<br />

~$6.1B<br />

CROs saw <strong>the</strong> first significant growth wave <strong>in</strong> <strong>the</strong> 1980s as pharmaceutical<br />

companies moved to outsource overflow projects, although demand and capacity<br />

utilization (and accord<strong>in</strong>gly, marg<strong>in</strong>s) rema<strong>in</strong>ed volatile.<br />

In 1994 Qu<strong>in</strong>tiles became <strong>the</strong> first public CRO, followed by Parexel and PPD (1996)<br />

and Covance (1997).<br />

Industry demand rema<strong>in</strong>ed strong for several years until pharmaceutical M&A led to<br />

a wave <strong>of</strong> cancelled and delayed projects beg<strong>in</strong>n<strong>in</strong>g <strong>in</strong> 2000. With excess capacity, a<br />

number <strong>of</strong> companies were forced to bid for projects at unpr<strong>of</strong>itable levels, and with<br />

multi-year contracts <strong>of</strong>ten <strong>in</strong> place, <strong>the</strong> fallout dampened earn<strong>in</strong>gs, lowered marg<strong>in</strong>s,<br />

and caused multiple contractions well <strong>in</strong>to 2003.<br />

However, <strong>the</strong> proliferation <strong>of</strong> specialty pharmaceutical and biotechnology companies<br />

<strong>in</strong> early 2000s led to a second growth wave for CROs as smaller companies, which<br />

<strong>of</strong>ten lacked <strong>the</strong> full capabilities needed for drug development, began outsourc<strong>in</strong>g an

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

<strong>in</strong>creas<strong>in</strong>gly broad range <strong>of</strong> precl<strong>in</strong>ical and cl<strong>in</strong>ical projects. At <strong>the</strong> same time,<br />

pharmaceutical companies began to embrace outsourc<strong>in</strong>g more strategically, as a<br />

means to conta<strong>in</strong> costs and address an <strong>in</strong>creas<strong>in</strong>gly global landscape.<br />

Figure 2: Number <strong>of</strong> Drugs <strong>in</strong> Development WW by Biopharmaceutical Companies<br />

No. <strong>of</strong> Drugs<br />

12000<br />

10000<br />

8000<br />

6000<br />

4000<br />

2000<br />

0<br />

Source: Pharmaprojects.<br />

5930 6046 5889<br />

No. <strong>of</strong> Drugs <strong>in</strong> Development<br />

6198 6416<br />

6994<br />

7360 7322 7406<br />

7737<br />

9217<br />

9605<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Year<br />

No. <strong>of</strong> Drugs<br />

Today, it is estimated that pharmaceutical and biotechnology companies spend over<br />

$110 billion on research and development ($36 billion on research, $74 billion on<br />

development), <strong>of</strong> which an estimated $22 billion is outsourced, <strong>in</strong>clud<strong>in</strong>g $6.1 billion<br />

<strong>in</strong>to early stage and $12.4 billion <strong>in</strong>to late stage development. Given <strong>the</strong> strong<br />

growth for outsourced services, we expect <strong>the</strong> market could grow to over $35 billion<br />

<strong>in</strong> <strong>the</strong> next 3-4 years.<br />

5

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

6<br />

North America Equity Research<br />

16 July 2009<br />

Figure 3: Total Number <strong>of</strong> Innovative Drugs Approved (1996-2008)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

3<br />

53<br />

6<br />

39<br />

7<br />

30<br />

3<br />

35<br />

2<br />

27<br />

5<br />

24<br />

7<br />

17<br />

6<br />

21<br />

5<br />

31<br />

2<br />

4<br />

18 18<br />

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008<br />

Source: Nature Reviews Drug Discovery, February 2009.<br />

Figure 4: Late Stage Pipel<strong>in</strong>e Rema<strong>in</strong>s Light<br />

NMEs BLAs<br />

Source: Pharmaprojects. P = Precl<strong>in</strong>ical; C1 = Cl<strong>in</strong>ical Phase I, C2 = Cl<strong>in</strong>ical Phase II; C3 = Cl<strong>in</strong>ical Phase III; PR = Pre-Registration;<br />

R = Registered; L = Launched; S = Suspended.<br />

At <strong>the</strong> heart <strong>of</strong> <strong>the</strong> CRO <strong>in</strong>dustry is a cont<strong>in</strong>ued focus by biopharmaceutical<br />

companies to improve marg<strong>in</strong>s and pr<strong>of</strong>itability. While <strong>the</strong>re are some advantages <strong>in</strong><br />

time, given that an average drug development campaign lasts 6-8 years, <strong>the</strong> key<br />

advantage stems from shift<strong>in</strong>g personnel and facilities from fixed to variable costs<br />

and add<strong>in</strong>g services that may not be available <strong>in</strong> house. Cost sav<strong>in</strong>gs can be<br />

significant as revenues for an FTE (full time employee) on CRO payroll can average<br />

$183,200 (for Covance, <strong>in</strong> this case), while with<strong>in</strong> large pharmaceutical companies<br />

<strong>the</strong> cost/employee can be closer to $400,000. The <strong>in</strong>creas<strong>in</strong>g complexity <strong>of</strong> cl<strong>in</strong>ical<br />

trials, a grow<strong>in</strong>g focus on <strong>in</strong>ternational markets, and greater demand for services<br />

2<br />

16<br />

3<br />

21

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

around safety and post market surveillance have also heightened <strong>the</strong> appetite for<br />

outsourced research and development.<br />

In areas such as toxicology, surpris<strong>in</strong>gly little bus<strong>in</strong>ess is outsourced today, with<br />

approximately 70% <strong>of</strong> studies still done with<strong>in</strong> large pharmaceutical facilities.<br />

However, as pharmaceutical and biotech companies consolidate and <strong>in</strong>creas<strong>in</strong>gly<br />

focus on core skills (discovery, strategic development, market<strong>in</strong>g), <strong>the</strong> emphasis on<br />

outsourced research should <strong>in</strong>crease, and we expect that outsourc<strong>in</strong>g levels could<br />

ultimately reach 50-60%, driven by top-l<strong>in</strong>e pressures (i.e., patent expirations,<br />

emergence <strong>of</strong> biosimilars), M&A cost synergies, and a l<strong>in</strong>ger<strong>in</strong>g commitment to<br />

mature, albeit commoditized research methods, such as comb<strong>in</strong>atorial chemistry. As<br />

shown below, <strong>the</strong> cost <strong>of</strong> drug development has also cont<strong>in</strong>ued to escalate, driven by<br />

more complex trials and surveillance needs, and it is estimated that only two out <strong>of</strong><br />

every ten marketed drugs ultimately return revenues that match or exceed <strong>the</strong> R&D<br />

costs. Generics have also taken a grow<strong>in</strong>g share <strong>of</strong> <strong>the</strong> market, account<strong>in</strong>g for 72% <strong>of</strong><br />

sales today from 54% <strong>in</strong> 2003 (source: PhRMA).<br />

Table 1: Drug Development Costs Have Escalated<br />

Cost to develop a drug<br />

2006 $1.318 billion<br />

2001 $802 million<br />

1987 $318 million<br />

1975 $138 million<br />

Cost to develop a biologic<br />

2006 $1.2 billion<br />

Source: PhRMA<br />

The emergence <strong>of</strong> new technologies, such as computer-simulated model<strong>in</strong>g and<br />

targeted market<strong>in</strong>g, which may be easier to buy (i.e., outsource) than build, is also<br />

likely to drive cont<strong>in</strong>ued adoption <strong>of</strong> outsourced services, while <strong>in</strong>creas<strong>in</strong>g regulatory<br />

requirements, <strong>in</strong> particular around post market<strong>in</strong>g surveillance; <strong>the</strong> <strong>in</strong>creased<br />

globalization <strong>of</strong> cl<strong>in</strong>ical trials to regions where large pharma has not historically<br />

conducted research; and <strong>the</strong> emergence <strong>of</strong> “new” <strong>the</strong>rapeutic areas outside <strong>of</strong><br />

historical research are all likely to drive demand for more record keep<strong>in</strong>g and<br />

improved data management go<strong>in</strong>g forward.<br />

Table 2: Cost <strong>of</strong> R&D<br />

Year PhRMA Members Total Industry<br />

2008 $50.3 billion $65.2 billion<br />

2007 $47.9 billion $63.2 billion<br />

2006 $43.4 billion $56.1 billion<br />

2005 $39.9 billion $51.8 billion<br />

2004 $37.0 billion $47.6 billion<br />

2000 $26.0 billion not available<br />

1990 $8.4 billion not available<br />

1980<br />

Source: PhRMA<br />

$2.0 billion not available<br />

F<strong>in</strong>ally, with <strong>the</strong> dramatic reduction <strong>in</strong> genetic analysis costs and grow<strong>in</strong>g effort by<br />

payers to control costs, pharmacogenomics (i.e., personalized medic<strong>in</strong>e) is expected<br />

to play an <strong>in</strong>creas<strong>in</strong>g role, although it rema<strong>in</strong>s early and we do not expect DNA<br />

sequenc<strong>in</strong>g to be <strong>in</strong>corporated <strong>in</strong>to cl<strong>in</strong>ical trials for at least ano<strong>the</strong>r decade. In <strong>the</strong><br />

<strong>in</strong>terim, as shown below, an <strong>in</strong>creas<strong>in</strong>g number <strong>of</strong> approved drugs have genetic tests<br />

associated with use, three <strong>of</strong> which are now mandated.<br />

7

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

8<br />

North America Equity Research<br />

16 July 2009<br />

Table 3: Some <strong>of</strong> <strong>the</strong> Drugs with Companion Diagnostics on <strong>the</strong> Label<br />

Biomarker Drug O<strong>the</strong>r Drugs Associated with Biomarker<br />

C-KIT expression Imat<strong>in</strong>ibmesylate<br />

CYP2C19 Variants Voriconazole Omeprazole, Pantoprazole, Esomeprazole<br />

diazepam, Nelf<strong>in</strong>avir, Rabeprazole<br />

CYP2C9 Variants Warfar<strong>in</strong><br />

CYP2D6 Variants Atomoxet<strong>in</strong>e Venlafax<strong>in</strong>e, Risperidone, Tiotropium<br />

CYP2D6 with alternate<br />

Context<br />

Source: www.FDA.gov<br />

bromide, Tamoxifen, Timolol, Maleate<br />

Fluoxet<strong>in</strong>e HCL Fluoxet<strong>in</strong>e HCL, Olanzap<strong>in</strong>e, Cevimel<strong>in</strong>e<br />

hydrochloride, Tolterod<strong>in</strong>e, Tolterod<strong>in</strong>e,<br />

Terb<strong>in</strong>af<strong>in</strong>e, Tramadol + Acetamophen,<br />

Clozap<strong>in</strong>e, Aripiprazole, Metoprolol,<br />

Propranolol, Carvedilol, Propafenone,<br />

Thioridaz<strong>in</strong>e, Protriptyl<strong>in</strong>e HCl

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

Understand<strong>in</strong>g Drug Development<br />

Drug development rema<strong>in</strong>s a highly risky, time consum<strong>in</strong>g, and expensive affair for<br />

biopharmaceutical companies. Average costs <strong>in</strong>curred <strong>in</strong> <strong>the</strong> development <strong>of</strong> a drug<br />

run close to $1.3 billion (or $1.2 billion for biologics), and it is estimated that only 1<br />

<strong>in</strong> 5,000 candidate compounds ultimately make it to market.<br />

Figure 5: The Pharma R&D Process<br />

Pre-discovery<br />

Drug<br />

Discovery<br />

5,000-10,000<br />

Compounds<br />

Cl<strong>in</strong>ical Trials<br />

Precl<strong>in</strong>ical Phase 1 Phase 2 Phase 3<br />

250 5<br />

Number <strong>of</strong> Volunteers:<br />

20-100 100-500 1,000-5,000<br />

FDA<br />

Review<br />

3-6 years 6-7 years ½-2 years<br />

IND<br />

submitted<br />

Source: PhRMA's Pharmaceutical Industry Pr<strong>of</strong>ile 2009<br />

Figure 6: Understand<strong>in</strong>g <strong>the</strong> New Drug Development Paradigm<br />

Source: Ba<strong>in</strong> & Company<br />

NDA<br />

submitted<br />

Large-<br />

Scale Mfg<br />

One FDA-<br />

Approved Drug<br />

Precl<strong>in</strong>ical<br />

Precl<strong>in</strong>ical studies <strong>in</strong>volve <strong>in</strong> vitro (test tube) and <strong>in</strong> vivo (animal) test<strong>in</strong>g to decide<br />

whe<strong>the</strong>r a study drug is reasonably safe to be adm<strong>in</strong>istered to research subjects (i.e.,<br />

“first <strong>in</strong> human” studies) and can be advanced as an <strong>in</strong>vestigational new drug (IND).<br />

Only after an IND application is approved can a drug enter phase I cl<strong>in</strong>ical trials,<br />

although notably 80% <strong>of</strong> candidate drugs fail dur<strong>in</strong>g <strong>the</strong> precl<strong>in</strong>ical development<br />

stage. Toge<strong>the</strong>r with Phase I studies, early activities account for approximately 25%<br />

9<br />

Phase 4: Post-market<strong>in</strong>g surveillance<br />

surveillance<br />

surveillance

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

10<br />

North America Equity Research<br />

16 July 2009<br />

<strong>of</strong> CRO revenues and generally require high fixed costs and, depend<strong>in</strong>g on <strong>the</strong> area,<br />

can be highly pr<strong>of</strong>itable. Major services <strong>in</strong>clude:<br />

• Toxicology: Services <strong>in</strong>clude <strong>the</strong> determ<strong>in</strong>ation <strong>of</strong> safe start<strong>in</strong>g doses, effects on<br />

target organs, reversibility and exposure levels. Studies, 70% <strong>of</strong> which are still<br />

done <strong>in</strong> house with<strong>in</strong> large pharmaceutical companies (much greater levels <strong>of</strong><br />

outsourc<strong>in</strong>g at biotech), are typically done on animals and cells to determ<strong>in</strong>e <strong>the</strong><br />

toxicity <strong>of</strong> a drug and metabolites, with results <strong>the</strong>n extrapolated to human<br />

research subjects (FDA requires that new drug candidates be tested on two<br />

species <strong>of</strong> animals for safety assessment before a drug can move to human<br />

models). Studies can <strong>in</strong>volve <strong>the</strong> determ<strong>in</strong>ation <strong>of</strong> acute, subacute, and chronic<br />

toxicity, carc<strong>in</strong>ogenicity, mutagenicity, and teratogenicity as well as <strong>the</strong> effects <strong>of</strong><br />

a drug on <strong>the</strong> reproductive system. Early toxicology work is <strong>of</strong>ten done <strong>in</strong> vitro<br />

on cultured bacteria or cells, while subsequent <strong>in</strong> vivo studies, which test a drug<br />

on animals (rodents, dogs, primates), are more commonly outsourced to CROs.<br />

Toxicology typically requires an <strong>in</strong>vestment <strong>in</strong> dedicated laboratory space, and a<br />

number <strong>of</strong> CROs have built facilities that match or exceed <strong>in</strong>-house capabilities<br />

<strong>of</strong> major pharmaceutical companies.<br />

• Chemistry: In chemistry studies, factors such as stability, solubility, metabolic<br />

stability, absorption, bioavailability, and compound half life are evaluated. Ease<br />

<strong>of</strong> manufactur<strong>in</strong>g and formulation are also determ<strong>in</strong>ed and evaluated before <strong>the</strong><br />

cl<strong>in</strong>ical trial stage. O<strong>the</strong>r services may <strong>in</strong>clude develop<strong>in</strong>g a pharmacological<br />

pr<strong>of</strong>ile and evaluat<strong>in</strong>g drug absorption, distribution, metabolism and excretion<br />

(ADME), which are essential to <strong>the</strong> successful launch <strong>of</strong> <strong>the</strong> drug. Chemistry labs<br />

can also serve o<strong>the</strong>r <strong>in</strong>dustries (agricultural, nutritional) by study<strong>in</strong>g <strong>the</strong> potential<br />

risk <strong>of</strong> a compound to humans, analyz<strong>in</strong>g nutritional content, etc.<br />

• O<strong>the</strong>r (research products, laboratory services, etc.): CRO laboratories also<br />

leverage <strong>in</strong>frastructure and know-how to provide clients with a number <strong>of</strong><br />

specialized products and services. Examples <strong>in</strong>clude polyclonal and monoclonal<br />

antibody services, validated assays, or purpose bred animals. The creation <strong>of</strong> such<br />

products, which are used <strong>in</strong> early stage test<strong>in</strong>g, are typically standardized enough<br />

to be outsourced.<br />

Cl<strong>in</strong>ical<br />

• Phase I: Phase I studies <strong>in</strong>volve test<strong>in</strong>g an experimental drug or treatment for <strong>the</strong><br />

first time on a small group (20-80 people) <strong>of</strong> generally healthy <strong>in</strong>dividuals, over<br />

<strong>the</strong> course <strong>of</strong> six to twelve months to evaluate safety (pharmacovigilance), dosage<br />

and side effects. Because Phase I studies are <strong>in</strong>patient trials, <strong>the</strong>y require<br />

significant fixed costs, <strong>in</strong>clud<strong>in</strong>g overnight facilities for patients and full-time<br />

medical staff (Phase I and IIa trials are <strong>of</strong>ten referred to by <strong>the</strong> broader term <strong>of</strong><br />

“cl<strong>in</strong>ical pharmacology”). A study <strong>of</strong> drug pharmacok<strong>in</strong>etics (what does <strong>the</strong> body<br />

do to <strong>the</strong> drug) and pharmacodynamics (what does <strong>the</strong> drug do to <strong>the</strong> body) is<br />

also done at this stage, as are label<strong>in</strong>g studies (drug/drug <strong>in</strong>teraction; food/drug<br />

<strong>in</strong>teraction; etc.)<br />

Phase II and III<br />

Phase II and III studies are <strong>the</strong> bread and butter <strong>of</strong> <strong>the</strong> CRO <strong>in</strong>dustry, represent<strong>in</strong>g<br />

over 25% <strong>of</strong> overall <strong>in</strong>dustry revenues. Less capital <strong>in</strong>tensive than Phase I, Phase II<br />

studies <strong>of</strong>fer large and lucrative contracts that typically run 2-4 years <strong>in</strong> length.

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

• Phase II: In Phase II studies, a drug/treatment is tested on a group <strong>of</strong> 100-300<br />

people to study effectiveness and fur<strong>the</strong>r evaluate safety. Phase II studies can be<br />

divided <strong>in</strong>to Phase IIA (dosage requirements) and Phase IIB (efficacy), and<br />

protocol design is critical as each new study requires unique endpo<strong>in</strong>ts,<br />

<strong>in</strong>clusion/exclusion criteria, and drug adm<strong>in</strong>istration processes. Designers must<br />

also decide what data to collect, layout <strong>of</strong> <strong>the</strong> case report form (CRF), and what<br />

statistical analysis will be used to draw conclusions.<br />

• Phase III: Phase III trials <strong>in</strong>volve test<strong>in</strong>g on larger groups (1,000-3,000 people)<br />

to confirm effectiveness and side effects, weigh aga<strong>in</strong>st commonly used<br />

treatments, and compile safety <strong>in</strong>formation. Follow<strong>in</strong>g successful completion <strong>of</strong><br />

Phase III trials, an NDA/BLA is filed with FDA.<br />

• Phase IV/Post Approval: Phase IV trials <strong>in</strong>volve post market<strong>in</strong>g studies,<br />

<strong>in</strong>clud<strong>in</strong>g safety surveillance (pharmacovigilance) to detect rare or long-term<br />

adverse effects. In <strong>the</strong> event that harmful effects are discovered, drug sales may<br />

be halted or restricted to certa<strong>in</strong> uses.<br />

Figure 7: Biopharma R&D Spend by Stage<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

27.3%<br />

Discovery/<br />

Precli ni cal<br />

7.4%<br />

Source: PhRMA, 2009 Annual Membership Survey<br />

13.0%<br />

28.5%<br />

5.0%<br />

13.4%<br />

5.2%<br />

Phase I Phase II Phase III Approval Phase IV Uncategorized<br />

Industry R&D spend<strong>in</strong>g has rema<strong>in</strong>ed stable, despite macroeconomic backdrop<br />

In 2008 U.S.-based pharmaceutical and biotech companies <strong>in</strong>vested approximately<br />

$65 billion <strong>in</strong> research and development as compared to $63 billion <strong>in</strong> 2007<br />

accord<strong>in</strong>g to PhRMA (Pharma Pr<strong>of</strong>ile 2009 Report).<br />

Today, <strong>the</strong>re are 2,900 compounds <strong>in</strong> <strong>the</strong> U.S. biopharmaceutical pipel<strong>in</strong>e await<strong>in</strong>g<br />

FDA review.<br />

11

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

12<br />

North America Equity Research<br />

16 July 2009<br />

Figure 8: Recent BioPharma R&D Spend<strong>in</strong>g Trend Has Been Steady<br />

$70.0<br />

$63.2<br />

$60.0<br />

$50.0<br />

$40.0<br />

$30.0<br />

$20.0<br />

$10.0<br />

$0.0<br />

$47.6<br />

$51.8<br />

$56.1<br />

$65.2<br />

2004 2005 2006 2007 2008<br />

Source: PhRMA, Pharmaceutical Industry Pr<strong>of</strong>ile 2009<br />

Table 4: Top R&D Spenders <strong>in</strong> 2008<br />

Company 2008 budget ($ <strong>in</strong> billions)<br />

Roche $8.18<br />

Pfizer $7.95<br />

Johnson & Johnson $7.58<br />

Novartis $7.21<br />

GlaxoSmithKl<strong>in</strong>e $6.83<br />

San<strong>of</strong>i-Aventis $6.74<br />

AstraZeneca $5.18<br />

Merck & Co. $4.81<br />

Takeda $4.58<br />

Eli Lilly $3.84<br />

Bristol-Myers Squibb $3.59<br />

Scher<strong>in</strong>g-Plough $3.53<br />

Wyeth $3.37<br />

Boehr<strong>in</strong>ger Ingelheim $3.11<br />

Amgen $3.03<br />

Genentech $2.80<br />

Abbott $2.69<br />

Bayer $2.57<br />

Daiichi Sankyo $1.89<br />

Astellas Pharma $1.62<br />

Source: PharmaLive.com

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

Table 5: Top 20 Biopharma (by R&D Spend <strong>in</strong> 2008) Drugs Await<strong>in</strong>g Approval<br />

Company (2008<br />

R&D <strong>in</strong> US$bn)<br />

Product Disease/Medical Use Region Type <strong>of</strong> Drug<br />

Pegasys Hepatitis B Europe Biotechnology Drug Delivery<br />

Xeloda Colorectal cancer Europe Chemical<br />

Roche<br />

MabThera Chronic lymphocytic leukemia Europe Biotechnology<br />

($8.18bn)<br />

Avast<strong>in</strong><br />

Renal cell carc<strong>in</strong>oma, Colorectal cancer,<br />

Breast Cancer<br />

Europe Biotechnology<br />

Tarceva Non-small cell lung cancer Europe Chemical<br />

Lyrica Fibromyalgia Europe Chemical<br />

Pfizer ($7.95bn)<br />

Fablyn<br />

Oporia<br />

Osteoporosis<br />

Vag<strong>in</strong>al atrophy<br />

United <strong>State</strong>s<br />

United <strong>State</strong>s<br />

Chemical<br />

Chemical<br />

Eraxis Candidemia Europe Biotechnology<br />

J&J ($7.58bn)<br />

Paliperidone Palmitate IM Long Act<strong>in</strong>g Injectable<br />

Comfyde Partial onset seizure<br />

United <strong>State</strong>s<br />

United <strong>State</strong>s<br />

Chemical<br />

Chemical<br />

Certican Organ transplant rejection United <strong>State</strong>s, Japan Biotechnology<br />

Reclast Corticosteroid-<strong>in</strong>duced osteoporosis United <strong>State</strong>s Chemical<br />

QAB149 Chronic obstructive pulmonary disease United <strong>State</strong>s Chemical Drug Delivery<br />

Xolair Allergic Asthma United <strong>State</strong>s Biotechnology<br />

Comtan Park<strong>in</strong>son disease Japan Chemical<br />

Galvus Type 2 diabetes United <strong>State</strong>s Chemical<br />

Stalevo Park<strong>in</strong>son disease United <strong>State</strong>s Chemical<br />

Novartis<br />

($7.21bn)<br />

Extavia<br />

Tekturna fixed dose comb<strong>in</strong>ation with Valsartan<br />

Exforge HCT<br />

Multiple Sclerosis<br />

Hypertension<br />

Hypertension<br />

United <strong>State</strong>s<br />

United <strong>State</strong>s<br />

Europe<br />

Biotechnology<br />

Chemical<br />

Chemical<br />

Xolair Allergic Asthma Europe Biotechnology<br />

Aclasta Cl<strong>in</strong>ical fracture prevention Europe Chemical<br />

Exelon Patch<br />

Dementia associated with park<strong>in</strong>son<br />

disease<br />

Europe Chemical Drug Delivery<br />

Eucreas Diabetes Mellitus Europe Chemical<br />

QAB149 Chronic obstructive pulmonary disease Europe Chemical Drug Delivery<br />

Ilaris Cryopyr<strong>in</strong>-associated periodic syndromes Europe Biotechnology<br />

Arixtra Acute coronary syndrome United <strong>State</strong>s Chemical<br />

Cervarix Human papillomavirus <strong>in</strong>fection United <strong>State</strong>s Biotechnology Biological<br />

Tykerb Metastatic breast cancer United <strong>State</strong>s Chemical<br />

Requib extended release Restless legs syndrome United <strong>State</strong>s Chemical Drug Delivery<br />

GlaxoSmithKl<strong>in</strong>e<br />

($6.83bn)<br />

Votrient<br />

Rezonic<br />

Solzira<br />

Renal cell cancer<br />

Postoperative nausea and vomit<strong>in</strong>g<br />

Restless legs syndrome<br />

United <strong>State</strong>s<br />

United <strong>State</strong>s<br />

United <strong>State</strong>s<br />

Chemical<br />

Chemical<br />

Chemical Drug Delivery<br />

Tyverb Metastatic breast cancer Europe Chemical<br />

Synflorix Streptococcus pneumonia Europe Biological<br />

Avandia<br />

Acute coronary syndrome, Type 2<br />

diabetes progression prevention<br />

Europe Chemical<br />

Multaq Atrial fibrillation Europe, United <strong>State</strong>s Chemical<br />

Ketek Sk<strong>in</strong> and s<strong>of</strong>t tissue <strong>in</strong>fections Japan Chemical<br />

Taxotere Prostate cancer Japan Chemical<br />

San<strong>of</strong>i-Aventis<br />

($6.74bn)<br />

Allegra<br />

Apidra<br />

Allegra ODT<br />

Allergies<br />

Diabetes Mellitus<br />

Allergic rh<strong>in</strong>itis<br />

Europe<br />

Japan, Europe<br />

Japan<br />

Chemical<br />

Biological Biotechnology<br />

Chemical Drug Delivery<br />

Ciltyri Chronic Insomnia Europe, United <strong>State</strong>s Chemical<br />

Lantus Ret<strong>in</strong>opathy United <strong>State</strong>s Biotechnology<br />

Sculptra Nasolabial fold wr<strong>in</strong>kles United <strong>State</strong>s Chemical<br />

Symbicort pMDI<br />

Asthma, Chronic obstructive pulmonary<br />

disease<br />

Europe, United <strong>State</strong>s Chemical<br />

Seroquel<br />

Bipolar disorder ma<strong>in</strong>ta<strong>in</strong>ance, bipolar<br />

depression<br />

Europe Chemical<br />

Seroquel Schizophrenia, acute manic episodes United <strong>State</strong>s Chemical<br />

AstraZeneca Nexium Peptic ulcer bleed<strong>in</strong>g Europe Chemical<br />

($5.18bn)<br />

Nexium<br />

Peptic ulcer bleed<strong>in</strong>g, Duodenal ulcers,<br />

Gastric ulcers<br />

United <strong>State</strong>s Chemical<br />

Iressa Non-small cell lung cancer Europe Biotechnology<br />

Seroquel XR<br />

Generalized anxiety disorder, major<br />

depressive disorder, bipolar depression<br />

Europe, United <strong>State</strong>s Chemical Drug Delivery<br />

Onglyza/Metform<strong>in</strong> Comb<strong>in</strong>ation Type 2 diabetes Europe Chemical<br />

Merck & Co.<br />

Arcoxia Rheumatoid arthiritis, Pa<strong>in</strong> United <strong>State</strong>s Chemical<br />

13

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

($4.81bn)<br />

Takeda ($4.58)<br />

Eli Lilly &<br />

Co.($3.84bn)<br />

Bristol-Myers<br />

Squibb<br />

($3.59bn)<br />

Scher<strong>in</strong>g-Plough<br />

($3.53bn)<br />

Wyeth ($3.37bn)<br />

Boehr<strong>in</strong>ger<br />

Ingelheim<br />

($3.11bn)<br />

14<br />

Gardasil<br />

North America Equity Research<br />

16 July 2009<br />

Cervical Cancer, Cervical <strong>in</strong>traepi<strong>the</strong>lial<br />

neoplasia, Vulvar <strong>in</strong>traepi<strong>the</strong>lial<br />

neoplasia, Vag<strong>in</strong>al <strong>in</strong>traepi<strong>the</strong>lial<br />

neoplasia, Genital warts, Vag<strong>in</strong>al Cancer,<br />

Vulvar Cancer<br />

United <strong>State</strong>s Biotechnology<br />

Gardasil Vag<strong>in</strong>al cancer Europe Biotechnology<br />

Isentress HIV Infection United <strong>State</strong>s Chemical<br />

Basen Impaired glucose tolerance Japan Chemical<br />

Actos Diabetes Japan Chemical<br />

Takepron Gastric Ulcers Japan Chemical<br />

Aloglipt<strong>in</strong> Type 2 diabetes Europe, United <strong>State</strong>s Chemical<br />

Aloglipt<strong>in</strong> Diabetes Mellitus Japan Chemical<br />

Ramelteon Insomnia Japan, Europe Chemical<br />

Enantone 6-Months Depot Prostate cancer Europe Chemical<br />

Vectibix Colorectal cancer Japan Biotechnology<br />

Blopress fixed-dose comb<strong>in</strong>ation with Amlodip<strong>in</strong>e<br />

Hypertension Japan Chemical<br />

besylate<br />

Alimta Non-small cell lung cancer Europe, United <strong>State</strong>s Chemical<br />

Cialis Pulmonary arterial hypertension Europe, Canada Chemical<br />

Cymbalta Chronic pa<strong>in</strong> United <strong>State</strong>s Chemical<br />

Forteo Osteoporosis United <strong>State</strong>s Biotechnology<br />

Arxxant Diabetic ret<strong>in</strong>opathy United <strong>State</strong>s Chemical<br />

Zyprexa Schizophrenia United <strong>State</strong>s Chemical<br />

Prasugrel A<strong>the</strong>rosclerosis United <strong>State</strong>s Chemical<br />

Humalog ILPS Diabetes United <strong>State</strong>s Biotechnology<br />

Exenatide Type 2 diabetes United <strong>State</strong>s Chemical<br />

Onglyza Type 2 diabetes United <strong>State</strong>s, Europe Chemical<br />

Iscover A<strong>the</strong>rothrombotic events Europe Chemical<br />

Ixempra Kit Breast cancer Europe Biotechnology<br />

Ixabepilone Breast cancer Europe, Japan Biotechnology<br />

Peglntron Malignant melanoma United <strong>State</strong>s<br />

Biotechnology Drug Delivery<br />

Biological<br />

Asmanex Asthma Japan Chemical Drug Delivery<br />

Noxafil Fungan Infections United <strong>State</strong>s Chemical<br />

Golimumab<br />

Psoriatic <strong>Art</strong>hiritis, Ankylos<strong>in</strong>g spondylitis,<br />

Europe Biotechnology<br />

Rheumatoid arthiritis<br />

Saphris Acute mania, Schizophrenia United <strong>State</strong>s Chemical<br />

Sugammadex Neuromuscular blocker United <strong>State</strong>s Chemical<br />

Remeron Depression Japan Chemical<br />

Fertavid Infertility Europe Biotechnology Biological<br />

Sycrest Schizophrenia, Bipolar I disorder Europe Chemical<br />

Viviant Postmenopausal osteoporosis United <strong>State</strong>s Chemical<br />

Prevnar 13 Pneumococcal disease United <strong>State</strong>s, Europe Biological<br />

Pristiq Vasomotor symptoms United <strong>State</strong>s Chemical<br />

Enbrel Psoriasis Europe Biotechnology<br />

Mylotarg Acute myeloid leukemia Europe Biotechnology<br />

Torisel Mantle cell lymphoma Europe Chemical<br />

Conbriza Osteoporosis Europe Chemical<br />

Xeristar Fibromyalgia Europe Chemical<br />

Aptivus Oral Solution HIV supression Europe Chemical<br />

Mimpara Hyperparathyroidism Europe Chemical<br />

Amgen<br />

($3.03bn)<br />

Denosumab<br />

Nplate<br />

Bone loss, Postmenopausal osteoporosis<br />

Blood disorder treatment<br />

United <strong>State</strong>s, Europe,<br />

Canada<br />

Canada<br />

Biotechnology<br />

Biotechnology Biological<br />

Enbrel Psoriasis United <strong>State</strong>s Biotechnology<br />

Genentech Avast<strong>in</strong> Breast cancer, Renal cell carc<strong>in</strong>oma United <strong>State</strong>s Biotechnology Biological<br />

($2.80bn) Tarceva Non-small cell lung cancer United <strong>State</strong>s Chemical<br />

Humira Juv<strong>in</strong>ile rheumatoid arthritis Europe Biotechnology<br />

Abbott<br />

Certriad Mixed dyslipidemia United <strong>State</strong>s Chemical<br />

($2.69bn)<br />

Flutiform Asthma United <strong>State</strong>s Chemical Drug Delivery<br />

Vicod<strong>in</strong> CR Pa<strong>in</strong> United <strong>State</strong>s Chemical Drug Delivery<br />

Bayer ($2.57bn) Visanne Endometriosis Europe Chemical<br />

Menostar Vasomotor symptoms Europe Chemical Drug Delivery<br />

Avelox Pelvic <strong>in</strong>flammatory disease Europe Chemical<br />

E2/LNG Menopausal symptoms Japan Chemical

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

Daiichi Sankyo<br />

($1.89bn)<br />

Astellas Pharma<br />

($1.62bn)<br />

North America Equity Research<br />

16 July 2009<br />

Magnevist MRA Magnetic resonance angiography Japan Chemical<br />

EOB Primovist Liver magnetic resonance imag<strong>in</strong>g Japan Chemical<br />

DUB-OC Prevention <strong>of</strong> pregnancy United <strong>State</strong>s Chemical<br />

Rivaroxaban Venous thromboembolism Canada Biotechnology<br />

Sevikar Hypertension Europe Chemical<br />

Feron Hepatitis C Japan Biotechnology<br />

CS-866AZ Hypertension Japan Chemical<br />

Lev<strong>of</strong>loxac<strong>in</strong> High-Dose Bacterial Infection Japan Chemical<br />

Telavanc<strong>in</strong><br />

Complicated sk<strong>in</strong> & sk<strong>in</strong> structure<br />

United <strong>State</strong>s Chemical<br />

<strong>in</strong>fection, Hospital acquired pneumonia<br />

YM617 Lower ur<strong>in</strong>ary tract syndrome Japan Chemical<br />

YM086 Type 2 diabetic nephropathy Japan Chemical<br />

Prograf Ulcerative colitis Japan Chemical<br />

Protopic Atopic dermatitis Europe Chemical Drug Delivery<br />

YM177 Low back pa<strong>in</strong>, shoulder periarthritis Japan Chemical<br />

Advagraf Organ transplant rejection Europe Chemical Drug Delivery<br />

Nategl<strong>in</strong>ide Type 2 diabetes Japan Chemical<br />

Modigraf Organ transplant rejection Europe Chemical<br />

Qutenza Post-herpetic neuralgia Europe Chemical Drug Delivery<br />

Source: PharmaLive.com<br />

Figure 9: Most Active Therapeutic Categories Await<strong>in</strong>g Approval<br />

# Investigational Drugs<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Source: PharmaLive.com<br />

78<br />

43<br />

Cancer Drugs Anti-Infectiv e<br />

Agents<br />

32 32 32<br />

Diabetes drugs GastroIntest<strong>in</strong>alPsy<br />

cho<strong>the</strong>rapeutic<br />

Drugs<br />

Agents<br />

Therapeutic categories<br />

Although drug sales have held, patent expirations loom<br />

Despite a firm market for drug sales, pharmaceutical companies cont<strong>in</strong>ue to grapple<br />

with sizable headw<strong>in</strong>ds that threaten both pric<strong>in</strong>g and pr<strong>of</strong>itability. Specific<br />

challenges <strong>in</strong>clude:<br />

• Competition from generic products, which can account for half <strong>of</strong> drug sales <strong>in</strong><br />

major markets<br />

• Patent expiration <strong>of</strong> major branded products, which need to be replaced by new<br />

revenue streams (see follow<strong>in</strong>g table)<br />

• Increas<strong>in</strong>gly complex cl<strong>in</strong>ical trials and regulatory approval processes, coupled<br />

with shorter exclusivity w<strong>in</strong>dows, that challenge pr<strong>of</strong>itability <strong>of</strong> new drugs<br />

15

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

16<br />

North America Equity Research<br />

16 July 2009<br />

• Hostility over end-user costs from government and managed care plans, a threat<br />

to pric<strong>in</strong>g power and pr<strong>of</strong>itability<br />

As shown below, patent expirations with<strong>in</strong> <strong>the</strong> biopharmaceutical <strong>in</strong>dustry are one <strong>of</strong><br />

<strong>the</strong> most significant challenges, with over $110 billion <strong>in</strong> drugs go<strong>in</strong>g <strong>of</strong>f patent by<br />

2015.

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

Table 6: Major Drugs Com<strong>in</strong>g Off Patent (2009-2015)<br />

Key Drugs<br />

Amgen<br />

2008 Revs<br />

($ <strong>in</strong> millions)<br />

Patent expiration<br />

Enbrel $3,598 2009<br />

Neulasta $3,318 2015<br />

Anaresp $3,137 EU: 2010<br />

Epogen $2,456 US: 2012, EU: Expired<br />

Neupogen $1,341 US: 2013, EU Expired<br />

Total<br />

Astra-Zeneca<br />

$13,850<br />

Seroquel $4,452 2012<br />

Symbicort $2,004 2013<br />

Arimidex $1,857 2010<br />

Atacand $1,471 2011<br />

Total<br />

Bristol Myers<br />

$9,784<br />

Plavix $5,603 2012<br />

Avapro $1,290 2012<br />

Sustiva $1,149 2013<br />

Total<br />

Eli Lilly<br />

$8,042<br />

Zyprexa/Zyprexa LAI $4,696 2011<br />

Evista $1,076 2012<br />

Gemzar $1,720 2013<br />

Cymbalta $2,697 2014<br />

Yentreve (Duloxet<strong>in</strong>e SUI) $25 2014<br />

Total<br />

Genentech<br />

$10,213<br />

Rituxan $2,587 5,677,180 <strong>in</strong> 2014; 5,736,137 <strong>in</strong> 2015; 2013 <strong>in</strong> EU<br />

Total<br />

Genzyme<br />

$2,587<br />

Cerezyme $1,239 Manufactur<strong>in</strong>g Patent – 2010; Composition <strong>of</strong> Matter Patent -2011<br />

Total<br />

Gilead<br />

$1,239<br />

Hepsera $341 2014 <strong>in</strong> US; 2011 <strong>in</strong> EU<br />

Total<br />

GlaxoSmithKl<strong>in</strong>e<br />

$341<br />

Valtrex $645 2009<br />

Lamictal $500 2009<br />

Avandia $435 2012<br />

Imigran / Imitrex $371 2011<br />

Boniva $128 2012<br />

Total<br />

Merck<br />

$2,078<br />

S<strong>in</strong>gulair $4,336 2012<br />

Cozaar/Hyzaar $3,557 2010<br />

Primax<strong>in</strong> $744 2009<br />

Maxalt $530 2012<br />

Crixivan $275 2012<br />

EMEND $264 2013<br />

Total<br />

Novartis<br />

$9,706<br />

Diovan $5,740 2012<br />

Zometa $1,342 2012<br />

Femara $1,129 2011<br />

Sandostat<strong>in</strong> $1,123 2013<br />

Total<br />

Pfizer<br />

$9,334<br />

Lipitor $12,401 2011<br />

Celebrex $2,489 2014<br />

Viagra $1,934 2012<br />

Xalatan/Xalcom $1,745 2011<br />

Detrol/LA $1,214 2012<br />

Geodon $1,007 2012<br />

17

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

18<br />

North America Equity Research<br />

16 July 2009<br />

Caduet (Norvasc+Lipitor) $589 2011<br />

Relpax $350 2013<br />

Total $21,729<br />

Roche<br />

Cellcept $2,266 2009<br />

Xeloda $1,307 2013<br />

Total $3,573<br />

San<strong>of</strong>i Aventis<br />

Plavix $4,176 2011<br />

Taxotere $1,382 2010<br />

Eloxat<strong>in</strong> $916 2010<br />

Ambien $563 2009<br />

Actonel $224 2013<br />

Total $7,261<br />

Scher<strong>in</strong>g-Plough<br />

Temodar $1,002 2014<br />

Clar<strong>in</strong>ex $789 2007 US; EU 2011<br />

Puregon/Follistim $576 2015 US; EU 2H 2009<br />

Avelox $376 2011<br />

Integril<strong>in</strong> $314 2015<br />

Caelyx $296 2010<br />

Implanon $151 2009<br />

Total $3,504<br />

Wyeth<br />

Zosyn/Tazoc<strong>in</strong> $1,264 2009<br />

Effexor XR $3,928 2010<br />

Protonix $806 2011<br />

Rapamune $376 2012<br />

Tygacil $216 2013<br />

Torisel (Temsirolimus) $118 2014<br />

Total $6,709<br />

Source: Phrma; Company reports.<br />

Assum<strong>in</strong>g that pharma R&D growth drops to 3-5%, which we feel is a logical floor<br />

given <strong>the</strong> need to replenish anemic pipel<strong>in</strong>es, outsourc<strong>in</strong>g – which had been grow<strong>in</strong>g<br />

100 bps a year – could still <strong>in</strong>crease 200 bps, br<strong>in</strong>g<strong>in</strong>g <strong>the</strong> total level <strong>of</strong> outsourced<br />

work to 39% by 2013. As such, <strong>the</strong> CRO <strong>in</strong>dustry should be positioned to grow at<br />

least 7-8% on <strong>the</strong> top l<strong>in</strong>e for <strong>the</strong> next several years, while Covance and a few select<br />

o<strong>the</strong>rs can likely cont<strong>in</strong>ue to capture share from smaller, more fragmented<br />

competitors.<br />

As a rem<strong>in</strong>der, approximately 29% <strong>of</strong> dollars spent <strong>in</strong> development today are<br />

outsourced, and this is expected to cont<strong>in</strong>ue grow<strong>in</strong>g, although we do not expect<br />

penetration to reach significantly more than 60-65%, given that biopharmaceutical<br />

companies still need <strong>in</strong>-house management to oversee CRO contracts, create study<br />

protocols, make strategic go/no-go decisions, etc.<br />

A better way to look at <strong>the</strong> market potential, <strong>in</strong> our view, is to look at <strong>the</strong> number <strong>of</strong><br />

projects outsourced. Today, 40-50% <strong>of</strong> precl<strong>in</strong>ical GLP projects are outsourced, and<br />

we expect this could reach closer to 80-90% longer-term. While some companies,<br />

such as Eli Lilly, now outsource 100% <strong>of</strong> GLP work (small/mid-cap biotech<br />

companies <strong>of</strong>ten outsource close to 95% <strong>in</strong> some cases), o<strong>the</strong>rs such as Merck and<br />

Wyeth outsource less than 5% <strong>of</strong> projects, someth<strong>in</strong>g that could <strong>in</strong>crease dramatically<br />

given that pend<strong>in</strong>g <strong>in</strong>tegrations are likely to force a broader strategic overhaul.<br />

Near-term CRO <strong>in</strong>dustry challenges<br />

Despite favorable longer term trends for <strong>the</strong> CRO <strong>in</strong>dustry, <strong>the</strong> group has faced<br />

challenges <strong>in</strong> recent years, someth<strong>in</strong>g reflected by stock performance over <strong>the</strong> past

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

year. As shown below, performance for a basket <strong>of</strong> CROs (CVD, ICON, PPDI,<br />

PRXL, KNDL, CRL) has tightened somewhat relative to <strong>the</strong> S&P, while for<br />

pharmaceutical companies (SGP, PFE, MRK, LLY, BMY, WYE) <strong>the</strong> correlation has<br />

historically been fairly tight.<br />

Figure 10: Relative Stock Performance: Average CRO vs. Pharma vs. S&P 500 (06/00-06/09)<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Jun-00<br />

Oct-00<br />

Feb-01<br />

Jun-01<br />

Oct-01<br />

Feb-02<br />

Jun-02<br />

Oct-02<br />

Feb-03<br />

CRO<br />

Jun-03<br />

Oct-03<br />

Feb-04<br />

Jun-04<br />

Oct-04<br />

Feb-05<br />

Jun-05<br />

Oct-05<br />

Feb-06<br />

Jun-06<br />

Oct-06<br />

CRO Pharma S&P 500<br />

Pharma<br />

S&P 500<br />

Feb-07<br />

Jun-07<br />

Oct-07<br />

Feb-08<br />

Jun-08<br />

Oct-08<br />

Feb-09<br />

Jun-09<br />

Source: FactSet. CRO Index <strong>in</strong>cludes CRL, CVD, ICLR, KNDL, PRXL, and PPDI. Pharma <strong>in</strong>dex <strong>in</strong>cludes BMY, LLY, MRK, PFE, SGP<br />

and WYE.<br />

Figure 11: Forward P/E: Average CRO vs. Pharma vs. S&P 500 (10/00-06/09)<br />

60.0x<br />

50.0x<br />

40.0x<br />

30.0x<br />

20.0x<br />

10.0x<br />

0.0x<br />

Oct-00<br />

Feb-01<br />

Jun-01<br />

Oct-01<br />

Feb-02<br />

Jun-02<br />

Oct-02<br />

Feb-03<br />

Jun-03<br />

Oct-03<br />

Feb-04<br />

Jun-04<br />

Oct-04<br />

Feb-05<br />

Jun-05<br />

Oct-05<br />

Feb-06<br />

Jun-06<br />

CRO Pharma S&P 500<br />

Oct-06<br />

Feb-07<br />

CRO<br />

Pharma S&P 500<br />

Source: FactSet. CRO Index <strong>in</strong>cludes CRL, CVD, ICLR, KNDL, PRXL, and PPDI. Pharma <strong>in</strong>dex <strong>in</strong>cludes BMY, LLY, MRK, PFE, SGP<br />

and WYE.<br />

Jun-07<br />

Oct-07<br />

Feb-08<br />

Jun-08<br />

Oct-08<br />

Feb-09<br />

Jun-09<br />

19

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

20<br />

North America Equity Research<br />

16 July 2009<br />

Pharma restructur<strong>in</strong>g/consolidation<br />

As mentioned previously, low visibility around pharmaceutical R&D plans rema<strong>in</strong>s a<br />

significant headw<strong>in</strong>d <strong>in</strong> <strong>the</strong> near term, with pend<strong>in</strong>g M&A transactions expected to<br />

<strong>in</strong>volve significant cost sav<strong>in</strong>gs, likely exceed<strong>in</strong>g <strong>in</strong>itial targets.<br />

Table 7: Biopharmaceutical M&A Transactions Announced <strong>in</strong> 2009<br />

Month Deal Size<br />

January Pfizer/Wyeth $66.7 billion<br />

January GSK/UCB $670 million<br />

February Lundbeck/Ovation $900 million<br />

March Merck/Scher<strong>in</strong> gPlough $42 billion<br />

March Gilead/CV Therapeutics $1.3 billion<br />

Source: In Vivo (May 2009)<br />

The follow<strong>in</strong>g table highlights some <strong>of</strong> <strong>the</strong> <strong>in</strong>itial anticipated cost synergies from<br />

announced M&A transactions, while Table 9 highlights restructur<strong>in</strong>g <strong>in</strong>itiatives<br />

disclosed over <strong>the</strong> past year.<br />

Table 8: Expected Synergies from Pend<strong>in</strong>g M&A Deals<br />

Expected Total Synergies Expected SG&A Sav<strong>in</strong>gs Expected R&D and Manufactur<strong>in</strong>g<br />

Sav<strong>in</strong>gs<br />

PFE/WYE ~$4bn - 50% <strong>in</strong> first 12 months, 75% <strong>in</strong> first ~50% from SG&A Comb<strong>in</strong>ed R&D and Manufactur<strong>in</strong>g<br />

24 months, 100% <strong>in</strong> first 36 months<br />

sav<strong>in</strong>gs ~50%<br />

SGP/MRK ~$3.5bn cost sav<strong>in</strong>gs expected beyond ~60% from Market<strong>in</strong>g & ~40% from R&D and Manufactur<strong>in</strong>g<br />

2011: 50% <strong>in</strong> first yr, 75% <strong>in</strong> first 2 yrs. Adm<strong>in</strong>istration<br />

comb<strong>in</strong>ed<br />

RHHBY/DNA Pretax sav<strong>in</strong>gs <strong>of</strong> ~$750-850mm/yr NA NA<br />

Source: Company reports

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

North America Equity Research<br />

16 July 2009<br />

Table 9: Top pharma R&D and outsourc<strong>in</strong>g strategies<br />

2008 Revenue /R&D<br />

Company expense Latest corporate / R&D strategy Latest on Outsourc<strong>in</strong>g<br />

Abbott $29.5bn (57%<br />

Annual Shareholders Meet<strong>in</strong>g (April 24, 2009)<br />

pharma)/$2.7bn<br />

“We cont<strong>in</strong>ue to <strong>in</strong>vest at a high rate to build our diverse R&D pipel<strong>in</strong>e.<br />

With our n<strong>in</strong>e new product launches last year alone, we’re now focused<br />

on our early- to mid-stage opportunities, where we’ve seen productivity<br />

improvements, and have nearly doubled our Phase I and Phase II<br />

starts. Many <strong>of</strong> <strong>the</strong> compounds <strong>in</strong> pharmaceutical pipel<strong>in</strong>e represent truly<br />

novel science and, if successful, would result <strong>in</strong> significant advances <strong>in</strong><br />

treatment for patients.”<br />

Baxter $12.3bn (44%<br />

Annual Meet<strong>in</strong>g <strong>of</strong> Shareholders Presentation (May 5, 2009)<br />

BioScience)/$868mm -- Accelerated R&D spend<strong>in</strong>g to historic level <strong>in</strong> 2008: 1) Received<br />

approval and launched an array <strong>of</strong> new products, 2) Initiated 8 Phase III<br />

cl<strong>in</strong>ical trials, and 3) Advanced numerous early-stage <strong>in</strong>ternal programs<br />

-- R&D Spend<strong>in</strong>g 2005 – 2008 = CAGR 18%<br />

2008 Annual Report<br />

-- (Baxter) cont<strong>in</strong>ues to <strong>in</strong>vest to support <strong>the</strong> company’s ongo<strong>in</strong>g strategic<br />

focus on R&D with <strong>the</strong> expansion <strong>of</strong> research facilities, pilot<br />

manufactur<strong>in</strong>g sites and laboratories.<br />

-- (Baxter) also plans to cont<strong>in</strong>ue to pursue bus<strong>in</strong>ess development<br />

<strong>in</strong>itiatives, collaborations and alliances as part <strong>of</strong> <strong>the</strong> execution <strong>of</strong> its<br />

long-term growth strategy.<br />

AstraZeneca $31.6bn/$5.2bn June 2009 presentation<br />

June 2009 presentation<br />

-- Restructur<strong>in</strong>g benefits <strong>of</strong> $2.5bn by 2013; reduction <strong>of</strong> ~15,000 positions -- Cl<strong>in</strong>ical data outsourc<strong>in</strong>g <strong>of</strong> 82 studies<br />

when completed, <strong>in</strong>cl. R&D headcount reduction <strong>of</strong> 1,400 when completed Activities <strong>in</strong> drug discovery/development<br />

-- Investment <strong>in</strong> externalization (40% <strong>of</strong> product portfolio <strong>in</strong> 2009 is -- Forms JV (<strong>in</strong>itially for 5 years) with Jubilant Biosys (Indian<br />

<strong>in</strong>-licensed, from 15% <strong>in</strong> 2005) and biologics (25% <strong>of</strong> product portfolio <strong>in</strong> subsidiary <strong>of</strong> Jubilant Organosys), which will develop<br />

2009 vs. 2% <strong>in</strong> 2005) deliver<strong>in</strong>g results<br />

precl<strong>in</strong>ical candidates <strong>in</strong> return for research fund<strong>in</strong>g, milestone<br />

-- Enhanced capabilities <strong>in</strong> Biologicals (<strong>in</strong>cl. expand<strong>in</strong>g external strategic payments and royalties (May 2009)<br />

opportunities), balanced with reduction <strong>in</strong> selected small molecule areas -- Extends previous agreement with WX ($14mm, 2-yrs) for<br />

-- “Faster, Leaner, Better”<br />

high throughput screen<strong>in</strong>g services for ano<strong>the</strong>r three years<br />

*Precl<strong>in</strong>ical and Phase I on target for 2010 speed with <strong>in</strong>creased<br />

(June 2008)<br />

volumes and decreased cost<br />

Activities <strong>in</strong> data management<br />

*Focus on Phase II <strong>in</strong> 2009<br />

-- Spent ~$12mm <strong>in</strong> 2008 for electronic cl<strong>in</strong>ical data<br />

F<strong>in</strong>ancial Times Interview with CEO David Brennan (April 17, 2009)<br />

management system from Medidata<br />

-- “Our view is more oriented toward collaboration than<br />

-- 5-yr deal with Cognizant for ma<strong>in</strong>tenance services <strong>of</strong><br />

consolidation. If <strong>the</strong>re were acquisition opportunities for AstraZeneca, research, cl<strong>in</strong>ical development, sales and market<strong>in</strong>g (Oct<br />

<strong>the</strong>y would be <strong>in</strong> <strong>the</strong> small company, product, technology side <strong>of</strong> th<strong>in</strong>gs, 2008)<br />

not a large-scale transaction to take out capacity. That's not what we're -- $95mm, 5-yr deal with Cognizant for a range <strong>of</strong> data<br />

look<strong>in</strong>g for.”<br />

management services for global cl<strong>in</strong>ical development<br />

programs (March 2008)<br />

Bristol- $20.6bn/$3.6bn May 27, 2009 presentation to <strong>in</strong>vestors<br />

May 27, 2009 presentation to <strong>in</strong>vestors<br />

Myers<br />

-- BMY is more focused – Biopharma is 86% <strong>of</strong> revenues<br />

-- Various outsourc<strong>in</strong>g <strong>in</strong>itiatives underway (HR, IM, R&D,<br />

Squibb<br />

-- Biopharma headcount is down 14% to about 30,000<br />

F<strong>in</strong>ance)<br />

-- Focus on productivity: $2.5bn <strong>in</strong> sav<strong>in</strong>gs <strong>in</strong>itiatives underway (<strong>in</strong>troduced IT outsourc<strong>in</strong>g<br />

<strong>in</strong> Dec 2007)<br />

-- $715mm, 7-yr agreement with EDS for streaml<strong>in</strong><strong>in</strong>g global<br />

-- Plans to reduce 27 manufactur<strong>in</strong>g plants by ~50%<br />

IT (Dec 2007)<br />

-- Procurement – vendor consolidation and terms<br />

-- $324mm, 10-yr agreement with IBM for HR functions across<br />

-- Rationaliz<strong>in</strong>g:<br />

<strong>the</strong> globe (Jun 2008)<br />

*155 focused markets <strong>in</strong> 2007 to 63 <strong>in</strong> 2011<br />

-- $550mm, 10-yr contract with Accenture for IT and f<strong>in</strong>ancial<br />

*212 products <strong>in</strong> 2007 to 92 products <strong>in</strong> 2011<br />

*6,550 mature brand SKUs to 2,450 SKUs <strong>in</strong> 2011<br />

support services (Sept 2008)<br />

21

Tycho W. Peterson<br />

(1-212) 622-6568<br />

tycho.peterson@jpmorgan.com<br />

22<br />

North America Equity Research<br />

16 July 2009<br />

Eli Lilly $20.4bn/$3.8bn Investor presentation (December 11, 2008)<br />

-- Transition<strong>in</strong>g from FIPCO (functional outsourc<strong>in</strong>g, Indiana-centric,<br />

centralized decision mak<strong>in</strong>g, LLY funds, absorbs all risk, control) to:<br />

-- FIPNet:<br />

*Integrated global capacity (cont<strong>in</strong>ued outsourc<strong>in</strong>g with greater<br />

coord<strong>in</strong>ation)<br />

*Global portfolio network<br />

*Common R&D goals, local execution<br />

*Shared risk/reward<br />

*Variety <strong>of</strong> deal structures, coord<strong>in</strong>ation mechanisms<br />

Outsourc<strong>in</strong>g-pharma.com (March 2008)<br />

-- Works with over 80 contractors to perform various functions across its<br />

bus<strong>in</strong>ess<br />

-- 20% <strong>of</strong> manufactur<strong>in</strong>g and sales, and 40% <strong>of</strong> IT work outsourced<br />

-- Expectation to outsource up to half <strong>of</strong> its precl<strong>in</strong>ical and cl<strong>in</strong>ical R&D by<br />

2010<br />

GlaxoSmith<br />

Kl<strong>in</strong>e<br />

Johnson &<br />

Johnson<br />

$45.1bn/$6.8bn (1) Releas<strong>in</strong>g resources to <strong>in</strong>vest <strong>in</strong> growth (February 5, 2009 <strong>in</strong>vestor<br />

presentation)<br />

-- Simplify<strong>in</strong>g manufactur<strong>in</strong>g network; announced closure <strong>of</strong> 12 sites s<strong>in</strong>ce<br />

2006<br />

-- US sales force restructure results <strong>in</strong> 1,450 headcount reduction <strong>in</strong> 2008<br />

-- Reduc<strong>in</strong>g <strong>in</strong>frastructure <strong>in</strong> R&D; announced planned closure <strong>of</strong> 3<br />

UK R&D sites <strong>in</strong> <strong>the</strong> past 2 years<br />

-- R&D strategy<br />

*Diversify and de-risk through externalization (acquisition <strong>of</strong> platform<br />

technologies, assets, academic collaborations)<br />

*Focused and cost-effective development (~30 assets <strong>in</strong> Phase III /<br />

registration)<br />

*Overall reduction <strong>of</strong> 36% <strong>in</strong>ternal discovery projects (exited urology,<br />

GI, hypertension)<br />

*Rebuild<strong>in</strong>g portfolios <strong>in</strong>ternally and externally (ophthalmology,<br />

sirtu<strong>in</strong>s)<br />

March 2008 announcement<br />

-- Opens first pilot plant <strong>in</strong> S<strong>in</strong>gapore ($82mm facility) for design <strong>of</strong><br />

$63.7bn (39% pharma)<br />

/$7.6bn<br />

manufactur<strong>in</strong>g processes<br />

Pharmaceutical Bus<strong>in</strong>ess Review, June 4, 2009<br />

-- Portfolio expansion through licens<strong>in</strong>g and acquisitions, establish<strong>in</strong>g<br />

collaborations, creat<strong>in</strong>g new partnerships <strong>in</strong> emerg<strong>in</strong>g regions<br />

-- Strategy for Pharmaceutical R&D: (1) focus on end-to-end, research<br />

to market approach <strong>in</strong> five <strong>the</strong>rapeutic areas, (2) comb<strong>in</strong>e <strong>in</strong>ternal<br />

<strong>in</strong>novation with external <strong>in</strong>novation (academic, biotech, govt, consortia),<br />

(3) embed customer, physician, and payor <strong>in</strong>sights, and (4) leverage<br />

broad-based expertise and global capabilities<br />

-- Build<strong>in</strong>g capabilities <strong>in</strong> Asia: (1) chemical pharmaceutical facility<br />